Veterinary Reference Laboratory Market by Service Type (Clinical Chemistry, Immunodiagnostics (ELISA), Molecular Diagnostics (PCR, Microarray)), Application (Pathology, Virology), Animal (Companion, Livestock), and Region - Global Forecast to 2027

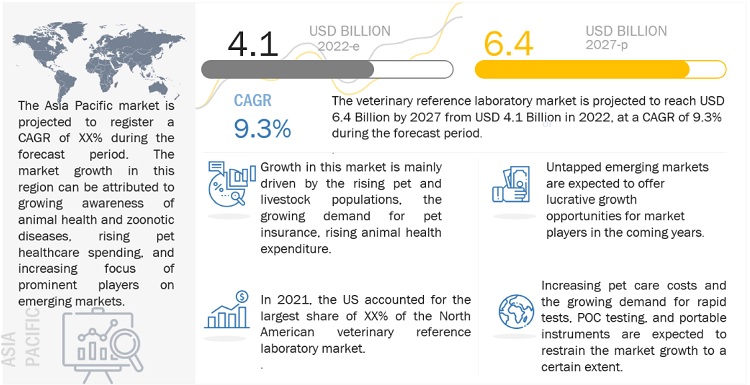

[314 Pages Report] The global veterinary reference laboratory market is projected to reach USD 6.4 billion by 2027 from USD 4.1 billion in 2022, at a CAGR of 9.3% during the forecast period. The main driving factors are increasing adoption of latest and technologically advanced instruments and consumable in veterinary reference laboratory across the globe. However, rising pet care cost and increasing the demand of POC testing are restraining the market growth upto certain extent.

Attractive Opportunities in the Veterinary Reference Laboratory Market

To know about the assumptions considered for the study, Request for Free Sample Report

Veterinary Reference Laboratory Market Dynamics

Driver: Growth in the companion animal population

The global demand for animal-derived food products, including beef, veal, buffalo meat, mutton, lamb and goat meat, pork, poultry meat, milk and dairy products, and eggs, is increasing. Livestock products account for 17% of kilocalorie consumption and 33% of protein consumption globally; however, this figure varies across developed and developing countries. The overall livestock sector is expected to witness significant growth due to the high consumption of animal-derived food products. An FAO (Food and Agriculture Organization of the United Nations) survey on mapping the supply and demand for animal-sourced food estimates that Asian countries will register the highest growth in the demand for livestock products such as beef, milk, mutton, pork, and poultry products (chicken and eggs).

According to the FAO, South Asia is one of the major regions for dairy production and accounted for 20–25% of global milk production in 2019. In this region, India was the largest producer and consumer of milk, followed by China and Pakistan. In 2020, the consumption of meat in India was over 3.9 million metric tons; by 2030, this is expected to increase to 14.7 million metric tons.

Restraints: Growing demand for rapid tests, POC testing and portable instruments

Portable diagnostic instruments meant for POC testing are witnessing growing adoption in the veterinary diagnostics space, mainly due to the challenges encountered in conventional testing, such as the collection and transportation of samples to a high-quality veterinary reference laboratory. This is particularly difficult in the case of rural or remote areas. Hence, major players in this market are focusing on launching portable instruments for field veterinarians for use in remote locations and emergencies.

Rapid tests are also gaining popularity owing to their ease of use, specificity, reproducibility, and low cost. This has correspondingly driven companies to focus on introducing rapid tests that can deliver definitive results in less than 24 hours or even during the course of the initial examination. New technologies that can ensure rapid result generation and real-time convenience of diagnosis will reduce the number of samples shared with reference laboratories by hospitals, clinics, and farms, which is expected to hamper the growth of this market.

Opportunity: Public-private partnerships in veterinary health

Most research institutions and pharmaceutical companies in the private sector offer a broad portfolio of services that include developing new technologies and capabilities for providing services, genetic evaluation, micro-financing farmers & other livestock owners, and training & workshops to educate farmers. Governments also partner with private companies involved in such activities to provide support while restricting their role in monitoring, evaluation, and surveillance.

