Automated Storage and Retrieval System Market Size, Share and Trends, 2025 To 2030

Automated Storage and Retrieval System Market by Type (Unit Load ASRS, Mini Load ASRS, Mid-Load ASRS, Vertical Lift Module (VLM), Vertical Carousel, Horizontal Carousel) by Payload Capacity (<500 kg, 500-1,500 kg, >1,500 kg) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global automated storage and retrieval system (ASRS) market is projected to grow from USD 9.86 billion in 2025 to USD 14.80 billion by 2030, at a CAGR of 8.5%. ASRS are technologically advanced automated systems that facilitate the storage and retrieval of goods in warehouses, manufacturing facilities, and distribution centers. These ASRS systems play a prominent role in enhancing operational efficiency by optimizing storage space, thereby reducing retrieval time and minimizing human errors.

KEY TAKEAWAYS

- The Asia Pacific automated storage and retrieval system (ASRS) market accounted for a 36.6% revenue share in 2024.

- By type, the unit load segment accounted for a share of 36.5% in terms of value in 2024.

- By industry, the food & beverage segment accounted for the largest market share of 14.8% in 2024.

- TGW Logistics Group, SSI SCHAEFER, and Daifuku Co., Ltd., were identified as Star players in the automated storage and retrieval system market, due to their strong global presence, advanced automation technologies, and broad solution portfolios.

- Ferretto Group SpA, SencorpWhite, Inc., and MIAS hhave distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The automated storage and retrieval system (ASRS) industry is expected to experience significant growth in the coming years, driven by increasing demand for warehouse automation, rising labor costs, and the rapid global expansion of e-commerce and logistics operations. Advances in robotics technology, control software, and integration with warehouse management systems (WMS) are additionally facilitating the accelerated adoption of these systems across various industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The automated storage and retrieval system market is fueled by changes in warehousing, logistics, and manufacturing operations that focus on automation and efficiency. End users such as e-commerce, automotive, and food & beverage companies are adopting automated storage and retrieval systems to handle increasing order volumes and space limitations. Trends like warehouse digitalization, integration with WMS and robotics, and the need for faster fulfillment directly impact operational costs and productivity. These changes reshape supply chain strategies, increasing investment in intelligent storage solutions and supporting steady growth for ASRS technology providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising emphasis on efficient space utilization in warehouses

-

Increasing deployment of automation technology in booming e-commerce sector

Level

-

High installation and maintenance costs

-

Risks of data security and cyber threats

Level

-

Increasing cold chain operations in Asia Pacific

-

Rising implementation of strict guidelines for medical intralogistics

Level

-

Complexities and technical issues associated with ASRS setup

-

Challenges in adapting to ever-evolving technologies and customer demands

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising emphasis on efficient space utilization in warehouses

Real estate prices are rising in developed countries such as the US and China, creating a growing gap between supply and demand for warehouse space. With European warehousing space nearing full capacity and demand increasing, developed countries in Asia Pacific and North America aim to optimize space utilization. Advanced automation technologies such as automated storage and retrieval systems (ASRS) play a key role in enhancing storage efficiency to meet consumer demand.

Restraint: High installation and maintenance costs

ASRS is a profitable automation system often used in warehouses; however, it demands a significant amount of capital for initial setup. Before purchasing the system, a thorough analysis of the supply chain and inventory management is essential. The implementation of ASRS involves installing racks, automated systems, and software, which can be expensive. It also requires a skilled workforce to ensure accurate setup.

Opportunity: Increasing cold chain operations in Asia Pacific

The Asia Pacific region is experiencing significant growth in cold chain logistics due to increasing demand for temperature-controlled storage and transportation of perishable goods such as food, pharmaceuticals, and chemicals. The use of ASRS solutions ensures precise temperature management, efficient storage utilization, and improved overall efficiency, fulfilling the needs of the growing cold chain industry.

Challenge: Complexities and technical issues associated with ASRS setup

Implementing ASRS systems requires careful planning, installation, and integration with existing warehouse operations. Technical challenges like software compatibility, system calibration, and downtime during setup can disrupt workflows and cause delays. These factors make it difficult for businesses to ensure a smooth transition to automated systems.

