Texture Paint Market by Resin Type (Acrylic and Epoxy), Technology (Water based, Solvent based), Product Type (Interior and Exterior), Application (Residential and Non - Residential), & Region (Asia Pacific, Europe, North America - Global Forecast to 2028

Updated on : November 11, 2025

Texture Paint Market

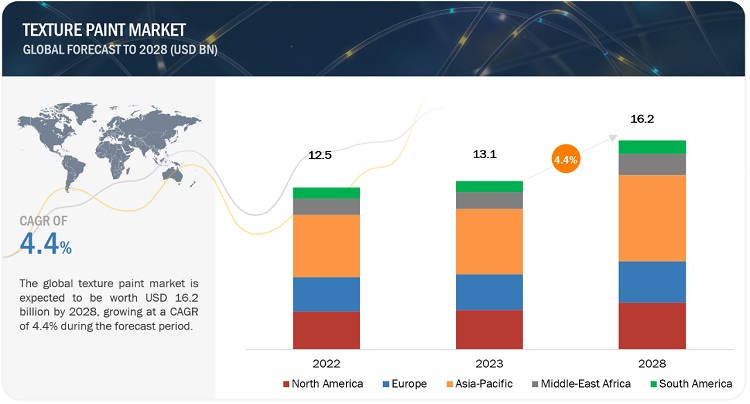

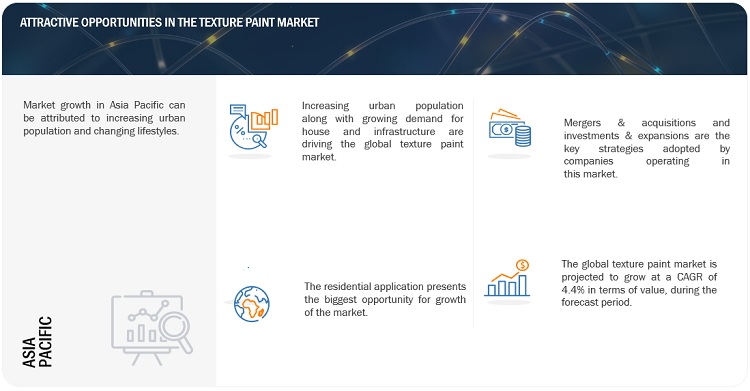

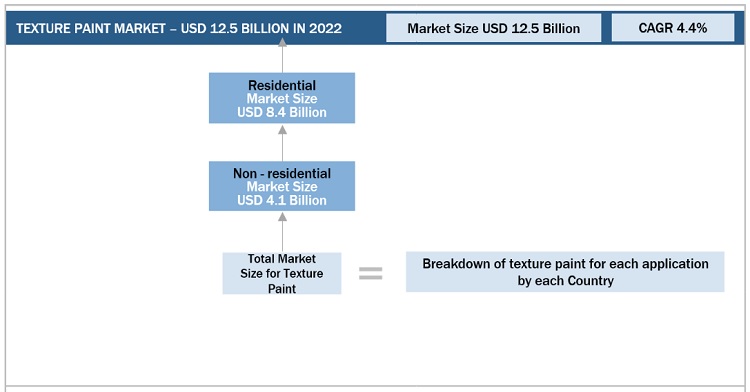

The global texture paint market was valued at USD 12.5 billion in 2022 and is projected to reach USD 16.2 billion by 2028, growing at 4.4% cagr from 2023 to 2028. Texture paint industry is categorized into two end use application: residential and non-residential. residential application accounts the largest share of texture paint market. Texture paints are gaining popularity because of its features such as realistic texture, creative expression, versatility, depth and dimension, and popularity in various art style. Paints and coatings sector is one of the most strictly regulated sector in the world and texture paint has low VOC emissions, and prduces less environmental damage these factors are positively supporting the texture paint market growth. Texture paint market is mainly dominated by few large players but there are many manufatueres of texture paint at regional level. India and China have rapidly growing economies with large populations, which present significant market potential for various industries, including the paint and coatings sector. Expanding operations in these countries allows companies to tap into the increasing demand for texture paint and other related products, also India and China are known for their relatively lower production and labor costs compared to many Western countries. Multinational companies can take advantage of these cost efficiencies by establishing manufacturing facilities or outsourcing production in these regions, which can help reduce overall production costs and enhance profitability.