For example, in Mali, livestock animals contribute close to 80% of the revenue for the rural population, making it essential for citizens to regularly vaccinate and monitor animals for their health. A PPP between the National Veterinary Services and private veterinarians helped the country improve its livestock vaccination coverage for several diseases.

The OIE also released a handbook during its general session (2017) to educate stakeholders on public-private partnerships in the veterinary domain under three different clusters—transactional, collaborative, and transformative. Under transformative PPP, OIE decided to develop guidelines to initiate joint programs with national veterinary services on disease control, product supply, and genetic evaluation. Such PPP initiatives will continue to contribute to the growth of the market and provide fresh opportunities for companies.

Challenge: Shortage of veterinarians in emerging markets

The global animal healthcare industry is marked by a shortage of skilled veterinarians and pathologists. This is particularly evident in the emerging markets across the Asia Pacific and Latin America, which show a huge gap in the demand and supply of veterinary professionals. According to the World Animal Health Information Database (2017), there were 180,821 veterinary professionals in India. According to the 20th Livestock Census (2019), India’s total livestock population was 535.8 million; this translates into a requirement of 60,000 veterinarians catering to bovine animals alone. The demand will increase if poultry, sheep, goats, pigs, and other animals are considered. Similar shortages are observed in other developing countries such as Brazil, China, and Southeast Asian countries. The general norm is to have at least one veterinary doctor for every 5,000 animals. India requires at least 110,000–120,000 professionals. Similar shortages are observed in the developing countries of Brazil and China. The shortage of veterinarians is expected to challenge the growth of the animal health industry, including the veterinary reference laboratory market.

“The PCR services held the largest share in veterinary reference laboratory market for molecular diagnostics service by type, during the forecast period”

Based on technology, the veterinary reference laboratory market for molecular diagnostics is segmented into PCR Tests, Microarray, and other molecular diagnostic tests. In 2021, the PCR tests segment accounted largest share of the veterinary reference laboratory market for molecular diagnostics. The large share of this segment is mainly attributed to advanced technologies like qRT-PCR, increasing laboratory usage of PCR in proteomics and genomics, and the automation of instruments.

“ Bacteriology held second largest share of the veterinary reference laboratory market in 2021”

The bacteriology accounted for the second largest share of the veterinary reference laboratory market in 2021. Veterinary bacteriology plays an important role in veterinary medicine, human health, and economics. Bacteriology includes a thorough study of bacteria that can cause infectious diseases in animals and humans. Common diseases diagnosed in companion and food-producing animals are diarrheal infections, respiratory infections, mastitis, pneumonia, kennel cough, leptospirosis, and infectious necrotic hepatitis.

“ Cattle dominates the veterinary reference laboratory market for livestock animals in 2021”

The cattle animal segment accounted for the largest share of the global veterinary reference laboratory market for livestock animals. Diagnostic sampling and tests can provide valuable information when investigating the causes of respiratory diseases within cattle; as a result, the need to ensure herd healthcare will drive the overall demand for cattle testing services. The largest share of cattle segment is due to rising demand for milk and related products, increasing cattle population, and increasing adoption of molecular diagnostics services amongst cattles.

