TV White Space Spectrum Market by End-Use (Rural Internet Access, Urban Connectivity, Emergency & Public Safety, Smart Grid Networks, Vehicle Broadband Access), Device (Fixed, Portal), Component, Software & Service, Range - Global Forecast to 2022

The overall TV white space spectrum market is expected to grow from USD 1.89 million in 2016 to USD 53.07 million by 2022, at a CAGR of 74.30% from 2016 to 2022. End-use Application areas for TV white space spectrum range from rural internet access and urban connectivity to emergency & public safety, smart grid networks, and so on. The base year considered for the study is 2015, and the forecast is for the period between 2016 and 2022.

Market Dynamics

Drivers

- Increasing importance for adoption of TVWS technology in smart grid applications

- High penetration of TVWS communications (Super Wi-Fi) to cover larger distances

Restraints

- Standards and regulations for the use of TV band white spaces are not completely commercialized

Opportunities

- Significant opportunities to deliver broadband Internet connectivity utilizing unused TV spectrum

Challenges

- Complex limitations such as avoiding interference with existing TV bands

Increasing importance for adoption of TVWS technology in smart grid applications

Smart grid refers to the technology that brings utility electricity delivery systems using computer-based remote control and automation. These smart grids are expected to revolutionize the existing electricity grid by allowing two-way communications, thereby improving efficiency, reliability, and sustainability of generation, transmission, and distribution of electric power. However, there are several issues associated with these grids, one being communication between the control center and smart metering installed at the customer premise.

To overcome these issues, several companies are using TVWS-based communication to provide middle-mile connectivity to facilitate smart metering and other smart grid solutions. As the smart grid application is not very bandwidth intensive, a limited number of TVWS channels are required for this application. In view of low bandwidth requirement, many countries have shown interest to adopt this communication network. For instance, Singapore is one of the first countries to deploy TVWS-based communication for various smart community projects. Through this TVWS communication network, the power grid control center helps to provide middle wire connectivity between control center and the smart metering at the customer base. Singapore has adopted this TVWS communication at CleanTech Park, Pulau Ubin micro-grid test bed, Punggol Eco-Town, and Jurong Lake District, among others.

The following are the major objectives of the study.

- To define, describe, and forecast the global TV white space spectrum market segmented on the basis of component, software and service, device, range, end-use application, and geography

- To provide the market statistics with detailed classifications and split in terms of value

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the commercial deployments, pilots, and trials worldwide with respect to the TV white space spectrum

- To provide a detailed Porter’s analysis and market life cycle analysis, along with technology and market roadmap for the TV white space spectrum market

- To forecast the size of the market segments with respect to four main geographies, namely, North America, Europe, Asia-Pacific, and Rest of the World

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape for the market players

- To strategically profile the key players operating in this market and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product launches, and research & development in the global TV white space spectrum market

- To map the competitive intelligence based on the company profiles, strategies of the key players, and game-changing developments such as product developments, collaborations, and acquisitions

The overall TVWS spectrum market is expected to be valued at USD 1.89 million in 2016 and is estimated to reach USD 53.07 million by 2022, at a CAGR of 74.30% between 2016 and 2022. The market growth can be attributed to the high penetration of TVWS communications (Super Wi-Fi) to cover larger distances. The growing importance of IoT & M2M, urban connectivity, and smart grid networks is further expected to drive the market in the future.

The rural Internet access segment is expected to hold the largest size of the TVWS spectrum market during the forecast period. The major factors contributing to this growth include the widespread adoption of TVWS technology to connect remote areas to the Internet. Earlier these areas were not serviced due to the lack of robust and affordable backhaul. Also, these services come at cost to the players, which involve regular maintenance. Furthermore, the immediate beneficiaries of this technology include the rural inhabitants in developed countries such as North America, Europe, and other Asian regions.

The market for portable white space devices expected to grow at the highest rate during the forecast period. Portable devices typically comprise laptops, Wi-Fi access points, tablets, and smartphones, among others. As these devices generate a relatively small spectrum footprint, they are allowed to operate in more places and on more channels than fixed devices.

