Yoga and Exercise Mats Market by Material (Polyvinyl Chloride, Natural Rubber, Polyurethane, Thermoplastic Elastomer, Others), Distribution Channel (E-Commerce, Supermarket & Hypermarket, Specialty Store), End-Use, Region - Global Forecast to 2025

Updated on : September 03, 2025

Yoga Mat Market

The global yoga mat market was valued at USD 8984 million in 2020 and is projected to reach USD 10430 million by 2025, growing at 3.0% cagr from 2020 to 2025. This growth can be attributed to the rising popularity of yoga and an increase in the prevalence of lifestyle diseases across the globe.

Yoga Mat Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Yoga and Exercise Mats Market

The COVID-19 has had a direct and indirect impact on nearly all the countries across regions, their economic performance, and the distribution channels of all the industries. However, the health sector and its affiliated market have witnessed a positive impact due to the pandemic. Yoga mat market is a part of fitness and healthcare products markets. The pandemic has not negatively impacted the global yoga mats market.

Nowadays people are becoming more creative and introducing yoga in their exercise routines. According to numerous consumer psychologists, people around the world have been purchasing items based on three needs: to protect, entertain, and connect. Furthermore, the global yoga mats market is projected to witness steady growth, even after the pandemic subsides, majorly due to the increase in awareness regarding the healthy lifestyle among people around the world.

Yoga and Exercise Mats Market Dynamics

Driver: Rise in popularity of Yoga

From the last few years the popularity of yoga is increasing mainly due to its numerous health benefits. Yoga has been consider as one of the most popular fitness activities in the world. Yoga is becoming popular worldwide and on June 21 the international yoga day is celebrated. The word “yoga” is among the 15 most popular words in the UK. This increase in popularity has led to increase in various accessories related to it which includes yoga mat. Yoga mat act as a insulation between the human body and the ground. This prevents any loss of heat, charge or energy from the body to the ground and thereby provides a thermo-insulation. Due to anti-slipping nature of yoga mat, it helps the person to keep strong hold on the surface Hence, the rise in popularity of yoga is projected to drive the growth of the yoga mat market.

Restraint: Volatility of raw material prices

There are various raw material used for manufacturing yoga mats such as polyvinyl chloride (PVC), thermoplastic elastomer (TPE), polyurethane (PU), and Natural Rubber, among others. Polyvinyl chloride (PVC), thermoplastic Elastomer (TPE), and Polyurethane (PU) are the polymers derived from crude oil. Hence, the yoga mat industry is directly dependent on crude oil prices. There are always fluctuation in the prices of crude oils and it has negative impact on the whole supply chain of yoga mat. Raw material suppliers are struggling to earn a profit, and yoga mat suppliers and OEMs are focusing on raising prices, however, suffering losses and a decrease in customer base. Hence, volatility in raw material prices acts as a restraint in the growth of the yoga mat market.

Opportunity: Use of eco-friendly and biodegradable materials

Many government bodies around the world is encouraging manufacturers to invest in environment-friendly components for developing yoga mats. In order to align with stringent government regulations, yoga mat manufacturers are shifting their focus from utilizing PVC materials to various eco-friendly material such as cotton, jute and many others. Companies such as Manduka, Prana, Yoloha, Jade Yoga, and Tomuno, among others, are focusing on utilizing components that dispense low carbon emission levels during the manufacturing process. For instance, leading yoga mat companies, such as Dragonfly Yoga, are diverting their investments toward developing eco-friendly and lightweight yoga mats to offer biodegradable and eco-friendly solutions.

Challenge: Availability of alternatives to yoga mats

Yoga mat provides good support and grip for the practitioners but some people does not feel its need. Instead, they use alternatives, such as woven carpets, grass lawns, wooden floor, bathmat, or a big rock, among others, as far as they meet the same purpose. In addition, buying a premium quality mat can be costly, and fitness enthusiasts may not be prepared to spend that amount right at the beginning. This poses a major challenge for manufacturers, impacting the growth of the yoga mat market.

