Trace Minerals in Feed Market by Type (Iron, Zinc, Manganese, Copper, Cobalt, Chromium, Other Types), Livestock , Chelate Type (Amino Acids, Proteinates, Polysaccharides, Other Chelate Types), Form, and Region - Global Forecast to 2025

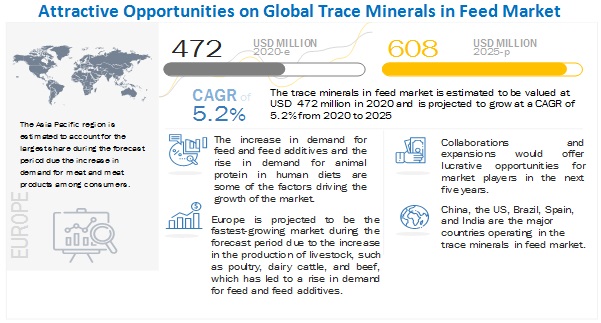

[282 Pages Report] The Global Trace Minerals in Feed Market size was valued at USD 472 million in 2020 and is expected to reach a value of USD 608 million by 2025, growing at a CAGR of 5.2% during the forecast period. Factors such increase in the production of compound feed, increase in demand for animal protein in human diet, the growing importance of animal nutrition in livestock production shas driven the market for trace minerals into further growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increase in the production of compound feed

With the rise in demand for meat and meat products and the increase in the importance of protein-rich diets among consumers across the globe, the demand for compound feed has been growing in the Asia Pacific, North American, and European countries. The Food and Agriculture Organization (FAO) estimates that by 2050, the demand for food products would grow by 60%, and that of animal protein would grow by 1.7% per year. It is also estimated that the production of meat, aquaculture, and dairy products would also increase. The major feed producing countries in the world include China, the US, Brazil, Mexico, Spain, India, and Russia. The demand for chicken and red meat has been growing in these countries, which has also contributed to the growth of the market. An increase in the number of feed mills could also be among the key factors, which have contributed to the overall increase in the production of compound feed.

Restraint: Stringent regulatory framework governing the permissible limits of certain minerals in feed products

Regulatory bodies such as the European Commission and the United States Department of Agriculture (USDA) have outlined the regulatory requirements for various feed additives. Over the years, the limits for essential minerals, such as zinc, copper, and manganese, have been lowered. However, minerals, such as selenium and chromium, have witnessed application in upper limits, which has remained consistent. Several amendments have been made to the existing maximum permissible zinc content in livestock feed. For instance, previously, the maximum permissible limits for zinc feed additives in complete feed was 200 mg/kg for fish and 150 mg/kg for other livestock species. As per the revised rules, the maximum permissible limit (MPL) has changed to 180 mg/kg for salmonids and 120 mg/kg for other species and categories.

Opportunity: Increase in the bioavailability of trace minerals

Bioavailability refers to the proportion of nutrients in food products, which is absorbed and utilized by the body of animals. In addition, utilization is the process of transportation, cellular assimilation, and conversion to a biologically active form. With the permissible limits being imposed on the use of trace elements in feed to reduce environmental risks, livestock farmers have not been able to improve feed conversion efficiency in livestock without providing a higher dosage of mineral supplements, as these elements are not easily absorbed by the digestive systems of animals. However, high demand is expected from unorganized livestock farmers and cooperative societies in developing countries. Therefore, manufacturers are developing techniques to supply these inorganic trace elements in organic forms, which would increase the bioavailability of these compounds and improve the productivity of livestock. The most commonly available trace elements in the organic form include copper, zinc, selenium, and chromium. The awareness about the benefits of organic mineral chelates among farmers is essential to bring a significant shift in the market demand for mineral supplements.

Challenge: High prices associated with trace minerals as an additive

Feed products are one of the major factors that add to the overall cost of livestock production. It accounts for nearly 70% of the total livestock production cost. According to the FAO, of the total feed of cost, 95% is used to meet the energy and protein requirements of the livestock, 3%–4% is used for major mineral, trace mineral, and vitamin requirements, and 1%–2% for other feed additives. Feed manufacturers assemble various cereals and their by-products, amino acids, vitamin & mineral supplements, and feed additives on a low-cost basis by taking into consideration the nutrient contents and the unit cost of each of these products.

The raw material prices for mineral sources, such as zinc and copper, tend to fluctuate based on movements in the London Metal Exchange (LME) or due to high import duties imposed in specific countries. In certain cases, a limited supply of scrap material also pushes the prices of raw materials up, which, in turn, leading to an increase in the prices of trace minerals. These high prices usually lead to the low adoption of these minerals by livestock breeders .The iron segment of the trace minerals in feed market is projected to account for the largest share, by type

By type, the iron segment accounted for the highest share in the trace minerals for feed market.

Iron is one of the most important minerals required for the optimum functioning of the body. Iron cannot be ingested in its elemental form, thus it is available in the form of oxides and carbonates. Red iron oxide, yellow iron oxide, ferrous sulfate, and iron carbonate are used as additional supplements for iron. The ferrous compounds are being approved in the recent years. As livestock species are most commonly by the deficiency of iron, this causes oxidative stress and anemia, iron is thus important element to be included in the feed. Due to its higher acceptance among regulatory bodies, the market for iron as a trace mineral in feed is projected to witness a high growth rate during the forecast period.

