Top 10 SDx and Networking Technologies (SDN & NFV, Software-Defined WAN, V-CPE, Wi-Fi-as-a-Service, Software-Defined Storage, Software-Defined Security, CDN, Software-Defined Data Center, Network Analytics, Unified Network Management)

[231 Pages Report] The top 10 Software-Defined Everything (SDx) and networking technologies market is expected to grow at a significant rate during the forecast period.

The objectives of the study are as follows:

- To define, describe, and forecast the market for Top 10 SDx and networking technologies: Software-Defined Networking (SDN) & Network Function Virtualization (NFV), software-defined Wide Area Network (WAN), Virtual Customer Premises Equipment (V-CPE), Wi-Fi-as-a-service, Software-Defined Storage (SDS), software-defined security, Content Delivery Network (CDN), software-defined data center, network analytics, and unified network management on the basis of various parameters

- To forecast the market size for various technologies with respect to the five main regions, namely, North America , Europe, Asia-Pacific (APAC), Middle East & Africa, and Latin America

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and Research & Developments (R&D) carried out in the top 10 SDx and networking technologies market

The research methodology used to estimate and forecast the top 10 SDx and networking technologies market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources referred to for this research study include information from various journals and databases, such as IEEE journals, Factiva, Hoovers, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the top 10 SDx and networking technologies market from the revenues of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews of people holding key positions in the industry, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The major players in the market for Top 10 SDx and networking technologies include IBM Corporation, Cisco Systems, Juniper Networks, Hewlett Packard Enterprise, Dell, Fujitsu Limited, Citrix Systems, Brocade Communications, NEC Corporation, and Versa Networks. The end-users of these mobility technologies are from the consumer, entertainment, industrial, automotive, military, defense, aviation, and others.

The Target Audience:

- Telecommunication providers

- Marketers and consumers

- System integrators

- Smartphone companies

- Network service providers

- Distributors and resellers

- Component providers

- Hardware manufacturers

- Software providers

- Government councils

The study answers several questions for the target audiences, primarily which market segments to focus on in the next two to five years for prioritizing their efforts and investments.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

In this report, the top 10 SDx and networking technologies market has been segmented into the following categories:

Software-defined networking and network Function Virtualization

- By solution

- By service

- By end-user

- By vertical

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Software-Defined Wide Area Network

- By component

- By service

- By vertical

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Virtual Customer Premises Equipment

- By component

- By application area

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Wi-Fi-as-a-Service

- By service type

- By user location

- By vertical

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Software-Defined Storage

- By component

- By usage

- By application area

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Software-Defined Security

- By enforcement type

- By component

- By end-user

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Content Delivery Network

- By type

- By core solution

- By adjacent service

- By service provider

- By vertical

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Software-Defined Data Center

- By component

- By data center type

- By vertical

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Network Analytics

- By type

- By end-user

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Unified Network Management

- By network type

- By solution

- By service

- By industry

- Geographic analysis (North America, APAC, Europe, MEA, and Latin America)

Company Profiles: Detailed analysis of the major companies present in the top 10 SDx and networking technologies market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

The top 10 Software-Defined Everything (SDx) and networking technologies market is expected to grow at a significant rate during the forecast period. The growth of this market is propelled by the advent of Internet of Things (IoT) & proliferation of massive amount of data through connected devices, increasing focus on competitive insights, need for increased business agility & scalability, and growing volume & variety of business data across industry verticals. This report categorizes the top 10 SDx and networking technologies market by software, service, application, end-user, and region.

