IoT Chip Market Size, Share by Hardware (Processor, Connectivity IC, Sensor, Memory Device and Logic Device), Power Consumption, End-use Application (Wearable Devices, Consumer Electronics, Building Automation and Retail) and Region - Global Forecast to 2025

IoT Chip Market

IoT Chip Market and Top Companies

- Intel Corporation (US) − Intel is a uniquely positioned company that powers the cloud and numerous smart and connected computing devices. Intel delivers computer, networking, and communication platforms to a broad set of customers, including OEMs, ODMs, cloud and communication service providers, and industrial, communications, and automotive equipment manufacturers.

- Texas Instruments (US) − Texas Instruments designs, manufactures, and sells analog and embedded processing chips. It has design, manufacturing, and sales operations in about 30 countries. Texas Instruments is one of the innovative companies that has a wide array of product offerings for the IoT market. The company offers cloud-ready system solutions, which are designed to access IoT through the industry’s group of wireless connectivity technologies, such as Wi-Fi, Bluetooth, Bluetooth low energy (BLE), and ZigBee.

- Qualcomm Incorporated (US) − Qualcomm is one of the key players in the global semiconductor industry involved in designing and marketing wireless telecommunications products and services that are widely adopted in mobile devices and other wireless products, including network equipment and broadband gateway equipment. Qualcomm develops and supplies integrated circuits (ICs and system software based on CDMA, OFDMA, and other technologies for use in mobile devices, wireless networks, devices used in IoT, broadband gateway equipment, consumer electronic devices, and automotive telematics and infotainment systems.

- STMicroelectronics N.V. (Switzerland) − the company designs, develops, manufactures, and markets a broad range of products, including discrete and general-purpose components, application-specific integrated circuits (ASICs), full-custom devices and semi-custom devices, and application-specific standard products (ASSPs) for analog, digital, and mixed-signal applications. The company addresses the following 4 end markets: automotive, industrial, personal electronics, and communications equipment.

- MediaTek, Inc. (Taiwan) – MediaTek is a semiconductor company that provides system-on-chips (SoC) solutions for areas such as digital home solutions, mobile communication solutions, and optical storage solutions. The company has a single major operating segment—Multimedia and Handset Chipsets. It specializes in R&D, production, manufacturing, and marketing of multimedia ICs, high-end customer-oriented ICs, computer peripheral-oriented ICs, and other ICs.

- NXP Semiconductors N.V. (Netherlands) – NXP provides high-performance mixed-signal and standard product solutions. Its product solutions are used in a range of automotive, identification, wireless infrastructure, lighting, industrial, mobile, consumer, and computing applications. The company has not only a widespread presence with operations in about 25 countries but also a comprehensive customer base and serves about 25,000 customers through its direct sales channel and its network of distribution channel partners.

- Microchip Technology Incorporated (US) – Microchip is a leading provider of MCUs, analog, FPGAs, and connectivity and power management semiconductors. The company serves customers across various sectors, such as automotive, industrial, aerospace & defense, consumer, communications, and computing. Microchip’s product mix includes MCUs and MPUs, power management, clock and timing, amplifiers and linear ICs, data converters, LED drivers and backlighting, memory, programmable logic, touch and gesture, and wireless connectivity for various applications, such as aerospace & defense, intelligent power, IoT, battery management, computing, security, and wireless connectivity.

IoT Chip Market and Top End-user Industries

- Consumer Electronics − With the emergence of a number of smart appliances that can connect to the Internet and smartphones, the growth of the IoT technology market in the consumer electronics segment is expected to get a boost. Smart appliances, also known as intelligent appliances, can measure and control their energy usage and communicate it with homeowners and utilities departments. These appliances can be connected to smart energy meters or home energy management systems and can help reduce electricity usage in off-peak hours.

- Healthcare − Medical devices that can measure daily routines and collect vital data, sensors in emergency rooms, and data analytics tools to integrate all these are expected to gain importance with the evolution of healthcare systems. Although there is a huge opportunity for IoT in the healthcare industry, currently, this market is in the initial stage. The initial target market for wireless portable medical devices is likely to be restricted to a variety of diagnostic and monitoring applications. The information gathered from these devices could play a significant role in optimizing the administration of existing therapies.

- Building Automation − The demand for energy-efficient solutions, enhanced security, increased venture capital funding, and the constant need for improving the standards of the individuals has led to the development of the building automation market. Building automation, which started with wired technology, has now entered the era of wireless technology with technologies such as ZigBee, Z-wave, EnOcean, Wi-Fi, and Bluetooth Smart revolutionizing the market. Growing awareness of energy conservation, stringent legislation and building directives, promotion of numerous smart grid technologies, and the availability of a number of open protocols are further driving the growth of the building automation market.

- Wearable Devices − Wearable computing or wearable technology refers to electronic devices or equipment which can be worn on the user’s body. Some of these wearable devices include watches, glasses, cameras, clothing, and activity monitors. Wearable devices offer a wide range of functionalities, from simple features such as monitoring heart rate and calories burned to advanced smart features, e.g., smartphones. The most advanced wearable devices enable the wearer to take and view pictures, record videos, read text messages and emails, respond to voice commands, and browse the web, among other functions.

- Automotive − IoT is accelerating the speed of modernization in the automotive & transportation industry. It helps the automotive & transportation industry solve challenges related to automotive safety, transportation efficiency, and vehicle infrastructure. It is driving the automotive industry through innovations such as autonomous cars, intelligent transportation infrastructure, and smart fleet management. Major companies are collaborating with automakers to utilize IoT and speed up innovation toward self-driven vehicles.

IoT Chip Market and Top Use Cases

- Manufacturing − Cisco Systems Inc. (US) and AetoScout (US) helped Stanley Black & Decker to overcome challenges in increasing visibility and production gains for its American plant. Cisco Systems Inc. manufactures and sells networking, hardware, software, and other technology services and products. AetoScout provides unified asset visibility solutions. Stanley Black & Decker was facing challenges associated with gaining transparency into its real-time production to schedule. Actual labor costs were exceeding standard costs and visibility into real-time overall equipment effectiveness and line productivity was less. Cisco implemented a robust wireless network and AeroScout’s industrial solutions to the plant. The Real-time Location system (RTLS) includes small and easy deployed Wi-Fi RFID tags that attach to virtually any material and provide real-time location and status to assembly workers, shift supervisors, and plant managers. With increased visibility across operations, managers could better understand how to remove obstacles, helping the plant achieving greater efficiency.

- Building Automation − Chunghwa Telecom (China), which provides wireless communication and internet services, aimed to create a new market with smart lock to utilize limited parking space in Taipei more efficiently. The company worked in partnership with USPACE, a shared parking space provider to supply smart locks. Lock users can rent out their parking spaces and allow immediate access to space via the app. Drivers wishing to park can see the location and availability of all parking spaces using the system, and when space is selected and paid for, the lock is lowered via its NB-IoT connection.