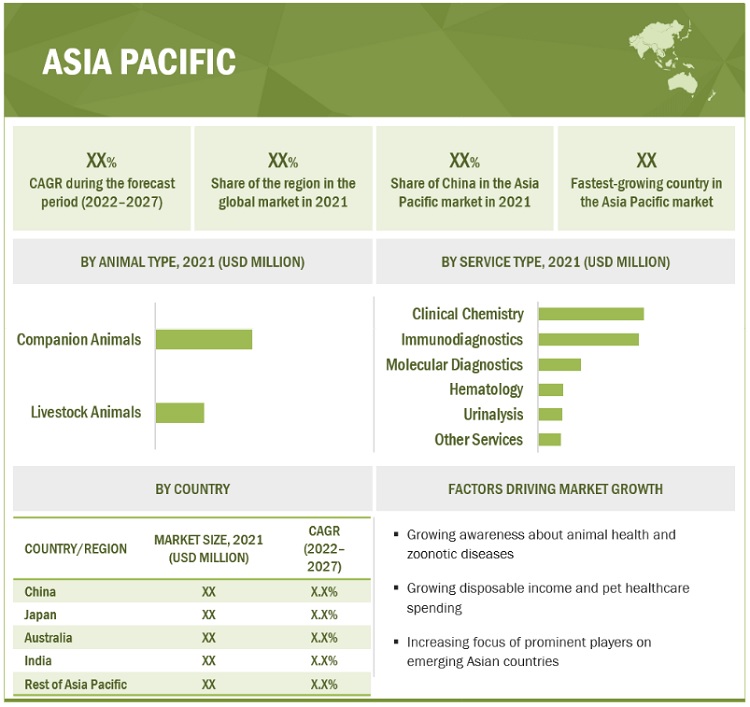

“AsiaPacific is expected to grow at highest growth rate of the global Veterinary Reference Laboratory Market, by region in the forecast period”

Asia Pacific region is expected to grow at highest growth rate of the global veterinary reference laboratory market. This growth is mainly attributed to the growing awareness of animal health and zoonotic diseases, rising pet healthcare spending, and increasing focus of prominent players on emerging markets.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players in the Veterinary Reference Laboratory Market: IDEXX Laboratories, Inc. (US), VCA, Inc. (US), GD Animal Health (Netherlands), Boehringer Ingelheim (Germany), Zoetis Inc. (US), NEOGEN Corporation (US), LABOKLIN GmbH (Germany), SYNLAB International GmbH (Germany), Heska Corporation (US), Virbac (US), Thermo Fisher Scientific, Inc. (US), Texas A&M Veterinary Medical Diagnostic Laboratory (US), University of Minnesota (Veterinary Diagnostic Laboratory) (US), Iowa State University (Veterinary Diagnostic Laboratory) (US), Vetnostics (Australia), ProtaTek International Inc. (US), Animal and Plant Health Agency (UK), Animal Health Diagnostic Center (Cornell University) (US), National Veterinary Services Laboratory USDA-APHIS (US), Washington Animal Disease Diagnostic Laboratory (US), Colorado State University (Veterinary Diagnostic Laboratories) (US), The Pirbright Institute (UK), IDVet (France), Friedrich-Loeffler-Institute (FLI) (Germany), and Kansas State Veterinary Diagnostic Laboratory (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Unit |

Value(USD) |

|

Segments covered |

Veterinary Reference Laboratory Market: |

|

Geographies covered |

|

|

Companies Covered |

IDEXX Laboratories, Inc. (US), VCA, Inc. (US), GD Animal Health (Netherlands), Zoetis Inc. (US), NEOGEN Corporation (US), LABOKLIN GmbH (Germany), SYNLAB International GmbH (Germany), Heska Corporation (US), Virbac (US), Vaxxinova Gmbh (Netherlands), Thermo Fisher Scientific, Inc. (US), Texas A&M Veterinary Medical Diagnostic Laboratory (US), University of Minnesota (Veterinary Diagnostic Laboratory) (US), Iowa State University (Veterinary Diagnostic Laboratory) (US), Vetnostics (Australia), ProtaTek International Inc. (US), Animal and Plant Health Agency (UK), Animal Health Diagnostic Center (Cornell University) (US), National Veterinary Services Laboratory USDA-APHIS (US), Washington Animal Disease Diagnostic Laboratory (US), Colorado State University (Veterinary Diagnostic Laboratories) (US), The Pirbright Institute (UK), GreenCross Limited (Australia), Friedrich-Loeffler-Institute (FLI) (Germany), and Kansas State Veterinary Diagnostic Laboratory (US) |

The research report categorizes the market into the following segments:

Veterinary Reference Laboratory Market, By Services Type

- Clinical Chemistry

-

Immunodiagnostics

- ELISA

- Lateral Flow Assays

- Other Immunodiagnostics Services

-

Molecular Diagnostics

- PCR Tests

- Microarrays

- Other Molecular Diagnostics Services

- Hematology

- Urinalysis

- Other Services

Veterinary Reference Laboratory Market, By Application

- Clinical Pathology

- Bacteriology

- Parasitology

- Virology

- Productivity Testing

- Pregnancy Testing

- Toxicology Testing

Veterinary Reference Laboratory Market, By Animal Type

-

Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals

-

Livestock Animals

- Cattle

- Swine

- Poultry

- Other Livestock Animals

Veterinary Reference Laboratory Market, by Region

-

North America North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments:

- In June 2022, IDEXX Laboratories, Inc. (US) launched Fecal Dx Antigen Testing, new reference laboratory tests and service to help veterinarians gain insights during wellness screenings and develop treatments plans for cats with chronic kidney diseases.