Texture Paint Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Texture Paint Market

Texture Paint Market Dynamics

Driver: the construction industry continues to thrive, the demand for texture paint is likely to increase due to its ability to enhance the appearance, protect surfaces, and provide design flexibility. This creates opportunities for manufacturers, suppliers, and professionals in the texture paint market to cater to the needs of the construction sector.

Economic growth and rising earnings often result in the emergence of the middle class. As more people join the middle-income category, their expectations for their standard of living rise. Texture paint allows homeowners to improve the appearance of their houses without undergoing extensive building work. Demand for texture paint is being driven by a growing middle class with more purchasing power.

Restraints: Texture paint can be more expensive than standard paint due to the additional materials and specialised procedures required to create textured surfaces. This additional cost may prevent economical buyers from selecting texture paint over less expensive options.

Texture paint is most commonly applied to walls and surfaces with sufficient texture or irregularities to create the desired effect. Smooth surfaces may need extra preparation, such as the application of texture-enhancing chemicals or primers, which can increase the total time and expense of the procedure. This constraint in application surfaces might limit the market's prospective consumer base.

Opportunity: the demand for high performance texture paint is growing because of its exceptional aesthetic appeal, chemical and weather resistance. Texture paint not only enhances aesthetics but also provides protection and durability to surfaces. The textured coating acts as a barrier against weather elements, moisture, and wear and tear, thereby extending the lifespan of walls and surfaces. This advantage appeals to customers looking for long-lasting solutions that can withstand various environmental conditions. Texture paint can successfully conceal surface flaws such as cracks, dents, and unevenness. By creating textured finishes, it helps hide flaws that would otherwise require extensive surface preparation or repairs. This feature is especially appealing to consumers looking for cost-effective ways to improve the appearance of their rooms without requiring costly modifications.

Challenges: Texture paint is often applied in thicker applications than standard paint. The desired texture effect on the surface is created by the texture particles, additives, or aggregates in the paint. The texture paint can add a modest to substantial thickness to the wall depending on the texture type, application technique, and number of coats used. Textured surfaces might be more difficult to clean and maintain than smooth ones. The presence of complex patterns, deep cracks, or porous textures can trap dirt, making cleaning and maintenance more time-consuming and labor-intensive.

Based on Resin, acrylic resin is estimated to register highest CAGR during the forecast period

Acrylic resin is widely used in texture paint formulations due to its favorable properties and versatility such as Excellent Adhesion and Durability, Fast Drying and Low Odor, Environmental Benefits, and Wide Range of Formulations. Acrylic resin provides excellent adhesion to various surfaces, including concrete, masonry, wood, and metal. This property ensures that the texture paint adheres well to the substrate, resulting in a long-lasting and durable finish. Acrylic-based texture paints are known for their resistance to cracking, peeling, and weathering, making them a preferred choice for both interior and exterior applications.

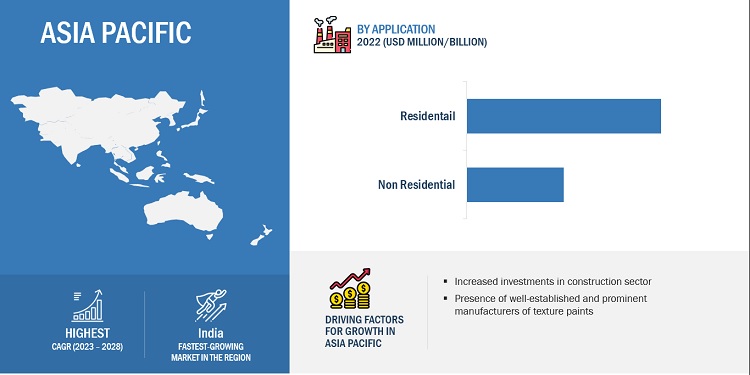

Asia Pacific market is estimated to register highest CAGR during the forecast period.

Asia Pacific is expected to lead the texture paint market in 2022. China and India have witnessed substantial investment in construction and infrastructure projects to support their growing economies. The construction industry's expansion creates a demand for texture paint, as it is widely used in both residential and non-residential projects to enhance aesthetics, provide protective coatings, and meet design requirements. The increasing investment in infrastructure development directly drives the demand for texture paint. China and India are experiencing rapid urbanization, leading to increased demand for housing and commercial spaces. The real estate sector, driven by urban development and population growth, fuels the need for texture paint as a decorative and functional solution. The desire for unique finishes and textured surfaces in urban areas drives the demand for texture paint products.

