Workflow Orchestration Market by Type (Cloud Orchestration, Data Center Orchestration, Business Process Orchestration, and Security Orchestration), Organization Size (SMEs and Large Enterprises), Vertical, and Region - Global Forecast to 2022

[118 Pages Report] The workflow orchestration market was valued at USD 11.08 Billion in 2016 and is expected to reach USD 50.82 Billion by 2022, at a CAGR of 29.8% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Objectives of the study:

- To define, describe, segment, and forecast the workflow orchestration market based on type, organization size, vertical, and region

- To analyze various macro and microeconomic factors that affect the growth of the market

- To forecast the size of market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze each submarket with respect to individual growth trends, prospects, and contribution to the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To profile key market players and provide comprehensive analysis based on their business overviews, product offerings, regional presence, business strategies, and key financials with the help of in-house statistical tools to understand the competitive landscape of the market

- To track and analyze competitive developments such as mergers & acquisitions, product developments, agreements, partnerships & collaborations, and Research & Development (R&D) activities undertaken by key players in the workflow orchestration market

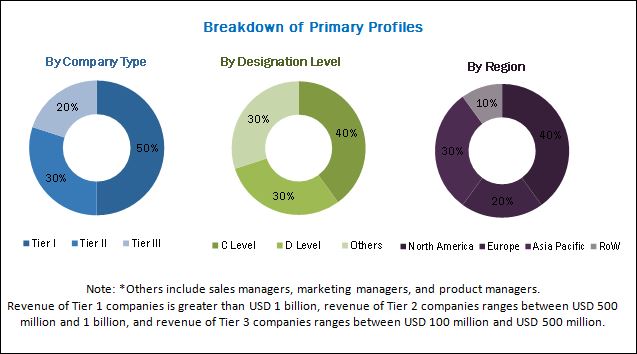

The research methodology used to estimate and forecast the size of the workflow orchestration market began with capturing data on key vendor revenues through secondary research. Secondary sources referred for this research study included annual reports, white papers, certified publications, databases, such as Factiva and Hoovers, press releases, and investor presentations of workflow orchestration vendors, as well as articles from recognized industry associations, statistics bureaus, and government publishing sources. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall size of the market by estimating revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The breakdown of profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The workflow orchestration market ecosystem includes key players, such as Microsoft (US), IBM (US), Cisco Systems (US), Oracle (US), VMware (US), CA Technologies (US), Arvato AG (Germany), BMC Software (US), ServiceNow (US), Micro Focus (UK), Dalet SA (France), and Ayehu Software Technologies (US).

Key Target Audience for Workflow Orchestration Market

- Workflow Orchestration Providers

- Workflow Automation Providers

- Cloud Orchestration Providers

- Business Process Management Providers

- Data Center Orchestration Providers

- Network Management Providers

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type, Service, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Microsoft (US), IBM (US), Cisco Systems (US), Oracle (US), VMware (US), CA Technologies (US), Arvato AG (Germany), BMC Software (US), ServiceNow (US), Micro Focus (UK), Dalet SA (France), and Ayehu Software Technologies (US). |

The research report categorizes the workflow orchestration market into the following segments and subsegments:

By Type

- Cloud Orchestration

- Data Center Orchestration

- Network Management

- Business Process Orchestration

- Security Orchestration

By Organization Size

- Large Enterprises

- SMEs

Workflow Orchestration Market By Vertical

- IT & Telecommunication

- Media & Entertainment

- Banking, Financial Services & Insurance (BFSI)

- E-commerce, Retail & Consumer Goods

- Public Sector

- Manufacturing & Automotive

- Healthcare & Pharmaceutical

- Travel & Hospitality

- Others (Education and Electricity & Utility)

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Available Customizations

Along with the given market data, MarketsandMarkets offers customization as per a company’s specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North America market

- Further country-level breakdown of the Europe market

- Further country-level breakdown of the Asia Pacific market

- Further country-level breakdown of the Middle East & Africa market

- Further country-level breakdown of the Latin America market

Company Information

- Detailed analysis and profiles of additional market players

The workflow orchestration market is projected to grow from USD 13.81 Billion in 2017 to USD 50.82 Billion by 2022, at a CAGR of 29.8% during the forecast period. The adoption of workflow orchestration by organizations to improve operational efficiency, productivity levels, and business outcomes is one of the most significant factors projected to drive the growth of the market. Digital transformation of organizations and the need to streamline business processes will offer lucrative growth opportunities to workflow orchestration providers in the near future.

