Virtual Private Server Market by Operating System (Windows and Linux), Organization Size (SMEs and Large Enterprises), Vertical (BFSI, Government and Defense, IT and Telecommunication, Retail, Healthcare), and Region - Global Forecast to 2023

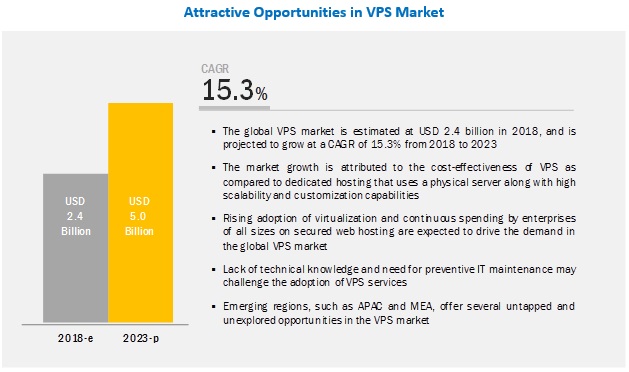

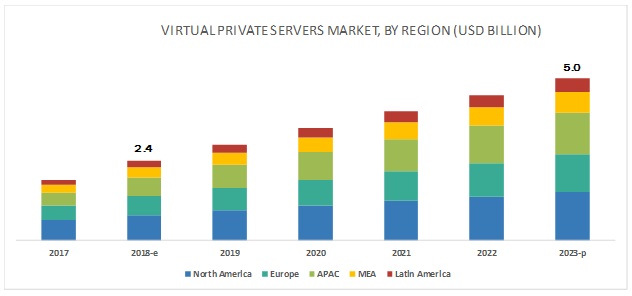

[99 Pages Report] The global virtual private server market size is expected to grow from USD 2.4 billion in 2018 to USD 5.0 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 15.3% during the forecast period. Major growth drivers for the market include several advantages of VPS such as availability of cost-effective virtual private server, provide greater customizations, and scalability and more control with virtual servers than shared hosting. VPS enables organizations avail dedicated servers in the virtual environment. The approach provides enhanced control over servers, agile deployment of virtualized workloads, reduced infrastructure cost, and improved operational efficiency.

With increasing virtualization, Small and Medium Enterprises (SMEs) are embracing both private and public cloud services to transform their business processes. The adoption of cloud services has, in turn, spurred the demand for virtual private server market for hosting and for supporting other critical business functions.

The report provides detailed insights into the market by operating system, organization size, vertical, and region.

Linux operating system to be the largest contributor to the virtual private server market growth during the forecast period

Organizations use VPS for their Windows and Linux applications. Linux VPS is one of the best options if a user wants more control over the things that have been installed on the server where the website has been hosted. Linux VPS provides with a multi-tenancy feature, which means allocation of resources, such as email accounts or disk space can be done easily. Linux VPS is easy to install and viable to deploy tools and add-ons as per user’s requirement. Thus, the Linux segment is expected to register higher growth in adoption.

Small and Medium-sized enterprises (SMEs) to show high affinity toward VPS offerings to reduce cost of operations

The virtual private server market has been segmented by organization size into large enterprises and SMEs. Currently, the market share of the large enterprises segment is estimated to be higher; however, the market size of the SMEs is expected to increase at a higher CAGR in the coming years. The growing awareness of the benefits of VPS and the business expansions by global vendors in the SMEs segment are expected to be driving factors for the growth of VPS market.

Asia Pacific (APAC) to account for the largest market size during the forecast period

APAC is expected to offer significant growth opportunities for VPS vendors during the forecast period, as enterprises and SMEs across industry verticals are now adopting VPS services owing to its numerous advantages over traditional and physical servers. Additionally, the emergence of many startups within the virtual private server market across APAC is expected to drive the market here. China, Japan, and India have significant potential for the global VPS vendors, because of the availability of significant proportion of end-user verticals, favorable economic conditions by extending services to these regions, multifold increase in the adoption rate of virtualization environment-based applications, and absence of intense competition for market entrants. The APAC region has always been cautious about investment plans in terms of funding, and hence the enterprises in the region are turning toward the adoption of affordable VPS.

