Microscopy Market Size, Growth, Share & Trends Analysis

Microscopy Market by Product (Optical Microscope: Stereo, Digital; Electron Microscope: SEM, TEM; AFM, STM), Application (Pharma Mfg., Pathology, Drug Discovery, Toxicology), End User (Pharma-Biopharma, F&B, Academia, Semiconductor) - Global Forecasts to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

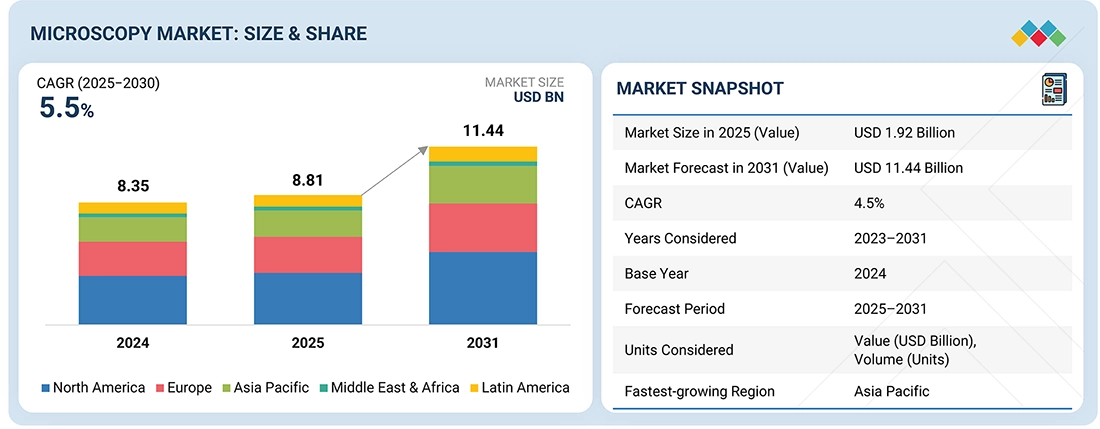

The global microscopy market, valued at USD 8.35 billion in 2024, stood at USD 8.81 billion in 2025 and is projected to advance at a resilient CAGR of 5.5% from 2025 to 2031, culminating in a forecasted valuation of USD 11.44 billion by the end of the period. The global microscopy market plays a very important and enabling part in the life sciences and research community, and its applications beyond biologic imaging are growing very rapidly in semiconductor device manufacturing. In addition to biologic imaging, microscopes today find important and widespread uses in semiconductor device wafer inspection, semiconductor device failure analysis, nanomanufacturing, and surface metrology. As semiconductor device technology continues to scale down into smaller nodes and integrates more diverse and complex technologies, the use of microscopes has shifted from being an important but supplemental analytical capability to being a highly critical and directly enabling one. Both the biologic and semiconductor device markets have widened the scope of the microscopy market.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is expected to register the highest CAGR in this market during the forecast period.

-

BY PRODUCTThe optical microscopes segment dominates the global microscopy market and accounted for 37% in 2025.

-

BY END USERThe semiconductors & electronics industry segment holds the largest share in the market; it was projected at 31% in 2025.

-

BY APPLICATIONBy application, the semiconductors & electronics applications segment accounted for 38% of the market share in 2025.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSCarl Zeiss AG (Germany), Thermo Fisher Scientific Inc. (US), and Danaher Corporation (US) maintain a strong position in the microscopy market due to their comprehensive product portfolios, large installed bases, and well-established application and service networks. Their sustained investments in advanced imaging technologies, combined with deep engagement with academic institutions, healthcare providers, and industrial customers, continue to reinforce their leadership across the market.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as Euromex (Netherlands), Etaluma, Inc. (US), ACCU-SCOPE (US), and Helmut Hund GmbH (Germany) are gaining traction in the microscopy market by offering cost-effective and application-specific solutions. These companies primarily address demand for optical, fluorescence, and digital microscopy systems, targeting education, routine clinical use, and budget-conscious research laboratories.

