Polystyrene Foam Market by Resin Type (EPS AND XPS), End-use Industry (Construction and Industrial Insulation, Packaging, Building and Construction), Region(APAC, Europe, North America, South America, and Middle East & Africa) - Global Forecast to 2026

Updated on : September 03, 2025

Polystyrene Foam Market

The global polystyrene foam market was valued at USD 26.4 billion in 2021 and is projected to reach USD 32.2 billion by 2026, growing at 4.1% cagr from 2021 to 2026. Grey EPS, by product type segment is the fastest-growing segment due to its better thermal and acoustic properties.

Attractive Opportunities in the Polystyrene Foam Market

Note: e – estimated, p - projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Polystyrene Foam Market Dynamics

Drivers: Stringent regulations to reduce greenhouse gas emissions

In March 2007, the European Heads of State agreed to a binding and unilateral GHG emission, which involves a significant reduction of greenhouse emissions. This agreement becomes a legal requirement in the European Union (EU) with plans to reduce GHG emissions by 40% by 2030. Therefore, the ongoing trend of reducing GHGs, which is followed by most of the countries, is increasing the demand for building thermal insulation.

Restraints: Volatility in raw material prices

Styrene prices are dependent on its raw materials, and benzene as a raw material substantially impacts styrene and polystyrene foam prices. R&D to improve the production process of styrene is a major trend in the developed market due to fluctuations in crude oil and raw material prices. Major styrene producers such as Royal Dutch Shell (Netherlands), The Dow Chemical Company (US), and LyondellBasell Industries N.V. (Netherlands) have begun investing in research to reduce investment and cut operating costs to improve their margins. As benzene prices are somewhat directly related to crude oil prices, major fluctuation can result in uncertain losses or consequences. As polystyrene foam prices are dependent on styrene prices and their raw materials, variations in prices can impact the overall profitability of manufacturers.

Opportunities: Polystyrene products can be recycled

EPS used in insulation and packaging is non-toxic and inert and is made without chlorofluorocarbons (CFCs). It has less impact on the environment than what other competitive materials have. However, it is almost indestructible, and the discarded EPS does not biodegrade for hundreds of years. It is also resistant to photolysis. Previously, EPS waste was dumped in landfills, but this trend is now changing, and post-consumer and post-commercial EPS recycling has increased.

Challenges: Growing prenference for molded pulp packaging

Historically, EPS had been a popular choice in the packaging industry for protecting products during distribution. However, the volatile oil prices and a growing trend toward the use of bio-based and environmentally friendly products have led to a marked surge in molded pulp packaging. In addition, since molded pulp can be easily nested, the end users have observed a decrease in the amount of space and an increase in the density of parts. This has resulted in a requirement of fewer vehicles that can transport more products.

White EPS Foam segment accounted for the fastest growing segment of polysyrene foams market

White EPS foam segment is the fastest-growing product type in the polystyrene foam market. It is the largest product type and is projected to grow at a higher rate during the forecast period. This growth is attributed to the high consumption of white EPS in the building & construction industry because white EPS reflects the sun better than grey, and therefore, its surface does not get as greasy in the heat of the sun. This means it is often not necessary to rasp the white EPS, saving several hours of work for an average installation. In Asia Pacific, where the building & construction industry is growing, there is high demand for white EPS.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is the fastest-growing polystyrene foam market.

Asia Pacific has emerged as the leading consumer and producer of EPS foam due to the increasing demand from the domestic front and rising income levels. The easy availability of low-cost labor and economical & accessible raw materials are increasing the production of EPS foam in the region, thereby driving foreign investments. Asia Pacific is also the largest and the fastest-growing EPS foams market. The government proposals to improve public infrastructure and rising cash-intensive non-residential construction are positively impacting the market growth. The demand in Asia Pacific will further increase in the next five years due to several on-going and upcoming building & construction projects in the developing countries. Strong growth mainly in China, India, and Southeast Asian countries due to the increase in purchasing power parity and demand from the end-use industries such as building & construction and packaging is driving the EPS foams market in Asia Pacific. Currently, EPS foam products from North America and Europe are appreciated for their high quality, and they have significant brand recognition in comparison to several products offered by players in Asia Pacific. However, the manufacturers in these regions face tough competition from players in Asia Pacific, in terms of cost which is an important factor for end customers. These factors make Asia Pacific an attractive market for investment.

