Decorative Coatings Market by Resin Type (Acrylic, Alkyd, vinyl, Polyurethane), Technology, Coating Type (Interior and Exterior), Color Type, User Type (DIY and Professional), Product Type, Application), and Region - Global Forecast to 2027

Updated on : August 21, 2025

Decorative Coatings Market

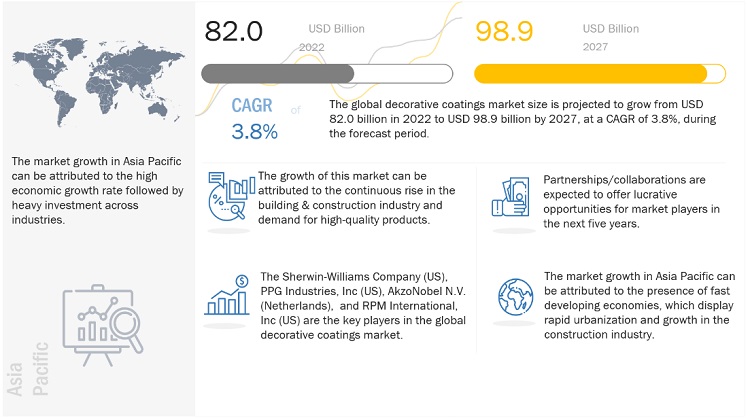

The global decorative coatings market was valued at USD 82.0 billion in 2022 and is projected to reach USD 98.9 billion by 2027, growing at 3.8% cagr from 2022 to 2027. The chemicals that are currently used to manufacture coatings are better than solvent-borne coatings. Products are currently sold with multi-year guarantees against corrosion, mostly due to improvements in the performance of coatings.

Decorative coatings can protect the exteriors of the buildings from heavy rainfall, strong wind, and snowfall. These coatings offer several benefits: durability, high flexibility, crack-bridging ability, waterproofing & weatherproofing, and resistance to dirt, mildew, and chemicals. In addition, producers are continuously introducing new products that are eco-friendly. The improved durability of coatings leads to the painting of window frames and doors less often, thus reducing the costs incurred by the end users. The enhanced scratch resistance allows parquet floors to be renovated less often. Apart from these, their water repellence and hydrophobic nature protect buildings from internal damage, help in maintaining the aesthetic appeal of buildings, and ensure a long life. These properties are increasing the demand for decorative coatings in various construction activities.

Attractive Opportunities in Decorative Coatings Market

Source: Interviews with Experts, Secondary Research, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Decorative Coatings Market Dynamics

Driver: Growth of construction industry

According to the Global Construction Perspectives and Oxford Economics, the global construction output will grow by 85% to reach USD 15.5 trillion by 2030. China, the US, and India will contribute up to 57% to this overall growth of the industry. This growth is attributed to the economic recovery in these major economies.

Factors such as globalization, urbanization, rising standard of living, increasing purchase power parity (PPP), infrastructural development, and the rapidly increasing need to construct megacities in emerging economies are fuelling the construction industry worldwide; therefore, positively influencing the demand for decorative coatings. The construction industry accounts for about 5% of GDP in developed countries and 8% in developing economies. It is expected that there will be a large infrastructure demand in the emerging economies in the next two decades. By 2040, global infrastructure investment is estimated to be USD 3.7 trillion per year.

COVID-19 has impacted every region, country, and industry worldwide. Lockdowns and slowdowns have been the norm for months. However, the crisis has gradually returned to normalcy, and businesses are bouncing back to usual. A construction boom is expected in the Asia Pacific region, based on infrastructure projects, increasing urbanization, and increased interest in technology implementation and business model remodelling. Sustainability trends such as prefabricated construction, sustainable construction, and green building technology are likely to revolutionize the conventional way of business in the construction sector.

In Asia Pacific, China and India are the most important economies which create high growth opportunities in the construction sector in the region. In 2019, the average consumption of paints and coatings for the region stood at 4.7 kg, while India accounted for 4.1 kg, whereas in developed countries in the region, the average consumption was 9.7 kg. According to the annual report of Berger Paints, there is a gradual shift from unorganized to organized players, and per capita paint consumption in India is expected to boost the paint & coatings industry. This increased consumption is supported by measures taken by major players such as AkzoNobel N.V., PPG Industries Inc., and Asian Paints Limited to create awareness about repainting and renovation of residential and non-residential buildings for a longer lifespan. Improvement in the standard of living, rise in disposable income, and growing trends in interior decoration also drive the per capita paint consumption. These factors are positively influencing the growth of the decorative coatings market.

Restraint: Stringent regulatory policies and time-consuming approvals

Regulatory policies have a significant impact on the paints & coatings industry. Potential changes in regulations can create uncertainty throughout the value chain. This uncertainty refers to the time taken by the manufacturers at each node to accept the new regulation and adopt new technology. Different time-consuming regulatory changes in different regions can affect the raw material producers, formulators, channel partners, and end users. With the increasing number of governments implementing stringent regulatory policies, decorative coatings producers must constantly evolve their processes to comply with the new policies and reduce VOC emissions.

For instance, in the UK and the US, the requirement for reduction in VOC emissions is effective under the Varnishes and Vehicle Refinishing Products Regulations 2005. The Environmental Protection Agency (EPA) has also enacted its policies in accordance with the Clean Air Act amendments of 1977 in the US. Products that fail to meet the legal requirements are not commercialized in the Western European market.