Automated Storage and Retrieval System market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Modular high-density ASRS for fast line replenishment, flexible SKU expansion, and digital integration in warehouse/distribution centers | Steady materials flow, increased throughput, labor reduction, inventory precision, facility scalability, and future-ready smart factory integration |

|

Vertical/lateral compact ASRS with integrated WMS for space optimization, secure storage, and automated pick-to-light processes in logistics hubs and retail | Maximum storage capacity, up to 85% floor space savings, labor minimization, 99.9% pick accuracy, cost effectiveness, and improved safety |

|

Multi-format ASRS solutions for manufacturing (incl. cold storage, e-commerce, pharma, distribution), shuttle and crane-based high-density retrieval | Continuous operation (24/7), labor savings, vertical space use, lower error rates, faster order fulfillment, energy efficiency, scalable sustainability |

|

Tailored ASRS for 24/7 warehousing, shuttle and mini-load systems integrating transport, sorting, and automated replenishment | Higher productivity, reduced labor, order accuracy, scalable storage, cost efficiency, reliability, and warehouse earthquake resistance |

|

ASRS for omnichannel, cold chain, pallet and retail units, using vertical lifts/shuttles for rapid, organized, and secure inventory handling in large and harsh environments | 24/7 operation, high throughput, labor reduction, improved storage density, enhanced safety and ergonomics, better inventory control, efficient cold storage handling |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ASRS market is supported by a mature network of automation experts and intralogistics solution providers. Leading companies include TGW Logistics Group (Austria), Kardex (Switzerland), Daifuku Co., Ltd. (Japan), Murata Manufacturing Co., Ltd. (Japan), and SSI SCHAEFER (Germany). These firms provide comprehensive ASRS solutions that combine robotics, control software, and warehouse management systems to enhance material flow, storage capacity, and operational efficiency. The strong presence of these global intralogistics leaders underscores the increasing trend toward warehouse automation and smart inventory management across manufacturing, e-commerce, and distribution industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automated Storage and Retrieval System Market, By Type

Unit load ASRS holds the largest market share, driven by widespread adoption in large manufacturing and distribution centers handling heavy pallets and bulk goods. These systems provide high load capacity, stable operation, and improved throughput for high-volume storage.

Automated Storage and Retrieval System Market, By Payload Capacity

The 500–1,500 kg segment dominates the market, as it aligns with standard palletized load requirements across diverse sectors including automotive, FMCG, and industrial manufacturing.

Automated Storage and Retrieval System Market, By Industry

Food & beverages represent the largest industry segment, supported by the need for temperature-controlled, automated storage systems ensuring safety, compliance, and efficient product rotation.

REGION

Asia Pacific is projected to lead global automated storage and retrieval system market during forecast period

Asia Pacific is expected to lead the global automated storage and retrieval system market through 2030, driven by robust manufacturing output, rapid industrial automation, and growth in e-commerce and logistics infrastructure in China, Japan, India, and South Korea. Additionally, rising investments in smart warehousing solutions and government initiatives supporting Industry 4.0 adoption are further boosting market growth in the region.

The Asia Pacific automated storage and retrieval system (ASRS) market is expected to grow from USD 3.67 billion in 2025 to USD 5.89 billion by 2030, registering a CAGR of 9.9%. Market growth is driven by the rapid development of large-scale logistics infrastructure across China, Japan, India, and Southeast Asia, supported by rising investments in warehouse automation and supply chain modernization. The integration of advanced control software, robotics, real-time system monitoring, and smart material flow management enhances storage density, operational accuracy, and system reliability. Additionally, continued investment in modern logistics parks, expansion of manufacturing capacity, and government initiatives promoting smart infrastructure and industrial automation are boosting the adoption of automated storage and retrieval systems throughout the Asia Pacific region.

The North American automated storage and retrieval system (ASRS) market is expected to grow from USD 3.11 billion in 2025 to USD 4.57 billion by 2030, at a CAGR of 8.0%. The North American ASRS market is gaining strong momentum as companies accelerate warehouse automation to boost throughput, counter labor shortages, and manage the soaring demands of e-commerce and fulfillment. Growth is further propelled by rising investments in high-density storage, cold chain modernization, and robotics-enabled distribution centers across the US and Canada.

