Automated Truck Loading System Market by Loading Dock (Flush, Enclosed, and Saw-tooth), System Type (Chain Conveyor, Slat Conveyor, Belt Conveyor, Skate Conveyor, Roller Track, and Automated Guided Vehicle), Industry, and Geography - Global Forecast to 2022

The global automated truck loading system market was valued at USD 1.67 Billion in 2015 and is expected to reach USD 2.88 Billion by 2022, at a CAGR of 7.65% during the forecast period.

The main objectives of the report include is to define, describe, and forecast the global automated truck loading system market segmented on the basis of loading dock (flush dock, enclosed dock, saw-tooth dock, and others), system type (chain conveyor systems, slat conveyor systems, belt conveyor systems, skate conveyor systems, roller track systems, automated guided vehicles and others), software and service, industry, and truck type. It includes the forecast of the market size, in terms of value, with respect to four main geographies, namely, North America, Europe, APAC, and RoW. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges for the market. It also profiles the key players operating in the ATLS market. The base year considered for the study is 2015 and the forecast period for the market has been considered between 2016 and 2022. The growth of this market is driven by factors such as significant reduction in turnaround time by using ATLS and increased safety of the work environment.

According to the Market forecast, the global automated truck loading system market is expected to be worth USD 2.88 Billion by 2022, at a CAGR of 7.65% between 2016 and 2022. The major factors driving the market include the growing adoption of ATLS systems in various industries as these automation systems helps in significantly reducing the turnaround times. Also, these systems are utilized to increase the safety in the work environment since most of the truck loading and unloading takes place in manufacturing/warehouse environments.

The report covers the market on the basis of loading dock, software and service, system type, industry, truck type, and geography. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges for the market. It also profiles the key players operating in the automated truck loading system market.

The different system type considered for the study include chain conveyor, slat conveyor, belt conveyor, skate conveyor, roller track system, and automated guided vehicle. Among these system types, the market for roller track systems is expected to grow at the highest the CAGR during the forecast period. Roller track system provides an efficient roller system to enable the movement of loads, product, or machinery within a predetermined location. It was mainly invented to improve the manual loading of vehicles. The principle of a roller track system is to have the rollers available only when movement is required, with the load safely located on a floor at all other times. Roller tracks can be incorporated with scissor lifts and dock levelers, which make it much easier to load and unload trailers with varying floor heights. Furthermore, Roller track system have a wide range of application in various industries including paper, FMGC, post and parcel, automotive, pharmaceutical, and warehouse and distribution.

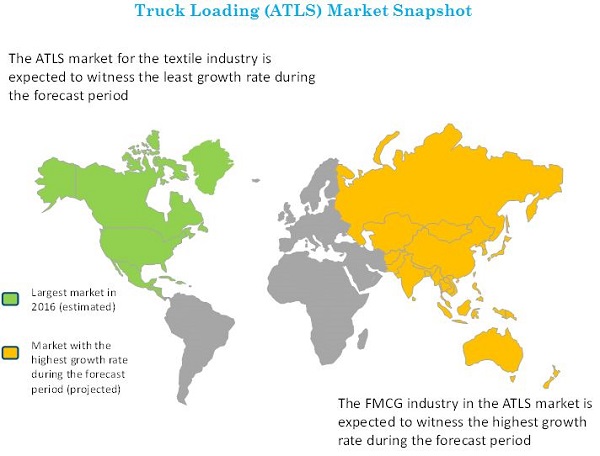

The key industries considered for the study include aviation, cement, paper, FMCG, post & parcel, automotive, textile, pharmaceutical, and warehouse & distribution. The automotive industry held the largest share of the market in 2015, followed by FMCG, warehouse & distribution, pharmaceutical, aviation, post & parcel, cement, and textile industries. The automotive industry is one of the front runners in the field of automation and mechanization of the logistics chain. The major reasons for this growth include the widespread deployment of ATLS in this industry. The loading system plays a very important role as the components have to be delivered at the correct place, at the correct time, and in the correct sequence.

