White Box Server Market by Form Factor (Rack & Tower, Blade, Density-Optimized), Business Type (Data Centers, Enterprise Customers), Processor (X86, non-X86), Operating System (Linux, Windows, UNIX), and Geography - Global Forecast to 2022

The white box server market was valued at USD 4.59 billion in 2015 and is expected to reach USD 14.43 billion by 2022, growing at a CAGR of 18.6% between 2016 and 2022. A white box server is a data center computer which is not manufactured by a well-known vendor. It can be found in large data centers run by giant Internet companies such as Google (U.S.) and Facebook Inc. (U.S.). White box servers are usually purchased in bulk quantities from original design manufacturers (ODMs). ODMs generally build their servers with commercial off-the-shelf (COTS) components that can be assembled in different ways or upgraded to provide the customer with a degree of system customization. The base year considered for study is 2015, and the forecast period is between 2016 and 2022.

Market Dynamics

Drivers

- Low cost and high degree of customization driving the white box server market

- Increasing adoption of white box servers among end users

- Growing number of data centers

- Rising adoption of Open Platforms such as Open Compute Project, Project Scorpio, and so on

Restraints

- ODMs' limited service and support capabilities and lack of channel partner skills affect the enterprise business

Opportunities

- Increase in demand for microservers from data centers

- Growing support for ARM processors in white box server market

Challenges

- OEMs entering into the custom server market

Low cost and high degree of customization drives the white box server market

White box servers cost less than the branded servers due to their usage of generally available components and absence of premium branding. The lower cost aids organizations use white box server systems to leverage equal or more computing power at a lower price than branded systems. Large-scale data centers, which are operated by large cloud service providers, benefit enormously from lower cost white box servers since they can purchase servers in bulks quantities. Servers from ODMs are being favored by hyperscale data center customers since they provide high degree of customization, along with the benefit of low cost. As white box servers are often assembled when ordered, each server can be put together from a large range of components from which a customer selects. A white box server offers a great amount of flexibility for configuration to meet the requirements of applications assembled to run the system. In contrast, big-name branded servers are available with only fixed or limited configurations

The following are the major objectives of the study.

- To define, describe, and forecast the global white box server market segmented on the basis of processor, business type, form factor, operating system, and geography

- To describe components of the white box server

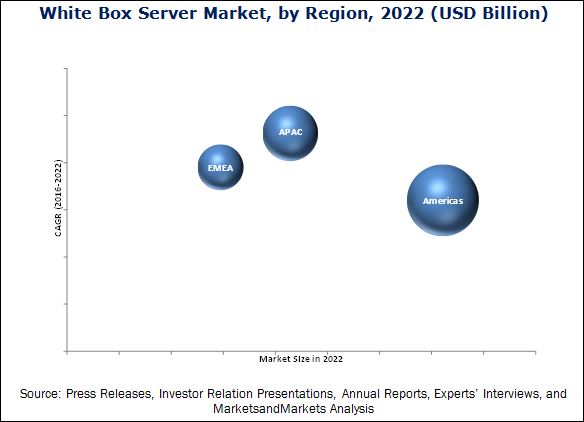

- To forecast the market size, in terms of value, for various segments with regard to main regions, namely, the Americas, Europe, the Middle East and Africa (EMEA), and Asia-Pacific (APAC)

- To provide detailed information regarding the major factors influencing the growth of the white box server market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide an overview of the value chain in the white box server market and analyze market trends with the Porter’s five forces

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product launches & developments, and R&D in the white box server market

This report provides a detailed analysis of the white box server market based on form factor, business type, processor, operating system, and geography. Report forecasts the market size, in terms of value, and main regions: the Americas, Europe, the Middle East & Africa (EMEA), and Asia-Pacific (APAC). It strategically profiles the key players and comprehensively analyzes their market rankings and core competencies, along with the detailed competitive landscape for the market leaders.