To know about the assumptions considered for the study, download the pdf brochure

Texture Paint Market Players

The texture paint market is dominated by a few globally established players such as The Sherwin-Williams Company (US), AkzoNobel N.V. (The Netherlands), PPG Industries, Inc (US), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), among others, are the key manufacturers. Major focus was given to the mergers & acquitions, and new product development due to the changing requirements of end industry users across the globe.

Texture Paint Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Resin Type, By Technology, By Product Type, By Application, By Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies covered |

The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), , Axalta Coating Systems LLC (US) |

Based on resin type, the texture paint market has been segmented as follows:

- Acrylic

- Others

Based on technology, the texture paint market has been segmented as follows:

- Water based

- Solvent based

Based on product type, the texture paint market has been segmented as follows:

- Interior

- Exterior

Based on application, the texture paint market has been segmented as follows:

- Residential

- Non-residential

Based on the region, the texture paint market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2021, PPG acquired Tikkurila. This is expected to help the company to expand paint and coating options that are expected to now include Tikkurila’s texture paints.

- In April 2022, AkzoNobel N.V. Acquiring Kansai Paint’s activities in the region will help us to further expand our paints and coatings business in Africa and provide a strong platform for future growth

- In September 2022, Hempel A/S, has acquired the Cap Couleurs Group’s store network in South-East France, maintaining Hempel’s segment leadership in the Var region and supporting its growth initiatives.

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the texture paint market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, Canada, China, India, Japan, Germany, UK and France are major countries considered in the report.

Who are the major manufacturers?

PPG Industries, Inc (US), The Sherwin Williams (US), AkzoNobel N.V. (Netherlands), Asian Paints Limited (India), Kansai Paints (Japan) are some of the leading players operating in the global texture paint market.

Which is the largest region in the texture paint market?

Asia Pacific is the largest region in laminating adhesive market.

What is the total CAGR expected to be recorded for the texture paint market during 2023-2028?

The CAGR is expected to record 4.4% from 2023-2028

Does this report cover the different product type of texture paint market?

Yes, the report covers the different product type of texture paint. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Thriving construction industry- Growing demand for aesthetic appeal and superior propertiesRESTRAINTS- High price of texture paints compared to conventional paintsOPPORTUNITIES- Increasing demand from middle-class populationCHALLENGES- High repainting cost due to increased surface area

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECAST

- 5.6 GLOBAL CONSTRUCTION INDUSTRY: TRENDS AND FORECAST

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.9 PRICING ANALYSIS

- 5.10 TRADE DATA STATISTICS

-

5.11 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHGLOBAL IMPACT OF SLOWDOWN/RECESSION- North America- Europe- Asia Pacific

-

5.12 VALUE CHAIN ANALYSISECOSYSTEM AND INTERCONNECTED MARKETS

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

-

5.14 PATENT ANALYSISMETHODOLOGYPATENT PUBLICATION TRENDSTOP APPLICANTSJURISDICTION ANALYSIS

-

5.15 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY LANDSCAPE AND STANDARDS- Legislative & regulatory policy update

- 5.16 KEY CONFERENCES AND EVENTS IN 2023

-

6.1 INTRODUCTIONACRYLIC RESIN- Flexibility of acrylic resin to drive demandOTHERS

- 7.1 INTRODUCTION

-

7.2 WATER-BASEDENVIRONMENTALLY FRIENDLY AND LOW CLEARCOAT REQUIREMENTS TO DRIVE MARKET

-

7.3 SOLVENT-BASEDHIGHER DURABILITY AND RESISTANCE TO WEATHERING TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 INTERIORURBANIZATION AND DEMAND FOR HOUSING FACILITIES TO DRIVE MARKET

-

8.3 EXTERIORRENOVATION AND REMODELING OF INFRASTRUCTURE TO FUEL DEMAND

- 9.1 INTRODUCTION

-

9.2 RESIDENTIALNEED FOR INCREASED LIFE SPAN OF BUILDING STRUCTURES TO DRIVE DEMAND

-

9.3 NON-RESIDENTIALGROWING INVESTMENT IN PRIVATE SECTOR AND INCREASING COMMERCIAL OFFICE SPACES TO DRIVE DEMAND

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Foreign investment and growing infrastructure to drive marketJAPAN- Government investment in reconstruction of commercial buildings to boost demandINDIA- Growing real estate industry to boost demandSOUTH KOREA- Growing population of homeowners to drive marketINDONESIA- Growth in construction industry supported by government, foreign investments, and private sector to drive marketTHAILAND- Increasing customer awareness about aesthetics and functionalities of texture paint fueling demandMALAYSIA- Rising disposable income and growing interest in home renovation to fuel marketREST OF ASIA PACIFIC

