Utility Markers Market by Type (Ball Markers, Disk Markers, Tape Markers, Spike Markers), Configuration (Passive, Programmable), Utility Type (Gas, Power, Telecommunications, Water & Wastewater) and Region - Global Forecast to 2028

Updated on : October 22, 2024

Utility Markers Market Size & Growth

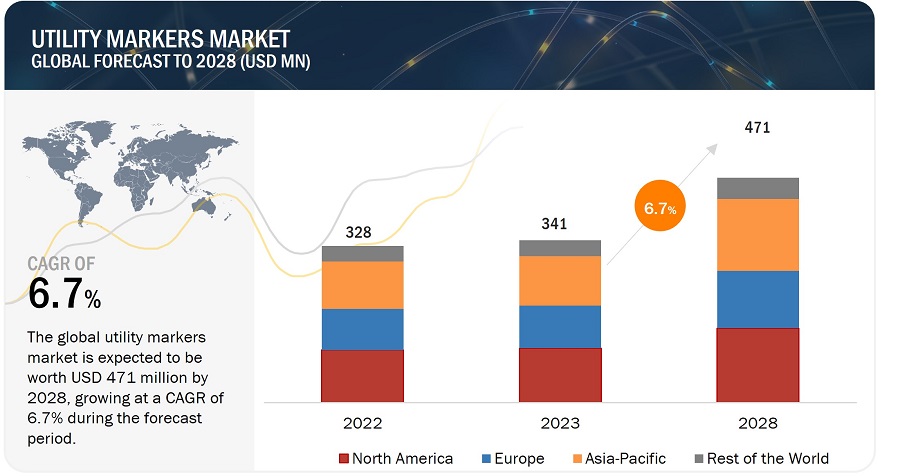

The utility markers market size is predicted to grow from USD 341 million in 2023 to USD 471 million by 2028, growing at a CAGR of 6.7% between 2023 to 2028.

Public infrastructure plays a crucial role in any economy as it creates job, attract foreign investment, improves the quality of life, and supports the growth and development of the country. Hence, economies globally whether developing or developed, are continuously focusing on developing and upgrading their public infrastructure such as transportation, water and wastewater systems, power grids, and communication networks. Moreover, the knowledge of underground utility location is beneficial in the planning and design of infrastructure upgrades. This information can be utilized to optimize the location of new infrastructure, avoid clashes with existing utilities, and ensure that upgrades are executed in a manner that is safe, efficient, and cost-effective. All these factors are driving the demand of utility markers market globally.

Utility Markers Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Utility Markers Market Analysis

The utility markers market is projected to witness significant growth during the forecast period, driven by the increasing emphasis on underground utility safety and the growing adoption of utility markers for asset management. The market is characterized by the presence of a few major players offering a wide range of utility marking solutions, intensifying the competition among key players.

Utility Markers Market Trends

Emerging trends in the utility markers market include the adoption of RFID technology for efficient asset tracking, a growing demand for eco-friendly and durable marker materials, and the integration of IoT solutions for enhanced utility management and maintenance. Increasing awareness about the importance of accurate utility marking to prevent damage to underground utilities is fostering the demand for high-visibility and durable utility markers made from materials such as fiberglass and plastics.

Utility Markers Market Dynamics

DRIVERS: Government regulations and mandates for utility location and mapping

Various utility location techniques are used to identify underlying utilities prior to digging or excavation with the help of utility locators and markers. Local governments and other service providers of the utilities install water, wastewater, telecommunication, gas and power pipelines beneath the ground level in public as well as private properties, which helps in uninterruptable supply. Spontaneous excavation, construction, or digging processes may damage the utility lines as well as cause hazardous situation in case of leakage in pipelines. To avoid these circumstances, governments globally have introduced regulations and mandates for prior utility location and mapping. Hence, such regulations and mandates are expected to fuel the market for utility markers during the forecast period.