Based on end-use, the personal segment accounted for the largest market share in 2019

The personal segment accounted for the largest market share in 2019 by end-use. Yoga mats offers several benefits and can be used as heat protectors, absorbing wipes, in garden laying, and other recreational activities. Home workout activities are increasing and yoga is preferred by many people around the world. Yoga mats offer more than basis functionalities, due to which their consumption has been steadily increasing in the consumer market

Based on distribution channel, the e-commerce segment accounted for the largest market share in 2019

The e-commerce segment accounted for the largest share of the yoga mat market in 2019 based on distribution channel. Businesses have been able to reach their potential customers by setting online stores where the products offered by manufacturers can be accessed globally. This channel includes online marketplaces, such as Amazon, Walmart, and eBay, along with third-party e-retailers who provide business merchandising online. Fitness products, such as yoga mats, witnessed a high demand due to the COVID-19-enforced lockdown on health clubs and gymnasiums. This has led to an increase in the expansion of e-commerce distribution channels and demand for fitness products.

Based on material, the Polyvinyl Chloride segment accounted for the largest market share in 2019

The Polyvinyl Chloride (PVC) segment accounted for the largest share of the yoga mat market in 2019 based on material. Many deveping countries such as India, Brazil, Argentina, and Mexico uses PVC to manufacture the yoga mats. PVC offers several benefits such as flexibility, durability, easily washable and is cheaper than other polymers

Asia Pacific accounted for the largest share of the yoga mat market in 2019

The largest share of the yoga mat market in 2019 was held by the Asia Pacfiic region. The large market share is due to the increasing popularity of yoga in countries such as China, Japan, Thailand, and Australia, among others. The government of India has also undertaken various initiatives to promote the benefits of yoga in the country. The popularity of yoga, along with the increase in government initiatives to promote yoga, is expected to drive the yoga mat market in the country.

To know about the assumptions considered for the study, download the pdf brochure

Yoga Mat Market Players

Lululemon Athletica Inc (Canada), Columbia Sportswear Company (US), Sequential Brands Group Inc. (US), Jade Yoga (US), Manduka LLC (US), Hugger Mugger Yoga Products (US), Liforme Ltd. (UK), Barefoot Yoga Co. (US), Fabrication Enterprises, Inc. (US), Quanzhou Sansheng Rubber Plastic Foamed Shoes Materials Co., Ltd. (China), adidas AG (Germany), and La Vie Boheme Yoga (US) are some of the leading players operating in the yoga mat market.

Yoga Mat Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 8,984 million |

|

Revenue Forecast in 2025 |

USD 10,430 million |

|

CAGR |

3.0% |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Thousand Unit) |

|

Segments |

Material, Distribution Channel, and End Use |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East, and South America |

|

Companies profiled |

Lululemon Athletica Inc (Canada), Columbia Sportswear Company (US), Sequential Brands Group Inc. (US), Jade Yoga (US), Manduka LLC (US), Hugger Mugger Yoga Products (US), Liforme Ltd. (UK), Barefoot Yoga Co. (US), Fabrication Enterprises, Inc. (US), Quanzhou Sansheng Rubber Plastic Foamed Shoes Materials Co., Ltd. (China), adidas AG (Germany), La Vie Boheme Yoga (US) (US), Accessory Arcade (India), Eupromed S.R.O. (Czech Republic), Ningbo Mylon Rubber & Plastic Co., Ltd. (China), Winboss International Co., Ltd (Taiwan), Xiamen Sanfan Sports Products Co, Ltd. (China), Alo Yoga (US), TEGO (India), Ecoyoga (US), Shenzhen Haifuxing Technology Co., Ltd (China), Shanghai Fitness Sourcing Inc. (China), Fitness Mats (India), and Yoga Direct LLC (US), among others

|

This research report categorizes the yoga mat market based on technology, application and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Yoga Mat Market based on the Material:

- Natural Rubber

- Polyvinyl Chloride

- Polyurethane

- Thermoplastic Elastomer

- Others (cotton and jute)

Yoga Mat Market based on the Distribution Channel

- E-commerce

- Supermarket & Hypermarket

- Specialty Store

Yoga Mat Market based on the End Use

- Personal

- Health Care

Yoga Mat Market based on the Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In July 2020, Lululemon Athletica Inc. entered into a definitive agreement to acquire MIRROR (US), an in-home fitness company. MIRROR offers a mirror-style product that mimics an in-studio experience, as well as more than 70 new classes and over 40 class types per week, including strength training, weight training, pre- and post-natal workouts, and yoga. This acquisition is expected to enhance the annual sale of yoga mats by Lululemon Athletica Inc.

