Vehicle Anti-Theft System Market by Product (Steering Lock, Alarm, Biometric Capture Device, Immobilizer), Technology (GPS, GSM, RTLS), Vehicle Type (Passenger Car, Commercial Vehicle, Off-Highway Vehicle), and Region - Global Forecast to 2021

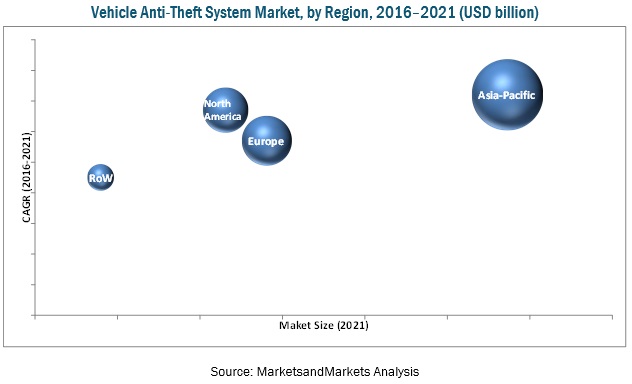

[154 Pages Report] The vehicle anti-theft system market, in terms of value, is projected to grow at a CAGR of 6.92% from 2016 to 2021. The market is estimated to be USD 8.33 billion in 2016, and is projected to reach 11.64 billion by 2021. In this study, 2015 has been considered the base year, and 2016 to 2021 the forecast period, for estimating the market size of the market.

The market report analyzes and forecasts (2016 to 2021) the market size, in terms of volume (units) and value (USD million), of the vehicle anti-theft system market. The report segments the market and forecasts its size, by volume and value, on the basis of region (Asia-Pacific, Europe, North America, and Rest of the World (RoW)). It provides a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges). It also segments the market and forecasts its size, by volume and value, on the basis of product type (alarms, immobilizers, steering locks, biometric capture devices, and passive keyless entry systems). Additionally, it segments the market and forecasts its size, by volume and value, on the basis of technology (global positioning system, global system for mobile communication, face detection system, real-time location system, remote frequency identification device, and automotive biometric technology). The report strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources such as Society of Indian Automobile Manufacturers (SIAM), China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), and paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the vehicle anti-theft system market. The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the country-wise production volumes and analyzing the demand trends.

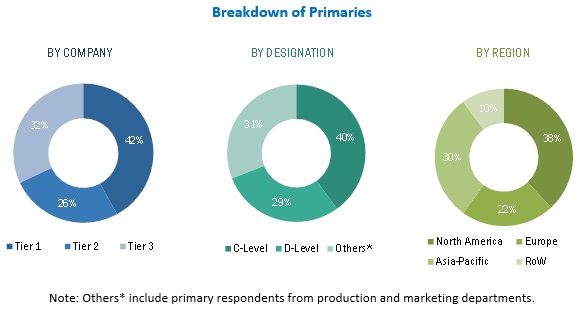

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

Market Dynamics

Drivers

- Increased safety regulations due to the high incident of vehicle thefts

- Multi-factor authentication for vehicle safety

- Technology advancements in the anti-theft industry

Restraints

- High cost of premium safety and anti-theft features

- Potential failure of electronic components used in vehicle anti-theft systems

Opportunities

- Rise in Bluetooth and NFC-based technologies

- Rise of biometric technology

Challenges

- Increase in cyber security risk

Objectives of the Study

- To define, describe, and forecast the global market for vehicle anti-theft systems on the basis of vehicle type, product type, active/passive type, technology, and region, in terms of volume (thousand/million units) and value (USD million/billion)

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze sub segments (vehicle type, product type, and technology) with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the size of market segments with respect to four main regions (along with key countries)— namely, Asia-Pacific, North America, Europe, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their strategies and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the vehicle anti-theft system market

Research Methodology

This research study involves the use of secondary sources such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases such as Hoover’s, Bloomberg Businessweek, and Factiva to identify and collect information for an extensive commercial study of the vehicle anti-theft system. The primary sources comprise industry experts, engineers, product managers, R&D managers, automobile OEMs, battery sensor manufacturers, battery manufacturers, and sales managers. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject-matter experts, technical experts, battery sensor experts of major market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure illustrates the market research methodology applied to make this report on the vehicle anti-theft system market.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the vehicle anti-theft system industry consists of manufacturers such as Robert Bosch GmbH (Germany), Continental AG (Germany), and Lear Corporation (U.S.), research institutes such as the Automotive Research Association of India (ARAI), European Automotive Research Partners Association (EARPA), and the United States Council for Automotive Research (USCAR), and regional automobile associations such as China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), and the European Automobile Manufacturers Association (ACEA).