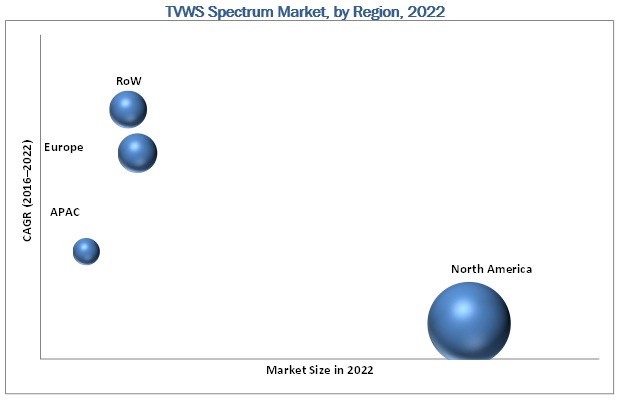

The TVWS spectrum market in North America dominated the global market in 2015, accounting for a share of 72.1% of the total market. The growth of the market can be attributed to the adoption of TVWS regulations by the FCC. The FCC has approved the usage of TVWS technology in the 470–698MHz spectrum band without causing interference to the existing TV channels. This led to the various players exploring the opportunities of various end-use applications such as urban connectivity, vehicle broadband access, transportation and logistics, and IoT & M2M, among others.

Rural Internet Access (Rural Broadband)

One of the major hindrances to providing Internet to the rural areas is the lack of robust and affordable backhaul. Various pilots and trials conducted worldwide proved that TVWS technology can be utilized to connect rural areas with broadband Internet connection. It is a cost-effective means to provide broadband to these areas, which is quite expensive using other existing technologies.

Some of the immediate beneficiaries of this technology include the rural inhabitants in developed countries such as North America, Europe, and other Asian regions. In addition, this technology is successfully tested by Microsoft in collaboration with the Government of Andhra Pradesh, India, to provide wireless Internet access to Srikakulam in Andhra Pradesh. Also, the Government of India is further planning to connect all villages in India through this TVWS technology.

Urban Connectivity

Over the past few decades, the popularity of smartphones, tablets, and other mobile devices has led to the increased demand for wireless connectivity to skyrocket. The growth in wireless usage in the recent past has led to the unprecedented growth in wireless data traffic as wireless systems became increasingly central to social, economic, and political life. These factors led to significant spectrum crunch, enabling the governments to open unlicensed spectrum bands. For instance, in July 2016, FCC proposed to open 11GHz of high-band spectrum to wireless uses, increasing network capacity for 5G and IoT. This spectrum allows for data transfer rates up to 10Gbps, but signals can travel only short distances; therefore, small cell deployments would be needed to deliver most wireless services.

Therefore, utilizing TVWS spectrum for wireless communications offers significant advantages compared to conventional Wi-Fi. TVWS signals provide better coverage of about 10km diameter due to their superior range and ability to penetrate obstacles such as trees, buildings, and rough terrains. Furthermore, TVWS is capable of connecting a wide range of smart devices, providing a broadband range that will enable smart cities with connected home devices, sports stadiums, shopping centers, and municipal areas, among others.

Emergency and Public Safety

Emergency and public safety is a communication network utilized by the emergency response and public safety organizations such as fire department, police force, and emergency medical teams responding to accidents, crimes, and natural disasters, among other events. There are several technologies for deploying emergency and public safety networks such as Wi-Fi, WiMAX, and Terrestrial Trunked RAdio (TETRA). However, the air interface operating in TVWS offers a fundamental advantage compared to the GHz spectrum due to the wider coverage range provided by the UHF/VHF wavelengths.

Additionally, the VHF/UHF bands also display more favorable characteristics in times of emergency response in disaster sites which may be demanding the high penetrating feature for critical operations such as a victim search party. As a trial deployment, in June 2011, the Yurok Reservation in Northern California, US, deployed first white space broadband communication for remote public safety environment. Through this, the Yurok community can access criminal databases besides having the ability to conduct live video training with their fire fighters, support clinics that can perform virtual telemedicine, and implement an emergency.

Standards and regulations for the use of TV band white spaces are not completely commercialized is restraining market growth. Moreover, complex limitations such as avoiding interferences with existing TV bands are a challenge for this market. This report describes the drivers, restraints, opportunities, and challenges pertaining to the TVWS spectrum market. Moreover, the report analyzes the current scenarios and forecasts the market until 2022.

Some of the major companies operating in the TVWS spectrum market are Aviacomm Inc. (U.S.), Adaptrum, Inc. (U.S.), ATDI S.A. (France), Carlson Wireless Technologies, Inc. (U.S.), Alphabet Inc. (U.S.), Keybridge LLC (U.S.), KTS Wireless (U.S.), Microsoft Corporation (U.S.), MELD Technology Inc. (U.S.), Metric Systems Corporation (U.S.), Spectrum Bridge, Inc. (U.S.), Shared Spectrum Company (U.S.), and Telcordia Technologies, Inc. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities for the TVWS Spectrum Market