The automated truck loading system market in Europe region held the largest market size, in terms of value in 2015; the market in APAC is expected to exhibit the fastest growth rate between 2016 and 2022. The factors contributing to this growth include the growing importance of adopting automation technologies for truck loading and unloading. The European region majorly comprises automotive and large process industries. These industries continuously strive to achieve greater efficiency by delivering goods on time. The adoption of ATLS can help in reduce the turnaround time of trucks, thereby reducing the requirement for manpower and saving cost.

However, the high capital investment required to install ATLS may hinder the growth of the market. The major vendors in automated truck loading system market are ATLS Ltd (Spain), Actiw Oy (Finland), Ancra Systems B.V. (Netherlands), Asbreuk Service B.V. (Netherlands), BEUMER Group GmbH & Co. KG (Germany), Cargo Floor B.V. (Netherlands), C&D Skilled Robotics Inc. (U.S.), GEBHARDT Fördertechnik GmbH (Germany), HAVER & BOECKER OHG (Germany), Joloda International Ltd (U.K.), Maschinenfabrik Möllers GmbH (Germany), Secon Components S.L. (Spain), and VDL Systems B.V. (Netherlands). These players adopted various strategies such as new product launches and developments, contracts, acquisitions, partnerships, and business expansions to cater to the needs of the market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the ATLS Market

4.2 Automated Truck Loading System Market, By Industry

4.3 Truck Loading System Market, By System Type and Geography

4.4 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automated Truck Loading System Market: By Loading Dock