The market for poultry segment is projected to account for the largest share during the forecast period

By livestock, poultry is the segment which accounted for the highest market share as well as the highest growth rate in the trace minerals in feed market. Global consumption peaked in 2019 and a continued upward consumption trend is expected, according to an IndexBox report. With a combined 40% share of global consumption. The increased focus on consumption of animal protein in daily diets is one of the preliminary aspects which has led to the growth of the market. The demand for white meat and eggs has been growing due to which the need for increasing livestock production has grown.

Amino acids have the ability to be easily absorbed in the body for the normal functioning of protein synthesis this drives the Trace minerals in feed market

By chelate type, the amino acids segment accounted for the largest market share in 2019. Amino acids are the ideal chelating agents because of its ability to get easily absorbed in the animal body. This is due to the attachment of amino acids to the mineral molecules that create a more stable structure, which helps the minerals survive in the acidic environment of the stomach. Furthermore, trace minerals are protected from various bacteria present in the body of animals, and enzymes are unable to degrade it. It also inhibits the antagonistic action between metal ions and decreases the breaking down of vitamins in the feed. Thus, it easily enters the small intestine where it is absorbed into the bloodstream. These characteristics make amino acids the most preferred chelating minerals among manufacturers.

The dry segment of the trace minerals in feed market is projected to account for the largest share,

By form, the dry segment accounted for the largest share in 2019. This is because, the trace mineral products in the dry form are able to sustain climatic conditions and have higher stability. Moreover, the hygienic supply of these ingredients, and the feeding system is comparatively easy to manage.

Apart from convenience of using dry mineral additives, there are other factors that have an increased usage of chelated trace minerals in dry form among feed manufacturers, such as low bulk weight, storage, transport, relatively high stability, high production capacity, and low manufacturing cost. Mostly, dry powders have low moisture content, thus, reducing the rate of quality degradation. Hence, dry powders can be stored for a longer time than other forms of products. However, the liquid form is witnessing at a comparatively fast rate, as it helps to deliver minerals consistently, which is optimal for the nutritional requirements of livestock.

Europe is the fastest-growing market during the forecast period in the global Trace minerals in feed market

The European market is one of the largest consumers of trace minerals in feed and is growing at a moderate rate. The wide-scale use of trace minerals in European animal nutrition is attributed to the European Commission’s focus on reducing input costs and enhancing animal health in the early stages of growth. The use of trace minerals in animal nutrition depends on factors such as cost-effectiveness, availability, policies, and regulations. Favorable conditions, such as rules pertaining to the use of feed materials, requirements for feed hygiene, and regulations pertaining to undesirable substances in feed set by the European Commission, have had a positive impact on the feed industry, which is projected to drive the growth of the trace minerals in feed market in Europe.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

Source: Secondary research, primary interviews, and MarketsandMarkets Analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million), Volume (Tons) |

|

Segments covered |

Type, livestock, Chelate type, Form, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, RoW |

|

Companies covered |

Cargill, Incorporated (US), Archer-Daniels-Midland Company (ADM) (US), BASF SE (Germany), Bluestar Adisseo Co., Ltd (China), Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Alltech (US), Zinpro (US), Orffa (Netherlands), Novus International (US), Kemin Industries, Inc. (US), Lallemand, Inc. (Canada), Virbac (France), Global Animal Nutrition (US), Dr. Paul Lohmann Gmbh & Co. KGAA (Germany), Biochem Zusatzstoffe (Germany), Veterinary Professional Services Ltd. (Vetpro) (New Zealand), Chemlock Nutrition Corporation (US), dr. eckel animal nutrition gmbh & co.kG (Germany), Vetline (India), Green Mountain Nutritional Services Inc. (US), Biorigin (Brazil), Tanke (China), JH Biotech, Inc. (US), QualiTech, Inc. (US). |

This research report categorizes the Trace minerals in feed market based on type, application, species, and region.

By Type:

- Zinc

- Copper

- Cobalt

- Manganese

- Iron

- Chromium

- Other types (iodine and selenium)

By livestock :

- Poultry

- Ruminant

- Swine

- Aquaculture

- Other livestock (equine and pets)

By chelate type

- Amino acids

- Proteinates

- Polysaccharides

- Other chelate types (propionates and peptides)

By form

- Dry

- Liquid

By region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)*

*Rest of the World (RoW) includes Africa and the Middle East

Recent Developments

- In March 2019, Zinpro Corporation launched a high-quality selenium performance trace mineral–Availa Se–for the European Union (EU). Availa-Se (zinc-L selenomethionine) enables Zinpro to offer another unique product that provides superior performance in the EU market.

- In April 2019, Zinpro Corporation had launched ProPath LQ in the US market for use in liquid applications in all-species. ProPath-LQ delivers trace mineral uptake and absorption, biological efficacy, diet flexibility, and consistency in applications where solubility is critical.