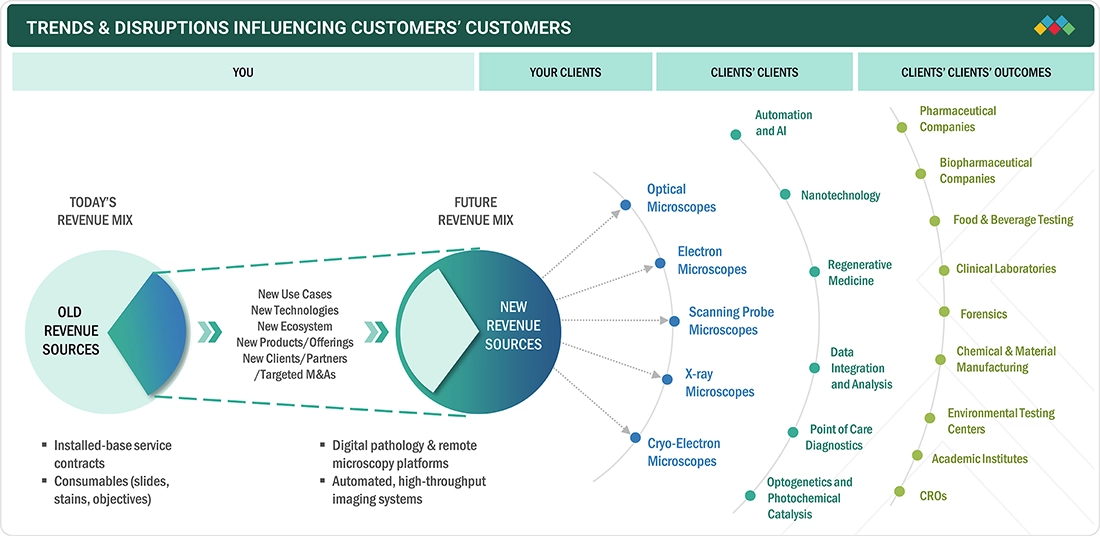

A defining trend in the microscopy market is the convergence of research-grade imaging with industrial-scale inspection requirements. Semiconductor and electronics manufacturers are increasingly demanding microscopes that offer nanometer-level resolution, faster scan speeds, and seamless integration with manufacturing execution and yield management systems. Optical microscopy is being augmented with advanced contrast techniques and AI-based defect recognition, while electron microscopy is increasingly deployed closer to the production line rather than confined to R&D labs. Across both industrial and life science domains, there is a strong shift toward data-centric microscopy, where image acquisition, analytics, and decision-making are tightly coupled.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Concerning the industrial market, especially the fabrication facilities and advanced manufacturing facilities, the main impact of microscopy-related disruptions is the result of increasing defect sensitivity levels and tightening process margins. The more traditional offline inspection approaches are being overtaken in the industry by the need for higher-speed, more automated, and more statistically sound imaging processes to limit yield loss. However, there is also a parallel need in the life sciences markets, along with the industrial markets, to decrease their reliance on experienced operators through the use of more automation from AI. Customers are being forced to change purchasing patterns in this area, giving higher priority to vendors who are able to address roadmap alignment rather than individual instrument sales.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid evolution of semiconductor manufacturing toward sub-5 nm nodes

-

Growing adoption of cryo-electron microscopy (cryo-EM)

Level

-

High capital investment

-

Complexity in data interpretation and workflow standardization

Level

-

Increasing demand for automated and AI-enabled microscopy for industrial manufacturing

-

Growing integration of artificial intelligence (AI) and machine learning

Level

-

Challenges associated with realizing scalability with ultra-high performance

-

Shortage of highly skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid evolution of semiconductor manufacturing toward sub-5 nm nodes

One of the strongest drivers for the microscopy market is the rapid evolution of semiconductor manufacturing toward sub-5 nm nodes, chiplet architectures, and advanced packaging technologies, all of which demand extremely high-resolution imaging and surface characterization. In parallel, growth in life sciences R&D, pharmaceutical innovation, and translational research continues to drive demand for optical and electron microscopy. Industrial quality control in automotive electronics, energy storage, and precision manufacturing is further expanding microscopy adoption beyond traditional research environments, reinforcing the market’s multi-industry growth engine.