- In May 2020, Columbia Sportswear Company (CSC) entered into a definitive agreement with Steelpoint Capital Partners (US) and other minority members to acquire all controlling interests of the yoga-inspired prAna apparel brand. prAna will join CSC’s portfolio of authentic, active outdoor brands and is expected to propel CSC into the yoga mat market.

- In January 2019, Columbia Sportswear Company (CSC) acquired the remaining interest in Columbia Sportswear Commercial (Shanghai) Company, its joint venture in China with Swire Resources Limited. This acquisition enhanced the distribution channel of CSC in the South-East Asian region.

Frequently Asked Questions (FAQ):

How big is the Yoga Mat Market?

Yoga Mat Market worth $10,430 million by 2025.

What is the growth rate of Yoga Mat Market?

Yoga Mat Market grows at a CAGR of 3.0% during the forecast period.

What is yoga mat?

Yoga mat is a type of mat that is made specifically for practicing yoga. It provides a non-slip and cushioned surface, which makes it easier to perform yoga asanas safely and comfortably.

What are the different materials used in yoga mats?

Natural Rubber, Polyvinyl Chloride, Polyurethane, Thermoplastic Elastomer, Cotton, and Jute are different materials used in yoga mats.

Which are the key countries expected to fuel the growth of yoga mat market?

The yoga mat market is expected to grow the fastest in China, followed by Saudi Arabia

What are the key driving factors for the yoga mat market?

Rise in popularity of Yoga, increase in the prevalence of lifestyle disease, increase in the rate of obesity are expected to drive the yoga mat market.

What are the major challenges which may hinder the growth of the yoga mat market?

Availability of alternatives to yoga mats is the major challenge that is expected to hinder the growth of the overall yoga mat market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 YOGA MATS

1.2.2 EXERCISE MATS

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 YOGA AND EXERCISE MATS MARKET, BY END USE: INCLUSIONS & EXCLUSIONS

TABLE 2 YOGA AND EXERCISE MAT MARKET, BY MATERIAL: INCLUSIONS & EXCLUSIONS

TABLE 3 YOGA MATS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YOGA AND EXERCISE MATS MARKET SEGMENTATION

FIGURE 1 YOGA AND EXERCISE MAT MARKET: SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 VOLUME

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 YOGA AND EXERCISE MATS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 DEMAND-SIDE APPROACH

2.3 MARKET ENGINEERING PROCESS

2.3.1 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 37)

TABLE 5 YOGA AND EXERCISE MATS MARKET SNAPSHOT, 2021 & 2026

FIGURE 5 POLYVINYL CHLORIDE (PVC) MATERIAL TYPE SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF YOGA AND EXERCISE MAT MARKET IN 2020

FIGURE 6 PERSONAL END-USE SEGMENT DOMINATED YOGA AND EXERCISE MATS MARKET IN 2020

FIGURE 7 E-COMMERCE DISTRIBUTION CHANNEL SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 8 ASIA PACIFIC TO LEAD YOGA AND EXERCISE MAT MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE YOGA AND EXERCISE MATS MARKET

FIGURE 9 INCREASE IN POPULARITY OF YOGA AND OTHER FORMS OF EXERCISE DRIVING YOGA AND EXERCISE MATS MARKET

4.2 YOGA AND EXERCISE MATS MARKET, BY REGION

FIGURE 10 YOGA AND EXERCISE MAT MARKET IN NORTH AMERICA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 ASIA PACIFIC YOGA AND EXERCISE MATS MARKET, BY MATERIAL TYPE & COUNTRY

FIGURE 11 POLYVINYL CHLORIDE MATERIAL TYPE SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARE IN 2021

4.4 YOGA AND EXERCISE MAT MARKET, BY MAJOR COUNTRIES

FIGURE 12 YOGA AND EXERCISE MATS MARKET IN THAILAND TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 YOGA AND EXERCISE MATS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising popularity of yoga and other forms of exercise

5.2.1.2 Increase in the prevalence of lifestyle diseases

5.2.1.3 Growing rate of obesity

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

TABLE 6 GLOBAL OIL & GAS PRICES, USD/BBL (2016–2020)