RESTRAINTS: Lack of awareness and standardization in emerging economies

Lack of awareness about the importance of utility detection is a common concern in many underdeveloped and emerging economies. This majorly leads to unsafe excavation practices, resulting in damage and loss of lives and public properties. This is especially common in rural areas, where small-scale contractors and individuals carry out construction without adequate training or understanding of the importance of utility detection before digging. Additionally, many developing and underdeveloped parts of the world do not have proper laws and regulations pertaining to the safety of underground utilities or mapping of underground utilities. Due to this, unorganized construction and excavation works can result in accidents and damage to underground utilities, such as water and sewer lines, which can pose a serious risk to public health and safety.

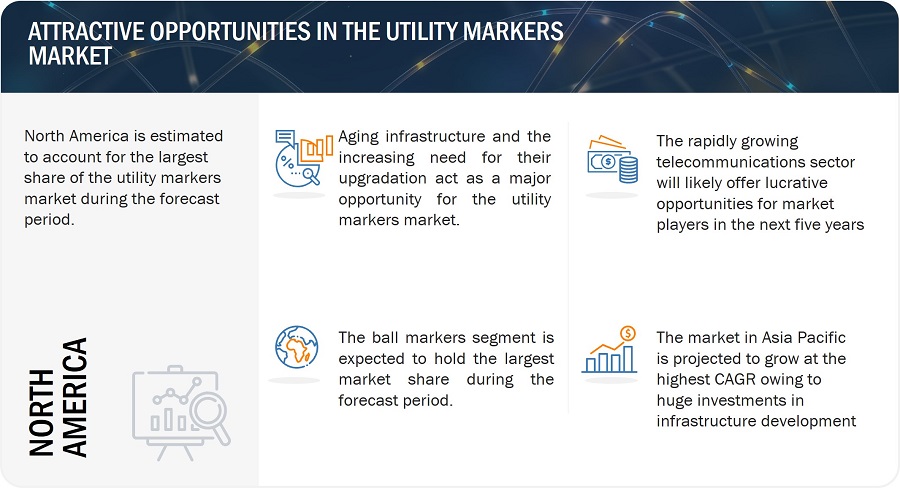

OPPORTUNITIES: Rapid growth in telecommunications industry

In the recent years, the global telecommunications industry has been expanding at a fast pace due to the increasing need for connectivity, technological advancements, and the growing adoption of mobile devices. Moreover, significant technology developments, such as 5G networks, cloud services, artificial intelligence, edge computing, and IoT, are contributing to the growth rate of the global telecommunications industry. The telecom utility infrastructure is the vital factor on which the continuous operations of the telecommunications industry are dependent. This includes telecom ducts and fiber cables installed underground for uninterruptable services. Besides, these cables provide internet services, calling services in all public and private sectors of any economy. Disruption in the any of the telecom services may lead to huge losses for both public and private sectors. Hence, it is crucial to mark, map, and locate underground telecom infrastructure. Thus, with the growing telecommunications industry worldwide, the need for locating and mapping underground telecom network is expected to grow and boost the demand for underground utility markers.

CHALLENGES: Technical issues and availability of other competing solutions

For utility location and detection, there are many solutions available in the utility markers market, including electromagnetic utility locators, RF cable & pipe locators, metal locators, and GPRs, which can directly detect and locate various types of underground utilities. Additionally, in few applications, such as in gas lines, gas/utility companies are now using tracer wires while laying the lines; hence, there is no need to use separate markers in such cases. Along with this, some buried ball markers can be disturbed due to external factors, such as backfill dirt, or in cases where they are not installed properly. This will directly impact their location accuracy, detection capability, and result in erroneous readings. Companies, including 3M, have launched ball markers with a self-leveling feature to tackle such issues. However, presently, many utility markers suffer from such technical issues, and it may challenge the growth of the utility markers industry in some specific applications.

Utility Markers Market Segmentation

Ball markers expected to hold the largest market share during the forecast period.

