IoT Technology Market Size, Share & Growth

IoT Technology Market by Node Component (Sensor, Memory Device, Connectivity IC, Processor, Logic Devices), Software Solution (Remote Monitoring, Data Management), Platform, Service, End-use Application, Geography - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The IoT technology market size is projected to reach USD 1,148.62 billion by 2030 from USD 959.30 billion in 2025, at a CAGR of 3.7% from 2025 to 2030. The IoT technology market is driven by the rapid adoption of connected devices across industries, enabling real-time data exchange and automation. Increasing demand for smart homes, wearables, and industrial IoT solutions is fueling large-scale deployments. Additionally, advancements in 5G, cloud computing, and AI integration are accelerating the growth of IoT ecosystems.

The IoT technology market share is witnessing rapid growth as businesses and industries increasingly adopt connected devices and intelligent systems to enhance operational efficiency, data-driven decision-making, and real-time monitoring. IoT applications span across smart homes, healthcare, manufacturing, transportation, retail, and energy management, enabling seamless integration of sensors, devices, and cloud platforms for automation and analytics. Advancements in AI, edge computing, and 5G connectivity are driving the market, allowing faster data processing, predictive insights, and improved system reliability. With rising demand for smart infrastructure, industrial automation, and connected consumer devices, the IoT technology market is expected to expand significantly, offering transformative solutions across multiple sectors worldwide.

KEY TAKEAWAYS

-

BY IOT NODE COMPONENTSIoT node components, comprising sensors and actuators, are set to dominate the market as they enable real-time data collection, automation, and connectivity across industries like healthcare, agriculture, and smart cities. Advancements in miniaturization, edge AI, and LPWAN technologies further enhance their versatility and drive large-scale adoption.

-

BY IOT SOLUTION SOFTWAREThe software solution segment is expected to have the highest growth rate. It includes real-time streaming analytics, network bandwidth management, remote monitoring systems, security solutions, and data management. Software solutions are designed to meet interoperability challenges arising from varied heterogeneous devices and to manage a large volume of data and its security and privacy.

-

BY IOT PLATFORMPlatforms are categorized into device, application, and network management. These platforms allow central monitoring and control of every activity that takes place in organizations across industry verticals. The platform generally refers to the collection of packages and the application programming interface (API). A highly customizable platform allows any external developer to develop specialized applications using its capabilities.

-

BY IOT SERVICEThe service segment is broadly divided into professional services and managed services. Furthermore, professional services include deployment and integration services, consulting services, and support and maintenance services.

-

BY END USE APPLICATIONThe IoT technology market has been segmented into industrial and consumer based on end-use applications. The industrial end-use application includes healthcare, automotive & transportation, building automation, manufacturing, retail, BFSI, oil & gas, agriculture, and aerospace & defense. The consumer end-use application includes wearable devices and consumer electronics.

-

BY REGIONAsia Pacific is set to lead the IoT technology market, driven by rapid digital transformation, strong government initiatives, and heavy investments in 5G, AI, and smart city infrastructure across countries such as China, India, Japan, and South Korea. A large tech-savvy population, expanding industrial IoT adoption, and growing ecosystem collaborations further fuel the region’s position as the fastest-growing IoT market worldwide.

-

COMPETITIVE LANDSCAPEKey players operating in the IoT technology market include Intel Corporation (US), Qualcomm (US), Texas Instruments Incorporated (US), Cisco Systems, Inc. (US), Hewlett Packard Enterprise (US), IBM (US), STMicroelectronics (Switzerland), Microsoft, PTC Inc. (US), and Amazon Web Services (US), among others. Key strategies adopted by the players in the IoT technology market ecosystem to enhance their product portfolios, increase their market share, and expand their presence in the market mainly include new product launches, partnerships, and acquisitions.

The IoT technology industry holds major opportunities in areas such as smart cities, connected healthcare, and industrial automation, where real-time data is transforming operations and services. Integration with AI, 5G, and edge computing will unlock advanced use cases such as predictive maintenance, autonomous systems, and intelligent transportation. Additionally, the rise of sustainable solutions and energy-efficient IoT applications offers significant growth potential across global industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The visual highlights how disruptive trends are reshaping customer business models, shifting revenue from traditional to emerging sources. The current revenue mix is dominated by established IoT components, platforms, and services. The growth is largely expected from new sources such as wearable devices, smart homes, and connected vehicles. These hot bets are driving clients to adapt to evolving imperatives in sectors such as healthcare, automotive, building automation, and retail. As clients transition, their revenue mix will increasingly depend on advanced applications such as ADAS, telemedicine, EV battery analytics, and RFID. Ultimately, this shift emphasizes the importance of aligning with future-ready technologies to capture emerging value streams.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Global rise in internet penetration

