2

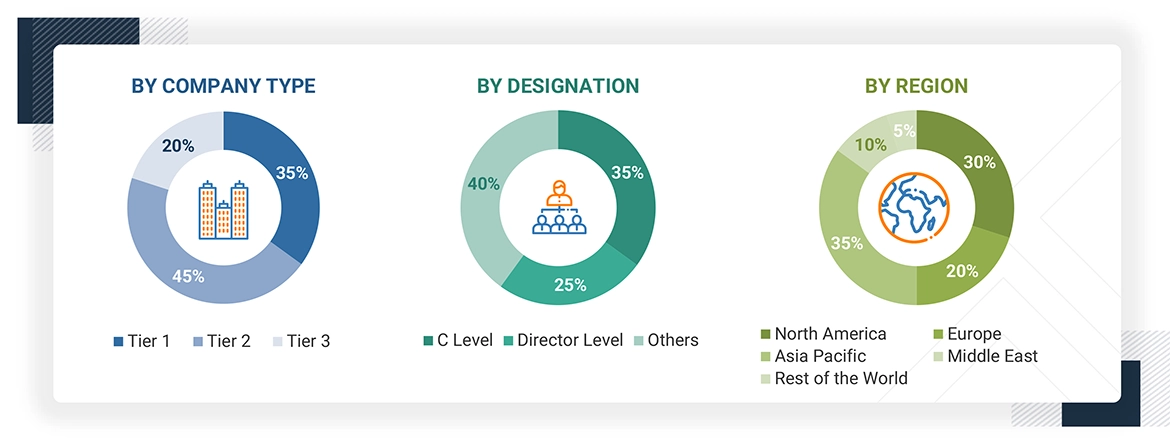

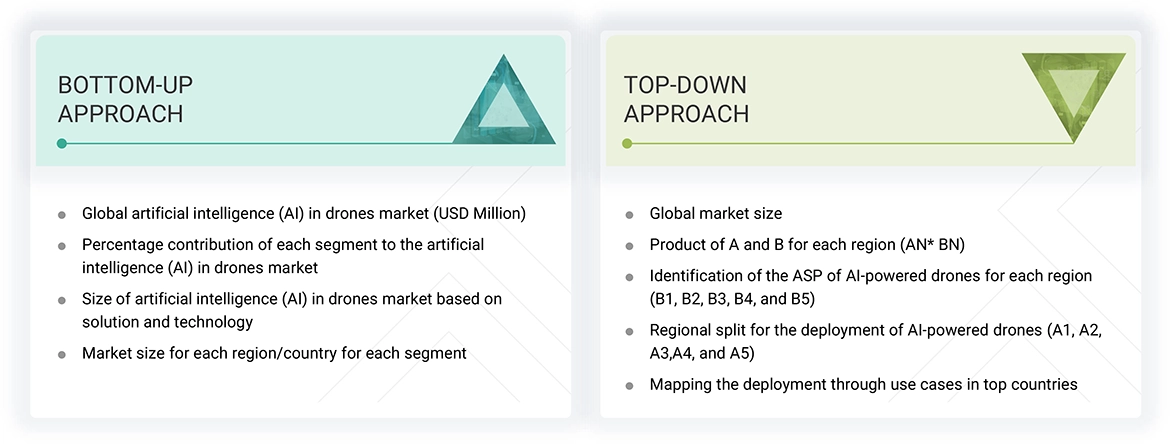

RESEARCH METHODOLOGY

37

5

MARKET OVERVIEW

Analyze Market Structure and Competitive Intensity to Anticipate New Growth Opportunities

52

5.2.1.1

Increasing need for autonomous operations in complex environments

5.2.1.2

Rise in investments in defense and security

5.2.1.3

Rapid expansion of commercial use of drones

5.2.1.4

Increasing demand for real-time data analytics

5.2.2.1

High cost of AI integration and onboard processing hardware

5.2.2.2

Lack of standardized regulations for autonomous drone operations

5.2.3.1

Expansion of autonomous Drone-as-a-Service (DaaS) Model

5.2.3.2

Deployment of AI-enabled swarm drones for defense and emergency response

5.2.3.3

Growth of intelligent ISR and border surveillance capabilities

5.2.4.1

Data privacy and cybersecurity concerns in AI-driven drone missions

5.2.4.2

Difficulty developing robust AI algorithms for GPS-denied and adverse environments

