Organic Acids Market

Organic Acids Market by Type (Acetic Acid, Citric Acid, Formic Acid, Lactic Acid, Propionic Acid), Application (Food & Beverages, Feed, Industrial, Pharmaceutical, Agriculture), Source, Form, Function, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

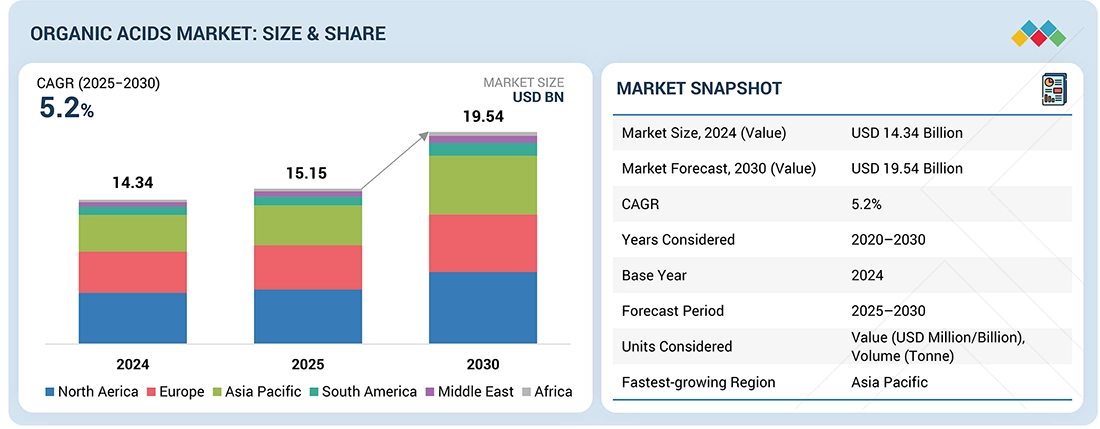

The organic acids market is projected to reach USD 19.54 billion by 2030 from USD 15.15 billion in 2025, at a CAGR of 5.2%. The growing demand for organic acids in the food & beverage, feed, and pharmaceutical industries is a key factor driving market expansion. In particular, the rising adoption of natural and bio-based ingredients in Asia Pacific countries is significantly boosting the use of citric, lactic, and formic acids for applications that enhance product safety, preservation, and nutritional quality.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific organic acid market accounted for a 47.6% revenue share in 2024.

-

BY TYPEBy type, the lactic acid segment is projected to register the highest CAGR of 9.4%.

-

BY APPLICATIONAmong applications, the industrial segment is dominant, accounting for half the market share.

-

BY SOURCEBy source, bio-based source is estimated to register the highest CAGR of 6.1%.

-

BY FORMThe liquid form dominated the source segment with 74.0% in the 2024.

