Veterinary Imaging Market Size, Growth, Share & Trends Analysis

Veterinary Imaging Market by Product (CT, MRI, Imaging Systems, Imaging Reagents, Imaging Software, Accessories), Animal Type (Small, Large), Application (Oncology, Dentistry), Modality (Portable, Stationary), End User, Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The veterinary imaging market is expected to grow from USD 2.29 billion in 2026 to USD 3.33 billion by 2031, at a CAGR of 7.7% during this period. This growth is driven by several factors, including an increase in pet ownership, rising spending on animal healthcare, a growing demand for early and accurate diagnosis, and advancements in imaging technologies such as digital radiography, ultrasound, computed tomography (CT), and magnetic resonance imaging (MRI). Additionally, the increasing adoption of AI-enabled diagnostic tools, portable imaging systems, and cloud-based imaging platforms is enhancing diagnostic accuracy, improving workflow efficiency, and increasing accessibility across veterinary clinics, hospitals, and mobile care settings, further supporting the expansion of the market.

KEY TAKEAWAYS

-

By RegionThe North America veterinary imaging market accounted for a share of 47.9% in 2025.

-

By ProductBy product, the veterinary imaging software segment is expected to register the highest CAGR of 10.1%.

-

By ModalityBy modality, the stationary instruments segment dominated the market with a 65.7% share in 2025.

-

By Delivery ModeBy delivery mode, the on-premises/hybrid software segment is expected to dominate the market with a 63.3% share in 2025.

-

By Animal TypeBy animal type, the small animals segment is projected to grow at the fastest rate from 2026 to 2031.

-

By ApplicationBy application, orthopedics accounted for the largest share of 26.3% in 2025.

-

By End UserBy end user, the veterinary hospitals & clinics segment dominated the market in 2025.

-

Competitive Landscape - Key PlayersGE Healthcare, Agfa-Gevaert Group, Carestream Health, Esaote S.p.A, and IDEXX Laboratories, Inc. were identified as some of the star players in the veterinary imaging market, given their extensive global reach and comprehensive product portfolios.

-

Competitive Landscape - StartupsIM3, Hallmarq Veterinary Imaging, and MyVet Imaging, among others, have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused product capabilities.

The veterinary imaging market is witnessing steady growth, driven by rising pet ownership, increasing demand for accurate diagnostic services, and greater awareness of animal health and early disease detection. Advancements in digital radiography, ultrasound, CT, and MRI systems, along with AI-enabled imaging software and portable diagnostic solutions, are transforming the market landscape. Additionally, increasing collaboration between veterinary equipment manufacturers, diagnostic service providers, and veterinary hospitals is further accelerating innovation and adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the veterinary imaging market is shaped by evolving animal healthcare needs, growing demand for early diagnosis, and continuous advancements in imaging technology. Veterinary hospitals, clinics, diagnostic centers, and research institutions are the primary adopters of imaging systems, focusing on accurate diagnostics, workflow efficiency, and improved clinical decision-making. The increasing need for fast, reliable, and minimally invasive diagnostic imaging directly supports better treatment planning and patient outcomes. These trends are accelerating the adoption of advanced digital radiography, ultrasound, CT, MRI, and AI-enabled analysis platforms, ultimately shaping the market’s growth trajectory and driving long-term investment in modern veterinary care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in companion animal population

-

Higher disease burden, preventive/early diagnostics, demand for non-invasive, accurate, rapid diagnostics

Level

-

High cost of veterinary imaging instruments

-

Rising cost of pet care

Level

-

Growth potential of emerging economies

Level

-

High capital cost and budget limitations in veterinary practices

-

Shortage of skilled veterinary radiologists and trained imaging technicians

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in companion animal population

The continued rise in the population of companion animals has largely fueled the growth of the veterinary imaging market. The number of people keeping pets worldwide is getting higher, and there is also a trend of treating pets as family members. These are the reasons behind the increased requests for advanced veterinary diagnostic and imaging services. More and more pet owners are becoming aware of the benefits of early diagnosis and preventive health care for their pets. Thus, animal clinics are increasingly using imaging tools such as digital radiography, ultrasound, CT, and MRI to detect chronic diseases, orthopedic injuries, cardiac disorders, and cancers. On top of that, higher spending on pet health care, combined with better access to specialized veterinary hospitals and diagnostic centers, is the main reason for the rapid adoption of imaging solutions. This growing number of patients drives steady demand for the latest medical imaging technologies, not only in developed areas but also in developing regions.