- In July 2020, Kemin Industries revealed architectural renderings for a new quality control laboratory (QC lab) that will be built onsite at its worldwide headquarters in Des Moines, Iowa (US). Kemin's advanced analytical capabilities ensure the potential production activity and specificity of its finished goods.

- In September 2020, Bluestar Adisseo Company acquired Framelco Group (Netherlands), which is a feed additive company. Through this strategy, the company focuses on contributing to the growth of the specialty product segment to become one of the leaders in the specialty feed ingredients market for animal nutrition.

Frequently Asked Questions (FAQ):

What are the significant trends that are disrupting the Trace minerals in feed market?

With the rise in demand for meat and meat products and the increase in the importance of protein-rich diets among consumers across the globe, the demand for compound feed has been growing in the Asia Pacific, North American, and European countries. The Food and Agriculture Organization (FAO) estimates that by 2050, the demand for food products would grow by 60%, and that of animal protein would grow by 1.7% per year.

What are some of the major regulatory challenges and restraints that the industry faces?

Regulatory bodies such as the European Commission (EU) and the United States Department of Agriculture (USDA) have outlined the regulatory requirements for various feed additives. Over the years, the limits for essential minerals, such as zinc, copper, and manganese, have been lowered. However, minerals, such as selenium and chromium, have witnessed application in upper limits, which have remained consistent.

Which region is projected to emerge as a global leader by 2025?

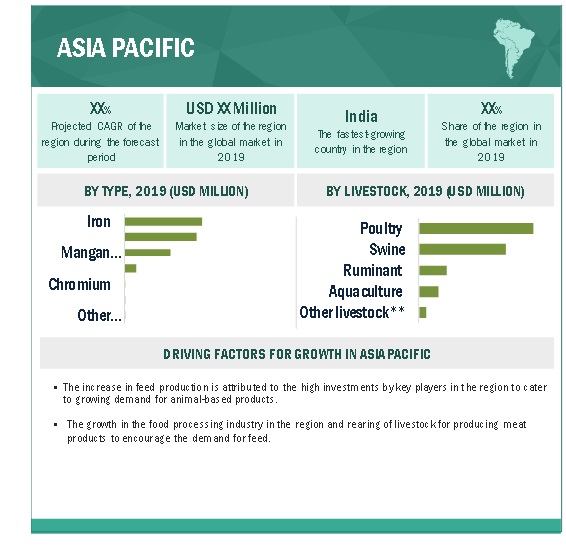

The Asia Pacific region is projected to be the fastest growing region owing to the growing demand for Trace minerals in feed in the masking of meat and dairy products. The trend of convenience products is also growing in the region due to which the demand for Trace minerals in feed in cattle farming and animal rearing.

What are key factors affecting the pricing of the mineral feed ?

Key factors, such as the increase in consumption of feed, rise in demand for animal protein in human diets, the growth of the meat and meat products markets, a shift toward natural growth promoters, and a surge in the bioavailability of trace minerals have contributed to the growth of the trace minerals market. However, fluctuations in the prices of raw materials and the lack of awareness in developing countries are projected to act as a factor inhibiting the growth of the market during the forecast period.

What are the technological advancements in the market?

improvements in technology, including balanced feeding, precision feeding, and other factors, such as optimal addition of amino acids & mineral micronutrients, development of improved pasture species, and animal husbandry systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 TRACE MINERALS IN FEED: MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2015–2019

1.6 UNITS

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN: TRACE MINERALS IN FEED MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 7 GLOBAL TRACE MINERALS IN FEED MARKET, 2018–2025 (USD MILLION)

FIGURE 8 IRON TO HOLD THE LARGEST MARKET SHARE DUE TO ITS INCREASED IMPORTANCE IN REDUCING IMMUNE DEFICIENCIES AND OXIDATIVE STRESS

FIGURE 9 POULTRY ACCOUNTS FOR THE LARGEST SHARE DUE TO THE INCREASE IN DEMAND FOR ANIMAL PROTEIN IN HUMAN DIETS

FIGURE 10 DRY FORM OF TRACE MINERALS TO ACCOUNT FOR THE LARGEST SHARE DURING THE FORECAST PERIOD

FIGURE 11 AMINO ACIDS TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD DUE TO THE EASE OF ABSORPTION

FIGURE 12 TRACE MINERALS IN FEED MARKET SNAPSHOT: ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE, 2019 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 OPPORTUNITIES IN THE TRACE MINERALS IN FEED MARKET

FIGURE 13 INCREASE IN DEMAND FOR COMPOUND FEED TO DRIVE THE MARKET GROWTH FOR TRACE MINERALS IN FEED

4.2 TRACE MINERALS IN FEED MARKET, BY TYPE

FIGURE 14 IRON HELD THE LARGEST SHARE IN THE TRACE MINERALS IN FEED MARKET IN 2019

4.3 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET, BY LIVESTOCK AND KEY COUNTRIES

FIGURE 15 ASIA PACIFIC: CHINA IS ONE OF THE LARGEST MARKETS FOR TRACE MINERAL IN FEED

4.4 TRACE MINERALS IN FEED MARKET, BY FORM AND REGION

FIGURE 16 DRY FORM ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET IN 2019 DUE TO ITS COST-EFFECTIVENESS AND EASE OF USAGE