Polystyrene Foam Market Players

Loyal Group (China), Wuxi Xingda Foam Plastics Materials Co., Ltd. (China), Synthos S.A. (Poland), BASF SE (Germany), Versalis S.P.A. (Italy) are the key players in the polystyrene foams market.

Polystyrene Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 26.4 billion |

|

Revenue Forecast in 2026 |

USD 32.2 billion |

|

Growth Rate |

CAGR of 4.1% from 2021 to 2026 |

|

Years considered for the study |

2019 – 2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021 – 2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Foam Type |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players Loyal Group (China), Wuxi Xingda New Foam Plastics Materials Co., Ltd. (China), BASF SE (Germany), Synthos S.A. (Poland), Jiangsu Leasty Chemicals Co., Ltd. (China), Sunpor Kunststoff GmbH (Austria), Total SE (France), Taita Chemical Co., Ltd. (Taiwan), Versalis S.p.A (Italy), DuPont (US), and others. |

This research report categorizes Polystyrene Foam market based on foam type, end-use industry, application, and region.

By Foam Type:

- EPS

- XPS

By End-use Industry:

-

EPS

- Building and Construction

- Packaging

- Others

-

XPS

- Construction & Industrial Insulation

- Packaging

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2021, Trinseo (Pennsylvania, US) and BASF SE (Ludwigshafen, Germany) have jointly announced their plan to expand their businesses with the production of styrene based on circular feedstock. The enhanced collaboration between them aims to increase efforts by both companies in the development and management of styrene featuring an improved environmental profile.

- Trinseo, (a global materials solutions provider and manufacturer of plastics, latex binders, and synthetic rubber) has recently been procuring first supplies of the synthetic chemical styrene based on circular feedstock from BASF for use in its solution-styrene butadiene rubber (S-SBR) and polystyrene (PS) products. Trinseo supplies S-SBR to major tire manufacturers while its PS products are used in applications such as food packaging and appliances, and the first few customers have already processed the material.

- In July 2016, The company developed a new welding technology for thick insulation foams. This technology can be used to combine a variety of insulation materials. With the help of this technology, BASF can produce customized insulation products to cater to a broad range of customers.

Frequently Asked Questions (FAQ):

How long does polystyrene foam last?

The lifespan of Styrofoam in a landfill has been estimated to be between 500 years and much longer.

What is polystyrene foam used for?

The most common applications for polystyrene foam are in construction, insulation, and packaging. As a result, it is frequently used to make coolers, hot tub covers, and packages with specific needs. It is also suitable for applications involving water vapours due to its resistance to moisture, mildew, and rot.

What is polystyrene foam?

Polystyrene is a thermoplastic polymer that is synthesised. It is made from the petroleum-based monomer styrene. The end result is a closed-cell foam that is lightweight but strong. Polystyrene is useful in a variety of applications, including construction, modelling, insulation, and others.

What are the factors influencing the growth of polystyrene foams?

The global polystyrene foams market is driven by stringent regulations to reduce greenhouse gas emissions.

What are the major applications for polystyrene foams?

The major end-use industries of polystyrene foams are building & construction, packaging, and others.

Who are the major manufacturers?

Loyal Group (China), Wuxi Xingda Foam Plastics Materials Co., Ltd. (China), Synthos S.A. (Poland), BASF SE (Germany), Versalis S.P.A. (Italy) are some of the leading players operating in the global polystyrene foams market.

Why polystyrene foams are gaining market share?

Increased demand for PS foams majorly in building & construction applications, along with improved global economic conditions, are attracting the manufacturers to invest in this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 INCLUSIONS

1.3.2 EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary data sources

2.1.3 KEY INDUSTRY INSIGHTS

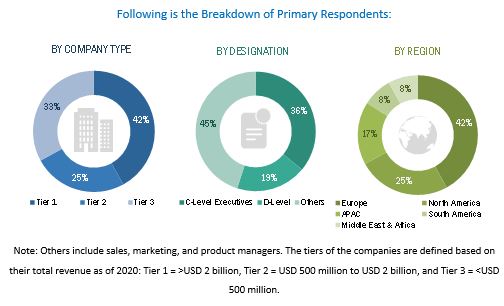

2.1.4 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.3 MARKET FORECAST APPROACH

