Unmanned Aerial Vehicle (UAV) Navigation Market by Solution (Hardware, Software), by Range (Visual Line of Sight, Extended Visual Line of Sight, Beyond Line of Sight), by Application (Commercial, Military, Public Safety, and Law Enforcement), by Mode of Operation (Remotely Piloted, Optionally Piloted, Fully Autonomous), and Region- Global Forecast To 2030

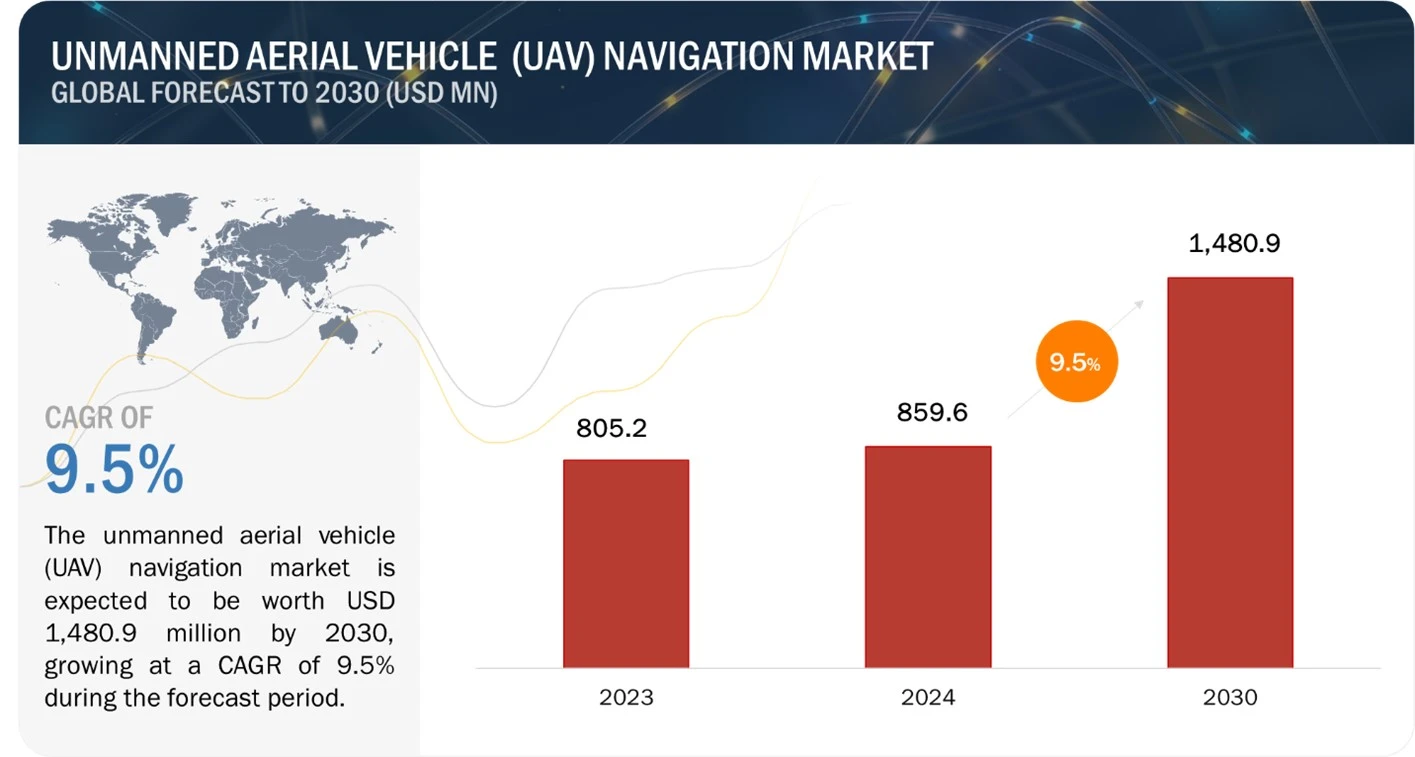

The Unmanned Aerial Vehicle (UAV) Navigation Market is projected to reach USD 1,480.9 million by 2030, from USD 859.6 million in 2024, at a CAGR of 9.5%. The Unmanned Aerial Vehicle (UAV) Navigation Market is focused on providing advanced systems that enable unmanned aerial vehicles (UAVs) to navigate autonomously with high precision and reliability. This market includes key components such as GPS systems, inertial measurement units (IMUs), sensors, and software for real-time data processing. It serves various sectors, including defense, agriculture, logistics, surveying, and infrastructure inspection, with a growing emphasis on military applications. This market is rapidly growing, driven by the increasing adoption of UAVs in commercial and defense applications. As UAV technology advances, the demand for more sophisticated navigation solutions continues to rise, driven by the need for improved accuracy, autonomy, and integration with emerging technologies like AI and machine learning.

ATTRACTIVE OPPORTUNITIES IN UNMANNED AERIAL VEHICLE (UAV) NAVIGATION MARKET