In China, many regulations are being implemented to reduce VOC emissions from decorative coatings by monitoring the boiling points of ingredients (similar to European regulations) and indoor air quality standards. In 2015, the US witnessed two major regulatory developments, namely, the globally harmonized system (GHS)—which necessitated the proper classification and labeling of products indicating the VOC emission and hazard levels of the products—and the adoption of new VOC-free tinting bases for use in architectural base colors in Southern California.

As of September 30, 2019, 73 countries, or 38% of all countries, have legally binding measures in place to limit the manufacturing, import, and sale of lead paints. In many countries, using lead paint in homes and schools is not restricted, posing a major danger of lead poisoning to children. The most effective way to reduce lead exposure from paints is to enact national laws that prohibit the use of lead additives in paints, including legislation, rules, and/or legally binding standards where necessary. Countries that have not yet done so are asked to develop and implement appropriate national laws, rules, and/or standards that will, at the very least, prohibit the manufacturing, importation, and sale of domestic decorative lead paints.

Opportunity: Investments in emerging markets

Emerging economies are investing in large-scale infrastructure development projects. The markets in these economies are witnessing higher growth than those in North America and Europe. This is attributed to the leading companies investing heavily in these regions as there is a tremendous opportunity. Asia Pacific, especially China and India, provides remarkable growth opportunities for decorative coatings manufacturers. Rapid urbanization, a stable economy, and a growing construction industry have fueled the demand for decorative coatings in some Asia Pacific countries. More residential buildings are being constructed in the region to meet the needs of the growing population in major cities of Indonesia, Malaysia, Thailand, Vietnam, and other countries.

The increasing income and purchasing power in the emerging economies of TiO2, the Middle East & Africa, and South America prompt higher investment in construction. Thus, decorative coating manufacturers have opportunities to capitalize on the growth of emerging markets, such as China, India, Russia, and Brazil.

Challenge: Adoption of new technologies

A major barrier to adopting new technologies is the risk of exposure because of the unknowns presented by a new material or process. There is a need for extensive long-term testing that simulates real-world conditions and converging stressors to reduce the risk. Substantial beta-testing programs are also needed before transitioning to full commercial deployment. Another major barrier is the testing standards required for any given industry.

The challenge of achieving an extensive adoption of a technology that may alter how one formulates is a bit more complex and treads on issues related to perception and tradition. This means what the manufacturer offers must be either transformative or help make the application of a new coating successful. Collaborations in the coating technology space between coating manufacturers and raw material suppliers will be necessary to bring forward the next generation of coating technologies. The company or the manufacturer need to show their customers that they (manufacturers) are knowledgeable in their field and can respond to their needs with viable solutions, not only on the pigment side but through a wide range of consultancy. The community and some stakeholders must write and publish success stories. The industry is still very conservative and reluctant to take new forms of cooperation such as open innovation.

The powder coatings segment is expected to register the highest CAGR during the forecast period.

The powder coating technology uses dry resin powders for coating substrates with thermoplastic or thermoset films. The coating is formed after a layer of powder is applied with a powder spray gun or fluidized bed tank to the substrate and heated, thereby melting the powder. A key driver of the powder coatings segment is increasingly stringent environmental regulations on VOC emission.

The powder-based technology uses dry resin powders for coating substrates with thermoplastic or thermoset films. The coating is formed after a layer of powder is applied with a powder spray gun or fluidized bed tank to the substrate and then heated, thereby melting the powder. A key driving force in the growth of the powder-based segment is increasingly stringent environmental regulations for zero or non-VOC coatings. Powder-based technology is eco-friendly and expected to witness rapid growth due to its unique features, such as high corrosion resistance, chipping, high-quality finish, and abrasion. It also offers protection from moisture, heat, and chemicals. These power coatings emit only a small number of VOCs.

The polyurethane segment is expected to be the fastest-growing segment, by resin type, in the decorative coatings market during the forecast period.

Polyurethane resins are made from reacting polyalcohol and organic di-isocyanate. Polyurethane resin paints possess properties such as high durability, toughness, and high gloss and are easy to clean. Owing to these properties, polyurethane resin paints are used in various applications worldwide. Polyurethane resin is a polymer material that is often used in decorative coatings. This resin can provide a variety of benefits, including durability, abrasion resistance, and scratch resistance. It can also provide UV protection, which can help to protect the surface from fading. Because of these benefits, polyurethane resin is often used in both exterior and interior coatings. Popular uses for polyurethane resin in decorative coatings include deck flooring, window frames, and wall panels. Polyurethane resin can also be used in a variety of colorants to create a variety of colors and textures.

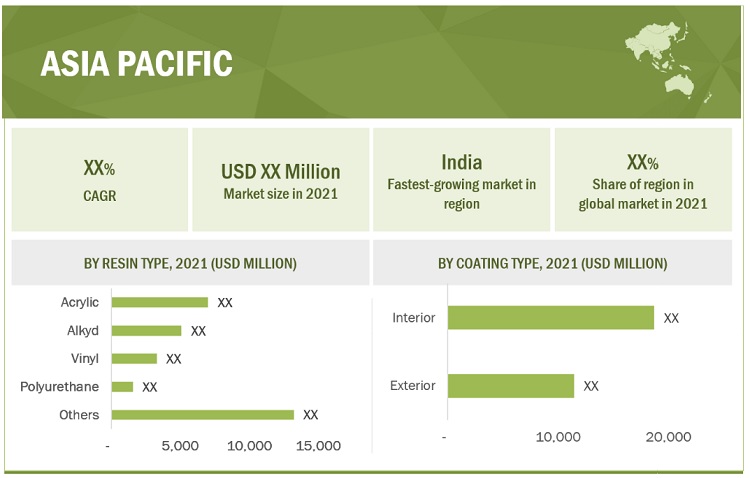

The decorative coatings market in Asia Pacific is expected to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is a fast expanding market with several potential for industry participants. The majority of the major companies in North America and Europe intend to relocate their manufacturing bases to this area because to the availability of low-cost raw materials, cheap production costs, and the desire to better service local customers. The region's desire for luxury items is expanding as the middle-class population grows. Government measures are also assisting the building and construction industry's expansion. These factors are projected to have a significant impact on the decorative coatings industry.