The European automated storage and retrieval system market is expected to grow from USD 2.42 billion in 2025 to USD 3.46 billion by 2030, at a CAGR of 7.4%. The European ASRS market is growing steadily as retailers, manufacturers, and 3PLs accelerate warehouse automation to improve efficiency, accuracy, and space utilization amid rising labor shortages and e-commerce volumes. Ongoing investments in smart logistics hubs, robotics, and high-density storage systems are further strengthening adoption across major European economies.

Automated Storage and Retrieval System market: COMPANY EVALUATION MATRIX

In the automated storage and retrieval system market matrix, Daifuku (Star) and Honeywell (Emerging Leader) maintain strong positions as a Star player and Emerging Leader, respectively, due to their extensive product portfolios, global reach, and solid financial strength. Their ongoing innovation and brand reputation enable them to lead widespread adoption of ASRS solutions worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 9.24 Billion |

| Market Forecast in 2030 (Value) | USD 14.80 Billion |

| Growth Rate | CAGR of 8.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Automated Storage and Retrieval System market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European E-commerce Fulfillment Operator |

|

|

| North American 3PL Service Provider |

|

|

| APAC Automotive Component Manufacturer |

|

|

RECENT DEVELOPMENTS

- November 2024 : Kardex partnered with Douglas Pharmaceuticals Limited to install New Zealand’s first AutoStore system. This automated storage and retrieval solution enhances storage efficiency and innovation.

- November 2024 : Ocado Group plc launched the 600 Series Bot, an advanced industrial product that uses 3D printing. This innovation leverages additive manufacturing techniques to enhance precision, efficiency, and scalability in automated storage and retrieval systems.

- October 2024 : SSI SCHAEFER collaborated with ALP to deliver infrastructure for OMEGA 1 Bukit Raja, a smart warehouse with a high-bay racking system. Located in Selangor, Malaysia, this warehouse will be the largest automated facility in Southeast Asia, spanning 1.8 million square feet.

- April 2024 : Daifuku Co., Ltd. upgraded its Shiga Works facility to increase production capacity and improve logistics. Building G will feature a cleanroom for semiconductor and LCD production systems, while Building M will handle maintenance parts and manufacturing automated guided vehicles (AGVs).

- March 2024 : SSI SCHAEFER introduced LOGIONE, a stand-alone software solution for the SSI LOGIMAT Vertical Lift Module. With intuitive and self-explanatory user interfaces, it simplifies storage location and article management, requiring no training.

Table of Contents

Methodology

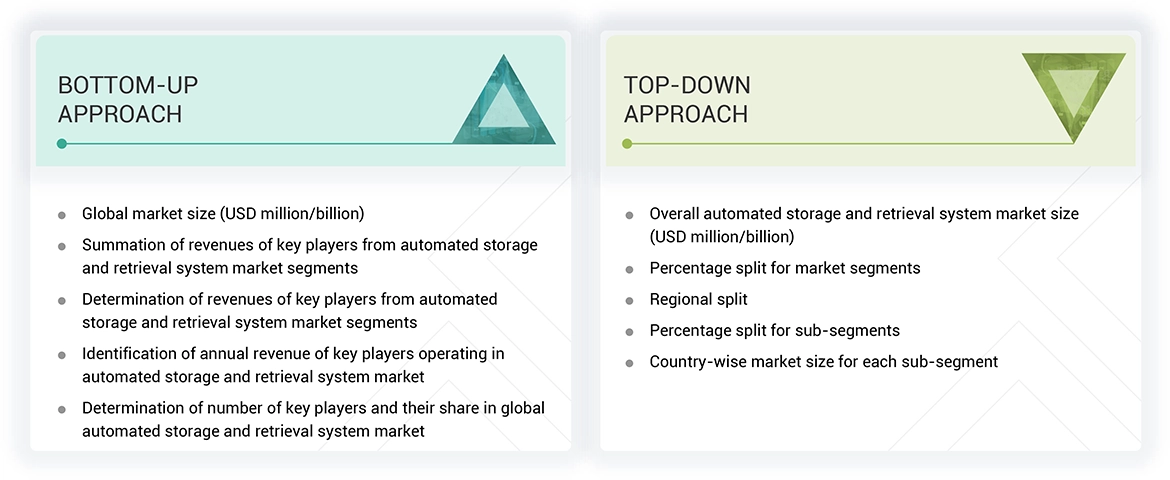

The study involved four major activities in estimating the current size of the automated storage & retrieval system market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the automated storage & retrieval system market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research..