-

10.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Implementation of stringent environmental regulations to increase production of texture paintsFRANCE- Development of affordable houses and renewable energy infrastructure to drive demandUK- Increasing government investments to spur market growthITALY- New project finance rules and investment policies in construction sector to support market growthTURKEY- Rapid urbanization, rising middle-class population, and increasing purchasing power to drive demandSPAIN- Government investments in infrastructure, housing units, and other infrastructures to boost marketREST OF EUROPE

-

10.4 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Increasing residential and non-residential constructions to boost marketCANADA- Increasing residential construction to drive marketMEXICO- New construction in residential segment to drive market

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICASAUDI ARABIA- Mega housing projects to boost demandUAE- Urban development projects driving demand for texture paintSOUTH AFRICA- Substantial demand for texture paint witnessed in building projectsREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Rising homeownership and living standards and easier credit availability to fuel demandARGENTINA- Increase in population and improved economic conditions to drive demandREST OF SOUTH AMERICA

- 11.1 OVERVIEW

-

11.2 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.3 START-UP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.4 STRENGTH OF PRODUCT PORTFOLIO

- 11.5 COMPETITIVE BENCHMARKING

- 11.6 MARKET SHARE ANALYSIS

- 11.7 MARKET RANKING ANALYSIS

- 11.8 REVENUE ANALYSIS

-

11.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 11.10 STRATEGIC DEVELOPMENTS

-

12.1 KEY PLAYERSPPG INDUSTRIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAKZONOBEL N.V.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHE SHERWIN-WILLIAMS COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHEMPEL GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewASIAN PAINTS LIMITED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNIPPON PAINTS HOLDINGS CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKANSAI PAINT COMPANY LIMITED- Business overview- Products/Services/Solutions offered- MnM viewJOTUN A/S- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAXALTA COATING SYSTEMS- Business overview- Products/Services/Solutions offered- MnM viewSK KAKEN CO., LTD.- Business overview- Products/Services/Solutions offered- MnM view

-

12.2 OTHER PLAYERSTIKKURILA OYJBERGER PAINTS INDIA LIMITEDKELLY-MOORE PAINTSDUNN-EDWARDSHAYMES PAINTSANVIL PAINTS & COATINGSSPECTRUM PAINTS LIMITEDCROWN PAINTS LIMITEDANDURA COATINGSTNEMEC COMPANY, INC.SAEKYUNG JOLYPATE CO., LTD.JIANGMEN CITY CRYSTONE PAINT CO., LTD.RETINA PAINTS PVT. LTD.ULTRATECH TEXTURE PAINTS PVT. LTD.SIRCA PAINTS INDIA LIMITED

-

13.1 INTRODUCTIONDECORATIVE COATINGS MARKET LIMITATIONS

- 13.2 DECORATIVE COATINGS MARKET DEFINITION

-

13.3 DECORATIVE COATINGS MARKET OVERVIEWDECORATIVE COATINGS MARKET ANALYSIS, BY TECHNOLOGYDECORATIVE COATINGS MARKET ANALYSIS, BY RESIN TYPEDECORATIVE COATINGS MARKET ANALYSIS, BY COATING TYPEDECORATIVE COATINGS MARKET ANALYSIS, BY USER TYPEDECORATIVE COATINGS MARKET ANALYSIS, BY PRODUCT TYPEDECORATIVE COATINGS MARKET ANALYSIS, BY APPLICATIONDECORATIVE COATINGS MARKET ANALYSIS, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 TEXTURE PAINT MARKET SNAPSHOT, 2022 VS. 2028

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS: TEXTURE PAINT MARKET

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP APPLICATIONS

- TABLE 4 KEY BUYING CRITERIA FOR TEXTURE PAINTS

- TABLE 5 GDP GROWTH RATE OF KEY COUNTRIES, 2020–2027 (%)

- TABLE 6 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 7 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 8 TEXTURE PAINT MARKET: STAKEHOLDERS IN VALUE CHAIN

