Wetroom Waterproofing Solutions Market by Type (Fabric/Fleece Backed Sheet Membrane, Pre-Waterproofed Substrates, Shower Pan Liner), Raw material (Polyurethane, PVC, Polyurea, Acrylic, ABS, Polystyrene), Application, & Region - Global Forecast 2028

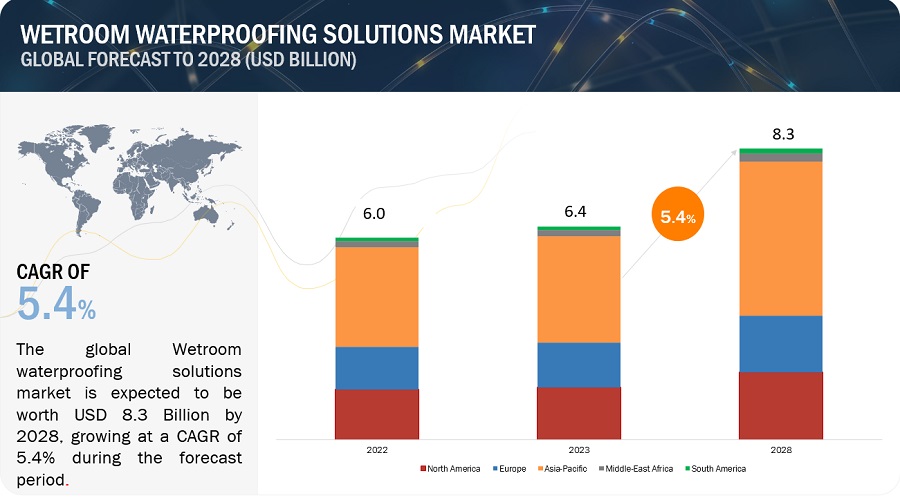

The global wetroom waterproofing solutions market is projected to reach USD 8.3 billion by 2028, at a CAGR of 5.4% from USD 6.4 billion in 2023. Growing demand for luxurious and functional wet spaces in residential and commercial settings, stringent regulations mandating waterproofing for moisture-prone areas, rising awareness about structural longevity, and the need to prevent water-related damages are key drivers propelling the wetroom waterproofing solutions market.

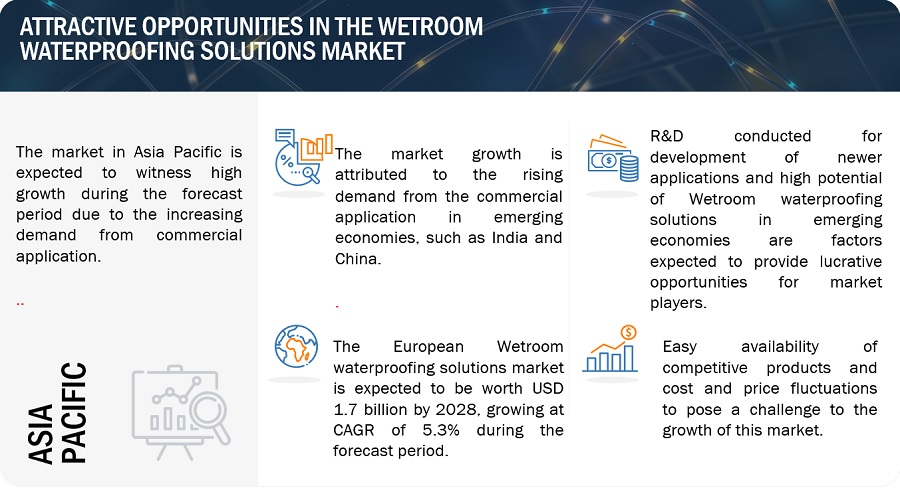

Attractive Opportunities in the Wetroom Waterproofing Solutions Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Wetroom Waterproofing Solutions Market Dynamics

Driver: Rise in construction activities

The rise in construction activities serves as a key driver in the wetroom waterproofing solutions market due to increased demand for durable, moisture-resistant solutions in new buildings and renovations. As construction escalates, particularly in urban areas, the need for effective waterproofing in wet spaces like bathrooms and pools becomes paramount to ensure long-term structural integrity and prevent costly water-related damages.

