Wearable Injectors Market by Type(On-body, Off-body), Technology (Spring, Motor Drive, Expanding Battery, Rotary Pump), Indications (Diabetes, Immuno- Oncology, Cardiovascular, Chronic Pain), End Users (Hospital & Clinic, Homecare) & Region - Global Forecast to 2029

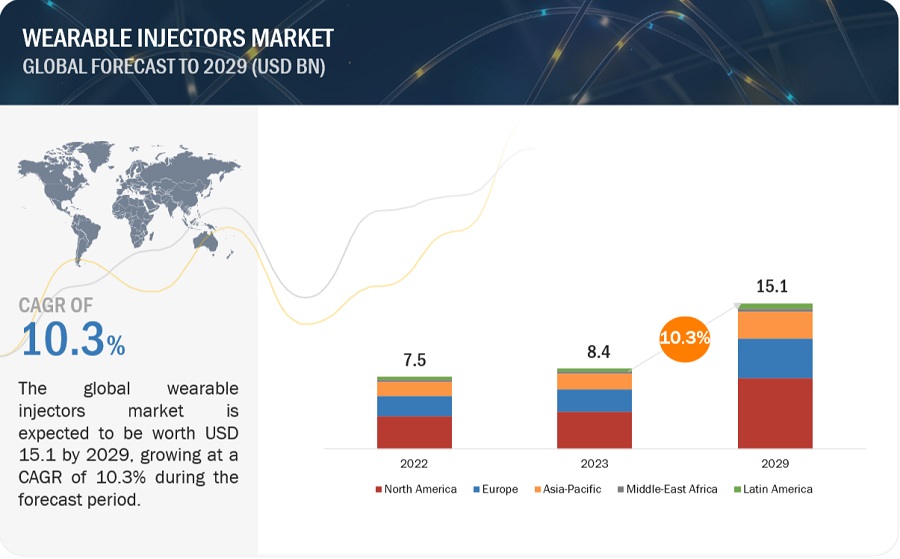

The global wearable injectors market in terms of revenue was estimated to be worth $8.4 Billion in 2023 and is poised to reach $15.1 Billion by 2029, growing at a CAGR of 10.3% from 2023 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market is largely driven by the a number of variables, including the rise in elderly population, the prevalence of chronic diseases, technological developments, and growing concern over needle stick injuries, are blamed for the growth. The market was dominated by North America, but there were also significant development prospects in Europe. Becton, Dickinson and Company, Johnson & Johnson Services, Inc., and Amgen, Inc. are some of the major companies in the market. With multiple large companies and a moderate level of competition, technological improvements are driving the industry. Chronic disorders like diabetes, autoimmune diseases, and pain management are a constant pulse in the landscape. The multitude of unfulfilled requirements provides an ideal environment for creative thinking, and wearable injectors, with their accurate dosing and intuitive features, ideally balance the need for convenience and adherence.

Attractive Opportunities in Wearable injectors market

To know about the assumptions considered for the study, Request for Free Sample Report

Wearable Injectors Market Dynamics

Driver: High prevalence of diabetes

With an estimated 463 million people worldwide expected to be diagnosed with diabetes in 2019, there is an increasing need for creative approaches to medicine administration. With their accurate dosage and intuitive functions, wearable injectors present a strong alternative to conventional syringes, streamlining the administration of insulin and improving adherence. The game-changing potential of wearable injectors, which give patients more ease and autonomy in managing their diabetes—a tune that resonates strongly with those who want autonomy and control. Conventional injections may cause discomfort and anxiety. With its pleasant hum in place of a harsh sting, wearable injectors reduce discomfort and free patients to concentrate on their health rather than the technical aspects of their therapy. Wearable injectors can be used as self-monitoring tools in addition to medicine dispensers, capturing and transferring data with ease. Thus, it is expected to boost the market.

Restraint: Oral insulin as alternative method of drug delivery

A more harmonious coexistence is promised by oral insulin, which makes treatment inconspicuous and easy to take. In the management of diabetes, missing dosages can cause severe discord. Because it may be easier to take, oral insulin has the potential to increase treatment effectiveness and improve long-term health outcomes. Pain at the injection site and needle anxiety are common discordant notes for patients. Oral insulin may provide a softer, more enjoyable tune, enhancing both the therapeutic experience and general health. Researchers are developing new strategies to shield insulin from the severe conditions of the digestive tract so that it can enter the bloodstream and be absorbed efficiently. In this technological opera, enteric coatings, nanoparticles, and microspheres are the main characters. The goal of research is to make the gut lining more permeable so that insulin can enter the bloodstream more readily.