The white box server market is expected to reach USD 14.43 billion by 2022, at a CAGR of 18.6% between 2016 and 2022. The growth of this market is propelled by the factors such as low cost and high degree of customization, growing number of data centers, increasing adoption of white box servers among end users, growing number of data centers, rising adoption of open platforms such as Open Compute Project, Project Scorpio, and so on. Increase in the demand for micro servers from data centers, and growing support for ARM processors in the white box server market are some of the factors that would provide huge growth opportunities for the white box server market in the coming years.

White box servers are the servers which are directly sold by ODMs or EMS providers rather than OEMs. White box servers are usually purchased in bulk quantities from suppliers called as original design manufacturers (ODMs). ODMs usually build their servers with commercial off-the-shelf (COTS) components that can be assembled in slightly different ways or upgraded to deliver the customer with a degree of system customization.

White box server market has been segmented, on the basis of business type into data centers and enetrprise customers. Data center is expected to dominate the white box server market druing the forecast period. Hyperscale data center operators such as Google Inc. (U.S.), Microsoft Corp. (U.S.), Amazon Web Services, Inc. (U.S.), and Facebook Inc. (U.S.) prefer to build servers directly from ODMs rather than OEMs due to low-cost of manufacturing with the same quality provided by OEMs and a high degree of customization, which is fuelling the growth of the white box server market. Projects such as OCP, Project Scorpio, and OpenPOWER Foundation are motivating the giant players to build their own servers. Major clients for ODMs include Facebook Inc. (U.S.), Microsoft Corp. (U.S.), Rackspace Inc. (U.S.), Google Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Alibaba Group Holding Ltd. (China), Baidu Inc. (China), Tecent Holdings Ltd. (China).

Different types of servers based on form factors include tower servers, rack servers, blade servers, and density-optimized servers.

Tower Servers:

Tower servers look most likely PCs. Each tower server is a standalone machine that is built into an upright case. In this type of tower servers, the data is stored in a single tower rather than being spread across various machines. It is relatively compact. One advantage of the tower server includes easier cooling because the overall component density is fairly low. Tower servers are used mostly in smaller data centers. Its simplicity and robustness also mean that the tower server is considered to be an ideal for small companies. It does not require robust maintenance.

Rack Server:

Rack servers are servers that are mounted in a rack. The rack is of a uniform width and servers are mounted to the rack using screws. Each rack can accommodate multiple servers, and the servers are typically stacked on top of each other which makes cooling more difficult, while scaling is much easier. A rack server is designed to be positioned in a bay, which assists one to stack various devices on top of each other in a large tower. The bay would accommodate all of the hardware devices the company needs to function, including the server, storage devices, and security and network appliances.

Blade Servers:

A blade server is basically a stripped-down version of a standard rack-mounted server unit that contains just the bare essentials: a CPU, RAM, integrated I/O ports, and network adapters. Other components, such as power converters, cooling equipment, and storage are provided by the blade server chassis, which itself fits into a standard rack enclosure. This makes blade servers even thinner and also more expensive.

Density Optimized Servers

Modular and dense server form factors were originally introduced to address the data center floor space and power/cooling costs of hyperscale data centers. Density-optimized servers are addressing an increasing number of web and HPC workloads for customers that require a balance of OPEX (power, space) with overall system throughput.

Density-optimized servers are designed for large-scale data center environments with streamlined systems designs that focus on performance, energy efficiency, and density. These systems are typically deployed in fully assembled rack configurations. Its examples include e-commerce, cloud computing, online game hosting, social networking sites, dedicated hosting, Hadoop, and (high-performance computing (HPC). High-density are the servers favoured by cloud service providers and other hyperscale data center server buyers

Rack & tower servers are expected to grow at the fastest rate during the forecast period due to the increasing adoption of rack servers in both data centers and enterprise customers while tower servers in enterprise customers. The market for non-X86 servers expected to grow at the fastest rate during forecast period due to more power-efficient feature; ARM processors are being preferred by data center operators and an ARM server is getting much support in the server market. The market for Linux servers expected to grow at a significant rate in coming years. More stability, scalability, cost efficiency offer greater adoption of Linux servers among end users.