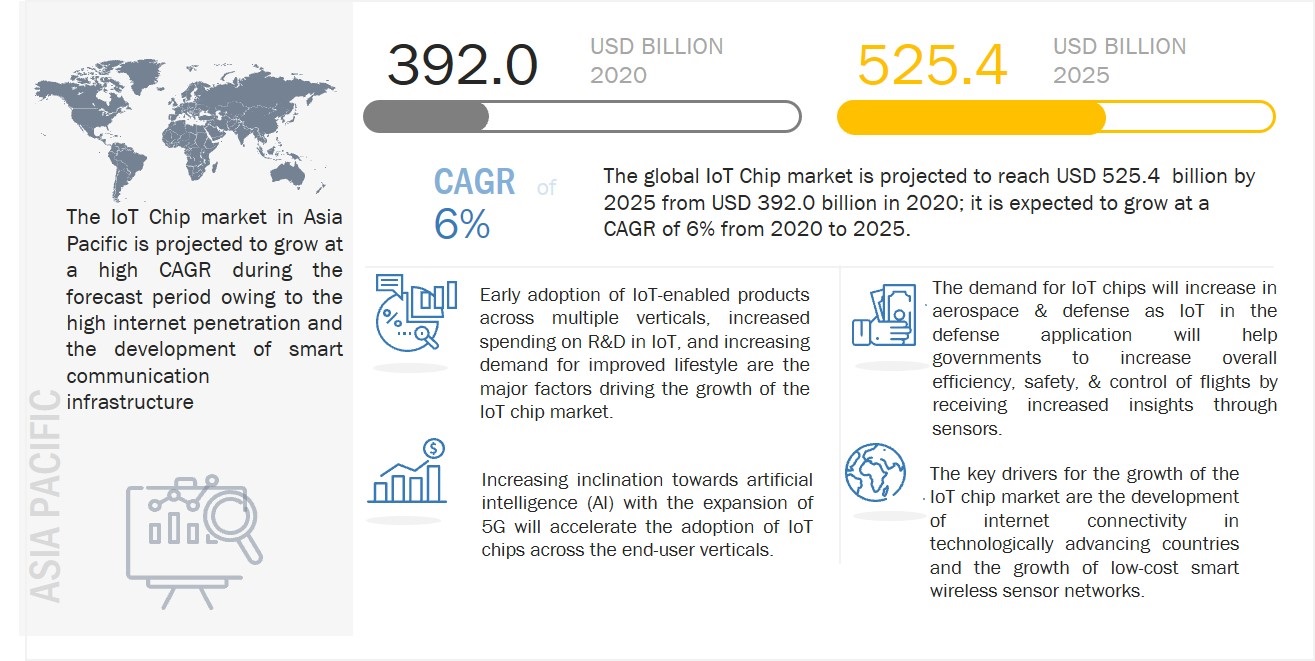

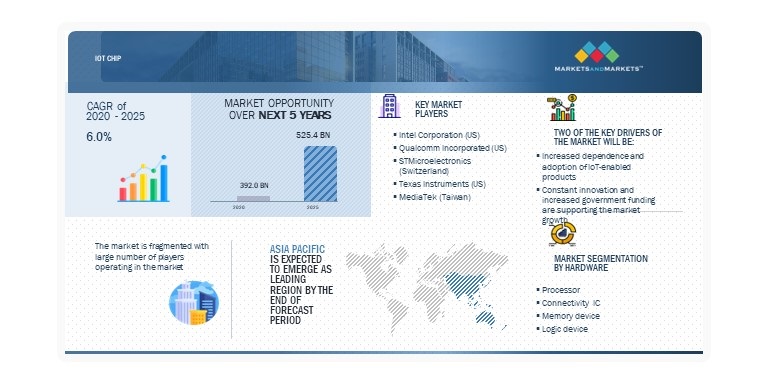

The IoT Chip market size is projected to grow from USD 392.0 billion in 2020 to USD 525.4 Billion by 2025, at a CAGR of 6.0% from 2020 to 2025.

IoT chip is a physical networking device, often referred as connected devices, with the help of embedded technologies, such as processors, sensors, connectivity ICs, memory devices, and logic devices. These technologies allow the exchange of data between these devices and collectively create the IoT chip market.

IoT Chip market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

End users' growth in the global IoT chip market size was majorly driven by consumer electronics and building automation applications. The development of intelligent transportation systems and a high potential for the growth of connected cars are expected to drive the growth of the IoT chip market in the automotive & transportation application during the forecast period. The development of the wearables segment is also likely to increase the demand for the IoT chip market, especially in components such as MCUs, application processors, connectivity ICs, and sensors.

As the IoT market is growing at a high rate, the IoT chip market size in APAC is expected to grow at the highest rate since most of the global population is concentrated in APAC. Hence, the number of new M2M connections per year, the demand for smart consumer devices, and the need for the industrial revolution are higher in this region.

Given the large population base in some of the developing economies such as China, India, and Thailand in APAC, coupled with related issues such as those of healthcare and energy management, the Internet of Things (IoT) applications seem to have more opportunities to improve the standard of living and revolutionize the industrial sector in APAC. Moreover, the investment by the government in the development and modernization of businesses in China and India have increased the incorporation rate of IoT elements.

Growing penetration of the Internet across commercial and residential spaces, a high consumer base, increasing disposable income, and improving IT infrastructure are some of the key determinants supplementing the growth of the IoT chip market in APAC. Moreover, the adoption of cloud-based services and the rising trend of industrial automation are the key growth drivers of the IoT chip market for commercial applications in countries such as China, South Korea, and Japan.

IoT Chip Market Dynamics:

Driver: Growing application-specific MCUs and flexible SoC-type designs

In the coming years, the unit shipments of embedded processors to be used for IoT applications are expected to grow faster than the rest of the embedded processing market.

Much of that growth is expected to emerge from MCU-based devices, especially 32-bit MCUs, which are becoming increasingly popular owing to the growing adoption of these devices across automotive, industrial, and medical applications requiring sophisticated real-time sensors possessing higher computing capabilities. Yet another trend that has been observed is the growth of application-specific MCUs with integrated wireless capabilities. These application-specific MCUs, which allow many home appliances and industrial devices to connect to the internet, are threatening traditional general-purpose MCUs.

IoT applications ideally require a single chip at an acceptable form factor and with very low power consumption, suitable for battery-operated devices. These requirements have led to the development of various SoC designs comprising multiple embedded cores, embedded GPU, and integrated wireless connectivity in a single package.

Restraint: Concerns regarding the security and privacy of user data

- IoT has tremendous potential owing to the substantial adoption rate in every end-use application, be it wearable, healthcare, or retail. However, privacy and data security are major restraints to the market's growth. As the number of connected devices is increasing with the growing adoption of IoT in end-use applications, a huge amount of data is being generated. Cybercriminals can hack into systems and use such data for espionage. For instance, such data can be used to acquire a person’s car insurance automatically, evaluate a person’s health status, track the behavior of a company’s strategies, and so on.

- The IoT gateway, which serves as a connectivity layer between edge devices and cloud services, must handle a large number of IoT devices and the data transferred between them. While performing the protocol translation, the IoT gateway must maintain data confidentiality. As IoT communication uses private and public networks, a secure network is required. Protocol translation makes it difficult for the IoT gateway to maintain data privacy. Although encryption security keys can be used to secure data, managing those keys would still be a significant concern.

Opportunity: Government funding in innovation and R&D related to IoT

The government sector is expected to be one of the largest potential customers of IoT, and governments worldwide are supporting and funding research and development for IoT to boost their productivity.

IoT can bring radical improvements and innovation in key areas, such as smart traffic management systems, energy conservation through smart meters, and security system improvements through smart cameras. Governments of many countries, such as Singapore, Finland, and Australia, are funding new IoT research projects for the development of smart cities in the future.