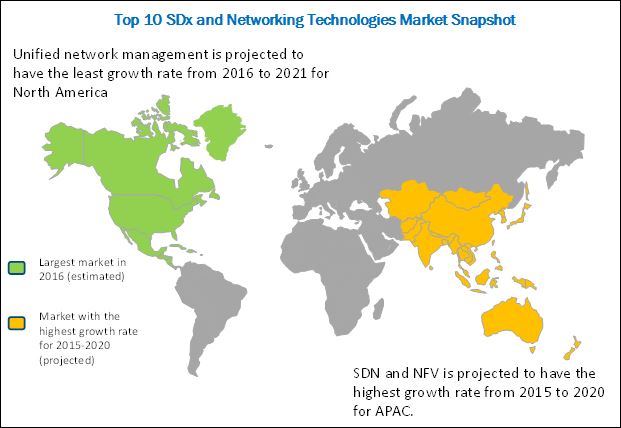

The market for Software-Defined Networking (SDN) and Network Function Virtualization (NFV) is expected to grow at the highest rate during the forecast period. SDN and NFV are evolving as promising networking technologies and are poised to redefine networking with an innovative approach of separating the data plane from the control plane, a lucid improvisation to the traditionally distributed control planes. The market for SDN is expected to evolve gradually from being a standards-driven one to becoming a function of software development, which would ultimately revolutionize network utilization. Over the next five years, SDN is expected to become highly pervasive, ubiquitous across telecom networks, and penetrating into enterprise networks. The major forces driving the market are factors, such as network expansion, telco Operating Expenditure (OPEX) savings, and mobility, which are likely to positively impact the SDN market. At the same time, opportunities in controller applications and Value-Added Reseller (VAR) products are expected to benefit the growth in this market.

Software-Defined Wide Area Network (SD-WAN) is another analytics technology that promises huge opportunities for diverse business applications in the current era. The increased adoption of WAN-based technologies for various functions by consumers across the world has resulted in a steep increase in the demand for seamless bandwidth within enterprises. Many enterprises also need a dependable high-performing network to access vital data stored in public, private, or hybrid cloud. To reduce the bottlenecks in network connections, many WAN service providers install SD-WAN solutions in the available network connections, thereby improving the network efficiency and capacity. SD-WAN improves the Quality of Service (QoS) provided by the Communication Service Providers (CSPs), thereby improving the revenue margins of service providers.

In 2015, North America accounted for the largest share of the top 10 SDx and networking technologies market. In addition, the presence of major industries and advancement in latest technologies are the factors that drive the demand for SDx and networking technologies in this region. Europe accounted for the second-largest share of the top 10 SDx and networking technologies market, while Asia-Pacific (APAC) is expected to have the highest growth rate in the top 10 SDx and networking technologies market.

This report describes the drivers and restraints pertaining to each technology in the top 10 SDx and networking technologies market. In addition, it analyzes the current scenario and forecasts the market size till 2020/2021.

The major players in the market for top 10 SDx and networking s technologies include IBM Corporation (U.S.), Cisco Systems (U.S.), Juniper Networks (U.S.), Hewlett Packard Enterprise (U.S.), Dell Technologies Inc. (U.S.), Fujitsu Limited (Japan), Citrix Systems (U.S.), Brocade Communications (U.S.), NEC Corporation (Japan) and Versa Networks (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Market Definition

