Wearable Payment Device Market Size, Share & Industry Trends Growth Analysis Report by Device Type (Smart Watches, Fitness Trackers), Technology (NFC, RFID), Sales Channel, Application (Retail/Grocery Stores, Restaurants, Entertainment Centers), and Geography - Global Growth Driver and Industry Forecast

Updated on : Oct 22, 2024

Wearable Payment Device Market Size & Growth

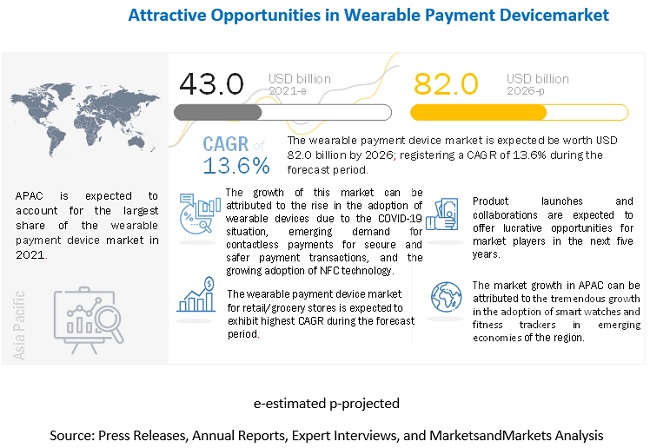

The growth of the wearable payment device market is majorly driven by surge in the adoption of contactless cards and wearable devices due to the COVID-19 situation, emerging demand for contactless payment for secure and safer payment transactions, and the growing adoption of NFC technology.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Wearable Payment Device Market

The market was not severely impacted by the COVID-19 pandemic. The demand for wearable devices has been boosted due to the rise in health concerns post-COVID-19.

The current pandemic has highlighted the importance and usefulness of wearable devices. Users are adopting wearable devices to measure, monitor, and continuously assess personal health regularly. The pandemic has also raised awareness toward the adoption of contactless payments.

It has accelerated the shift from cash to digital options through smartphones and wearable payment devices, due to the risk of contamination. Contactless payments have emerged as an essential solution for all businesses as they help them to drive their business forward along with ensuring safety to combat the coronavirus pandemic.

Wearable Payment Devices Market Share

Indirect Sales Channel expected to contribute the largest share to the market

Indirect sales channels or third parties hold a major share of the market as these channels are mainly adopted by wearable payment device providers to offer their devices to different end users.

Most key players in the market have well-established sales networks and provide their products globally. At present, in the wearable device market, the contactless payment function is mostly adopted by smart watches. Major companies in this market such as Apple, Samsung, Fitbit, Garmin, and others, rely on indirect sales channels for revenue generation. Besides, the ongoing COVID-19 scenario, globally, has created a shift in consumer behavior, as they are now preferring contact-less shopping experience and practicing social distancing.

Customers also prefer purchasing consumer electronics such as smartphones and wearable devices through third-party providers considering the periodic discounts and offers offered by online shopping websites.

Retail and grocery stores segment expected to lead the wearable payment devices market in 2020

Consumers have been using contactless payment through wearable devices for billing in retail and grocery stores, as they are convenient and allow the consumers to keep a record of their transactions.

Besides, with the ongoing COVID-19 pandemic, consumers are increasingly veering away from handling cash due to the fear of spreading the disease. Also, several retailers across the world are investing in contactless payment technologies to keep customers safe. Thus, the market for retail and grocery stores is expected to grow at the highest rate during the forecast period.