2.3.1 DEMAND SIDE FORECAST PROJECTION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE POLYSTYRENE FOAMS MARKET

4.2 POLYSTYRENE FOAMS MARKET, BY TYPE AND END-USE INDUSTRY, 2020

4.3 EPS FOAMS MARKET SIZE, DEVELOPED VS. DEVELOPING COUNTRIES

4.4 Polystyrene Foam Market ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

5.2.1 POLYSTYRENE FOAMS MARKET: SUPPLY CHAIN ECOSYSTEM

5.2.2 COVID-19 IMPACT ON VALUE CHAIN

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Stringent regulations to reduce greenhouse gas emissions

5.3.1.2 Development of green buildings

5.3.1.3 Reduction in energy consumption and its related cost

5.3.1.4 Presence of stringent building energy codes

5.3.1.5 Rebates and tax credits

5.3.2 RESTRAINTS

5.3.2.1 Volatility in raw material prices

5.3.3 OPPORTUNITIES

5.3.3.1 Polystyrene products can be recycled

5.3.3.2 High energy requirements

5.3.4 CHALLENGES

5.3.4.1 Growing preference for molded pulp packaging

5.3.4.2 Rising stringent government regulations

5.3.4.3 Lack of awareness

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 AVERAGE PRICING ANALYSIS

5.6 FOAMS ECOSYSTEM

5.6.1 YC AND YCC SHIFT

5.7 MACROECONOMIC OVERVIEW

5.7.1 GLOBAL GDP TRENDS AND FORECASTS

5.8 INDUSTRY TRENDS

5.8.1 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

5.9 COVID-19 IMPACT ANALYSIS

5.9.1 COVID-19 ECONOMIC ASSESSMENT

5.9.2 EFFECTS ON GDP OF COUNTRIES

5.9.3 SCENARIO ASSESSMENT

5.9.4 IMPACT ON CONSTRUCTION INDUSTRY

5.10 POLYSTYRENE FOAM PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

5.10.3 INSIGHTS

5.10.4 JURISDICTION ANALYSIS

5.10.5 TOP APPLICANTS

5.11 POLICY & REGULATIONS

5.12 TRADE DATA ANALYSIS

5.12.1 POLYSTYRENE AND EXPANSIBLE POLYSTYRENE IMPORT-EXPORT TREND IMPACTING THE EPS AND XPS FOAMS PRODUCTION IN GLOBAL MARKET

5.13 CASE STUDY ANALYSIS

5.14 TECHNOLOGY ANALYSIS

5.14.1 EPS MANUFACTURING PROCESS

5.14.1.1 Pre-expansion

5.14.1.2 Intermediate Maturing and Stabilization

5.14.1.3 Expansion And Final Molding

6 POLYSTYRENE FOAMS MARKET, BY FOAM TYPE (Page No. - 72)

6.1 INTRODUCTION

6.1.1 EXPANDED POLYSTYRENE (EPS)

6.1.1.1 EPS replacing paper, kapok, and other natural packaging materials

6.1.1.2 Market Segmentation

6.1.1.3 WHITE EXPANDED POLYSTYRENE

6.1.1.3.1 Packaging industry to fuel the demand for white EPS

6.1.1.4 GREY EXPANDED POLYSTYRENE

6.1.1.4.1 Additional thermal efficiency and enhanced fire retardancy to drive the demand for grey EPS

6.1.2 EXTRUDED POLYSTYRENE FOAM (XPS)

6.1.2.1 XPS is a good thermal insulator and is often used as an insulating material in the construction industry

6.1.2.2 Market Segmentation

7 POLYSTYRENE FOAMS MARKET, BY END-USE INDUSTRY (Page No. - 80)

7.1 INTRODUCTION

7.2 EPS FOAM

7.2.1 BUILDING & CONSTRUCTION

7.2.1.1 Increasing population and growing urbanization to drive the demand for EPS in the building & construction industry