Key Players for Virtual Private Server Market

Major vendors in the global market include AWS (US), United Internet (UK), GoDaddy (US), Endurance International Group (US), OVH (France), DigitalOcean (US), Plesk (Switzerland), Rackspace (US), A2 Hosting (US), Liquid Web (US), Linode (US), Vultr (US), DreamHost (US), InMotion Hosting (US), and TekTonic (US).

Rackspace, a leading managed cloud company, was founded in 1998 and is headquartered in Texas, US. It is a global hosting, cloud, and IT services company. Its product portfolio consists of public and private cloud services, network services, storage services, infrastructure and developer tools, and email hosting services. It offers robust support for VMware, AWS, GCP, Microsoft Azure, and OpenStack Cloud. It caters to customers in more than 120 countries. The company has a strong presence in Europe, North America, Latin America, and APAC.

Rackspace provides managed cloud services, managed hosting services, colocation services, application services, professional services, and security and compliance services. The company offers its products and services to more than 300,000 customers. Additionally, it offers IT transformation, application transformation, and database platform services. It maintains healthy partner relations with potential companies, such as HPE, AWS, and Cloud Technology Partners (CTP). It caters to various verticals, including education, finance, healthcare, government, manufacturing, retail, and business services. Please visit 360Quadrants to see the vendor listing of Virtual Private Servers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

OS, Organization Size, Verticals, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

AWS (US), United Internet (UK), GoDaddy (US), Endurance International Group (US), OVH (France), DigitalOcean (US), Plesk (Switzerland), Rackspace (US), A2 Hosting (US), Liquid Web (US), Linode (US), Vultr (US), DreamHost (US), InMotion Hosting (US), and TekTonic (US) |

The research report categorizes the virtual private server market to forecast the revenues and analyze the trends in each of the following subsegments:

By Operating System (OS)

- Windows

- Linux

By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- IT and Telecommunication

- Manufacturing

- Retail

- Healthcare

- Others (Travel and Hospitality, Media and Entertainment, and Education)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- Asia Pacific (APAC)

- Australia and New Zealand (ANZ)

- India

- China

- Rest of APAC

- Middle East and Africa (MEA)

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming verticals for the virtual private server market?

- Which segment provides the most opportunity for growth?

- Which are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is virtual private server (VPS)?

How does a virtual private server work?

What is a virtual private server used for?

What is the virtual private server market size?

Which are the leading vendors operating in this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.4 Regions Covered

1.5 Years Considered for the Study

1.6 Currency Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.5.1 Limitations of the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Virtual Private Server Market

4.2 Market, Market Share of Top 3 Verticals and Regions, 2018

4.3 Market, By 0perating System, 2018

4.4 Market, By Organization Size, 2018

4.5 Market, By Region, 2018 vs 2023

4.6 Market, By Vertical, 2018 vs 2023

4.7 Market Investment Scenario

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Availability of Cost-Effective VPS