Wearable Payment Device Market Regional Analysis

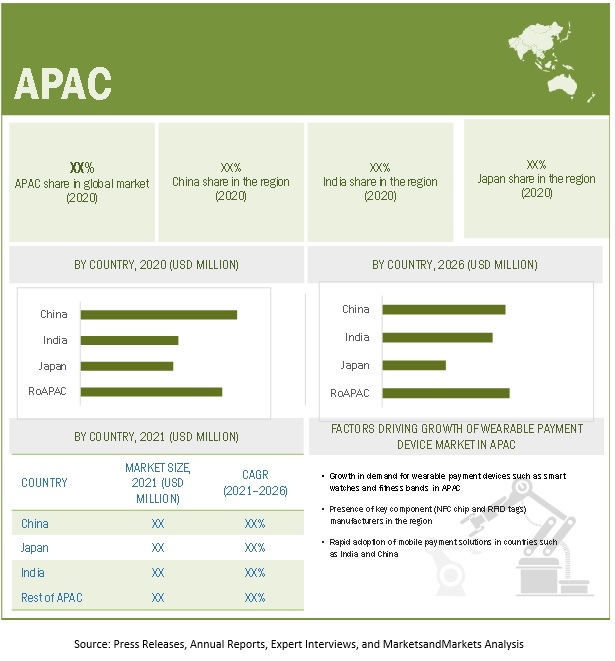

Wearable payment devices market in APAC contributed the largest share.

APAC accounted for the largest share of the market in 2020. The region has the presence of prominent players of wearable devices.

The manufacturers in China and India offer wearable devices at a low price, making them affordable for customers. Many international players get their wearable devices manufactured and assembled by local manufacturers based in the region and then brand their names.

The region holds many highly populated countries, which account for the high adoption rate of consumer electronics. The ongoing COVID-19 pandemic has accelerated the rise of the digital economy, particularly contactless payments. This, in turn, is expected to increase the demand for wearable payment devices in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Top Wearable Payment Device Companies - Key Market Players

The wearable payment device players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, and acquisitions to strengthen their offerings in the market.

- Apple Inc. (US)

- Samsung Electronics Co., Ltd. (South Korea),

- Fitbit Inc. (US),

- Garmin AB (Switzerland),

- Xiaomi Corporation (China) ,

- Google LLC (US),

- Tappy Technologies Ltd. (US),

- Barclays PLC (UK),

- VISA Inc. (US),

- PayPal Holding Inc. (US), and

- Mastercard, Inc. (US) are some of the major players in market.

The study includes an in-depth competitive analysis of these key players in the wearable payment devicemarket with their company profiles, recent developments, and key market strategies.

Wearable Payment Device Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 43.0 billion in 2021 |

|

Projected Market Size |

USD 82.0 billion by 2026 |

|

Wearable Payment Devices Market Growth rate |

CAGR of 13.6% |

|

Years Considered |

2017–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD million and USD billion), Volume (Million Units) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Top Wearable Payment Device Companies Covered |

|

| Key Market Driver | Growing inclination toward contactless payment methods due to hygiene concerns amid COVID-19 |

| Key Market Opportunity | Increasing adoption of advanced technologies, such as NFC, RFID, and host card emulation, in wearable payment devices |

| Largest Growing Region | APAC |

| Largest Market Share Segment | Indirect Sales Channel |

| Highest CAGR Segment | Wearable Payment Device |

Wearable Payment Device Market Dynamics

Driver: Growing inclination toward contactless payment methods due to hygiene concerns amid COVID-19

Wearable payment includes payment transactions carried out through wearable devices integrated with wireless technologies such as NFC and RFID.

Wearable payment devices not only offer customers a convenient and contactless mode of payment but also ensure safety and hygiene, especially after the outbreak of COVID-19. Due to the spread of COVID-19, customers prefer doing cashless transactions for hygiene reasons. For instance, Mastercard witnessed a surge of 40% in contactless payments in the first quarter of 2020. Likewise, 60% of VISA users who live outside the US have also used tap-to-pay technology for contactless payments.

Therefore, several financial institutions, banks, and payment service providers have started accepting the digital payment agenda; however, to ensure customer satisfaction, they have to apply stronger security measures to these payment devices.

Restraint: Battery drain issues in wearable payment devices

It is essential to regularly recharge the device to ensure its smooth operation; if the device gets discharged, it immediately disengages the user. This may lead to the inadequacy of data or missing data cluster, which, in turn, affects the payment process.

With improved technologies and form factors, wearable payment devices are getting smaller than ever, which creates the need for small-sized batteries to power payment functionality. Moreover, when a wearable device is powered by advanced operating systems, it requires a high battery backup to ensure uninterrupted performance. However, the direct connectivity of the device to the cellular network can quickly drain the battery of wearable devices. It may have an adverse impact on battery life.