7.2.1.2 Applications

7.2.1.2.1 Exterior insulating & finishing systems

7.2.1.2.2 Insulating concrete forms

7.2.1.2.3 Structural insulated panels

7.2.1.2.4 Sheathing

7.2.1.2.5 Below grade foundation

7.2.1.2.6 Roofing systems

7.2.1.2.7 Door cores

7.2.1.2.8 Cold storage

7.2.2 PACKAGING

7.2.2.1 EPS packaging reduces food wastage

7.2.2.2 Packaging types

7.2.2.3 Applications

7.2.2.3.1 Transport packaging

7.2.2.3.2 Loose fill packaging

7.2.2.3.3 Protective and display packaging

7.2.3 OTHERS

7.3 XPS FOAM

7.3.1 CONSTRUCTION & INDUSTRIAL INSULATION

7.3.1.1 Increasing population and growing urbanization to drive the demand for XPS foam

7.3.1.2 Residential

7.3.1.3 Commercial

7.3.1.4 Others

7.3.2 PACKAGING

8 POLYSTYRENE FOAMS MARKET, BY REGION (Page No. - 94)

8.1 INTRODUCTION

8.2 APAC

8.2.1 COVID-19 IMPACT ON APAC

8.2.2 CHINA

8.2.2.1 Energy conservation law to reduce energy losses in buildings driving the polystyrene foams market

8.2.3 SOUTH KOREA

8.2.3.1 Increased demand from the construction industry contributes significantly to the growth of the polystyrene foams market in the country

8.2.4 INDIA

8.2.4.1 Availability of resources, rapid economic growth, increasing disposable income, and urbanization to influence the Polystyrene Foam Market

8.2.5 JAPAN

8.2.5.1 Increase in new housing projects and housing equipment driving the Polystyrene Foam Market

8.2.6 THAILAND

8.2.6.1 Initiation of large infrastructure projects by the government to fuel the demand for EPS in the country

8.2.7 INDONESIA

8.2.7.1 Rising consumer awareness and a hectic lifestyle to boost the demand for polystyrene foam packaging

8.2.8 MALAYSIA

8.2.8.1 Rapid growth of the economy and high purchasing power have made it one of the major Polystyrene Foam Market in the ASEAN countries

8.2.9 REST OF APAC

8.3 EUROPE

8.3.1 COVID-19 IMPACT ON EUROPE

8.3.2 GERMANY

8.3.2.1 Increasing focus on the construction industry to drive the Polystyrene Foam Market in the country

8.3.3 POLAND

8.3.3.1 Polish building & construction industry to witness the fastest growth

8.3.4 RUSSIA

8.3.4.1 Demand for thermal insulation, water-resistant polystyrene foam board, and other construction materials to drive the Polystyrene Foam Market

8.3.5 ITALY

8.3.5.1 New construction projects to drive the demand for polystyrene foams market in the country

8.3.6 TURKEY

8.3.6.1 R&D capabilities, investments in construction, and an increase in exports to boost the Turkish polystyrene foams market

8.3.7 FRANCE

8.3.7.1 Reviving construction industry to fuel the demand for polystyrene foams in France

8.3.8 SPAIN

8.3.8.1 Changing consumer habits as well as government efforts to prevent food wastage to drive the packaging industry

8.3.9 CZECH REPUBLIC

8.3.9.1 Improved economic conditions, low interest rates, and increased investment to drive the Polystyrene Foam Market in the country

8.3.10 UK

8.3.10.1 Consumer preference for sustainability and quality to drive the demand for EPS packaging industry

8.3.11 REST OF EUROPE

8.4 NORTH AMERICA

8.4.1 COVID-19 IMPACT ON NORTH AMERICA

8.4.2 US

8.4.2.1 Strong presence of manufacturing facilities, strong economic sector, and increasing expenditure driving the Polystyrene Foam Market

8.4.3 CANADA

8.4.3.1 Growth of the economy and construction industry to drive the polystyrene foams market in the country

8.4.4 MEXICO

8.4.4.1 Strong rebound in exports and improved business confidence to strengthen the Mexican polystyrene foams market

8.5 MIDDLE EAST & AFRICA

8.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

8.5.2 SAUDI ARABIA

8.5.2.1 Largest and fastest-growing Polystyrene Foam Market in the Middle East & Africa

8.5.3 AFRICA

8.5.3.1 Surge in construction activities to drive the Polystyrene Foam Market in the country

8.5.4 IRAN

8.5.4.1 Building & construction to lead the polystyrene foams market in Iran

8.5.5 UAE

8.5.5.1 Large scope for new infrastructural development to drive the polystyrene foams market

8.5.6 QATAR

8.5.6.1 Robust growth in the construction sector to generate demand for polystyrene foam in the country

8.5.7 REST OF MIDDLE EAST

8.6 SOUTH AMERICA

8.6.1 COVID-19 IMPACT ON SOUTH AMERICA

8.6.2 BRAZIL

8.6.2.1 One of fastest-growing manufacturing hubs in the world

8.6.3 ARGENTINA

8.6.3.1 Demand to grow owing to growing population and improving economic conditions

8.6.4 COLOMBIA

8.6.4.1 Demand for high-performance, cost-effective, and environmentally advanced building products to drive the Polystyrene Foam Market