5.3

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4.1

RESEARCH & DEVELOPMENT

5.4.2

COMPONENT & CHIPSET MANUFACTURING

5.4.3

AI SOFTWARE DEVELOPMENT

5.5.1

PROMINENT COMPANIES

5.5.2

PRIVATE AND SMALL ENTERPRISES

5.6.1

AVERAGE SELLING PRICE OF AI-POWERED DRONES FOR KEY PLAYERS, BY SOLUTION

5.6.2

AVERAGE SELLING PRICE OF AI-POWERED DRONE SOLUTIONS, BY REGION

5.6.3

AVERAGE SELLING PRICE OF AI-POWERED DRONES, BY END USER

5.7.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7.2

REGULATORY FRAMEWORK, BY REGION

5.7.2.5

Latin America & Africa

5.8

KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.9.1.1

Vision Transformers (ViTs)

5.9.1.3

Reinforcement Learning (RL)

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.2.1

Sensor fusion systems

5.9.2.2

Edge AI processors

5.9.3

ADJACENT TECHNOLOGIES

5.9.3.1

Digital twin platforms

5.9.3.2

Geospatial Information Systems (GISs)

5.10.1

CASE STUDY 1: DRONEDESK INTEGRATED ALTITUDE ANGEL’S GUARDIANUTM API INTO ITS WORKFLOW MANAGEMENT SYSTEM

5.10.2

CASE STUDY 2: INTEL DEPLOYED DRONES EQUIPPED WITH AI, COMPUTER VISION, AND EDGE COMPUTING TO MAP TERRAIN, MONITOR VEGETATION, AND ASSESS SOIL CONDITIONS

5.10.3

CASE STUDY 3: CALTRANS PARTNERED WITH SKYDIO TO DEPLOY AUTONOMOUS DRONES WITH ADVANCED AI AND COMPUTER VISION CAPABILITIES

5.11

KEY CONFERENCES AND EVENTS, 2025–2026

5.12

INVESTMENT & FUNDING SCENARIO

5.13.3

PRICE IMPACT ANALYSIS

5.13.4

IMPACT ON COUNTRY/REGION

5.13.4.3

Asia Pacific (APAC)

5.13.5

IMPACT ON END-USE INDUSTRIES

5.14

MACROECONOMIC OUTLOOK

5.15

TOTAL COST OF OWNERSHIP (TCO)

5.16

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: BUSINESS MODELS

5.18.1

REAL-TIME OBJECT DETECTION & TRACKING

5.18.2

AUTONOMOUS NAVIGATION

5.18.3

EDGE AI PROCESSING

5.18.4

SWARM INTELLIGENCE/MULTI-AGENT AI

5.18.5

NATURAL LANGUAGE INTERFACES

5.19

IMPACT OF MEGA TRENDS

5.19.1

ADDITIVE MANUFACTURING

5.19.2

ADVANCED MATERIAL INTEGRATION

5.19.3

BIG DATA ANALYTICS

5.20

SUPPLY CHAIN ANALYSIS

6

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION

Market Size and Forecast to 2030 – USD Million

93

6.2.1

INCREASING NEED FOR EDGE COMPUTING AND HIGH-PERFORMANCE ONBOARD PROCESSING TO DRIVE MARKET

6.2.2.2

Edge computing modules

6.2.3.1

Flash/SSD modules

6.3.1

GROWING DEMAND FOR REAL-TIME, AUTONOMOUS DECISION-MAKING CAPABILITIES ACROSS COMMERCIAL AND DEFENSE APPLICATIONS TO DRIVE MARKET