5.2.3 OPPORTUNITIES

5.2.3.1 Innovative technological solutions to offer high-quality yoga and exercise mats

5.2.3.2 Use of eco-friendly and biodegradable materials

5.2.4 CHALLENGES

5.2.4.1 Availability of alternatives to yoga and exercise mats

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS: YOGA AND EXERCISE MATS MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 DEGREE OF COMPETITION

5.4 VALUE CHAIN ANALYSIS OF YOGA MATS

FIGURE 15 THE YOGA MATS VALUE CHAIN

5.5 CASE STUDY ANALYSIS

5.5.1 PHYSICAL THERAPY AND REHABILITATION

5.5.1.1 Airex AG provides special exercise mats intended for use in physical therapy and rehabilitation at clinics

5.5.2 PEDIATRIC ACTIVITY

5.5.2.1 Fabrication Enterprises, Inc. provides exercise mats used in pre-schools and kindergarten

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 16 REVENUE SHIFT & NEW REVENUE POCKETS FOR YOGA AND EXERCISE MAT MANUFACTURERS

5.7 ECOSYSTEM FOR YOGA AND EXERCISE MATS MARKET

FIGURE 17 ECOSYSTEM MARKET MAP FOR YOGA AND EXERCISE MAT MARKET

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 INSIGHTS

FIGURE 18 PUBLICATION TRENDS (2010-2021)

TABLE 8 TOP 10 OWNERS OF YOGA AND EXERCISE MAT PATENTS

FIGURE 19 NO. OF YOGA AND EXERCISE MAT PATENTS BY COUNTRY (2010-2021)

5.8.3 TOP ASSIGNEES

FIGURE 20 NO. OF PATENT APPLICATIONS (2010-2021)

5.9 AVERAGE SELLING PRICE TREND

TABLE 9 AVERAGE PRICES OF YOGA MAT RAW MATERIALS, BY REGION (USD) (2020)

5.10 TECHNOLOGY ANALYSIS

5.11 TARIFFS & REGULATORY LANDSCAPE

TABLE 10 AVERAGE TARIFFS ON IMPORT OF ARTICLES AND EQUIPMENT FOR GENERAL PHYSICAL EXERCISE

TABLE 11 REGULATIONS ON FITNESS PRODUCTS IN THE EUROPEAN UNION

TABLE 12 REGULATIONS ON FITNESS PRODUCTS IN US

5.12 TRADE ANALYSIS

5.12.1 IMPORT ANALYSIS

FIGURE 21 IMPORT OF EQUIPMENT FOR GENERAL PHYSICAL EXERCISE, BY KEY COUNTRY, 2016-2020 (USD MILLION)

5.12.2 EXPORT ANALYSIS

FIGURE 22 EXPORT OF EQUIPMENT FOR GENERAL PHYSICAL EXERCISE, BY KEY COUNTRY, 2016-2020 (USD MILLION)

5.13 COVID-19 IMPACT ON YOGA AND EXERCISE MATS MARKET

5.13.1 COVID-19 HEALTH ASSESSMENT

FIGURE 23 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 24 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

FIGURE 25 THREE SCENARIO-BASED ANALYSIS OF COVID-19 IMPACT ON GLOBAL ECONOMY

5.13.2 COVID-19 IMPACT ON THE YOGA AND EXERCISE MATS MARKET

6 YOGA AND EXERCISE MATS MARKET, BY MATERIAL (Page No. - 69)

6.1 INTRODUCTION

FIGURE 26 YOGA AND EXERCISE MATS MARKET, BY MATERIAL, 2021 VS. 2026 (USD MILLION)

TABLE 13 YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (THOUSAND UNIT)

TABLE 14 YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

6.2 POLYVINYL CHLORIDE (PVC)

6.2.1 PREFERRED FOR MANUFACTURING LOW-COST MATS

6.2.2 COVID-19 IMPACT ON POLYVINYL CHLORIDE

TABLE 15 POLYVINYL CHLORIDE: YOGA AND EXERCISE MATS MARKET SIZE, BY REGION, 2018–2026 (THOUSAND UNIT)

TABLE 16 POLYVINYL CHLORIDE: YOGA AND EXERCISE MAT MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

6.3 POLYURETHANE (PU)

6.3.1 HIGH DEMAND FOR POLYURETHANE YOGA AND EXERCISE MATS IN ASIA PACIFIC

6.3.2 COVID-19 IMPACT ON POLYURETHANE

TABLE 17 POLYURETHANE: YOGA AND EXERCISE MATS MARKET, BY REGION, 2018–2026 (THOUSAND UNIT)