Critical Questions which the report answers:

- What are major industry trends of the anti-theft system market?

- What would be the impact of increased safety regulations due to high incident of vehicle theft on vehicle anti-theft system market?

- What are the technological developments in the market?

- Which are the market leaders in market?

Target Audience

- Manufacturers of vehicle anti-theft systems

- Dealers and distributors of vehicle anti-theft systems

- Industry associations

- Investment firms

- Equity research firms

- Private equity firms

Scope of the Report

-

By Product Type

- Steering Lock

- Alarm

- Biometric Capture Device

- Immobilizer

- Remote Keyless Entry

- Central Locking

-

By Technology

- Global Positioning System (GPS)

- Global System for Communication (GSM)

- Face Detection System

- Global Radio Frequency Identification

- Real Time Location System (RTLS)

- Automotive Biometric Technology

-

By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Off-Highway Vehicle

-

By Region

- North America

- Asia-Oceania

- Europe

- RoW

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional regions (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

The vehicle anti-theft system market, in terms of value, is projected to grow at a CAGR of 6.92% from 2016 to 2021. The market is estimated to be USD 8.33 billion in 2016, and is projected to reach USD 11.64 billion by 2021. The growth of the market is fueled by increasingly stringent safety regulations, technological advancements, and the growing adoption of biometric technologies.

The vehicle anti-theft system market has been segmented on the basis of product, technology, vehicle type, and region. The market has been segmented on the basis of product type into alarms, steering locks, immobilizers, passive keyless entry, biometric capture devices, and central locking. The immobilizer segment is estimated to account for the largest market share, in terms of value, in 2016.

The vehicle anti-theft system market has been segmented by technology into global positioning system, global system for communication, face detection system, real time location system, remote frequency identification device, and automotive biometric technology. The automotive biometric technology segment is expected to hold the largest market share, by value, in 2016. A key factor driving the market is the progressively stringent safety regulations in the automotive industry. Upcoming advanced safety technologies are also expected to boost market growth.

The Asia-Pacific region is estimated to dominate the vehicle anti-theft system market, in terms of value, in 2016. The increasing demand for multifactor authentication and rising use of biometric technology are key factors driving the growth of the anti-theft system market across all regions.

Vehicle anti-theft applications in Product type, Alarm and Immobilizer would drive the growth of Vehicle Anti-theft system market

Passenger Cars

A Passenger Car (PC), as defined by the OICA, is a motor vehicle equipped with at least 4 wheels, comprising not more than 8 seats. The PC segment is the largest, by vehicle type, and includes sedans, hatchbacks, station wagons, Sports Utility Vehicles (SUVs), and Multi-Utility Vehicles (MUVs). This vehicle segment is the most promising market for electric vehicles as it is the largest segment in the automotive industry. The PC segment of the electric vehicle market is growing at a significant rate in emerging economies in the Asia Pacific region. The market growth in the region can be attributed to a rise in the GDP and population, improvement in lifestyle, increased purchasing power of consumers, and development of infrastructure.

Light Commercial Vehicles

Vehicles that have authorized mass between 3.5 tons and 7 tons are called light commercial vehicles. LCVs have come a long way from having bare essential features to full-blown utility vehicles that can be used for passengers as well as commercial purposes.

Heavy Commercial Vehicles

The HCV segment comprises trucks/lorries, buses, and coaches. Vehicles that have authorized mass more than 7 tons are called heavy commercial vehicles. HCVs combine 2 categories of vehicles heavy trucks and buses and coaches. The nature of these vehicles limits their production volume and growth rates as they are used in specific applications such as logistics, construction, and mining industries

Active Anti-Theft System

An active alarm needs to be activated by the driver. In case of the vehicle alarm, the driver needs to turn on the alarm, using a remote or clicking a button. This repetitive task means that users find this system to be inconvenient when compared to passive system. It also hampers the vehicle protection as the user could forget to activate the system while steeping out of the vehicle.

