Vacuum Valve Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Pressure Control Valves, Isolation Valves, Transfer Valves), Pressure Range, Industry (Semiconductor, Flat-panel Display Manufacturing, Thin-film Coating), and Geography (2021-2026)

Updated on : Oct 23, 2024

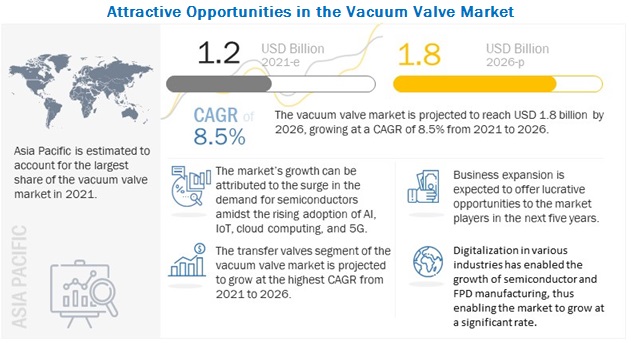

The global vacuum valve market size is projected to reach USD 1.8 billion by 2026 from an estimated USD 1.2 billion in 2021, growing at a CAGR of 8.5% from 2021 to 2026.

Rapidly growing semiconductor industry and growing adoption of advanced displays creating demand for vacuum-based manufacturing processes which in turn drives the demand for vacuum valves industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Vacuum Valve Market Dynamics:

Driver: Rapidly growing semiconductor industry increases demand for vacuum valves

The semiconductor industry is one of the significantly growing industries globally. Semiconductors, such as memory chips and transistors, are an integral part of existing and emerging technologies. Some of the key factors fueling the long-term demand for the chip industry include the Internet of Things (IoT), wireless communications, automotive electronics, artificial intelligence (AI), cloud computing, machine learning, consumer electronics, and data storage. The increasing demand for consumer electronics, such as smartphones, TVs, tablets, and laptops, coupled with the adoption of AI and deployment of 5G cellular networks, would require advanced semiconductor components and devices. Thus, processes in the semiconductors manufacturing industry must be upgraded to meet the needs for higher memory output and better performance, thus producing IC chips of the highest quality.

Semiconductor chips are used to power technologies that enable electronics products to work effectively and help run businesses with high productivity. These chips require higher vacuum purity and thus, need to be manufactured under vacuum. The demand for vacuum valves in the semiconductor industry is mainly driven by the reduction in semiconductor node sizes to get more processing power into a smaller space. As node sizes shrink and chip architectures change, the need for purer vacuums and the number of process steps under vacuum also increase, thus generating demand for vacuum valves.

Restraint: Lack of standardized norms and governing policies

The manufacturers of vacuum valves need to adhere to certain norms and regulations. Different regions have different certifications and policies with respect to valves. This factor creates diversity in demand due to the wide applicability of valves in various industries, such as semiconductors, analytical instruments, chemicals, flat-panel display manufacturing, food & beverages, paper & pulp, and pharmaceuticals. However, this diversity is hindering the growth of the valves market, as industry players have to amend the same product according to the regional policies, which makes it difficult for them to achieve an ideal cost of installation. To resolve this issue, they have to invest their resources in setting up manufacturing facilities worldwide, which requires additional capital.

Opportunity: Increased focus on research & development enables advanced vacuum valve products

With the increasing competition, businesses are making significant investments in R&D to boost their business growth by developing new products and services. R&D activities involve product R&D to create new products and improve the existing ones.

The leading companies in the vacuum valve market, such as VAT Group, Pfeiffer Vacuum, Agilent Technologies, and MKS Instruments, are focusing considerably on R&D activities and can be seen increasing their R&D investments year-on-year to gain or maintain their leading position. These investments are expected to help manufacturers with innovations in vacuum valves, thus enabling them to enhance business with existing customers and expand in adjacent markets. In 2020, VAT Group invested around USD 44 million or 6% of its net sales into R&D, the majority of which was focused on developing products with the precision and purity required for the coming era of nodes of 5 nm and smaller in semiconductor manufacturing. The company also aims to broaden its product range to serve adjacent markets, such as flat-panel display manufacturing and solar panel manufacturing. Such research initiatives and the development of new enhanced products and technologies by the industrial players are expected to boost the vacuum valve market during the forecast period.