Restraint: High capital investment

High capital investment remains a key restraint, particularly for advanced electron and scanning probe microscopes required in semiconductor and materials applications. Industrial users also face challenges related to infrastructure readiness, including vibration control, cleanroom compatibility, and environmental stability. From a broader market perspective, the complexity of integrating microscopy outputs into industrial data systems and quality frameworks can slow adoption, especially in fabs and factories where downtime and validation risks are tightly controlled.

Opportunity: Increasing demand for automated and AI-enabled microscopy for industrial manufacturing

The increasing demand for automated and AI-enabled microscopy for industrial manufacturing settings is, in turn, opening a great window of opportunity. Semiconductor fabs are increasingly investing in defect classification, pattern recognition, and predictive analytics powered by microscopy data. Those vendors that can offer application-specific solutions for wafer inspection, advanced packaging analysis, and failure diagnostics while maintaining cross-compatibility with life sciences workflows are indeed at an advantage. The localization of semiconductor manufacturing to the Asia Pacific and North America is further creating new greenfield demand for advanced microscopy infrastructure.

Challenge: Challenges associated with realizing scalability with ultra-high performance

A major issue in the microscopy market is realizing scalability with ultra-high performance. Microscopy performed by semiconductor manufacturers needs to produce results that can be precisely repeated with different tools. It is always challenging to meet such characteristics with methodologies that require higher precision. Increased data, cybersecurity, and compatibility with industrial software platforms have continued to be problems. On the other hand, enriching high innovation rates with qualification procedures common to semiconductor manufacturing has continued to make it more challenging.

MICROSCOPY MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Danaher’s introduction of the Vivent LS2 light-sheet microscope supports high-resolution, low-phototoxicity imaging for developmental biology and life sciences research across US universities, national laboratories, and biotechnology companies. The system is optimized for long-duration live imaging, making it suitable for cell biology, neuroscience, and translational research applications. | Improves long-term sample viability during extended imaging experiments | Reduces phototoxic effects while maintaining high spatial resolution |

|

Nikon’s ECLIPSE Ji AI-enabled inverted microscope is widely deployed in US biomedical research laboratories, pharmaceutical R&D centers, and core imaging facilities to support automated and routine cell imaging applications. | Enhances workflow automation and reproducibility through integrated AI capabilities | Reduces manual intervention and user-to-user variability |

|

ZEISS’s INSPECT multisensor imaging microscope is utilized in the US advanced manufacturing, aerospace, automotive, and semiconductor industries for precision inspection and dimensional metrology of complex components. | Enables high-accuracy inspection of components with diverse geometries and materials | Improves productivity and measurement reliability in industrial inspection processes |

|

Thermo Fisher Scientific’s advanced transmission electron microscopy (TEM) systems, integrated with electron energy-loss spectroscopy (EELS), are widely used in US materials science, nanotechnology, and semiconductor R&D. | Provides atomic-level structural and chemical analysis capabilities | Delivers high-resolution insights critical for semiconductor and advanced materials development |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The microscopy ecosystem encompasses companies involved in instrument manufacturing, optical & detector component suppliers, vacuum & motion control component suppliers, software & AI solution suppliers, and service companies. In the industrial manufacturing domain, especially in semiconductors, there is an ever-increasing blur with companies involved in metrology, inspection, and yield management. The end users of microscopy range from academic research organizations and pharmaceutical companies to semiconductor facilities, electronics manufacturers, and materials scientists. Value addition is gradually shifting toward software, application engineering, and long-term services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Microscopy Market, By Product