Opportunity: Increased adoption of on body wearable injectors

Novel approaches are encouraged by the wide range of chronic conditions, such as diabetes, autoimmune diseases, and pain management. With their longer wear periods and intuitive features, on-body injectors strike the ideal balance between the patient's desire for more control over their health and the convenience and consistency of drug delivery. The emphasis on patient autonomy and self-management in healthcare is growing. This trend is nicely complemented by on-body injectors, which give patients more comfort and autonomy over their therapy. Patients looking for discreet and practical drug delivery options are driving market demand as a result of this shift in focus. The early emphasis on insulin delivery in the therapy of diabetes is quickly giving way to a more diverse range of uses. Recent research is looking on using on-body injectors to deliver painkillers, antibiotics, and vaccines.

Challenge: Needlestick injuries

Needle stick injuries (NSIs) have the potential to provide a serious obstacle to the market expansion for wearable injectors. Healthcare personnel are at significant risk of contracting bloodborne infections such as HIV, hepatitis B, and hepatitis C from these unintentional needle pricks or punctures caused by tainted needles. Hospitals and physicians are forced to bear the financial burden of costly post-exposure prophylaxis (PEP) treatments, medical monitoring, and potential lawsuits as a result of NSIs. The emotional weight of worry, dread, and possible stigmatization that NSIs place on healthcare personnel can have an adverse effect on their well-being and level of job satisfaction. Wearable injectors may come under fire due to unfavorable media coverage or high-profile NSI incidents, which could raise questions about their safety and discourage patients and healthcare professionals from using them.

Wearable Injectors Industry Ecosystem

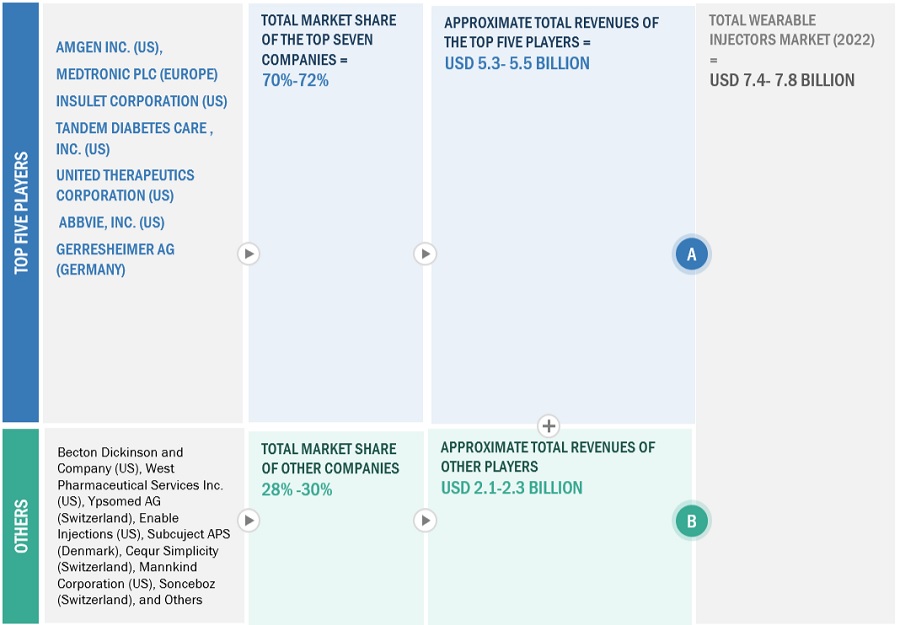

Leading players in this market include well-established and financially stable service providers of wearable injectors. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Amgen Inc. (US), Medtronic PLC (Europe), Insulet Corporation (US), Tandem Diabetes Care, Inc. (US), United Therapeutics Corporation (US), Abbvie Inc. (US), Gerresheimer AG (Germany), Becton Dickinson and Company (US), West Pharmaceutical Services Inc. (US), Ypsomed AG (Switzerland), Enable Injections (US), Subcuject APS (Denmark), Cequr Simplicity (Switzerland), Mannkind Corporation (US), Sonceboz (Switzerland), CC Bio (Japan), Elcam Drug Delivery Devices (Israel), Stevanato Group (Italy), Debiotech SA (Switzerland), Bexson Biomedical (US), Nemera (France), LTS Lohmann Therapie Systeme AG (Germany), Kymanox Corporation (US), Novo Engineering (US), and Eoflow (South Korea).

The off body segment accounted for the highest CAGR in of the product and services segment of wearable injectors industry.