Challenge: High power consumption of connected devices

Improved power management and optical power consumption are the key requirements for any IoT device. Connectivity load would be another critical challenge since hundreds or even thousands of devices must be connected simultaneously.

The average smart home, for instance, may contain 50 to 100 connected appliances, lights, thermostats, and other devices, each with its own power requirements. Equipment such as smart meters would be used to make the line power more efficient. As frequent manual replacement of the batteries of thousands of sensors, actuators, and other connected devices within IoT systems is not feasible, the main hurdle is the power management of devices using wireless technologies, such as Wi-Fi, which consume high power. Although semiconductor manufacturers are already working toward producing ultra-low power chips and modules, there is still a challenge for innovation in battery technology and power management of portable and wearable electronics.

IoT Chip Market Segment Insights:

Based on hardware, the processor segment held largest market share in terms of shipment

Based on hardware, the IoT chip market size has been segmented into processor, sensor, connectivity IC, a memory device, and logic device.

The increasing demand for edge devices is the key factor supporting the growth of the processor segment. In addition, increasing demand for consumer electronics and the soaring popularity of smart homes, which use different processors like microcontrollers and microprocessors as per application, is expected to drive the demand for processors further.

Based on end-use applications, the consumer electronics market to dominate market

The Internet of Things (IoT) ecosystem is growing at a high rate due to various application-specific smart products in the market.

The growth of IoT in the consumer electronics end-use application was driven by evolving trends and opportunities for smart household appliances. Increasing internet penetration can also be another contributing factor to the widespread expansion of IoT-enabled consumer electronics because consumers can view and control devices anytime and anywhere. The consumer electronics segment comprises smart consumer appliances.

With the emergence of several smart appliances that can connect to the Internet and smartphones, the growth of the IoT technology market in the consumer electronics segment is expected to boost. Smart appliances, also known as intelligent appliances, can measure and control their energy usage and communicate it with homeowners and utility departments. These appliances can be connected to smart energy meters or home energy management systems and can help reduce electricity usage in off-peak hours.

Based on application, the retail segment is stipulated to create the highest revenue generation opportunity

The concept of IoT in retail has revolutionized the way retailers interact with their customers. It helps retailers increase operational efficiency and optimize the customer experience.

The connectivity between sensors and devices enables retailers to streamline their inventory management and supply chain management and aids in real-time advertising and marketing and analytics-based decisions. The implications of its usage can be widely seen in functional areas such as kiosks, advertising and marketing, smart doors and shelves, digital signage, vending machines, payment processing, and inventory management.

Although the overall adoption of IoT in retail is limited, the technology is increasingly deployed for inventory management as it assists in the proper utilization and management of inventory and reduces instances of shrinkage through theft analysis. Apart from this, advertising and real-time analytics are other areas of deployment that help retailers drive targeted promotional campaigns and increase revenue per customer.

IoT Chip Market Regional Insights:

North America led the overall IoT chip market in terms of value generation

An established IT ecosystem and early adoption of various IoT-enabled products across multiple end-use applications are the prominent factors supporting the growth of the regional market.

The US is expected to be the largest market for IoT chips in North America during the forecast period. It is home to some of the most prominent companies engaged in the manufacturing of IoT hardware, namely, NXP Semiconductors (US), Intel Corporation (US), and Texas Instruments Incorporated (US). The increased research and development (R&D) in the field of IoT for new and improved technologies, growing investment by the government in the implementation of the IoT solutions in healthcare and industrial applications, and inclination toward advanced lifestyle are the major factors driving the growth of the IoT chip market.

IoT Chip market by Region

To know about the assumptions considered for the study, download the pdf brochure

Emerging R&D at both academic and industry levels is broadening the application areas of the Internet of Things (IoT) in different sectors, such as consumer electronics, retail, automotive & transportation, and healthcare.

Moreover, the US government has provided an ideal environment for research and innovation, facilitating massive advancements in various fields of science and technology. The government is focusing on enhancing the quality of life of its citizens. The US government is investing primarily in three sectors—hardware (such as sensors, cloud storage, and wireless devices), software, and cybersecurity solutions. The abundance of capital and strong government support has increased the adoption of IoT solutions in the US.

Europe region held the third-largest share in the IoT Chip market

The European Commission has taken the initiative to encourage the development of the energy and power sector. The European Commission has set the target that 80% of homes in Europe would be equipped with smart meters, which can monitor and analyze the energy usage in the building.

Furthermore, as part of the EU SAVE Program, all houses (and other buildings) in the UK would have to acquire Energy Performance Certificates (EPC) whenever a property is built, sold, or rented. This program aims at promoting energy efficiency and encouraging energy saving. These regulations aim to improve the energy efficiency of residential and commercial applications and proportionately fuel the adoption of smart HVAC controls. These initiatives taken by government bodies are expected to be the major drivers for the growth of the IoT chip market in the region.

The UK is well placed among the emerging world leaders in reaping the benefits from IoT technologies and services. Cambridge, London, and Liverpool have emerging clusters of companies. Tech City is growing small digital businesses across London and the rest of the UK. The UK has a high growth potential in the supply side (high technology manufacturing, telecommunications, and digital services) and the demand side (healthcare and social care, transport, retail, and utilities). The UK has a world-class digital infrastructure, a favorable regulatory environment, and a record of adapting to emerging technologies.

Key Market Players in IoT Chip Industry

Some of the Major players in the IoT chip market are Intel Corporation (US), Qualcomm Incorporated (US), STMicroelectronics (Switzerland), Texas Instruments (US), and MediaTek (Taiwan). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches further to expand their presence in the IoT Chip market.

Intel Corporation (Intel) (US) ranked first in the overall IoT chip market. Intel is a uniquely positioned company that powers the cloud and numerous smart and connected computing devices. Intel delivers computer, networking, and communication platforms to a broad set of customers, including OEMs, ODMs, cloud, and communication service providers, and industrial, communications, and automotive equipment manufacturers.

Qualcomm (US) has been ranked second in the IoT chip market and is one of the key players in the global semiconductor industry involved in designing and marketing wireless telecommunications products and services that are widely adopted in mobile devices and other wireless products, including network equipment and broadband gateway equipment. In addition to cellular devices, the company’s technology and products are suitable for automotive, IoT, data center, networking, and computing and machine learning applications. Qualcomm develops and supplies integrated circuits (ICs)—also known as chips or chipsets—and system software based on CDMA, OFDMA, and other technologies for use in mobile devices, wireless networks, devices used in IoT, broadband gateway equipment, consumer electronic devices, and automotive telematics and infotainment systems.

IoT Chip Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 392.0 billion |

| Revenue Forecast in 2025 | USD 525.4 Billion |

| Growth Rate | 6.0% |

|

Market size available for years |

2015–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units |

USD Million/Billion and Million/Billion Units |

|

Segments covered |

Hardware, End-use Application, Power Consumption, and Region |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Intel Corporation (US), Texas Instruments Incorporated (US), Qualcomm Incorporated (US), NXP Semiconductors N.V. (Netherlands), MediaTek Inc. (Taiwan), Marvell Technology Group Ltd. (Bermuda), Microchip Technology Inc. (US), Cypress Semiconductor Corporation (US), Renesas Electronics Corporation (Japan), Huawei Technologies Co., Ltd. (China), NVIDIA Corporation (US), Samsung Electronics (South Korea), Advanced Micro Devices (US), STMicroelectronics N.V. (Switzerland), TE Connectivity Ltd (Switzerland), Nordic Semiconductor (Norway), GainSpan (US), Expressif Systems (China), Dialog Semiconductor (UK), and Silicon Labs (US) |

This report categorizes the IoT chip market based on hardware, end-use application, power consumption, and region.