The workflow orchestration market has been segmented on the basis of type, organization size, vertical, and region. Based on type, the market has been segmented into cloud orchestration, data center orchestration, network management, business process orchestration, and security orchestration. The business process orchestration segment of the market is expected to grow at the highest CAGR during the forecast period. Business process orchestration offers distinguished ways to connect heterogeneous systems within organizations, besides improving data quality and reducing data entry efforts through workflow automation.

Based on organization size, the workflow orchestration market has been segmented into large enterprises and SMEs. The SMEs segment is expected to grow at a higher CAGR as compared to the large enterprises segment during the forecast period. The adoption of workflow orchestration by SMEs is growing at a rapid pace, as it helps reduce expenditure on operations and IT infrastructure. This, in turn, is projected to drive the growth of the SMEs segment of the market.

Based on vertical, the IT & telecommunication segment of the workflow orchestration market is expected to grow at the highest CAGR during the forecast period. Organization in the IT & telecommunication sector are increasing adopting workflow orchestration to improve operational efficiency by streamlining business processes, ensuring improved resource utilization, and reducing costs.

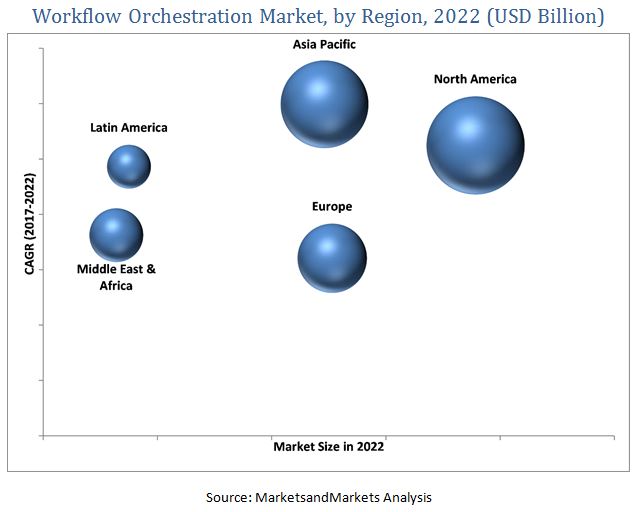

North America is estimated to be the largest market for workflow orchestration in 2017, as organizations in this region are early adopters of the orchestration technology. Organizations in North America are shifting their focus towards digitalization for realigning business processes. The digitalization of organizations has created an opportunity to refine and streamline various business activities through workflow automation and orchestration.

A key restraining factor impacting the growth of the market is lack of technical expertise. Skills required for integrating workflow orchestration are entirely different from skills needed to manage the traditional IT infrastructure. Adequate knowledge is also required for interfacing, interconnecting, and analyzing processes and applications for effective and seamless integration. Thus, difficulties associated with the integration of new and existing systems through workflows are acting as a key challenge to the growth of the workflow orchestration market.

Major companies operating in the workflow orchestration market include Microsoft (US), IBM (US), VMware (US), Oracle (US), Cisco Systems (US), CA Technologies (US), ServiceNow (US), BMC Software (US), Dalet SA (France), Arvato AG (Germany), Ayehu Software Technologies (US), and Micro Focus (UK). These companies focus on the adoption of various growth strategies such as new product launches, product enhancements, agreements, partnerships, and collaborations, to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Workflow Orchestration Market

4.2 North America: Market, By Type

4.3 Asia Pacific: Market, By Organization Size

4.4 IT & Telecommunication: Market, By Region

4.5 Market, By Region & Vertical

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increases Efficiency and Productivity Level