Restraint: High cost of veterinary imaging instruments

The high prices of advanced veterinary imaging equipment remain a significant factor holding back market growth. Devices such as CT scanners, MRI machines, digital radiography systems, and high-quality ultrasound equipment must be purchased at very high prices. Small and medium veterinary clinics are likely to struggle to raise such large amounts for capital investment. In addition, operating costs remain significantly high due to regular equipment maintenance, software updates, radiation safety compliance, and the hiring of experienced imaging technicians. Many developing nations lack the funds and reimbursement mechanisms to support the introduction of these technologies. Therefore, even though there is significant demand, advanced veterinary imaging equipment is not widely used mainly because of the high initial and operating costs, especially in areas where people are more price-conscious.

Opportunity: Growth potential of emerging economies

Emerging economies offer major growth possibilities for the veterinary imaging market. Increased disposable incomes, pet adoption, and the growth of livestock sectors in Asia Pacific, Latin America, and parts of the Middle East are driving the need for better veterinary healthcare infrastructure. Both governments and the private sector are spending on veterinary facility upgrades, including diagnostic centers equipped with the latest imaging technologies. Furthermore, the rapid growth of veterinary chains, enhanced knowledge of preventive care, and the wider availability of affordable digital imaging solutions are driving faster adoption. Moreover, these markets are seeing a rise in demand for livestock health monitoring, driven by food safety concerns and productivity enhancement initiatives. All these factors combined create many opportunities for imaging manufacturers to expand their share in regions with high growth potential.

Challenge: High capital cost and budget limitations in veterinary practices

Budget constraints often hinder veterinary practices, especially small, independent practices, from upgrading their imaging technology. Besides the initial cost of the equipment, the need for skilled personnel to operate and interpret the imaging also adds to the already constrained operational costs. To avoid the high costs of buying and operating imaging equipment, most clinics rely on referral centers, which may delay diagnosis, and pets from rural/underserved areas may face inconveniences. Economic downturns, unstable cash flow, and limited borrowing options further worsen the situation. Therefore, the significant financial burden of installing and operating imaging systems continues to be a major barrier to widespread veterinary use globally.

VETERINARY IMAGING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

IDEXX Web PACS and diagnostic imaging solutions that integrate X-ray, dental, ultrasound, CT/MR and telemedicine into a single image management platform, fully integrated with leading practice management systems | Streamlines image capture, viewing, sharing, and archiving | Saves staff time per procedure; improves diagnostic workflow and client communication through secure, cloud-hosted access |

|

AI-enabled teleradiology service combining artificial intelligence with board-certified veterinary radiologists to deliver digital radiology interpretations from stored X-ray, CT and MRI images | Provides fast, accurate radiology reports in minutes, supports early detection of disease, and increases diagnostic confidence without adding in-house specialist headcount |

|

LOGIQ family portable and cart-based ultrasound systems (e.g., LOGIQ Fortis/LOGIQ e) used in multi-disciplinary settings, including veterinary, to deliver high-quality imaging in a compact, mobile form factor. | Offers high-quality, real-time imaging at the point of care; improves workflow with customizable, streamlined scanning | Supports flexible use across exam rooms and field settings |

|

Dedicated veterinary ultrasound and MRI systems developed specifically for small animals, equine, and mixed practices | Provides species-specific imaging protocols and high-quality images, enabling faster and more accurate diagnosis | Integrated solutions help veterinarians deliver optimal care across diverse animal types |

|

Digital X-ray solutions designed for veterinary practices, offering compact, affordable computed radiography as an in-house “bridge” from film to full digital DR | Enables clinics to upgrade from film to digital at lower upfront cost; delivers high-quality images with multiple throughput options | improves workflow efficiency for small and mid-size veterinary hospitals |

|

Veterinary-dedicated CR/DR systems with MUSICA image processing and small-animal/equine solutions, including mobile DR configurations with workstation software | Delivers low-dose, high-resolution images for small and large animals | enhances workflow and productivity with optimized image processing and portable DR options for clinics and field vets |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The veterinary imaging market ecosystem comprises a network of stakeholders that collectively support innovation, product development, and clinical adoption across veterinary care settings. Core participants include imaging manufacturers such as GE HealthCare, Esaote, Carestream, Agfa-Gevaert, and IDEXX, who develop ultrasound, digital radiography, CT, and MRI systems tailored for veterinary applications. Complementing them are software and AI solution providers offering PACS systems, cloud-based storage, remote viewing, and automated diagnostic interpretation, often integrated directly with imaging hardware. Veterinary clinics, hospitals, specialty centers, and mobile care providers serve as primary end users, while universities and research institutes contribute to training, validation, and continued development of clinical imaging standards. Telemedicine networks and diagnostic service providers are also expanding access to expert interpretation and specialized radiology support. Regulatory bodies such as the FDA (US), EMA (EU), and equivalent regional authorities ensure the safety, quality, and compliance of veterinary imaging equipment and software.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Veterinary Imaging Market, By Product