By Hardware:

- Processors

- Connectivity Integrated Circuits (ICs)

- Sensors

- Memory devices

- Logic devices

By Power Consumption:

- Less than 1 W

- 1–3 W

- 3–5 W

- 5–10 W

- More than 10 W

By End-use Application:

- Wearable Devices

- Healthcare

- Consumer Electronics

- Automotive & Transportation

- Building Automation

- Manufacturing

- Retail

- BFSI

- Oil & Gas

- Agriculture

- Aerospace & Defense

By Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

IoT Chip Market Highlights:

What is new?

- Significant developments that can change the business landscape as well as market forecasts.

Retail is one of the high revenue generation end-use applications with high penetration of wireless technologies is expected to change the face of the businesses. High benefits associated with warehouse and logistics management. Companies that rely significantly on transportation are reaping the benefits of IoT such as enhanced transparency, improved last-mile delivery, real-time tracking, high workforce performance, and predictive maintenance from IoT-based interconnected devices as they help in the localization of supply chain defects by eliminating any blind spots from the logistics processes.

- Addition/refinement in segmentation–Increase the depth or width of market segmentation.

-

IoT Chip, by Hardware

-

Processor

- Microcontroller (MCU)

- Microprocessor (MPU)

- Digital signal processor (DSP)

- Power management integrated circuit (PMIC)

-

Connectivity IC

-

Wireless

- Wi-Fi

- Bluetooth

- GPS/GNSS Module

- Cellular Network

- Bluetooth/WLAN

- ZigBee

- Bluetooth Smart/BLE

- NFC

- WHART

- ISA100

- ANT+

-

Wired

- Ethernet/IP

- Modbus

- PROFINET

- Foundation Fieldbus (FF)

-

Wireless

-

Sensor

- Temperature sensor

- Ambient light sensor

- Motion & position sensor

- Pressure sensor

- Heart rate sensor

- IMU (6-Axis, 9-Axis)

- Humidity sensor

- Carbon monoxide sensor

- Image sensor

- Flow sensor

- Accelerometer (3-Axis)

- Blood glucose sensor

- Level sensor

- Chemical sensor

- Blood oxygen sensor

- Camera module

- ECG sensor

- Others

-

Memory Device

- On-Chip Memory

- Off-Chip Memory

- Logic Device

- Coverage of new market players and change in the market share of existing players of the IoT Chip market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total of 20 players (15 major, 5 Startups/SME). Moreover, the share of companies operating in the IoT Chip market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the IoT Chip market.

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the IoT Chip market till 2019/2020 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to quickly analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2017 to 2020. This will assist in underrating the players in this market and their strategies to expand their global presence and increase market shares.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of startups /SME, which covers details about employees, financial status, the latest funding round, and total funding.

- Inclusion of the impact of megatrends on the IoT Chip market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in IoT Chip market

- Inclusion of patent registrations to have an overview of R&D activities in the IoT Chip market.

- The startup evaluation matrix is added in this report edition, covering drone startups.

The new edition of the report consists of trends/disruptions on customer’s business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand IoT Chip's market dynamics.

Recent Developments in IoT Chip Industry

- In September 2022, Silicon Labs announced a series of products that extend its multiprotocol interoperability-driven and secure IoT portfolio with Matter, Amazon Sidewalk, Wi-Sun, and Wifi 6.

- In July 2022, Infineon Technologies AG acquired NoBug Consulting SRL (Romania) and NoBug d.o.o. (Serbia), to strengthen its market expertise in the IoT industry.

- In October 2021, STMicroelectronics and Sierra Wireless formed an alliance to simplify and accelerate the deployment of connected IoT solutions. The alliance will leverage Sierra Wireless’s cellular technologies to be used in STMicroelectronics’s MCUs.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQ’s)

What is the current size of the IoT Chip market?

The IoT Chip market is projected to grow from USD 392.0 billion in 2020 to USD 525.4 Billion by 2025, at a CAGR of 6.0% from 2020 to 2020.

Who are the winners in the IoT Chip market?

Intel Corporation (US), Qualcomm Incorporated (US), STMicroelectronics (Switzerland), Texas Instruments (US), and MediaTek (Taiwan).

What are some of the technological advancements in the market?

MQTT protocol, which stands for messaging queuing telemetry transport protocol, is a machine-to-machine (M2M) data distribution technology. It reduces network bandwidth consumption and is used for remote sensing, as well as for control functions. The latest version of this technology is MQTT Version 3.1.1, which enables SCADA systems to access IIoT data from remote sites. Seamless connectivity is one of the most important aspects of a well-functioning IoT system. This can be accomplished by selecting an appropriate communication protocol. MQTT is an excellent option for IoT products, but there are other options as well. In terms of performance and overhead, CoAP, for instance, outperforms MQTT. In terms of security, AMQP takes the lead.

What are the factors driving the growth of the market?

The use of IoT Chip is growing rapidly across many applications. Early adoption of IoT-enabled products across multiple verticals, increased spending on R&D in IoT, and increasing demand for improved lifestyle are the major factors driving the growth of the IoT chip market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

Processor

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 IOT CHIP MARKET, 2020–2025 (USD BILLION)

4.2 IOT CHIP MARKET, BY POWER CONSUMPTION

4.3 IOT CHIP MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

4.4 IOT CHIP MARKET BY REGION

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing application-specific MCUs and flexible SoC-type designs