Challenge: Unplanned downtime due to malfunctioning or failure of valves

Malfunctioning or failure of valves results in unplanned downtime or shutdown of a process. In such scenarios, repairing or replacing are the only options, which result in downtime. Unplanned downtime can result in considerable losses in terms of production, emergency repair costs paid to technicians, wastage of raw materials, customer dissatisfaction due to delayed delivery or poor product quality, etc. However, industry players are trying to overcome this issue by adopting monitoring, predictive maintenance, connected infrastructure, or condition monitoring solutions. Valve monitoring is another development through which manufacturers can overcome downtime issues and help their customers improve process efficiency.

Isolation valves to account for the largest size of the market during the forecast period.

The growth of isolation valves can be attributed to the rising demand for high-quality valves in analytical instruments manufacturing, food & beverages, chemicals, and R&D industries to mitigate particle generation and outgassing drives the demand for isolation valves at present, and a similar trend is likely to be observed during the forecast period. The pharmaceuticals industry is also expected to create growth opportunities considering the positive impact of COVID-19 on the industry, as isolation valves are used in applications such as freeze-drying and vacuum sterilization.

The high vacuum pressure range segment of the vacuum valve market is projected to grow at the highest CAGR from 2021 to 2026

The high vacuum pressure range segment of vacuum valve market is expected to grow at the highest CAGR during the forecast period. Vacuum valves with high vacuum pressure range feature a low operating cost and extended maintenance cycle. Industries witnessing significant growth, such as semiconductors, flat-panel display manufacturing, lightning, and solar, largely drive the demand for high-vacuum valves, as these valves find applications in sub-fab systems, thin-film coatings, display dry etching, solar thin film deposition, and lightning thin film deposition.

The vacuum valve market for semiconductor is expected to witness growth at the highest CAGR during the forecast period

The vacuum valve market for semiconductor is expected to witness growth at the highest CAGR during the forecast period. Technological advancements in computers, smartphones, medical equipment, and data centers, which form an integral parts of several industries, are dependent on semiconductors. Semiconductor manufacturing is a system-critical industry, and the demand for high-precision semiconductors is increasing. Manufacturing of such semiconductors includes different fabrication processes under vacuum. This, in turn, drives the demand for vacuum valves.

In 2026, the APAC is projected to hold the largest share of the overall vacuum valve market

To know about the assumptions considered for the study, download the pdf brochure

In 2026, APAC is expected to account for the largest share of the overall vacuum valve market in 2020. The vacuum valve market in APAC for the semiconductor and flat-panel display (FPD) production industry is growing at a significant rate, and a similar trend is likely to be observed in the coming years. Asia Pacific has become a world-class innovation-driven hub for the production of semiconductors and displays. The reasons behind this include the availability of low-priced skilled labor, business-friendly environment, and low production costs, coupled with the growing demand for electronic products and displays in different consumer and industrial applications worldwide. The growth in semiconductor and FPD industries has enabled the APAC vacuum valve market to grow at a significant rate. Additionally, the region consists of a few fast-growing economies, such as China, India, and Southeast Asian countries, which are expected to hold growth opportunities for several manufacturing industries.

Key Market Players

VAT Group AG (Switzerland), MKS Instruments (US), CKD Corporation (Japan), V-TEX Corporation (Japan), ULVAC, Inc. (Japan), SMC Corporation (Japan), HVA LLC (US), Kitz SCT Corporation (Japan), Pfeiffer Vacuum (Germany), and Agilent Technologies (US); are some of the key players in the vacuum valve companies.

Vacuum Valve Market Report Scope

|

Report Metric |

Detail |

|

Market Size Availability for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By type, pressure range, and industry |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

VAT Group AG (Switzerland), MKS Instruments (US), CKD Corporation (Japan), V-TEX Corporation (Japan), ULVAC, Inc. (Japan), SMC Corporation (Japan), HVA LLC (US), Kitz SCT Corporation (Japan), Pfeiffer Vacuum (Germany), and Agilent Technologies (US); are some of the key players in the vacuum valve market. |

This research report categorizes the vacuum valve market based on type, pressure range, industry, and region

Vacuum Valve Market:

Based on valve type:

-

Pressure Control Valves

- Butterfly Valves

- Angle and Inline Valves

- Pendulum Valves

-

Isolation Valves

- Butterfly Valves

- Gate Valves

- Angle and Inline Valves

- Pendulum Valves

- Ball Valves

- Transfer Valves

- Air Admittance Valves

- Check Valves

Based on Pressure Range

- Low-to-Medium Vacuum (>10-3 torr)

- High Vacuum (<10-3–>10-8 torr)

- Very High Vacuum (<10-8 torr)

Based on Industry:

- Analytical Instruments

- Chemicals

- Flat-panel Display Manufacturing

- Food & Beverages

- Paper & Pulp

- Pharmaceuticals

- Semiconductor

- Thin-film Coating

- Others

Based on Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Taiwan

- South Korea

- Japan

- India

- Rest of APAC

-

Rest of the world

- Middle East

- Africa

- South America

Frequently Asked Questions (FAQ):

Which are the major companies in the vacuum valve market? What are their major strategies to strengthen their market presence?