4.5 TRACE MINERALS IN FEED MARKET, MAJOR REGIONAL SUBMARKETS

FIGURE 17 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE TRACE MINERALS IN FEED MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASING LIVESTOCK PRODUCTION

FIGURE 18 SHARE OF LIVESTOCK POPULATION, BY SPECIES, 2014

5.2.2 GROWING MEAT CONSUMPTION ACROSS THE GLOBE

FIGURE 19 MEAT PRODUCTION AND CONSUMPTION AT A GLOBAL SCALE, 2019 (THOUSAND TON)

5.3 MARKET DYNAMICS

FIGURE 20 INCREASE IN DEMAND FOR MEAT AND OTHER LIVESTOCK PRODUCTS TO DRIVE THE GROWTH OF THE TRACE MINERALS IN FEED MARKET

5.3.1 DRIVERS

5.3.1.1 Increase in the production of compound feed

FIGURE 21 COMPOUND FEED PRODUCTION, 2012–2017 (MILLION METRIC TON)

FIGURE 22 COMPOUND FEED PRODUCTION, BY COUNTRY, 2016–2018 (MILLION METRIC TON)

5.3.1.2 Increase in demand for animal protein in human diets

TABLE 2 PER CAPITA CONSUMPTION OF LIVESTOCK PRODUCTS

5.3.1.3 Increase in importance of animal nutrition in livestock production

TABLE 3 COMMON VITAMIN AND MINERAL DEFICIENCIES AMONG LIVESTOCK SPECIES

5.3.2 RESTRAINTS

5.3.2.1 Stringent regulatory framework governing the permissible limits of certain minerals in feed products

5.3.3 OPPORTUNITIES

5.3.3.1 Increase in the bioavailability of trace minerals

5.3.3.2 Growing market for specialty feed ingredients

5.3.3.3 Shift toward natural growth promoters (NGPs) due to the increase in awareness pertaining to feed and food safety

5.3.4 CHALLENGES

5.3.4.1 High prices associated with trace minerals as an additive

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

FIGURE 24 NUMBER OF PATENTS GRANTED FOR TRACE MINERAL PRODUCTS, 2016–2020

FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED IN THE TRACE MINERALS IN FEED MARKET, 2016–2020

TABLE 4 LIST OF A FEW PATENTS IN THE TRACE MINERALS IN FEED MARKET, 2019–2020

5.6 TECHNOLOGY ANALYSIS

5.7 MARKET ECOSYSTEM

5.8 AVERAGE PRICE ANALYSIS

FIGURE 26 AVERAGE PRICE TREND FOR TRACE MINERALS IN FEED, 2015–2020 (USD/KG)

5.9 TRADE ANALYSIS

FIGURE 27 EXPORT OF KEY MINERAL ORES AND CONCENTRATES, 2015–2019 (USD MILLION)

5.10 YC–YCC SHIFTS IN THE TRACE MINERALS IN FEED MARKET

FIGURE 28 DEMAND FOR TRACE MINERALS TO IMPROVE THE METABOLISM IS THE NEW HOT BET IN THE MARKET

5.11 REGULATORY FRAMEWORK

5.11.1 NORTH AMERICA

5.11.1.1 US

5.11.1.2 Canada

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.3.1 China

5.11.3.2 Japan

5.11.4 REST OF THE WORLD

5.11.4.1 South Africa

5.12 COVID-19 IMPACT ON THE TRACE MINERALS IN FEED MARKET

5.13 CASE STUDY ANALYSIS

5.13.1 SAMPLE: SPECIALTY FEED ADDITIVES MARKET – GLOBAL FORECAST TO 2025

6 TRACE MINERALS IN FEED, BY TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 29 TRACE MINERALS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 5 TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD MILLION)

TABLE 6 TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 7 TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 8 TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

6.2 IRON

6.2.1 INCREASE IN ACCEPTANCE FROM REGULATORY BODIES FOR USE AS A FEED ADDITIVE DRIVES THE DEMAND FOR IRON AS A TRACE MINERAL

TABLE 9 IRON: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 IRON: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 11 IRON: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 12 IRON: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

6.3 ZINC

6.3.1 NEED FOR IMPROVING REPRODUCTIVE HEALTH AMONG SWINE AND CATTLE IS DRIVING THE DEMAND FOR ZINC

TABLE 13 ZINC: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 ZINC: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 15 ZINC: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 16 ZINC: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

6.4 COPPER

6.4.1 HIGH DEMAND FOR IMPROVED SHELF LIFE OF FEED PRODUCTS TO DRIVE THE GROWTH OF THE MARKET FOR NEWER COMPOUNDS OF COPPER

TABLE 17 COPPER: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 COPPER: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 19 COPPER: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 20 COPPER: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

6.5 MANGANESE

6.5.1 COST-EFFECTIVENESS OF MANGANESE TO DRIVE ITS MARKET GROWTH DURING THE FORECAST PERIOD

TABLE 21 MANGANESE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 MANGANESE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 23 MANGANESE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 24 MANAGNESE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