6.3.2

AI DEVELOPMENT TOOLS

6.3.2.1

Software development kits (SDKs) and machine learning (ML) frameworks

6.3.2.2

Vision-specific AI toolkits

6.3.3

AI APPLICATION PLATFORMS

6.3.3.1

Onboard autonomy stacks

6.3.3.2

Fleet/Cloud platforms

6.4.1

INCREASING DEMAND FOR CUSTOMIZED, END-TO-END AI INTEGRATION ACROSS DIVERSE INDUSTRIES TO DRIVE MARKET

6.4.3

INTEGRATED SERVICES

7

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER

Market Size and Forecast to 2030 – USD Million

100

7.2.1

INCREASING NEED FOR AUTONOMOUS, GPS-INDEPENDENT SYSTEMS IN CONTESTED ENVIRONMENTS TO DRIVE MARKET

7.3.1

RISING DEMAND FOR REAL-TIME ANALYTICS AND AUTOMATION ACROSS LARGE-SCALE INDUSTRIAL OPERATIONS TO DRIVE MARKET

7.4

GOVERNMENT & LAW ENFORCEMENT

7.4.1

EMPHASIS ON SMART SURVEILLANCE AND RAPID EMERGENCY RESPONSE CAPABILITIES TO DRIVE MARKET

8

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION

Market Size and Forecast to 2030 – USD Million

103

8.2

FLIGHT & MISSION OPERATIONS

8.2.1

RISING NEED FOR FULLY AUTONOMOUS DRONE OPERATIONS IN COMMERCIAL APPLICATIONS TO DRIVE MARKET

8.2.2

AUTONOMOUS FLIGHT PLANNING & SCHEDULING

8.2.2.1

Use case: Walmart & Wing’s drones schedule optimized delivery missions within 30 minutes

8.2.3

ROUTE OPTIMIZATION & DYNAMIC REROUTING

8.2.3.1

Use case: MIT’s AI navigates wind deviations mid-flight, improving accuracy by 50%

8.2.4

OBSTACLE AVOIDANCE & PATH CORRECTION

8.2.4.1

Use case: Amazon’s Prime AIR MK30 drones navigate and avoid obstacles using AI, enabling safer BVLOS flights

8.2.5

REAL-TIME WEATHER AVOIDANCE

8.2.5.1

Use case: Adaptive control systems allow wildfire drones to adjust paths to avoid turbulent winds

8.2.6

AIRSPACE DECONFLICTION/SWARM PATH COORDINATION

8.2.6.1

Use case: EPFL’s drone swarm flies through simulated forests 57% faster using predictive coordination

8.3

MAINTENANCE, DIAGNOSTICS, AND ASSET HEALTH

8.3.1

NEED TO MINIMIZE UNSCHEDULED DOWNTIME AND EXTEND DRONE FLEET LONGEVITY TO DRIVE DEMAND

8.3.2

PREDICTIVE MAINTENANCE & FAULT FORECASTING

8.3.2.1

Use case: Heycoach’s AI predicts maintenance needs based on sensor data to prevent unscheduled downtimes

8.3.3.1

Use case: Donecle uses AI-powered drones to inspect for damage, reducing inspection time dramatically, visually

8.3.4

WARRANTY & CLAIM AUTOMATION

8.3.4.1

Use case: Insurers use drone data and AI to automate damage claims and accelerate settlement cycles

8.4

GROUND CONTROL & FLEET MANAGEMENT

8.4.1

GROWING COMPLEXITY OF MULTI-DRONE OPERATIONS IN URBAN AND COMMERCIAL ENVIRONMENTS TO DRIVE GROWTH

8.4.2

AI-BASED GROUND CONTROL SYSTEM OPTIMIZATION

8.4.2.1

Use case: Airwayz’s UTM software optimizes ground control and flight coordination in Israeli urban airspace

8.4.3

PREDICTIVE FLEET USAGE & ALLOCATION

8.4.3.1

Use case: Lorenz Technology uses AI via balenaCloud to manage drone fleets for surveillance

8.4.4

DRONE-GROUND SYNCHRONIZATION & SAFE RECOVERY

8.4.4.1

Use case: UTM-level AI ensures seamless recovery and takeoff coordination

8.4.5

AUTONOMOUS TAKEOFF/LANDING ZONE SELECTION

8.4.5.1

Use case: NASA’s UTM tests landing zone optimization powered by AI

8.5

CUSTOMER EXPERIENCE & SERVICE INTERFACE

8.5.1

DEMAND FOR INTUITIVE, REAL-TIME MISSION INTERACTION AND SUPPORT SYSTEMS TO DRIVE GROWTH

8.5.2

VOICE-ASSISTED MISSION BRIEFING TOOLS

8.5.2.1

Use case: Primordial Labs’ ANURA enables simple English voice commands

8.5.3

REAL-TIME CHATBOT FOR SUPPORT

8.5.3.1

Use case: Delivery platforms integrate AI-driven chatbots for drone tracking and customer updates