5.2.1.2 Rising adoption of IPV6 internet protocol

5.2.1.3 Increasing inclination toward utilization of AI and 5G technologies

5.2.1.4 Surging internet usage

5.2.1.5 Growing low-cost smart wireless sensor networks

5.2.2 RESTRAINTS

5.2.2.1 Concerns regarding security and privacy of user data

5.2.3 OPPORTUNITIES

5.2.3.1 Government funding in innovation and R&D related to IoT

5.2.3.2 Smart cities

5.2.3.3 Cross-domain collaborations

5.2.4 CHALLENGES

5.2.4.1 Lack of common protocols and communication standards across platforms

5.2.4.2 High power consumption of connected devices

5.3 IMPACT OF COVID-19 ON IOT CHIP MARKET

5.4 VALUE CHAIN ANALYSIS

5.5 TECHNOLOGY ANALYSIS

5.6 CASE STUDY ANALYSIS

5.6.1 MANUFACTURING

5.6.1.1 Cisco and AeroScout transform operations for Stanley Black & Decker in its Latin American plant

5.6.1.2 Colfax implemented IoT platform ThingWorx to enhance product functionality in its business lines

5.6.2 BUILDING AUTOMATION

5.6.2.1 Chunghwa Telecom deployed NB-IoT powered smart lock to prevent unauthorized parking in Taipei

6 IOT CHIP MARKET, BY HARDWARE (Page No. - 53)

6.1 INTRODUCTION

6.2 PROCESSOR

6.2.1 PROCESSORS IN IOT DEVICES OR SYSTEMS TO SUPPORT REAL-TIME DATA MONITORING AND ANALYTICS

6.2.1.1 Microcontroller (MCU)

6.2.1.2 Microprocessor (MPU)

6.2.1.3 Digital signal processor (DSP)

6.2.1.4 Power management integrated circuit (PMIC)

6.3 SENSOR

6.3.1 GROWING DEMAND FOR SENSORS DUE TO INCREASED DEMAND FOR CONNECTED DEVICES

6.3.1.1 Accelerometer

6.3.1.2 Inertial measurement unit (IMU)

6.3.1.3 Heart rate sensor

6.3.1.4 Pressure sensor

6.3.1.5 Temperature sensor

6.3.1.6 Blood glucose sensor

6.3.1.7 Blood oxygen sensor

6.3.1.8 Electrocardiogram (ECG) sensor

6.3.1.9 Humidity sensor

6.3.1.10 Image sensor

6.3.1.11 Ambient light sensor

6.3.1.12 Flow sensor

6.3.1.13 Level sensor

6.3.1.14 Chemical sensor

6.3.1.15 Carbon monoxide sensor

6.3.1.16 Motion and position sensor

6.3.1.17 Camera module

6.4 CONNECTIVITY IC

6.4.1 WIRED

6.4.1.1 Growing popularity of Ethernet/IP-wired connectivity technology driving IoT chip market

6.4.1.1.1 Ethernet/IP

6.4.1.1.2 Modbus

6.4.1.1.3 PROFINET

6.4.1.1.4 Foundation Fieldbus (FF)

6.4.2 WIRELESS

6.4.2.1 Wi-Fi and Bluetooth are major wireless connectivity technologies for IoT connectivity

6.4.2.1.1 ANT+

6.4.2.1.2 Bluetooth

6.4.2.1.3 Bluetooth Smart/Bluetooth Low Energy (BLE)

6.4.2.1.4 ZigBee

6.4.2.1.5 Wireless fidelity (Wi-Fi)

6.4.2.1.6 Near-field communication (NFC)

6.4.2.1.7 Cellular network

6.4.2.1.8 Wireless highway addressable remote transducer (WHART)

6.4.2.1.9 Global positioning system (GPS)/global navigation satellite system (GNSS) module

6.4.2.1.10 ISA100

6.4.2.1.11 Bluetooth/WLAN

6.5 MEMORY DEVICE

6.5.1 ON-CHIP MEMORY

6.5.1.1 On-chip memory offers high-speed performance with reduced power consumption

6.5.2 OFF-CHIP MEMORY/EXTERNAL MEMORY

6.5.2.1 High usage in servers, PCs, and mobile devices

6.6 LOGIC DEVICE

6.6.1 LOGIC DEVICE OFFERS ADVANTAGES SUCH AS RAPID PROTOTYPING, SHORTER TIME-TO-MARKET, AND LONG OPERATIONAL LIFE

6.6.1.1 Field-programmable gate array (FPGA)

7 IOT CHIP MARKET, BY END USE (Page No. - 77)

7.1 INTRODUCTION

7.2 WEARABLE DEVICES

7.2.1 PRODUCTS IN WEARABLE DEVICES

7.2.1.1 Smartwatches dominating wearable devices market

7.2.1.1.1 Activity monitor

7.2.1.1.2 Smartwatch

7.2.1.1.3 Smart glass

7.2.1.1.4 Body-worn camera

7.2.1.1.5 Smart clothing

7.3 HEALTHCARE

7.3.1 PRODUCTS IN HEALTHCARE

7.3.1.1 Adoption of IoT technology through wireless portable medical devices

7.3.1.1.1 Fitness & heart rate monitor

7.3.1.1.2 Blood pressure monitor

7.3.1.1.3 Blood glucose meter

7.3.1.1.4 Continuous glucose monitor

7.3.1.1.5 Pulse oximeter

7.3.1.1.6 Automated external defibrillator

7.3.1.1.7 Programmable syringe pump

7.3.1.1.8 Wearable injector

7.3.1.1.9 Multiparameter monitor

7.4 CONSUMER ELECTRONICS

7.4.1 PRODUCTS IN CONSUMER ELECTRONICS

7.4.1.1 Consumer electronics driven by market for smart TVs and smart washing machines

7.4.1.1.1 Smart speaker

7.4.1.1.2 Smart TV

7.4.1.1.3 Smart washing machine

7.4.1.1.4 Smart dryer

7.4.1.1.5 Refrigerator

7.4.1.1.6 Smart oven

7.4.1.1.7 Smart cooktop

7.4.1.1.8 Smart cooker

7.4.1.1.9 Smart deep freezer

7.4.1.1.10 Smart dishwasher

7.4.1.1.11 Smart coffee maker

7.4.1.1.12 Smart kettle

7.4.1.1.13 Smart water heater

7.4.1.1.14 Smart vacuum cleaner

7.5 BUILDING AUTOMATION

7.5.1 PRODUCTS IN BUILDING AUTOMATION

7.5.1.1 Rising need for security and energy-efficient solutions to drive demand for smart home devices

7.5.1.1.1 Occupancy sensor

7.5.1.1.2 Daylight sensor

7.5.1.1.3 Smart thermostat

7.5.1.1.4 IP camera

7.5.1.1.5 Smart meter

7.5.1.1.6 Smart lock

7.5.1.1.7 Smoke detector

7.6 INDUSTRIAL

7.6.1 PRODUCTS IN INDUSTRIAL

7.6.1.1 Growing adoption of Industry 4.0 and smart factories to propel market growth

7.6.1.1.1 Temperature sensor

7.6.1.1.2 Pressure sensor

7.6.1.1.3 Level sensor

7.6.1.1.4 Flow sensor

7.6.1.1.5 Chemical sensor

7.6.1.1.6 Humidity sensor

7.6.1.1.7 Motion & position sensor

7.6.1.1.8 Image sensor

7.7 AUTOMOTIVE & TRANSPORTATION

7.7.1 PRODUCTS IN AUTOMOTIVE & TRANSPORTATION

7.7.1.1 IoT-enabled devices allow real-time tracking of vehicle location

7.7.1.1.1 Connected car

7.7.1.1.2 In-car infotainment

7.7.1.1.3 Traffic management

7.7.1.1.3.1 Vehicle detection sensor

7.7.1.1.3.2 Pedestrian presence sensor

7.7.1.1.3.3 Speed sensor

7.7.1.1.3.4 Thermal camera

7.7.1.1.3.5 Automated incident detection (AID) camera

7.7.1.1.4 E-tolls

7.8 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

