Wind Tunnel Market by Solution (Products, Services), Alignment (Horizontal, Vertical), Application (Aerospace & Defense, Transportation, Racing Championship, Construction, Adventure Skydiving, Simulation), Air Speed, and Region - Global Forecast to 2023

[170 Pages Report] The wind tunnel market is estimated to be USD 2.56 Billion in 2017 and is projected to reach USD 2.88 Billion by 2023, at a CAGR of 2.01% from 2018 to 2023.

The objectives of this study are to analyze the wind tunnel market along with the statistics from 2018 to 2023, as well as to define, describe, and forecast the wind tunnel market on the basis of application, solution, alignment, airspeed and region. The year 2017 is considered to be the base year, whereas, 2018 to 2023 is considered as the forecast period for the market study.

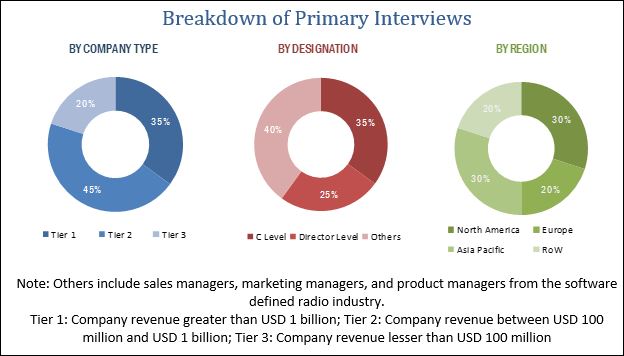

\The research methodology used to estimate and forecast the wind tunnel market begins with capturing data on wind tunnel products and services revenues through secondary sources, such as National Aeronautics and Space Administration (NASA), American Institute of Aeronautics and Astronautics (AIAA), Fédération Internationale de l'Automobile (FIA), Library of Congress, Indoor Skydiving Source (ISS), journals, and paid databases. Wind tunnel services are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall wind tunnel market size from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

\

To know about the assumptions considered for the study, download the pdf brochure

\The wind tunnel ecosystem comprises testing services providers such as NASA (US), Boeing (US), Lockheed Martin (US), ETW (Europe), CSTB (France), FKFS (Germany), DNW (Netherlands), RTA (Austria), Mitsubishi Heavy Industries (Japan), Horiba (Japan), BMT (UK), FORCE Technology (Denmark), and Aerodyn (US) among others. Some major manufactures include Aerolab (US), Aiolos (Canada), Foran (Brazil), Aerodium Technologies (Latvia), and Skyventure (Canada) among others.

\Target Audience for this Report:

\- \

- Manufacturers of Wind Tunnels\

- Aerospace Component Manufacturers\

- Automobile Manufacturers\

- Racing Championship Teams\

- Aviation Research Institutes and Universities\

- Skydiving Institutes\

- Computational Fluid Dynamics Software Providers\

- Sub-component Manufacturers\

- Original Equipment Manufacturers\

- Component Suppliers\

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

\Get online access to the report on the World's First Market Intelligence Cloud

\- \

- Easy to Download Historical Data & Forecast Numbers\

- Company Analysis Dashboard for high growth potential opportunities\

- Research Analyst Access for customization & queries\

- Competitor Analysis with Interactive dashboard\

- Latest News, Updates & Trend analysis\

Scope of the Report

\This research report categorizes the Wind tunnel market into the following segments and sub segments:

\- \

- By Application\

- \

- Aerospace & Defense\

- Transportation\

- Racing Championship\

- Building Construction & Wind Energy\

- Adventure Sports Skydiving\

- Training & Simulation\

- By Solution\

- \

- Products\

- Services\

- By Alignment \

- \

- Vertical\

- Horizontal\

- By Airspeed\

- \

- Subsonic\

- Transonic\

- Supersonic\

- Hypersonic\

- By Region \

- \

- North America\

- Europe\

- Asia Pacific\

- Rest of the World\

Available Customizations

\Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

\- \

- Geographic Analysis\

- \

- Further breakdown of the Rest of the World market\

- Company Information\

- \

- Detailed analysis and profiling of additional market players (up to five)\

Please click here to get the relevant report of Non-Destructive Testing (NDT) Market by Component (Equipment, Services) Method (Ultrasonic, Radiography, Liquid Penetrant, Magnetic) End-User (Oil & Gas, Aerospace & Defense, Automotive, Infra) Technique, Application & Region - Global Forecast to 2022

\\

The wind tunnel market is projected to grow from USD 2.61 Billion in 2018 to reach USD 2.88 Billion by 2023, at a CAGR of 2.01% from 2018 to 2023. The growth of this market can be attributed to the development of new generation of supersonic and hypersonic aircraft and missiles.