Opportunity: Increasing adoption of advanced technologies, such as NFC, RFID, and host card emulation, in wearable payment devices

NFC, RFID, and host card emulation (HCE) technologies are integral parts of different wearable and contactless payment devices.

Many wearable device manufacturers such as Apple, Samsung, and Huawei are integrating NFC and RFID technologies into their wearable devices and payment platforms, thereby offering lucrative opportunities for the growth of the wearable payment devices market.

Similarly, market players are adopting host card emulation technologies for providing customers easy access to any products by displaying product information on their smart devices.

Challenge: Security concerns related to wearable payment devices

Wearable devices interact with several elements in the ecosystem on a wider scale, which includes internet services, multiple devices such as embedded chips, mobile apps, computing apps, and many others.

Wearables payment devices have become ubiquitous in grocery stores, restaurants, hospitals/pharmacies, and entertainment centers due to their convenience, fast transaction speed, along with their ability to capture and analyze complex data in real time. However, companies using wearable payment devices are putting themselves at the risk of a data breach.

The interconnectivity of devices and the use of cellular networks make them vulnerable to attacks. However, wearable payment device companies can resolve these security-related challenges in a short span of time by updating their software and devices.

Wearable Payment Device Market Report Categorization

In this report, the overall market has been segmented based on device type, technology, sales channel, application, and region

Wearable Payment Devices Market, By Device Type:

- Smart Watches

- Fitness Trackers

- Payment Wristbands

- Smart Rings

Market, By Technology

- Near Field Communication Technology (NFC)

- Radio Frequency Identification (RFID)

- QR & Barcode

Market, By Sales Channel

- Direct Sales

- Indirect Sales

Market, By Application

- Retail/Grocery Stores

- Restaurants

- Hospitals/Pharmacies

- Entertainment Centers

- Others

Wearable Payment Device Market Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Rest of Europe)

- Asia Pacific (China, Japan, India, and Rest of APAC)

- Rest of the World (South America and Middle East & Africa)

Recent Developments in Wearable Payment Device Industry

- In January 2021, Google LLC has acquired Fitbit Inc. to enter the wearable payment devices market, for USD 2.1 billion in an all-cash deal. This acquisition is a move that could shore up the internet giant’s hardware business while increasing antitrust scrutiny.

- In September 2020, Apple Inc. launched Apple Watch Series 6 and Apple Watch SE, two iPad models, the first fitness experience built for Apple Watch that brings significant developments in health and wellness features to iPhone, iPad, and Apple TV. Apple Watch Series 6 expanded the health capabilities of previous Apple Watch models with a new feature that measures the oxygen saturation of blood for a better understanding of fitness and wellness, as well as enables payment through Apple Pay.

Frequently Asked Questions (FAQ):

What is the market size of wearable payment devicemarket expected in 2020?

The Wearable payment devicemarket is expected to be valued USD 82 billion by 2026.

Which are the top players in the wearable payment devicemarket?

The major vendors operating in the wearable payment device market include Apple, Samsung Electronics, Fitbit, Garmin, and Xiaomi and among others.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries.

Which are the major application of wearable payment devices?

Reatil and grocery stores, and restuarants are major adopters of wearable payment device.

Does this report include the impact of COVID-19 on the market?

Yes, the report includes the impact of COVID-19 on the Wearable payment devicemarket. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side):

FIGURE 2 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market share by top-down analysis (supply side):

FIGURE 3 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY FOR WEARABLE PAYMENT DEVICE MARKET THROUGH SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 1 MARKET, IN TERMS OF VALUE AND VOLUME, 2017–2020

TABLE 2 MARKET, IN TERMS OF VALUE AND VOLUME, 2021–2026

FIGURE 6 EFFECT OF COVID-19 ON MARKET

3.1 POST-COVID-19 SCENARIO

TABLE 3 POST-COVID-19 SCENARIO: WEARABLE PAYMENT DEVICE MARKET

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 4 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 5 PESSIMISTIC SCENARIO (POST-COVID-19): WEARABLE PAYMENT DEVICE MARKET