The deployment of active anti-theft systems may result in higher insurance premiums compared to those for passenger cars fitted with passive anti-theft systems. Many OEMs such as Ford Motors have come up with active anti-theft systems fitted on their cars, in order to provide additional safety.

Passive Anti-Theft System

A passive alarm system turns itself on automatically once the user removes key from ignition and the vehicle doors are closed. In this entire process, the user is not required to physically engage with the anti-theft system. Vehicle protection is also ensured as the driver is not required to manually turn on the vehicle alarm each time they step out of the vehicle.

Using a passive vehicle anti-theft system may result in lower insurance premiums as the risk of theft associated with passive systems is lesser than that of active anti-theft systems. Ford Motors has also installed passive anti-theft keys on their sports utility vehicles and trucks such as the Ford Expedition, Explorer, and Excursion line of cars, among other models.

Critical questions the report answers:

- Which product type of vehicle anti-theft system market will lead the in long term?

- Which type of technology will lead the vehicle anti-theft system market?

- What will be the impact of increasing demand for connected vehicle technology on the vehicle anti-theft system market?

Restraints of the vehicle anti-theft system market:

Vehicle anti-theft systems are highly dependent on electronic components such as electrical wiring and batteries for their smooth functioning. Failure in any of these components could adversely affect the vehicle security system. This results in a large number of replacements in case of minor damages to the security system. The reliability of electronic components is essential in the case of complex security systems such as passive keyless entry. Thus, the potential failure of electronic components could prove to be a restraint for the vehicle anti-theft system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Secondary Data

2.1.1 Key Secondary Sources

2.1.2 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Sampling Techniques & Data Collection Methods

2.2.2 Primary Participants

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Impact of Infrastructure Investment on Vehicle Sales

2.3.2.2 Urbanization vs Passenger Cars Per 1,000 People

2.3.2.3 Increasing Vehicle Production in Major OEM-Based Countries

2.3.3 Supply Side Analysis

2.3.3.1 Technological Development

2.4 Market Size Estimation

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Opportunities in the Vehicle Anti-Theft System Market

4.2 Market, By Region, 2016 & 2021

4.3 Off-Highway Market, By Region, 2016 & 2021

4.4 Market, By Product Type

4.5 Market, By Technology

4.6 Market - Product Life Cycle

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Vehicle Anti-Theft System Market

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Safety Regulations Due to the High Incidence of Vehicle Theft

5.3.1.2 Multi-Factor Authentication for Vehicle Safety

5.3.1.3 Technological Advancements in the Anti-Theft Industry

5.3.2 Restraints

5.3.2.1 High Cost of Premium Safety and Anti-Theft Features

5.3.2.2 Potential Failure of Electronic Components Used in Vehicle Anti-Theft Systems

5.3.3 Opportunities

5.3.3.1 Rise in Bluetooth and NFC-Based Technologies

5.3.3.2 Rise of Biometric Technology

5.3.4 Challenges

5.3.4.1 Increase in Cyber Security Risk

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.1.1 Presence of Established Market Players

5.4.2 Threat of Substitutes

5.4.2.1 Advanced NFC Technology

5.4.3 Bargaining Power of Suppliers

5.4.3.1 Large Number of Organized & Unorganized Players

5.4.3.2 Rising Number of Players in the Aftermarket Segment

5.4.4 Bargaining Power of Buyers

5.4.4.1 Increasing Number of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.4.5.1 High Exit Barriers

5.5 Android Application for Vehicle Theft Prevention and Tracking System

5.5.1 Emergence of Stolen Vehicle Recovery Systems

6 Vehicle Anti-Theft System Market, By Region

The Chapter is Further Segmented at Country Level By Product Type (Steering Lock, Alarm, Biometric Capture Device, Immobilizer, Passive Keyless Entry and Central Locking System)