According to the IMF, the Russia-Ukraine war has had a broad impact on the Asian economy in terms of trade and financial market uncertainty, as well as inflation, and the risk of fragmentation in the area is substantial. Falling foreign demand is one of its significant effects on Asia. The second focuses on food and commodity costs, which have risen dramatically since the conflict. The epidemic has already harmed the Asian economy, which has further exacerbated in the setting of conflict and caused economic uncertainty. Conflicts in commerce between many nations existed prior to the epidemic and war, particularly between China and the United States. As a result, trade concerns have grown dramatically.

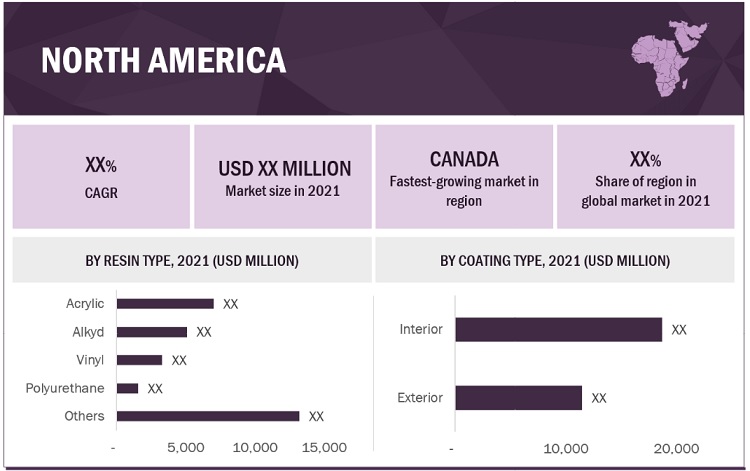

North America shows tremendous growth during the forecast period.

The decorative coatings market in North America, comprising the US, Mexico, and Canada, accounted for a share of 20.6%, in terms of value, of the global market in 2021. However, it is highly regulated by the Environment Protection Agency (EPA), which is expected to reduce the market for the solvent-borne technology segment as it emits VOCs during the formulation and coating stage. Technological advancements in the manufacturing sector are driving the market in this region. The US accounted for the largest share of the North American decorative coatings market in 2021.

Most of the leading decorative coating manufacturers, such as PPG Industries, Inc., the Sherwin-Williams Company, Masco Corporation, and RPM International Inc., are present in this region.

Decorative Coatings Market Players

The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), BASF Coating GMBH (Germany), Jotun A/s (Norway), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), RPM International, Inc (US), Masco Corporation (US) are the key players operating in the global market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Decorative Coatings Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Resin Type, Technology, Coating Type, Color Type, Product Type, User Type, Application, And Region |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

The Sherwin-Williams Company (US), PPG Industries, Inc (US), AkzoNobel N.V. (The Netherlands), BASF Coating GMBH (Germany), Jotun A/s (Norway), Asian Paints Limited (India), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), RPM International, Inc (US), Masco Corporation (US) |

This research report categorizes the decorative coatings market based on resin type, technology, coating type, color type, product type, user type, application, and region.

Based on resin type, the decorative coatings market has been segmented as follows:

- Acrylic

- Alkyd

- Vinyl

- Polyurethane

- Others

Based on technology, the decorative coatings market has been segmented as follows:

- Waterborne

- Solventborne

- Powder coatings

Based on application, the decorative coatings market has been segmented as follows:

-

Residential

- New construction

- Remodel and repaint

-

Non-residential

- Commercial

- Industrial

- Infrastructure

Based on coating type, the decorative coatings market has been segmented as follows:

- Interior

- Exterior

Based on user type, the decorative coatings market has been segmented as follows:

- DIY

- Professional

Based on color type, the decorative coatings market has been segmented as follows:

- White

- Others

Based on product type, the decorative coatings market has been segmented as follows:

- Emulsions

-

Wood Coatings

- Varnishes

- Stains

- Enamels

- Others

Based on the region, the decorative coating market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2021, AkzoNobel N.V. expanded its business in South and Central America after reaching an agreement to acquire Colombia- based paints and coatings company Grupo Orbis. Grupo Orbis is present in 10 countries in South America and Central America and The Antilles. This is a grow & deliver strategy.

- In June 2021, PPG acquired Tikkurila. This is expected to help the company to expand paint and coating options that are expected to now include Tikkurila’s environment-friendly decorative products and high-quality industrial coatings.

- In June 2019, Jotun planned to invest about USD 80 million in its new factory in Vietnam. This new factory is expected to be its third plant operating in Vietnam and is also the largest single investment abroad by the company. The company has completed the construction of its new water-based and powder coatings factory, which is expected to commence operations in the Hiep Phuoc Industrial Park, Ho Chi Minh City.