8.5.4

AUTOMATED MISSION LOGGING & REPORTS

8.5.4.1

Use case: AWS AI workforce dashboard synthesizes real-time mission data, generating actionable insights

8.6

REVENUE OPTIMIZATION & ASSET UTILIZATION

8.6.1

DEMAND FOR SCALABLE, COST-EFFECTIVE DRONE LOGISTICS AND INSPECTION SERVICES TO DRIVE GROWTH

8.6.2

MISSION-BASED PRICING & COST PREDICTION

8.6.2.1

Use case: Wing’s drone delivery adjusts fees for Walmart+ members and pilots urban deployment profitability

8.6.3

ROUTE PROFITABILITY OPTIMIZATION

8.6.3.1

Use case: AI favors highest-demand delivery zones like Wing/Walmart hubs

8.6.4.1

Use case: Langham Logistics uses AI-equipped warehouse drones to count inventory and predict future restocking needs

8.7

TRAINING, SIMULATION, AND HUMAN-MACHINE TEAMING

8.7.1

RISING COMPLEXITY OF AUTONOMOUS DRONE OPERATIONS AND DEMAND FOR SAFE, SCALABLE PILOT TRAINING TO DRIVE GROWTH

8.7.2

AI-BASED FLIGHT SIMULATION

8.7.2.1

Use case: Platforms like Ardupilot’s SITL integrate predictive AI for pilot training

8.7.3

VIRTUAL MISSION SANDBOXING

8.7.3.1

Use case: Digital twin platforms (Duality AI Falcon) simulate drone missions with synthetic training environments

8.8

R&D & MODEL OPTIMIZATION

8.8.1

NEED FOR REAL-TIME AI MODEL ADAPTATION AND SAFER PRE-DEPLOYMENT TESTING ENVIRONMENTS TO DRIVE MARKET

8.8.2

DIGITAL TWIN PROTOTYPING

8.8.2.1

Use case: Bentley’s digital twin + drone system monitors infrastructure (power lines, wind farms) before deployment

8.8.3

IN-MISSION FEEDBACK & RETRAINING

8.8.3.1

Use case: AI feedback loops analyze telemetry mid-flight to retrain navigation/path models in simulation

9

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY

Market Size and Forecast to 2030 – USD Million

118

9.2.1

GROWING DEMAND FOR PREDICTIVE ANALYTICS AND ADAPTIVE AUTOMATION TO DRIVE MARKET

9.2.2

SUPERVISED LEARNING

9.2.3

UNSUPERVISED LEARNING

9.2.4

REINFORCEMENT LEARNING

9.3.1

RISING ADOPTION OF DRONES FOR INFRASTRUCTURE INSPECTION AND SURVEILLANCE TO DRIVE GROWTH

9.3.3

SCENE & TERRAIN MAPPING

9.4

NATURAL LANGUAGE PROCESSING

9.4.1

FOCUS ON HANDS-FREE CONTROL AND REAL-TIME REPORT AUTOMATION IN DEFENSE, PUBLIC SAFETY, AND EMERGENCY SERVICES TO SPUR DEMAND

9.4.2

VOICE COMMAND RECOGNITION

9.4.3

AI-GENERATED MISSION BRIEFS

9.5.1

GENERATIVE AI ENABLES DRONES TO CREATE NEW MISSION PATHS

9.5.2

AUTONOMOUS MISSION PLANNING

9.5.3

AI SIMULATION ENVIRONMENTS

9.6.1

INCREASING DEMAND FOR PRECISION SITUATIONAL AWARENESS TO DRIVE MARKET

9.6.2

CONTEXT-AWARE RECOMMENDED SYSTEMS

9.6.4

CONTEXT-AWARE VIRTUAL ASSISTANTS

10

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY REGION

Market Size and Forecast to 2030, Country Level Analysis – USD Million

125

10.2.2.1

Growing need for defense modernization to drive market

10.2.3.1

Increased government support and R&D incentives to drive market

10.3.2.1

Strategic government incentives and emerging AI startups to drive growth

10.3.3.1

Increasing need for defense modernization to drive growth

10.3.4.1

Growth in investments toward R&D to drive growth

10.3.5.1

Focus on defense and border surveillance modernization to drive growth

10.3.6

REST OF ASIA PACIFIC

10.4.2.1

Increasing focus on industrial automation and demand for infrastructure inspection to drive growth