- In April, 2022, Zoetis Inc. (US) added AI blood smear testing to the Vetscan Imagyst.

- In December 2021, Neogen Corporation (US) acquired Genetic Veterinary Sciences, Inc. (US) to increase its genetic testing portfolio for companion animals

- In September, 2021, Heska Corporation (US) acquired Biotech Laboratories (US) to expand its product offerings in rapid assays.

Frequently Asked Questions (FAQ):

Which are the top industry players in the global Veterinary Reference Laboratory Market?

The top market players in the global Veterinary Reference Laboratory Market are IDEXX Laboratories, Inc. (US), VCA, Inc. (US), GD Animal Health (Netherlands), Zoetis Inc. (US), NEOGEN Corporation (US), LABOKLIN GmbH (Germany), SYNLAB International GmbH (Germany), Heska Corporation (US), Virbac (US) and Thermo Fisher Scientific, Inc. (US).

What are the current trends in veterinary reference laboratory market?

Adoption of multiple testing panels, outsourcing of veterinary diagnostics testing services are some of the industry trends in this market

Which geographical region is dominating in the veterinary reference laboratory market?

The North America region is leading region in this market, holding for the largest share of the veterinary reference laboratory market in 2021. The main factors driving the growth of this market is due to the increasing pet population, and developing the animal care infrastructure.

Which is the leading segment in the veterinary reference laboratory market by Service type?

The clinical chemistry services segment accounted for the largest share of the veterinary reference laboratory market. The large share of this segment can primarily be attributed to the clinical chemistry analyzers are used to analyze the metabolic profiles, electrolyte profiles, protein analysis, and hepatic function of companion and farm animals. Typically, two or more clinical chemistry tests are bundled together and offered as a panel of tests for small and large animals. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary reference laboratory market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

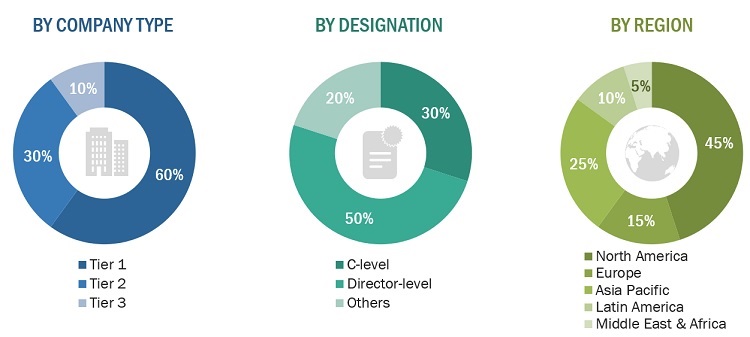

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The veterinary reference laboratory market comprises several stakeholders such as veterinary reference laboratory service manufacturers and distributors and regulatory organizations. The demand side of this market is characterized by Veterinary reference laboratory personnel, hospitals & clinics personnel, veterinarians, researchers and animal farms.

Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents for veterinary reference laboratory market is provided below:

* Others include sales managers, marketing managers, and product managers

Note: Tiers of companies are defined by their total revenues; as of 2020, Tier 1>= USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3<= USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by service type, application, by animal type, and by region).

Data Triangulation

After arriving at the market size, the total veterinary reference laboratory market was divided into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the veterinary reference laboratory market on the basis of service type, application, animal type and region.

- To provide detailed information on the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market segments with respect to North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, partnerships, acquisitions and other developments in the market.

- To understand the impact of economic recession on the veterinary reference laboratory market

- To benchmark players within the veterinary reference laboratory market using the Competitive Leadership Mapping framework which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific veterinary reference laboratory market into South Korea, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Reference Laboratory Market