FIGURE 7 SMART WATCHES TO LEAD MARKET, BY DEVICE TYPE, FROM 2021 TO 2026

FIGURE 8 NFC TECHNOLOGY TO HOLD LARGEST SIZE OF MARKET IN 2026

FIGURE 9 MARKET FOR RETAIL/GROCERY STORES EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 10 MARKET IN APAC EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 OPPORTUNITIES IN WEARABLE PAYMENT DEVICE

FIGURE 11 ATTRACTIVE OPPORTUNITIES IN MARKET FROM 2021 TO 2026

4.2 MARKET, BY DEVICE TYPE

FIGURE 12 SMART WATCH SEGMENT HELD LARGEST SHARE OF MARKET IN 2021

4.3 MARKET IN APAC, BY APPLICATION AND COUNTRY, 2026

FIGURE 13 RETAIL/GROCERY STORES AND CHINA EXPECTED TO BE LARGEST SHAREHOLDERS OF MARKET IN APAC IN 2026

4.4 MARKET, BY APPLICATION

FIGURE 14 RETAIL/GROCERY STORES EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 MARKET, BY COUNTRY

FIGURE 15 MARKET IN INDIA EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing inclination toward contactless payment methods due to hygiene concerns amid COVID-19

5.2.1.2 Surging adoption of secure and advanced technology-based digital payment solutions

5.2.1.3 Increasing focus of wearable technology providers on offering enhanced customer services with mobile applications

5.2.1.4 Escalating use of NFC technology in wearable devices

5.2.1.5 Rising demand for wearable electronic devices, which, in turn, would propel growth of wearable payment devices

FIGURE 17 GLOBAL SHIPMENT OF WEARABLE DEVICES, 2017–2020 (MILLION UNITS)

FIGURE 18 IMPACT OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 Battery drain issues in wearable payment devices

5.2.2.2 Shorter life cycle of consumer electronics

FIGURE 19 IMPACT OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of advanced technologies, such as NFC, RFID, and host card emulation, in wearable payment devices

FIGURE 20 IMPACT OF OPPORTUNITY ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Security concerns related to wearable payment devices

FIGURE 21 IMPACT OF CHALLENGE ON MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS OF WEARABLE PAYMENT DEVICE ECOSYSTEM

5.4 ECOSYSTEM ANALYSIS

TABLE 6 ECOSYSTEM: WEARABLE PAYMENT DEVICES

FIGURE 23 YC-YCC SHIFT: WEARABLE PAYMENT DEVICES

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 IMPACT OF EACH FORCE ON MARKET (2020)

5.6 CASE STUDY ANALYSIS

TABLE 8 PARTNERSHIP BETWEEN TITAN AND SBI TO ADOPT TAPPY TECH’S WEARABLE PAYMENT TECHNOLOGY FOR CONTACTLESS PAYMENTS THROUGH SMART WATCHES

TABLE 9 COLLABORATION BETWEEN BANK OF AMERICA AND FITPAY TO SPEED UP WEARABLE PAYMENTS

5.7 TECHNOLOGY ANALYSIS

5.7.1 GROWING POPULARITY OF IOT AND CONNECTED DEVICES

5.7.2 RISING FOCUS ON IMPLEMENTING ARTIFICIAL INTELLIGENCE IN WEARABLES

5.7.3 SURGING REQUIREMENT TO IMPROVE PERFORMANCE OF WEARABLE PAYMENT DEVICES BY ADDING 5G TECHNOLOGY

5.8 PRICING ANALYSIS

TABLE 10 AVERAGE SELLING PRICES OF WEARABLE PAYMENT DEVICE TYPES, 2020

TABLE 11 AVERAGE SELLING PRICES OF SMART WATCHES OFFERED BY TOP COMPANIES, 2020

TABLE 12 AVERAGE SELLING PRICES OF FITNESS TRACKERS OFFERED BY TOP COMPANIES, 2020

TABLE 13 AVERAGE SELLING PRICES OF PAYMENT WRISTBANDS OFFERED BY TOP COMPANIES, 2020

TABLE 14 AVERAGE SELLING PRICES OF SMART RINGS OFFERED BY TOP COMPANIES, 2020

FIGURE 24 AVERAGE SELLING PRICES OF WEARABLE PAYMENT DEVICES, 2020–2026

5.9 TRADE ANALYSIS

TABLE 15 IMPORT DATA, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 16 EXPORT DATA, 2015–2019 (USD MILLION)