5.2.2 Automated Truck Loading System Market, By Truck Type

5.2.3 Automated Truck Loading System Market, By System Type

5.2.4 Automated Truck Loading System Market, By Software & Service

5.2.5 Automated Truck Loading System Market, By Industry

5.2.6 ATLS Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Significant Reduction in Turnaround Time By Using ATLS

5.3.1.2 Increased Safety of the Work Environment

5.3.2 Restraints

5.3.2.1 High Capital Investment Required for Installation

5.3.3 Opportunities

5.3.3.1 Help in Optimizing the Logistics Supply Chain

5.3.3.2 Growing Warehouse Space Globally

5.3.4 Challenges

5.3.4.1 High Costs of Maintenance and Updating of Various Subsystems

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

6.4 Strategic Benchmarking

6.4.1 Technology Integration and Product Enhancement

7 Market, By Loading Dock (Page No. - 53)

7.1 Introduction

7.2 Flush Docks

7.3 Enclosed Docks

7.4 Saw Tooth Docks

7.5 Others

8 Market, By Software and Service (Page No. - 61)

8.1 Introduction

8.2 Software & Services

8.2.1 Software

8.2.2 Services

9 Market, By System Type (Page No. - 64)

9.1 Introduction

9.2 Chain Conveyor Systems

9.3 Slat Conveyor Systems

9.4 Belt Conveyor Systems

9.5 Skate Conveyor Systems

9.6 Roller Track Systems

9.7 Automated-Guided Vehicles

9.8 Others

10 Market, By Industry (Page No. - 85)

10.1 Introduction

10.2 Aviation Industry

10.3 Cement Industry

10.4 Paper Industry

10.5 FMCG Industry

10.6 Post & Parcel Industry

10.7 Automotive Industry

10.8 Textile Industry

10.9 Pharmaceutical Industry

10.10 Warehouse & Distribution Industry

11 Market, By Truck Type (Page No. - 109)

11.1 Introduction

11.2 Modified Truck Type

11.3 Non-Modified Truck Type

12 Market, By Geography (Page No. - 112)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 U.K.

12.3.3 France

12.3.4 Netherlands

12.3.5 Rest of Europe

12.4 Asia-Pacific

12.4.1 Japan

12.4.2 China

12.4.3 South Korea

12.4.4 Rest of APAC

12.5 Rest of the World (RoW)

12.5.1 Middle East

12.5.2 Africa

12.5.3 South America

13 Competitive Landscape (Page No. - 131)

13.1 Introduction

13.2 Ranking of Players in the Truck Loading System Market, 2015

13.3 Competitive Scenario

13.4 Recent Developments

14 Company Profiles (Page No. - 136)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

14.1 Introduction

14.2 Actiw OY.

14.3 Beumer Group GmbH & Co. Kg.

14.4 Cargo Floor B.V.

14.5 Gebhardt Fördertechnik GmbH

14.6 Haver & Boecker OHG

14.7 Ancra Systems B.V.

14.8 Asbreuk Service B.V.

14.9 ATLS Ltd.

14.10 C&D Skilled Robotics, Inc.

14.11 Joloda International Ltd.

14.12 Maschinenfabrik Möllers GmbH.

14.13 Secon Components S.L.

14.14 VDL Systems B.V.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 161)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (69 Tables)

Table 1 Porter’s Five Forces Analysis: Threat of Substitutes Likely to Have Minimum Impact on the Overall Market in 2015

Table 2 Automated Truck Loading Systems Market, By Loading Dock, 2013–2022 (USD Million)

Table 3 Automated Truck Loading Systems Market for Flush Docks, By System Type, 2013–2022 (USD Million)

Table 4 Automated Truck Loading Systems Market for Enclosed Loading Docks, By System Type, 2013–2022 (USD Million)

Table 5 Automated Truck Loading Systems Market for Saw Tooth Docks, By System Type, 2013–2022 (USD Million)

Table 6 Automated Truck Loading Systems Market for Others Docks, By System Type, 2013–2022 (USD Million)

Table 7 Automated Truck Loading System Market, By Software & Service, 2013–2022 ( USD Million)

Table 8 Truck Loading System Market, By System Type, 2013–2022 (USD Million)

Table 9 Truck Loading System Market for Chain Conveyor Systems, By Industry, 2013–2022 (USD Million)

Table 10 Automated Truck Loading System Market for Chain Conveyor Systems, By Region, 2013–2022 (USD Million)

Table 11 ATLS Market for Chain Conveyor Systems, By Loading Docks, 2013–2022 (USD Million)

Table 12 ATLS Market for Slat Conveyor Systems, By Industry, 2013–2022 (USD Million)

Table 13 Automated Truck Loading System Market for Slat Conveyor Systems, By Region, 2013–2022 (USD Million)

Table 14 Truck Loading System Marketfor Slat Conveyor Systems, By Loading Docks, 2013–2022 (USD Million)

Table 15 ATLS Market for Belt Conveyor Systems, By Industry, 2013–2022 (USD Million)

Table 16 Truck Loading System Market for Belt Conveyor Systems, By Region, 2013–2022 (USD Million)

Table 17 ATLS Market for Belt Conveyor Systems, By Loading Dock, 2013–2022 (USD Million)

Table 18 Automated Truck Loading System Market for Skate Conveyor Systems, By Industry, 2013–2022 (USD Million)

Table 19 Truck Loading System Market for Skate Conveyor Systems, By Region, 2013–2022 (USD Million)

Table 20 ATLS Market for Skate Conveyor Systems, By Loading Docks, 2013–2022 (USD Million)

Table 21 Truck Loading System Market for Roller Track Systems, By Industry, 2013–2022 (USD Million)

Table 22 ATLS Market for Roller Track Systems, By Region, 2013–2022 (USD Million)

Table 23 Automated Truck Loading System Market for Roller Track Systems, By Loading Docks, 2013–2022 (USD Million)

Table 24 Automated Truck Loading System Market for Automated-Guided Vehicles, By Industry, 2013–2022 (USD Million)

Table 25 Truck Loading System Market for Automated-Guided Vehicles, By Region, 2013–2022 (USD Million)

Table 26 ATLS Market for Automated-Guided Vehicles, By Loading Dock, 2013–2022 (USD Million)

Table 27 Automated Truck Loading System Market for Others System Types, By Industry, 2013–2022 (USD Million)

Table 28 Truck Loading System Market for Others System Types, By Region, 2013–2022 (USD Million)

Table 29 ATLS Market for Others System Types, By Loading Docks, 2013–2022 (USD Million)