6.6 COBALT

6.6.1 HIGH DEMAND FOR INCREASING NUTRITION IN CATTLE FEED TO DRIVE THE GROWTH OF THE COBALT MARKET

TABLE 25 COBALT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 26 COBALT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 27 COBALT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 28 COBALT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

6.7 CHROMIUM

6.7.1 BENEFITS OF CHROMIUM TO IMPROVE MILK PRODUCTION AND INSULIN RESISTANCE INCREASING ITS DEMAND IN THE MARKET

TABLE 29 CHROMIUM: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 30 CHROMIUM: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 31 CHROMIUM: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 32 CHROMIUM: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

6.8 OTHER TYPES

6.8.1 HIGH BIO-EFFICACY OF ORGANIC SELENIUM HAS LED TO AN INCREASE IN ADOPTION AMONG LIVESTOCK SPECIES

TABLE 33 OTHER TYPES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 34 OTHER TYPES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 35 OTHER TYPES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 36 OTHER TYPES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

7 TRACE MINERALS IN FEED MARKET, BY LIVESTOCK (Page No. - 92)

7.1 INTRODUCTION

FIGURE 30 TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020 VS. 2025

TABLE 37 TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 38 TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 39 TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 40 TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (TON)

7.2 POULTRY

7.2.1 TRACE MINERALS PLAY AN IMPORTANT ROLE TO IMPROVE THE IMMUNITY OF POULTRY ANIMALS

TABLE 41 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 42 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 43 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 44 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 45 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD THOUSAND)

TABLE 46 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD THOUSAND)

TABLE 47 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 48 POULTRY: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

7.3 RUMINANT

7.3.1 INCREASE IN CONSUMPTION OF PROCESSED DAIRY PRODUCTS HAS LED TO A HIGH DEMAND FOR TRACE MINERALS TO IMPROVE PRODUCTIVITY AMONG DAIRY COWS

TABLE 49 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 50 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 51 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 52 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 53 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD THOUSAND)

TABLE 54 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD THOUSAND)

TABLE 55 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 56 RUMINANT: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

7.4 SWINE

7.4.1 INCREASE IN CONSUMPTION OF PORK HAS LED TO A RISE IN DEMAND FOR TRACE MINERALS THAT ENHANCE THE MEAT QUALITY

TABLE 57 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD THOUSAND)

TABLE 58 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 59 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 60 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 61 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD THOUSAND)

TABLE 62 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD THOUSAND)

TABLE 63 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 64 SWINE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

7.5 AQUACULTURE

7.5.1 AS FRESHWATER OR SEAWATER IS UNABLE TO PROVIDE AQUATIC ANIMALS WITH ADEQUATE TRACE MINERALS, EXTERNAL SUPPLEMENTATION HAS BEEN INCREASED

TABLE 65 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 66 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 67 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 68 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 69 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD THOUSAND)

TABLE 70 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD THOUSAND)

TABLE 71 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 72 AQUACULTURE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

7.6 OTHER LIVESTOCK

7.6.1 EQUINE AND PET ANIMALS ARE SUPPLEMENTED WITH TRACE MINERALS TO IMPROVE THEIR HEALTH AND OVERALL WELL-BEING

TABLE 73 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD THOUSAND)

TABLE 74 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 75 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 76 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

TABLE 77 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD THOUSAND)

TABLE 78 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD THOUSAND)

TABLE 79 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 80 OTHER LIVESTOCK: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

8 TRACE MINERALS IN FEED MARKET, BY CHELATE TYPE (Page No. - 116)

8.1 INTRODUCTION

FIGURE 31 TRACE MINERALS IN FEED MARKET SHARE (VALUE), BY CHELATE TYPE, 2020 VS. 2025

TABLE 81 TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2016- 2019 (USD MILLION)

TABLE 82 TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2020–2025 (USD MILLION)

8.2 AMINO ACIDS

8.2.1 MOST TRACE MINERAL MANUFACTURERS PROVIDE AMINO ACID CHELATES AS THEY ARE EASILY ABSORBED BY THE BODY OF ANIMALS

TABLE 83 ANIMO ACIDS: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 84 AMINO ACIDS: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 PROTEINATES

8.3.1 AS PROTEINATES PRODUCE LESS HARSH METAL WASTE, ITS ADOPTION IS INCREASING GRADUALLY

TABLE 85 PROTEINATES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 86 PROTEINATES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 POLYSACCHARIDES

8.4.1 PROPER MINERAL ABSORPTION AND ENERGY STORAGE IN ANIMAL BODY HAVE LED TO THE INCREASE IN USE OF POLYSACCHARIDE CHELATES IN FEED PRODUCTS

TABLE 87 POLYSACCHARIDES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 88 POLYSACCHARIDES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.5 OTHER CHELATE TYPES

8.5.1 HIGH SOLUBILITY OF PROTEINATES AND VARIOUS HEALTH BENEFITS OF PEPTIDES TO DRIVE THEIR DEMAND

TABLE 89 OTHER CHELATE TYPES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 90 OTHER CHELATE TYPES: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 TRACE MINERALS IN FEED MARKET, BY FORM (Page No. - 124)