10.4.3.1

Focus on defense modernization and emergency response readiness to drive growth

10.4.4.1

Dual-use technology promotion and sovereign industrial strategy to drive growth

10.4.5.1

Increasing need for infrastructure safety and border security enhancement to drive growth

10.4.6.1

Increasing need for environmental monitoring and agricultural optimization to drive growth

10.5.2.1

Focus on strengthening military autonomy with AI-powered drone systems to drive growth

10.5.3

REST OF MIDDLE EAST

10.6

LATIN AMERICA & AFRICA

10.6.2.1

Increasing agricultural modernization to drive market

10.6.3.1

Increasing smart border surveillance and urban infrastructure monitoring to drive growth

10.6.4.1

Growing public health and environmental conservation initiatives to drive growth

10.6.5.1

Rising need for real-time monitoring across critical sectors to drive growth

10.6.6

REST OF LATIN AMERICA & AFRICA

11

COMPETITIVE LANDSCAPE

Market Share Analysis (%) & Competitive Positioning Matrix

219

11.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2025

11.3

REVENUE ANALYSIS, 2020–2025

11.4

MARKET SHARE ANALYSIS, 2024

11.5

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

11.5.5.1

Solution footprint

11.5.5.2

End user footprint

11.5.5.3

Technology footprint

11.5.5.4

Region footprint

11.6

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

11.6.1

PROGRESSIVE COMPANIES

11.6.2

RESPONSIVE COMPANIES

11.6.5

COMPETITIVE BENCHMARKING

11.6.5.1

List of startups/SMEs

11.6.5.2

Competitive benchmarking of startups/SMEs

11.7

BRAND/PRODUCT COMPARISON

11.8

COMPANY VALUATION AND FINANCIAL METRICS

11.9

COMPETITIVE SCENARIO

12

COMPANY PROFILES

In-Depth Profiles of Key Players with SWOT, Financials, and Recent Developments

240

12.1.1.1

Business overview

12.1.1.2

Products offered

12.1.1.3

Recent developments

12.1.6

IDEAFORGE TECHNOLOGY LTD.

12.1.7

AEROVIRONMENT, INC.

12.1.9

DRAGANFLY INNOVATIONS INC.

12.1.11

DEDRONE HOLDINGS INC.

12.1.12

HONEYWELL INTERNATIONAL INC.

12.1.13

QUALCOMM TECHNOLOGIES, INC.

13.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES, 2019–2024

TABLE 2

COMMERCIAL DRONE USE CASES, BY INDUSTRY

TABLE 3

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 4

AVERAGE SELLING PRICE OF AI-POWERED DRONES FOR DJI, BY KEY SOLUTION, 2024 (USD MILLION)

TABLE 5

AVERAGE SELLING PRICE OF AI-POWERED DRONES FOR DRONEDEPLOY, BY SOLUTION, 2024 (USD MILLION)

TABLE 6

AVERAGE SELLING PRICE OF AI-POWERED DRONES FOR SHIELDAI, BY SOLUTION, 2024 (USD MILLION)

TABLE 7

AVERAGE SELLING PRICE OF A-POWERED DRONES FOR SKYDIO, BY SOLUTION, 2024 (USD MILLION)

TABLE 8

AVERAGE SELLING PRICE OF AI-POWERED DRONES FOR TELEDYNE FLIR LLC, BY SOLUTION, 2024 (USD MILLION)

TABLE 9

AVERAGE SELLING PRICE OF AI-POWERED DRONE SOLUTIONS, BY REGION, 2024 (USD MILLION)

TABLE 10

AVERAGE SELLING PRICE OF AI-POWERED DRONES, BY END USER, 2024 (USD THOUSAND)

TABLE 11

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

TABLE 17

KEY BUYING CRITERIA, BY END USER

TABLE 18

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 19

RECIPROCAL TARIFF RATES ADJUSTED BY US

TABLE 20

IMPACT OF TARIFFS ON END-USE INDUSTRIES

TABLE 21

COMPARISON BETWEEN BUSINESS MODELS

TABLE 22

LIST OF MAJOR PATENTS PUBLISHED, 2024–2025

TABLE 23

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 24

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 25

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY INFRASTRUCTURE, 2021–2024 (USD MILLION)

TABLE 26

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY INFRASTRUCTURE, 2025–2030 (USD MILLION)