The major companies in the Vacuum Valve market are – VAT Group AG (Switzerland), MKS Instruments (US), CKD Corporation (Japan), V-TEX Corporation (Japan), ULVAC, Inc. (Japan), SMC Corporation (Japan), HVA LLC (US), Kitz SCT Corporation (Japan), Pfeiffer Vacuum (Germany), and Agilent Technologies (US). The major strategies adopted by these players are product development, market development and geographic expansions.

Which is the potential market for vacuum valve in terms of the region?

The APAC region is expected to dominate the vacuum valve market due to the presence of semiconductor and flat-panel display manufacturers.

What are the opportunities for new market entrants?

There are significant opportunities in the vacuum valve market for start-up companies. These companies can provide vacuum valve solutions to solar and flat-panel display industry. Also, they can develop digital valve solutions that can be used to reduce downtime and enable predictive maintenance.

What are the drivers and opportunities for the vacuum valve market?

Factors such as rapidly growing semiconductor industry increases demand for vacuum valves and growing adoption of advanced displays drives flat-panel display manufacturing industry are among the driving factors of the vacuum valve market. Moreover, increased focus on research & development enables advanced vacuum valve products and focus of industry players on offering improved customer services to create lucrative opportunities in the vacuum valve market.

Who are the major consumers of vacuum valve that are expected to drive the growth of the market in the next 5 years?

The major consumers for semiconductor, flat-panel display manufacturing, thin-film coating, and analytical instruments industries are expected to have a significant share in this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VACUUM VALVE MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 VACUUM VALVE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size through bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size through top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 7 IMPACT OF COVID-19 ON VACUUM VALVE MARKET

3.1 REALISTIC SCENARIO (POST-COVID-19)

TABLE 1 REALISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD MILLION)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 2 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD MILLION)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD MILLION)

FIGURE 8 ISOLATION VALVES TO LEAD MARKET FROM 2021 TO 2026

FIGURE 9 HIGH VACUUM PRESSURE RANGE TO HOLD LARGEST MARKET SHARE FROM 2021 TO 2026

FIGURE 10 SEMICONDUCTOR INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2021

FIGURE 11 ASIA PACIFIC TO BE LARGEST MARKET FOR VACUUM VALVES IN 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN VACUUM VALVE MARKET

FIGURE 12 SURGE IN DEMAND FOR SEMICONDUCTORS AND NEED FOR MINIATURE AND HIGH-SPEED COMPONENTS WOULD DRIVE MARKET

4.2 MARKET, BY TYPE

FIGURE 13 TRANSFER VALVES TO BE FASTEST-GROWING SEGMENT OF MARKET DURING 2021–2026

4.3 MARKET, BY PRESSURE RANGE

FIGURE 14 HIGH VACUUM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY INDUSTRY

FIGURE 15 SEMICONDUCTOR TO BE LARGEST INDUSTRY IN MARKET BY 2026

4.5 MARKET, BY COUNTRY

FIGURE 16 US TO LEAD MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 VACUUM VALVE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rapidly growing semiconductor industry increases demand for vacuum valves

5.2.1.2 Growing adoption of advanced displays drives flat-panel display manufacturing industry

FIGURE 18 GLOBAL DISPLAY MARKET, 2017–2026

5.2.2 OPPORTUNITIES

5.2.2.1 Increased focus on research & development enables advanced vacuum valve products

5.2.2.2 Focus of industry players on offering improved customer services

FIGURE 19 MARKET: IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES

5.2.3 RESTRAINTS

5.2.3.1 Lack of standardized norms and governing policies

5.2.3.2 Low-cost valves offered by local manufacturers

5.2.4 CHALLENGE

5.2.4.1 Unplanned downtime due to malfunctioning or failure of valves

FIGURE 20 MARKET: IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES

5.3 TRENDS

5.3.1 TECHNOLOGY TRENDS

5.3.1.1 Compact vacuum valve

5.3.1.2 Artificial intelligence

5.3.1.3 Internet of Things (IoT)

5.3.2 INDUSTRY AND MARKET TRENDS

5.3.2.1 Semiconductors

5.3.2.2 Pharmaceuticals

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 RAW MATERIAL AND COMPONENT SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS COLLECTIVELY ADD MAJOR VALUE TO PRODUCT