Restraint: Building regulations and approval challenges

Building regulations and approval challenges present a restraint in the wetroom waterproofing solutions market by creating compliance hurdles. Varying regulations across regions demand meticulous adherence, delaying project timelines and increasing costs. Navigating complex approval processes might be time-consuming and demanding, deterring seamless implementation of waterproofing solutions. This restraint adds intricacy to project planning and execution, impacting market growth as businesses must allocate additional resources to meet diverse regulatory requirements.

Opportunities: Rapid urbanization and infrastructure development

Rapid urbanization and infrastructure development offer a significant opportunity in the wetroom waterproofing solutions market. As cities expand and infrastructures evolve, there's an increased demand for modern amenities, including advanced wet spaces. This creates a burgeoning need for reliable waterproofing solutions to ensure the longevity of structures and prevent water-related damages. The growing emphasis on quality and durability aligns with the market's offerings, presenting a favorable environment for providers of wetroom waterproofing solutions to cater to expanding urban landscapes.

Challenges: High initial costs and technical complexity

High initial costs and technical complexity pose challenges in the wetroom waterproofing solutions market. Implementing quality waterproofing systems involves significant upfront investments in materials and skilled labor. Moreover, the intricate nature of application techniques demands specialized expertise. These factors may deter budget-conscious customers and create barriers for smaller businesses. Overcoming these challenges requires clear communication about long-term benefits, cost savings through prevention, and simplified solutions that address technical complexities while catering to diverse customer needs.

Wetroom Waterproofing Solutions Market: Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of wetroom waterproofing solutions. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Sika AG (Switzerland), BASF SE (Germany), Pidilite Industries Inc. (India), The Dow Chemical Company (US), Mapei Corporation (Italy).

Based on raw material, acrylic is projected to account for the second largest share of the wetroom waterproofing solutions market

Acrylic holds the second-largest share in the raw material segment of the wetroom waterproofing solutions market due to its balanced properties that make it suitable for various wetroom applications. Acrylic coatings and sealants provide effective waterproofing while offering good adhesion to a wide range of substrates, contributing to its popularity. Its ability to form a durable protective layer with decent flexibility and UV resistance makes it well-suited for outdoor and indoor applications alike. The cost-effectiveness and ease of application of acrylic-based products also contribute to their significant market presence, catering to both residential and commercial projects.

Based on type, pre-waterproofed substrates is projected to account for the second largest share of the wetroom waterproofing solutions market

Pre-waterproofed substrates capture the second-largest share in the wetroom waterproofing solutions market owing to their efficiency in simplifying the construction process and ensuring consistent quality. These substrates come equipped with factory-applied waterproofing layers, reducing the need for on-site application and accelerating project timelines. Their precision application minimizes the risk of errors, ensuring a reliable waterproofing barrier. This solution appeals to contractors seeking streamlined construction processes and developers aiming to mitigate risks associated with incorrect application. The convenience, time-saving advantages, and assurance of a well-executed waterproofing system contribute to the substantial adoption of pre-waterproofed substrates in the market.

Based on uses, refurbishment is projected to account for the second largest share of the wetroom waterproofing solutions market

Refurbishment claims the second-largest share in the uses segment of the wetroom waterproofing solutions market due to the growing emphasis on revitalizing existing structures. As older properties undergo renovations to meet modern standards and aesthetic preferences, the need for effective wetroom waterproofing solutions becomes evident. Refurbishing wet areas such as bathrooms, spas, and pool decks requires advanced waterproofing technologies to address deteriorated or outdated waterproofing systems. The cost-effectiveness of refurbishing over new construction, coupled with the ability to breathe new life into aging spaces, drives the substantial adoption of waterproofing solutions in refurbishment projects.