\Based on application, the wind tunnel market is segmented into aerospace & defense, transportation, racing championship, building construction & wind energy, adventure sports skydiving, and training & simulation. The aerospace & defense application segment is expected to lead the wind tunnel market in 2018. The growth of the aerospace & defense application segment of the wind tunnel market can be attributed to the increased use of wind tunnels for testing aircraft used for aerospace & defense application as these aircraft are generally exposed to critical climatic conditions

\By alignment, the horizontal segment is estimated to lead the wind tunnel market in 2018. Horizontal wind tunnels includes aerodynamic, aeroacoustic and climatic wind tunnels used in various industries such as aerospace & defense, racing championship, transportation and building construction & wind energy.

\By airspeed, the subsonic segment is estimated to lead the wind tunnel market in 2018. This segment is majorly driven by the demand for commercial aircraft and automotive testing services. Subsonic wind tunnels are also used in racing championship aerodynamic testing.

\By solution, the services segment is expected to lead the wind tunnel market in 2018. The growth of this segment can be attributed to the minimized Operation & Maintenance (O&M) costs of wind tunnels and easy availability of technical expertise to carry out their installation and maintenance.

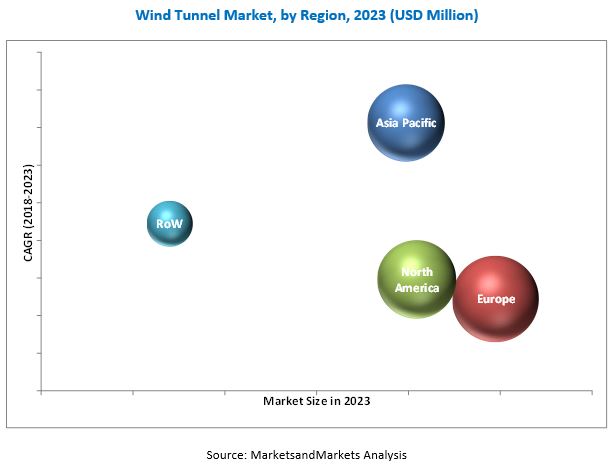

\By region, the Asia Pacific wind tunnel market is projected to grow at the highest rate from 2018 to 2023. Countries such as China, India, Japan, South Korea, Taiwan, and Australia are investing in indigenous development programs to manufacture various types of new and advanced aircraft for commercial and defense applications, along with the development of electric automotive vehicles. China has substantially increased its spending for the development of new and advanced systems for the aerospace & defense and automotive sectors. This, in turn, is expected to contribute toward increased demand for wind tunnels and wind tunnel testing services in the country. Moreover, countries such as Japan, India, and South Korea are also spending increasingly for the development of rail, automotive, and marine infrastructures, which require wind tunnel testing.

\

The growth in wind tunnel market can be attributed to increase in electric vehicles and development of high speed aircrafts and missiles. However, increased usage of CFD software, along with restriction imposed in various racing championships by FIA are expected to hinder market growth. Additionally, issues associated with accurate calibration of sensors act as a challenge for the growth of the market. On the other hand, developments in adventure sports and military training offer key growth opportunities to manufacturers of wind tunnels.

\Leading players in the Wind Tunnel Market include include Boeing (US), Lockheed Martin (US), ETW (Europe), CSTB (France), FKFS (Germany), DNW (Netherlands), RTA (Austria), Mitsubishi Heavy Industries (Japan), Horiba (Japan), BMT Group (UK), FORCE Technology (Denmark), and Aerodyn Wind Tunnel (US) among others. Some major manufactures include Aerolab (US), Aiolos (Canada), Foran (Brazil), Aerodium Technologies (Latvia), and Skyventure (Canada) among others.

\To speak to our analyst for a discussion on the above findings, click Speak to Analyst

\#

Growth opportunities and latent adjacency in Wind Tunnel Market