- TABLE 9 NUMBER OF PATENTS PUBLISHED, BY COMPANY

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INTERNATIONALLY RECOGNIZED TEST METHODS

- TABLE 15 RELEVANT STANDARDS

- TABLE 16 TEXTURE PAINT MARKET: KEY CONFERENCES AND EVENTS

- TABLE 17 TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 18 TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 19 TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 20 TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 21 PROPERTIES AND APPLICATIONS OF ACRYLIC PAINTS & COATINGS

- TABLE 22 ACRYLIC TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 23 ACRYLIC TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 24 ACRYLIC TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 ACRYLIC TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 OTHERS TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 27 OTHERS TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 OTHERS TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 OTHERS TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 31 TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 32 TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 33 TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 34 WATER-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 35 WATER-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 36 WATER-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 WATER-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SOLVENT-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 39 SOLVENT-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 SOLVENT-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 SOLVENT-BASED TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 43 TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 44 TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 45 TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 46 INTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 47 INTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 INTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 INTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 EXTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 51 EXTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 EXTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 EXTERIOR TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 55 TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 56 TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 TEXTURE PAINT MARKET SIZE IN RESIDENTIAL, BY REGION, 2019–2022 (KILOTON)

- TABLE 59 TEXTURE PAINT MARKET SIZE IN RESIDENTIAL, BY REGION, 2023–2028 (KILOTON)

- TABLE 60 TEXTURE PAINT MARKET SIZE IN RESIDENTIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 TEXTURE PAINT MARKET SIZE IN RESIDENTIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 TEXTURE PAINT MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2019–2022 (KILOTON)

- TABLE 63 TEXTURE PAINT MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023–2028 (KILOTON)

- TABLE 64 TEXTURE PAINT MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 TEXTURE PAINT MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 67 TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 68 TEXTURE PAINT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 TEXTURE PAINT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 71 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 72 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 75 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 76 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 79 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 80 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 83 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 84 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 87 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 88 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 91 EUROPE: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 92 EUROPE: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 95 EUROPE: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 96 EUROPE: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 99 EUROPE: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 100 EUROPE: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 103 EUROPE: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 104 EUROPE: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 107 EUROPE: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 108 EUROPE: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 EUROPE: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 111 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 112 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 115 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 116 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 119 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 120 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 123 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 124 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 125 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 127 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 128 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 136 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 140 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 144 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 151 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 152 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 155 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 156 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 158 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 159 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 160 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 162 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 163 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 164 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 165 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 166 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 167 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 168 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 169 SOUTH AMERICA: TEXTURE PAINT MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 STRATEGIES ADOPTED BY KEY TEXTURE PAINT PLAYERS (2018–2022)

- TABLE 171 TEXTURE PAINT MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 172 TEXTURE PAINT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 173 TEXTURE PAINT MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

- TABLE 174 TEXTURE PAINT MARKET: DEGREE OF COMPETITION, 2022

- TABLE 175 STRATEGIC DEVELOPMENTS, BY KEY COMPANIES

- TABLE 176 HIGHEST ADOPTED STRATEGIES

- TABLE 177 NUMBER OF GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

- TABLE 178 COMPANY APPLICATION FOOTPRINT

- TABLE 179 COMPANY REGION FOOTPRINT

- TABLE 180 COMPANY OVERALL FOOTPRINT

- TABLE 181 TEXTURE PAINT MARKET: DEALS, 2018–2023

- TABLE 182 TEXTURE PAINT MARKET: OTHERS, 2018–2023

- TABLE 183 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 184 PPG INDUSTRIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 PPG INDUSTRIES: DEALS

- TABLE 186 AKZONOBEL N.V.: COMPANY OVERVIEW

- TABLE 187 AKZONOBEL N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 AKZONOBEL N.V.: DEALS

- TABLE 189 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 190 THE SHERWIN-WILLIAMS COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 192 HEMPEL GROUP: COMPANY OVERVIEW

- TABLE 193 HEMPEL GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 HEMPEL GROUP: DEALS

- TABLE 195 HEMPEL GROUP: OTHERS

- TABLE 196 ASIAN PAINTS LIMITED: COMPANY OVERVIEW

- TABLE 197 ASIAN PAINTS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 ASIAN PAINTS LIMITED: DEALS

- TABLE 199 NIPPON PAINTS HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 200 NIPPON PAINTS HOLDINGS CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 NIPPON PAINTS HOLDINGS CO., LTD.: DEALS

- TABLE 202 KANSAI PAINT COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 203 KANSAI PAINT COMPANY LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 JOTUN A/S: COMPANY OVERVIEW