TABLE 18 POLYURETHANE: YOGA AND EXERCISE MAT MARKET, BY REGION, 2018–2026 (USD MILLION)

6.4 THERMOPLASTIC ELASTOMER (TPE)

6.4.1 HIGH DEMAND FOR YOGA AND EXERCISE MATS MADE FROM TPE IN NORTH AMERICA

6.4.2 COVID-19 IMPACT ON THERMOPLASTIC ELASTOMER

TABLE 19 THERMOPLASTIC ELASTOMER: YOGA AND EXERCISE MATS MARKET SIZE, BY REGION, 2018–2026 (THOUSAND UNIT)

TABLE 20 THERMOPLASTIC ELASTOMER: YOGA AND EXERCISE MAT MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

6.5 NATURAL RUBBER

6.5.1 NATURAL RUBBER TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

6.5.2 COVID-19 IMPACT ON NATURAL RUBBER

TABLE 21 NATURAL RUBBER: YOGA AND EXERCISE MATS MARKET SIZE, BY REGION, 2018–2026 (THOUSAND UNIT)

TABLE 22 NATURAL RUBBER: YOGA AND EXERCISE MAT MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

6.6 OTHERS

6.6.1 RAW MATERIALS SUCH AS COTTON AND JUTE TO WITNESS SIGNIFICANT DEMAND DUE TO ECO-FRIENDLINESS

6.6.2 COVID-19 IMPACT ON OTHER MATERIALS

TABLE 23 OTHER MATERIALS: YOGA AND EXERCISE MATS MARKET, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 24 OTHER MATERIALS: YOGA AND EXERCISE MAT MARKET, BY REGION, 2018–2026 (USD MILLION)

7 YOGA AND EXERCISE MATS MARKET, BY END USE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 27 YOGA AND EXERCISE MATS MARKET, BY END USE, 2021 VS 2026, (USD MILLION)

TABLE 25 YOGA AND EXERCISE MAT MARKET SIZE, BY END USE, 2018–2026 (UNIT THOUSAND)

TABLE 26 YOGA AND EXERCISE MATS MARKET SIZE, BY END USE, 2018–2026 (USD MILLION)

7.2 HEALTH CLUB

7.2.1 HEALTH CLUBS TO WITNESS HIGH GROWTH POST-2021

7.2.2 COVID-19 IMPACT ON HEALTH CLUBS

7.3 PERSONAL

7.3.1 PERSONAL USE OF YOGA MATS TO GROW DUE TO PREFERENCE FOR IN-HOME WORKOUT SESSIONS

7.3.2 COVID-19 IMPACT ON PERSONAL USE

8 YOGA AND EXERCISE MATS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 81)

8.1 INTRODUCTION

FIGURE 28 YOGA AND EXERCISE MATS MARKET, BY DISTRIBUTION CHANNEL, 2021 VS. 2026 (USD MILLION)

TABLE 27 YOGA AND EXERCISE MAT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (THOUSAND UNIT)

TABLE 28 YOGA AND EXERCISE MATS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

8.2 SUPERMARKET & HYPERMARKET

8.2.1 SUPERMARKETS & HYPERMARKETS TO WITNESS SECOND-FASTEST GROWTH

8.2.2 COVID-19 IMPACT ON SUPERMARKETS & HYPERMARKETS

8.3 SPECIALTY STORE

8.3.1 SPECIALTY STORES SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

8.3.2 COVID-19 IMPACT ON SPECIALTY STORE

8.4 E-COMMERCE

8.4.1 E-COMMERCE SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

8.4.2 COVID-19 IMPACT ON E-COMMERCE

9 YOGA AND EXERCISE MATS MARKET, BY REGION (Page No. - 86)

9.1 INTRODUCTION

TABLE 29 YOGA AND EXERCISE MATS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

FIGURE 29 YOGA AND EXERCISE MAT MARKET GROWTH RATE, BY KEY COUNTRIES, 2021–2026

9.2 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: YOGA AND EXERCISE MATS MARKET SNAPSHOT

TABLE 30 ASIA PACIFIC: YOGA MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

TABLE 31 ASIA PACIFIC: EXERCISE MATS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Health-conscious consumers to drive market growth