6.1 Introduction

6.2 North America

6.2.1 U.S.

6.2.2 Canada

6.2.3 Mexico

6.3 Europe

6.3.1 Germany

6.3.2 France

6.3.3 U.K.

6.3.4 Italy

6.4 Asia-Pacific

6.4.1 China

6.4.2 Japan

6.4.3 India

6.5 Rest of the World

6.5.1 Brazil

6.5.2 Russia

7 Vehicle Anti-Theft System Market, By Vehicle Type

7.1 Introduction

7.2 Passenger Car

7.3 Commercial Vehicle

7.4 Off-Highway Vehicle (Construction Vehicles)

8 Vehicle Anti-Theft System Market, By Product

8.1 Introduction

8.2 Alarm

8.3 Immobilizer

8.4 Steering Lock

8.5 Passive Keyless Entry

8.6 Central Locking System

8.7 Biometric Capture Device

9 Vehicle Anti-Theft System Market, By Technology

9.1 Introduction

9.2 Global Positioning System

9.3 Global System for Mobile Communication

9.4 Face Detection System

9.5 Real-Time Location System

9.6 Automotive Biometric Technology

9.7 Remote Frequency Identification Device

10 Vehicle Anti-Theft System Market, By Active and Passive

10.1 Introduction

10.2 Active Anti-Theft System

10.3 Passive Anti-Theft System

11 Competitive Landscape

11.1 Overview

11.2 Market Ranking Analysis: Vehicle Anti-Theft System Market

11.3 Expansion

11.4 Agreements/Partnerships/Supply Contracts/Collaborations-Collate

11.5 New Product Launches

11.6 Joint Ventures/Mergers & Acquisitions

12 Company Profiles

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Continental AG

12.2 Delphi Automotive

12.3 Lear Corporation

12.4 ZF TRW Automotive Holdings Corporation

12.5 Robert Bosch GmbH

12.6 Mitsubishi Electric Corporation

12.7 Voxx International

12.8 Tokai Rika Co., Ltd.

12.9 Johnson Electric

12.10 U-Shin Ltd

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix

13.1 Key Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

List of Tables (93 Tables)

Table 1 Vehicle Anti-Theft System Market Size, By Region, 2014–2021 (‘000 Units)

Table 2 Market Size, By Region, 2014–2021 (USD Million)

Table 3 North America: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 4 North America: Market Size, By Product Type, 2014–2021 (USD Million)

Table 5 U.S.: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 6 U.S.: Market Size, By Product Type, 2014–2021 (USD Million)

Table 7 Canada: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 8 Canada: Market Size, By Product Type, 2014–2021 (USD Million)

Table 9 Mexico: Market Size, , By Product Type, 2014–2021 (‘000 Units)

Table 10 Mexico: Market Size, By Product Type, 2014–2021 (USD Million)

Table 11 Europe: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 12 Europe: Market Size, By Product Type, 2014–2021 (USD Million)

Table 13 Germany: Vehicle Anti-Theft System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 14 Germany: Market Size, By Product Type, 2014–2021 (USD Million)

Table 15 France: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 16 France: Market Size, By Product Type, 2014–2021 (USD Million)

Table 17 U.K.: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 18 U.K.: Market Size, By Product Type, 2014–2021 (USD Million)

Table 19 Italy: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 20 Italy: Market Size, By Product Type, 2014–2021 (USD Million)

Table 21 Asia-Pacific: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 22 Asia-Pacific: Market Size, By Product Type, 2014–2021 (USD Million)

Table 23 China: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 24 China: Market Size, By Product Type, 2014–2021 (USD Million)

Table 25 Japan: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 26 Japan: Market Size, By Product Type, 2014–2021 (USD Million)

Table 27 India: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 28 India : Market Size, By Product Type, 2014–2021 (USD Million)

Table 29 RoW: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 30 RoW: Vehicle Anti-Theft System Market Size, By Product Type, 2014–2021 (USD Million)

Table 31 Brazil: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 32 Brazil: Market Size, By Product Type, 2014–2021 (USD Million)

Table 33 Russia: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 34 Russia: Market Size, By Product Type, 2014–2021 (USD Million)

Table 35 Off-Highway: Market Size, By Region, 2014–2021 (‘000 Units)

Table 36 Off-Highway: Market Size, By Region, 2014–2021 (USD Million)