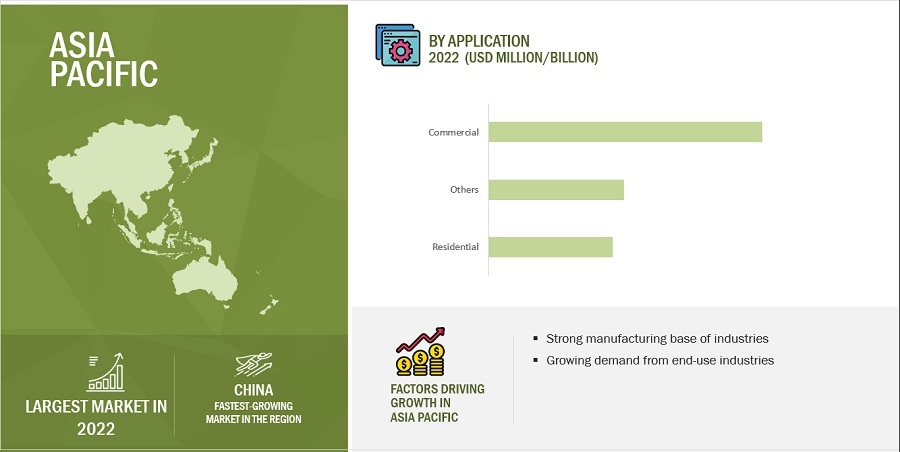

Based on application, commercial application to be the fastest-growing application segment of the wetroom waterproofing solutions market

The commercial sector is the fastest growing segment in the application segment of the wetroom waterproofing solutions market due to the widespread demand for robust waterproofing solutions in high-traffic public spaces. Commercial establishments such as hotels, resorts, restaurants, and fitness centers require effective wetroom protection to maintain both structural integrity and guest satisfaction. With constant foot traffic and extensive use of wet areas, the need for durable and reliable waterproofing solutions is paramount. Implementing these solutions ensures compliance with regulations, minimizes business disruptions caused by water-related issues, and enhances the longevity of infrastructure investments. As the commercial sector prioritizes customer experiences and facility longevity, it drives the adoption of wetroom waterproofing solutions to safeguard both reputation and assets.

Asia Pacific is expected to be the fastest growing market during the forecast period.

Asia Pacific is the fastest growing market for wetroom waterproofing solutions due to a combination of rapid urbanization, booming construction activities, and changing lifestyle preferences in the region. The surge in residential and commercial development, coupled with a rising demand for modern amenities and luxury spaces, propels the need for effective wetroom waterproofing. Additionally, the region's tropical climate necessitates robust protection against moisture-related damages. Increasing awareness about construction quality and longevity further fuels the adoption of waterproofing solutions. With a dynamic real estate landscape and a burgeoning hospitality sector, Asia Pacific stands as a pivotal market, representing significant growth opportunities for manufacturers and providers of wetroom waterproofing solutions.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The wetroom waterproofing solutions market is dominated by a few major players that have a wide regional presence. The key players in the wetroom waterproofing solutions market are Sika AG (Switzerland), BASF SE (Germany), Pidilite Industries Ltd. (India), The Dow Chemical Company (US), Mapei Corporation (Italy), Knauf Gypsum Pty Ltd. (Australia), Henry Company (US), Henkel Polybit (Germany), Laticrete International Inc. (US), Kemper System America, Inc. (US), Noble Company (US), Schluter Systems (Germany), Wedi (Germany). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the wetroom waterproofing solutions market.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2021-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Raw Material, Type, Uses, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Sika AG (Switzerland), BASF SE (Germany), Pidilite Industries Ltd. (India), The Dow Chemical Company (US), Mapei Corporation (Italy), Knauf Gypsum Pty Ltd. (Australia), Henry Company (US), Henkel Polybit (Germany), Laticrete International Inc. (US), Kemper System America, Inc. (US), Noble Company (US), Schluter Systems (Germany), Wedi (Germany) |