FIGURE 31 PERCENTAGE SPLIT OF YOGA PRACTITIONERS, BY EMPLOYMENT POSITION, 2018

9.2.1.2 COVID-19 impact on China

TABLE 32 CHINA: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.2 INDIA

9.2.2.1 India accounted for the largest share in the regional yoga and exercise mats market

9.2.2.2 COVID-19 impact on India

TABLE 33 INDIA: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Presence of prominent yoga chains and studios to spur demand

9.2.3.2 COVID-19 impact on Japan

TABLE 34 JAPAN: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 High consumption of natural rubber-made yoga and exercise mats

9.2.4.2 COVID-19 impact on South Korea

TABLE 35 SOUTH KOREA: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.5 MALAYSIA

9.2.5.1 Leading raw material supplier for yoga and exercise mats market

TABLE 36 MALAYSIA: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.6 THAILAND

9.2.6.1 Wellness tourism to spur demand for travel yoga mats

TABLE 37 THAILAND: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.7 AUSTRALIA

9.2.7.1 Growing need for healthy lifestyles to propel demand for yoga and exercise mats

9.2.7.2 COVID-19 impact on Australia

TABLE 38 AUSTRALIA: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.2.8 SINGAPORE

9.2.8.1 Presence of a multitude of yoga and fitness studios

TABLE 39 SINGAPORE: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: YOGA AND EXERCISE MATS MARKET SNAPSHOT

TABLE 40 NORTH AMERICA: EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: YOGA MAT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.3.1 US

9.3.1.1 High demand for yoga mats made from natural rubber

FIGURE 33 US: YOGA PARTICIPATION, 2012 VS. 2015 VS. 2020 (MILLION)

FIGURE 34 US: YOGA INDUSTRY REVENUE, 2012 VS. 2015 VS. 2020 (BILLION)

9.3.1.2 COVID-19 impact on US

TABLE 42 US: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Increase in popularity of yoga to drive market growth

9.3.2.2 COVID-19 impact on Canada

TABLE 43 CANADA: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Increased obesity rate to spur demand for fitness products

9.3.3.2 COVID-19 impact on Mexico

TABLE 44 MEXICO: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.4 EUROPE

FIGURE 35 EUROPE: YOGA AND EXERCISE MAT MARKET SNAPSHOT

TABLE 45 EUROPE: YOGA MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

TABLE 46 EUROPE: EXERCISE MATS MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Natural rubber material segment to grow fastest during forecast period

9.4.1.2 COVID-19 impact on Germany

TABLE 47 GERMANY: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Mature fitness industry creates demand for yoga and exercise mats

9.4.2.2 COVID-19 impact on France

TABLE 48 FRANCE: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.4.3 ITALY

9.4.3.1 Growing demand for home fitness products to drive market

9.4.3.2 COVID-19 impact on Italy

TABLE 49 ITALY: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.4.4 UK

9.4.4.1 Mature yoga industry boosts market growth

9.4.4.2 COVID-19 impact on the UK

TABLE 50 UK: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.4.5 POLAND

9.4.5.1 Emerging European yoga and exercise mats market

9.4.5.2 COVID-19 impact on Poland

TABLE 51 POLAND: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 52 SOUTH AMERICA: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

TABLE 53 SOUTH AMERICA: YOGA AND EXERCISE MAT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Popularity of mats made from polyvinyl chloride

TABLE 54 BRAZIL: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Increased use of in-home workouts contributing to rising demand

TABLE 55 ARGENTINA: YOGA AND EXERCISE MAT MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.6 MIDDLE EAST

TABLE 56 MIDDLE EAST: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

TABLE 57 MIDDLE EAST: YOGA AND EXERCISE MAT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.6.1 SAUDI ARABIA

9.6.1.1 Increased demand for yoga and exercise mats due to focus on physical well-being

TABLE 58 SAUDI ARABIA: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

9.6.2 UAE

9.6.2.1 Demand for eco-friendly yoga mats made from natural rubber

TABLE 59 UAE: YOGA AND EXERCISE MATS MARKET SIZE, BY MATERIAL, 2018–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 117)

10.1 OVERVIEW

FIGURE 36 COMPANIES ADOPTED INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2019 AND DECEMBER 2020

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 MARKET EVALUATION FRAMEWORK: 2020 SAW ACQUISITIONS LEADING THIS SPACE