1.1.1 Software-Defined Networking and Network Fuction Virtualization

1.1.2 Software-Defined Wide Area Network

1.1.3 Virtual Customer Premises Equipement

1.1.4 Wi-Fi-as-a-Service

1.1.5 Software-Defined Storage

1.1.6 Unified Network Management

1.1.7 Software-Defined Security

1.1.8 Content Delivery Netowrk

1.1.9 Software-Defined Data Center

1.1.10 Network Analytics

1.2 Currency

1.3 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Market Size Estimation

2.3 Research Assumptions

3 Software-Defined Networking and Network Function Virtualization (Page No. - 25)

3.1 Executive Summary

3.2 Market Dynamics

3.2.1 Introduction

3.2.2 Drivers and Restraints

3.3 Industry Trends

3.3.1 Introduction

3.3.2 SDN Ecosystem

3.3.3 Standards and Regulations

3.3.4 Business Model

3.3.5 SDN-Adoption Factors

3.4 SDN and NFV Market Analysis, By Solution

3.5 SDN and NFV Market Analysis, By Service

3.6 SDN and NFV Market Analysis, By End-User

3.7 SDN and NFV Market Analysis, By Vertical

3.8 Geographic Analysis

4 Software-Defined Wide Area Network (Page No. - 51)

4.1 Executive Summary

4.2 Market Dynamics

4.2.1 Introduction

4.2.2 Drivers and Restraints

4.3 Industry Trends

4.3.1 Introduction

4.4 SD-WAN Market Analysis, By Component

4.5 SD-WAN Market Analysis, By Service

4.6 SD-WAN Market Analysis, By Vertical

4.7 Geographic Analysis

5 Virtual Customer Premises Equipment (V-CPE) (Page No. - 65)

5.1 Executive Summary

5.2 Market Dynamics

5.2.1 Introduction

5.2.2 Drivers and Restraints

5.3 Industry Trends

5.3.1 Introduction

5.3.2 Comparison Between Virtual Customer Premises Equipment and Traditional Customer Premises Equipment

5.3.3 Virtual Customer Premises Equipment Potential Solution Approaches

5.3.4 Standards

5.4 Virtual Customer Premise Equipment Market Analysis, By Component

5.5 Virtual Customer Premise Equipment Market Analysis, By Application Area

5.6 Geographic Analysis

6 Wi-Fi-as-a-Service (Page No. - 81)

6.1 Executive Summary

6.2 Market Dynamics

6.2.1 Introduction

6.2.2 Drivers and Restraints

6.3 Industry Trends

6.3.1 Introduction

6.3.2 Value Chain Analysis

6.4 Wi-Fi-as-a-Service Market Analysis By, Service Type

6.5 Wi-Fi-as-a-Service Market Analysis By, User Location

6.6 Wi-Fi-as-a-Service Market Analysis, By Vertical

6.7 Geographic Analysis

7 Software-Defined Storage Market (SDS) (Page No. - 95)

7.1 Executive Summary

7.2 Market Dynamic

7.2.1 Introduction

7.2.2 Drivers and Restraints

7.3 Industry Trends

7.3.1 Introduction

7.3.2 Software-Defined Storage Market Value Chain

7.3.3 Standards and Regulations

7.4 Software-Defined Storage Market Analysis, By Component

7.5 Software-Defined Storage Market Analysis, By Usage

7.6 Software-Defined Storage Market Analysis, By Application Area

7.7 Geographic Analysis

8 Software-Defined Security Market (Page No. - 114)

8.1 Executive Summary

8.2 Market Dynamics

8.2.1 Introduction

8.2.2 Drivers and Restraints

8.3 Industry Trends

8.3.1 Introduction

8.3.2 Pillars of Software-Defined Security

8.3.3 Architecture of Software-Defined Security Model

8.4 Software-Defined Security Market Analysis, By Enforcement Point

8.5 Software-Defined Security Market Analysis, By Component

8.6 Software-Defined Security Market Analysis, By End-User

8.7 Geographic Analysis

9 Content Delivery Network (Page No. - 130)

9.1 Executive Summary

9.2 Market Overview

9.2.1 Introduction

9.2.2 Drivers and Restraints

9.2.3 Content Delivery Network: Key Concepts

9.3 Content Delivery Network Market Analysis, By Type

9.4 Content Delivery Network Market Analysis, By Core Solution

9.5 Content Delivery Network Market Analysis, By Adjacent Service

9.6 Global Content Delivery Network Market Analysis, By Service Provider

9.7 Content Delivery Network Market Analysis, By Vertical

9.8 Geographic Analysis

10 Software-Defined Data Center (Page No. - 149)

10.1 Executive Summary

10.2 Market Dynamics

10.2.1 Introduction

10.2.2 Drivers and Restraints

10.3 Industry Trends

10.3.1 Introduction

10.3.2 Value Chain Analysis

10.3.3 Technology and Standards

10.4 Software-Defined Data Center Market Analysis, By Component

10.5 Software-Defined Data Center Market Analysis, By Data Center Type

10.6 Software-Defined Data Center Market Analysis, By Vertical

10.7 Geogrpahic Analysis

11 Network Analytics (Page No. - 163)

11.1 Executive Summary

11.2 Market Dynamics

11.2.1 Drivers and Restraints

11.2.2 Demand Overview

11.2.3 Network Intelligence Need, Best Practices, and Certification

11.3 Network Analytics Market Analysis, By Type

11.4 Network Analytics Market Analysis, By End-User

11.5 Geographical Analysis

12 Unified Network Management (Page No. - 176)

12.1 Executive Summary

12.2 Market Dynamics

12.2.1 Introduction

12.2.2 Drivers and Restraints

12.3 Industry Trends

12.3.1 Introduction

12.3.2 Value Chain Analysis

12.3.3 Current Trends in the Unified Network Management Market

12.4 Unified Network Management Market Analysis, By Network Type

12.5 Unified Network Management Market Analysis, By Solution

12.6 Unified Network Management Market Analysis, By Service

12.7 Unified Network Management Market Analysis, By Industry

12.8 Geographic Analysis

13 Company Profiles (Page No. - 191)

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.1 International Business Machines Corporation