9.1 INTRODUCTION

FIGURE 32 TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020 VS. 2025

TABLE 91 TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 92 TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

9.2 DRY

9.2.1 COST-EFFECTIVENESS OF DRY TRACE MINERALS TO DRIVE THE MARKET GROWTH

TABLE 93 DRY: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 94 DRY: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.3 LIQUID

9.3.1 LIQUID TRACE MINERALS TO WITNESS HIGH DEMAND AS THEY CAN BE DIRECTLY INJECTED IN ANIMALS AND ARE CONSIDERED MORE EFFECTIVE ON THEIR HEALTH

TABLE 95 LIQUID: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 96 LIQUID: TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10 TRACE MINERALS IN FEED MARKET, BY REGION (Page No. - 130)

10.1 INTRODUCTION

FIGURE 33 CATTLE STOCK IN SELECTED COUNTRIES, 2019 VS 2020, (1000 HEADS)

FIGURE 34 ITALY TO GROW AT THE HIGHEST CAGR IN THE TRACE MINERALS IN FEED MARKET DURING THE FORECAST PERIOD

TABLE 97 TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (USD MILLION)

TABLE 98 TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 99 TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2016- 2019 (TON)

TABLE 100 TRACE MINERALS IN FEED MARKET SIZE, BY REGION, 2020–2025 (TON)

10.2 NORTH AMERICA

FIGURE 35 THE US DOMINATED THE NORTH AMERICAN TRACE MINERALS IN FEED MARKET IN 2019

TABLE 101 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2016- 2019 (USD MILLION)

TABLE 102 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 103 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 104 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 105 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 106 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (TON)

TABLE 107 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD MILLION)

TABLE 108 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 109 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 110 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

TABLE 111 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 112 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 113 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2016- 2019 (USD MILLION)

TABLE 114 NORTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Expansion of the beef, pork, and dairy industries has led to a rise in the use of health-enriching feed additives, driving the growth of the trace minerals in feed market in the US

FIGURE 36 PET FOOD FED TO ANIMALS IN THE US IN 2016 (MILLION TON)

FIGURE 37 COW MILK PRODUCTION IN THE US (1000 MT)

TABLE 115 US: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 116 US: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 The well-established pork meat food processing industry drives the growth of the trace minerals in feed market for swine

FIGURE 38 SWINE PRODUCTION IN CANADA (1000 HEADS)

TABLE 117 CANADA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 118 CANADA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Increase in production and development of the egg sector has created a high demand for quality feed to improve poultry performance

FIGURE 39 EGG PRODUCTION IN MEXICO (1000 MT)

TABLE 119 MEXICO: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 120 MEXICO: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3 EUROPE

FIGURE 40 EUROPE: TRACE MINERALS IN FEED MARKET SNAPSHOT

TABLE 121 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2016- 2019 (USD MILLION)

TABLE 122 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 123 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 124 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 125 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 126 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (TON)

TABLE 127 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD MILLION)

TABLE 128 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 129 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 130 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

TABLE 131 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 132 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 133 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2016- 2019 (USD MILLION)

TABLE 134 EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2020–2025 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Domestic consumption of meat products plays a key role in driving the demand for feed additives and trace minerals in the market

TABLE 135 FRANCE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 136 FRANCE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 High preference for animal-sourced products, including meat products and milk, has led to a consistent quality supply of feed, driving the demand for trace minerals

TABLE 137 GERMANY: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 138 GERMANY: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3.3 ITALY

10.3.3.1 Increase in consumption of white meat and poultry rearing to drive the growth of the trace minerals in the feed market in Italy

TABLE 139 ITALY: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 140 ITALY: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Increase in production of poultry meat and demand for the organic chicken to widen the application of trace minerals in the feed nutrition industry

TABLE 141 SPAIN: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 142 SPAIN: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3.5 UK

10.3.5.1 Increase in consumption of ruminants and swine-sourced meat among consumers in the UK drives the growth of the trace minerals in feed market

TABLE 143 UK: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 144 UK: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Increase in export of meat products to encourage the demand for nutritional feed in Russia

FIGURE 41 RUSSIA: MEAT EXPORT 2018–2019 (TON)

TABLE 145 RUSSIA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 146 RUSSIA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 147 REST OF EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 148 REST OF EUROPE: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SNAPSHOT

TABLE 149 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2016- 2019 (USD MILLION)

TABLE 150 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 151 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 152 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 153 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 154 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (TON)

TABLE 155 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 157 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (TON)

TABLE 158 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

TABLE 159 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 160 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 161 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2016- 2019 (USD MILLION)

TABLE 162 ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Growing demand for poultry products such as white meat and eggs to drive the market for trace minerals to improve productivity of feed

TABLE 163 CHINA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 164 CHINA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Demand for poultry in the country remains high as consumers are becoming health-conscious and chicken is a convenient source of protein

TABLE 165 INDIA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 166 INDIA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 China’s consumption of livestock has witnessed a shift from seafood to poultry, which is witnessing a high demand

TABLE 167 JAPAN: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 168 JAPAN: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4.4 THAILAND