5.2.1.2 Improves Business Outcomes With Better Strategic Decisions

5.2.2 Restraints

5.2.2.1 Lack of Technical Expertise

5.2.3 Opportunities

5.2.3.1 Digital Transformation Initiatives Across Enterprises

5.2.3.2 Rising Demand to Streamline Business Processes

5.2.4 Challenges

5.2.4.1 Difficulties in Integrating New and Existing Systems Through Workflows

5.2.4.2 High Implementation Cost

5.3 Ecosystem

5.4 Innovation Spotlight

6 Workflow Orchestration Market, By Type (Page No. - 35)

6.1 Introduction

6.2 Cloud Orchestration

6.3 Data Center Orchestration

6.4 Network Management

6.5 Business Process Orchestration

6.6 Security Orchestration

7 Market, By Organization Size (Page No. - 41)

7.1 Introduction

7.2 Small & Medium-Sized Enterprises (SMES)

7.3 Large Enterprises

8 Workflow Orchestration Market, By Vertical (Page No. - 45)

8.1 Introduction

8.2 IT & Telecommunication

8.3 Media & Entertainment

8.4 Banking Financial Services & Insurance (BFSI)

8.5 E-Commerce, Retail & Consumer Goods

8.6 Public Sector

8.7 Manufacturing & Automotive

8.8 Healthcare & Pharmaceutical

8.9 Travel & Hospitality

8.10 Others

9 Regional Analysis (Page No. - 53)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Latin America

9.6 Middle East & Africa (Mea)

10 Competitive Landscape (Page No. - 78)

10.1 Overview

10.2 Key Players in the Workflow Orchestration Market

10.3 Competitive Situation and Trends

10.3.1 New Product Launches & Product Enhancements

10.3.2 Agreements, Collaborations & Partnerships

10.3.3 Acquisitions

11 Company Profiles (Page No. - 83)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 Microsoft

11.2 IBM

11.3 Cisco Systems

11.4 Oracle

11.5 VMware

11.6 CA Technologies

11.7 Arvato AG

11.8 Bmc Software

11.9 Servicenow

11.10 Micro Focus

11.11 Dalet S.A.

11.12 Ayehu Software Technologies

11.13 Key Innovators

11.13.1 Check Point Software Technologies

11.13.2 Threatmetrix

11.13.3 Root6 Limited

11.13.4 Ooyala

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 110)

12.1 Industry Excerpts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (65 Tables)

Table 1 USD Exchange Rate, 2014-2016

Table 2 Workflow Orchestration Market Size, By Type, 2015–2022 (USD Million)

Table 3 Cloud Orchestration: Market Size, By Region, 2015–2022 (USD Million)

Table 4 Data Center Orchestration: Market Size, By Region, 2015–2022 (USD Million)

Table 5 Network Management: Market Size, By Region, 2015–2022 (USD Million)

Table 6 Business Process Orchestration: Market Size, By Region, 2015–2022 (USD Million)

Table 7 Security Orchestration: Market Size, By Region, 2015–2022 (USD Million)

Table 8 Workflow Orchestration Market Size, By Organization Size, 2015-2022 (USD Million)

Table 9 Small & Medium-Sized Enterprises (SMES): Market Size, By Region, 2015-2022 (USD Million)

Table 10 Large Enterprises: Market Size, By Region, 2015-2022 (USD Million)

Table 11 Market Size, By Vertical, 2015-2022 (USD Million)

Table 12 IT & Telecommunication: Market Size, By Region, 2015-2022 (USD Million)

Table 13 Media & Entertainment: Market Size, By Region, 2015-2022 (USD Million)

Table 14 Banking Financial Services & Insurance (BFSI): Market Size, By Region, 2015-2022 (USD Million)

Table 15 E-Commerce, Retail & Consumer Goods: Market Size, By Region, 2015-2022 (USD Million)

Table 16 Public Sector: Market Size, By Region, 2015-2022 (USD Million)

Table 17 Manufacturing & Automotive: Market Size, By Region, 2015-2022 (USD Million)

Table 18 Healthcare & Pharmaceutical: Market Size, By Region, 2015-2022 (USD Million)

Table 19 Travel & Hospitality: Market Size, By Region, 2015-2022 (USD Million)

Table 20 Others: Workflow Orchestration Market Size, By Region, 2015-2022 (USD Million)

Table 21 Market Size, By Region, 2015-2022 (USD Million)

Table 22 North America Workflow Orchestration Services Market Size, By Type, 2015-2022 (USD Million)

Table 23 North America Market Size, By Organization Size, 2015-2022 (USD Million)

Table 24 North America Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 25 Cloud Orchestration: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 26 Data Center Orchestration: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 27 Network Management: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 28 Business Process Orchestration: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 29 Security Orchestration: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 30 Europe Workflow Orchestration Services Market Size, By Type, 2015-2022 (USD Million)