In 2025, veterinary imaging systems/instruments were the leading segment of the veterinary imaging market. They mainly consist of radiography systems, ultrasound devices, CT scanners, MRI systems, and fluoroscopy units, which have become indispensable tools for a wide range of diagnostics, from routine checks to emergency care, and are also used for orthopedic, cardiology, oncology, and reproductive evaluations of animals. These devices are part of the daily clinical routine, and the strong demand for veterinary hospitals, specialty clinics, and diagnostic centers allows manufacturers to continue generating revenue. The segment's dominance is also supported by the increased adoption of digital imaging technologies, AI, diagnostic software, and portable imaging units. Among the reasons for broader use in pet and farm animal healthcare are continuous innovations in high-resolution imaging, cloud-based image storage, and radiation dose optimization.

Veterinary Imaging Market, By Application

Since pets, especially dogs, suffer from musculoskeletal disorders, trauma, fractures, arthritis, hip dysplasia, and ligament tears at very high rates, the orthopedic segment accounted for the largest share of the veterinary imaging market in 2025. Various imaging modalities, such as X-ray, CT, and MRI scans, have served as indispensable tools for diagnosing structural abnormalities, post-surgical follow-up, surgical planning, and assisting in minimally invasive procedures. Moreover, the availability of pet insurance, the increase in pet obesity rates, and the need for advanced orthopedic care have led to increased use of imaging in the field. In addition, innovations in digital radiography, 3D CT image reconstruction, and motion-corrected MRI continue to raise diagnostic standards, and thus the orthopedic imaging segment holds the largest market share.

Veterinary Imaging Market, By Animal Type

Until 2025, the largest share of the veterinary imaging market was held by small animals. This was mainly due to the significant increase in companion animal ownership and the growing emphasis on preventive and early-stage diagnostics. Dogs and cats are the main users of imaging, as they require it for diseases related to cardiology, oncology, gastroenterology, neurology, and orthopedics, resulting in high demand at veterinary clinics where they are treated. Also, because of their smaller size, they can be easily accommodated by advanced modalities such as micro-ultrasound, compact CT systems, and high-field MRI scanners. The trend of pet owners being more willing to spend on high-quality veterinary care, along with the growth of multispecialty veterinary hospitals, continually helps maintain the strong use of imaging systems in the small animal area.

Veterinary Imaging Market, By End User

The veterinary hospitals & clinics segment held the major share of the veterinary imaging market in 2025, largely due to the growing number of veterinary practices adopting advanced diagnostic tools. These facilities typically rely on imaging devices for routine health checks, disease screening, pre-surgical planning, emergency diagnostics, and chronic disease monitoring. In addition, hospitals must cater to large patient volumes and diverse clinical applications, so they generally invest in comprehensive suites of imaging modalities, including digital radiography, ultrasound, CT, and MRI. Further, increasing investments in specialized veterinary care, a mounting caseload of companion animals, and the incorporation of AI-based imaging analytics that provide greater diagnostic accuracy and higher operational efficiency also contribute to this market growth. In addition, continuous enhancements to imaging infrastructure, coupled with easier access to financing, enable veterinary hospitals and clinics to remain dominant in the market.

REGION

Asia Pacific to be fastest-growing region in global veterinary imaging market during forecast period

The Asia Pacific veterinary imaging market is expected to experience the fastest growth rate over the next few years due to increased pet ownership, the expansion of veterinary healthcare facilities, and rising awareness of early animal disease diagnosis. Urbanization, middle-class expansion, and increased spending on companion animal healthcare in China, India, Japan, and South Korea are among the main factors creating demand for advanced diagnostic imaging technologies. In addition, the construction of veterinary hospitals, the rise of multispecialty pet clinics, and the high-level adoption of digital radiography, ultrasound, CT, and MRI technologies are all market penetration factors in the Asia Pacific region. On the one hand, government focus on animal health and the increasing number of livestock, and on the other hand, rising partnerships between global imaging companies and local veterinary institutions, are both factors that result in long-term market growth in the Asia Pacific region.