5.2.1.2 VPS Provides Greater Customizations and Scalability

5.2.1.3 Organizations Gain More Control With VPS Than Shared Hosting

5.2.2 Restraints

5.2.2.1 Improper Resource Allocation May Affect VPS Performance

5.2.2.2 Availability of Shared Hosting, Dedicated Hosting, and Cloud Servers

5.2.3 Opportunities

5.2.3.1 Integration of Ai, Machine Learning, and Containers With VPS to Provide Growth Opportunities for VPS Providers

5.2.3.2 Adoption of Cloud-Based Services Among Global Organizations

5.2.4 Challenges

5.2.4.1 Increase in Number of VPS on A Single Server Hampers VPS Performance

5.3 Best Practices for Virtual Private Server Security

5.3.1 Regular Server Audit

5.3.2 Regular Backup and Updation

5.3.3 Protecting Secure Shell Configuration

5.3.4 Blocking Unwanted Traffic

5.4 Virtual Private Server Architecture

6 Virtual Private Server Market, By Operating System (Page No. - 36)

6.1 Introduction

6.2 Windows

6.2.1 Windows-Based Operating System to Gain Popularity Due to Accessibilty Provided to the Users

6.3 Linux

6.3.1 Linux Operating System to Gain Popularity Among Enterprises Due to Its Ease of Use, and Increased Security, Reliability, and Affordablity at the Same Time

7 Market, By Organization Size (Page No. - 40)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.2.1 Small and Medium-Sized Enterprises Showing High Affinity Toward Virtual Private Server Offerings as It Reduces Cost of Operations

7.3 Large Enterprises

7.3.1 Large Enterprises Majorly Investing in Advanced Technologies Like Virtual Private Servers to Increase Their Overall Productivity and Efficiency

8 Market, By Vertical (Page No. - 44)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.2.1 Growing Need for Scalability and Flexibility to Drive the Adoption of Virtual Private Server in the BFSI Vertical

8.3 Government and Defense

8.3.1 Demand for Operational Efficiency to Drive the Adoption of Virtual Private Server in the Government and Defense Sector

8.4 IT and Telecommunication

8.4.1 Increasing Use of Digital Solutions to Drive the Growth of Virtual Private Servers Market in the IT and Telecommunication Vertical

8.5 Manufacturing

8.5.1 Need for Reduced Hardware and Operational Costs to Boost the Adoption of Virtual Private Server in the Manufacturing Vertical

8.6 Retail

8.6.1 Growing Need for Enhanced Storage, Backup, Security, Computing, and Disaster Recovery to Boost the Adoption of Virtual Private Server in the Retail Vertical

8.7 Healthcare

8.7.1 Growing Demand for Improved Collaboration Among Healthcare Solution Providers, Clinicians, and Patients to Drive the Growth of Market in the Healthcare Vertical

8.8 Others

9 Virtual Private Server Market, By Region (Page No. - 53)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 Growing Popularity of Cost-Effective VPS to Fuel the Growth of the VPS Market in the US

9.2.2 Canada

9.2.2.1 Organizations’ Need to Gain Full Control Over Their Servers in A Shared Environment Fueling the Adoption of VPS in Canada

9.3 Europe

9.3.1 United Kingdom

9.3.1.1 Need for Data Protection and Enhanced Performance Capabilities to Drive the Growth of VPS Market in the UK

9.3.2 Germany

9.3.2.1 GDPr Requirements Compelling German Organizations to Shift From Shared Hosting to VPS

9.3.3 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China to Increasingly Use VPS to Manage Frequently Changing System Requirements Effectively

9.4.2 India

9.4.2.1 Increasing Need to Gain More Control Over the Server Driving the Adoption of VPS in India

9.4.3 Australia and New Zealand

9.4.3.1 Organization’s Strategic Shift From Shared Hosting to VPS Driving the Growth of Market in ANZ

9.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Cost-Effectiveness of VPS to Drive the Growth of Virtual Private Server Market in the Middle East

9.5.2 Africa

9.5.2.1 Increased IT Infrastructure Investments in South Africa to Fuel the Growth of Market in the Region

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Growing Need for More Control Over Server to Drive the Growth of Market in Latin America

9.6.2 Mexico

9.6.2.1 Organization’s Strategic Shift From Shared Servers to VPS Fueling the Growth of Market in Mexico

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 70)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Terminology/Nomenclature