Ball markers are shaped in a ball form and contain various components within, protecting them against dust, chemicals, and water when buried underground. These markers have a self-leveling feature, ensuring they maintain a horizontal position irrespective of their placement in the ground. For instance, Tempo Communications, Inc. (US) offers an electronic marker ball that provides accurate positioning of the buried assets. The ball is specifically designed so the coil inside automatically repositions itself horizontally. This patented design of the omni marker ball is environmentally friendly, durable, reusable, and recyclable. The operating depth of the ball is more than 5 ft underground. Also, Programmable ball markers offered by other companies, such as 3M Company (US), allow crucial data to be stored on these markers that can be read later. Ball markers are being widely used for all utility applications, including gas, power, telecommunications, and water & wastewater.

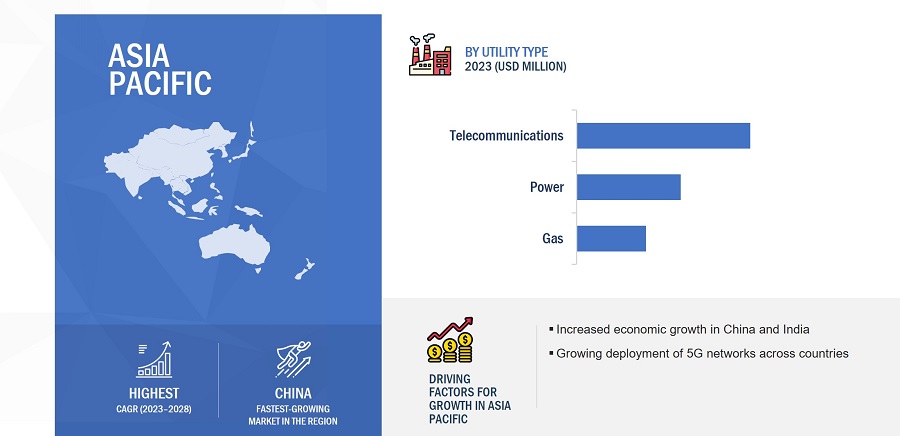

The utility markers market for telecommunications is projected to grow at highest CAGR during the forecast period

With the growing demand for telecom services, high-speed internet, and increased adoption of 5G networks, the telecommunications sector is expected to grow at a fast pace, driving the demand for utility markers. Governments worldwide are making investments in the expansion of the telecommunications sector to support consumer and commercial demand from industries. Furthermore, China has adopted 5G technology in numerous fields, such as medical care, transportation, culture and tourism, and education. Similarly, other countries are also adopting 5G technology in various fields and increasing internet connectivity networks, leading to the growth of the telecommunications sector. This is, in turn, driving the demand for utility markers for underground cables.

Utility Markers Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Regional Analysis - Utility Markers Market

The utility markers market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

The Asia Pacific utility markers market includes China, India, Japan, South Korea, and the Rest of Asia Pacific. The increased economic growth in China and India primarily drives the demand for utility markers. Furthermore, Asia Pacific countries are increasingly investing in the power grid and telecom projects. The growing deployment of 5G networks in developing nations and the expansion of gas pipeline networks in Asian countries are other key factors supporting the adoption of utility markers. For instance, Japan’s urban infrastructure ranks among the best infrastructures worldwide. The country is constantly focusing on upgrading its existing infrastructure as well as building new ones to accommodate the demands of the growing population and urbanization. Hence, the demand for utility markers is expected to grow at a fast pace in Asia Pacific region.

Top Utility Markers Companies - Key Market Players

Major key players in the utility markers companies are

- 3M Company (US),

- Tempo Communications, Inc. (US),

- Komplex (Slovakia),

- Hexatronic Group AB (Sweden),

- Radiodetection Ltd. (UK),

- Rycom Instruments, Inc. (US),

- Seton (US),

- Berntsen International, Inc. (US).