APAC is expected to be the fastest-growing market for the white box servers during the forecast period due to the increasing presence of cloud service providers in APAC. There are number of reasons behind the growth of Asia-Pacific data center industry such as increasing number of internet users, increasing need for an infrastructure refresh in older data centers, growing role of data sovereignty as data privacy laws mature in Southeast Asia. Hong Kong and Singapore, being strategic locations for the white box server market, presence of giant players such as Alibaba Group Holding Ltd. (China), Tecent Holdings Ltd. (China), Baidu Inc. (China) which play an important role in the white box server market. Also, players such as Facebook Inc. (U.S), Microsoft Corp. (U.S.), Amazon Web Services Inc. (U.S.), and Google Inc. (U.S.), among many others are increasing their presence in the APAC market. Moreover, many cloud service providers inclined toward the adoption of white box servers over branded servers. Large enterprises in APAC also expected to adopt white box servers in the coming years.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the growth opportunities in white box server market?

ODMs' limited service and support capabilities and lack of channel partner engagement affect enterprise business restraining the growth of the market. Currently, ODMs have maximum contribution to the hyperscale data center segment which constitutes giant data center operators such as Google Inc. (U.S.), Facebook Inc. (U.S.), Microsoft Corp. (U.S.) Amazon Web Services, Inc. (U.S.), Baidu Inc., (China), Alibaba Group Holding Ltd. (China), and Tencent Holdings Ltd. (China) among others. ODMs still don’t have any hold on to enterprise customers; this is mainly due limited service and support capabilities of ODMs. OEMs offer better maintenance or after-sales services than ODMs. Top server vendors (OEMs), such as Hewlett-Packard Co. (U.S.) and IBM Corp. (U.S.), have built their businesses around making advanced support technicians available all time.

The major players in the white box server market include Quanta Computer Inc. (Taiwan), Wistron Corporation (Taiwan), Inventec Corporation (Taiwan), Hon Hai Precision Industry Company Ltd. (Taiwan), MiTAC Holdings Corp. (Taiwan), Celestica Inc. (Canada), Compal Electronics (Taiwan), Hyve Solutions (U.S.), Penguin Computing (U.S.), Servers Direct (U.S.), Stack Velocity Group (U.S.), Super Micro Computer Inc. (U.S.), Silicon Mechanics (U.S.), ZT Systems (U.S.), and so on.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

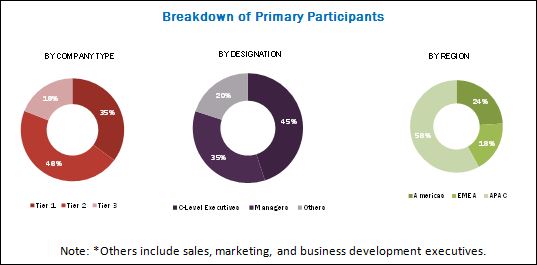

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Report Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 White Box Server Market to Grow at A High Rate During the Forecast Period (2016–2022)

4.2 White Box Server Market, By Business Type

4.3 White Box Server Market, By Region and By Form Factor

4.4 White Box Server Market: Geographical Snapshot (2015)

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 White Box Server Market, By Form Factor

5.2.2 White Box Server Market, By Business Type

5.2.3 White Box Server Market, By Processor

5.2.4 White Box Server Market, By Operating System

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Low Cost and High Degree of Customization Drive the White Box Server Market