10.4.4.1 Large-scale production of mineral-based aquafeed for marine animals drives the market growth in Thailand

TABLE 169 THAILAND: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 170 THAILAND: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 With the lack of resources for producing feed in the country, feed import has become a major concern in South Korea

TABLE 171 SOUTH KOREA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 172 SOUTH KOREA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4.6 INDONESIA

10.4.6.1 Demand for mineral additives in poultry and aquaculture to drive the growth of the market

TABLE 173 INDONESIA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 174 INDONESIA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

10.4.7.1 Rest of Asia Pacific comprises countries such as the Philippines and Australia that increase the market size of the region

TABLE 175 REST OF ASIA PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 176 REST OF AIS PACIFIC: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 177 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2016- 2019 (USD MILLION)

TABLE 178 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 179 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 180 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 181 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 182 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (TON)

TABLE 183 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD MILLION)

TABLE 184 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 185 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 186 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

TABLE 187 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 188 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 189 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2016- 2019 (USD MILLION)

TABLE 190 SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2020–2025 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Increase in export of beef to drive the growth of the trace minerals in feed market in Brazil

FIGURE 43 BEEF PRODUCTION IN BRAZIL, 2018-2020 (1000 MT)

FIGURE 44 BRAZIL CONSUMER MEAT PREFERENCE, 2018

TABLE 191 BRAZIL: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 192 BRAZIL: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Increase in focus on developing high-quality chicken meat products to drive the demand for trace minerals in feed products to improve animal health

FIGURE 45 HUMAN CHICKEN MEAT CONSUMPTION, 2018–2020 (1000 MT)

TABLE 193 ARGENTINA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 194 ARGENTINA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

10.5.3.1 Increase in consumption of processed meat and dairy products to drive the demand for trace minerals

TABLE 195 REST OF SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 196 REST OF SOUTH AMERICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.6 ROW

TABLE 197 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2016- 2019 (USD MILLION)

TABLE 198 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 199 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 200 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 201 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016–2019 (TON)

TABLE 202 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (TON)

TABLE 203 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016- 2019 (USD MILLION)

TABLE 204 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 205 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2016–2019 (TON)

TABLE 206 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY TYPE, 2020–2025 (TON)

TABLE 207 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 208 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

TABLE 209 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2016- 2019 (USD MILLION)

TABLE 210 ROW: TRACE MINERALS IN FEED MARKET SIZE, BY CHELATE TYPE, 2020–2025 (USD MILLION)

10.6.1 MIDDLE EAST

10.6.1.1 Growing demand for chicken meat products to drive the growth of the trace minerals in feed market

FIGURE 46 CHICKEN MEAT PRODUCTION IN SAUDI ARABIA, 2018–2021 (MT)

TABLE 211 MIDDLE EAST: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD MILLION)

TABLE 212 MIDDLE EAST: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

10.6.2 AFRICA

10.6.2.1 High consumption of pork and beef in Africa has led to an increase in their production, which, in turn, is projected to drive the growth of the trace minerals in feed market

FIGURE 47 THE PER CAPITA CONSUMPTION OF MEAT IN SOUTH AFRICA, 2018 (KG/ANNUM)

TABLE 213 AFRICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2016- 2019 (USD THOUSAND)

TABLE 214 AFRICA: TRACE MINERALS IN FEED MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 208)

11.1 OVERVIEW

FIGURE 48 MARKET EVALUATION FRAMEWORK

11.2 RANKINGS OF KEY PLAYERS

FIGURE 49 CARGILL, INCORPORATED DOMINATED THE TRACE MINERALS IN FEED MARKET IN 2019

11.3 MARKET SHARE ANALYSIS

11.4 COMPETITIVE SCENARIO

FIGURE 50 KEY DEVELOPMENTS IN THE TRACE MINERALS FOR FEED MARKET (2018—2020)