5.10 PATENT ANALYSIS

TABLE 17 PATENTS IN WEARABLE PAYMENT DEVICE MARKET

5.11 TARIFF & REGULATORY LANDSCAPE

5.11.1 TARIFF LANDSCAPE

TABLE 18 TARIFF DATA FOR WRIST WATCHES FOR CHINA, BY COUNTRY, 2020

TABLE 19 TARIFF DATA FOR WRIST WATCHES FOR US, BY COUNTRY, 2020

TABLE 20 TARIFF DATA FOR WRIST WATCHES FOR GERMANY, BY COUNTRY, 2020

5.11.2 REGULATORY LANDSCAPE

6 WEARABLE PAYMENT DEVICE MARKET, BY DEVICE TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 25 MARKET, BY DEVICE TYPE

FIGURE 26 SMART WATCHES TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

6.2 SMART WATCHES

6.2.1 SMART WATCHES ARE MOST POPULAR WEARABLE PAYMENT DEVICES

TABLE 23 SMART WATCH MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 24 SMART WATCH MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 25 SMART WATCH MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 26 SMART WATCH MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 27 SMART WATCH MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 28 SMART WATCH MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 29 SMART WATCH MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 SMART WATCH MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 FITNESS TRACKERS

6.3.1 PAYMENT FUNCTIONS ARE INTEGRATED INTO FITNESS TRACKERS TO INNOVATE DEVICES AND ENHANCE CUSTOMERS’ CONVENIENCE

TABLE 31 FITNESS TRACKER MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 32 FITNESS TRACKER MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 33 FITNESS TRACKER MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 34 FITNESS TRACKER MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 35 FITNESS TRACKER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 36 FITNESS TRACKER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 37 FITNESS TRACKER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 FITNESS TRACKER MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 PAYMENT WRISTBANDS

6.4.1 PAYMENT WRISTBANDS ARE WIDELY USED FOR CLOSED-LOOP PAYMENTS

TABLE 39 PAYMENT WRISTBAND MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 40 PAYMENT WRISTBAND MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 41 PAYMENT WRISTBAND MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 42 PAYMENT WRISTBAND MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 43 PAYMENT WRISTBAND MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 44 PAYMENT WRISTBAND MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 45 PAYMENT WRISTBAND MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 PAYMENT WRISTBAND MARKET, BY REGION, BY REGION, 2021–2026 (USD MILLION)

6.5 SMART RINGS

6.5.1 SMART RINGS ALLOW CUSTOMERS TO PAY FOR SMALL PURCHASES

TABLE 47 SMART RING MARKET, BY TECHNOLOGY, 2017–2020 (USD THOUSAND)

TABLE 48 SMART RING MARKET, BY TECHNOLOGY, 2021–2026 (USD THOUSAND)

TABLE 49 SMART RING MARKET, BY SALES CHANNEL, 2017–2020 (USD THOUSAND)

TABLE 50 SMART RING MARKET, BY SALES CHANNEL, 2021–2026 (USD THOUSAND)

TABLE 51 SMART RING MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 52 SMART RING MARKET, BY APPLICATION, 2021–2026 (USD THOUSAND)

TABLE 53 SMART RING MARKET, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 54 SMART RING MARKET, BY REGION, BY REGION, 2021–2026 (USD THOUSAND)

7 WEARABLE PAYMENT DEVICE MARKET, BY TECHNOLOGY (Page No. - 89)

7.1 INTRODUCTION

FIGURE 27 MARKET, BY TECHNOLOGY

FIGURE 28 MARKET FOR NFC TECHNOLOGY SEGMENT EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 55 MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 56 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 NFC (NEAR FIELD COMMUNICATIONS)