Frequently Asked Questions (FAQ):

Does this report cover the different resin type of decorative coatings market?

Yes, the report covers the different resin type of decorative coatings.

Does this report covers different technologies of decorative coatings?

Yes the report covers different technologies of decorative coatings.

Does report covers the volume tables in addition to value tables?

Yes, the report covers the market both in terms of volume as well as value.

What is the current competitive landscape in the decorative coatings market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of construction industry- Environment-friendly coating systems- Durable coatings with better performance and aestheticsRESTRAINTS- Stringent regulatory policies and time-consuming approvalsOPPORTUNITIES- Growth potential in less-regulated economies- Investments in emerging marketsCHALLENGES- Adoption of new technologies- Volatility in prices of titanium dioxide

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

-

5.5 KEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 MACRO INDICATOR ANALYSISINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

-

5.7 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHRUSSIA–UKRAINE WARCHINA- China’s debt problem- Australia-China trade war- Environmental commitmentsEUROPE- Energy crisis in Europe

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PRICING ANALYSIS

-

5.10 PAINTS & COATINGS XECOSYSTEM AND INTERCONNECTED MARKET

- 5.11 YC AND YCC SHIFT

- 5.12 TRADE ANALYSIS

-

5.13 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

- 5.14 CASE STUDY ANALYSIS

- 5.15 TECHNOLOGY ANALYSIS

- 5.16 KEY CONFERENCES AND EVENTS IN 2023

-

5.17 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 WATERBORNE DECORATIVE COATINGSENVIRONMENTALLY FRIENDLY AND LOW CLEARCOAT REQUIREMENTS TO DRIVE MARKET

-

6.3 SOLVENTBORNE DECORATIVE COATINGSHIGHER DURABILITY AND LOW SENSITIVITY TO BASE UNDERNEATH TO DRIVE MARKET

-

6.4 POWDER COATINGSENDURING ABRASION AND CORROSION RESISTANCE PROPERTIES TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 ACRYLIC RESINFLEXIBILITY PROPERTY OF ACRYLIC RESIN TO DRIVE SEGMENT

-

7.3 ALKYD RESINASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET

-

7.4 POLYURETHANE RESINEXCELLENT COMBINATION OF PROPERTIES TO DRIVE MARKET

-

7.5 VINYL RESINWIDELY USED RESIN DUE TO SUPERIOR TOUGHNESS AND WATER & CHEMICAL RESISTANCE

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 INTERIORRISE IN REMODELING AND RENOVATION ACTIVITIES TO DRIVE DEMAND

-

8.3 EXTERIORWEATHER RESISTANCE, DURABILITY, AND RESISTANCE TO PHYSICAL DAMAGE TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 DIYCOST CONSTRAINTS, CREATIVE CONTROL, AND FORCED LOCKDOWN INFLUENCED HOMEOWNERS TO OPT FOR DIY PAINTING

-

9.3 PROFESSIONALINCREASE IN SPENDING POWER OF CONSUMERS TO SUPPORT MARKET GROWTH

- 10.1 INTRODUCTION

-

10.2 EMULSIONSFASTER DRYING AND LOW VOC EMISSION PROPERTIES TO DRIVE DEMAND

-

10.3 WOOD COATINGSEXPANSION OF HOUSING MARKET TO DRIVE DEMANDVARNISHES- Superior durability, resistance to UV radiation, and improved aesthetics to drive marketSTAINS- ease of use, quick cleaning, and availability in wide range of colors to drive demand

-

10.4 ENAMELSPROTECTION FROM CORROSION AND INCREASE IN AESTHETIC APPEARANCE OF MATERIALS TO DRIVE DEMAND

- 10.5 OTHERS

- 11.1 INTRODUCTION

-

11.2 RESIDENTIALNEW CONSTRUCTION- Energy efficiency and lower maintenance costs to drive demandREMODEL AND REPAINT- Need for increased life span of structure to drive demand

-

11.3 NON-RESIDENTIALCOMMERCIAL- Rise in private sector investments and increasing commercial office spaces to drive demandINDUSTRIAL- Resurgence in industrial sector to drive decorative coatings demandINFRASTRUCTURE- Need for better development in emerging countries to create opportunities for manufacturers

- 12.1 INTRODUCTION

-

12.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Foreign investment to drive marketINDIA- Boom in real estate industry to drive marketJAPAN- Investments by government in commercial and reconstruction of buildings to boost demandINDONESIA- Continuous growth supported by government, foreign investments, and private sectorTHAILAND- Increasing customer awareness about aesthetics and functionalities of decorative coating productsREST OF ASIA PACIFIC

-

12.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Increase in private residential and non-residential construction to boost marketCANADA- Residential construction to be major contributor to growth of marketMEXICO- New construction in residential segment to drive market

-

12.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Implementation of stringent environmental regulations to increase production of decorative coatingsRUSSIA- Growing population leading to rise in application of decorative coatingsUK- Growing construction sector to boost demandFRANCE- Development of affordable houses and renewable energy infrastructure to drive demandITALY- New project finance rules and investment policies in construction sector to support market growthSPAIN- Government investments in infrastructure, housing units, and other infrastructures to boost marketTURKEY- Rapid urbanization, rising middle-class population, and increasing purchasing power to drive demandREST OF EUROPE