- TABLE 205 JOTUN A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 JOTUN A/S: DEALS

- TABLE 207 AXALTA COATING SYSTEMS: COMPANY OVERVIEW

- TABLE 208 AXALTA COATING SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 209 SK KAKEN CO., LTD.: COMPANY OVERVIEW

- TABLE 210 SK KAKEN CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 TIKKURILA OYJ: COMPANY OVERVIEW

- TABLE 212 TIKKURILA OYJ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 BERGER PAINTS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 214 BURGER PAINTS INDIA LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 KELLY- MOORE PAINTS: COMPANY OVERVIEW

- TABLE 216 KELLY-MORE PAINTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 217 DUNN-EDWARDS: COMPANY OVERVIEW

- TABLE 218 DUNN-EDWARDS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 HAYMES PAINTS: COMPANY OVERVIEW

- TABLE 220 HAYMES PAINTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 ANVIL PAINTS & COATINGS: COMPANY OVERVIEW

- TABLE 222 ANVIL PAINTS & COATINGS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 SPECTRUM PAINTS LIMITED: COMPANY OVERVIEW

- TABLE 224 SPECTRUM PAINTS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 CROWN PAINTS LIMITED: COMPANY OVERVIEW

- TABLE 226 CROWN PAINTS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 ANDURA COATINGS: COMPANY OVERVIEW

- TABLE 228 ANDURA COATINGS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 229 TNEMEC COMPANY, INC.: COMPANY OVERVIEW

- TABLE 230 TNEMEC COMPANY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 231 SAEKYUNG JOLYPATE CO., LTD.: COMPANY OVERVIEW

- TABLE 232 SAEKYUNG JOLYPATE CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 JIANGMEN CITY CRYSTONE PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 234 JIANGMEN CITY CRYSTONE PAINT CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 235 RETINA PAINTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 236 RETINA PAINTS PVT. LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 ULTRATECH TEXTURE PAINTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 238 ULTRATECH TEXTURE PAINTS PVT. LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 239 SIRCA PAINTS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 240 SIRCA PAINTS INDIA LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 241 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 242 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 243 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 244 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 245 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 246 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 247 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 248 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 249 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 250 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 251 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 252 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 253 DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 254 DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 255 DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 256 DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 257 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 258 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 259 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 260 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 261 DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 262 DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 263 DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 264 DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 265 DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 266 DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 267 DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 268 DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- FIGURE 1 TEXTURE PAINT MARKET SEGMENTATION

- FIGURE 2 TEXTURE PAINT MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION, BY VALUE

- FIGURE 5 TEXTURE PAINT MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 TEXTURE PAINT MARKET SIZE ESTIMATION, BY PRODUCT TYPE

- FIGURE 7 TEXTURE PAINT MARKET SIZE ESTIMATION, BY APPLICATION

- FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF TEXTURE PAINT MARKET

- FIGURE 10 TEXTURE PAINT MARKET: SUPPLY-SIDE FORECAST

- FIGURE 11 TEXTURE PAINT MARKET: DEMAND-SIDE FORECAST

- FIGURE 12 FACTOR ANALYSIS OF TEXTURE PAINT MARKET

- FIGURE 13 TEXTURE PAINT MARKET: DATA TRIANGULATION

- FIGURE 14 ASIA PACIFIC TEXTURE PAINT MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 NON-RESIDENTIAL SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 INTERIOR TEXTURE PAINT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 WATER-BASED TEXTURE PAINT TO BE DOMINANT SEGMENT BETWEEN 2023 AND 2028

- FIGURE 18 ASIA PACIFIC WAS LARGEST TEXTURE PAINT MARKET IN 2022

- FIGURE 19 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 20 INTERIOR TEXTURE PAINT SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BETWEEN 2023 AND 2028

- FIGURE 21 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 22 TEXTURE PAINT MARKET TO REGISTER HIGHER CAGR IN DEVELOPING COUNTRIES

- FIGURE 23 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TEXTURE PAINT MARKET

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: TEXTURE PAINT MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA FOR TEXTURE PAINTS

- FIGURE 28 COUNTRY-WISE CONTRIBUTION TO GLOBAL CONSTRUCTION GROWTH, 2020–2030

- FIGURE 29 AVERAGE PRICE COMPETITIVENESS, BY REGION (2022)

- FIGURE 30 AVERAGE PRICE COMPETITIVENESS, BY PRODUCT TYPE (2022)