7.2.1 MOST OF WEARABLE PAYMENT DEVICES ARE INTEGRATED WITH NFC TECHNOLOGY TO ENABLE PAYMENT FUNCTIONS

TABLE 57 NFC TECHNOLOGY: MARKET, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 58 NFC TECHNOLOGY: MARKET, BY DEVICE TYPE, 2021–2026 (USD MILLION)

7.3 RFID (RADIO FREQUENCY IDENTIFICATION)

7.3.1 CONTACTLESS TRANSACTIONS ENABLED BY RFID TECHNOLOGY ARE FASTER, CONVENIENT, AND MORE SECURE

TABLE 59 RFID TECHNOLOGY: MARKET, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 60 RFID TECHNOLOGY: MARKET, BY DEVICE TYPE, 2021–2026 (USD MILLION)

7.4 QR & BARCODES

7.4.1 QR & BARCODE TECHNOLOGY HAS BEEN ADOPTED IN FITNESS TRACKERS TO ENABLE PAYMENT FUNCTIONS

TABLE 61 QR & BARCODES TECHNOLOGY: MARKET, BY DEVICE TYPE, 2017–2020 (USD THOUSAND)

TABLE 62 QR & BARCODES: MARKET, BY DEVICE TYPE, 2021–2026 (USD THOUSAND)

8 WEARABLE PAYMENT DEVICE MARKET, BY SALES CHANNEL (Page No. - 96)

8.1 INTRODUCTION

FIGURE 29 MARKET, BY SALES CHANNEL

FIGURE 30 INDIRECT SALE CHANNEL TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

8.2 DIRECT SALES CHANNEL

8.2.1 MAJOR PLAYERS IN MARKET OFFER THEIR WEARABLE PAYMENT DEVICES THROUGH THEIR ONLINE AND OFFLINE STORES

TABLE 65 MARKET FOR DIRECT SALES CHANNEL, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR DIRECT SALES CHANNEL, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 67 MARKET FOR DIRECT SALES CHANNEL, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR DIRECT SALES CHANNEL, BY REGION, 2021–2026 (USD MILLION)

8.3 INDIRECT SALES CHANNEL

8.3.1 INDIRECT SALES IS MOST PREFERRED BY WEARABLE DEVICE PROVIDERS, GLOBALLY

TABLE 69 MARKET FOR INDIRECT SALES CHANNEL, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR INDIRECT SALES CHANNEL, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 71 MARKET FOR INDIRECT SALES CHANNEL, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR INDIRECT SALES CHANNEL, BY REGION, 2021–2026 (USD MILLION)

9 WEARABLE PAYMENT DEVICE MARKET, BY APPLICATION (Page No. - 103)

9.1 INTRODUCTION

9.2 IMPACT OF COVID-19 ON APPLICATIONS OF MARKET

FIGURE 31 MARKET, BY APPLICATION

FIGURE 32 MARKET FOR RETAIL/GROCERY STORES EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

9.3 RETAIL/GROCERY STORES

9.3.1 COVID-19 PANDEMIC HAS INCREASED ADOPTION OF WEARABLE PAYMENT DEVICES IN GROCERY STORES

TABLE 75 MARKET FOR RETAIL/GROCERY STORES, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR RETAIL/GROCERY STORES, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR RETAIL/GROCERY STORES, BY REGION, 2017–2020 (USD MILLION)

FIGURE 33 APAC EXPECTED TO LEAD MARKET FOR RETAIL/GROCERY STORES FROM 2021 TO 2026

TABLE 78 MARKET FOR RETAIL/GROCERY STORES, BY REGION, 2021–2026 (USD MILLION)

9.4 RESTAURANTS

9.4.1 NFC-ENABLED WEARABLE DEVICES TO ENHANCE CUSTOMER EXPERIENCE IN RESTAURANTS

TABLE 79 MARKET FOR RESTAURANTS, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR RESTAURANTS, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR RESTAURANTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR RESTAURANTS, BY REGION, 2021–2026 (USD MILLION)

9.5 HOSPITALS/PHARMACIES

9.5.1 SECURE, SIMPLE, AND EFFICIENT PAYMENT METHODS DRIVING GROWTH OF WEARABLE PAYMENT DEVICES

TABLE 83 MARKET FOR HOSPITALS/PHARMACIES, BY DEVICE TYPE, 2017–2020 (USD MILLION)