5.3.1.2 Increasing Adoption of White Box Servers Among End Users

5.3.1.3 Growing Number of Data Centers

5.3.1.4 Rising Adoption of Open Platforms Such as Open Compute Project, Project Scorpio, and So On

5.3.2 Restraints

5.3.2.1 Odms' Limited Service and Support Capabilities and Lack of Channel Partner Skills Affect Enterprise Business

5.3.3 Opportunities

5.3.3.1 Increase in Demand for Microservers From Data Centers

5.3.3.2 Growing Support for Arm Processors in the White Box Server Market

5.3.4 Challenges

5.3.4.1 Oems Entering Into the Custom Server Market to Fight Against Odms

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of Substitutes

6.3.4 Threat of New Entrants

6.3.5 Intensity of Competitive Rivalry

6.4 Industrial Developments

6.4.1 Quanta Inc. Designed Server in Conjunction With Facebook as A Part of Open Compute Project in 2011

6.4.2 Amazon Followed Google and Chose Quanta and Foxconn to Build Its Servers in Tandem

6.4.3 Hyve Solutions Built Servers for Facebook

6.4.4 Wistron and Quanta Built Servers for Rackspace Inc. in 2013

6.4.5 Cloudflare Chose Quanta Computer Inc. to Build Its Servers in 2013

6.4.6 Lenovo Acquired Ibm’s Intel-Based Server Business Strengthening Its Position in the Server Market

6.4.7 Hewlett-Packard (U.S.) and Foxconn Technology Group (Taiwan) Entered Into Jv Agreement to Build Low-Cost Server

6.4.8 Nautanix Entered Into Strategic Partnership With Dell Inc.

6.4.9 Foxconn and 21vianet Entered Into A Joint Venture Agreement With Smart Time Technologies

6.4.10 Hyve Solutions, Quanta, Wiwynn, ZT Systems Supporting for Microsoft's Open Cloud Server Specification Version 2

6.4.11 Quanta and Wiwynn Setting Up Factories in Germany and Mexico

6.4.12 Quanta Cloud Technology Expands Its Presence in the APAC Market

6.4.13 Taiwan Server Players Such as Inventec, Mitac International and Aic Expanding Presence in China

6.4.14 Alibaba Expanding Its Presence in India and Japan, Parts of the Middle East, and Europe

6.4.15 Dell Expanding Presence in Hyperscale Data Center Market By Introducing New Line of Business

6.4.16 Dell Serving Its Custom Servers for Second Tier Hyperscale Customers

6.4.17 Cisco Systems Inc. (U.S.) Selects Wistron Corp. (Taiwan) to Provide Servers

6.4.18 Quanta Receives Orders From Uber While Wiwynn From Twitter for Data Centers

6.4.19 Nokia Introduced Open Compute Project (OCP)-Based Servers, Software, and Services for Hyperscale Deployments

6.4.20 Lenovo Enhances Partnership With Inventec to Compete for Server Orders From Baidu, Alibaba, Tencent

6.4.21 Goldman Sachs Shifted to the Open Compute Platform

6.4.22 Google Inc. Contributing to OCP

6.4.23 Apple Started Building Its Own Servers

6.4.24 Google and Rackspace Shifting to Non-X86 Processor for Its Server Design

6.4.25 Tech Data Europe Partnered With Quanta Cloud Technology

6.4.26 Red Hat, Inc. Partnered With Quanta Computer Technology for Private Cloud Solutions and Reference Architecture

6.4.27 Lenovo in Collaboration With Odm Compal to Produce Servers

6.4.28 Quanta and Wiwynn Competing for the Orders for Servers Small- and Medium-Size Data Centers

6.4.29 Facebook’s New Data Center in Europe is Under Construction Providing Opportunities for Odms

6.4.30 Inventec Corp. Won Server Orders From the Alibaba Group in 2016

6.4.31 Micros0ft and Amazon Web Services to Open Data Centers in the U.K.

6.4.32 Lenovo to Supply Servers to Microsoft Data Centers

7 Market, By Form Factor (Page No. - 60)

7.1 Introduction

7.2 Tower Server

7.3 Rack Server

7.4 Blade Server

7.5 Density-Optimized Server

8 Market, By Business Type (Page No. - 66)

8.1 Introduction

8.2 Data Centers

8.3 Enterprise Customers

9 Market, By Processor Type (Page No. - 70)

9.1 Introduction

9.2 X86 Server

9.3 Non-X86 Server

9.4 Recent Developments in the Non-X86 Server Market

9.4.1 Wistron Corp. Selected Applied Micro’s Appliedmicro X-Gene for New X5 Server Series’ OCP-Compliant Chassis Design

9.4.2 Hyve Solutions Entered Into Strategic Partnership With Cavium Inc. (U.S.) to Bring Arm-Based Solutions in the Market