- FIGURE 31 AVERAGE PRICE COMPETITIVENESS, BY APPLICATION (2022)

- FIGURE 32 AVERAGE PRICE COMPETITIVENESS, BY COMPANY (2022)

- FIGURE 33 TEXTURE PAINT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 34 PAINTS & COATINGS: ECOSYSTEM MAPPING

- FIGURE 35 REVENUE SHIFT IN TEXTURE PAINT MARKET

- FIGURE 36 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 37 PATENTS PUBLISHED BY MAJOR PLAYERS, 2018–2023

- FIGURE 38 PATENTS PUBLISHED, BY JURISDICTION (2018–2023)

- FIGURE 39 ACRYLIC TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 WATER-BASED SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 EXTERIOR TEXTURE PAINT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NON-RESIDENTIAL SEGMENT EXPECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: TEXTURE PAINT MARKET SNAPSHOT

- FIGURE 45 EUROPE: TEXTURE PAINT MARKET SNAPSHOT

- FIGURE 46 NORTH AMERICA: TEXTURE PAINT MARKET SNAPSHOT

- FIGURE 47 SAUDI ARABIA TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2028

- FIGURE 48 SOUTH AMERICA: TEXTURE PAINT MARKET SNAPSHOT

- FIGURE 49 TEXTURE PAINT MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 TEXTURE PAINT MARKET: COMPANY EVALUATION MATRIX FOR START- UPS/SMES, 2022

- FIGURE 51 PRODUCT PORTFOLIO ANALYSIS: TEXTURE PAINT MARKET

- FIGURE 52 MARKET SHARE BY KEY PLAYERS (2022)

- FIGURE 53 RANKING OF LEADING PLAYERS IN TEXTURE PAINT MARKET, 2022

- FIGURE 54 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 55 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 57 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 58 HEMPEL GROUP: COMPANY SNAPSHOT

- FIGURE 59 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

- FIGURE 60 NIPPON PAINTS HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 KANSAI PAINT COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 62 JOTUN A/S: COMPANY SNAPSHOT

- FIGURE 63 AXALTA COATING SYSTEMS: COMPANY SNAPSHOT

- FIGURE 64 SK KAKEN CO., LTD.: COMPANY SNAPSHOT

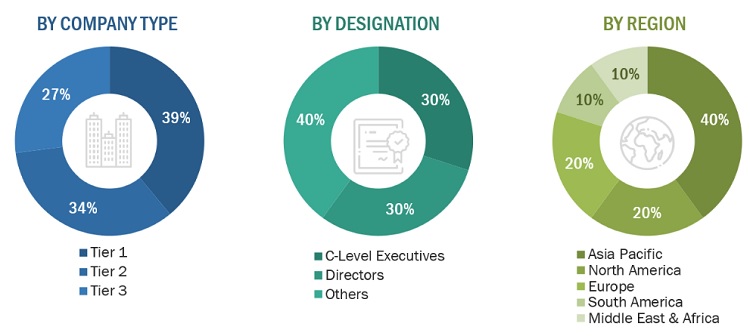

The study involved four major activities in order to estimating the current size of the texture paint market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including the National Institute for Occupational Safety and Health (NIOSH), United States Environmental Protection Agency (USEPA), Society for Protective Coatings (SSPC), and European Inventory of Existing Commercial Chemical Substances (EINECS), The Adhesive and Sealant Council, and The Pressure Sensitive Tape Council.

Primary Research

Extensive primary research was carried out after gathering information about texture paint market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the texture paint market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to resin type, technology, product type, applications, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

Asian Paints Limited |

Sales Manager |

|

PPG Industries, Inc |

Project Manager |

|

The Sherwin-Williams Company |

Individual Industry Expert |

|

AkzoNobel N.V. |

Director |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the texture paint market. The market sizing of the texture paint market was undertaken from the demand side. The market size was estimated based on procurements and advancement in the construction industry at a regional level. Such procurements provide information on the demand for texture paints.

Global Texture Paint Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Texture Paint Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments.To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Texture paints are specialized coatings or finishes used to add texture, depth, and visual interest to various surfaces such as walls, ceilings, furniture, and other interior or exterior surfaces. These paints contain additives or aggregates, such as sand, granules, or other materials, which create unique patterns, designs, or tactile effects when applied.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the texture paint market based on resin type, technology, product type, application, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the texture paint market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the texture paint market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the texture paint Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Texture Paint Market