Utility Markers Industry Overview

The utility markers market industry operates at the intersection of infrastructure management and safety, providing essential solutions for identifying and protecting underground utilities. Key players in the industry range from manufacturers producing a variety of marker types, such as surface markers, detectable markers, and RFID-enabled markers, to distributors and service providers offering installation and maintenance services. These markers play a critical role in preventing accidental damage to buried utilities during excavation and construction activities, thereby ensuring public safety and minimizing disruptions to essential services. Industry stakeholders collaborate closely with regulatory bodies and standards organizations, such as the American Public Works Association (APWA) and the Occupational Safety and Health Administration (OSHA), to uphold best practices and compliance requirements.

Utility Markers Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 341 million in 2023 |

|

Expected Value |

USD 471 million by 2028 |

|

Growth Rate |

CAGR of 6.7% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million) |

|

Segments Covered |

Type, Configuration, and Utility Type |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: 3M Company (US), Tempo Communications, Inc. (US), Komplex (Slovakia), Hexatronic Group AB (Sweden), Radiodetection Ltd. (UK), Rycom Instruments, Inc. (US), Seton (US), Berntsen International, Inc. (US), Dura-Line Corporation (US), National Marker Company (US), and Trident Solutions (US) and Others- (Total 24 players have been covered) |

Utility Markers Market Highlights

This research report categorizes the utility markers market by type, configuration, utility type and region.

|

Segment |

Subsegment |

|

By Type: |

|

|

By Configuration: |

|

|

By Utility Type: |

|

|

By Region |

|

Recent Developments in Utility Markers Industry

- In January 2022, Trident Solutions announced the acquisition of LEM Products, Inc., a manufacturer of industrial identification products. Through the acquisition, it supports its safety marking and identification products portfolio.

- In August 2019, Tempo Communications, Inc. announced the launch of the next-generation Omni Marker II balls. This version comes with an enhanced patent design and technology to improve the location precision of these environment-friendly marker balls.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the utility markers market during 2023-2028?

The global utility markers market is expected to record a CAGR of 6.7% from 2023–2028.

What are the driving factors for the utility markers market share?

Major factors driving the utility markers market include the advantages of electronic markers over traditional marking technologies, the increased importance of utility location techniques to ensure the safety of underground assets, government regulations and mandates for utility location mapping, and growing infrastructure development and upgradation activities globally.

Which utility type will grow at a fast rate in the future?

The telecommunications utility type is expected to grow at the highest CAGR during the forecast period. With the growing demand for telecom services, high-speed internet connectivity, and the adoption of new technologies such as 5G, the telecommunications sector is growing rapidly. Utility markers are widely used to mark telecom cable networks; hence, with the growth of the telecommunications sector, the demand for utility markers is also increasing.

Which are the significant players operating in the utility markers market share?

3M Company (US), Tempo Communications, Inc. (US), Komplex (Slovakia), Hexatronic Group AB (Sweden), Radiodetection Ltd. (UK), Rycom Instruments, Inc. (US), Seton (US), and Berntsen International, Inc. (US), are among a few key players in the utility markers market.

Which region will grow at a fast rate in the future?

The utility markers market in Asia pacific is expected to grow at the highest CAGR during the forecast period. Developing countries in Asia Pacific are undergoing rapid industrialization and urbanization, thus driving investments in infrastructure development. The region is also increasingly adopting 5G technology, boosting the growth of the telecommunications sector. Furthermore, governments are emphasizing the use of safe utility detection techniques involving utility markers for marking buried utilities. Given these factors, the demand for utility markers is expected to grow at a fast pace in this region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advantages of electronic/RF markers over traditional marking technologies- Growing importance of utility location techniques to ensure safety of underground assets- Government regulations and mandates for utility location and mapping- Infrastructural developments and upgradesRESTRAINTS- Lack of awareness and standardization in emerging economiesOPPORTUNITIES- Growing significance of real-time data for enhanced utility management- Rapid growth in telecommunications industryCHALLENGES- Technical issues and availability of other competing solutions

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEINTERNET OF THINGSELECTRONIC MARKING/MARKER SYSTEMAUGMENTED REALITY

- 5.8 PORTER’S FIVE FORCES ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 BALL MARKERSSELF-LEVELING DESIGNS AND PROGRAMMABLE FEATURES TO DRIVE MARKET