-

Growing adoption of cloud platform

Level

-

Data security and privacy concerns

Level

-

Increasing cross-domain collaborations

-

Government-led funding to develop IoT research projects

Level

-

Interoperability challenges and lack of common standards

-

Lack of IoT-related skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Global rise in internet penetration

The global rise in internet penetration is a key driver for the IoT technology market trends, as it enables seamless connectivity between devices, applications, and users. Expanding access to high-speed networks allows IoT solutions to deliver real-time monitoring, automation, and data-driven insights. This growing digital reach accelerates adoption across healthcare, manufacturing, smart homes, and transportation worldwide.

Restraint: Data security and privacy concerns

Data security and privacy concerns restrain the IoT technology market growth due to the vast amount of sensitive information exchanged across connected devices. Vulnerabilities such as cyberattacks, unauthorized access, and data breaches create risks for both consumers and enterprises. These challenges increase regulatory pressures and adoption hesitancy, slowing large-scale IoT deployments.

Opportunity: Government-led funding to develop IoT research projects

Government-led funding for IoT research projects presents a major opportunity by accelerating innovation and fostering the development of advanced IoT solutions. Such initiatives support collaborations between academia, industry, and startups, driving breakthroughs in connectivity, security, and edge intelligence. This proactive investment strengthens digital infrastructure and boosts large-scale IoT adoption across critical sectors such as healthcare, smart cities, and manufacturing.

Challenge: Lack of IoT-related skilled professionals

The IoT market faces a restraint due to the shortage of skilled professionals to develop, deploy, and maintain complex IoT solutions. Its diverse ecosystem demands expertise across hardware, software, data science, and cybersecurity, making it difficult for specialists in narrow fields to adapt. Effective IoT implementation also requires strong cross-disciplinary collaboration, which remains a significant challenge.

IoT Technology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

IoT Core platform enabling secure device connectivity and cloud integration for enterprises | Real-time data processing, scalable cloud infrastructure, enhanced security for IoT devices |

|

Smart factory IoT solutions using the MindSphere platform for industrial automation | Improved operational efficiency, predictive maintenance, reduced downtime |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The IoT technology ecosystem comprises key hardware providers, including Intel, Qualcomm, Texas Instruments, and STMicroelectronics, which supply the essential semiconductor components and devices that enable connectivity and sensing. On the software and platform side, IoT technology companies major players such as IBM, AWS, SAP, Hewlett Packard Enterprise, and PTC offer cloud services, data analytics, and IoT management platforms critical for device orchestration and data processing. This ecosystem supports a diverse range of end users across various sectors, including smart homes, banking, commercial buildings, aviation, industrial manufacturing, agriculture, and automotive. The integration of hardware, software, and diverse applications illustrates the interconnected and multi-layered nature of the IoT industry, driving innovation and adoption across industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

IoT Technology Market, By Node Component

The processor market in node components is expected to have the largest market share during the forecast period. IoT devices continue to grow exponentially across diverse sectors, such as smart homes, industrial automation, healthcare, agriculture, and smart cities. Each device requires a processor to manage data processing, connectivity, and functionality. As IoT applications become more sophisticated, the demand for processors capable of handling increased data processing and analytics grows.

IoT Technology Market, By Software Solution

The data management software solution segment accounted for the largest market size. Software solutions are designed to meet interoperability challenges arising from varied heterogeneous devices and manage a large volume of data and its security and privacy. With the increase in the number of connected devices, the volume of data is also proliferating. Connected devices generate a huge volume of unstructured data daily. This data can be used to gain insights by analyzing the data generated. Data management software solutions are required to manage the massive volume of data.

IoT Technology Market, By Platform

The network management segment held the largest share of the IoT technology market for the platform segment. IoT network management enables functionalities such as authenticating, provisioning, configuring, monitoring, routing, and device software management (e.g., firmware updates, bug fixes, and so forth). These functionalities help to maintain good network performance and are generally provided in an IoT environment as a network service. A solid network management solution is device-agnostic and offers a simple way to incorporate cross-vendor hardware models and data structures into the IoT workflow.

IoT Technology Market, By Service

Professional services held a larger share of the IoT technology market for the service segment. Professional services are required during and after the implementation of IoT systems. These services include planning, designing, consulting, and upgrading. The increasing complexity of operations and the growing use of IoT solutions are driving the market for professional services. The proliferation of connected devices generates massive amounts of data. IoT professional services providers help organizations manage data, including data collection, storage, processing, and analysis. These services assist in developing data analytics strategies and implementing tools and technologies to derive actionable insights from IoT-generated data. Organizations can make informed decisions, optimize processes, and drive innovation by leveraging advanced analytics.