VETERINARY IMAGING MARKET: COMPANY EVALUATION MATRIX

In the veterinary imaging market matrix, IDEXX Laboratories, Inc. (Star) is at the top, with a solid market presence and a vast portfolio of digital radiography systems, state-of-the-art ultrasound devices, and AI-powered imaging software used in veterinary hospitals and clinics worldwide. The company's supremacy is supported by its all-in-one diagnostic ecosystem, worldwide distribution network, and ongoing product innovation. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Emerging Leader) is recognized for its affordable, high-quality veterinary imaging solutions, including portable ultrasound and digital radiography systems. Mindray's rapid technological development, growing global presence, and competitive pricing make it likely that the company will move to the leaders' quadrant as demand for efficient and affordable imaging systems grows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- GE Healthcare (US)

- Agfa-Gevaert Group (Belgium)

- Carestream Health (US)

- Esaote SPA (Italy)

- IDEXX Laboratories, Inc. (US)

- Shenzhen Mindray Animal Medical Technology Co., Ltd (China)

- Antech diagnostics, Inc. (US)

- Siemens Healthcare PTY LTD. (Germany)

- Fujifilm Holdings Corporation (Japan)

- Oehm und Rehbein GmbH (Germany)

- Canon Inc. (Japan)

- Sedecal (Spain)

- Draminski (Poland)

- E.I Medical Imaging (US)

- Samsung Electronics Co., Ltd (South Korea)

- Konica Minolta, Inc. (Japan)

- Vetel Diagnostics (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.13 BN |

| Market Size in 2031 (Value) | USD 3.33 BN |

| Growth Rate | 7.7% |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: VETERINARY IMAGING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of key veterinary imaging modalities: Digital Radiography (X-ray), Ultrasound, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), and Fluoroscopy. Digital radiography dominates due to its wide applicability in routine diagnostics, orthopedics, dentistry, and emergency care, along with its high image clarity, fast processing, and continuous improvements in image enhancement and workflow efficiency. |

|

| Company Information | Key players: GE Healthcare (US), Agfa-Gevaert Group (Belgium), Carestream Health (US), Esaote S.p.A (Italy), IDEXX Laboratories, Inc. (US). Top 3-5 players market share analysis at Asia Pacific and European country level. | Provided insights on revenue transitions toward emerging applications |

| Geographic Analysis | A detailed analysis of the Rest of Asia Pacific was provided to one of the top players. The client focused on country-level analysis of veterinary imaging adoption and localization strategies in ASEAN markets. | Supported country-level demand mapping to guide new product launches and regional manufacturing strategies |

RECENT DEVELOPMENTS

- September 2025 : Samsung Medison announced its acquisition of Sonio, a French company that specializes in artificial intelligence for obstetric ultrasound diagnostics and automated fetal reporting workflows. Sonio’s FDA-cleared AI platform can detect and validate fetal anatomical views in real time from ultrasound cine clips. This technology will be integrated into Samsung Medison’s ultrasound systems to improve the accuracy, consistency, and efficiency of examinations.

- August 2025 : Esaote North America, Inc. announced a strategic partnership with Epica International, a global leader in advanced CT and imaging technologies. This collaboration brings together two complementary portfolios to enhance market presence and accelerate the adoption of high-performance MRI and CT solutions in both human and veterinary healthcare sectors.

- May 2025 : Antech Diagnostics, Inc. launched RapidRead Dental, an AI-powered radiology interpretation tool that delivers accurate dental radiograph evaluations in approximately 10 minutes. Developed by Board-Certified Veterinary Dentists using over 55,000 images and 275,000 teeth, the tool offers comprehensive tooth-by-tooth analysis with 98% accuracy.

Table of Contents

Methodology

This research study extensively utilized both primary and secondary sources. It involved analyzing various factors that influence the industry to identify segmentation types, industry trends, key players, the competitive landscape, key market dynamics, and strategies employed by major players.

Secondary Research

This research study used a range of comprehensive secondary sources, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, company house documents, investor presentations, and SEC filings from various companies. Secondary research was used to gather information crucial for an in-depth, technical, market-oriented, and commercial analysis of the veterinary imaging market. This approach also helped identify key players in the industry and enabled classification and segmentation based on emerging trends at the most granular level. Furthermore, significant developments from both market and technological perspectives were documented. A database of primary industry leaders was created as part of this secondary research.

Primary Research

In the primary research process, a range of sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources from the supply side include project, sales, marketing, and business development managers; presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers in the biochips market. Primary sources from the demand side include researchers at biotechnology and pharmaceutical companies; healthcare professionals at hospitals and diagnostic centers; and academic and research institutes, as well as contract research organizations.