8.6.5 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 137)

9.1 OVERVIEW

9.2 MARKET SHARE ANALYSIS

9.3 COMPANY REVENUE ANALYSIS

9.4 COMPANY EVALUATION QUADRANT MATRIX, 2020

9.4.1 STAR

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE

9.4.4 PARTICIPANTS

9.5 STRENGTH OF PRODUCT PORTFOLIO

9.6 BUSINESS STRATEGY EXCELLENCE

9.6.1 MARKET EVALUATION FRAMEWORK

9.6.2 MARKET EVALUATION MATRIX

9.7 COMPETITIVE SCENARIO

10 COMPANY PROFILES (Page No. - 153)

10.1 KEY PLAYERS

10.1.1 LOYAL GROUP

10.1.2 WUXI XINGDA NEW FOAM PLASTICS MATERIALS CO., LTD.

10.1.3 BASF SE

10.1.3.1 SWOT analysis

10.1.3.2 MNM view

10.1.4 SYNTHOS S.A.

10.1.4.1 SWOT analysis

10.1.4.2 MNM view

10.1.5 JIANGSU LEASTY CHEMICALS CO. LTD.

10.1.6 SUNPOR KUNSTSTOFF GMBH

10.1.6.1 SWOT analysis

10.1.6.2 MNM view

10.1.7 TOTAL SE

10.1.7.1 SWOT analysis

10.1.7.2 MNM view

10.1.8 TAITA CHEMICAL CO., LTD.

10.1.9 VERSALIS S.P.A.

10.1.10 DUPONT

10.1.10.1 SWOT analysis

10.1.10.2 MNM view

10.2 OTHER PLAYERS

10.2.1 ALPEK

10.2.2 BEWI GROUP

10.2.2.1 Business Overview

10.2.3 KINGSPAN GROUP PLC

10.2.3.1 SWOT analysis

10.2.3.2 MNM view

10.2.4 THE RAVAGO GROUP

10.2.5 OWENS CORNING

10.2.5.1 SWOT analysis

10.2.5.2 MNM view

10.2.6 SUPREME PETROCHEMICAL LTD.

10.2.7 STYROCHEM

10.2.8 TECHNONICOL CORPORATION

10.2.9 SIBUR

10.2.10 LG CHEM

10.2.10.1 SWOT analysis

10.2.10.2 MNM view

10.2.11 JIANGSU SUNCHEM NEW MATERIALS CO. LTD.

10.2.12 FINNFOAM OY

10.2.13 MING DIH GROUP CORPORATION

10.2.14 UNIPOL

10.2.15 STYRO INSULATION MAT. IND. LLC.

11 APPENDIX (Page No. - 201)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (154 Tables)

TABLE 1 POLYSTYRENE FOAMS MARKET SNAPSHOT (2021 VS. 2026)

TABLE 2 REGION-WISE REGULATIONS TO REDUCE GHG EMISSIONS

TABLE 3 POLYSTYRENE FOAMS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018–2025

TABLE 5 GLOBAL REGULATIONS

TABLE 6 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

TABLE 7 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

TABLE 8 NORTH AMERICA: EPS PROCESSING COMPANIES

TABLE 9 EUROPE: EPS PROCESSING COMPANIES

TABLE 10 APAC: EPS PROCESSING COMPANIES

TABLE 11 MIDDLE EAST & AFRICA: EPS PROCESSING COMPANIES

TABLE 12 PS FOAMS MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 13 PS FOAMS MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTON)

TABLE 14 POLYSTYRENE FOAMS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 16 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 17 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 18 WHITE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 WHITE MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 20 GREY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 GREY MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 22 POLYSTYRENE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 24 MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 25 MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 26 PROPERTIES OF EPS FOAM USED IN BUILDING & CONSTRUCTION INDUSTRY

TABLE 27 MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION,2019–2026 (USD MILLION)

TABLE 28 MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (KILOTON)

TABLE 29 PROPERTIES OF EPS FOAM USED IN PACKAGING END-USE INDUSTRY

TABLE 30 MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (KILOTON)

TABLE 32 MARKETARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

TABLE 34 MARKET SIZE, BY END USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 35 MARKET SIZE, BY END USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 36 MARKET SIZE IN CONSTRUCTION & INDUSTRIAL INSULATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 MARKET SIZE IN CONSTRUCTION & INDUSTRIAL INSULATION, BY REGION, 2019–2026 (KILOTON)