-

6.3 DISK MARKERSINCREASED USAGE FOR LOCATING FLUSH-MOUNTED FACILITIES TO BOOST MARKET

-

6.4 TAPE MARKERSCOST-EFFECTIVENESS OF TAPE MARKERS TO PROPEL MARKET

- 6.5 OTHERS

- 7.1 INTRODUCTION

-

7.2 PASSIVEUSE IN DIVERSE APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

-

7.3 PROGRAMMABLEDEPLOYMENT IN LESS-DEPTH OR NARROW TRENCHES TO FAVOR MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 GASUSE OF UTILITY MARKERS IN SAFELY LOCATING BURIED GAS LINES TO HELP MARKET GROWTH

-

8.3 POWERINCREASED INVESTMENTS IN POWER INDUSTRY TO DRIVE MARKET

-

8.4 TELECOMMUNICATIONSRISING DEMAND FOR TELECOM SERVICES AND INTERNET CONNECTIVITY TO TRIGGER MARKET GROWTH

-

8.5 WATER & WASTEWATERCONTINUOUS UPGRADE AND EXPANSION OF WATER PIPELINE NETWORKS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Government initiatives for strengthening domestic infrastructure to drive marketCANADA- Rigorous investments in infrastructure upgrades to boost marketMEXICO- Focus on expansion of fiber optic cable networks to be favorable for market

-

9.3 EUROPEGERMANY- Emphasis on expansion of domestic power infrastructure to drive marketUK- Continuous investments in public utility networks to influence marketFRANCE- Growth in domestic telecommunications sector to generate positive impact on marketREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Investments in power and water supply projects to drive marketJAPAN- Need to upgrade infrastructure to be major market driverSOUTH KOREA- Expansion of domestic 5G telecom network to drive marketINDIA- Focus on expanding telecommunications infrastructure to add to market growthREST OF ASIA PACIFIC

-

9.5 ROWMIDDLE EAST- Large-scale investments in construction projects to drive marketAFRICA- Favorable agreements for economic and industrial growth to drive marketSOUTH AMERICA- Improvements in solar energy infrastructure to aid market growth

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- 10.4 MARKET SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION QUADRANT FOR SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 UTILITY MARKERS MARKET: COMPANY FOOTPRINT

- 10.8 COMPETITIVE BENCHMARKING

-

10.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERS3M COMPANY- Business overview- Products offered- MnM viewTEMPO COMMUNICATIONS, INC.- Business overview- Products offered- Recent developments- MnM viewKOMPLEX- Business overview- Products offered- MnM viewHEXATRONIC GROUP AB- Business overview- Products offered- MnM viewRADIODETECTION LTD.- Business overview- Products offered- Recent developments- MnM viewBERNTSEN INTERNATIONAL, INC.- Business overview- Products offeredDURA-LINE CORPORATION- Business overview- Products offeredNATIONAL MARKER COMPANY- Business overview- Products offeredRYCOM INSTRUMENTS, INC.- Business overview- Products offeredSETON- Business overview- Products offeredSHENZHEN EEDENG TECHNOLOGY CO., LTD.- Business overview- Products offeredTRIDENT SOLUTIONS- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSCAMPBELL INTERNATIONALDAMAGE PREVENTION SOLUTIONS, LLCKELMAPLAST G. KELLERMANN GMBHMARKING SERVICES, INC.NORTHTOWN COMPANYOMEGA MARKING COMPANYPROSOLVESAVITRI TELECOM SERVICESSVWCISPARCO MULTIPLAST PVT. LTD.TRUMBULL MANUFACTURINGVHL ENGINEERING

- 12.1 INTRODUCTION

-

12.2 GROUND PENETRATING RADAR MARKET: BY TYPEINTRODUCTIONHANDHELD SYSTEMS- Concrete investigation to drive demand for handheld ground penetrating radar systemsCART-BASED SYSTEMS- Cart-based systems considered highest-quality ground inspection data providersVEHICLE-MOUNTED SYSTEMS- Transportation infrastructure to drive demand for vehicle-mounted systems