Unmanned Aerial Vehicle (UAV) Navigation Market Dynamics:

Driver: Increasing adoption of UAVs in commercial and defense applications

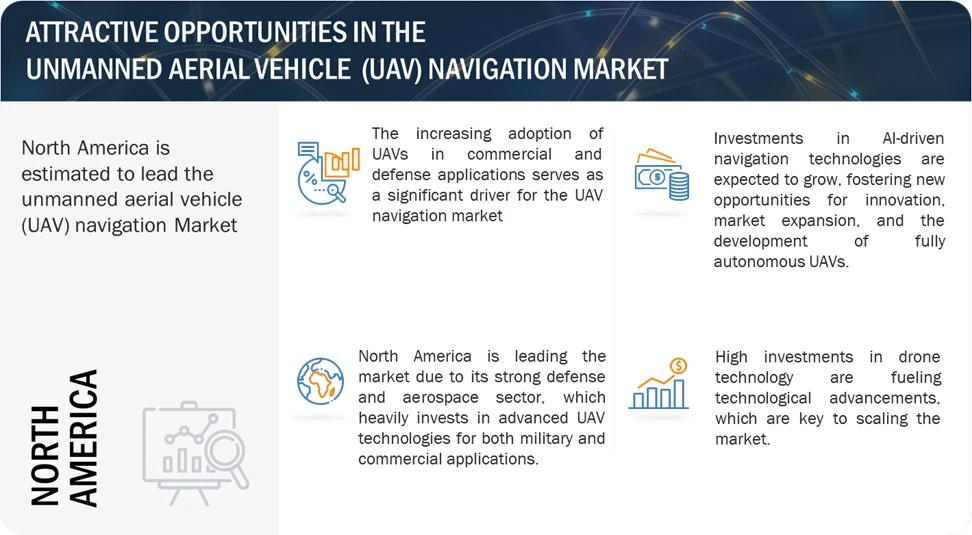

The increasing adoption of UAVs in commercial and defense applications serves as a significant driver for the UAV navigation market. In the commercial sector, industries such as agriculture, logistics, construction, and energy are rapidly integrating UAVs into their operations for tasks like precision farming, aerial surveying, infrastructure inspection, and parcel delivery. These applications demand highly accurate navigation systems to ensure operational efficiency, safety, and precision, especially in environments where GPS signals may be weak or absent. Similarly, in the defense sector, UAVs are becoming indispensable tools for intelligence, surveillance, reconnaissance (ISR), and combat operations. Advanced navigation technologies, including GNSS (Global Navigation Satellite Systems), inertial navigation systems (INS), and sensor fusion solutions, are critical for enabling autonomous flight, obstacle detection, and mission accuracy. The growing demand for UAVs to operate in complex and diverse environments, such as urban areas, mountainous terrain, or contested military zones, further accelerates the development of robust navigation systems, driving innovation and investment in the UAV navigation market.