TABLE 38 MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (KILOTON)

TABLE 40 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 42 APAC: POLYSTYRENE FOAMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 44 APAC: POLYSTYRENE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 45 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 46 APAC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 47 APAC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 48 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 49 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 50 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 51 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 52 EUROPE: POLYSTYRENE FOAMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: POLYSTYRENE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 54 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 56 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 58 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 60 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 62 NORTH AMERICA: POLYSTYRENE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 66 NORTH AMERICA: POLYSTYRENE FOAMS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 72 MIDDLE EAST & AFRICA: POLYSTYRENE FOAMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 74 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA: POLYSTYRENE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 76 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: POLYSTYRENE FOAM MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 78 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 80 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 82 SOUTH AMERICA: POLYSTYRENE FOAMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 83 SOUTH AMERICA: POLYSTYRENE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 84 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 85 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 86 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 87 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 88 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 89 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 90 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 92 POLYSTYRENE FOAMS MARKET: DEGREE OF COMPETITION

TABLE 93 COMPANY PRODUCT FOOTPRINT

TABLE 94 COMPANY REGION FOOTPRINT

TABLE 95 COMPANY INDUSTRY FOOTPRINT

TABLE 96 NEW PRODUCT LAUNCH/DEVELOPMENT, 2015–2021

TABLE 97 DEALS, 2015–2021

TABLE 98 OTHERS, 2015–2021

TABLE 99 LOYAL GROUP: BUSINESS OVERVIEW

TABLE 100 LOYAL GROUP: PRODUCTS OFFERED

TABLE 101 WUXI XINGDA NEW FOAM PLASTICS MATERIALS CO., LTD.: BUSINESS OVERVIEW

TABLE 102 WUXI XINGDA NEW FOAM PLASTICS MATERIALS CO., LTD.: PRODUCTS OFFERED

TABLE 103 BASF SE: BUSINESS OVERVIEW

TABLE 104 BASF SE: PRODUCTS OFFERED

TABLE 105 BASF SE: RECENT DEVELOPMENTS

TABLE 106 SYNTHOS S.A.: BUSINESS OVERVIEW

TABLE 107 SYNTHOS S.A.: PRODUCTS OFFERED

TABLE 108 SYNTHOS S.A.: RECENT DEVELOPMENTS

TABLE 109 JIANGSU LEASTY CHEMICALS CO. LTD.: BUSINESS OVERVIEW

TABLE 110 JIANGSU LEASTY CHEMICALS CO. LTD.: PRODUCTS OFFERED

TABLE 111 SUNPOR KUNSTSTOFF GMBH.: BUSINESS OVERVIEW

TABLE 112 SUNPOR KUNSTSTOFF GMBH.: PRODUCTS OFFERED

TABLE 113 TOTAL SE: BUSINESS OVERVIEW

TABLE 114 TOTAL SE: PRODUCTS OFFERED

TABLE 115 TOTAL SE: RECENT DEVELOPMENTS