-

12.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Mega housing projects to boost demandSOUTH AFRICA- Substantial demand for decorative coatings witnessed in building projectsEGYPT- New business and residential projects under construction to drive demandREST OF MIDDLE EAST & AFRICA

-

12.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Rising homeownership and living standards and easier credit availability to fuel demandARGENTINA- Increase in population and improved economic conditions to drive demandREST OF SOUTH AMERICA

- 13.1 OVERVIEW

-

13.2 COMPETITIVE LEADERSHIP MAPPING, 2021STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

13.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021RESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 13.4 STRENGTH OF PRODUCT PORTFOLIO

- 13.5 BUSINESS STRATEGY EXCELLENCE

- 13.6 COMPETITIVE BENCHMARKING

- 13.7 MARKET SHARE ANALYSIS

- 13.8 MARKET RANKING ANALYSIS

- 13.9 REVENUE ANALYSIS

-

13.10 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 13.11 STRATEGIC DEVELOPMENTS

-

14.1 MAJOR PLAYERSSHERWIN-WILLIAMS COMPANY- Business overview- Products offered- Recent developments- MnM viewPPG INDUSTRIES, INC- Business overview- Products offered- Recent developments- MnM viewAKZONOBEL N.V.- Business overview- Products offered- Recent developments- MnM viewBASF COATING GMBH- Business overview- Products offered- Recent developments- MnM viewJOTUN A/S- Business overview- Products offered- Recent developments- MnM viewASIAN PAINTS LIMITED- Business overview- Products offered- Recent developments- MnM viewKANSAI PAINT CO., LTD.- Business overview- Products offered- Recent developments- MnM viewNIPPON PAINT HOLDINGS CO., LTD.- Business overview- Products offered- Recent developments- MnM viewRPM INTERNATIONAL, INC.- Business overview- Products offered- Recent developments- MnM viewMASCO CORPORATION- Business overview- Products offered- MnM view

-

14.2 OTHER COMPANIESHEMPEL A/S- HEMPEL A/S: Company overview- Products offered- Recent developmentsDAW SE- DAW SE: Company overview- Products offered- Recent developmentsCROMOLOGY (FORMERLY MATERIS PAINTS)- CROMOLOGY: Company overview- Products offeredDIAMOND VOGEL PAINT COMPANY- DIAMOND VOGEL PAINT COMPANY: Company overview- Products offeredKELLY-MOORE PAINTS- KELLY-MOORE: Company overview- Products offeredBERGER PAINTS INDIA LIMITED- BERGER PAINTS INDIA LIMITED: Company overview- Products offeredSHALIMAR PAINTS- SHALIMAR PAINTS: Company overview- Products offeredBENJAMIN MOORE & CO- BENJAMIN MOORE & CO: Company overview- Products offeredBRILLUX GMBH & CO. KG- BRILLUX GMBH & CO. KG: Company overview- Products offeredCARPOLY CHEMICAL GROUP CO.,- CARPOLY CHEMICAL GROUP CO., LTD: Company overview- Products offeredCLOVERDALE PAINT INC- CLOVERDALE PAINT INC: Company overview- Products offeredSTO CORP- STO CORP: Company overview- Products offeredLANCO PAINTS- LANCO PAINTS: Company overview- Products offeredGUANGDONG MAYDOS BUILDING MATERIALS CO., LTD- GUANGDONG MAYDOS BUILDING MATERIALS CO., LTD: Company overview- Products offeredFUJIKURA KASEI CO., LTD- FUJIKURA KASEI CO., LTD: Company overview- Products offered

- 15.1 INTRODUCTION

- 15.2 PAINTS & COATINGS MARKET LIMITATIONS

- 15.3 PAINTS & COATINGS MARKET DEFINITION

- 15.4 PAINTS & COATINGS MARKET OVERVIEW

- 15.5 PAINTS & COATINGS MARKET ANALYSIS, BY TECHNOLOGY

- 15.6 PAINTS & COATINGS MARKET ANALYSIS, BY RESIN TYPE

- 15.7 PAINTS & COATINGS MARKET ANALYSIS, BY END-USE INDUSTRY

- 15.8 PAINTS & COATINGS MARKET ANALYSIS, BY REGION

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 DECORATIVE COATINGS MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 2 DECORATIVE COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR DECORATIVE COATINGS

- TABLE 5 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2020–2027

- TABLE 6 DECORATIVE COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 7 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 9 PATENT COUNT, BY COMPANY

- TABLE 10 DECORATIVE COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 16 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 17 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 18 DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 19 WATERBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 20 WATERBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 21 WATERBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 22 WATERBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 23 SOLVENTBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 24 SOLVENTBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 25 SOLVENTBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 26 SOLVENTBORNE: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 27 POWDER COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 28 POWDER COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 29 POWDER COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 30 POWDER COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 31 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 32 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 33 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 34 DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 35 PROPERTIES AND APPLICATIONS OF ACRYLIC PAINTS & COATINGS