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 UTILITY MARKERS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 MARKET: RISK ASSESSMENT

- TABLE 3 MARKET: ROLE IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF UTILITY MARKERS OFFERED BY KEY PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE OF UTILITY MARKERS, BY REGION (USD)

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 UTILITY TYPES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 UTILITY TYPES

- TABLE 9 WATERONE IMPLEMENTED EMS MARKERS FOR LOCATING AND MARKING UTILITIES

- TABLE 10 SACRAMENTO AREA SEWER DISTRICT (SASD) ADOPTED ELECTRONIC MARKING SYSTEMS FOR NEWLY BURIED SEWER FORCE MAINS

- TABLE 11 BP GAS USED BALL MARKERS TO MARK GAS PIPELINES

- TABLE 12 SOUTHWEST GAS CORPORATION ADOPTED BALL MARKERS TO PINPOINT PIPELINE LOCATIONS

- TABLE 13 FEDERAL AVIATION ADMINISTRATION (FAA) MARKED UNDERGROUND FACILITIES AT NEW AIRPORT CONSTRUCTION USING BALL MARKERS

- TABLE 14 US GOVERNMENT LABORATORY INSTALLED BALL MARKERS TO LOCATE UNDERGROUND FACILITIES INSIDE CAMPUS

- TABLE 15 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 16 LIST OF PATENTS IN MARKET, 2020–2021

- TABLE 17 MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 STANDARDS FOR MARKET

- TABLE 23 COLOR CODING FOR MARKERS, BY APWA

- TABLE 24 UTILITY MARKERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 BALL MARKERS: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 27 BALL MARKERS: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 28 BALL MARKERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 BALL MARKERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 DISK MARKERS: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 31 DISK MARKERS: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 DISK MARKERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 DISK MARKERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 TAPE MARKERS: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 35 TAPE MARKERS: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 TAPE MARKERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 TAPE MARKERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 OTHERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 39 OTHERS: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 40 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 MARKET, BY CONFIGURATION, 2019–2022 (USD MILLION)

- TABLE 43 MARKET, BY CONFIGURATION, 2023–2028 (USD MILLION)

- TABLE 44 PASSIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 PASSIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 PROGRAMMABLE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 PROGRAMMABLE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 49 UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 GAS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 51 GAS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 52 GAS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 GAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 POWER: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 55 POWER: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 POWER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 POWER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 TELECOMMUNICATIONS: UTILITY MARKERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 59 TELECOMMUNICATIONS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 TELECOMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 TELECOMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 WATER & WASTEWATER: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 WATER & WASTEWATER: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 WATER & WASTEWATER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 WATER & WASTEWATER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 UTILITY MARKERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY CONFIGURATION, 2019–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY CONFIGURATION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY CONFIGURATION, 2019–2022 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY CONFIGURATION, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: UTILITY MARKERS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY CONFIGURATION, 2019–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY CONFIGURATION, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 92 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 95 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 ROW: MARKET, BY CONFIGURATION, 2019–2022 (USD MILLION)

- TABLE 97 ROW: MARKET, BY CONFIGURATION, 2023–2028 (USD MILLION)

- TABLE 98 ROW: MARKET, BY UTILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 99 ROW: MARKET, BY UTILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 101 UTILITY MARKERS MARKET SHARE ANALYSIS, 2022

- TABLE 102 COMPANY FOOTPRINT

- TABLE 103 TYPE: COMPANY FOOTPRINT

- TABLE 104 UTILITY TYPE: COMPANY FOOTPRINT

- TABLE 105 REGION: COMPANY FOOTPRINT

- TABLE 106 MARKET: LIST OF STARTUPS/SMES

- TABLE 107 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 108 MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 109 UTILITY MARKERS MARKET: DEALS, 2019–2022