10.2.1.1 Visionary Leaders

10.2.1.2 Innovators

10.2.1.3 Dynamic Differentiators

10.2.1.4 Emerging Companies

10.2.2 Strength of Product Portfolio

10.2.3 Business Strategy Excellence

10.3 Competitive Scenario

10.3.1 Business Expansions

10.3.2 New Product Launches/Product Enhancements

10.3.3 Mergers and Acquisitions

11 Company Profiles (Page No. - 77)

11.1 Introduction

11.2 Amazon Web Services

11.2.1 Business Overview

11.2.2 Solutions Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 GoDaddy

11.3.1 Business Overview

11.3.2 Service Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Rackspace

11.4.1 Business Overview

11.4.2 Solutions Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Liquid Web

11.5.1 Business Overview

11.5.2 Solutions Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 Digitalocean

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.7 OVH Group

11.7.1 Business Overview

11.7.2 Solutions Offered

11.7.3 Recent Developments

11.8 DreamHost

11.8.1 Business Overview

11.8.2 Solutions Offered

11.9 Endurance International Group

11.9.1 Business Overview

11.9.2 Products Offered

11.10 United Internet AG

11.10.1 Business Overview

11.10.2 Products Offered

11.11 A2 Hosting

11.11.1 Business Overview

11.11.2 Solutions Offered

11.11.3 Recent Developments

11.12 Inmotion Hosting

11.13 Plesk International

11.14 Tektonic

11.15 Vultr Holdings Corporation

11.16 Linode

12 Appendix (Page No. - 94)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (40 Tables)

Table 1 Virtual Private Server Market Size and Growth, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Market Size, By Operating System, 2016–2023 (USD Million )

Table 3 Windows: Market Size, By Region, 2016–2023 (USD Million )

Table 4 Linux: Market Size, By Region, 2016–2023 (USD Million )

Table 5 Market Size, By Organization Size, 2016–2023 (USD Million )

Table 6 Small and Medium-Sized Enterprises: Market Size, By Region, 2016–2023 (USD Million )

Table 7 Large Enterprises: Market Size, By Region, 2016–2023 (USD Million )

Table 8 Market Size, By Vertical, 2016–2023 (USD Million )

Table 9 Banking, Financial Services, and Insurance: Virtual Private Server Market Size, By Region, 2016–2023 (USD Million )

Table 10 Government and Defense: Market Size, By Region, 2016–2023 (USD Million )

Table 11 IT and Telecommunication: Market Size, By Region, 2016–2023 (USD Million )

Table 12 Manufacturing: Market Size, By Region, 2016–2023 (USD Million )

Table 13 Retail: Market Size, By Region, 2016–2023 (USD Million)

Table 14 Healthcare: Market Size, By Region, 2016–2023 (USD Million )

Table 15 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 16 Market Size, By Region, 2016–2023 (USD Million)

Table 17 North America: Virtual Private Server Market Size, By Operating System, 2016–2023 (USD Million)

Table 18 North America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 19 North America: Market Size, By Vertical, 2016–2023 (USD Million)

Table 20 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 21 Europe: Market Size, By Operating System, 2016–2023 (USD Million)

Table 22 Europe: Virtual Private Server Market Size, By Organization Size, 2016–2023 (USD Million)

Table 23 Europe: Market Size, By Vertical, 2016–2023 (USD Million)

Table 24 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 25 Asia Pacific: Market Size, By Operating System, 2016–2023 (USD Million)

Table 26 Asia Pacific: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 27 Asia Pacific: Market Size, By Vertical, 2016–2023 (USD Million)

Table 28 Asia Pacific: Virtual Private Server Market Size, By Country, 2016–2023 (USD Million)

Table 29 Middle East and Africa: Market Size, By Operating System, 2016–2023 (USD Million)

Table 30 Middle East and Africa: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 31 Middle East and Africa: Market Size, By Vertical, 2016–2023 (USD Million)

Table 32 Middle East and Africa: Market Size, By Subregion, 2016–2023 (USD Million)

Table 33 Latin America: Market Size, By Operating System, 2016–2023 (USD Million)