Table 30 ATLS Market, By Industry, 2013–2022 (USD Million)

Table 31 Automated Truck Loading System Market for Aviation Industry, By System Type, 2013–2022 (USD Million)

Table 32 Truck Loading System Market for Aviation Industry, By Truck Type, 2013–2022 (USD Million)

Table 33 Truck Loading System Market for Aviation Industry, By Region, 2013–2022 (USD Million)

Table 34 ATLS Market for Cement Industry, By System Type, 2013–2022 (USD Million)

Table 35 Truck Loading System Market for Cement Industry, By Region, 2013–2022 (USD Million)

Table 36 Automated Truck Loading System Market for Paper Industry, By System Type, 2013–2022 (USD Million)

Table 37 Truck Loading System Market for Paper Industry, By Truck Type, 2013–2022 (USD Million)

Table 38 Automated Truck Loading System Market for Paper Industry, By Region, 2013–2022 (USD Million)

Table 39 Truck Loading System Market for FMCG Industry, By System Type, 2013–2022 (USD Million)

Table 40 Truck Loading System Market for FMCG Industry, By Truck Type, 2013–2022 (USD Million)

Table 41 ATLS Market for FMCG Industry, By Region, 2013–2022 (USD Million)

Table 42 Automated Truck Loading System Market for Post & Parcel Industry, By System Type, 2013–2022 (USD Million)

Table 43 ATLS Market for Post & Parcel Industry, By Truck Type, 2013–2022 (USD Million)

Table 44 Automated Truck Loading System Market for Post & Parcel Industry, By Region, 2013–2022 (USD Million)

Table 45 Truck Loading System Market for Automotive Industry, By System Type, 2013–2022 (USD Million)

Table 46 Truck Loading System Market for Automotive Industry, By Truck Type, 2013–2022 (USD Million)

Table 47 Truck Loading System Market for Automotive Industry, By Region, 2013–2022 (USD Million)

Table 48 Truck Loading System Market for Textile Industry, By System Type, 2013–2022 (USD Million)

Table 49 Truck Loading System Market for Textile Industry, By Truck Type, 2013–2022 (USD Million)

Table 50 Truck Loading System Market for Textile Industry, By Region, 2013–2022 (USD Million)

Table 51 Automated Truck Loading System Market for Pharmaceutical Industry, By System Type, 2013–2022 (USD Million)

Table 52 Automated Truck Loading System Market for Pharmaceutical Industry, By Truck Type, 2013–2022 (USD Million)

Table 53 Truck Loading System Market for Pharmaceutical Industry, By Region, 2013–2022 (USD Million)

Table 54 Automated Truck Loading System Market for Warehouse & Distribution Industry, By System Type, 2013–2022 (USD Million)

Table 55 ATLS Market for Warehouse & Distribution Industry, By Truck Type, 2013–2022 (USD Million)

Table 56 Truck Loading System Market for Warehouse & Distribution Industry, By Region, 2013–2022 (USD Million)

Table 57 ATLS Market, By Truck Type, 2013–2022 (USD Million)

Table 58 Truck Loading System Market, By Region, 2013–2022 (USD Million)

Table 59 Automated Truck Loading System Market in North America, By Country, 2013–2022 (USD Million)

Table 60 ATLS Market in North America, By System Type, 2013–2022 (USD Million)

Table 61 Automated Truck Loading System Market in Europe, By Country, 2013–2022 (USD Million)

Table 62 Truck Loading System Market in Europe, By System Type, 2013–2022 (USD Million)

Table 63 Truck Loading System Market in APAC, By Country, 2013–2022 (USD Million)

Table 64 Automated Truck Loading System Market in APAC, By System Type, 2013–2022 (USD Million)

Table 65 ATLS Market in RoW, By Region, 2013–2022 (USD Million)

Table 66 Automated Truck Loading System Market in RoW, By System Type, 2013–2022 (USD Million)