7.8.1 PRODUCTS IN BFSI

7.8.1.1 Adoption of contactless payment services driving market growth

7.8.1.1.1 Mobile point of sale (mPOS)

7.8.1.1.2 Smart kiosk

7.9 AGRICULTURE

7.9.1 PRODUCTS IN AGRICULTURE

7.9.1.1 Increasing demand for food globally and adoption of smart farming practices driving market growth

7.9.1.1.1 Climate sensor

7.9.1.1.2 Soil moisture sensor

7.9.1.1.3 Level sensor

7.10 RETAIL

7.10.1 PRODUCTS IN RETAIL

7.10.1.1 Digital signage and intelligent vending machines driving market growth

7.10.1.1.1 Intelligent vending machine

7.10.1.1.2 Contactless checkout/PoS

7.10.1.1.3 Smart mirror

7.10.1.1.4 Smart shopping cart

7.10.1.1.5 Digital signage

7.10.1.1.6 Smart tag

7.10.1.1.7 Wireless beacon

7.11 OIL & GAS

7.11.1 PRODUCTS IN OIL & GAS

7.11.1.1 Wireless sensor network-based manufacturing propelling market growth

7.11.1.1.1 Temperature sensor

7.11.1.1.2 Pressure sensor

7.11.1.1.3 Level sensor

7.11.1.1.4 Flow sensor

7.11.1.1.5 Image sensor

7.11.1.1.6 Other sensors (humidity sensor, motion & position sensor, and chemical & gas sensor)

7.12 AEROSPACE & DEFENSE

7.12.1 PRODUCTS IN AEROSPACE & DEFENSE

7.12.1.1 Smart beacon market to grow at highest CAGR in aerospace & defense

7.12.1.1.1 Smart baggage tag

7.12.1.1.2 Smart beacon

7.12.1.1.3 ePassport gate

7.12.1.1.4 Drone/Unmanned aerial vehicle (UAV)

8 IOT CHIP MARKET, BY POWER CONSUMPTION (Page No. - 142)

8.1 INTRODUCTION

8.2 LESS THAN 1 W

8.2.1 WEARABLES CONSUME <1 W

8.3 1–3 W

8.3.1 ELECTRONIC DEVICES CONSUME 1–3 W

8.4 3–5 W

8.4.1 SMART SPEAKERS TO LEAD IOT CHIP MARKET FOR 3–5 W

8.5 5–10 W

8.5.1 SURVEILLANCE CAMERAS TO BE MAJOR MARKET FOR 5–10 W

8.6 MORE THAN 10 W

8.6.1 CONNECTED CAR AND INFOTAINMENT SYSTEMS TO DRIVE MARKET FOR DEVICES THAT CONSUME >10 W

9 GEOGRAPHIC ANALYSIS (Page No. - 146)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Large presence of leading IoT companies to boost market growth

9.2.2 CANADA

9.2.2.1 Adoption of IoT technology by small and medium enterprises to drive market growth

9.2.3 MEXICO

9.2.3.1 Growing adoption of IoT in telecommunication industry to propel market

9.3 EUROPE

9.3.1 UK

9.3.1.1 Industrial revolution driving market growth

9.3.2 GERMANY

9.3.2.1 Surging deployment of smart factory solutions due to adoption of Industry 4.0 to drive market

9.3.3 FRANCE

9.3.3.1 Increasing investments in R&D to modernize industrial sector fueling market growth

9.3.4 REST OF EUROPE

9.4 APAC

9.4.1 CHINA

9.4.1.1 Growing adoption of IoT technology to boost market growth

9.4.2 JAPAN

9.4.2.1 Contribution by robotics and other cutting-edge technologies to IoT driving market growth

9.4.3 INDIA

9.4.3.1 Government initiatives fueling market growth

9.4.4 SOUTH KOREA

9.4.4.1 Advancements in cellular technologies driving market growth

9.4.5 REST OF APAC

9.5 ROW

9.5.1 MIDDLE EAST & AFRICA

9.5.2 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 163)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

10.3 KEY MARKET DEVELOPMENTS

10.3.1 PRODUCT LAUNCHES AND DEVELOPMENTS

10.3.2 PARTNERSHIPS, ACQUISITIONS, COLLABORATIONS, AND AGREEMENTS

11 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 169)

11.1 OVERVIEW

11.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.2.1 MARKET RANKING

11.2.2 STAR

11.2.3 PERVASIVE

11.2.4 EMERGING LEADER

11.3 COMPANY EVALUATION MATRIX, 2019

11.4 COMPANY PROFILES

11.4.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, and Recent Developments)*

11.4.1.1 Intel Corporation

11.4.1.2 Texas Instruments Incorporated

11.4.1.3 Qualcomm Incorporated

11.4.1.4 NXP Semiconductors N.V.

11.4.1.5 MediaTek Inc.

11.4.1.6 Marvell Technology Group Ltd.

11.4.1.7 Microchip Technology Inc.

11.4.1.8 Cypress Semiconductor Corporation

11.4.1.9 Renesas Electronics Corporation

11.4.1.10 Huawei Technologies Co., Ltd.

11.4.1.11 NVIDIA Corporation

11.4.1.12 Samsung Electronics

11.4.1.13 Advanced Micro Devices (AMD)

11.4.1.14 STMicroelectronics N.V.

11.4.1.15 TE Connectivity Ltd.

11.4.2 OTHER KEY PLAYERS

11.4.2.1 Nordic semiconductor

11.4.2.2 Gainspan

11.4.2.3 Expressif Systems

11.4.2.4 Dialog Semiconductor

11.4.2.5 Silicon Labs

*Details on Business Overview, Products/Solutions/Services Offered, and Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 229)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (104 TABLES)

TABLE 1 KEY PLATFORMS SUPPORTING MULTIPLE COMMUNICATION STANDARDS

TABLE 2 IOT CHIP MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 3 MARKET FOR PROCESSOR, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 4 MARKET FOR PROCESSOR, BY END-USE APPLICATION, 2015–2025 (MILLION UNITS)

TABLE 5 MARKET FOR SENSOR, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 6 MARKET FOR SENSOR, BY END-USE APPLICATION, 2015–2025 (MILLION UNITS)

TABLE 7 MARKET FOR CONNECTIVITY IC, BY CONNECTIVITY TECHNOLOGY, 2015–2025 (MILLION UNITS)

TABLE 8 MARKET FOR CONNECTIVITY IC, BY WIRED CONNECTIVITY TECHNOLOGY, 2015–2025 (MILLION UNITS)

TABLE 9 MARKET FOR CONNECTIVITY IC, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2015–2025 (MILLION UNITS)

TABLE 10 MARKET FOR CONNECTIVITY IC, BY END USER, 2015–2025 (MILLION UNITS)

TABLE 11 MARKET FOR MEMORY DEVICE, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 12 MARKET FOR MEMORY DEVICE, BY END-USE APPLICATION, 2015–2025 (MILLION UNITS)

TABLE 13 MARKET FOR LOGIC DEVICE, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 14 MARKET FOR LOGIC DEVICE, BY END-USE APPLICATION, 2015–2025 (MILLION UNITS)

TABLE 15 MARKET, BY END-USE APPLICATION, 2015–2025 (USD MILLION)