5.5 ECOSYSTEM ANALYSIS

FIGURE 22 GLOBAL VACUUM VALVE MARKET: ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.7 CASE STUDY ANALYSIS

5.7.1 ARGONNE NATIONAL LABORATORY TO USE VAT VALVES FOR UPGRADE OF ITS ADVANCED PHOTON SOURCE

5.7.2 VAT SUPPORTS ITER PROJECT WITH DEDICATED VALVE PRODUCT PORTFOLIO

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF EACH FORCE ON MARKET (2020)

5.9 TECHNOLOGY ANALYSIS

5.9.1 PREDICTIVE MAINTENANCE

5.9.2 IIOT

5.10 TRADE ANALYSIS

FIGURE 23 IMPORTS DATA, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 24 EXPORTS DATA, BY COUNTRY, 2016–2020 (USD BILLION)

5.11 PATENTS ANALYSIS

FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 6 TOP 20 PATENT OWNERS IN LAST 10 YEARS

FIGURE 26 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

TABLE 7 LIST OF MAJOR PATENTS

5.12 REGULATORY LANDSCAPE

5.12.1 ISO 27895:2009

5.12.2 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS)

5.12.3 SEMI STANDARDS

5.12.4 FOOD AND DRUG ADMINISTRATION (FDA)

6 VACUUM VALVE MARKET, BY TYPE (Page No. - 61)

6.1 INTRODUCTION

FIGURE 27 MARKET, BY VALVE TYPE

TABLE 8 MARKET, 2017–2026 (USD MILLION)

FIGURE 28 TRANSFER VALVES MARKET TO GROW AT HIGHEST CAGR BETWEEN 2021 AND 2026

TABLE 9 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 PRESSURE CONTROL VALVES

TABLE 11 PRESSURE CONTROL VALVES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 12 PRESSURE CONTROL VALVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 13 PRESSURE CONTROL VALVES MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 14 PRESSURE CONTROL VALVES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

6.2.1 BUTTERFLY VALVES

6.2.1.1 Butterfly valves ensure reliable operations, tight shut-off, and precise control

6.2.2 ANGLE AND INLINE VALVES

6.2.2.1 Resistance against high differential pressure makes angle and inline valves suitable for different applications

6.2.3 PENDULUM VALVES

6.2.3.1 Smooth gate closing and opening operation of pendulum valves ensures minimum particle release

6.2.4 OTHERS

6.3 ISOLATION VALVES

TABLE 15 ISOLATION VALVES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 ISOLATION VALVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 17 ISOLATION VALVES MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 18 ISOLATION VALVES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

6.3.1 BUTTERFLY VALVES

6.3.1.1 Butterfly valves hold ~6% share of revenue of isolation valves

6.3.2 GATE VALVES

6.3.2.1 Market for isolation gate valves to grow at higher CAGR than other types of isolation valves between 2021 and 2026

6.3.3 ANGLE AND INLINE VALVES

6.3.3.1 Angle/ inline and gate valves jointly account for ~76% share of revenue of isolation valves

6.3.4 PENDULUM VALVES

6.3.4.1 Pendulum valves provide reliable isolation performance

6.3.5 BALL VALVES

6.3.5.1 Ball valves are suitable for dirty vacuum operations

6.3.6 OTHERS

6.4 TRANSFER VALVES

6.4.1 TRANSFER VALVES ARE LARGELY ADOPTED IN SEMICONDUCTOR INDUSTRY

TABLE 19 TRANSFER VALVES MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 20 TRANSFER VALVES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

6.5 AIR ADMITTANCE VALVES

6.5.1 AIR ADMITTANCE VALVES ENABLE PRESSURE RELEASE IN CASE OF SYSTEM MALFUNCTIONING

TABLE 21 AIR ADMITTANCE VALVES MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 22 AIR ADMITTANCE VALVES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

6.6 CHECK VALVES

6.6.1 CHECK VALVES ARE USED IN APPLICATIONS REQUIRING UNIDIRECTIONAL FLOW CONTROL

TABLE 23 CHECK VALVES MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 24 CHECK VALVES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7 VACUUM VALVE MARKET, BY PRESSURE RANGE (Page No. - 73)