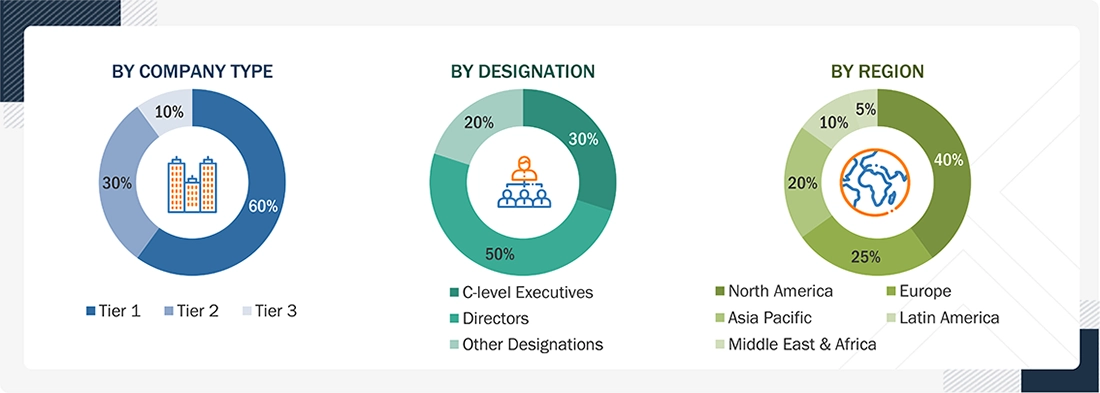

A breakdown of the primary respondents is provided below:

BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS, BY COMPANY TYPE, DESIGNATION, AND REGION

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales, marketing, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

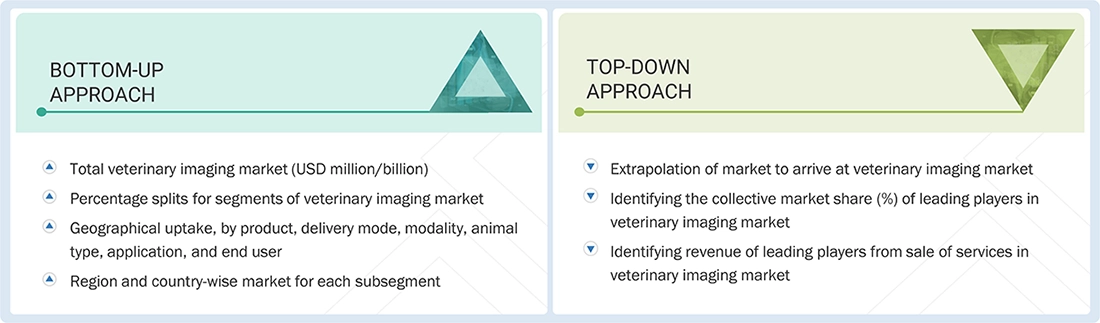

The total size of the veterinary imaging market was determined through data triangulation across three approaches, as outlined below. After each approach, the weighted average of the three approaches was calculated based on the level of assumptions used in each approach.

Data Triangulation

After determining the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Veterinary imaging uses specialized diagnostic imaging systems, reagents, software, and accessories to visualize anatomical structures and physiological functions in animals. It encompasses a range of modalities, including radiography (CR/DR), ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), nuclear imaging, and video endoscopy. Veterinary imaging solutions also include contrast reagents, PACS/RIS software, AI-enabled image analysis tools, and consumables for clinical use. These technologies enable veterinarians to diagnose diseases, assess injuries, guide treatment planning, and monitor health conditions in small animals, large animals, and exotic species across veterinary clinics, hospitals, mobile practices, and research settings.

Key Stakeholders

- Veterinary imaging equipment manufacturers

- Veterinary imaging equipment distributors

- Animal health research & development (R&D) companies

- Veterinary reference laboratories

- Veterinary hospitals and diagnostic imaging laboratories

- Veterinary clinics and diagnostic centers

- Market research and consulting firms

- Government associations

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, and forecast the veterinary imaging market by product, animal type, modality, delivery mode, application, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall veterinary imaging market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the veterinary imaging market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To profile key players in the veterinary imaging market and comprehensively analyze their core competencies and market share

- To analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Available customizations:

With the given market data, MarketsandMarkets offers customizations to meet your company’s specific needs. The following customization options are available for the report:- Company Information

Detailed analysis and profiling of additional market players (up to 5)

- Geographic Analysis

Further breakdown of the Rest of Europe veterinary imaging market into Austria, Finland, Switzerland, and other countries

Further breakdown of the Rest of Latin America biochips market into Colombia, Chile, and other countries

- Competitive Landscape Assessment

Market share analysis for North America and Europe, which provides market shares of the top 3–5 key players in the veterinary imaging market

Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Veterinary Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Veterinary Imaging Market