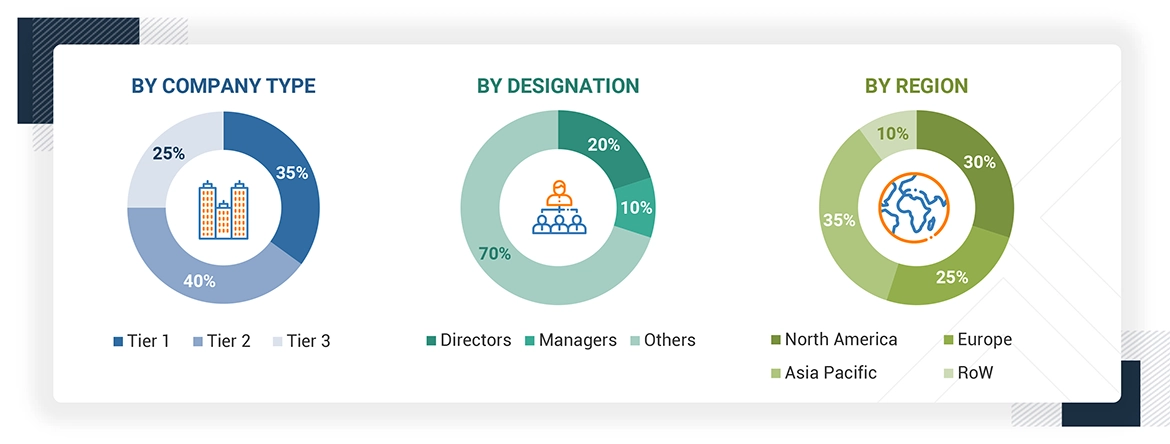

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the automated storage & retrieval system market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than USD 1 billion; Tier 2 - revenue between USD 500 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 500 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the automated storage & retrieval system market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Automated Storage and Retrieval System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the automated storage & retrieval system market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

The Automated Storage & Retrieval System market develops, produces, and implements sophisticated systems to automate the storage and retrieval of goods in industrial, commercial, and logistics environments. Unit-load, mini-load, vertical lift modules (VLM), carousels, and Mid load ASRS solutions include automated storage & retrieval systems with the latest technologies of robotics, machine learning, and advanced sensors for optimized storage density, increased retrieval speed, and minimum human intervention. With the growing trend of Industry 4.0, an increasing focus on efficient inventory management, and a rapidly growing trend toward automation to minimize operational costs, ASRS has become an essential component of modern warehousing, manufacturing, and supply chain operations that support higher productivity and accuracy in material handling processes.

Key Stakeholders

- Associations, forums, and alliances related to automated storage and retrieval systems

- Assembly and packaging vendors

- Electronic hardware equipment manufacturers

- Companies from verticals such as automotive, chemicals, aviation, semiconductor & electronics, e-commerce, retail, food & beverages, healthcare, and metals & heavy machinery

- Integrated device manufacturers (IDMs)

- Original device manufacturers (ODMs)

- Original equipment manufacturers (OEMs)

- Original technology designers and suppliers

- Raw material suppliers

- Research institutes and organizations

- Standard organizations and regulatory authorities related to the material-handling industry

- System integrators

Report Objectives

- To define, describe, and forecast the automated storage & retrieval system market, in terms of value, by type, payload capacity, industry, and region.

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the growth of the market, namely, drivers, restraints, opportunities, and challenges.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the probable impact of the recession on the market in the future.

- To study the complete value chain of the automated storage & retrieval system ecosystem, along with market trends and use cases.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market.

- To strategically profile key players and comprehensively analyze their core competencies along with detailing the competitive landscape for market leaders.

- To analyze competitive developments such as product launches, acquisitions, partnerships, and expansions in the automated storage & retrieval system market.

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories and product strategies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automated Storage and Retrieval System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automated Storage and Retrieval System Market