4.2 TV white space spectrum market, By End-Use Application

4.3 TV white space spectrum market, By Component and Geography

4.4 Life Cycle Analysis, By Geography

5 TV White Space Spectrum Standards and Regulations (Page No. - 32)

5.1 Overview

5.2 TVWS in Different Countries

5.3 White Space Standards

5.3.1 IEEE 802.22

5.3.2 IEEE 802.11af

5.3.3 IEEE 802.15.4m

5.3.4 IEEE P1900.4a

5.3.5 IEEE 802.16h

5.3.6 IEEE P1900.7

5.3.7 ECMA 392

5.3.8 ETSI En 301 598

6 Market Overview (Page No. - 35)

6.1 Introduction

6.2 Market Segmentation

6.2.1 TV White Space Spectrum Market: By Component

6.2.2 TV White Space Spectrum Market, By Software and Service

6.2.3 TV White Space Spectrum Market, By Device

6.2.4 TVWS Spectrum Market, By End-Use Application

6.2.5 TVWS Spectrum Market, By Range

6.2.6 TVWS Spectrum Market, By Geography

6.3 Market Evolution

6.4 Worldwide Commercial Deployments, Pilots, and Trials

6.4.1 North America

6.4.2 South America

6.4.3 Europe

6.4.4 Asia-Pacific

6.4.5 Africa

6.5 Market Dynamics

6.5.1 Drivers

6.5.1.1 Increasing Importance for Adoption of TVWS Technology in Smart Grid Applications

6.5.1.2 High Penetration of TVWS Communications (Super Wi-Fi) to Cover Larger Distances

6.5.2 Restraints

6.5.2.1 Standards and Regulations for the Use of TV Band White Spaces are Not Completely Commercialized

6.5.3 Opportunities

6.5.3.1 Significant Opportunities to Deliver Broadband Internet Connectivity Utilizing Unused TV Spectrum

6.5.4 Challenges

6.5.4.1 Complex Limitations Such as Avoiding Interferences With Existing TV Bands

7 Industry Trends (Page No. - 50)

7.1 Introduction

7.2 Value Chain Analysis

7.3 Strategic Benchmarking

7.3.1 Technology Integration and Product Enhancement

8 Market, By Component (Page No. - 52)

8.1 Introduction

8.2 Radios

8.3 Antennas

8.4 Cables

8.5 Power Supplies

8.6 Backhaul and Services

9 Market, By Software and Service (Page No. - 56)

9.1 Introduction

9.2 Software & Service

9.2.1 Software

9.2.2 Service

10 Market, By Device (Page No. - 59)

10.1 Introduction

10.2 Fixed TV White Space Devices

10.3 Portable TV White Space Devices

11 Market, By End-Use Application (Page No. - 62)

11.1 Introduction

11.2 Rural Internet Access (Rural Broadband)

11.3 Urban Connectivity

11.4 Emergency and Public Safety

11.5 Smart Grid Networks

11.6 Transportation and Logistics

11.7 Vehicle Broadband Access

11.8 IoT & M2M

12 Market, By Range (Page No. - 68)

12.1 Introduction

12.2 Medium Range

12.3 Long Range

12.4 Very Long Range

13 Market, By Geography (Page No. - 71)

13.1 Introduction

13.2 North America

13.2.1 North America

13.2.1.1 U.S.

13.2.1.2 Canada

13.3 Europe

13.3.1 U.K.

13.3.2 Finland

13.3.3 Rest of Europe

13.4 Asia-Pacific

13.4.1 Japan

13.4.2 Singapore

13.4.3 Rest of APAC

13.5 Rest of the World

13.5.1 Africa

13.5.2 South America

14 Competitive Landscape (Page No. - 95)

14.1 Introduction

14.2 Market Ranking Analysis: TVWS Spectrum Market

14.3 Competitive Scenario

14.4 Recent Developments

15 Company Profiles (Page No. - 99)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

15.1 Introduction

15.2 Microsoft Corporation

15.3 Carlson Wireless Technologies, Inc.

15.4 Alphabet Inc. (Google)

15.5 Adaptrum, Inc.

15.6 Aviacomm Inc.

15.7 ATDI S.A.

15.8 Keybridge LLC

15.9 KTS Wireless

15.10 Meld Technology Inc.

15.11 Metric Systems Corporation

15.12 Spectrum Bridge, Inc.

15.13 Shared Spectrum Company

15.14 Telcordia Technologies, Inc. (Iconectiv)

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 120)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (25 Tables)

Table 1 TVWS UHF Bands, By Country/Geography

Table 2 Difference Between Wi-Fi and Super Wi-Fi

Table 3 TV White Space Spectrum Market, By Component, 2015–2022 (USD Thousand)