Restraint: Regulatory challenges and airspace integration issues

Governments and aviation authorities worldwide impose strict regulations to ensure airspace safety and prevent potential risks associated with UAV operations, such as collisions, privacy violations, and security threats. For instance, restrictions on beyond-visual-line-of-sight (BVLOS) flights and operations in restricted or urban airspaces directly impact the adoption of advanced navigation technologies. Moreover, the lack of standardized frameworks for integrating UAVs into national airspace systems creates operational uncertainties for industries relying on UAVs. These challenges necessitate the development of highly reliable and compliant navigation solutions that meet stringent regulatory requirements, including features such as geofencing, automatic dependent surveillance-broadcast (ADS-B), real-time obstacle detection, and AI integration in UAVs. While such innovations could drive technological advancements in navigation systems, the overall growth of the market remains constrained by slow regulatory processes and inconsistent policies across different regions.

Opportunity: Advancement and adoption of AI-driven autonomous navigation systems

AI-powered systems enhance UAVs’ ability to operate independently by leveraging real-time data processing, machine learning algorithms, and sensor fusion. This capability allows UAVs to navigate complex environments, avoid obstacles, and adapt to dynamic conditions without relying solely on GPS or human intervention. Such autonomy is particularly valuable in GPS-denied environments, such as dense urban areas, underground spaces, or contested military zones. In commercial applications, AI-driven navigation is enabling innovations like drone deliveries, precision agriculture, and infrastructure inspections, where real-time adaptability and efficiency are crucial. Similarly, in defense, autonomous navigation enhances the capabilities of UAVs for surveillance, reconnaissance, and combat missions, reducing risks to human operators. As industries increasingly demand more intelligent and efficient UAV operations, investments in AI-driven navigation technologies are expected to grow, fostering new opportunities for innovation, market expansion, and the development of fully autonomous UAV ecosystems.

Challenge: Ensuring reliable performance in GPS-denied or contested environments

In environments where GPS signals are obstructed, such as dense urban landscapes, forests, underground facilities, or indoor spaces, UAVs struggle to maintain their operational integrity. Additionally, in military applications, GPS signals are often jammed or spoofed by adversaries, rendering standard navigation systems ineffective. Overcoming this challenge requires the development of alternative navigation technologies, such as advanced inertial navigation systems (INS), visual odometry, LiDAR-based mapping, or AI-driven sensor fusion techniques. These solutions need to ensure not only accuracy but also robustness in highly dynamic and unpredictable conditions. However, integrating such technologies adds complexity and cost to UAV navigation systems, creating barriers to adoption, especially in cost-sensitive markets. Furthermore, the testing and certification of these alternative systems in real-world conditions remain a daunting task, slowing their implementation and scalability.

Based on solution, the Hardware segment will lead the Unmanned Aerial Vehicle (UAV) Navigation Market in 2024

The hardware segment is leading the UAV navigation market in 2024 due to its critical role in ensuring the performance, reliability, and precision of unmanned aerial systems. Key components such as GPS modules, inertial measurement units (IMUs), magnetometers, and advanced processors are foundational to enabling accurate navigation and autonomous capabilities. The growing adoption of UAVs across industries like defense, agriculture, logistics, and surveying has amplified the demand for sophisticated navigation hardware to support complex missions and extended operational ranges.

Based on applcations, the military segment will lead the market in 2024.

The military segment is leading the UAV navigation market in 2024 due to the increasing reliance on unmanned aerial vehicles for a wide range of defense applications, including surveillance, reconnaissance, intelligence gathering, and precision strikes. UAVs offer unparalleled advantages in terms of reducing human risk, providing real-time data, and enabling high levels of operational flexibility. As military operations become more complex and data-driven, the need for highly accurate and secure navigation systems has grown, driving demand for advanced navigation solutions.