No more uncomfortable skin contact or noticeable spots. Off-body injectors provide a more discrete and comfortable experience for patients, especially those with sensitive skin or self-consciousness about appearance. These injectors are usually worn on belts or linked to garments. More scheduling and dose flexibility are made possible by these injectors, which can provide medication at precise times and durations. This is especially helpful for illnesses that call for precise timing or longer release. Off-body devices reduce the chance of missed doses from discomfort or patch removal. To further improve medication consistency, some even have smart connectivity that can send reminders and track adherence. Off-body injectors are being investigated for a wide range of pharmaceuticals, including complicated biologics, painkillers, vaccinations, and antibiotics, in addition to insulin administration.

The rotary pump technology segment of wearable injectors industry is estimated to grow at a higher CAGR during the forecast period.

In contrast to spring-based systems, rotary pumps dispense medications with unmatched control and precision. Their fluid mechanics minimize mistake risk and maximize therapeutic efficacy by ensuring consistent flow even with low-volume or viscous medicines. For high-stakes drugs like biologics, where dosing precision is critical, this dependability is very important. One tune is not the limit for rotary pumps. Compared to previous technologies, they can accommodate a greater range of drug viscosities and volumes, allowing them to adapt to a variety of therapeutic applications. Consider insulin, immunizations, biologics, and analgesics; the options are as endless as a gifted musician's repertory. By prolonging wear periods and lowering the need for frequent replacements, rotary pumps complement the requirement for an effective battery life. Increased patient comfort and satisfaction are a result of its economical performance.

The hospitals and clinics segment of wearable injectors industry is expected to grow at the highest CAGR during the forecast period.

Wearable injectors complement the hospital's requirement for more efficient drug delivery. They shorten injection times and improve workflows by enabling nurses and professionals to provide medication quickly and consistently. By increasing efficiency, this reduces costs and frees up critical time for patient care. In hospital settings, missing doses can cause treatment plans to fall through and raise readmission rates. Wearable injectors guarantee constant medicine delivery, reducing missed doses and enhancing patient outcomes with their longer wear times and intelligent reminders. Patients and healthcare professionals alike commend this better adherence. Hospitals are emphasizing patient self-management and autonomy more and more. Wearable injectors give patients more autonomy by letting them administer their own medications, particularly for long-term diseases that require frequent dose adjustments.

APAC is estimated to be the fastest-growing regional market for wearable injectors industry .

The global wearable injectors market is segmented into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for wearable injectors market. The aging population of Asia Pacific is large and growing, which is driving up demand for chronic illness treatment programs. Wearable injectors efficiently fulfill this demand with their accurate and convenient delivery of medication, especially for autoimmune illnesses, diabetes, and pain management. The region is home to a thriving IT industry, with a number of nations setting the standard for production and innovation. This encourages the quick development and use of innovative wearable injector technologies, driving the market ahead. Wearable injector accessibility is expanding thanks to increasingly advantageous reimbursement regulations in nations like China and Japan. A substantial entry hurdle for patients and healthcare providers is eliminated by this financial harmonization.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the wearable injectors market are Amgen Inc. (US), Medtronic PLC (Europe), Insulet Corporation (US), Tandem Diabetes Care, Inc. (US), United Therapeutics Corporation (US), Abbvie Inc. (US), Gerresheimer AG (Germany), Becton Dickinson and Company (US), West Pharmaceutical Services Inc. (US), Ypsomed AG (Switzerland), Enable Injections (US), Subcuject APS (Denmark), Cequr Simplicity (Switzerland), Mannkind Corporation (US), Sonceboz (Switzerland), CC Bio (Japan), Elcam Drug Delivery Devices (Israel), Stevanato Group (Italy), Debiotech SA (Switzerland), Bexson Biomedical (US), Nemera (France), LTS Lohmann Therapie Systeme AG (Germany), Kymanox Corporation (US), Novo Engineering (US), and Eoflow (South Korea) . Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market.

Scope of the Wearable Injectors Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$8.4 Billion |