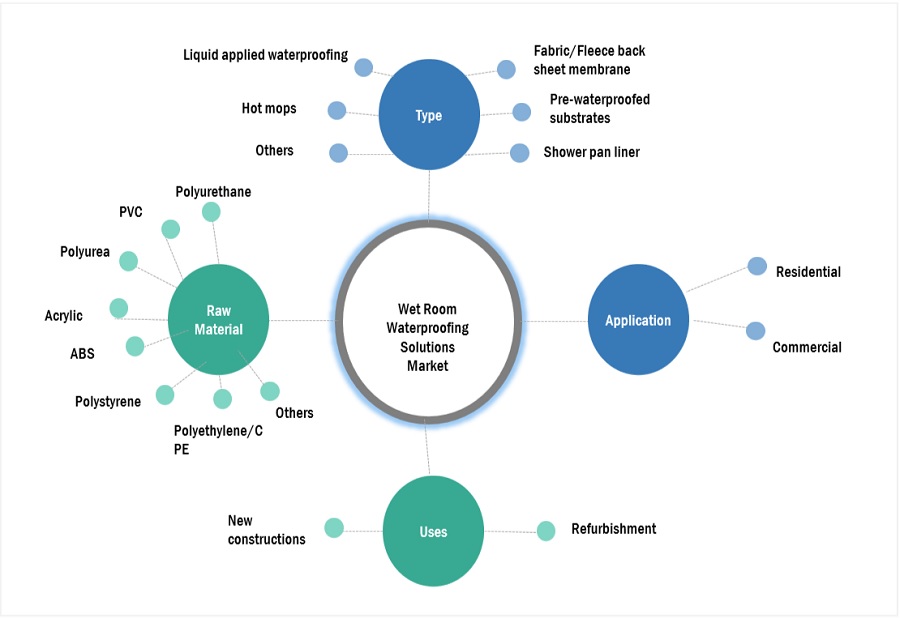

This report categorizes the global wetroom waterproofing solutions market based on raw material, Type, uses, application, and region.

On the basis of raw material, the wetroom waterproofing solutions market has been segmented as follows:

- Polyurethane

- PVC

- POLYUREA

- ACRYLIC

- ABS

- POLYSTYRENE

- POLYETHYLENE/CPE

- OTHERS (Fiberglass, etc.)

On the basis of type, the wetroom waterproofing solutions market has been segmented as follows:

- FABRIC/FLEECE BACKED SHEET MEMBRANE

- PRE-WATERPROOFED SUSTRATES

- FOAM BOARD WITH FIBERGLAS REINFORCED CEMENTITIOUS COATING

- FABRIC/FLEECE BACKED SHEET MEMBRANE ON FOAM BOARD

- WATERPROOF FIBERBOARD

- LIQUID COATED FOAM PAN

- SHOWER PAN LINER

- PVC

- CPE

- LIQUID APPLIED WATERPROOFING

- Air Cured

- Chemical curing

- Hot mops

- Others

On the basis of uses, the wetroom waterproofing solutions market has been segmented as follows:

- New Constructions

- Refurbishments

On the basis of application, the wetroom waterproofing solutions market has been segmented as follows:

- Residential

- Commercial

- Others

On the basis of region, the wetroom waterproofing solutions market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- Sika AG has acquired Shenzhen Landun Holding Co. Ltd. a leading manufacturer of waterproofing systems in China in August 2021. The acquisition provides a platform for Sika to further grow and strengthen its position in the fast-growing Chinese waterproofing market.

- Sika AG has acquired American Hydrotech Inc. and its affiliate Hydrotech Membrane Corporation in Canada, a leading manufacturer of green roofs and waterproofing systems in the North America in July 2021. The acquisition strengthens Sika’s roofing and waterproofing portfolio, and complements Sika’s sustainability focus.

- In March 2023, MAPEI Corporation had launched MAPEGUARD Board, a multipurpose, premium-performance, lightweight, high-density, waterproof backer-board panel that is designed for use under ceramic tile and stone installations. It fits in with company’s waterproofing products, such as MAPEGUARD WP ST sealing tape, MAPELASTIC AQUADEFENSE or MAPELASTIC Turbo, to create a system solution for showers.

- In February 2022, Henry Company entered into an agreement with CICO Waterproofing to distribute its products in Asia. CICO Waterproofing is a leading global waterproofing company headquartered in Singapore. The agreement will help Henry Company to expand its presence in the growing Asian market.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the wetroom waterproofing solutions market?

The growth of this market can be attributed to the growing demand for modern bathroom designs and stringent building regulations and standards.

Which are the key applications driving the wetroom waterproofing solutions market?

The sectors driving the demand for wetroom waterproofing solutions are commercial, residential, and others.

Who are the major manufacturers?

Major manufacturers include BASF SE (Germany), Sika AG (Switzerland), Mapei Corporation (Italy), and The Dow Chemical Company (US) among others.

What will be the growth prospects of the wetroom waterproofing solutions market?

Rise in construction activities, government regulation and technological advancements are some of the driving factors.

What will be the growth prospects of the wetroom waterproofing solutions market in terms of CAGR in next five years?