Table 4 TVWS Spectrum Market, By Software & Service, 2015–2022 (USD Thousand)

Table 5 TVWS Spectrum Market, By Device, 2013–2022 (USD Thousand)

Table 6 TVWS Spectrum Market, By End-Use Application, 2015–2022 (USD Thousand)

Table 7 TVWS Spectrum Market, By Range, 2015–2022 (USD Thousand)

Table 8 TVWS Spectrum Market, By Region, 2015–2022 (USD Thousand)

Table 9 TVWS Spectrum Market, By Country, 2015–2022 (USD Thousand)

Table 10 TV White Space Spectrum Market in the U.S., By End-Use Application, 2015–2022 (USD Thousand)

Table 11 TVWS Spectrum Market in Canada, By End-Use Application, 2015–2022 (USD Thousand)

Table 12 TV White Space Spectrum Market in Europe, 2015–2022 (USD Thousand)

Table 13 TVWS Spectrum Market in the U.K., By End-Use Application, 2015–2022 (USD Thousand)

Table 14 TV White Space Spectrum Market in Finland, By End-Use Application, 2015–2022 (USD Thousand)

Table 15 TVWS Spectrum Market in Rest of Europe, By End-Use Application, 2015–2022 (USD Thousand)

Table 16 TVWS Spectrum Market in APAC, By Country, 2015–2022 (USD Thousand)

Table 17 TVWS Spectrum Market in Japan, By End-Use Application, 2015–2022 (USD Thousand)

Table 18 TVWS Spectrum Market in Singapore, By End-Use Application, 2015–2022 (USD Thousand)

Table 19 TVWS Spectrum Market in Rest of APAC, By End-Use Application, 2015–2022 (USD Thousand)

Table 20 TVWS Spectrum Market in RoW, By Geography, 2015–2022 (USD Thousand)

Table 21 TVWS Spectrum Marketin Africa, By End-Use Application, 2015–2022 (USD Thousand)

Table 22 TVWS Spectrum Market in South America, By End-Use Application, 2015–2022 (USD Thousand)

Table 23 Market Ranking of the Top 5 Players in the TVWS Spectrum Market, 2015

Table 24 New Product Launches, 2014–2015

Table 25 Contracts, Agreements, and Partnerships, 2013–2016

List of Figures (59 Figures)

Figure 1 Market Segmentation

Figure 2 TV White Space Spectrum Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for the Research Study

Figure 7 TV White Space Spectrum Market, 2015–2022 (USD Thousand)

Figure 8 Rural Internet Access Expected to Hold the Largest Size of the TVWS Spectrum Market Between 2016 and 2022

Figure 9 Radios Expected to Hold the Largest Size of the TVWS Spectrum Market Based on Components During the Forecast Period

Figure 10 Market for Portable White Space Devices Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 TV White Space Spectrum Market, By Region, 2015

Figure 12 Global Recognition for White Space Technology By Various Governments Worldwide to Provide Affordable Broadband Services Expected to Drive the Market During the Forecast Period

Figure 13 Rural Internet Access Expected to Dominate the TVWS Spectrum Market in 2016

Figure 14 North America Held the Largest Share of the TVWS Spectrum Market in 2015

Figure 15 TVWS Spectrum Market in North America Entered the Growth Phase in 2015

Figure 16 Evolution of the TVWS Network

Figure 17 Market Dynamics: Overview

Figure 18 Value Chain Analysis: Major Value Added During the Manufacturing and Assembly Phases

Figure 19 Strategic Benchmarking: Key Players Adopted Both Organic and Inorganic Growth Strategies for New Product and Technology Development

Figure 20 TV White Space Spectrum Market, By Component

Figure 21 Radios Expected to Hold the Largest Size of the TVWS Spectrum Market Based on Components During the Forecast Period

Figure 22 TVWS Spectrum Market, By Software & Service

Figure 23 Pre-Sale Services Segment Expected to Hold the Largest Size of the TVWS Spectrum Market During the Forecast Period

Figure 24 TV White Space Spectrum Market, By Device

Figure 25 Market for Portable White Space Devices Expected to Grow at the Highest Rate During the Forecast Period

Figure 26 TV White Space Spectrum Market: By End-Use Application

Figure 27 Rural Internet Access Expected to Hold the Largest Size of the TVWS Spectrum Market During the Forecast Period

Figure 28 TVWS Spectrum Market, By Range

Figure 29 Market for Very Long Range Expected to Grow at the Highest Rate During the Forecast Period

Figure 30 TVWS Spectrum Market, By Region

Figure 31 North America Expected to Dominate the TVWS Spectrum Market During the Forecast Period