|

Projected Revenue by 2029 |

$15.1 Billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.3% |

|

Market Driver |

High prevalence of diabetes |

|

Market Opportunity |

Increased adoption of on body wearable injectors |

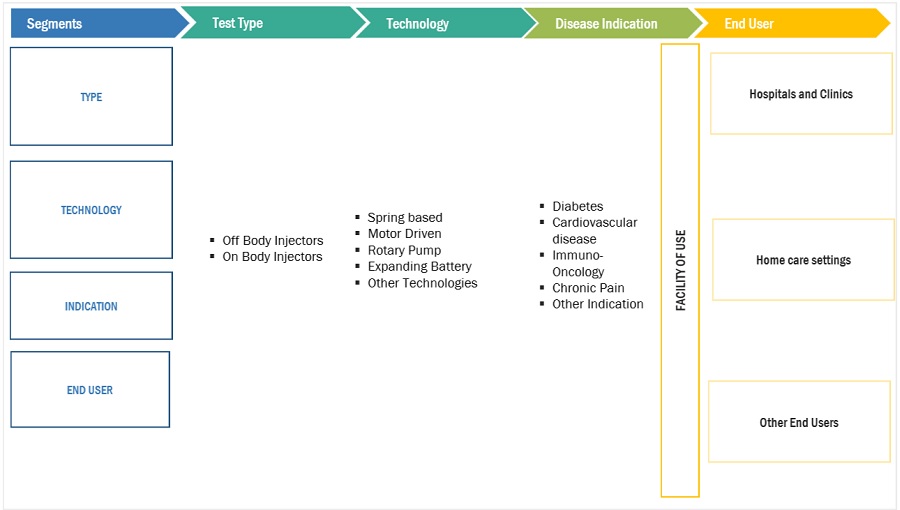

The research report categorizes wearable injectors market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- On-Body wearable injector

- Off-Body wearable injector

By Technology

- Spring based

- Motor Driven

- Rotary Pump

- Expanding Battery

- Other technologies

By Indicaton

- Diabetes

- Immuno-Oncology

- Cardiovascular diseases

- Chronic Pain

- Other Indications

By End User

- Hospitals and Clinics

- Home care settings

- Others end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

- Middle East and Africa

- GCC

Recent Developments of Wearable Injectors Industry:

- In February 2023, Insulet Corporation acquired the assets of Automated Glucose Control LLC (AGC), a company focused on developing and commercializing best-in-class automated insulin delivery technology. The company was involved in the development of Omnipod (Insulet’s star product)

- In January 2023, Tandem acquired infusion set developer, Capillary Biomedical.

- In July 2022, Becton Dickinson and Company acquired Parata Systems. This acquisition will boost the market growth of BD.

- In January 2022, Enable Injections received The company received USD 215 million Series C funding. The funding will provide additional resources to onboard Enable Injections along with important new pharma partner programs and accelerate their commercialization programs and platforms with existing pharma partners.

- In September 2021, Ypsomed AG, YpsoDose single-use injector is an electromechanical pre-filled and pre-assembled patch device for 10 mL glass cartridges. Needle insertion, injection, end of injection feedback, and needle safety steps are all performed automatically. The needle remains hidden at all times and is made safe after injection and device removal.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global Wearable Injectors Market?

The global Wearable Injectors market boasts a total revenue value of $15.1 Billion by 2029.

What is the estimated growth rate (CAGR) of the global Wearable Injectors Market?

The global Wearable Injectors market has an estimated compound annual growth rate (CAGR) of 10.3% and a revenue size in the region of $8.4 Billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