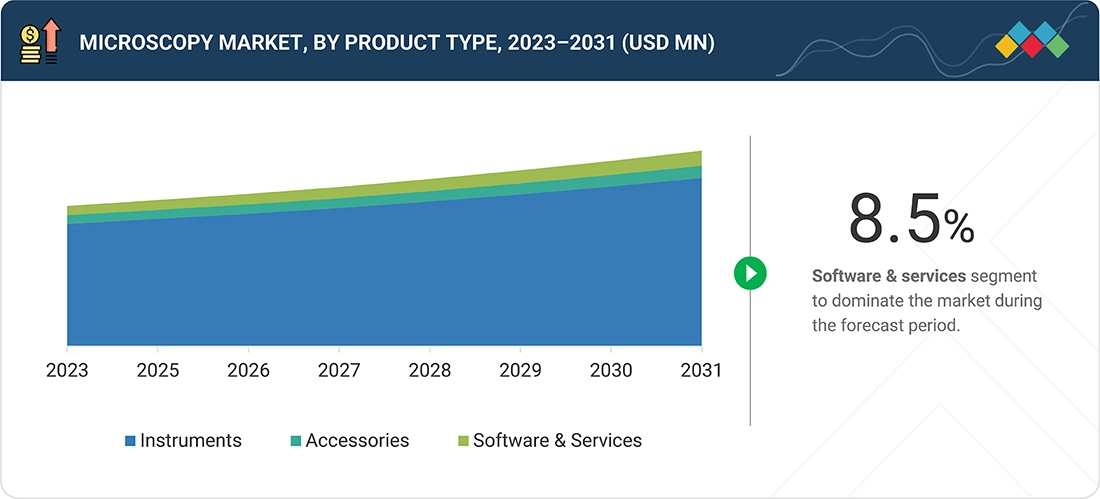

Due to its versatility, optical microscopy has remained the biggest product segment in both life sciences and industrial quality control, including routine inspection in electronics and precision manufacturing. The segment has continued to innovate with digital imaging, automated stage control, and AI-based defect detection, which sustains its dominance. On the other hand, electron microscopy is the most strategically critical segment for semiconductor manufacturing, particularly at atomic scale resolution, which is needed to validate process nodes, perform failure analysis, and inspect advanced packaging. Scanning probe microscopy continues to find niche industrial applications in areas like surface roughness measurement and nanomechanical characterization; its growth is steady.

Microscopy Market, By Application

Semiconductor & electronics applications dominated the market owing to continued digitalization & automation of lab workflows coupled with integration of AI capabilities with image analysis software, recent technological developments in the field of nanotechnology, and the expansion of semiconductor manufacturing that required advanced electron microscopes & other microscopy technology.

Microscopy Market, By End User

The microscopy market is primarily dominated by the semiconductor & electronics industry, as advanced microscopy methods enable defect inspection, failure analysis, and process optimization to be performed at micro and nanoscale levels, particularly in semiconductor and nanotechnology sectors. The market is heavily supported by significant capital investments from industrial players and the rising demand for high-throughput automated imaging systems. Long-term benefits for the industrial segments in microscopy investments are likely to proceed with the continuous development of advanced manufacturing and nanofabrication technologies.

REGION

Asia-Pacific to be the fastest-growing region in the global microscopy market during the forecast period