Table 67 Ranking of the Top 5 Players in the ATLS Market in 2015

Table 68 New Product Launches, 2014–2016

Table 69 Contracts, Agreements, & Partnerships, 2014–2016

List of Figures (96 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for the Research Study

Figure 7 Automated Truck Loading Systems Market, 2013–2022 (USD Million)

Figure 8 Automated Truck Loading System Market for the FMCG Industry Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 9 Slat Conveyor Systems to Lead the ATLS Market, By System Type, Between 2016 and 2022

Figure 10 Flush Dock Expected to Lead the ATLS Market, By Loading Dock, During the Forecast Period

Figure 11 Truck Loading System Market, By Region, 2015

Figure 12 Increasing Adoption of ATLS in FMCG, Automotive, and Warehouse & Distribution Industries Expected to Drive the Market During the Forecast Period

Figure 13 Automotive Industry Expected to Dominate the ATLS Market in 2016

Figure 14 Slat Conveyor System Led the ATLS Market in 2015

Figure 15 Automated Truck Loading System Market in the APAC Region Was Inthe Growth Phase in 2015

Figure 16 Market Dynamics: Overview

Figure 17 Type of Vehicles Involved in the Accidents at Work Place

Figure 18 Value Chain Analysis: Major Value Added During the Manufacturing and Assembly Phases

Figure 19 Porter’s Five Forces Analysis (2015) - Competitive Rivalry to Have Medium Impact on the Market

Figure 20 Automated Truck Loading System Market: Porter’s Five Forces Analysis

Figure 21 Medium Intensity of Competitive Rivalry Due to the Presence of Established Players

Figure 22 Low Threat of Substitutes as There is No Direct Substitute for ATLS

Figure 23 Medium Bargaining Power of Buyers Because of Long Lifetime of Automated Truck Loading Systems

Figure 24 Low Bargaining Power of Suppliers Due to the Presence of A Limited Number of Players

Figure 25 Low Impact of Threat of New Entrants Because of the Retaliation From Existing Firms

Figure 26 Strategic Benchmarking: Key Players Largely Adopted Organic Growth Strategies for New Product and Technology Development

Figure 27 Automated Truck Loading System Market, By Loading Docks

Figure 28 Flush Docks are Expected to Hold the Largest Size in the ATLS Market During the Forecast Period

Figure 29 Slat Conveyor Systems Expected to Hold the Largest Market Size for Flush Docks During the Forecast Period

Figure 30 Roller Track Systems Expected to Grow at the Highest Rate in the Enclosed Docks Market During the Forecast Period

Figure 31 Slat Conveyor System Expected to Hold the Largest Market in the Saw Tooth Dock System Between 2016 and 2022

Figure 32 Roller Track Conveyor System Expected to Grow at the Highest Rate in the Market for Other Loading Docks During the Forecast Period

Figure 33 ATLS Market, By Software & Service

Figure 34 Post-Sale Services is Expected to Hold the Largest Size in the ATLS Market During the Forecast Period

Figure 35 Truck Loading System Market, By System Type

Figure 36 Slat Conveyor System Expected to Hold the Largest Market Size During the Forecast Period

Figure 37 Aviation Industry Expected to Hold the Largest Size in the Chain Conveyor System Between 2016 and 2022

Figure 38 Europe Expected to Hold the Largest Market Size in the Chain Conveyor Systems During the Forecast Period

Figure 39 Automotive Industry Expected to Hold the Largest Market Size in the ATLS Market for Slat Conveyor Systems Type Between 2016 and 2022

Figure 40 Europe is Estimated to Hold the Largest Size in the Slat Conveyor System During the Forecast Period

Figure 41 Cement Industry Expected to Hold the Largest Market Size in the Belt Conveyor Systems Between 2016 and 2022

Figure 42 Market in APAC Expected to Grow at the Highest Rate in the Belt Conveyor System Type Between 2016 and 2022

Figure 43 Automotive Industry Expected to Hold the Largest Marekt Size in the Skate Conveyor Systems During the Forecast Period

Figure 44 Europe Expected to Hold the Largest Market Size in the Skate Conveyor System Type During the Forecast Period