- TABLE 110 3M COMPANY: COMPANY OVERVIEW

- TABLE 111 3M COMPANY: PRODUCTS OFFERED

- TABLE 112 TEMPO COMMUNICATIONS, INC.: COMPANY OVERVIEW

- TABLE 113 TEMPO COMMUNICATIONS, INC.: PRODUCTS OFFERED

- TABLE 114 TEMPO COMMUNICATIONS, INC.: PRODUCT LAUNCHES

- TABLE 115 TEMPO COMMUNICATIONS, INC.: DEALS

- TABLE 116 KOMPLEX: COMPANY OVERVIEW

- TABLE 117 KOMPLEX: PRODUCTS OFFERED

- TABLE 118 HEXATRONIC GROUP AB: COMPANY OVERVIEW

- TABLE 119 HEXATRONIC GROUP AB: PRODUCTS OFFERED

- TABLE 120 RADIODETECTION LTD.: COMPANY OVERVIEW

- TABLE 121 RADIODETECTION LTD.: PRODUCTS OFFERED

- TABLE 122 RADIODETECTION LTD.: PRODUCT LAUNCHES

- TABLE 123 RADIODETECTION LTD.: DEALS

- TABLE 124 BERNTSEN INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 125 BERNTSEN INTERNATIONAL, INC.: PRODUCTS OFFERED

- TABLE 126 DURA-LINE CORPORATION: COMPANY OVERVIEW

- TABLE 127 DURA-LINE CORPORATION: PRODUCTS OFFERED

- TABLE 128 NATIONAL MARKER COMPANY: COMPANY OVERVIEW

- TABLE 129 NATIONAL MARKER COMPANY: PRODUCTS OFFERED

- TABLE 130 RYCOM INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 131 RYCOM INSTRUMENTS, INC.: PRODUCTS OFFERED

- TABLE 132 SETON: COMPANY OVERVIEW

- TABLE 133 SETON: PRODUCTS OFFERED

- TABLE 134 SHENZHEN EEDENG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 135 SHENZHEN EEDENG TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 136 TRIDENT SOLUTIONS: COMPANY OVERVIEW

- TABLE 137 TRIDENT SOLUTIONS: PRODUCTS OFFERED

- TABLE 138 TRIDENT SOLUTIONS: DEALS

- TABLE 139 GROUND PENETRATING RADAR MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 140 GROUND PENETRATING RADAR MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 141 HANDHELD SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 142 HANDHELD SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 143 CART-BASED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 144 CART-BASED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 145 VEHICLE-MOUNTED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 146 VEHICLE-MOUNTED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- FIGURE 1 UTILITY MARKERS MARKET SEGMENTATION

- FIGURE 2 MARKET: REGIONS COVERED

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET: RESEARCH APPROACH

- FIGURE 5 MARKET: BOTTOM-UP APPROACH

- FIGURE 6 UTILITY MARKERS MARKER: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY THROUGH SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES, 2023

- FIGURE 10 MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 BALL MARKERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 UPGRADE OF AGING INFRASTRUCTURE AND GROWING TELECOMMUNICATIONS SECTOR TO DRIVE MARKET

- FIGURE 15 BALL MARKERS TO ACQUIRE LARGEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 16 PROGRAMMABLE SEGMENT TO REGISTER HIGHER CAGR BY 2028

- FIGURE 17 TELECOMMUNICATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 TELECOMMUNICATIONS AND US SEGMENTS TO ACCOUNT FOR LARGEST SHARES

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARKET

- FIGURE 21 UTILITY MARKERS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF UTILITY MARKERS, 2022–2028

- FIGURE 28 AVERAGE SELLING PRICE OF UTILITY MARKERS OFFERED BY KEY PLAYERS

- FIGURE 29 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 UTILITY TYPES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 UTILITY TYPES

- FIGURE 33 IMPORT SCENARIO FOR RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 36 NUMBER OF PATENTS GRANTED FROM 2012 TO 2022