7.1 INTRODUCTION

FIGURE 29 MARKET, BY PRESSURE RANGE

FIGURE 30 HIGH VACUUM SEGMENT TO LEAD AND GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 MARKET, BY PRESSURE RANGE, 2017–2020 (USD MILLION)

TABLE 26 MARKET, BY PRESSURE RANGE, 2021–2026 (USD MILLION)

7.2 LOW-TO-MEDIUM VACUUM (>10-3 TORR)

7.2.1 COMPACT DESIGN AND SMALL MOUNTING DIMENSION ENABLE INSTALLATION OF THESE VALVES IN TIGHT SPACES

7.3 HIGH VACUUM (<10-3–>10-8 TORR)

7.3.1 HIGH VACUUM RANGE VALVES ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

7.4 VERY HIGH VACUUM (<10-8 TORR)

7.4.1 CONSIDERABLE DEMAND FOR VERY HIGH VACUUM VALVES FROM R&D APPLICATIONS DRIVES GROWTH

8 VACUUM VALVE MARKET, BY INDUSTRY (Page No. - 77)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY INDUSTRY

TABLE 27 MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 28 MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 32 SEMICONDUCTOR TO LEAD MARKET BY 2026

8.2 ANALYTICAL INSTRUMENTS MANUFACTURING

8.2.1 GROWING DEMAND FOR SCIENTIFIC INSTRUMENTS FROM PHARMACEUTICALS INDUSTRY TO DRIVE MARKET

TABLE 29 MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 31 MARKET FOR ANALYTICAL INSTRUMENTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR ANALYTICAL INSTRUMENTS, BY REGION, 2021–2026 (USD MILLION)

8.3 CHEMICALS

8.3.1 VACUUM VALVES HELP MEET STRINGENT STANDARDS IN CHEMICALS INDUSTRY

TABLE 33 MARKET FOR CHEMICALS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR CHEMICALS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 35 MARKET FOR CHEMICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 MARKET FOR CHEMICALS, BY REGION, 2021–2026 (USD MILLION)

8.4 FLAT-PANEL DISPLAY MANUFACTURING

8.4.1 DEMAND FOR HIGH-PRECISION DISPLAYS FROM VARIOUS APPLICATIONS TO CREATE GROWTH OPPORTUNITIES

TABLE 37 VACUUM VALVE MARKET FOR FLAT-PANEL DISPLAY MANUFACTURING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR FLAT-PANEL DISPLAY MANUFACTURING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 39 MARKET FOR FLAT-PANEL DISPLAY MANUFACTURING, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR FLAT-PANEL DISPLAY MANUFACTURING, BY REGION, 2021–2026 (USD MILLION)

8.5 FOOD & BEVERAGES

8.5.1 IMPLEMENTATION OF VACUUM VALVE TO IMPROVE PROCESS EFFICIENCY

TABLE 41 MARKET FOR FOOD & BEVERAGES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 43 MARKET FOR FOOD & BEVERAGES, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR FOOD & BEVERAGES, BY REGION, 2021–2026 (USD MILLION)

8.6 PAPER & PULP

8.6.1 PAPER & PULP INDUSTRY HOLDS SLUGGISH MARKET PROSPECTS DUE TO GROWTH OF PAPERLESS COMMUNICATION

TABLE 45 MARKET FOR PAPER & PULP, BY TYPE, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR PAPER & PULP, BY TYPE, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR PAPER & PULP, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR PAPER & PULP, BY REGION, 2021–2026 (USD MILLION)

8.7 PHARMACEUTICALS

8.7.1 NORTH AMERICA TO LEAD VACUUM VALVE MARKET FOR PHARMACEUTICALS INDUSTRY DURING 2021–2026

TABLE 49 MARKET FOR PHARMACEUTICALS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR PHARMACEUTICALS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR PHARMACEUTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR PHARMACEUTICALS, BY REGION, 2021–2026 (USD MILLION)

8.8 SEMICONDUCTOR

8.8.1 SEMICONDUCTOR TO REMAIN LARGEST MARKET FOR VACUUM VALVES THROUGHOUT FORECAST PERIOD

TABLE 53 MARKET FOR SEMICONDUCTOR, BY TYPE, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR SEMICONDUCTOR, BY TYPE, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR SEMICONDUCTOR, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR SEMICONDUCTOR, BY REGION, 2021–2026 (USD MILLION)