TABLE 116 TAITA CHEMICAL CO., LTD.: BUSINESS OVERVIEW

TABLE 117 TAITA CHEMICAL CO., LTD.: PRODUCTS OFFERED

TABLE 118 VERSALIS S.P.A: BUSINESS OVERVIEW

TABLE 119 VERSALIS S.P.A: PRODUCTS OFFERED

TABLE 120 DUPONT: BUSINESS OVERVIEW

TABLE 121 DUPONT: PRODUCTS OFFERED

TABLE 122 DUPONT: RECENT DEVELOPMENTS

TABLE 123 ALPEK: BUSINESS OVERVIEW

TABLE 124 ALPEK: PRODUCTS OFFERED

TABLE 125 BEWI GROUP: BUSINESS OVERVIEW

TABLE 126 BEWI: PRODUCTS OFFERED

TABLE 127 BEWI: RECENT DEVELOPMENTS

TABLE 128 KINGSPAN GROUP PLC: BUSINESS OVERVIEW

TABLE 129 KINGSPAN GROUP PLC: PRODUCTS OFFERED

TABLE 130 KINGSPAN GROUP PLC: RECENT DEVELOPMENTS

TABLE 131 THE RAVAGO GROUP: BUSINESS OVERVIEW

TABLE 132 THE RAVAGO GROUP: PRODUCTS OFFERED

TABLE 133 OWENS CORNING: BUSINESS OVERVIEW

TABLE 134 OWENS CORNING: PRODUCTS OFFERED

TABLE 135 SUPREME PETROCHEMICAL LTD. (SPL): BUSINESS OVERVIEW

TABLE 136 SUPREME PETROCHEMICAL LTD. (SPL): PRODUCTS OFFERED

TABLE 137 STYROCHEM: BUSINESS OVERVIEW

TABLE 138 STYROCHEM: PRODUCTS OFFERED

TABLE 139 TECHNONICOL CORPORATION: BUSINESS OVERVIEW

TABLE 140 TECHNONICOL CORPORATION: PRODUCTS OFFERED

TABLE 141 SIBUR: BUSINESS OVERVIEW

TABLE 142 SIBUR: PRODUCTS OFFERED

TABLE 143 LG CHEM: BUSINESS OVERVIEW

TABLE 144 LG CHEM: PRODUCTS OFFERED

TABLE 145 JIANGSU SUNCHEM NEW MATERIALS CO., LTD.: BUSINESS OVERVIEW

TABLE 146 JIANGSU SUNCHEM NEW MATERIALS CO., LTD.: PRODUCTS OFFERED

TABLE 147 FINNFOAM OY: BUSINESS OVERVIEW

TABLE 148 FINNFOAM OY: PRODUCTS OFFERED

TABLE 149 MING DIH GROUP CORPORATION: BUSINESS OVERVIEW

TABLE 150 MING DIH GROUP CORPORATION: PRODUCTS OFFERED

TABLE 151 UNIPOL: BUSINESS OVERVIEW

TABLE 152 UNIPOL: PRODUCTS OFFERED

TABLE 153 STYRO INSULATION MAT. IND. LLC: BUSINESS OVERVIEW

TABLE 154 STYRO INSULATION MAT. IND. LLC: PRODUCTS OFFERED

LIST OF FIGURES (63 Figures)

FIGURE 1 POLYSTYRENE FOAMS MARKET SEGMENTATION

FIGURE 2 XX

FIGURE 3 POLYSTYRENE FOAMS MARKET: RESEARCH DESIGN

FIGURE 4 POLYSTYRENE FOAMS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: POLYSTYRENE FOAMS MARKET

FIGURE 6 POLYSTYRENE FOAMS MARKET, BY REGION

FIGURE 7 POLYSTYRENE FOAMS MARKET, BY END-USE INDUSTRY

FIGURE 8 POLYSTYRENE FOAMS MARKET: DATA TRIANGULATION

FIGURE 9 WHITE EPS TO REGISTER HIGHEST CAGR IN THE POLYSTYRENE FOAMS MARKET

FIGURE 10 BUILDING & CONSTRUCTION TO BE THE LARGEST AND FASTEST-GROWING END-USE INDUSTRY OF EPS FOAM BETWEEN 2021 AND 2026

FIGURE 11 APAC TO DOMINATE THE POLYSTYRENE FOAMS MARKET BETWEEN 2021 AND 2026

FIGURE 12 CONSTRUCTION & INDUSTRIAL INSULATION TO BE THE FASTER-GROWING END-USE INDUSTRY OF XPS FOAM BETWEEN 2021 AND 2026

FIGURE 13 EUROPE TO LEAD THE POLYSTYRENE FOAM MARKET BETWEEN 2021 AND 2026

FIGURE 14 POLYSTYRENE FOAMS MARKET TO WITNESS GROWTH BETWEEN 2021 AND 2026

FIGURE 15 WHITE EPS AND BUILDING & CONSTRUCTION ACCOUNTED FOR LARGEST SHARES

FIGURE 16 POLYSTYRENE FOAM MARKET: CONSTRUCTION & INDUSTRIAL INSULATION SEGMENT TO GROW AT THE FASTEST RATE BETWEEN 2021 AND 2026

FIGURE 17 EPS MARKET TO GROW AT A FASTER RATE IN THE DEVELOPING COUNTRIES

FIGURE 18 CHINA TO REGISTER THE HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 19 POLYSTYRENE FOAMS MARKET: VALUE CHAIN ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE POLYSTYRENE FOAMS MARKET

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS OF POLYSTYRENE FOAMS MARKET