11.4.1 NEW PRODUCT LAUNCHES

TABLE 215 NEW PRODUCT LAUNCHES, 2018-2020

11.4.2 EXPANSIONS & INVESTMENTS

TABLE 216 EXPANSIONS & INVESTMENTS, 2018-2020

11.4.3 ACQUISITIONS

TABLE 217 ACQUISITIONS, 2018-2020

11.4.4 PARTNERSHIPS, MERGERS, AND COLLABORATIONS

TABLE 218 PARTNERSHIPS, MERGERS, AND COLLABORATIONS, 2018-2019

12 COMPANY PROFILES (Page No. - 216)

12.1 OVERVIEW

12.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

12.2.1 STAR

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE

12.2.4 PARTICIPANT

FIGURE 51 TRACE MINERALS IN FEED COMPANY EVALUATION QUADRANT, 2019

12.3 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, Right to win)*

12.3.1 CARGILL, INCORPORATED

FIGURE 52 CARGILL, INCORPORATED: COMPANY SNAPSHOT

12.3.2 ARCHER DANIELS MIDLAND COMPANY

FIGURE 53 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

12.3.3 BASF SE

FIGURE 54 BASF SE : COMPANY SNAPSHOT

12.3.4 BLUESTAR ADISSEO CO., LTD

FIGURE 55 BLUESTAR ADISSEO CO., LTD. : COMPANY SNAPSHOT

12.3.5 KONINKLIJKE DSM N.V.

FIGURE 56 KONINKLIJKE DSM N.V. : COMPANY SNAPSHOT

12.3.6 NUTRECON.V

12.3.7 ALLTECH

12.3.8 ZINPRO CORPORATION

12.3.9 ORFFA

12.3.10 NOVUS INTERNATIONAL

12.4 START-UPS/SME’S EVALUATION MATRIX, 2019

12.4.1 PROGRESSIVE COMPANIES

12.4.2 STARTING BLOCKS

12.4.3 RESPONSIVE COMPANIES

12.4.4 DYNAMIC COMPANIES

FIGURE 57 TRACE MINERALS IN FEED MARKET COMPANY EVALUATION QUADRANT (FOR START-UPS/SME’S), 2019

12.4.5 KEMIN INDUSTRIES, INC.

12.4.6 LALLEMAND, INC.

12.4.7 VIRBAC

FIGURE 58 VIRBAC: COMPANY SNAPSHOT

12.4.8 GLOBAL ANIMAL PRODUCTS

12.4.9 DR. PAUL LOHMANN GMBH & CO. KGAA

12.4.10 BIOCHEM ZUSATZSTOFFE

12.4.11 VETERINARY PROFESSIONAL SERVICES LTD

12.4.12 CHEMLOCK NUTRITION CORPORATION

12.4.13 DR. ECKEL ANIMAL NUTRITION GMBH & CO.KG

12.4.14 VETLINE

12.4.15 GREEN MOUNTAIN NUTRITIONAL SERVICES INC.

12.4.16 BIORIGIN

12.4.17 TANKE

12.4.18 JH BIOTECH, INC.

12.4.19 QUALITECH, INC.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 273)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

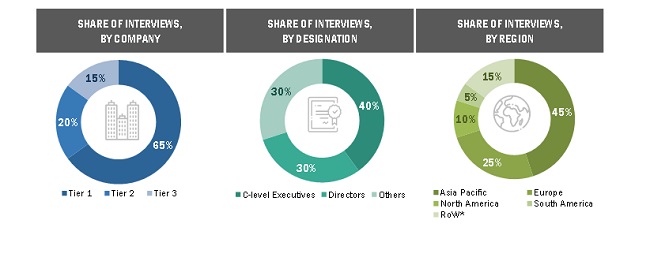

The study involves four major activities to estimate the current market size of the trace minerals in feed market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The trace minerals in feed market comprises several stakeholders such feed manufacturers, animal breeders, commercial research organisations/agencies/laboratories, and regulatory bodies such as the intermediary suppliers, wholesalers, traders, research institutes and organization, and regulatory bodies such as United States Department of Agriculture (USDA), Association of American Feed Control Officials (AAFCO), Compound Feed Manufacturers Association (CLFMA), EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA), International Feed Industry Federation (IFIF), Food and Agriculture Organisation (FAO) and Animal Feed Manufacturers Association (AFMA)

The demand side is comprised of strong demand from the various animal breeders, nutritional supplements for animals producers, and feed manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

*Others include sales managers, marketing managers, and product managers.

**RoW includes the Middle East and Africa.

Note: The three tiers of the companies are defined based on their total revenues in 2017 or 2018, as per the availability of financial data. Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million <= Revenue < =USD 1 billion; Tier 3: Revenue < USD 100 million.

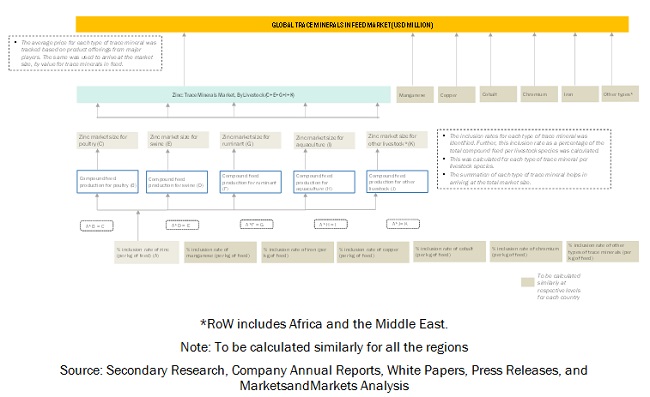

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the trace minerals in feed market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Trace Minerals in Feed Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

*RoW includes Africa and the Middle East.

Note: To be calculated similarly for all the regions

Source: Secondary Research, Company Annual Reports, White Papers, Press Releases, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the trace minerals in feed market.

Report Objectives

- To define, segment, and estimate the size of the trace minerals in feed market with respect to its type, livestock, chelate type, form, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the trace minerals in feed market

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

Geographic Analysis

- Further breakdown of the Rest of Europe market for trace minerals in feed which includes countries such as Poland, Ukraine, Hungary and Denmark

- Further breakdown of the Rest of Asia Pacific market for trace minerals in feed , which includes countries such as Malaysia,Australia, Vietnam and Philippines.

- Further breakdown of the Rest of South America market for trace minerals in feed which includes countries such as Peru, Uruguay and Venezuela

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Trace Minerals in Feed Market