8.9 THIN-FILM COATING

8.9.1 COST-EFFECTIVE THIN-FILM COATING TECHNIQUES TO CREATE MARKET OPPORTUNITIES

TABLE 57 MARKET FOR THIN-FILM COATING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 58 MARKET FOR THIN-FILM COATING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 59 MARKET FOR THIN-FILM COATING, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 MARKET FOR THIN-FILM COATING, BY REGION, 2021–2026 (USD MILLION)

8.10 OTHER

TABLE 61 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 94)

9.1 INTRODUCTION

FIGURE 33 VACUUM VALVE MARKET IN TAIWAN TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 65 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: SNAPSHOT OF MARKET

TABLE 67 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 69 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 70 MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Surge in domestic manufacturing sector to drive demand

9.2.2 CANADA

9.2.2.1 Growth in food & beverages and pharmaceuticals industries to create opportunities for market growth in Canada

9.2.3 MEXICO

9.2.3.1 Mexico holds moderate growth opportunities for market

9.3 EUROPE

FIGURE 35 EUROPE: SNAPSHOT OF MARKET

TABLE 71 VACUUM VALVE MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 72 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 73 MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

9.3.1 UK

9.3.1.1 UK to hold largest share in European market in 2026

9.3.2 GERMANY

9.3.2.1 Growth prospects of process industries to drive market growth

9.3.3 FRANCE

9.3.3.1 market in France to grow at lower CAGR of 6.7% during the forecast period

9.3.4 REST OF EUROPE

9.4 APAC

FIGURE 36 APAC: SNAPSHOT OF MARKET

TABLE 75 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 76 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 77 MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China is among countries offering significant opportunities for vacuum valves globally

9.4.2 TAIWAN

9.4.2.1 Taiwan is one of the leading chip manufacturers in the world

9.4.3 SOUTH KOREA

9.4.3.1 Presence of semiconductor manufacturing giants to drive market growth

9.4.4 JAPAN

9.4.4.1 Presence of key component suppliers favors market growth in Japan

9.4.5 INDIA

9.4.5.1 Emerging economy to offer high growth opportunities for market

9.4.6 REST OF APAC

9.5 ROW

TABLE 79 VACUUM VALVE MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 82 MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

9.5.1 MIDDLE EAST

9.5.1.1 Pharmaceuticals industry to drive market growth in Middle East

9.5.2 AFRICA

9.5.2.1 Emergence of African economies as manufacturing hub to drive market growth

9.5.3 SOUTH AMERICA

9.5.3.1 Increasing FDI to promote domestic manufacturing would drive market growth

10 COMPETITIVE LANDSCAPE (Page No. - 111)

10.1 OVERVIEW

10.2 REVENUE ANALYSIS OF TOP FIVE COMPANIES

FIGURE 37 VACUUM MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2016–2020

10.3 MARKET SHARE ANALYSIS, 2020

TABLE 83 MARKET: MARKET SHARE ANALYSIS (2020)

10.4 MARKET DEVELOPMENT STRATEGIES

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 38 MARKET: COMPANY EVALUATION QUADRANT, 2020

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 39 MARKET (GLOBAL): SME EVALUATION QUADRANT, 2020

10.7 VACUUM VALVE MARKET: COMPANY FOOTPRINT

TABLE 84 COMPANY FOOTPRINT

TABLE 85 PRODUCT FOOTPRINT OF COMPANIES

TABLE 86 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 87 REGIONAL FOOTPRINT OF COMPANIES

11 COMPANY PROFILES (Page No. - 121)

(Business overview, Products offered, MNM View, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1 KEY PLAYERS

11.1.1 AGILENT TECHNOLOGIES

TABLE 88 AGILENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 40 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT

11.1.2 MKS INSTRUMENTS

TABLE 89 MKS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 41 MKS INSTRUMENTS: COMPANY SNAPSHOT

11.1.3 PFEIFFER VACUUM

TABLE 90 PFEIFFER VACUUM: BUSINESS OVERVIEW

FIGURE 42 PFEIFFER VACUUM: COMPANY SNAPSHOT

11.1.4 ULVAC, INC.

TABLE 91 ULVAC, INC.: BUSINESS OVERVIEW

FIGURE 43 ULVAC, INC.: COMPANY SNAPSHOT

11.1.5 VAT GROUP AG

TABLE 92 VAT GROUP: BUSINESS OVERVIEW

FIGURE 44 VAT GROUP: COMPANY SNAPSHOT

11.1.6 BOBOO HITECH CO., LTD

TABLE 93 BOBOO HITECH: BUSINESS OVERVIEW

11.1.7 FLOMATIC CORPORATION

TABLE 94 FLOMATIC CORPORATION: BUSINESS OVERVIEW

11.1.8 HVA LLC

TABLE 95 HVA LLC: BUSINESS OVERVIEW

11.1.9 IRIE KOKEN CO., LTD

TABLE 96 IRIE KOKEN: BUSINESS OVERVIEW

11.1.10 SHANGHAI VACUUM VALVE MANUFACTURING CO., LTD

TABLE 97 SHANGHAI VACUUM VALVE MANUFACTURING CO., LTD: BUSINESS OVERVIEW

11.1.11 SMC CORPORATION

TABLE 98 SMC CORPORATION: BUSINESS OVERVIEW

FIGURE 45 SMC CORPORATION: COMPANY SNAPSHOT

11.1.12 HTC VACUUM

TABLE 99 HTC VACUUM: BUSINESS OVERVIEW

FIGURE 46 HTC VACUUM: COMPANY SNAPSHOT

11.1.13 CKD CORPORATION

TABLE 100 CKD CORPORATION: BUSINESS OVERVIEW

FIGURE 47 CKD CORPORATION: COMPANY SNAPSHOT

11.1.14 MDC PRECISION

TABLE 101 MDC PRECISION: BUSINESS OVERVIEW

11.1.15 PRESYS

TABLE 102 PRESYS: BUSINESS OVERVIEW

11.1.16 SRT

TABLE 103 SRT: BUSINESS OVERVIEW

11.1.17 VACOM

TABLE 104 VACOM: BUSINESS OVERVIEW

11.1.18 VACUUBRAND

TABLE 105 VACUUBRAND: BUSINESS OVERVIEW

11.1.19 V-TEX CORPORATION

TABLE 106 V-TEX CORPORATION: BUSINESS OVERVIEW

11.1.20 GNB KL GROUP

TABLE 107 GNB KL GROUP: BUSINESS OVERVIEW

11.1.21 N2TECH

TABLE 108 N2TECH: BUSINESS OVERVIEW

11.1.22 TERATECH

TABLE 109 TERATECH: BUSINESS OVERVIEW

11.1.23 KURT J. LESKER COMPANY

TABLE 110 KURT J. LESKER COMPANY: BUSINESS OVERVIEW

11.1.24 KITZ SCT CORPORATION

TABLE 111 KITZ SCT CORPORATION: BUSINESS OVERVIEW

*Details on Business overview, Products offered, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 163)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY

12.3.1 INTRODUCTION

TABLE 112 HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 113 HYGIENIC PUMPS AND VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

12.3.2 PROCESSED FOOD

12.3.2.1 processed food industry to hold largest share of global hygienic pumps and valves market in 2021

12.3.2.2 Impact of COVID-19

TABLE 114 HYGIENIC PUMPS AND VALVES MARKET FOR PROCESSED FOOD, BY REGION, 2017–2020 (USD MILLION)

TABLE 115 HYGIENIC PUMPS AND VALVES MARKET FOR PROCESSED FOOD, BY REGION, 2021–2026 (USD MILLION)

12.3.3 DAIRY

12.3.3.1 Increasing demand for dairy products drives demand for hygienic pumps and valves

12.3.3.2 Impact of COVID-19

TABLE 116 HYGIENIC PUMPS AND VALVES MARKET FOR DAIRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 117 DAIRY HYGIENIC PUMPS AND VALVES MARKET FOR DAIRY, BY REGION, 2021–2026 (USD MILLION)

12.3.4 NONALCOHOLIC BEVERAGES

12.3.4.1 Demand for high level of safety and hygiene leads to adoption of hygienic equipment in nonalcoholic beverages industry

12.3.4.2 Impact of COVID-19

TABLE 118 HYGIENIC PUMPS AND VALVES MARKET FOR NONALCOHOLIC BEVERAGES, BY REGION, 2017–2020 (USD MILLION)

TABLE 119 HYGIENIC PUMPS AND VALVES MARKET FOR NONALCOHOLIC BEVERAGES, BY REGION, 2021–2026 (USD MILLION)

12.3.5 ALCOHOLIC BEVERAGES

12.3.5.1 Increasing awareness regarding hygiene in alcoholic beverages industry boosts adoption of hygienic pumps and valves