The CAGR of the market will be in between 5-6% in next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the wetroom waterproofing solutions market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key wetroom waterproofing solutions, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The wetroom waterproofing solutions market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the wetroom waterproofing solutions market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the wetroom waterproofing solutions industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of wetroom waterproofing solutions and future outlook of their business which will affect the overall market.

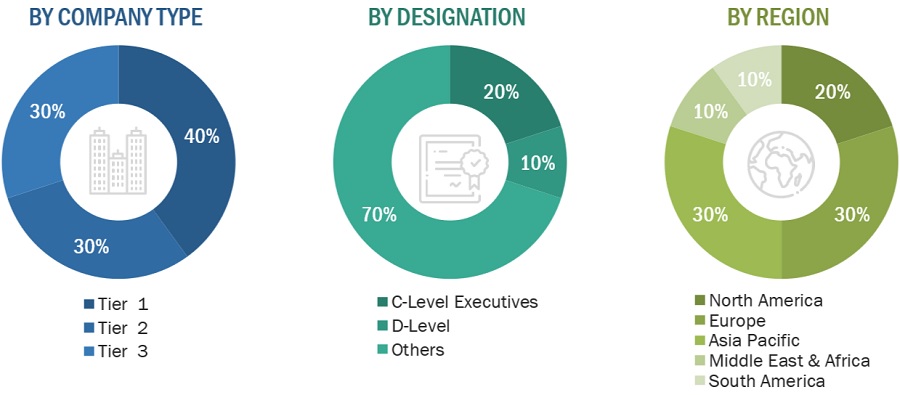

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for wetroom waterproofing solutions for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on raw material, type, uses, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

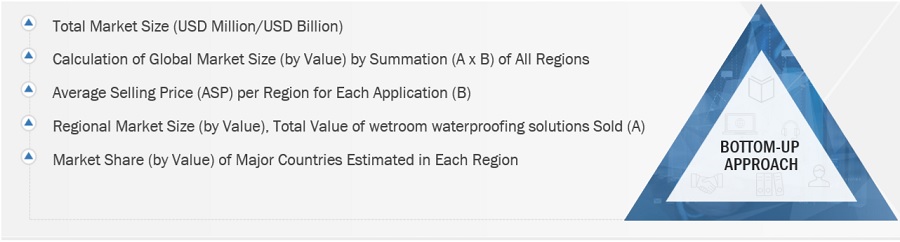

Wetroom Waterproofing Solutions Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

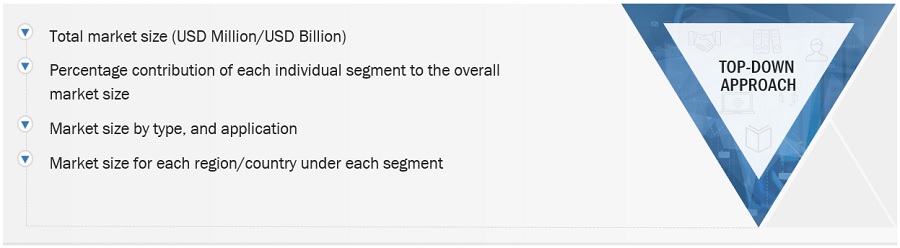

Wetroom Waterproofing Solutions Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process wetroom waterproofing solutions above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Wetroom waterproofing solutions refer to specialized systems and methods employed within the construction and hospitality industries to create impermeable environments in wet areas such as bathrooms, spas, and swimming pool areas. These solutions encompass a range of technologies, including advanced membranes, sealants, and coatings that prevent water infiltration, safeguarding underlying structures from moisture-related damage. By effectively containing water within designated spaces and preventing leaks, wetroom waterproofing solutions ensure the longevity of the surrounding infrastructure while minimizing maintenance costs. These solutions are pivotal in achieving compliance with industry regulations, enhancing guest experiences, and sustaining the aesthetic and functional integrity of high-moisture environments.

Key Stakeholders

- wetroom waterproofing solutions Manufacturers

- wetroom waterproofing solutions Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the wetroom waterproofing solutions market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on raw material, type, uses, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on wetroom waterproofing solutions market

By Form Analysis

- Market size for wetroom waterproofing solutions in terms of value

Growth opportunities and latent adjacency in Wetroom Waterproofing Solutions Market