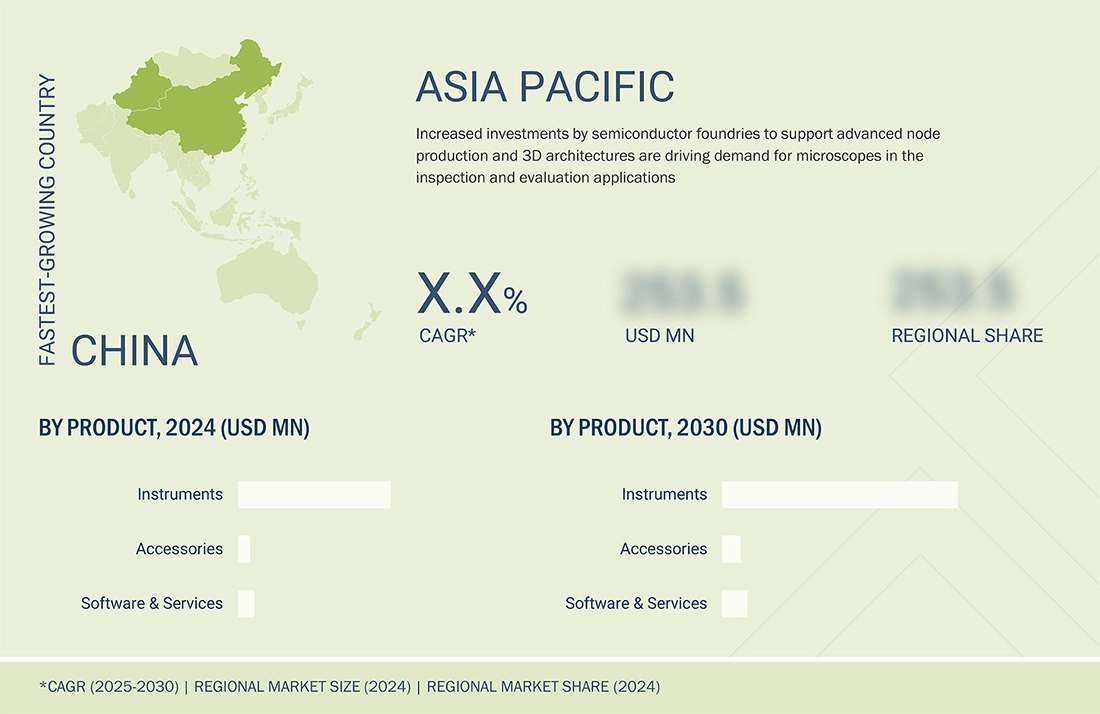

The Asia Pacific region offers cost advantages, including low-cost labor, raw materials, and a dense network of local OEMs, enabling competitive manufacturing and localized assembly of microscopes and key components. This cost advantage, combined with expanding regional supply chains, reduces acquisition and service expenses for end users and lessens reliance on imports. These factors have contributed to lowering the total acquisition cost of microscopes, helping to expand the overall market. Asia-Pacific hosts major semiconductor manufacturing facilities in Taiwan, South Korea, China, and Japan, where wafer inspection and defect analysis depend heavily on SEM/TEM and wafer-inspection microscopes. Rapid investments by leading foundries and IDMs to support smaller node production and 3D architectures are driving above-average demand for high-resolution inspection systems across the region. With substantial government investments in research infrastructure focusing on nanotechnology and biotechnology, such public initiatives are expected to boost microscopy adoption, which will contribute to significant market growth.

MICROSCOPY MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

The microscopy market is getting increasingly competitive as vendors are moving beyond the core of traditional imaging performance to industrial-grade automation, AI analytics, and workflow integration. Market leaders like Carl Zeiss, Thermo Fisher Scientific, Leica Microsystems, Olympus, and Bruker maintain their leading positions based on breadth of technology, semiconductor-ready solutions, software ecosystems, and global service capability. Smaller specialized players remain focused on specific niche industrial or nanoscale applications; however, competitive advantage is increasingly being dictated by a vendor's ability to support both life science discovery and high-volume industrial manufacturing requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Danaher Corporation (US)

- Thermo Fisher Scientific (US)

- Nikon Corporation (Japan)

- Oxford Instruments plc (UK)

- Keyence Corporation (Japan)

- Euromex Microscope bv (Netherlands)

- Carl Zeiss AG (Germany)

- EVIDENT (Japan)

- JEOL Ltd. (Japan)

- Hitachi High-Tech Corporation (Japan)

- Shimadzu Corporation (Japan)

- Bruker Corporation (US)