The North American region is to have the largest share in 2024.

The North American region is leading the UAV navigation market in 2024 due to its strong defense and aerospace sector, which heavily invests in advanced UAV technologies for both military and commercial applications. The U.S. Department of Defense remains a major driver, leveraging UAVs for surveillance, reconnaissance, and tactical operations, thus fueling demand for cutting-edge navigation systems. Additionally, the region benefits from a highly developed infrastructure, robust research and development capabilities, and a strong presence of leading UAV manufacturers and technology providers.

Key Market Players

- Hexagon AB (Sweden)

- UAV Navigation S.L. (Spain)

- SZ DJI Technology Co., Ltd. (China)

- SBG Systems S.A.S (France)

- RTX Corporation (US)

These players have adopted various strategies, such as partnerships and contracts, to enhance their customer base and increase reach. Major focus was given to contracts, partnerships, and product developments. All these developments have helped these players boost their market share.

Scope Of The Report

|

Report Metric |

Details |

|

Estimated Market Size (2024) |

USD 859.6 million |

|

Projected Market Size (2030) |

USD 1,480.9 million |

|

Market Growth Rate (CAGR) |

9.5% |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Solution, Range, Application, Mode of Operation, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Latin America, and Africa |

|

Companies covered |

Hexagon AB (Sweden), UAV Navigation S.L. (Spain), SZ DJI Technology Co., Ltd. (China), SBG Systems S.A.S (France), RTX Corporation (US), a total of 25 companies |

Unmanned Aerial Vehicle (UAV) Navigation Market Highlights

The study categorizes the Unmanned Aerial Vehicle (UAV) Navigation Market based on Solution, Range, Application, Mode of Operation, and region.

|

Segment |

Subsegment |

|

Solution |

o Hardware § Global Navigation Satellite Systems (GNSS) § Barometer § Optical Flow Sensors § Lidar Sensors § Others o Software |

|

Range |

o Visual Line of Sight o Extended Visual Line of Sight o Beyond Line of Sight |

|

Application |

o Commercial § Inspection & Monitoring § Surveying & Mapping § Remote Sensing § Delivery § Public Transport o Military § Combat § ISR § Delivery o Public Safety and Law Enforcement § Border Management § Firefighting and Disaster Management § Police Operations & Investigations § Maritime Security |

|

Mode of Operation |

o Remotely Piloted o Optionally Piloted o Fully Auronomous |

|

Region |

o North America o Europe o Asia Pacific o Middle East o Latin America o Africa |

Recent Developments

- In December 2024, UAV Navigation-Oesia Group inaugurated a new high-tech center in San Sebastián de los Reyes, Madrid. This strategic investment strengthens its position as a leader in the global market for autonomous and intelligent systems, facilitating further expansion and technological development.

- In November 2024, Advanced Navigation, an autonomous systems and navigation technologies provider, along with MBDA, have signed a MoU to co-develop a resilient navigation system integrating MBDA’s NILEQ absolute positioning technology.

- In October 2024, UAV Navigation-Oesia Group developed Heads-Up Display (HUD) technology to improve first-person visualization of UAV flight. New HUD technology provides UAV operators with a better situational awareness, for both civil and military applications.

Frequently Asked Questions (FAQ’s)

- What is the current size of the Unmanned Aerial Vehicle (UAV) Navigation Market?

- The Unmanned Aerial Vehicle (UAV) Navigation Market is estimated to reach USD 859.6 million in 2024

- What is the projected growth of the Unmanned Aerial Vehicle (UAV) Navigation Market?

- the Unmanned Aerial Vehicle (UAV) Navigation Market is projected to grow at a CAGR of 9.5% from 2024 to 2030.

- Who are the winners in the Unmanned Aerial Vehicle (UAV) Navigation Market?

- Hexagon AB (Sweden), UAV Navigation S.L. (Spain), SZ DJI Technology Co., Ltd. (China), SBG Systems S.A.S (France), RTX Corporation (US).