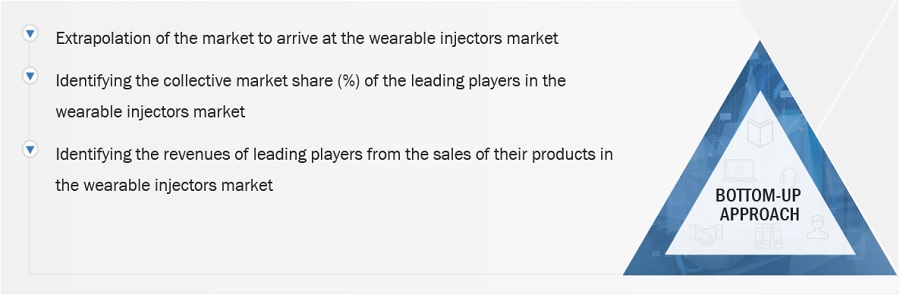

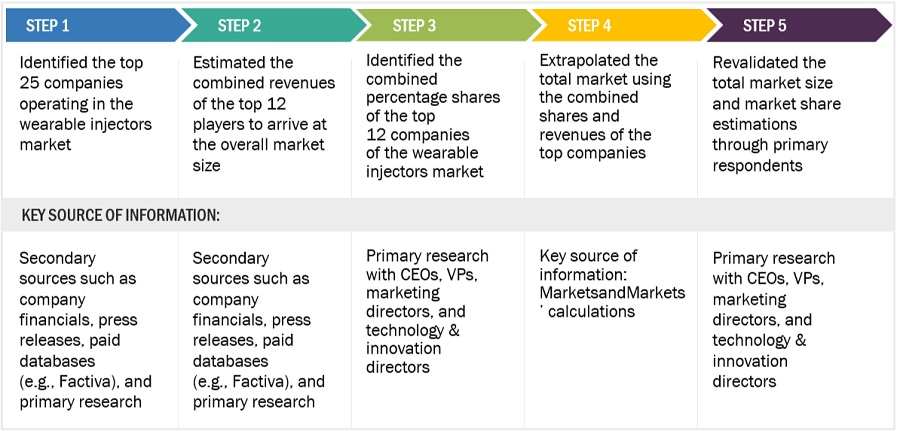

The market size for wearable injectors market was estimated using four main methods in this study. The market, as well as its peer and parent markets, were the subject of extensive research. The subsequent phase involved doing primary research to confirm these conclusions, presumptions, and estimates with industry professionals across the value chain. Top-down and bottom-up strategies were both used for estimating the value market. The market size of segments and subsegments was then estimated using market breakdown and data triangulation processes.

Secondary Research

There were several secondary sources used in this study, including directories, databases like Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, corporate house documents, investor presentations, and firm SEC filings. To find and gather data for the detailed, technical, market-focused, and commercial analysis of the wearable injectors market, secondary research was carried out. Relevant information on major companies, market classification and segmentation according to industry trends down to the most basic level, and significant changes regarding market and technological views were also obtained. Additionally, utilizing secondary research, a database of the important industry executives was created.

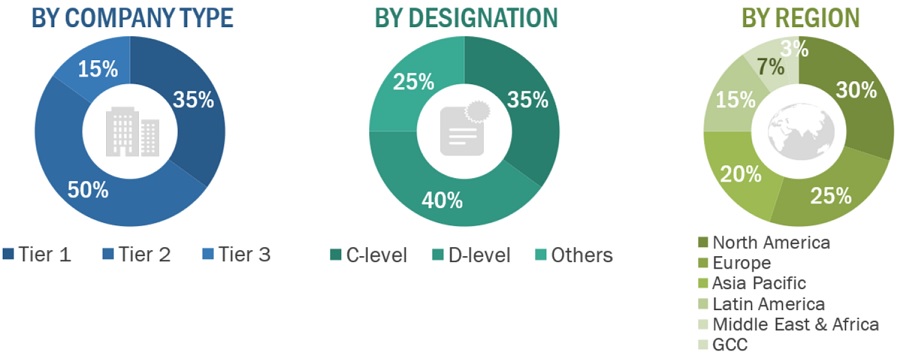

Primary Research

To gather qualitative and quantitative data for this study, a variety of sources from the supply and demand sides were interviewed during the main research phase. CEOs, vice presidents, marketing and sales directors, business development managers, technology, and innovation directors of wearable injectors market manufacturing businesses, key opinion leaders, suppliers, and distributors are the main sources on the supply side.

Breakdown of Primary Interviews

Tiers are defined based on a company’s total revenue. As of 2022: Tier 1= >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3= <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size for wearable injectors market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for wearable injectors market was calculated using data from four distinct sources, as will be discussed below:

Wearable injectors market: Bottom up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Wearable injectors market: Top down approach

Wearable injectors market: Revenue Share Analysis

Wearable injectors market: Supply side analysis of top companies

Data Triangulation

The entire market was split up into several segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of respiratory diagnostics. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Wearable injectors are devices capable of delivering large volumes of drugs subcutaneously. These devices are easy-to-handle and cost-effective that can be used by patients and caregivers to deliver a dose of a particular drug. Wearable injectors are used to manage post-chemotherapy and other chronic conditions, such as diabetes and cardiovascular diseases.

Key Stakeholders

- Wearable injector manufacturing companies

- Original equipment manufacturing companies

- Suppliers and distributors of wearable injectors

- Healthcare service providers

- Teaching hospitals and academic medical centers

- Health insurance players

- Government bodies/municipal corporations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the wearable injectors market by type, technology, indication, end user, and region.

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, challenges, and industry trends

- To strategically analyze the regulatory scenario, Porter’s five force analysis, value chain analysis, supply chain analysis, ecosystem map, recession impact, and patent analysis

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall wearable injectors market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies2

- To strategically analyze the wearable injectors market in five regions: North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC.

- To track and analyze competitive developments such as acquisitions, product launches, partnerships, and expansions in the wearable injectors market.

- To evaluate the impact of the recession on the wearable injectors market market worldwide.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe wearable inejctors market into the Netherlands, Switzerland, Austria, Belgium, and others

- Further breakdown of the Rest of Asia Pacific wearable injectors market into Singapore, Malaysia, and others

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wearable Injectors Market

How latest advancements in technologies impacting the revenue growth of Wearable Injectors Market?

What are the key factors driving revenue opportunities in Wearable Injectors Market?

Can you give some more information on demand of wearable injectors in end-user industry?