Figure 45 FMCG Industry Expected to Hold the Largest Market Size in the Roller Track Systems Between 2016 and 2022

Figure 46 APAC Region Expected to Grow at the Highest Rate in the Automated Truck Loading System Market for Roller Track Systems During the Forecast Period

Figure 47 Automotive Industry Expected to Hold the Largest Market Size in the ATLS Market for Automated-Guided Vehicle Type Between 2016 and 2022

Figure 48 Europe Expected to Hold the Largest Size in the ATLS Market for Automated-Guided Vehicle Type During the Forecast Period

Figure 49 Warehouse & Distribution Industry Expected to Hold the Largest Market Size in the Others Systems Type Between 2016 and 2022

Figure 50 Europe Expected to Hold the Largest Market Size in the Other Systems Type During the Forecast Period

Figure 51 Automated Truck Loading System Market, By Industry

Figure 52 Automotive Industry Expected to Hold the Largest Size in the ATLS Market During the Forecast Period

Figure 53 Chain Conveyor System Type Expected to Hold the Largest Market Size in the Aviation Industry Between 2016 and 2022

Figure 54 Slat Conveyor System Expected to Hold the Largest Size in the Automated Truck Loading System Market for Cement Industry Between 2016 and 2022

Figure 55 Skate Conveyor System Estimated to Hold the Largest Market in the Paper Industry During the Forecast Period

Figure 56 APAC Expected to Grow at the Highest Rate in the ATLS Market for Paper Industry Between 2016 and 2022

Figure 57 Automated Guided Vehicles Expected to Grow at the Highest Rate in ATLS Market for FMCG Industry During the Forecast Period

Figure 58 Europe Expected to Hold the Largest Market Size in the in ATLS Market for FMCG Industry Between 2016 and 2022

Figure 59 Slat Conveyor System Expected to Hold the Largest Size in the Post & Parcel Industry During the Forecast Period

Figure 60 APAC Expected to Grow at the Highest Rate in the ATLS Market for Post & Parcel Industry Between 2016 and 2022

Figure 61 Slat Conveyor System Expected to Hold the Largest Size in the in ATLS Market for Automotive Industry Between 2016 and 2022

Figure 62 Europe Expected to Dominate the Automated Truck Loading System Market for Automotive Industry By Holding the Largest Size During the Forecast Period

Figure 63 Belt Conveyor Systems Expected to Grow at the Highest Rate in the ATLS Market for Textile Industry Between 2016 and 2022

Figure 64 North America Expected to Hold the Largest Market Size in the in ATLS Market for Textile Industry During the Forecast Period

Figure 65 Skate Conveyor System Expected to Hold the Largest Market Size in the ATLS Market for the Pharmaceutical Industry Between 2016 and 2022

Figure 66 Europe Expected to Hold the Largest Market Size in the Pharmaceutical Industry Between 2016 and 2022

Figure 67 Slat Conveyor System Expected to Hold the Largest Market Size in the ATLS Market for Warehouse & Distribution Industry During the Forecast Period

Figure 68 Europe Expected to Hold the Largest Market Size in the in ATLS Market for Warehouse & Distribution Industry Between 2016 and 2022

Figure 69 Automated Truck Loading System Market, By Truck Type

Figure 70 Modified Truck Type Expected to Hold the Largest Market Size During the Forecast Period

Figure 71 ATLS Market, By Region

Figure 72 Europe Expected to Dominate the Automated Truck Loading System Market During the Forecast Period

Figure 73 North America: ATLS Market Snapshot

Figure 74 The ATLS Market in North America

Figure 75 The ATLS Market in the U.S. Expected to Hold the Largest Size During the Forecast Period

Figure 76 Slat Conveyor System Expected to Dominate the ATLS Market in the North American Region Between 2016 and 2022

Figure 77 Europe: Truck Loading System Market Snapshot

Figure 78 The Automated Truck Loading System Market in Europe

Figure 79 Germany Expected to Hold the Largest Size in the European ATLS Market Between 2016 and 2022