TABLE 16 GLOBAL IOT CHIP WEARABLE DEVICES MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 17 GLOBAL IOT CHIP WEARABLE DEVICES MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 18 GLOBAL IOT CHIP WEARABLE MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 19 NORTH AMERICA: IOT CHIP WEARABLE DEVICES MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 20 EUROPE: IOT CHIP WEARABLE DEVICES MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 21 APAC: IOT CHIP WEARABLE DEVICES MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 22 ROW: IOT CHIP WEARABLE DEVICES MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 23 GLOBAL IOT CHIP HEALTHCARE MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 24 GLOBAL IOT CHIP HEALTHCARE MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 25 GLOBAL IOT CHIP HEALTHCARE MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 26 NORTH AMERICA: IOT CHIP HEALTHCARE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 27 EUROPE: IOT CHIP HEALTHCARE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 28 APAC: IOT CHIP HEALTHCARE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 29 ROW: IOT CHIP HEALTHCARE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 30 GLOBAL IOT CHIP CONSUMER ELECTRONICS MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 31 GLOBAL IOT CHIP CONSUMER ELECTRONICS MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 32 GLOBAL IOT CHIP CONSUMER ELECTRONICS MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 33 NORTH AMERICA: IOT CHIP CONSUMER ELECTRONICS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 34 EUROPE: IOT CHIP CONSUMER ELECTRONICS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 35 APAC: IOT CHIP CONSUMER ELECTRONICS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 36 ROW: IOT CHIP CONSUMER ELECTRONICS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 37 GLOBAL IOT CHIP BUILDING AUTOMATION MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 38 GLOBAL IOT CHIP BUILDING AUTOMATION MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 39 GLOBAL IOT CHIP BUILDING AUTOMATION MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: IOT CHIP BUILDING AUTOMATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 41 EUROPE: IOT CHIP BUILDING AUTOMATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 42 APAC: IOT CHIP BUILDING AUTOMATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 43 ROW: IOT CHIP BUILDING AUTOMATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 44 GLOBAL IOT CHIP INDUSTRIAL MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 45 GLOBAL IOT CHIP INDUSTRIAL MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 46 GLOBAL IOT CHIP INDUSTRIAL MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: IOT CHIP INDUSTRIAL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 48 EUROPE: IOT CHIP INDUSTRIAL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 49 APAC: IOT CHIP INDUSTRIAL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 50 ROW: IOT CHIP INDUSTRIAL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 51 GLOBAL IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 52 GLOBAL IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 53 GLOBAL IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 55 EUROPE: IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 56 APAC: IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 57 ROW: IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 58 GLOBAL IOT CHIP BFSI MARKET, BY HARDWARE, 2015–2025 (THOUSAND UNITS)

TABLE 59 GLOBAL IOT CHIP BFSI MARKET, BY TYPE, 2015–2025 (THOUSAND UNITS)

TABLE 60 GLOBAL IOT CHIP BFSI MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: IOT CHIP BFSI MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 62 EUROPE: IOT CHIP BFSI MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 63 APAC: IOT CHIP BFSI MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 64 ROW: IOT CHIP BFSI MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 65 GLOBAL IOT CHIP AGRICULTURE MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 66 GLOBAL IOT CHIP AGRICULTURE MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 67 GLOBAL IOT CHIP AGRICULTURE MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: IOT CHIP AGRICULTURE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 69 EUROPE: IOT CHIP AGRICULTURE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 70 APAC: IOT CHIP AGRICULTURE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 71 ROW: IOT CHIP AGRICULTURE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 72 GLOBAL IOT CHIP RETAIL MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 73 GLOBAL IOT CHIP RETAIL MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 74 GLOBAL IOT CHIP RETAIL MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: IOT CHIP RETAIL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 76 EUROPE: IOT CHIP RETAIL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 77 APAC: IOT CHIP RETAIL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 78 ROW: IOT CHIP RETAIL MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 79 GLOBAL IOT CHIP OIL & GAS MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 80 GLOBAL IOT CHIP OIL & GAS MARKET, BY TYPE, 2015–2025 (MILLION UNITS)

TABLE 81 GLOBAL IOT CHIP OIL & GAS MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: IOT CHIP OIL & GAS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 83 EUROPE: IOT CHIP OIL & GAS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 84 APAC: IOT CHIP OIL & GAS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 85 ROW: IOT CHIP OIL & GAS MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 86 GLOBAL IOT CHIP AEROSPACE & DEFENSE MARKET, BY HARDWARE, 2015–2025 (MILLION UNITS)

TABLE 87 GLOBAL IOT CHIP AEROSPACE & DEFENSE MARKET, BY TYPE, 2015–2025 (THOUSAND UNITS)

TABLE 88 GLOBAL IOT CHIP AEROSPACE & DEFENSE MARKET, BY TYPE, 2015–2025 (USD MILLION)

TABLE 89 NORTH AMERICA: IOT CHIP AEROSPACE & DEFENSE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 90 EUROPE: IOT CHIP AEROSPACE & DEFENSE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 91 APAC: IOT CHIP AEROSPACE & DEFENSE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 92 ROW: IOT CHIP AEROSPACE & DEFENSE MARKET, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 93 IOT CHIP MARKET, BY POWER CONSUMPTION, 2015–2025 (MILLION UNITS)

TABLE 94 IOT CHIP MARKET, BY REGION, 2015–2025 (USD BILLION)

TABLE 95 IOT CHIP MARKET IN NORTH AMERICA, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 96 IOT CHIP MARKET IN NORTH AMERICA, BY END-USE APPLICATION, 2015–2025 (USD MILLION)

TABLE 97 IOT CHIP MARKET IN EUROPE, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY END-USE APPLICATION, 2015–2025 (USD MILLION)

TABLE 99 MARKET IN APAC, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 100 MARKET IN APAC, BY END-USE APPLICATION, 2015–2025 (USD MILLION)

TABLE 101 MARKET IN ROW, BY COUNTRY, 2015–2025 (USD MILLION)

TABLE 102 MARKET IN ROW, BY END-USE APPLICATION, 2015–2025 (USD MILLION)

TABLE 103 10 MOST RECENT PRODUCT LAUNCHES IN IOT CHIP MARKET

TABLE 104 10 MOST RECENT PARTNERSHIPS, COLLABORATIONS, ACQUISITIONS, AND AGREEMENTS IN IOT CHIP MARKET

LIST OF FIGURES (73 FIGURES)

FIGURE 1 IOT CHIP MARKET: SEGMENTATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

FIGURE 4 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

FIGURE 5 DATA TRIANGULATION

FIGURE 6 ASSUMPTIONS OF RESEARCH STUDY

FIGURE 7 PROCESSORS TO HOLD MAJOR SHARE OF IOT CHIP MARKET, 2020–2025

FIGURE 8 AEROSPACE & DEFENSE TO BE FASTEST-GROWING VERTICAL IN END-USE APPLICATIONS, 2020–2025

FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF IOT CHIP MARKET, 2019

FIGURE 10 INCREASED GOVERNMENT FUNDING FOR R&D RELATED TO IOT AND INTEGRATION OF CONNECTIVITY CAPABILITIES IN DEVICES PROPEL MARKET GROWTH

FIGURE 11 DEVICES WITH POWER CONSUMPTION BETWEEN 5 AND 10 W TO GROW AT HIGHEST CAGR, 2020–2025

FIGURE 12 CONSUMER ELECTRONICS HELD LARGEST SHARE OF IOT CHIP MARKET, 2019

FIGURE 13 APAC TO GROW AT HIGHEST CAGR, 2020–2025

FIGURE 14 IOT CHIP MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 15 MARKET DRIVERS AND THEIR IMPACT

FIGURE 16 NUMBER OF INTERNET USERS AS OF MARCH 2020, BY REGION

FIGURE 17 INTERNET PENETRATION RATE AS OF MARCH 2020, BY REGION

FIGURE 18 MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 19 MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 20 SMART CITY ECOSYSTEM