9.4.3 Hp is A Major Player Offering Arm-Based Servers

9.4.4 Dell Inc. Introduced 64-Bit Arm Server A Proof of Concept

9.4.5 Lenovo Joined Hp and Dell for Developing an Arm Server

9.4.6 Cavium and Marvell Introduced New Arm Chips for Servers and Appliances at Computex

9.4.7 Qualcomm’s Entering Into the Data Center Market With Its Arm Chips

9.4.8 Google to Choose Qualcom as It’s Chip Supplier for Its Data Center

9.4.9 Google and Rackspace Designing Servers Based on Power9 Processor

9.4.10 Morgan Stanley Tested A Server With Arm Processors From Appliedmicro in It’s Data Centers

9.4.11 Paypal Deployed Applied Micro’s Arm Servers in It’s Data Center

9.4.12 Applied Micro and Hp Teamed to Introduce Armv8 Server

10 Market, By Operating System (Page No. - 77)

10.1 Introduction

10.2 Linux Operating System

10.2.1 Aspects of Linux

10.2.1.1 Stability

10.2.1.2 Security

10.2.1.3 Cost

10.2.1.4 Hardware and Scalability

10.2.1.5 Liberty

10.3 Other Operating Systems (Windows, Unix)

10.3.1 Windows Operating System

10.3.1.1 Aspects of Windows

10.3.1.1.1 Stability

10.3.1.1.2 Support

10.3.1.1.3 Cost

10.3.1.1.4 Vendor Support

10.3.2 Unix Operating System

11 Components of A White Box Server (Page No. - 82)

11.1 Introduction

11.2 Motherboard

11.3 Processor

11.4 Memory (Ram)

11.5 Hard Drive

11.6 Server Case/Chassis

11.7 Network Adapter

11.8 Power Supply Device

12 Geographical Analysis (Page No. - 86)

12.1 Introduction

12.2 Americas

12.2.1 Americas Largest Shareholder of the White Box Server Market

12.2.2 Presence of Giant End-Users in the White Box Server Market Such as Facebook, Amazon, Google, and Microsoft

12.2.3 Canada is an Appealing Data Center Location

12.2.4 Chinese Internet Giant Alibaba Launched Second Cloud Data Center in the U.S.

12.2.5 Google Inc. Building Its 15th Data Center Located in Clarksville, Tennessee

12.3 Emea (Europe, the Middle East, Africa)

12.3.1 Germany—An Attractive Destination in Europe for Building Data Centers

12.3.2 Facebook Building Its Second Data Center in Ireland, Europe

12.3.3 Netherlands—One of the Best Destinations to Build Data Centers

12.3.4 Impact of Brexit on European and Britain Data Center Industry

12.3.5 Amazon Still Firm on Its Plan to Open Data Centers in the U.K.Despite Brexit

12.3.6 Apple Inc. Spending USD 1.9 Billion on New European Data Centers

12.3.7 Role of the Middle East and Africa in the Data Center Industry

12.4 Asia-Pacific

12.4.1 Asia-Pacific Fastest-Growing Region for the Data Center Market

12.4.2 Hong Kong Plays A Vital Role in the APAC Market

12.4.3 Singapore Emerging as A Destination for Cloud Service Providers to Build Data Centers

12.4.4 Alibaba Expands Its Data Center Operation in Singapore

12.4.5 China Mobile, A Chinese Telecom Player, is Working With Baidu to Build A Data Center in Beijing for Mobile Internet Users

12.4.6 Tecent Holdings Investing USD 1.57 Billion in Cloud Computing Over Five Years

12.4.7 Amazon Launched First Indian Aws Data Center in Mumbai

12.4.8 Facebook Planning to Build Its First Asia-Pacific Data Center in Taiwan

12.4.9 Microsoft Plans to Build Cloud Data Center in South Korea

13 Competitive Landscape (Page No. - 96)

13.1 Key Player Ranking Analysis for the Server and Whitebox Server Market

13.2 New Product Launches

13.3 Agreements/Contracts/Collaborations/Partnerships

14 Company Profiles (Page No. - 100)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Introduction

14.2 Quanta Computer Inc.

14.3 Wistron Corporation

14.4 Inventec Corporation

14.5 Hon Hai Precision Industry Company, Ltd.

14.6 Mitac Holdings Corp.

14.7 Celestica Inc.

14.8 Compal Electronics

14.9 Hyve Solutions

14.10 Penguin Computing Inc.

14.11 Servers Direct

14.12 Silicon Graphics International Corp. (SGI)

14.13 Silicon Mechanics

14.14 Stackvelocity Group

14.15 Super Micro Computer Inc.

14.16 ZT Systems

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 141)