IoT Technology Market, By End-use Application

The industrial application of IoT is expected to register the highest CAGR as enterprises increasingly adopt connected solutions for automation, predictive maintenance, and process optimization. Rising Industry 4.0 initiatives and digital transformation efforts are driving large-scale deployment of IoT in manufacturing, logistics, and energy sectors. Additionally, integration with AI, robotics, and analytics enhances efficiency and cost savings, accelerating adoption across industrial ecosystems.

REGION

Asia Pacific is expected to be the fastest-growing region in the global IoT Technology market during the forecast period.

Asia Pacific is expected to be the fastest-growing market for IoT technology due to rapid digital transformation and large-scale adoption of smart devices across industries. Governments in countries such as China, Japan, South Korea, and India are heavily investing in smart city projects and Industry 4.0 initiatives. The presence of a strong manufacturing base, coupled with increasing demand for connected solutions in automotive, healthcare, and consumer electronics, further fuels growth. Additionally, expanding 5G infrastructure and supportive regulatory policies are creating a favorable ecosystem for IoT expansion in the region

The Asia Pacific IoT technology market is projected to reach USD 351.03 billion by 2030 from USD 260.76 billion in 2025, at a CAGR of 6.1%. The market in the Asia Pacific region is witnessing robust growth, driven by the rising adoption of smart devices, the accelerated rollout of 5G networks, and the large-scale implementation of smart city and digital infrastructure projects across the region

The North America IoT Technology market is projected to reach USD 314.75 billion by 2030 from USD 279.90 billion in 2025, at a CAGR of 2.4% from 2025 to 2030. The market is experiencing strong growth, driven by the early adoption of advanced digital technologies across various industries. Increased investments in smart manufacturing, smart cities, healthcare IoT, and connected vehicles are accelerating market expansion. Additionally, the widespread deployment of 5G and the development of strong cloud and AI ecosystems are further supporting IoT adoption in the region.

The Europe IoT Technology market is projected to reach USD 272.11 billion by 2030 from the estimated USD 246.63 billion in 2025, at a CAGR of 2.0% from 2025 to 2030. The IoT technology market in Europe is experiencing strong growth due to increased adoption of smart devices, the rollout of 5G, and the deployment of smart cities.

IoT Technology Market: COMPANY EVALUATION MATRIX

Intel Corporation (Star) has well-established channels throughout the value chain. It has a broad portfolio, innovative product offerings, and a global presence. Hewlett Packard Enterprise Development LP (Emerging Leader) is investing in R&D to launch several products in the market. It has a unique portfolio of innovative products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | 929.50 BN |

| Market Forecast in 2030 (Value) | 1,148.62 BN |

| Growth Rate | CAGR of 3.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: IoT Technology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| IoT Technology market in Saudi Arabia | Detailed market size by offering and end-use industry |

|

RECENT DEVELOPMENTS

- March 2025 : Qualcomm announced its agreement to acquire Edge Impulse, a leader in edge AI platforms, expanding capabilities for developer enablement and further powering AI-enabled IoT solutions for critical sectors such as retail, energy, security, and manufacturing.

- October 2024 : Qualcomm launched the industrial-grade IQ series platform for extreme IIoT applications, focused on AI performance (up to 100 TOPS), safety-grade operations, and power efficiency for robots, drones, and advanced inspection systems.

- March 2024 : Texas Instruments launched the IoT Cloud Ecosystem, a third-party platform connecting developers and manufacturers with certified cloud service providers to accelerate IoT solution development and deployment. This ecosystem aims to simplify seamless integration for end users seeking scalable, secure cloud-connected IoT architectures.

- February 2024 : Intel launched a new Edge Platform, a modular, open software solution for enterprises to efficiently develop, deploy, manage, and secure edge and AI applications at scale. This platform enables cloud-like simplicity for edge deployments, bringing improved cost savings and streamlined operations for IoT environments.

- January 2024 : Texas Instruments introduced new semiconductors designed to improve automotive safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the industry's first for satellite radar architecture, enabling higher levels of autonomy by improving sensor fusion and decision-making in ADAS.

FAQ

1: What is the IoT technology market and what are its applications?

The IoT technology market comprises connected devices, sensors, and platforms that enable data collection, analysis, and automation across industries. Applications include smart homes, healthcare, manufacturing, transportation, retail, energy management, and industrial automation, where real-time insights improve efficiency, productivity, and decision-making.