- TABLE 36 ACRYLIC RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 37 ACRYLIC RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 38 ACRYLIC RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 39 ACRYLIC RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 40 ALKYD RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 41 ALKYD RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 42 ALKYD RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 43 ALKYD RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 44 POLYURETHANE RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 45 POLYURETHANE RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 46 POLYURETHANE RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 47 POLYURETHANE RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 48 VINYL RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 49 VINYL RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 50 VINYL RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 51 VINYL RESIN: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 52 OTHER RESINS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 53 OTHER RESINS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 54 OTHER RESINS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 55 OTHER RESINS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 56 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 57 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 58 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 59 DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 60 INTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 61 INTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 62 INTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 63 INTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 64 EXTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 65 EXTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 66 EXTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 67 EXTERIOR: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 68 DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 69 DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 70 DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 71 DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 72 DIY: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 73 DIY: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 74 DIY: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 75 DIY: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 76 PROFESSIONAL: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 77 PROFESSIONAL: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 78 PROFESSIONAL: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 79 PROFESSIONAL: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 80 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 81 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 82 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 83 DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 84 EMULSIONS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 85 EMULSIONS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 86 EMULSIONS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 87 EMULSIONS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 88 WOOD COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 89 WOOD COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 90 WOOD COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 91 WOOD COATINGS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 92 WOOD COATINGS (VARNISHES): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 93 WOOD COATINGS (VARNISHES): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 94 WOOD COATINGS (VARNISHES): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 95 WOOD COATINGS (VARNISHES): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 96 WOOD COATINGS (STAINS): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 97 WOOD COATINGS (STAINS): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 98 WOOD COATINGS (STAINS): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 99 WOOD COATINGS (STAINS): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 100 ENAMELS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 101 ENAMELS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 102 ENAMELS: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 103 ENAMELS: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 104 OTHER PRODUCT TYPE: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 105 OTHER PRODUCT TYPE: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 106 OTHER PRODUCT TYPE: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 107 OTHER PRODUCT TYPE: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 108 DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 109 DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 110 DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 111 DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 112 RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 113 RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 114 RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 115 RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 116 RESIDENTIAL (NEW CONSTRUCTION): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 117 RESIDENTIAL (NEW CONSTRUCTION): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 118 RESIDENTIAL (NEW CONSTRUCTION): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 119 RESIDENTIAL (NEW CONSTRUCTION): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 120 RESIDENTIAL (REMODEL AND REPAINT): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 121 RESIDENTIAL (REMODEL AND REPAINT): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 122 RESIDENTIAL (REMODEL AND REPAINT): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 123 RESIDENTIAL (REMODEL AND REPAINT): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 124 NON-RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 125 NON-RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 126 NON-RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 127 NON-RESIDENTIAL: DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 128 NON-RESIDENTIAL (COMMERCIAL): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 129 NON-RESIDENTIAL (COMMERCIAL): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 130 NON-RESIDENTIAL (COMMERCIAL): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 131 NON-RESIDENTIAL (COMMERCIAL): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 132 NON-RESIDENTIAL (INDUSTRIAL): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 133 NON-RESIDENTIAL (INDUSTRIAL): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 134 NON-RESIDENTIAL (INDUSTRIAL): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 135 NON-RESIDENTIAL (INDUSTRIAL): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 136 NON-RESIDENTIAL (INFRASTRUCTURE): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 137 NON-RESIDENTIAL (INFRASTRUCTURE): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 138 NON-RESIDENTIAL (INFRASTRUCTURE): DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 139 NON-RESIDENTIAL (INFRASTRUCTURE): DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 140 DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 141 DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 142 DECORATIVE COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 143 DECORATIVE COATINGS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 144 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 147 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 148 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 151 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 152 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 155 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 156 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 159 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 160 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 163 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 164 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 167 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 168 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (USD MILLION)

- TABLE 170 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (KILOTON)

- TABLE 171 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (KILOTON)

- TABLE 172 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 173 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 174 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 175 ASIA PACIFIC: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 176 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 177 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 178 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 179 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 180 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 181 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 182 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 183 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 184 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 185 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 186 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 187 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 188 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 189 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 190 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 191 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 192 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 193 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 194 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 195 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 196 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 197 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 198 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 199 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 200 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (USD MILLION)

- TABLE 201 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (USD MILLION)

- TABLE 202 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (KILOTON)

- TABLE 203 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (KILOTON)

- TABLE 204 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 205 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 206 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 207 NORTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 208 EUROPE: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 209 EUROPE: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 210 EUROPE: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 211 EUROPE: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 212 EUROPE: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 213 EUROPE: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 214 EUROPE: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 215 EUROPE: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 216 EUROPE: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 217 EUROPE: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 218 EUROPE: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 219 EUROPE: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 220 EUROPE: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 221 EUROPE: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 222 EUROPE: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 223 EUROPE: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 224 EUROPE: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 225 EUROPE: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 226 EUROPE: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 227 EUROPE: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 228 EUROPE: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 229 EUROPE: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 230 EUROPE: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 231 EUROPE: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 232 EUROPE: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (USD MILLION)

- TABLE 233 EUROPE: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (USD MILLION)

- TABLE 234 EUROPE: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (KILOTON)

- TABLE 235 EUROPE: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (KILOTON)

- TABLE 236 EUROPE: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 237 EUROPE: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 238 EUROPE: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 239 EUROPE: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 240 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 243 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 247 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 248 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 251 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 252 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 255 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 259 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 260 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 263 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 264 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (KILOTON)

- TABLE 267 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (KILOTON)

- TABLE 268 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 271 MIDDLE EAST & AFRICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 272 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 273 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 274 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 275 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 276 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 277 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 278 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 279 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 280 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 281 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 282 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 283 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 284 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 285 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 286 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 287 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 288 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (USD MILLION)

- TABLE 289 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (USD MILLION)

- TABLE 290 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2017–2020 (KILOTON)

- TABLE 291 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021–2027 (KILOTON)

- TABLE 292 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (USD MILLION)