12.3.5.2 Impact of COVID-19

TABLE 120 HYGIENIC PUMPS AND VALVES MARKET FOR ALCOHOLIC BEVERAGES, BY REGION, 2017–2020 (USD MILLION)

TABLE 121 HYGIENIC PUMPS AND VALVES MARKET FOR ALCOHOLIC BEVERAGES, BY REGION, 2021–2026 (USD MILLION)

12.3.6 PHARMACEUTICALS

12.3.6.1 Critical quality and safety standards in pharmaceuticals industry are driving adoption of hygienic pumps and valves

12.3.6.2 Impact of COVID-19

TABLE 122 HYGIENIC PUMPS AND VALVES MARKET FOR PHARMACEUTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 123 HYGIENIC PUMPS AND VALVES MARKET FOR PHARMACEUTICAL, BY REGION, 2021–2026 (USD MILLION)

12.3.7 OTHERS

12.3.7.1 Impact of COVID-19

TABLE 124 HYGIENIC PUMPS AND VALVES MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 125 HYGIENIC PUMPS AND VALVES MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

13 APPENDIX (Page No. - 175)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the vacuum valve market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the vacuum valve market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the vacuum valve industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the vacuum valve market based on type, pressure range, industry, and region. It also includes information about the key developments undertaken from both markets- and technology-oriented perspectives.

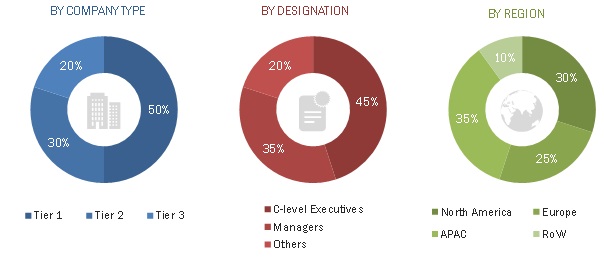

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the vacuum valve market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

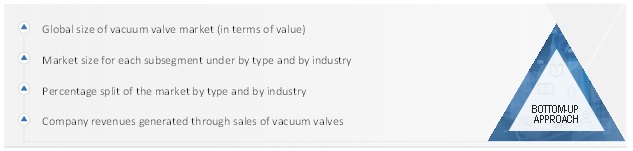

The bottom-up procedure has been employed to arrive at the overall size of the vacuum valve market.

- Identifying various manufacturing companies that use or are expected to implement vacuum valves at their production lines and analyzing their implementation patterns

- Estimating the size of the vacuum valve market on the basis of the demand for vacuum valves from manufacturing companies in different industries

- Conducting primaries with a few major players operating in the vacuum valve market for validating the global size of the market

- Validating the market size through secondary sources, including company websites, press releases, research journals, and magazines

- Calculating the CAGR of the vacuum valve market through historical and future market trend analyses by understanding the industry penetration rate of various types of vacuum valves and their demand and supply scenario for different industries

- Verifying and cross-checking the estimates at every level through discussions with key opinion leaders such as corporate executives, directors, and sales heads, as well as with the domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

To know about the assumptions considered for the study, Request for Free Sample Report

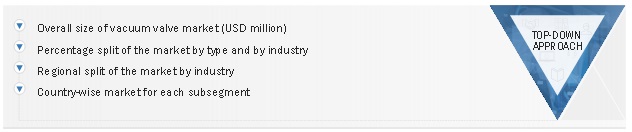

The top-down approach has been used to estimate and validate the total size of the vacuum valve market.

- Information related to revenues obtained from key manufacturers and providers of vacuum valves was studied and analyzed to estimate the global size of the vacuum valve market.

- Revenues, geographic presence, key industries served, and different types of offerings of all identified players in the vacuum valve market, were studied to estimate and arrive at the percentage split of the different segments of the market.

- All major players in each category (type and pressure range) of the vacuum valve market were identified through secondary research and verified through brief discussions with industry experts.

- Multiple discussions were conducted with key opinion leaders of all major companies involved in developing vacuum valves to validate the market split based on type, pressure range, industry, and region.

- Geographic splits were estimated using secondary sources based on various factors, such as the number of players offering vacuum valves in a specific country or region and the type of vacuum valves offered by these players.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the vacuum valve market.

Report Objectives

- To define and forecast the size of the vacuum valve market, in terms of value, on the basis of type, pressure range, and industry

- To describe and forecast the size of the vacuum valve market in four key regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their key countries

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the vacuum valve market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the vacuum valve ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of their ranking as well as core competencies2

- To provide a competitive landscape of the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vacuum Valve Market