13.2 Cisco Systems, Inc.

13.3 Juniper Networks, Inc.

13.4 Hewlett Packard Enterprise Development LP

13.5 Dell

13.6 Fujitsu Limited

13.7 Citrix Systems, Inc.

13.8 Brocade Communications System Inc.

13.9 NEC Corporation

13.10 Versa Networks

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 228)

14.1 Knowledge Store: Marketsandmarkets Subscription Portal

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customization

14.4 Author Details

List of Tables (62 Tables)

Table 1 Global SDN and NFV Market Size, 20132020 (USD Million, Y-O-Y %)

Table 2 SDN and NFV Market Size, By Solution, 20132020 (USD Million)

Table 3 SDN and NFV Market Size, By Service, 20132020 (USD Million)

Table 4 SDN and NFV Market Size, By End-User, 20132020 (USD Million)

Table 5 SDN and NFV Market Size, By Vertical, 20132020 (USD Million)

Table 6 SDN and NFV Market Size, By Region, 20132020 (USD Million)

Table 7 SD-WAN Market Size and Growth Rate, 20142021 (USD Million, Y-O-Y %)

Table 8 SD-WAN Market Size, By Component, 20162021 (USD Million)

Table 9 SD-WAN Market Size, By Service, 20162021 (USD Million)

Table 10 SD-WAN Market Size, By Vertical, 20162021 (USD Million)

Table 11 SD-WAN Market Size, By Region, 20142021 (USD Million)

Table 12 Global Virtual Customer Premises Equipment Market Size, 20162021 (USD Billion, Y-O-Y %)

Table 13 Difference Between Virtual Customer Premises Equipment and Traditional Customer Premises Equipment

Table 14 Virtual Customer Premise Equipment Market Size, By Component, 20142021 (USD Million)

Table 15 Virtual Customer Premise Equipment Market Size, By Solution/Tool, 20142021 (USD Million)

Table 16 Virtual Customer Premise Equipmenmarket Size, By Service, 20142021 (USD Million)

Table 17 Virtual Customer Premise Equipment Market Size, By Application Area, 20142021 (USD Million)

Table 18 Enterprises: Virtual Customer Premise Equipment Market Size, By Industry, 20142021 (USD Million)

Table 19 Virtual Customer Premise Equipment Market Size, By Region, 20142021 (USD Million)

Table 20 Wi-Fi-as-a-Service Market Size and Growth Rate, 20142021 (USD Million)

Table 21 Wi-Fi-as-a-Service Market Size, By Service Type, 20142021 (USD Million)

Table 22 Wi-Fi-as-a-Service Market Size, By User Location, 20142021 (USD Million)

Table 23 Wi-Fi-as-a-Service Market Size, By Vertical, 20142021 (USD Million)

Table 24 Wi-Fi-as-a-Service Market Size, By Region, 20142021 (USD Million)

Table 25 Global Software-Defined Storage Market Size, 20162021 (USD Billion, Y-O-Y %)

Table 26 Major Governance, Risk, and Compliance Standards and Regulations

Table 27 Software-Defined Storage Market Size, By Component, 20142021 (USD Million)

Table 28 Software-Defined Storage Market Size, By Platform/Solution, 20142021 (USD Million)

Table 29 Software-Defined Storage Market Size, By Service, 20142021 (USD Million)

Table 30 Software-Defined Storage Market Size, By Usage, 20142021 (USD Million)

Table 31 Software-Defined Storage Market Size, By Application Area, 20142021 (USD Million)

Table 32 Software-Defined Storage Market Size, By Region, 20142021 (USD Million)

Table 33 Global Software-Defined Security Market Size and Growth Rate, 2014-2021 (USD Million, Y-O-Y %)

Table 34 Software-Defined Security Market Size, By Enforcement Point, 20142021 (USD Million)

Table 35 Software-Defined Security Market Size, By Component, 20142021 (USD Million)

Table 36 Solutions: Software-Defined Security Market Size, By Type, 20142021 (USD Million)

Table 37 Software-Defined Security Market Size, By Service, 20142021 (USD Million)

Table 38 Software-Defined Security Market Size, By End-User, 20142021 (USD Million)

Table 39 Software-Defined Security Market Size, By Region, 20142021 (USD Million)

Table 40 Global Content Delivery Network Market Size and Growth Rate, 20142021 (USD Million, Y-O-Y %)

Table 41 Content Delivery Network Market Size, By Type, 20142021 (USD Million)

Table 42 Content Delivery Network Market Size, By Core Solution, 20142021 (USD Million)