Table 37 North America: Off-Highway Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 38 North America: Off-Highway Market Size, By Product Type, 2014–2021 (USD Million)

Table 39 Europe: Off-Highway Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 40 Europe: Off-Highway Market Size, By Product Type, 2014–2021 (USD Million)

Table 41 Asia-Pacific: Off-Highway Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 42 Asia-Pacific: Off-Highway Market Size, By Product Type, 2014–2021 (USD Million)

Table 43 RoW: Off-Highway Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 44 RoW: Off-Highway Market Size, By Product Type, 2014–2021 (USD Million)

Table 45 Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 46 Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 47 Passenger Car Anti-Theft System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 48 Passenger Car Anti-Theft System Market Size, By Product Type, 2014–2021 (USD Million)

Table 49 Commercial Vehicle Anti-Theft System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 50 Commercial Vehicle Anti-Theft System Market Size, By Product Type, 2014–2021 (USD Million)

Table 51 Off-Highway Vehicle Anti-Theft System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 52 Off-Highway Vehicle Anti-Theft System Market Size, By Product Type, 2014–2021 (USD Million)

Table 53 Anti-Theft System Market Size, By Product, 2014–2021 (‘000 Units)

Table 54 Vehicle Anti-Theft System Market Size, By Product, 2014–2021 (USD Million)

Table 55 Alarm: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 56 Alarm: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 57 Immobilizer: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 58 Immobilizer: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 59 Steering Lock: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 60 Steering Lock: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 61 Passive Keyless Entry: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 62 Passive Keyless Entry: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 63 Central Locking System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 64 Central Locking System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 65 Biometric Capture Device: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 66 Biometric Capture Device: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 67 Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 68 Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (USD Million)

Table 69 Global Positioning System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 70 Global Positioning System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 71 Global System for Mobile Communication: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 72 Global System for Mobile Communication: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 73 Face Detection System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 74 Face Detection System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 75 Real-Time Location System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 76 Real-Time Location System: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 77 Automotive Biometric Technology: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 78 Automotive Biometric Technology: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 79 Remote Frequency Identification Device: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 80 Remote Frequency Identification Device: Vehicle Anti-Theft System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 81 Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 82 Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (USD Million)

Table 83 Passenger Car Anti-Theft System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 84 Passenger Car Anti-Theft System Market Size, By Technology, 2014–2021 (USD Million)

Table 85 Commercial Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 86 Commercial Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (USD Million)

Table 87 Off-Highway Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 88 Off-Highway Vehicle Anti-Theft System Market Size, By Technology, 2014–2021 (USD Million)

Table 89 Vehicle Anti-Theft System Market Ranking: 2016

Table 90 Expansions, 2013–2016

Table 91 Agreements/Partnerships/Supply Contracts/Collaborations, 2013–2016

Table 92 New Product Launches, 2013–2016

Table 93 Joint Ventures/Mergers & Acquisitions, 2014–2016

List of Figures (61 Figures)

Figure 1 Vehicle Anti-Theft System Market Segmentation

Figure 2 Vehicle Anti-Theft System Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Urbanization vs Passenger Cars Per 1,000 People

Figure 6 Vehicle Production, 2010–2014

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Immobilizers to Be the Largest Contributor to the Vehicle Anti-Theft System Market, By Product Type (2016 & 2021)

Figure 9 Face Detection System to Be the Largest Contributor to the Vehicle Anti-Theft System Market, By Technology (2016 & 2021)

Figure 10 Vehicle Anti-Theft System Market, By Product Type & Technology, 2021

Figure 11 Off-Highway Vehicle Anti-Theft System Market, By Product Type & Technology (2016 & 2021)

Figure 12 Asia-Pacific Estimated to the Largest Share in the Vehicle Anti-Theft System Market, By Product Type, in 2021

Figure 13 Technological Advancements & the Growth of the Automotive Industry are Expected to Drive the Vehicle Anti-Theft System Market

Figure 14 Asia-Pacific to Be the Largest Market for Vehicle Anti-Theft Systems for Passenger Cars and Commercial Vehicles

Figure 15 Asia-Pacific to Hold the Largest Share in the Off-Highway Vehicle Anti-Theft System Market

Figure 16 Immobilizer Segment Estimated to Occupy the Largest Share in the Vehicle Anti-Theft System Market From 2016 to 2021