TABLE 27

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOFTWARE, 2021–2024 (USD MILLION)

TABLE 28

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOFTWARE, 2025–2030 (USD MILLION)

TABLE 29

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SERVICE, 2021–2024 (USD MILLION)

TABLE 30

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 31

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 32

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 33

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 34

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 35

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FLIGHT & MISSION OPERATION, 2021–2024 (USD MILLION)

TABLE 36

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FLIGHT & MISSION OPERATION, 2025–2030 (USD MILLION)

TABLE 37

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY MAINTENANCE, DIAGNOSTICS, & ASSET HEALTH, 2021–2024 (USD MILLION)

TABLE 38

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY MAINTENANCE, DIAGNOSTICS & ASSET HEALTH, 2025–2030 (USD MILLION)

TABLE 39

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY GROUND CONTROL & FLEET MANAGEMENT, 2021–2024 (USD MILLION)

TABLE 40

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY GROUND CONTROL & FLEET MANAGEMENT, 2025–2030 (USD MILLION)

TABLE 41

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY CUSTOMER EXPERIENCE & SERVICE INTERFACE, 2021–2024 (USD MILLION)

TABLE 42

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY CUSTOMER EXPERIENCE & SERVICE INTERFACE, 2025–2030 (USD MILLION)

TABLE 43

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY REVENUE OPTIMIZATION & ASSET UTILIZATION, 2021–2024 (USD MILLION)

TABLE 44

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY REVENUE OPTIMIZATION & ASSET UTILIZATION, 2025–2030 (USD MILLION)

TABLE 45

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TRAINING, SIMULATION & HUMAN-MACHINE TEAMING, 2021–2024 (USD MILLION)

TABLE 46

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TRAINING, SIMULATION & HUMAN-MACHINE TEAMING, 2025–2030 (USD MILLION)

TABLE 47

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY R&D & MODEL OPTIMIZATION, 2021–2024 (USD MILLION)

TABLE 48

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY R&D & MODEL OPTIMIZATION, 2025–2030 (USD MILLION)

TABLE 49

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 50

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 51

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY MACHINE LEARNING, 2021–2024 (USD MILLION)

TABLE 52

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY MACHINE LEARNING, 2025–2030 (USD MILLION)

TABLE 53

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COMPUTER VISION, 2021–2024 (USD MILLION)

TABLE 54

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COMPUTER VISION, 2025–2030 (USD MILLION)

TABLE 55

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 56

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 57

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 58

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 59

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 60

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 61

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 62

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 63

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 64

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 65

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 66

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 67

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 68

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 69

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 70

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 71

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 72

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 73

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 74

US: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 75

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 76

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 77

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 78

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 79

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 80

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 81

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 82

CANADA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 83

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2021–2024 (USD MILLION)

TABLE 84

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2025–2030 (USD MILLION)

TABLE 85

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 86

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 87

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 88

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 89

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 90

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 91

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 92

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 93

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 94

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 95

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 96

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 97

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 98

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 99

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 100

INDIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 101

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 102

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 103

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 104

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 105

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 106

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 107

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 108

AUSTRALIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 109

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 110

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 111

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 112

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 113

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 114

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 115

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 116

JAPAN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 117

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 118

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 119

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 120

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 121

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 122

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 123

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 124

SOUTH KOREA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 125

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 126

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 127

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 128

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 129

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 130

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 131

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 132

REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 133

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2021–2024 (USD MILLION)

TABLE 134

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2025–2030 (USD MILLION)

TABLE 135

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 136

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 137

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 138

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 139

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 140

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 141

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 142

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 143

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 144

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 145

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 146

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 147

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 148

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 149

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 150

GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 151

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 152

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 153

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 154

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 155

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 156

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 157

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 158

UK: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 159

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 160

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 161

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 162

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 163

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 164

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 165

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 166

FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 167

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 168

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 169

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 170

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 171

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 172

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 173

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 174

ITALY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 175

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 176

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 177

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 178

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 179

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 180

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 181

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 182

SPAIN: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 183

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 184

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 185

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 186

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 187

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 188

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 189

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 190

REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 191

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2021–2024 (USD MILLION)

TABLE 192

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2025–2030 (USD MILLION)