Table 43 Content Delivery Network Market Size, By Adjacent Service, 20142021 (USD Million)

Table 44 Content Delivery Network Market Size, By Service Provider, 20142021 (USD Million)

Table 45 Content Delivery Network Market Size, By Vertical, 20142021 (USD Million)

Table 46 Content Delivery Network Market Size, By Region, 20142021 (USD Million)

Table 47 Global Software-Defined Data Center Market Size and Growth Rate, 20142021 (USD Billion, Y-O-Y %)

Table 48 Software-Defined Data Center Market: By Component, 20142021 (USD Billion)

Table 49 Software-Defined Data Center Market: By Solution, 20142021 (USD Billion)

Table 50 Software-Defined Data Center Market Size, By Service, 20142021 (USD Billion)

Table 51 Software-Defined Data Center Market Size, By Data Center Type, 20142021 (USD Billion)

Table 52 Software-Defined Data Center Market Size, By Vertical, 20142021 (USD Billion)

Table 53 Software-Defined Data Center Market Size, By Region, 20142021 (USD Billion)

Table 54 Network Analytics Market Size, By Type, 20132020 (USD Million)

Table 55 Network Analytics Market Size, By End-User, 20132020 (USD Million)

Table 56 Network Analytics Market Size, By Region, 20132020 (USD Million)

Table 57 Global Unified Network Management Market Size and Growth Rate, 20142021 (USD Million, Y-O-Y %)

Table 58 Unified Network Management Market Size, By Networking Type, 20142021 (USD Million)

Table 59 Unified Network Management Market Size, By Solution, 20142021 (USD Million)

Table 60 Unified Network Management Market Size, By Service, 20142021 (USD Million)

Table 61 Unified Network Management Market Size, By Industry, 20142021 (USD Million)

Table 62 Unified Network Management Market Size, By Region, 20142021 (USD Million)

List of Figures (84 Figures)

Figure 1 SDN and NFV Market is Expected to Grow Exponentially With the Growing Demand From Service Providers

Figure 2 Aster*X Controller Design for the Main Control Logic

Figure 3 Google SDN WANHistory

Figure 4 Software-Defined Storage Platforms are Expected to Exhibit the Highest Adoption Rate During the Forecast Period

Figure 5 Network Security Services and Analytics Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 6 Telecommunication Service Providers are Expected to Exhibit the Highest Adoption Rate of SDN and NFV Solutions During the Forecast Period

Figure 7 Government and Defense Sector is Expected to Exhibit the Highest Adoption Rate of SDN and NFV Solution and Services During the Forecast Period

Figure 8 Asia-Pacific is Expected to Grow With the Highest CAGR During the Forecast Period

Figure 9 Geographic Snapshot

Figure 10 SD-WAN Market Size, 2014-2021 (USD Million)

Figure 11 Hybrid Segment is Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 Managed Services is Expected to Dominate the Market in 2021

Figure 13 Manufacturing Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Geographic Snapshot (20162021): Asia-Pacific is Expected to Grow at the Highest CAGR

Figure 16 Virtual Customer Premises Equipment Market Size, 20142021 (USD Billion)

Figure 17 Virtual Router Segment is Expected to Be the Fastest-Growing Solution in the Virtual Customer Premise Equipment Market

Figure 18 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Application Areas in Education are Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Asia-Pacific is Projected to Exhibit the Highest Growth Rate in the V-CPE Market

Figure 21 Asia-Pacific Expected to Grow at the Highest CAGR, 20162021

Figure 22 Wi-Fi-as-a-Service Market Size, 20142021 (USD Million)

Figure 23 Wi-Fi-as-a-Service Market: Value Chain Analysis

Figure 24 Network Planning and Designing is Expected to Have the Largest Market Size in 2016

Figure 25 Indoor Segment is Expected to Hold A Larger Market Size in 2016

Figure 26 Education Vertical Expected to Hold the Largest Market Size in Wi-Fi-as-a-Service Market in 2016

Figure 27 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 28 Geographic Snapshot

Figure 29 Software-Defined Storage Market Snapshot (2016 vs 2021)

Figure 30 Software-Defined Storage Market: Value Chain Analysis

Figure 31 Data Security and Compliance Software is Essentially the Most Critical Solution Component of Software-Defined Storage Offering

Figure 32 Training and Consulting Services Segment is Expected to Lead the Software-Defined Storage Market With an Increase in Adoption of Software-Defined Storage Solutions