Figure 17 Face Detection System to Hold the Largest Share in the Vehicle Anti-Theft System Market, By Technology, From 2016 to 2021

Figure 18 Product Life Cycle of Vehicle Anti-Theft Systems

Figure 19 Immobilizers to Hold the Largest Share in the Vehicle Anti-Theft System Market, By Product Type, in 2016

Figure 20 Vehicle Anti-Theft System Market Segmentation

Figure 21 Technological Advancements in the Anti-Theft Systems Industry to Drive the Market

Figure 22 Regional Snapshot– Italian Vehicle Anti-Theft System Market Set to Grow at the Highest CAGR of 9.04% for Passenger Cars and Commercial Vehicles During the Forecast Period

Figure 23 North American Market Snapshot: Demand to Be Driven By the Increasing Vehicle Production

Figure 24 Vehicle Anti-Theft System Market Split, By Country, in Major European Markets (2016 vs 2021)

Figure 25 Asia-Pacific Vehicle Anti-Theft System Market Snapshot – China to Account for the Largest Market Share in 2016

Figure 26 Vehicle Anti-Theft System Market Split, By Country, in Major Rest of the World Markets (2016 vs 2021)

Figure 27 Off-Highway Vehicle Anti-Theft System Market Split, By Region (2016 vs 2021)

Figure 28 Vehicle Anti-Theft System Market Size, By Vehicle Type, 2016–2021

Figure 29 Passenger Car Anti-Theft System Market Growth, 2016–2021

Figure 30 Commercial Vehicle Anti-Theft System Market, 2016 vs 2021

Figure 31 Off-Highway Vehicle Anti-Theft System Market, 2016 vs 2021

Figure 32 Anti-Theft System Market, By Product, 2016–2021

Figure 33 Passenger Cars to Constitute the Largest Market for Immobilizers

Figure 34 Passenger Car Segment to Hold the Largest Share in the Steering Lock Market

Figure 35 Passenger Cars to Hold the Largest Share in the Biometric Capture Device Market

Figure 36 Vehicle Anti-Theft System Market, By Technology

Figure 37 Global Positioning System Market, By Vehicle Type

Figure 38 Face Detection System Market Share, By Vehicle Type

Figure 39 Automotive Biometric Technology Market Share, By Vehicle Type

Figure 40 Vehicle Anti-Theft System Market, By Vehicle Type, 2016–2021

Figure 41 Passenger Car Anti-Theft System Market Growth, 2016–2021

Figure 42 Commercial Vehicle Anti-Theft Market, 2016 vs 2021

Figure 43 Off-Highway Vehicle Anti-Theft System Market, 2016 vs 2021

Figure 44 Companies Adopted Agreements/Partnerships/Supply Contracts/Collaborations as Key Growth Strategies From 2012 to 2016

Figure 45 Market Evaluation Framework: Agreements/Partnerships/Supply Contracts/Collaborations Fuelled Market Growth From 2013 - to 2016

Figure 46 Battle for Market Share: Expansions Were the Key Strategy

Figure 47 Company Snapshot: Continental Ag

Figure 48 Continental AG: SWOT Analysis

Figure 49 Company Snapshot: Delphi Automotive

Figure 50 Delphi Automotive: SWOT Analysis

Figure 51 Company Snapshot: Lear Corporation

Figure 52 Lear Corporation: SWOT Analysis

Figure 53 Company Snapshot: ZF TRW Automotive Holdings Corporation

Figure 54 ZF TRW Automotive: SWOT Analysis

Figure 55 Company Snapshot: Robert Bosch GmbH

Figure 56 Robert Bosch GmbH: SWOT Analysis

Figure 57 Company Snapshot: Mitsubishi Electric Corporation

Figure 58 Company Snapshot: Voxx International

Figure 59 Company Snapshot: Tokai Rika Co. Ltd.

Figure 60 Company Snapshot:Johnson Electric

Figure 61 Company Snapshot: U-Shin Ltd.

Growth opportunities and latent adjacency in Vehicle Anti-Theft System Market

I am currently looking for a comprehensive report on the anti-theft systems and components: technology, sales, forecast, competitors, market trends, theft data for both the AM and the OE channels.