FIGURE 34 MARKET FOR SMART WATCHES TO HOLD LARGEST SHARE IN HOSPITALS/PHARMACIES FROM 2021 TO 2026

TABLE 84 MARKET FOR HOSPITALS/PHARMACIES, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR HOSPITALS/PHARMACIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR HOSPITALS/PHARMACIES, BY REGION, 2021–2026 (USD MILLION)

9.6 ENTERTAINMENT CENTERS

9.6.1 PAYMENT WRISTBANDS TO ENHANCE CUSTOMER EXPERIENCE POST-PANDEMIC

TABLE 87 MARKET FOR ENTERTAINMENT CENTERS, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR ENTERTAINMENT CENTERS, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR ENTERTAINMENT CENTERS, BY REGION, 2017–2020(USD MILLION)

TABLE 90 MARKET FOR ENTERTAINMENT CENTERS, BY REGION, 2021–2026 (USD MILLION)

9.7 OTHERS

TABLE 91 WEARABLE PAYMENT DEVICE MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2017–2020 (USD THOUSAND)

TABLE 92 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2021–2026 (USD THOUSAND)

TABLE 93 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 35 APAC EXPECTED TO LEAD WEARABLE PAYMENT DEVICES MARKET FOR OTHER APPLICATIONS FROM 2021 TO 2026

TABLE 94 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 117)

10.1 INTRODUCTION

FIGURE 36 MARKET IN INDIA AND CHINA TO WITNESS SIGNIFICANT GROWTH FROM 2021 TO 2026

TABLE 95 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

10.2.1 US

10.2.1.1 Surging adoption of contactless payments and wearable device technologies

10.2.2 CANADA

10.2.2.1 Increasing use of consumer electronics to drive wearable payment device market in Canada

10.2.3 MEXICO

10.2.3.1 Rising adoption of wearable payment devices in hospitals/pharmacies

TABLE 97 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 101 MARKET IN NORTH AMERICA, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN NORTH AMERICA, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 103 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 UK

10.3.1.1 Wearable payment devices are being adopted to enhance customer satisfaction

10.3.2 GERMANY

10.3.2.1 Growing consumer adoption of wearable devices to define market growth

10.3.3 FRANCE

10.3.3.1 Surging demand for wearable electronic products, especially from country’s healthcare and consumer sectors

10.3.4 REST OF EUROPE

TABLE 105 WEARABLE PAYMENT DEVICE MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 MARKET IN EUROPE, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN EUROPE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN EUROPE, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN EUROPE, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 111 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 38 APAC: WEARABLE PAYMENT DEVICE MARKET SNAPSHOT

10.4.1 CHINA

10.4.1.1 China being innovation hub of consumer electronics driving growth of market

10.4.2 JAPAN

10.4.2.1 Technologically-advanced manufacturing industry to drive growth of market

10.4.3 INDIA

10.4.3.1 Market in India is primarily driven by increasing applications in consumer and healthcare sectors

10.4.4 REST OF APAC

TABLE 113 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN APAC, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN APAC, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN APAC, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN APAC, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

&nbsnbsp; TABLE 120 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

10.5 ROW

10.5.1 SOUTH AMERICA

10.5.1.1 Electronic payment systems have substantially improved over past several years in South America

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Adoption of contactless payment in MEA to drive market growth

TABLE 121 MARKET IN ROW, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 MARKET IN ROW, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 123 MARKET IN ROW, BY DEVICE TYPE, 2017–2020 (USD THOUSAND)

TABLE 124 MARKET IN ROW, BY DEVICE TYPE, 2021–2026 (USD THOUSAND)

TABLE 125 MARKET IN ROW, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 126 MARKET IN ROW, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 128 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 139)

11.1 INTRODUCTION

11.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 39 WEARABLE PAYMENT DEVICE MARKET: REVENUE ANALYSIS (2019)

11.3 MARKET SHARE ANALYSIS, 2020

TABLE 129 MARKET: MARKET SHARE ANALYSIS (2020)

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 40 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.4.5 MARKET: PRODUCT FOOTPRINT