FIGURE 22 AVERAGE PRICE COMPETITIVENESS IN POLYSTYRENE FOAMS MARKET

FIGURE 23 FOAMS ECOSYSTEM

FIGURE 24 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

FIGURE 25 GDP FORECASTS OF G20 COUNTRIES IN 2020

FIGURE 26 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

FIGURE 27 PUBLICATION TRENDS, 2017–2021

FIGURE 29 POLYSTYRENE FOAM: NUMBER OF PATENTS, BY COMPANY, 2017–2021

FIGURE 30 EPS MANUFACTURING TECHNOLOGY PROCESS

FIGURE 31 EPS FOAM VS XPS FOAM

FIGURE 32 EPS FOAM SEGMENT TO REGISTER HIGHER CAGR

FIGURE 33 BUILDING & CONSTRUCTION TO BE THE LARGEST END-USE INDUSTRY OF EPS

FIGURE 34 PACKAGING TO BE THE LARGER END-USE INDUSTRY OF XPS FOAM

FIGURE 35 APAC TO REGISTER THE HIGHEST CAGR IN THE POLYSTYRENE FOAMS MARKET

FIGURE 36 APAC: POLYSTYRENE FOAMS MARKET SNAPSHOT

FIGURE 37 EUROPE: POLYSTYRENE FOAMS MARKET SNAPSHOT

FIGURE 38 NORTH AMERICA: POLYSTYRENE FOAMS MARKET SNAPSHOT

FIGURE 39 SAUDI ARABIA IS THE KEY POLYSTYRENE FOAMS MARKET IN THE REGION

FIGURE 40 UAE IS THE KEY XPS MARKET IN THE REGION

FIGURE 41 BRAZIL IS THE KEY POLYSTYRENE FOAMS MARKET IN THE REGION

FIGURE 42 ARGENTINA IS THE KEY XPS MARKET IN THE REGION

FIGURE 43 NEW PRODUCT LAUNCH/DEVELOPMENT IS MOST FOLLOWED STRATEGY BY LEADING PLAYERS BETWEEN 2015 AND 2020

FIGURE 44 CAPACITY SHARE ANALYSIS IN 2020

FIGURE 45 POLYSTYRENE FOAMS MARKET: COMPANY REVENUE ANALYSIS, 2020

FIGURE 46 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 48 BASF SE: SWOT ANALYSIS

FIGURE 49 SYNTHOS S.A.: SWOT ANALYSIS

FIGURE 50 SUNPOR KUNSTSTOFF GMBH: SWOT ANALYSIS

FIGURE 51 TOTAL SE: COMPANY SNAPSHOT

FIGURE 52 TOTAL SE: SWOT ANALYSIS

FIGURE 53 TAITA CHEMICAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 54 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

FIGURE 55 DUPONT: SWOT ANALYSIS

FIGURE 56 ALPEK: COMPANY SNAPSHOT

FIGURE 57 KINGSPAN GROUP PLC: COMPANY SNAPSHOT

FIGURE 58 KINGSPAN GROUP PLC: SWOT ANALYSIS

FIGURE 59 OWENS CORNING: COMPANY SNAPSHOT

FIGURE 60 OWENS CORNING: SWOT ANALYSIS

FIGURE 61 SIBUR: COMPANY SNAPSHOT

FIGURE 62 LG CHEM: COMPANY SNAPSHOT

FIGURE 63 LG CHEM: SWOT ANALYSIS

The study involves four major activities in estimating the current market size of Polystyrene foam. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The Polystyrene Foam market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as construction and industrial insulation, packaging and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

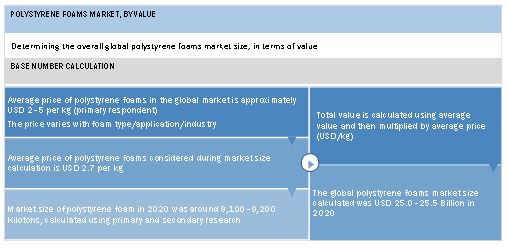

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Polystyrene Foam market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Polystyrene Foam Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Polystyrene Foam market size, in terms of value and volume

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on resin type, and end-use industry

- To analyze the market segmentation and project the market size, in terms of value and volume, for key regions such as North America, Europe, Asia Pacific (APAC), South America, and Middle East & Africa

- To analyze market opportunities for stakeholders and provide details of a competitive landscape of market leaders

- To analyze competitive developments such as new product launches, investment & expansions, mergers & acquisitions, and partnerships & agreements in the Polystyrene Foam market

- To strategically profile key players and analyze their core competencies1 in the Polystyrene Foam market.

Note: Core competencies1 of the companies are covered in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Polystyrene market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polystyrene Foam Market