2: What is the current size and growth forecast of the IoT technology market?

The IoT technology market is growing rapidly due to rising adoption of connected devices, AI, edge computing, and 5G networks. The market is expected to continue expanding at a healthy CAGR, driven by industrial automation, smart infrastructure, and consumer IoT solutions worldwide.

3: What are the key trends shaping the IoT technology market?

Key trends include AI and machine learning integration, edge computing for real-time data processing, 5G connectivity for faster communication, cloud-based IoT platforms, and increased adoption of smart and connected devices across multiple industries.

4: Which industries are driving the demand for IoT technology?

The leading industries adopting IoT solutions include manufacturing and industrial automation, healthcare and medical devices, smart homes and buildings, transportation and logistics, energy and utilities, and retail. These sectors use IoT for operational efficiency, predictive maintenance, safety, and cost reduction.

5: What is the future outlook for the IoT technology and application market?

The IoT technology market is expected to grow significantly, driven by advancements in AI, IoT platforms, edge computing, and 5G networks. Increasing deployment of smart cities, connected industries, and digital infrastructure globally will continue to fuel market expansion, with significant opportunities in both mature and emerging regions.

Table of Contents

Methodology

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the IoT technology market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the IoT technology market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the IoT technology market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; IoT technology products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification, and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the IoT technology market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

Note: The three tiers of companies have been defined based on their total revenue as of 2024: tier 1: revenue greater than USD 1 billion; tier 2: revenue between USD 500 million and USD 1 billion; and tier 3: revenue less than USD 500 million.

Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

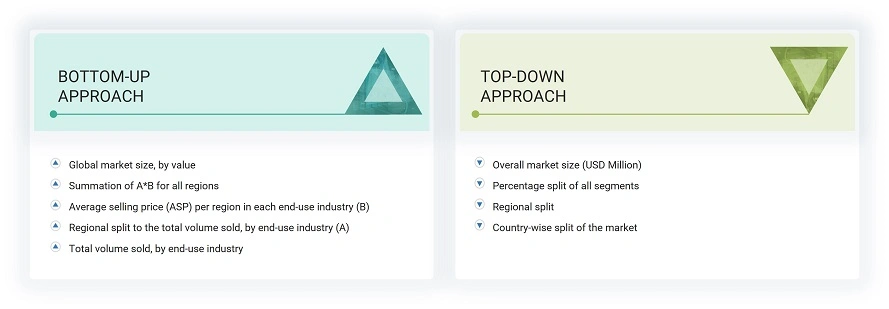

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the IoT technology market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

IoT Technology Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the IoT technology market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

IoT is a key digital transformation technology, enabling businesses to increase their operational efficiency. Other technologies, such as edge computing, digital twin, Wi-Fi, and big data analytics, are spurring the demand for the digital transformation of businesses. Various application areas, such as retail, manufacturing, transportation, and healthcare, are undergoing digital transformation. Hence, the growing demand for IoT-based digital transformation of businesses is expected to provide growth opportunities for the IoT technology market during the forecast period.

Key Stakeholders

- Original Technology Designers and Suppliers

- System Integrators

- Electronic Hardware Equipment Manufacturers

- Technical Universities

- Government Research Agencies and Private Research Organizations

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Sensor Manufacturers

- Technology Standard Organizations, Forums, Alliances, and Associations

- Raw Material and Manufacturing Equipment Suppliers

- Semiconductor Wafer Vendors

- Fabless Players

- EDA and IP Core Vendors

- Foundry Players

- Original Equipment Manufacturers (OEMs)

- Original Design Manufacturers (ODM) and OEM Technology Solution Providers

- Distributors and Retailers

- Technology Investors

- Operating System (OS) Vendors

- Content Providers

- Software Providers

Report Objectives

- To define and forecast the IoT technology market size, by node component, software solution, platform, service, and end-use application, in terms of value.

- To describe and forecast the global IoT technology market, by node components, in terms of volume.

- To describe and forecast the market size for various segments with regard to four main regions—North America, Latin America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to the IoT technology market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To describe in brief the value chain of IoT technology solutions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with the detailed competitive landscape of the market.

- To analyze competitive developments, such as product launches and developments, partnerships, agreements, expansions, acquisitions, contracts, alliances, and research & development (R&D), undertaken in the IoT technology market.

- To benchmark market players using the proprietary ‘Company Evaluation Matrix,’ which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

- To analyze the probable impact of the recession on the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the IoT Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in IoT Technology Market

Dec, 2022

Is SIGFOX a good solution for international business at IOT Field? .