TABLE 193

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 194

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 195

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 196

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 197

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 198

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 199

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 200

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 201

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 202

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 203

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 204

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 205

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 206

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 207

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 208

UAE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 209

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 210

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 211

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 212

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 213

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 214

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 215

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 216

SAUDI ARABIA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 217

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 218

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 219

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 220

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 221

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 222

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 223

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 224

TURKEY: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 225

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 226

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 227

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 228

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 229

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 230

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 231

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 232

REST OF MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 233

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2021–2024 (USD MILLION)

TABLE 234

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY COUNTRY/REGION, 2025–2030 (USD MILLION)

TABLE 235

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 236

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 237

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 238

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 239

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 240

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 241

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 242

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 243

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 244

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 245

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 246

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 247

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 248

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 249

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 250

BRAZIL: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 251

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 252

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 253

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 254

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 255

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 256

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 257

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 258

MEXICO: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 259

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 260

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 261

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 262

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 263

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 264

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 265

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 266

SOUTH AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 267

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 268

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 269

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 270

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 271

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 272

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 273

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 274

EGYPT: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 275

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 276

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 277

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 278

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 279

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 280

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 281

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2021–2024 (USD MILLION)

TABLE 282

REST OF LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY FUNCTION, 2025–2030 (USD MILLION)

TABLE 283

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2025

TABLE 284

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: DEGREE OF COMPETITION

TABLE 285

SOLUTION FOOTPRINT

TABLE 286

END USER FOOTPRINT

TABLE 287

TECHNOLOGY FOOTPRINT

TABLE 288

REGION FOOTPRINT

TABLE 289

LIST OF STARTUPS/SMES

TABLE 290

COMPETITIVE BENCHMARKING OF STARTUPS/SMES

TABLE 291

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: PRODUCT LAUNCHES, MAY 2020–MAY 2024