- What solution for UAV navigation will lead the market in 2024?

- The hardware navigation solutions will lead the market in 2024.

- Which region is expected to hold the highest market share in the Unmanned Aerial Vehicle (UAV) Navigation Market?

- The Unmanned Aerial Vehicle (UAV) Navigation Market in the North America region is estimated to hold the largest market share in 2024.

“To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab.”

1... INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 MARKET STAKEHOLDERS

1.6 INCLUSIONS & EXCLUSIONS

2... RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Major Secondary Sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Industry Insights

2.1.3 SECONDARY AND PRIMARY RESEARCH APPROACH

2.2 MARKET SIZE ESTIMATION

2.2.1 UAV NAVIGATION MARKET

2.2.1.1 Bottom-up Approach

2.2.1.2 Top-down Approach

2.2.3 MARKET PROJECTIONS

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-side Indicators

2.3.3 Supply-side indicators

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

2.6 RISK ANALYSIS

2.7 LIMITATION

3... EXECUTIVE SUMMARY

4... PREMIUM INSIGHTS

5... MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 OPERATIONAL DATA

5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.5 ECOSYSTEM ANALYSIS

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

5.7.1 INDICATIVE PRICING ANALYSIS, BY APPLICATION

5.7.2 INDICATIVE PRICING ANALYSIS, BY REGION

5.8 CASE STUDY ANALYSIS

5.7.1 CASE STUDY 1

5.7.2 CASE STUDY 2

5.7.1 CASE STUDY 3

5.9 TRADE ANALYSIS

5.10 KEY CONFERENCES AND EVENTS, 2024–2025

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 TARIFF DATA (HS CODE: 901420) - INSTRUMENTS AND APPLIANCES FOR AERONAUTICAL OR SPACE NAVIGATION (EXCL. COMPASSES AND RADIO NAVIGATIONAL EQUIPMENT)

5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.3 KEY REGULATIONS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