10.3 MARKET SHARE ANALYSIS: YOGA AND EXERCISE MATS MARKET (2020)

10.3.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN EXERCISE AND YOGA MATS MARKET

TABLE 60 YOGA AND EXERCISE MATS MARKET: DEGREE OF COMPETITION

10.3.2 REVENUE ANALYSIS OF TOP PLAYERS IN YOGA AND EXERCISE MAT MARKET

FIGURE 38 TOP PLAYERS – REVENUE ANALYSIS (2017-2020)

10.4 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2020

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 PARTICIPANTS

FIGURE 39 YOGA AND EXERCISE MATS MARKET: COMPETITIVE LANDSCAPE MAPPING, 2020

10.5 COMPETITIVE BENCHMARKING

10.5.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN YOGA AND EXERCISE MATS MARKET

10.5.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN YOGA AND EXERCISE MATS MARKET

10.6 SME MATRIX, 2020

10.6.1 PROGRESSIVE COMPANIES

10.6.2 DYNAMIC COMPANIES

10.6.3 RESPONSIVE COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 42 YOGA AND EXERCISE MATS MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES, 2020

TABLE 61 COMPANY INDUSTRY FOOTPRINT, 2020

TABLE 62 COMPANY DISTRIBUTION FOOTPRINT, 2020

TABLE 63 COMPANY REGION FOOTPRINT, 2020

TABLE 64 COMPANY OVERALL FOOTPRINT, 2020

10.7 KEY MARKET DEVELOPMENTS

TABLE 65 YOGA AND EXERCISE MATS MARKET: DEALS, JANUARY 2019 – DECEMBER 2020

TABLE 66 YOGA AND EXERCISE MAT MARKET: OTHERS, JANUARY 2019 – DECEMBER 2020

11 COMPANY PROFILES (Page No. - 134)

11.1 KEY PLAYERS

(Business overview, Financial assessment, Products offered, Yoga and Exercise Mats Market: Deals, January 2019 – December 2020, COVID-19 related development, Recent Developments, Winning imperative, MNM view)*