15.1 Insights From Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customization

15.6 Related Reports

List of Tables (12 Tables)

Table 1 White Box Server Market, By Form Factor

Table 2 White Box Server Market, By Business Type

Table 3 White Box Server Market, By Processor

Table 4 White Box Server Market, By Operating System

Table 5 White Box Server Market, By Form Factor, 2014–2022 (USD Billion)

Table 6 White Box Servers Market, By Business Type, 2014–2022 (USD Billion)

Table 7 White Box Server Market, By Processor, 2014–2022 (USD Billion)

Table 8 White Box Server Market, By Operating System, 2014–2022 (USD Billion)

Table 9 White Box Server Market, By Region, 2014–2022 (USD Billion)

Table 10 Key Player Ranking for the White Box Server Market

Table 11 New Product Launches, 2015–2016

Table 12 Agreements/Joint Ventures/Partnerships, 2014–2016

List of Figures (46 Figures)

Figure 1 White Box Server Market Segmentation

Figure 2 Global White Box Server Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Density-Optimized Servers Expected to Play A Vital Role in the White Box Server Market Between 2016 and 2022

Figure 7 White Box Server Market, By Business Type (2015 vs 2022)

Figure 8 Market for Non-X86 Servers Expected to Grow at A Higher Rate Than the Market for X86 Servers Between 2016 and 2022

Figure 9 White Box Server Market, By Geography, 2015

Figure 10 Growth Opportunities for the White Box Server Market Between 2016 and 2022

Figure 11 Data Centers Expected to Play A Vital Role in White Box Server Market During Forecast Period

Figure 12 Rack & Tower Servers Held the Major Share of the White Box Server Market in 2015

Figure 13 Americas Held the Largest Share of the Global White Box Server Market in 2015

Figure 14 Low Cost and High of Customization Driving White Box Server Market

Figure 15 Value Chain Analysis of the White Box Server Market: Major Value is Added By Component Manufacturers and Product Manufacturers

Figure 16 Porter’s Five Forces Analysis: White Box Server Market (2015)

Figure 17 Porter’s Five Forces Analysis: White Box Server Market

Figure 18 White Box Server Market: Bargaining Power of Suppliers

Figure 19 White Box Server Market: Bargaining Power of Buyers

Figure 20 White Box Server Market: Threat of Substitutes

Figure 21 White Box Server Market: Threat of New Entrants

Figure 22 White Box Server Market: Intensity of Competitive Rivalry

Figure 23 Overview of Different Types of Servers Based on Form Factors

Figure 24 Density-Optimized Sevrer Gaining Traction in the Hyperscale Data Center Segment

Figure 25 Traditional and New Business Models for the Server Market

Figure 26 Players Offring X86 and Non-86 Server Chips

Figure 27 Market for Non-X86 Servers Expected to Grow at the Highest Rate During the Forecast Period

Figure 28 Linux Expected to Lead the White Box Server Market During the Forecast Period

Figure 29 Components of A Server

Figure 30 White Box Server Market in APAC Expected to Grow at the Highest Rate During the Forecasted Period

Figure 31 New Product Launches Was the Key Growth Strategy Over the Last Three Years (2013–2016)

Figure 32 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 33 Quanta Computer Inc.: Company Snapshot

Figure 34 SWOT Analysis: Quanta Computer Inc.

Figure 35 Wistron Corp.: Company Snapshot

Figure 36 SWOT Analysis: Wistron Corp.

Figure 37 Inventec Corporation: Company Snapshot

Figure 38 SWOT Analysis: Inventec Corp.