FIGURE 21 KEY SMART CITY PROJECTS WORLDWIDE

FIGURE 22 CROSS-DOMAIN COLLABORATIONS USING IOT

FIGURE 23 MARKET CHALLENGES AND THEIR IMPACT

FIGURE 24 VALUE CHAIN ANALYSIS OF IOT ECOSYSTEM: SEMICONDUCTOR PROVIDERS AND CONNECTIVITY PROVIDERS ADD MAXIMUM VALUE

FIGURE 25 MARKET, BY HARDWARE

FIGURE 26 PROCESSOR SEGMENT HELD LARGEST MARKET SHARE IN TERMS OF SHIPMENT, 2019

FIGURE 27 PMIC SEGMENT HELD LARGEST MARKET SHARE FOR PROCESSOR TYPE, 2019

FIGURE 28 CONSUMER ELECTRONICS HELD LARGEST MARKET SHARE, IN TERMS OF, VOLUME, FOR PROCESSOR, 2019

FIGURE 29 IOT CHIP FLOW SENSOR MARKET TO GROW AT HIGHEST CAGR, 2020–2025

FIGURE 30 BUILDING AUTOMATION TO BE LARGEST CONSUMER OF SENSORS, 2020–2025

FIGURE 31 WIRELESS CONNECTIVITY TECHNOLOGY SEGMENT HELD LARGEST MARKET SHARE FOR CONNECTIVITY IC, IN TERMS OF VOLUME, 2019

FIGURE 32 FOUNDATION FIELDBUS SHIPMENT TO GROW AT HIGHEST CAGR, 2020–2025

FIGURE 33 KEY WI-FI-ENABLED IOT DEVICES

FIGURE 34 WIFI TO HOLD LARGEST SHARE, IN TERMS OF VOLUME, IN CONNECTIVITY IC MARKET, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2020–2025

FIGURE 35 ON-CHIP MEMORY DEVICES SEGMENT TO HAVE HIGHEST SHIPMENT, 2020–2025

FIGURE 36 IOT CHIP MARKET, BY END-USE APPLICATION

FIGURE 37 CONSUMER ELECTRONICS MARKET TO DOMINATE MARKET, 2020–2025

FIGURE 38 LOGIC DEVICE TO WITNESS HIGHEST GROWTH RATE IN IOT CHIP WEARABLE DEVICES MARKET, 2020–2025

FIGURE 39 CONTINUOUS GLUCOSE MONITOR TO WITNESS HIGHEST CAGR IN HEALTHCARE MARKET, 2020–2025

FIGURE 40 US TO LEAD NORTH AMERICAN IOT CHIP CONSUMER ELECTRONICS MARKET, 2020–2025

FIGURE 41 SENSOR TO LEAD IOT CHIP BUILDING AUTOMATION MARKET, 2020–2025

FIGURE 42 US TO LEAD NORTH AMERICAN IOT CHIP INDUSTRIAL MARKET, 2020–2025

FIGURE 43 SENSOR TO GROW AT HIGHEST CAGR IN IOT CHIP AUTOMOTIVE & TRANSPORTATION MARKET, 2020–2025

FIGURE 44 CHINA TO LEAD APAC’S IOT CHIP AGRICULTURE MARKET, 2020–2025

FIGURE 45 PROCESSOR TO GROW AT HIGHEST CAGR IN IOT CHIP RETAIL MARKET, 2020–2025

FIGURE 46 US TO DOMINATE NORTH AMERICAN IOT CHIP OIL & GAS MARKET, 2020–2025

FIGURE 47 DEVICES WITH 1–3 W TO ACCOUNT FOR LARGEST SHARE, 2020

FIGURE 48 IMPROVING IOT ECOSYSTEM IN CHINA AND INDIA TO BOOST IOT CHIP MARKET IN APAC

FIGURE 49 NORTH AMERICA MARKET SNAPSHOT: INCREASED SPENDING IN R&D FOR DEVELOPMENT OF IOT FRAMEWORK TO BOOST MARKET GROWTH

FIGURE 50 EUROPE MARKET SNAPSHOT: GOVERNMENT INITIATIVES FOR DEVELOPMENT IN IOT TO DRIVE MARKET GROWTH

FIGURE 51 APAC MARKET SNAPSHOT: GOVERNMENT FUNDING AND PROGRAMS TO DRIVE MARKET

FIGURE 52 ROW MARKET SNAPSHOT: INCREASING DEVELOPMENT OF IOT TO DRIVE MARKET GROWTH

FIGURE 53 KEY GROWTH STRATEGIES, 2017–2020

FIGURE 54 MARKET EVALUATION FRAMEWORK, 2016–2020

FIGURE 55 TOP 5 PLAYERS IN IOT CHIP MARKET

FIGURE 56 COMPANY EVALUATION MATRIX, 2019

FIGURE 57 INTEL CORPORATION: COMPANY SNAPSHOT

FIGURE 58 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

FIGURE 59 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

FIGURE 60 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

FIGURE 61 MEDIATEK INC.: COMPANY SNAPSHOT

FIGURE 62 MARVELL TECHNOLOGY GROUP: COMPANY SNAPSHOT

FIGURE 63 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

FIGURE 64 CYPRESS SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 65 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 66 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

FIGURE 67 NVIDIA CORPORATION: COMPANY SNAPSHOT

FIGURE 68 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 69 ADVANCED MICRO DEVICES (AMD): COMPANY SNAPSHOT

FIGURE 70 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

FIGURE 71 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

FIGURE 72 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

FIGURE 73 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

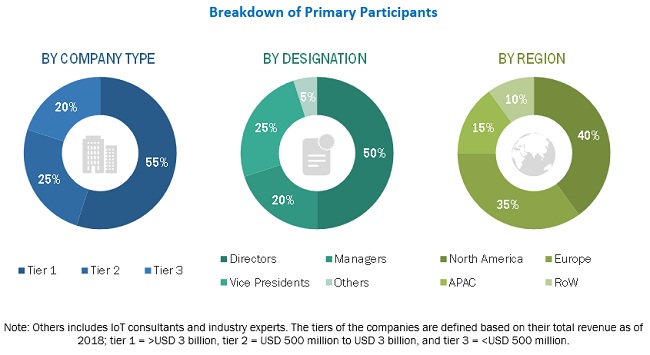

The study involved 4 major activities in estimating the current size of the IoT chip market. Exhaustive secondary research was conducted to collect information about the market, the peer markets, and the parent market. Validating the findings, assumptions, and sizing with industry experts through primary research was the next step. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the IoT chip market begins with capturing data on revenues of the key vendors in the market through secondary research. In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been carried out to mainly obtain critical information about the industry’s supply chain, value chain, total pool of key players, and market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the IoT chip market. Primary sources from the demand side include chief information officers, technicians and technologists, and purchase managers of hardware components used in IoT, such as sensors and gateways.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the IoT chip market and various other dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that influence the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures in the next section show the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size through the processes explained in the earlier sections, the total IoT chip market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Moreover, the market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe, segment, and forecast the IoT chip market, by hardware, by end-use application, by power consumption, and by region in terms of value

- To describe and forecast the market for various segments, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the growth of the IoT chip market

- To analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall IoT chip market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the IoT chip market and provide details of the competitive landscape for the market leaders

- To profile key players in the IoT chip market and comprehensively analyze their market ranking in terms of revenues, shares, and core competencies

- To analyze growth strategies, such as product launches and developments, acquisitions, partnerships, collaborations, and agreements, adopted by the major players in the IoT chip market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the IoT chip market report.

- Product matrix, which gives a detailed comparison of product portfolio of each company

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in IoT Chip Market