11.1.1 LULULEMON ATHLETICA INC.

FIGURE 43 LULULEMON ATHLETICA INC.: COMPANY SNAPSHOT

TABLE 67 LULEMON ATHLETICA INC.: COMPANY SNAPSHOT

11.1.2 COLUMBIA SPORTSWEAR COMPANY

FIGURE 44 COLUMBIA SPORTSWEAR COMPANY: COMPANY SNAPSHOT

TABLE 68 COLUMBIA SPORTSWEAR COMPANY: COMPANY SNAPSHOT

11.1.3 ADIDAS AG

FIGURE 45 ADIDAS AG: COMPANY SNAPSHOT

TABLE 69 ADIDAS AG: COMPANY SNAPSHOT

11.1.4 QUANZHOU SANSHENG RUBBER PLASTIC FOAMED SHOES MATERIALS CO., LTD.

TABLE 70 QUANZHOU SANSHENG RUBBER PLASTIC FOAMED SHOES MATERIALS CO., LTD.: COMPANY SNAPSHOT

11.1.5 SEQUENTIAL BRANDS GROUP, INC.

FIGURE 46 SEQUENTIAL BRANDS GROUP, INC.: COMPANY SNAPSHOT

TABLE 71 SEQUENTIAL BRANDS GROUP, INC.: COMPANY SNAPSHOT

11.1.6 UNDER ARMOUR, INC.

FIGURE 47 UNDER ARMOUR, INC.: COMPANY SNAPSHOT

TABLE 72 UNDER ARMOUR, INC.: COMPANY SNAPSHOT

11.1.7 AIREX AG

TABLE 73 AIREX AG: COMPANY SNAPSHOT

11.1.8 FABRICATION ENTERPRISES, INC.

TABLE 74 FABRICATION ENTERPRISES, INC.: COMPANY SNAPSHOT

11.1.9 HUGGER MUGGER YOGA PRODUCTS

TABLE 75 HUGGER MUGGER YOGA PRODUCTS: COMPANY SNAPSHOT

11.1.10 MANDUKA, LLC

TABLE 76 MANDUKA, LLC: COMPANY SNAPSHOT

11.2 STARTUP/ SME PLAYERS

11.2.1 BAREFOOT YOGA CO.

TABLE 77 BAREFOOT YOGA CO.: COMPANY SNAPSHOT

11.2.2 EVERLAST WORLDWIDE, INC.

TABLE 78 EVERLAST WORLDWIDE, INC.: COMPANY SNAPSHOT

11.2.3 JADE YOGA

TABLE 79 JADE YOGA: COMPANY SNAPSHOT

11.2.4 LA VIE BOHEME YOGA

TABLE 80 LA VIE BOHEME YOGA: COMPANY SNAPSHOT

11.2.5 LIFORME LTD.

TABLE 81 LIFORME LTD.: COMPANY SNAPSHOT

*Details on Business overview, Financial assessment, Products offered, Yoga and Exercise Mats Market: Deals, January 2019 – December 2020, COVID-19 related development, Recent Developments, Winning imperative, MNM view might not be captured in case of unlisted companies.

11.3 OTHER COMPANIES

11.3.1 UWIN

11.3.2 STILELIBERO LTD.

11.3.3 ACCESSORY ARCADE

11.3.4 EUPROMED S.R.O.

11.3.5 NINGBO MYLON RUBBER &PLASTIC CO., LTD.

11.3.6 WINBOSS INDUSTRIAL CO., LTD.

11.3.7 XIAMEN SANFAN SPORTS PRODUCTS CO, LTD.

11.3.8 ALO YOGA

11.3.9 BAYA

11.3.10 ECOYOGA LTD

11.3.11 TEGO

11.3.12 SHENZHEN HAIFUXING TECHNOLOGY CO., LTD.

11.3.13 SHANGHAI FITNESS SOURCING INC.

11.3.14 FITNESS MATS INDIA

11.3.15 YOGA DIRECT, LLC

12 APPENDIX (Page No. - 178)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the yoga and exercise mats market. Exhaustive secondary research was undertaken to collect information on the yoga and exercise mats market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the yoga and exercise mat value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the market. After that, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the yoga and exercise mats market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the yoga and exercise mats market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Primary Research

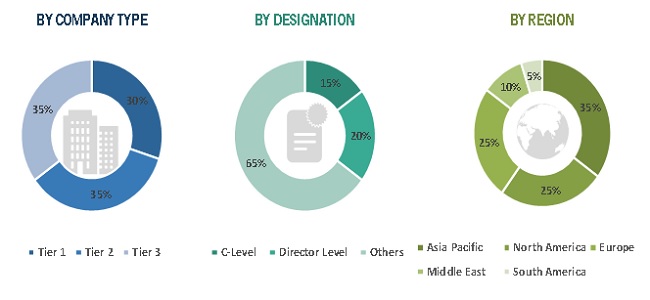

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the yoga and exercise mats market. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the yoga and exercise mats market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

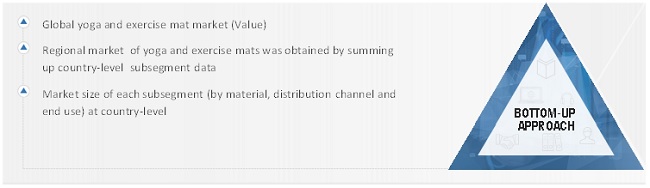

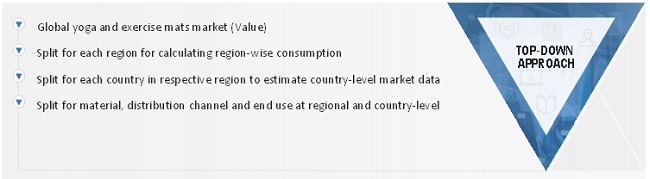

Both top-down and bottom-up approaches were used to estimate and validate the total size of the yoga and exercise mats market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the size of the yoga and exercise mats market based on material, distribution channel, end-use, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To forecast the size of the various segments of the yoga and exercise mats market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East—along with key countries in each of these regions

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders

- To analyze recent developments, such as expansions, acquisitions, and agreements, in the yoga and exercise mats market

- To strategically profile the key players in the market and comprehensively analyze their core competencies*

Note: Core competencies of the companies are determined in terms of product offerings and business strategies adopted by them to sustain in the market.

The following customization options are available for the report

MarketsandMarkets offers customizations according to the specific needs of companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Yoga and Exercise Mats Market