- TABLE 293 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (USD MILLION)

- TABLE 294 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2017–2020 (KILOTON)

- TABLE 295 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY USER TYPE, 2021–2027 (KILOTON)

- TABLE 296 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (USD MILLION)

- TABLE 297 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (USD MILLION)

- TABLE 298 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2017–2020 (KILOTON)

- TABLE 299 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY COLOR TYPE, 2021–2027 (KILOTON)

- TABLE 300 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

- TABLE 301 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

- TABLE 302 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2017–2020 (KILOTON)

- TABLE 303 SOUTH AMERICA: DECORATIVE COATINGS MARKET, BY PRODUCT TYPE, 2021–2027 (KILOTON)

- TABLE 304 OVERVIEW OF STRATEGIES ADOPTED BY KEY DECORATIVE COATINGS PLAYERS (2016–2022)

- TABLE 305 DECORATIVE COATINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 306 DECORATIVE COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 307 COMPANY EVALUATION MATRIX: DECORATIVE COATINGS

- TABLE 308 DECORATIVE COATINGS MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2021

- TABLE 309 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 310 HIGHEST ADOPTED STRATEGIES

- TABLE 311 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 312 COMPANY INDUSTRY FOOTPRINT

- TABLE 313 COMPANY REGION FOOTPRINT

- TABLE 314 COMPANY FOOTPRINT

- TABLE 315 DECORATIVE COATINGS MARKET: PRODUCT LAUNCHES, 2016–2022

- TABLE 316 DECORATIVE COATINGS MARKET: DEALS, 2016–2022

- TABLE 317 DECORATIVE COATINGS MARKET: OTHERS, 2016–2022

- TABLE 318 SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 319 SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 320 SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 321 PPG INDUSTRIES, INC: COMPANY OVERVIEW

- TABLE 322 PPG INDUSTRIES, INC: PRODUCT LAUNCHES

- TABLE 323 PPG INDUSTRIES: DEALS

- TABLE 324 PPG INDUSTRIES, INC: OTHERS

- TABLE 325 AKZONOBEL N.V.: BUSINESS OVERVIEW

- TABLE 326 AKZONOBEL N.V.: PRODUCT LAUNCHES

- TABLE 327 AKZONOBEL N.V.: DEALS

- TABLE 328 BASF COATING GMBH: BUSINESS OVERVIEW

- TABLE 329 BASF COATINGS GMBH: PRODUCT LAUNCHES

- TABLE 330 BASF SE: OTHERS

- TABLE 331 JOTUN A/S: COMPANY OVERVIEW

- TABLE 332 JOTUN A/S: DEALS

- TABLE 333 ASIAN PAINTS LIMITED: COMPANY OVERVIEW

- TABLE 334 ASIAN PAINTS LIMITED: PRODUCT LAUNCHES

- TABLE 335 ASIAN PAINTS LIMITED: DEALS

- TABLE 336 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 337 KANSAI PAINT CO., LTD.: PRODUCT LAUNCHES

- TABLE 338 KANSAI PAINTS CO., LTD.: DEALS

- TABLE 339 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 340 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 341 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

- TABLE 342 RPM INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 343 RPM INTERNATIONAL, INC: DEALS

- TABLE 344 MASCO CORPORATION: COMPANY OVERVIEW

- TABLE 345 HEMPEL A/S: DEALS

- TABLE 346 DAW SE: DEALS

- TABLE 347 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 348 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 349 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 350 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 351 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 352 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 353 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 354 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 355 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 356 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 357 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 358 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 359 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 360 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 361 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 362 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 363 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 364 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

- TABLE 365 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 366 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

- TABLE 367 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 368 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 369 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 370 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (KILOTON)

- FIGURE 1 DECORATIVE COATINGS MARKET SEGMENTATION

- FIGURE 2 DECORATIVE COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DECORATIVE COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 DECORATIVE COATINGS MARKET, BY RESIN TYPE

- FIGURE 8 DECORATIVE COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF DECORATIVE COATINGS MARKET

- FIGURE 10 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON DECORATIVE COATINGS MARKET

- FIGURE 11 DECORATIVE COATINGS MARKET: DATA TRIANGULATION

- FIGURE 12 ACRYLIC RESIN TO ACCOUNT FOR LARGEST SHARE OF DECORATIVE COATINGS MARKET

- FIGURE 13 WATERBORNE TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE

- FIGURE 14 RESIDENTIAL SEGMENT TO BE LARGER APPLICATION OF DECORATIVE COATINGS

- FIGURE 15 ASIA PACIFIC LED DECORATIVE COATINGS MARKET IN 2021

- FIGURE 16 DECORATIVE COATINGS MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 17 POLYURETHANE TO BE FASTEST-GROWING SEGMENT BETWEEN 2022 AND 2027

- FIGURE 18 EMERGING ECONOMIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 ACRYLIC RESIN SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

- FIGURE 20 INDIA TO EMERGE AS LUCRATIVE MARKET FOR DECORATIVE COATINGS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DECORATIVE COATINGS MARKET

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS OF DECORATIVE COATINGS MARKET

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR DECORATIVE COATINGS

- FIGURE 25 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 26 DECORATIVE COATINGS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN DECORATIVE COATINGS MARKET, BY REGION, 2021

- FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN DECORATIVE COATINGS MARKET, BY TECHNOLOGY, 2021

- FIGURE 29 AVERAGE PRICE COMPETITIVENESS IN DECORATIVE COATINGS MARKET, BY RESIN TYPE, 2021

- FIGURE 30 AVERAGE PRICE COMPETITIVENESS IN DECORATIVE COATINGS MARKET, BY COATING TYPE, 2021

- FIGURE 31 AVERAGE PRICE COMPETITIVENESS IN DECORATIVE COATINGS MARKET, BY COMPANY, 2022

- FIGURE 32 PAINTS & COATINGS ECOSYSTEM

- FIGURE 33 NUMBER OF PATENTS PUBLISHED, 2017–2022

- FIGURE 34 PATENTS PUBLISHED BY JURISDICTION, 2017–2022

- FIGURE 35 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2015–2021

- FIGURE 36 WATERBORNE COATINGS TO BE LARGEST TECHNOLOGY SEGMENT DURING FORECAST PERIOD

- FIGURE 37 ACRYLIC TO REMAIN LARGEST RESIN TYPE FOR DECORATIVE COATINGS DURING FORECAST PERIOD

- FIGURE 38 INTERIOR SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 39 PROFESSIONAL SEGMENT TO ACCOUNT FOR LARGER SIZE OF OVERALL DECORATIVE COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 40 EMULSIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF OVERALL DECORATIVE COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 41 RESIDENTIAL SEGMENT TO DOMINATE OVERALL DECORATIVE COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 43 ASIA PACIFIC: DECORATIVE COATINGS MARKET SNAPSHOT

- FIGURE 44 NORTH AMERICA: DECORATIVE COATINGS MARKET SNAPSHOT

- FIGURE 45 EUROPE: DECORATIVE COATINGS MARKET SNAPSHOT

- FIGURE 46 SAUDI ARABIA TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 47 BRAZIL TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 48 DECORATIVE COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 49 DECORATIVE COATINGS MARKET: EMERGING COMPANIES’ (SMES’) COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN DECORATIVE COATINGS MARKET

- FIGURE 51 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN DECORATIVE COATINGS MARKET

- FIGURE 52 MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 53 MARKET RANKING ANALYSIS, 2021

- FIGURE 54 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

- FIGURE 55 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 56 PPG INDUSTRIES, INC: COMPANY SNAPSHOT

- FIGURE 57 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 58 BASF COATING GMBH: COMPANY SNAPSHOT

- FIGURE 59 JOTUN A/S: COMPANY SNAPSHOT

- FIGURE 60 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

- FIGURE 61 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 RPM INTERNATIONAL, INC: COMPANY SNAPSHOT

- FIGURE 64 MASCO CORPORATION: COMPANY SNAPSHOT

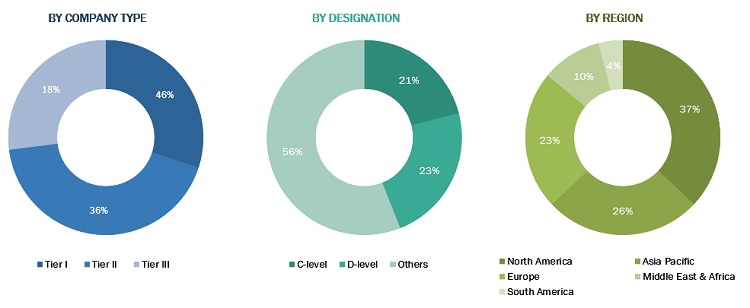

The study involved four major activities in estimating the current market size of decorative coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the decorative coatings market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The decorative coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the construction industry and its end uses such as residential and non-residential. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = <USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size included the following steps:

- The key players in the market were identified in the respective regions through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined through secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from the MarketsandMarkets data repository and presented in this report .

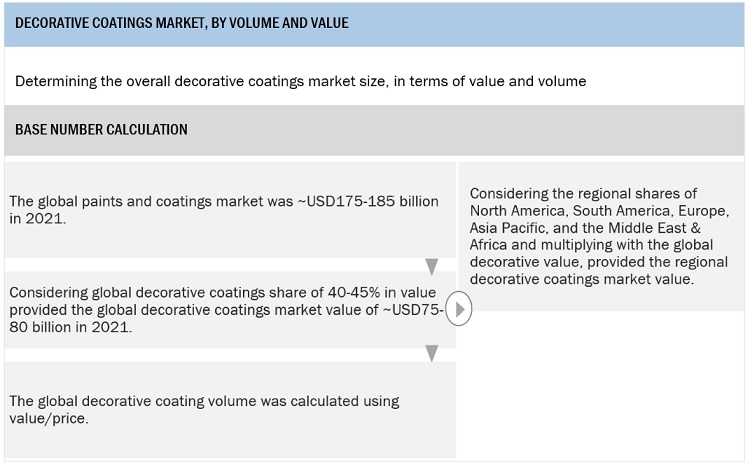

Global Decorative Coatings Market: Top-Down Approach

Source: Secondary Research, and Interviews with Experts

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data has been assumed to be correct.

Report Objectives

- To analyze and forecast the size of the decorative coatings market in terms of value

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market and its submarkets

- To define, describe, and forecast the size of the market by resin type, technology, coating type, color type, product type, user type, application, and region

- To forecast the size of the market and its submarkets with respect to five regions (along with their major countries), namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To strategically analyze each micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments and provide a competitive landscape of market leaders

- To track and analyze competitive developments such as new product launches, mergers & acquisitions, investment & expansions, and joint ventures in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Decorative Coatings Market