- FIGURE 37 UTILITY MARKERS MARKET, BY TYPE

- FIGURE 38 COMPARISON BETWEEN KEY UTILITY MARKERS

- FIGURE 39 BALL MARKERS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 MARKET, BY CONFIGURATION

- FIGURE 41 PASSIVE MARKERS TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 MARKET, BY UTILITY TYPE

- FIGURE 43 APPLICATIONS OF UTILITY MARKERS, BY UTILITY TYPE

- FIGURE 44 TELECOMMUNICATIONS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 MARKET, BY REGION

- FIGURE 46 CHINA TO BE FASTEST-GROWING COUNTRY IN MARKET BY 2028

- FIGURE 47 US TO ACCOUNT FOR LARGEST MARKET SHARE IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 49 GERMANY TO REGISTER HIGHEST CAGR IN EUROPE DURING FORECAST PERIOD

- FIGURE 50 EUROPE: MARKET SNAPSHOT

- FIGURE 51 CHINA TO REGISTER FASTEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 52 ASIA PACIFIC: UTILITY MARKERS MARKET SNAPSHOT

- FIGURE 53 MIDDLE EAST TO LEAD MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 54 MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2017–2021

- FIGURE 55 SHARE OF KEY PLAYERS IN MARKET, 2022

- FIGURE 56 MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 57 UTILITY MARKERS MARKET: COMPANY EVALUATION QUADRANT FOR SMES, 2022

- FIGURE 58 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 59 HEXATRONIC GROUP AB: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the utility markers market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the utility markers market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred utility markers providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

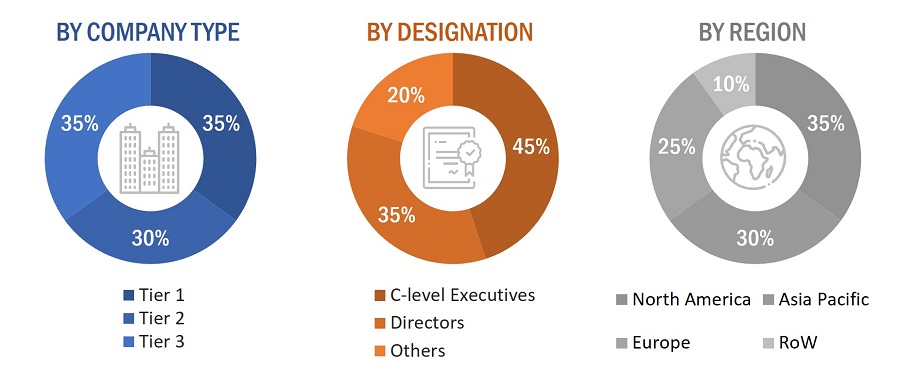

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from utility markers providers, such as 3M Company (US), Tempo Communications, Inc. (US), and Komplex (Slovakia); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the utility markers market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Utility markers are used for identifying, detecting, and labeling various underground utilities or buried lines. These utilities may include telecommunications lines, storm drains, water/recycled water/sewage water lines, electricity distribution lines, natural gas lines, cable television lines, and fiber optic networks, among others,, which can be either owned by a private or public sector or by both. The detection depth varies based on different markers and can be in the range of 2 feet to up to 10 feet. Utility markers are of various types, such as ball markers, disk/flat markers, tape markers/detectable warning tapes/ detectable utility tapes, near-surface markers, and magnet markets, and they are mainly used in gas, power, telecommunications, and water & wastewater applications.

Key Stakeholders

- Raw Material Suppliers

- Component Designers, Manufacturers, and Suppliers

- Original Equipment Manufacturers (OEMs)

- System Integrators

- Technology, Service, and Solution Providers

- Testing, Inspection, and Certification Companies

- Suppliers and Distributors

- Government and Other Regulatory Bodies

- Industry Forums, Alliances, and Associations

- Research Institutes and Organizations

- Market Research and Consulting Firms

- End Users

Report Objectives

- To define and forecast the utility markers market in terms of type, configuration, and utility type.

- To describe and forecast the market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain and allied industry segments of the utility markers market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the utility markers market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Utility Markers Market