- Helmut Hund GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 8.81 Million |

| Market Forecast in 2031 (value) | USD 11.44 Million |

| Growth Rate | CAGR of 5.5% from 2025–2031 |

| Years Considered | 2023–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

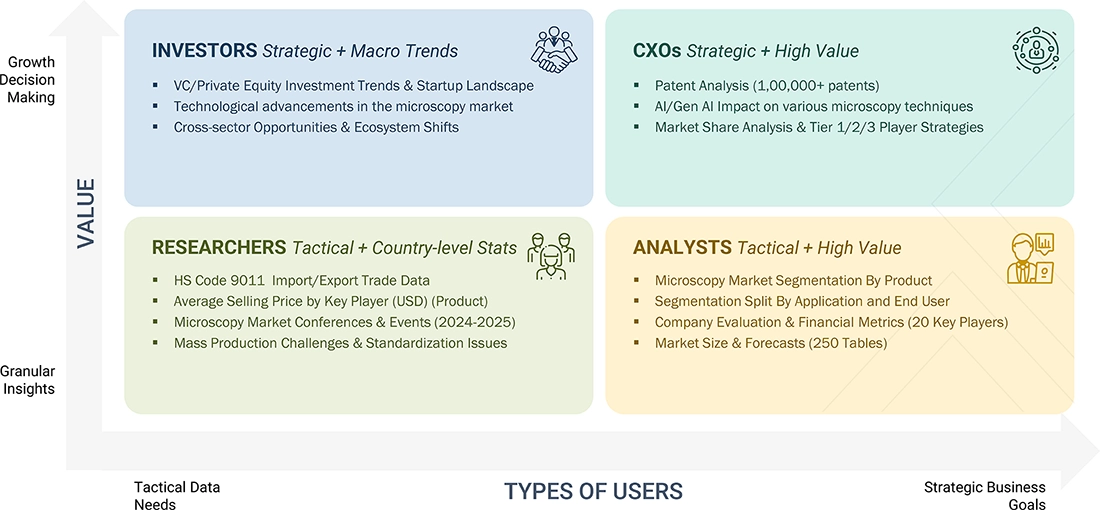

WHAT IS IN IT FOR YOU: MICROSCOPY MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Microscopy Instrument Manufacturers |

|

|

| Pharmaceutical & Biopharmaceutical Companies and CROs |

|

|

| Diagnostic & Pathology Laboratories |

|

|

RECENT DEVELOPMENTS

- November 2024 : Carl Zeiss AG launched ZEISS O-INSPECT, which combines optical and tactile measurement technology and helps to measure complex components, from large workpieces such as circuit boards and fuel cells to smaller components.

- October 2024 : Thermo Fisher Scientific launched Iliad, a transmission electron microscopy (TEM) system with integrated electron energy loss spectroscopy (EELS) for advanced analysis.

- September 2023 : Nikon revealed ECLIPSE Ji, an AI-powered inverted microscope aimed at offering improved stability and enhanced functional ??????flexibility.