Figure 80 Roller Track System Expected to Grow at the Highest Rate in the ATLS Market in Europe During the Forecast Period

Figure 81 APAC: ATLS Market Snapshot

Figure 82 The ATLS Market in Asia-Pacific

Figure 83 Japan Expected to Witness the Largest Market Size in the ATLS Market in APAC During the Forecast Period

Figure 84 Slat Conveyor System Expected to Hold the Largest Size in the ATLS Market in APAC Between 2016 and 2022

Figure 85 The Automated Truck Loading System Market in the RoW

Figure 86 South America Expected to Hold the Largest Size in the ATLS Market in RoW During the Forecast Period

Figure 87 Slat Conveyor System to Hold the Largest Size in the Truck Loading System Market in RoW During the Forecast Period

Figure 88 Key Growth Strategies Adopted By the Top Companies Between 2013 and 2015

Figure 89 Market Evaluation Framework: New Product Launches Fuelled the Growth and Innovation Between 2013 and 2015

Figure 90 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 91 Geographic Revenue Mix of Major Players in the Truck Loading System Market

Figure 92 Actiw OY: SWOT Analysis

Figure 93 Beumer Group GmbH & Co.Kg.: SWOT Analysis

Figure 94 Cargo Floor B.V.: SWOT Analysis

Figure 95 Gebhardt Fördertechnik GmbH : SWOT Analysis

Figure 96 Haver & Boecker OHG: SWOT Analysis

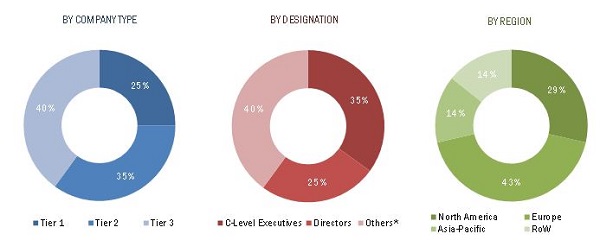

The research methodology used to estimate and forecast the automated truck loading system market begins with gathering data on key vendor revenues through secondary research such as Material Handling Institute (MHI) and International Warehouse Logistics Association (IWLA) among others. The top-down and bottom-up approaches have been used to estimate and validate the size of the global ATLS market. The research methodology also includes the study of annual and financial reports of the top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the ATLS market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the following figure.

To know about the assumptions considered for the study, download the pdf brochure

The ATLS ecosystem comprises manufacturers such as Actiw Oy (Finland), GEBHARDT Fördertechnik GmbH (Germany), HAVER & BOECKER OHG (Germany), and ATLS Ltd. (Spain) among others; component manufacturers such as Joloda International Ltd. (U.K.), C&D Skilled Robotics, Inc. (U.S.), and VDL Systems B.V. (Netherlands) among others; and distributors including Reno Forklift, Inc. (U.S.) and FLSmidth (U.S.), Inc. among others.

Target Audience of the Report:

The intended audience for this report includes:

- ATLS equipment product and solution providers

- ATLS system-related service providers

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to ATLS engineering

- Government bodies such as regulating authorities and policy makers

- Venture capitalists, private equity firms, and start-up companies

- End users who want to know more about the ATLS market

Scope of the Report:

This report categorizes the global automated truck loading system market on the basis of loading dock, system type, industry, and geography.

By Loading Dock:

- Flush Dock

- Enclosed Dock

- Saw tooth Dock

- Others

By Software and Service:

- Software

- Services

By System Type:

- Chain Conveyor Systems

- Slat Conveyor Systems

- Belt Conveyor Systems

- Skate Conveyor Systems

- Roller Track Systems

- Automated Guided Vehicles

- Others

By Industry:

- Aviation

- Cement

- Paper

- FMCG

- Post & Parcel

- Automotive

- Textile

- Pharmaceutical

- Warehouse & Distribution

By Truck Type

- Modified Truck Type

- Non-modified Truck Type

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Market Analysis

- Further breakdown of the global ATLS market, by geography

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Automated Truck Loading System Market