Figure 33 Storage Provisioning and High Availability is Expected to Showcase the Highest Adoption

Figure 34 The Healthcare Application Area is Expected to Have the Highest CAGR During the Forecast Period

Figure 35 Asia-Pacific is Projected to Exhibit the Highest Growth in the Software-Defined Storage Market

Figure 36 Grographic Snapshot: Asia-Pacific Expected to Grow at the Highest CAGR, 20162021

Figure 37 Software-Defined Security Market Size, Global Market, 20162021

Figure 38 Pillars of SDSEC Security Model

Figure 39 SDSEC: Architecture

Figure 40 Virtual Machines/Server/Storage Security is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 41 Support and Maintenance Services are Expected to Grow at the Highest CAGR During the Forecast Period

Figure 42 Support and Maintenance Services are Expected to Grow at the Highest CAGR During the Forecast Period

Figure 43 Cloud Service Providers End-User Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 44 Middle East and Africa Region is Projected to Exhibit the Highest Growth in the Software-Defined Security Market

Figure 45 Geographic Snapshot: North America is Estimated to Account for the Largest Share in the Software-Defined Security Market

Figure 46 Content Delivery Network Market Size, 20162021 (USD Million)

Figure 47 Video Content Delivery Network is Expected to Have the Largest Market Size During the Forecast Period

Figure 48 Cloud Security is Expected to Grow With the Highest CAGR During the Forecast Period

Figure 49 Content Delivery Network Design is Expected to Grow With the Highest Growth Rate During the Forecast Period

Figure 50 Cloud Service Providers Segment is Expected to Have the Highest CAGR During the Forecast Period

Figure 51 Media and Entertainment is Expected to Be the Dominant Vertical in the Content Delivery Network Market

Figure 52 Asia-Pacific is Expected to Grow With the Highest Growth Rate From 20162021

Figure 53 Asia-Pacific is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 54 Top Segments in Terms of Market Share in the Software-Defined Data Center Market

Figure 55 Value Chain Analysis: Software-Defined Data Center Market

Figure 56 SDN is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 57 Integration and Deployment Services are Expected to Grow at A Higher CAGR During the Forecast Period

Figure 58 APAC is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 59 Geographic Snapshot (20162021): North America is Expected to Have the Largest Market Share in 2016

Figure 60 The Global Network Analytics Market is Expected to Grow Rapidly in the Near Future

Figure 61 The Network Analytics Solutions Segment is Gaining Traction Due to the Increased Network Infrastructure

Figure 62 CSP Adoption to Grow Rapidly Due to Expanding Communication Networks and Subscribers

Figure 63 North America Dominates With Major Presence of the Solution Vendor Cluster

Figure 64 Asia-Pacific Region Shows Rapid Market Growth Due to the Exploding Telecom Infrastructure Needs in the Future

Figure 65 Unified Network Management Market Size, 2013-2021 (USD Million)

Figure 66 Unified Network Management: Value Chain Analysis

Figure 67 Wireless Networking is Expected to Have the Largest Market Size in the Market

Figure 68 Network Monitoring Management is Expected to Grow at the Highest CAGR in the Unified Network Management Market

Figure 69 Services Segment is Expected to Grow Extensively in the Unified Network Management Market During Forecast Period

Figure 70 High-Tech and Telecom Sector is Growing Significantly Among Other Industries in the Unified Network Management Market

Figure 71 Asia-Pacific is Expected to Grow With the Highest CAGR During the Forecast Period

Figure 72 Geographic Snapshot

Figure 73 IBM Corporation: Company Snapshot

Figure 74 IBM: SWOT Analysis

Figure 75 Cisco Systems: Company Snapshot

Figure 76 Cisco: SWOT Analysis

Figure 77 Juniper Networks, Inc.: Company Snapshot

Figure 78 Juniper Networks Inc. : SWOT Analysis

Figure 79 Hewlett Packard Enterprise Development LP: Company Snapshot

Figure 80 Hewlett Packard Enterprises : SWOT Analysis

Figure 81 Fujitsu Limited : Company Snapshot

Figure 82 Citrix Systems, Inc.: Company Snapshot

Figure 83 Brocade Communications System Inc.: Company Snapshot

Figure 84 NEC Corporation: Company Snapshot

Growth opportunities and latent adjacency in Top 10 SDx and Networking Technologies