Table of Contents

Methodology

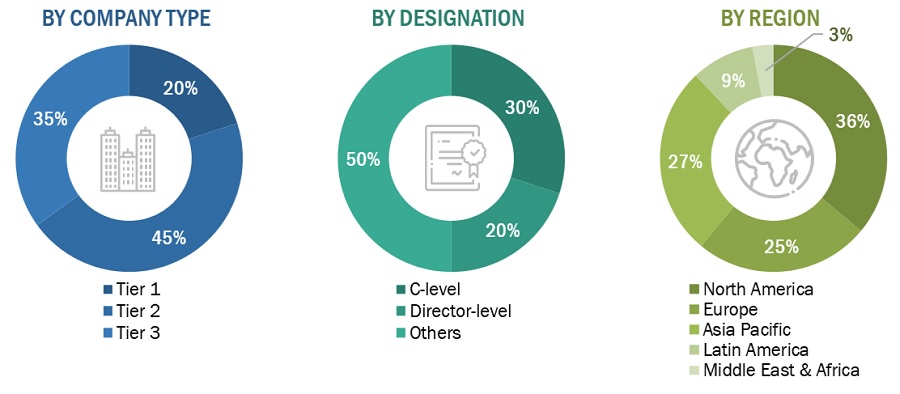

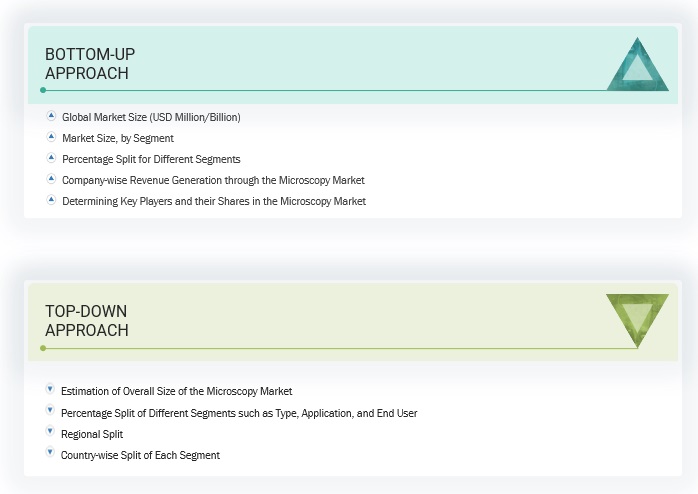

The study effectively strikes a balance between primary and secondary research for microscopy market. Several market variables for both small and medium-sized businesses and the major players are analyzed as part of the research. The study encompassed the identification of significant market segments, emerging patterns, the competitive environment, and the regulatory framework. The study also looks at several important players strategies. The top-down and bottom-up approaches were used to estimate the market size, resulting in data triangulation at the end to determine the final market size estimate. Throughout the course of the investigation, primary research was conducted to verify and test each of the hypotheses.

Secondary Research

The secondary research process extensively utilizes various secondary sources, including directories, databases like Bloomberg Businessweek, Factiva, and D&B Hoovers, white papers, annual reports, company house documents, investor presentations, and SEC filings. This research approach was employed to gather and compile data essential for a comprehensive, technical, and market-focused study of the microscopy market. Additionally, it provided valuable insights into key players, market classification, and segmentation based on industry trends, as well as significant developments related to market and technology perspectives. A database of leading industry figures was also created through secondary research.

Primary Research

For the part of primary research and to obtain qualitative and quantitative data a range of personalities from the supply and demand sides were questioned during the phase of primary research. Key positions from the industry like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed from key players. Among the demand-side primary sources were academic institutions, research organizations. In order to validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are categorized into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

Based on a review of key competitors' revenue shares, the size of the worldwide microscopy market was calculated for this report. To achieve this, major market participants were identified, and their microscopy business revenues were calculated using a variety of insights obtained throughout the primary and secondary research stages. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of global market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

- List of major players that operates in microscopy market on regional or country level

- Performing product mapping of manufacturers of microscopes and associated product line at country or regional level

- Annual revenue mapping of listed players from the microscopes and associated products/services (or the nearest reported business unit)

- Revenue mapping of major players to cover at least ~70% of the global market share as of 2023.

- Revenue mapping extrapolation for the listed players will drive the global market value for the respective segment.

- Adding market value of all segments and subsegments at last to achieve the actual value of global microscopy market.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the microscopy market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the microscopy market was validated using both top-down and bottom-up approaches.

Market Definition

Microscopes are basically optical instruments utilized to visualize objects on a nanoscale that can't be observed by the naked eye. Microscopy is the process of using a microscope to examine small objects. The technique has numerous applications in life science research, healthcare, semiconductors, and electronics.

Key Stakeholders

- Biotech and Pharmaceutical Companies.

- Pharmaceutical and biotechnology companies

- Manufacturers and suppliers of microscopes, accessories, and software

- Product suppliers, distributors, and channel partners

- Semiconductor product manufacturers

- Automotive industry

- Food & beverage industry

- Medical research institutes and independent research labs

- Academic & research institutes

- Community centers and hospitals

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

Objectives of the Study

- To define, describe, and forecast the microscopy market based on product, product type, type, application, end-user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the microscopy market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the microscopy market

- To analyze key growth opportunities in the microscopy market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global microscopy market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global microscopy market, such as product launches; agreements; expansions; and mergers & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present microscopy market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe microscopy market into Russia, Belgium, Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific microscopy market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Microscopy Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Microscopy Market