Table 31 Europe Workflow Orchestration Market Size, By Organization Size, 2015-2022 (USD Million)

Table 32 Europe Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 33 Cloud Orchestration: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 34 Data Center Orchestration: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 35 Network Management: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 36 Business Process Orchestration: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 37 Security Orchestration: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 38 Asia Pacific Workflow Orchestration Services Market Size, By Type, 2015-2022 (USD Million)

Table 39 Asia Pacific Market Size, By Organization Size, 2015-2022 (USD Million)

Table 40 Asia Pacific Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 41 Cloud Orchestration: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 42 Data Center Orchestration: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 43 Network Management: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 44 Business Process Orchestration: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 45 Security Orchestration: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 46 Latin America Workflow Orchestration Services Market Size, By Type, 2015-2022 (USD Million)

Table 47 Latin America Workflow Orchestration Market Size, By Organization Size, 2015-2022 (USD Million)

Table 48 Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 49 Cloud Orchestration: Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 50 Data Center Orchestration: Latin America Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 51 Network Management: Latin America Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 52 Business Process Orchestration: Latin America Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 53 Security Orchestration: Latin America Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 54 Middle East & Africa Workflow Orchestration Services Market Size, By Type, 2015-2022 (USD Million)

Table 55 Middle East & Africa Workflow Orchestration Market Size, By Organization Size, 2015-2022 (USD Million)

Table 56 Middle East & Africa Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 57 Cloud Orchestration: Middle East & Africa Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 58 Data Center Orchestration: Middle East & Africa Workflow Orchestration Market Size, By Vertical, 2015-2022 (USD Million)

Table 59 Network Management: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 60 Business Process Orchestration: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 61 Security Orchestration: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 62 Market Ranking of Key Players in the Workflow Orchestration Market, 2017

Table 63 New Product Launches & Product Enhancements, July 2017-November 2017

Table 64 Agreements, Collaborations & Partnerships, August 2017-November 2017

Table 65 Acquisitions, January 2015-November 2017

List of Figures (39 Figures)

Figure 1 Market Segmentation

Figure 2 Workflow Orchestration Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Assumptions

Figure 7 Business Process Orchestration Segment Expected to Grow at Highest CAGR During Forecast Period

Figure 8 SMES Segment Expected to Witness Higher CAGR During Forecast Period

Figure 9 Top Four Revenue Verticals of Workflow Orchestration Market in 2017

Figure 10 Asia Pacific Expected to Grow at Highest Rate During Forecast Period

Figure 11 Increasing Focus of Organizations to Maximize Efficiency and Productivity is Expected to Drive the Growth of the Market

Figure 12 The Business Process Orchestration Segment of the North America Workflow Orchestration Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 13 The Large Enterprises Segment is Projected to Lead the Asia Pacific Workflow Orchestration Market During the Forecast Period

Figure 14 The Asia Pacific IT & Telecommunication Workflow Orchestration Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 15 The Market in the Asia Pacific Region is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Workflow Orchestration Ecosystem

Figure 18 The Cloud Orchestration Segment is Estimated to Lead the Workflow Orchestration Market in 2017

Figure 19 The Small & Medium-Sized Enterprises (SMES) Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 IT & Telecommunication Vertical is Estimated to Lead the Global Market During the Forecast Period

Figure 21 North America is Projected to Lead the Workflow Orchestration Market From 2017 to 2022

Figure 22 North America Market Snapshot

Figure 23 Asia Pacific Market Snapshot

Figure 24 Companies Adopted Agreements, Collaborations & Partnerships as Key Growth Strategies Between 2015 and 2017

Figure 25 Market Evaluation Framework

Figure 26 Microsoft: Company Snapshot

Figure 27 Microsoft: SWOT Analysis

Figure 28 IBM: Company Snapshot

Figure 29 IBM: SWOT Analysis

Figure 30 Cisco Systems: Company Snapshot

Figure 31 Oracle: Company Snapshot

Figure 32 VMware: Company Snapshot

Figure 33 VMware: SWOT Analysis

Figure 34 CA Technologies: Company Snapshot

Figure 35 CA Technologies: SWOT Analysis

Figure 36 Servicenow: Company Snapshot

Figure 37 Servicenow: SWOT Analysis

Figure 38 Micro Focus: Company Snapshot

Figure 39 Dalet SA: Company Snapshot

Growth opportunities and latent adjacency in Workflow Orchestration Market