TABLE 292

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: DEALS, MAY 2020–MAY 2024

TABLE 293

DJI: COMPANY OVERVIEW

TABLE 294

DJI: PRODUCTS OFFERED

TABLE 296

DRONEDEPLOY: COMPANY OVERVIEW

TABLE 297

DRONEDEPLOY: PRODUCTS OFFERED

TABLE 298

DRONEDEPLOY: DEALS

TABLE 299

TELEDYNE FLIR LLC: COMPANY OVERVIEW

TABLE 300

TELEDYNE FLIR LLC: PRODUCTS OFFERED

TABLE 301

TELEDYNE FLIR LLC: PRODUCT LAUNCHES

TABLE 302

SKYDIO, INC.: COMPANY OVERVIEW

TABLE 303

SKYDIO, INC.: PRODUCTS OFFERED

TABLE 304

SHIELD AI: COMPANY OVERVIEW

TABLE 305

SHIELD AI: PRODUCTS OFFERED

TABLE 306

SHIELD AI: DEALS

TABLE 307

IDEAFORGE TECHNOLOGY LTD.: COMPANY OVERVIEW

TABLE 308

IDEAFORGE TECHNOLOGY LTD.: PRODUCTS OFFERED

TABLE 309

IDEAFORGE TECHNOLOGY LTD.: DEALS

TABLE 310

AEROVIRONMENT, INC.: COMPANY OVERVIEW

TABLE 311

AEROVIRONMENT, INC.: PRODUCTS OFFERED

TABLE 312

AEROVIRONMENT, INC.: DEALS

TABLE 313

DAC.DIGITAL: COMPANY OVERVIEW

TABLE 314

DAC.DIGITAL: PRODUCTS OFFERED

TABLE 315

DRAGANFLY INNOVATIONS INC.: COMPANY OVERVIEW

TABLE 316

DRAGANFLY INNOVATIONS INC.: PRODUCTS OFFERED

TABLE 317

PIX4D SA: COMPANY OVERVIEW

TABLE 318

PIX4D SA: PRODUCTS OFFERED

TABLE 319

DEDRONE HOLDINGS INC.: COMPANY OVERVIEW

TABLE 320

DEDRONE HOLDINGS INC.: PRODUCTS OFFERED

TABLE 321

HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 322

HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

TABLE 323

HONEYWELL INTERNATIONAL INC.: DEALS

TABLE 324

QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

TABLE 325

QUALCOMM TECHNOLOGIES, INC.: PRODUCTS OFFERED

TABLE 326

QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

TABLE 327

PERCEPTO LTD.: COMPANY OVERVIEW

TABLE 328

PERCEPTO LTD.: PRODUCTS OFFERED

TABLE 329

ESRI: COMPANY OVERVIEW

TABLE 330

ESRI: PRODUCTS OFFERED

TABLE 331

PRECISION AI INC.: COMPANY OVERVIEW

TABLE 332

FLYPIX AI GMBH: COMPANY OVERVIEW

TABLE 333

SAIWA: COMPANY OVERVIEW

TABLE 334

ASTERIA.CO.IN: COMPANY OVERVIEW

TABLE 335

VOLARIOUS: COMPANY OVERVIEW

TABLE 336

BRINC DRONES INC.: COMPANY OVERVIEW

TABLE 337

SKYFIRE AI, INC.: COMPANY OVERVIEW

TABLE 338

AUTEL ROBOTICS: COMPANY OVERVIEW

TABLE 339

HYLIO: COMPANY OVERVIEW

TABLE 340

3DSURVEY: COMPANY OVERVIEW

FIGURE 1

RESEARCH DESIGN MODEL

FIGURE 3

BOTTOM-UP APPROACH

FIGURE 4

TOP-DOWN APPROACH

FIGURE 5

DATA TRIANGULATION

FIGURE 6

COMMERCIAL SEGMENT TO LEAD MARKET BY 2030

FIGURE 7

MACHINE LEARNING SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2025

FIGURE 8

FLIGHT & MISSION OPERATIONS SEGMENT TO LEAD MARKET IN 2025

FIGURE 9

INFRASTRUCTURE SEGMENT TO LEAD MARKET IN 2025

FIGURE 10

NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2025

FIGURE 11

INCREASING NEED FOR AUTONOMOUS OPERATIONS OF DRONES TO DRIVE MARKET GROWTH

FIGURE 12

COMMERCIAL SEGMENT TO LEAD MARKET IN 2025

FIGURE 13

MACHINE LEARNING SEGMENT TO LEAD MARKET IN 2025

FIGURE 14

INFRASTRUCTURE SEGMENT TO LEAD MARKET IN 2025

FIGURE 15

FLIGHT & MISSION OPERATIONS SEGMENT TO LEAD MARKET IN 2025

FIGURE 16

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 18

VALUE CHAIN ANALYSIS

FIGURE 19

ECOSYSTEM ANALYSIS

FIGURE 20

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

FIGURE 21

KEY BUYING CRITERIA, BY END USER

FIGURE 22

INVESTMENT & FUNDING SCENARIO

FIGURE 23

TOTAL COST OF OWNERSHIP (TCO) IN ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET

FIGURE 24

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: BUSINESS MODELS

FIGURE 25

EVOLUTION OF TECHNOLOGY

FIGURE 26

TECHNOLOGY ROADMAP, 2020–2025

FIGURE 27

SUPPLY CHAIN ANALYSIS

FIGURE 28

LIST OF MAJOR PATENTS GRANTED, 2016–2025

FIGURE 29

SOFTWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 30

COMMERCIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 31

FLIGHT & MISSION OPERATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 32

GENERATIVE AI SEGMENT TO LEAD MARKET BY 2030

FIGURE 33

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET, BY REGION

FIGURE 34

NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET SNAPSHOT

FIGURE 35

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET SNAPSHOT

FIGURE 36

EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET SNAPSHOT

FIGURE 37

MIDDLE EAST: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET SNAPSHOT

FIGURE 38

LATIN AMERICA & AFRICA: ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET SNAPSHOT

FIGURE 39

REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2024 (USD MILLION)

FIGURE 40

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 41

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 42

COMPANY FOOTPRINT

FIGURE 43

ARTIFICIAL INTELLIGENCE (AI) IN DRONES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

FIGURE 44

BRAND/PRODUCT COMPARISON

FIGURE 45

FINANCIAL METRICS OF PROMINENT MARKET PLAYERS, 2025

FIGURE 46

VALUATION OF PROMINENT MARKET PLAYERS, 2025

FIGURE 47

TELEDYNE FLIR LLC: COMPANY SNAPSHOT

FIGURE 48

AEROVIRONMENT, INC.: COMPANY SNAPSHOT

FIGURE 49

HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 50

QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Artificial Intelligence (AI) in Drones Market