Figure 39 Hon Hai Precision Industry Co., Ltd.: Company Snapshot

Figure 40 SWOT Analysis: Hon Hai Precision Industry Company Ltd.

Figure 41 Mitac Holdings Corp.: Company Snapshot

Figure 42 SWOT Analysis: Mitac Holdings Corp.

Figure 43 Celestica, Inc.: Company Snapshot

Figure 44 Compal Electronics: Company Snapshot

Figure 45 Silicon Graphics International Corp. : Company Snapshot

Figure 46 Super Micro Computer Inc.: Company Snapshot

The research methodology used to estimate and forecast the white box server market begins with capturing data on key vendor revenue through secondary research sources such as secondary literature, MTG Blog, factiva, and so on. The vendor offerings are also taken into consideration to determine the market segmentation. Top down and bottom-up procedures have been employed to arrive at the overall size of the global white box server market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments which have been verified through the primary research by conducting extensive interviews of people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The white box server ecosystem comprises material and component providers, ODMs, end users such as data centers and enterprise customers. The players involved in the white box server market include Quanta Computer Inc. (Taiwan), Wistron Corporation (Taiwan), Inventec Corporation (Taiwan), Hon Hai Precision Industry Company Ltd. (Taiwan), MiTAC Holdings Corp. (Taiwan), Celestica Inc. (Canada), Compal Electronics (Taiwan), Hyve Solutions (U.S.), Penguin Computing (U.S.), Servers Direct (U.S.), Stack Velocity Group (U.S.), Super Micro Computer Inc. (U.S.), Silicon Mechanics (U.S.), and ZT Systems (U.S.).

Major Market Developments

- In April 2016, Google Inc. (U.S.) and Rackspace Inc. (U.S.) designed a server based on IBM Corp.’s (U.S.) upcoming Power9 processor.

- In July 2016, Lenovo Group Ltd. (U.S.) established a joint venture agreement with LCFC (Hefei) Electronics Technology, Compal Electronics (Taiwan) is expected to start production for servers

- Microsoft Corporation (Azure) (U.S.) planned to build two data centers in the U.K. in 2016. Amazon Web Services, Inc. (U.S.) also planned to build data center in London

- In March 2016, Google Inc. (U.S.) contributed designs for its high-voltage server racks to the non-profit Open Compute Project Foundation, an effort to share designs for data-enter equipment that has changed the balance of power in the computer-hardware industry

Target Audience of the Report:

- Associations, organizations, forums, and alliances

- Raw material vendors

- Component providers

- Original design manufacturers

- Original equipment manufacturers

- Cloud service providers

- Operating system providers

- Processor manufacturers

- Research organizations

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the global white box server market on the basis of form factor, business type, processor, operating system, and geography.

White Box Server Market, by Form Factor:

- Rack & tower servers

- Blade servers

- Density-optimized servers

White Box Server Market, by Business Type:

- Data centers

- Enterprise customers

White Box Server Market, by Processor:

- X86 servers

- Non-X86 servers

White Box Server Market, by Operating System:

- Linux

- Others (Windows, UNIX)

White Box Server Market, by Geography:

- Americas

- Europe, Middle East, and Africa (EMEA)

- Asia-Pacific (APAC)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in White Box Server Market

I would like to learn more about white box server; the market size, solutions provided by the players in the market and current news about this technology.

Hi, Would you have the similar analysis after 2020. thanks!

I would like to obtain an in depth understanding and knowledge about the white box server market, with emphasis on the APAC market.

Hi...Wondering if I could buy a specific report instead of a general license. I'm specifically interested in the White box Server report as well as the Aftermarket report. What would the price be for each report?

We would like to get details on white box server market penetration in North America, Europe, and Asia-Pacific and relative rankings amongst top white box server providers in the respective regions.

We want to see the Market for ODMs more clearly. Are the white box servers sold to the customer directly or are there any third party vendors involved? Any information on various types of server along with its form factor would be added advantage. P.S. If we make a long-term contract, can you update periodically? (Monthly / Quarterly).