Table 34 Latin America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 35 Latin America: Virtual Private Server Market Size, By Vertical, 2016–2023 (USD Million)

Table 36 Latin America: Market Size, By Country, 2016–2023 (USD Million)

Table 37 Market Share Analysis/Ranking of Key Players, 2018

Table 38 Business Expansions, 2017–2018

Table 39 New Product Launches/Product Enhancements, 2016–2018

Table 40 Mergers and Acquisitions, 2016–2018

List of Figures (31 Figures)

Figure 1 Virtual Private Server Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Factor Analysis

Figure 4 Witness Significant Growth in the Global Market During the Forecast Period

Figure 5 North America to Hold the Highest Market Share in 2018

Figure 6 Fastest-Growing Segments of the Virtual Private Server Market

Figure 7 Cost-Effectiveness and Scalability to Drive the Demand for Virtual Private Server

Figure 8 IT and Telecommunication Vertical, and North America to Have the Highest Market Shares in 2018

Figure 9 Linux Operating System to Have A Higher Market Share in 2018

Figure 10 Large Enterprises Segment to Hold A Higher Market Share in 2018

Figure 11 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 12 Retail Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 13 Asia Pacific to Emerge as the Best Market for Investment in the Next 5 Years

Figure 14 Drivers, Restraints, Opportunities, and Challenges: Virtual Private Server Market

Figure 15 Virtual Private Server Architecture

Figure 16 Linux Operating System Segment to Grow at A Higher Rate During the Forecast Period

Figure 17 Small and Medium-Sized Enterprises Segment to Grow at A Higher Rate During the Forecast Period

Figure 18 Retail Vertical to Grow at the Highest Rate During the Forecast Period

Figure 19 Asia Pacific to Grow at the Highest Rate During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Virtual Private Server Market Competitive Leadership Mapping, 2018

Figure 23 Analysis of Product Portfolio for Major Players in the Market

Figure 24 Business Strategies Adopted By Major Players in the Market

Figure 25 Key Developments By the Leading Players in the Market for 2016–2018

Figure 26 Amazon Web Services: Company Snapshot

Figure 27 SWOT Analysis: Amazon Web Services

Figure 28 GoDaddy: Company Snapshot

Figure 29 SWOT Analysis: GoDaddy

Figure 30 SWOT Analysis: Rackspace

Figure 31 SWOT Analysis: Liquid Web

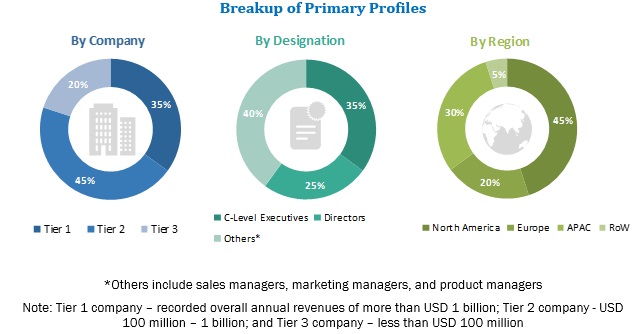

The study involved 4 major activities to estimate the current market size of the virtual private server market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. Secondary sources considered for the study included Factiva and D&B Hoovers. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing VPS. The primary sources from the demand side included the end users of VPS, including Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the virtual private server market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the virtual private server market.

Report Objectives

- To define, describe, and forecast the VPS market by Operating System (OS), organization size, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the growth of market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders by identifying the high-growth segments of the market

- To forecast the market size of the segments with respect to 5 main regions, namely North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players in the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments, such as new product launches; business expansions; mergers and acquisitions; and partnerships, agreements, and collaborations, in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Growth opportunities and latent adjacency in Virtual Private Server Market

Good analysis with segment-specific dynamics and factors for all exhibits

Report has lot of cross-tables with easy to consume data charts

Well written with rich insights and segmentation