TABLE 130 COMPANY FOOTPRINT

TABLE 131 APPLICATION FOOTPRINT OF COMPANIES

TABLE 132 REGIONAL FOOTPRINT OF COMPANIES

11.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2020

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 41 MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 MARKET: PRODUCT LAUNCHES, JANUARY 2018– FEBRUARY 2021

11.6.2 MARKET: DEALS, JANUARY 2018– Feb-21

12 COMPANY PROFILES (Page No. - 151)

12.1 INTRODUCTION

12.2 IMPACT OF COVID-19 ON PLAYERS OF MARKET

12.3 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.3.1 APPLE INC.

FIGURE 42 APPLE INC.: COMPANY SNAPSHOT

12.3.2 FITBIT, INC.

FIGURE 43 FITBIT, INC.: COMPANY SNAPSHOT

12.3.3 XIAOMI CORPORATION

FIGURE 44 XIAOMI: COMPANY SNAPSHOT

12.3.4 SAMSUNG ELECTRONIC CO., LTD.

FIGURE 45 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

12.3.5 GARMIN LTD.

FIGURE 46 GARMIN: COMPANY SNAPSHOT

12.3.6 GOOGLE LLC

FIGURE 47 GOOGLE LLC: COMPANY SNAPSHOT

12.3.7 TAPPY TECHNOLOGIES LTD.

12.3.8 BARCLAYS PLC

FIGURE 48 BARCLAYS PLC: COMPANY SNAPSHOT

12.3.9 VISA INC.

FIGURE 49 VISA INC.: COMPANY SNAPSHOT

12.3.10 PAYPAL HOLDING INC.

FIGURE 50 PAYPAL HOLDING INC.: COMPANY SNAPSHOT

12.3.11 MASTERCARD

FIGURE 51 MASTERCARD INC.: COMPANY SNAPSHOT

12.4 OTHER KEY PLAYERS

12.4.1 MICROSOFT CORPORATION

12.4.2 HUAWEI TECHNOLOGIES

12.4.3 SONY CORPORATION

12.4.4 THALES SA

12.4.5 WESTPAC

12.4.6 INTELLIGENT VENUE SOLUTIONS

12.4.7 CAXIA BANK

12.4.8 INTELLITIX

12.4.9 NYMI

12.4.10 MCLEAR LTD.

12.4.11 JAKCOM TECHNOLOGY CO.

12.4.12 TOKEN

12.4.13 INFINEON TECHNOLOGIES AG

12.4.14 PRINTPLAST

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 200)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

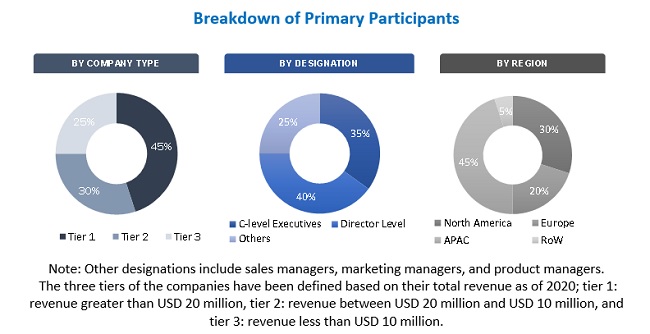

The study involves four major activities for estimating the size of the wearable payment device market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the wearable payment device industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the wearable payment device market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which have been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand and supply sides (Wearable payment device manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 20% of the primary interviews have been conducted with the demand side and 80% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the Wearable payment device market and other dependent submarkets listed in this report.

- The key players in the wearable payment device industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define and forecast the wearable payment device market size, by device type, technology, sales channel, and application, in terms of value and volume

- To describe and forecast the wearable payment device market size in four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the wearable payment device market

- To provide the detailed impact of COVID-19 on the wearable payment device market

- To provide the impact of COVID-19 on the market segments and the players operating in the wearable payment device market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the wearable payment device ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide details of the competitive landscape

- To analyze strategic approaches such as product launches, collaborations, contracts, acquisitions, agreements, expansions, and partnerships in the wearable payment device market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wearable Payment Device Market