Figure 32 North America: TVWS Spectrum Market Snapshot

Figure 33 TV White Space Spectrum Market in North America

Figure 34 Rural Internet Access in the U.S. Expected to Hold the Largest Size of the Market During the Forecast Period

Figure 35 Market for Smart Grid Networks in Canada Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 36 Europe: TV White Space Spectrum Market Snapshot

Figure 37 TVWS Spectrum Market in Europe

Figure 38 U.K. Expected to Hold the Largest Market Size in Europe Between 2016 and 2022

Figure 39 Smart Grid Networks Expected to Hold the Largest Size of the TVWS Spectrum Market in the U.K. Between 2016 and 2022

Figure 40 Market for IoT & M2M in Finland Expected to Grow at the Highest Rate During the Forecast Period

Figure 41 IoT & M2M Expected to Hold the Largest Size of the TVWS Spectrum Market in Rest of Europe Between 2016 and 2022

Figure 42 APAC: TVWS Spectrum Market Snapshot

Figure 43 TVWS Spectrum Market in Asia-Pacific

Figure 44 Rest of APAC Expected to Hold the Largest Size of the TVWS Spectrum Market in APAC During the Forecast Period

Figure 45 IoT & M2M Expected to Hold the Largest Size of the TVWS Spectrum Market in Japan During the Forecast Period

Figure 46 Market for Smart Grid Networks Expected to Grow at the Highest Rate in Singapore During the Forecast Period

Figure 47 Rural Internet Access Expected to Witness the Highest Market Value in Rest of APAC Market Between 2016 and 2022

Figure 48 Rest of the World: TVWS Spectrum Market Snapshot

Figure 49 TV White Space Spectrum Market in RoW

Figure 50 Africa Expected to Hold the Largest Size of the TVWS Spectrum Market in RoW During the Forecast Period

Figure 51 Key Growth Strategies Adopted By the Top Companies Between 2013 and 2016

Figure 52 Battle for Market Share: Contracts, Agreements, and Partnerships Were the Key Strategies Adopted By the Players

Figure 53 Microsoft Corporation: Company Snapshot

Figure 54 Microsoft Corporation: SWOT Analysis

Figure 55 Carlson Wireless Technologies, Inc.: SWOT Analysis

Figure 56 Alphabet Inc.: Company Snapshot

Figure 57 Alphabet Inc. (Google).: SWOT Analysis

Figure 58 Adaptrum, Inc.: SWOT Analysis

Figure 59 Aviacomm Inc.: SWOT Analysis

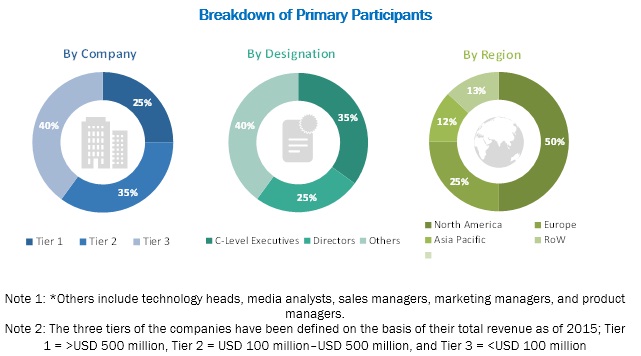

During this research study, major players operating in the TV white space spectrum market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the TVWS spectrum market and various other dependent submarkets. The key players in the market have been identified through the secondary research, and their market share in the respective regions has been determined through primary and secondary research. This entire research methodology involves the study of annual and financial reports of the top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the TVWS spectrum market. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through the primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

This research report categorizes the TVWS spectrum market based on component, software and services, device, end-use application, range, and geography.

By Component:

- Radios

- Antennas

- Cables

- Power supplies

- Backhaul and services

By Software and Services:

- Software

- Services

By Device:

- Fixed TV white space devices

- Portable TV white space devices

By End-use application:

- Ural internet access (rural broadband)

- Urban connectivity

- Emergency and public safety

- Smart grid networks

- Transportation and logistics

- Vehicle broadband access

- IoT & M2M

By Range:

- Medium range

- Long range

- Very long range

By Region:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- U.K.

- Germany

- France

- Rest of Europe

-

Asia-Pacific (APAC)

- China

- Japan

- South Korea

- India

- Rest of APAC

-

Rest of the World (RoW)

- Africa

- South America

Critical questions which the report answers

- How the TVWS disrupts the way rural broadband are carried?

- What are the new application areas which TVWS technology companies are exploring?

- What are the regulatory regime for TVWS spectrum allocation in developing countries?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market for all 4 regions based on various application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in TV White Space Spectrum Market