5.12.2 BUYING CRITERIA

5.13 TECHNOLOGY ANALYSIS

5.13.1 KEY TECHNOLOGY

5.13.1.1 GPS/GNSS (Global Navigation Satellite Systems)

5.13.1.2 Inertial Measurement Units (IMUs)

5.13.2 COMPLIMENTARY TECHNOLOGY

5.13.2.1 Radar

5.13.2.2 Lidar (Light Detection and Ranging)

5.13.3 ADJACENT TECHNOLOGY

5.13.3.1 Drone Mapping and Data Analytics Software

5.13.3.2 Battery Technology

5.14 INVESTMENT AND FUNDING SCENARIO

5.15 BUSINESS MODELS OF THE TOP 5 PLAYERS

5.16 TOTAL COST OF OWNERSHIP

5.17 MACROECONOMIC OUTLOOK

5.18 BILL OF MATERIAL

6... INDUSTRY TRENDs

6.1 INTRODUCTION

6.2 Technology Trends for UAV (DRONE) NAVIGATION SYSTEMS MARKET

6.3 TECHNOLOGY ROADMAP

6.4 IMPACT OF MEGATRENDS

6.5 IMPACT OF AI ON THE UNMANNED AERIAL VEHICLE (UAV) NAVIGATION MARKET

7... UAV (DRONE) NAVIGATION SYSTEMS MARKET, BY Solution

7.1 introduction

7.2 Hardware

7.2.1 Global Navigation Satellite Systems (GNSS)

7.2.2 Barometer

7.2.3 Optical flow sensors

7.2.4 Lidar sensors

7.2.5 Others

7.3 sOFTWARE

8... UAV (DRONE) NAVIGATION SYSTEMS MARKET, BY range

8.1 introduction

8.2 Visual Line of Sight (VLOS)

8.3 Extended Visual Line of Sight (eVLOS)

8.4 Beyond line of sight (BLOS)

9... UAV (DRONE) NAVIGATION SYSTEMS MARKET, BY application

9.1 INTRODUCTION

9.2 commercial

9.2.1 inspection & monitoring

9.2.2 surveying & mapping

9.2.3 remote sensing

9.2.4 delivery

9.2.5 public transport

9.3 military

9.3.1 combat

9.3.2 isr

9.3.3 delivery

9.4 PUBLIC SAFETY and law enforcement

9.4.1 border management

9.4.2 firefighting and disaster management

9.4.3 police operations & investigations

9.4.4 maritime security

10. UAV (DRONE) NAVIGATION SYSTEMS MARKET, BY mode of operation

10.1 introduction

10.2 remotely Piloted

10.3 Optionally piloted

10.4 fully Autonomous

11. UAV (DRONE) NAVIGATION SYSTEMS MARKET, REGIONAL ANALYSIS

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 Pestle Analysis: North America

11.2.2 US

11.2.3 CANADA

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

11.3.2 UK

11.3.3 GERMANY

11.3.4 FRANCE

11.3.5 RUSSIA

11.3.6 Ukraine

11.3.7 Italy

11.3.7 Rest of Europe

11.4 Asia Pacific

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

11.4.2 CHINA

11.4.3 INDIA

11.4.4 JAPAN

11.4.5 AUSTRALIA

11.4.6 SOUTH KOREA

11.4.6 Rest of Asia Pacific

11.5 Middle East

11.5.1 PESTLE ANALYSIS: Middle East

11.5.2 GCC Countries

11.5.2.1 Qatar

11.5.2.2 UAE

11.5.3 Israel

11.5.4 turkey

11.5.5 Rest of Middle East

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

11.6.2 BRAZIL

11.6.3 MEXICO

11.6.3 Rest of LATIN AMERICA

11.6 Africa

11.6.1 PESTLE ANALYSIS: Africa

11.6.2 South Africa

11.6.3 Rest of Africa

12. COMPETITIVE LANDSCAPE

12.1 Introduction

12.2 Key Player Strategies/Right to Win

12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2023

12.4 REVENUE ANALYSIS 2020–2023

12.5 BRAND/ Product COMPARISON

12.6 COMPANY VALUATION AND FINANCIAL METRICS

12.7 COMPANY EVALUATION matrix: KEY PLAYERS, 2024

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

12.7.5 COMPANY FOOTPRINT, KEY PLAYERS, 2024

12.7.5.1 COMPANY FOOTPRINT

12.7.5.2 REGION FOOTPRINT

12.7.5.3 SOLUTION FOOTPRINT

12.7.5.4 RANGE FOOTPRINT

12.7.5.5 APPLICATION FOOTPRINT

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

12.8.5 Company Footprint: Start-ups/SMEs, 2024

12.8.5.1 DETAILED LIST OF KEY STARTUPS/SMES

12.8.5.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.9 COMPETITIVE SCENARIO

12.9.1 LATEST DEVELOPMENTS

13. COMPANY PROFILES

13.1 MAJOR PLAYERS

13.1.1 ANALOG DEVICES

13.1.2 DII

13.1.3 honeywell aerospace

13.1.4 Northrop Grumman Corporation

13.1.5 collins aerospace

13.1.6 te connectivity

13.1.7 bae systems

13.1.8 Thales

13.1.9 Velodyne

13.1.10 SKYDIO

13.2 Other Players

13.2.1 DroneDeploy

13.2.2 AirMap

13.2.3 Percepto

13.2.4 Autel Robotics

13.2.5 PrecisionHawk

14. APPENDIX

14.1 discussion guide

14.2 Laundry List of studied companies

14.3 Knowledge Store: MarketsandMarkets’ subscription portal

14.4 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

14.5 Available Customization

14.6 related reports

14.7 AUTHOR DETAILS

Growth opportunities and latent adjacency in Unmanned Aerial Vehicle (UAV) Navigation Market