-

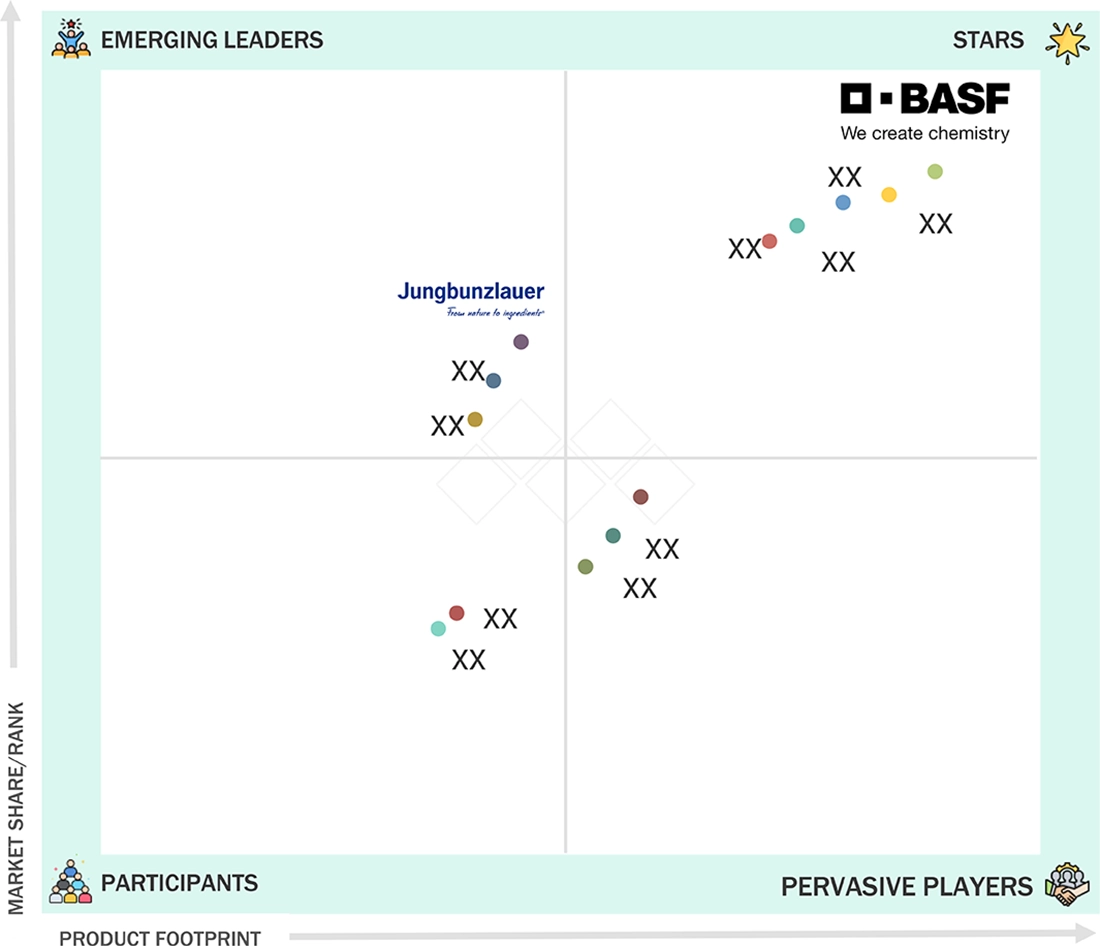

COMPETITIVE LANDSCAPE - KEY PLAYERSKey players such as BASF SE, Corbion N.V., Cargill Incorporated, Jungbunzlauer Suisse AG, and ADM focus on capacity expansions, product innovations, and sustainable manufacturing technologies. Companies are also investing in bio-based acid production and forming partnerships to enhance their regional footprint and cater to diverse industrial applications.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESCompanies such as Citribel NV, Peer Chemical Industries, and Geocon Products, among others, have distinguished themselves among SMEs in the organic acids market by securing strong footholds in specialized niche segments, showcasing their capability to innovate and scale, and underscoring their potential as emerging market leaders.

Organic acids are naturally occurring compounds widely used across food & beverage, feed, pharmaceutical, and industrial sectors for their preservative, acidulant, and antimicrobial properties. Derived from bio-based or synthetic sources, key acids such as citric, lactic, formic, and acetic acids play vital roles in enhancing product stability, flavor, and shelf life. The rising consumer shift toward clean-label and sustainable ingredients, along with increased demand for natural preservatives and feed additives, continues to drive market growth. As industries seek eco-friendly and cost-efficient alternatives, organic acids are becoming essential components in diverse formulations supporting product safety and quality.

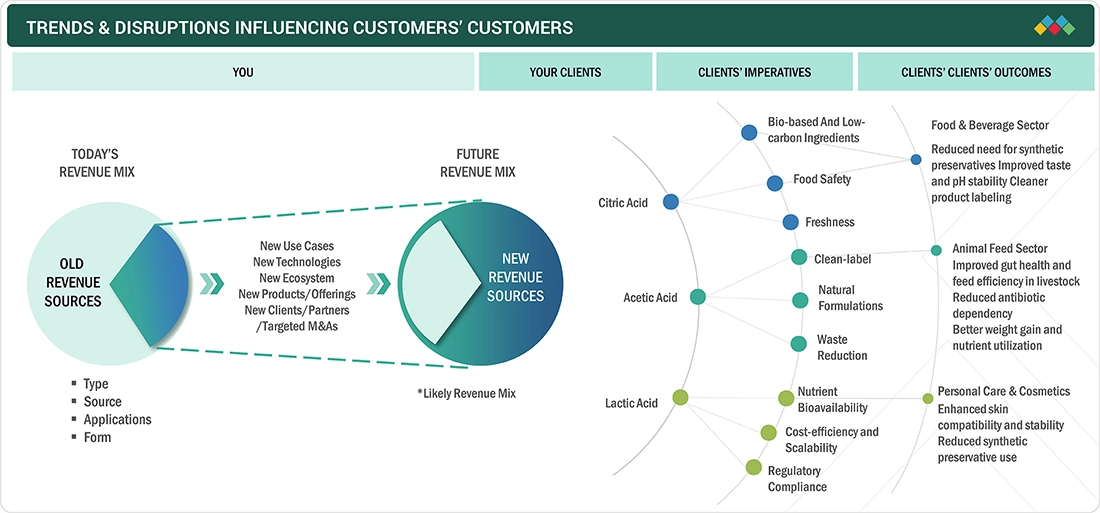

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in consumer preferences or industry developments significantly influence the operations of food, beverage, and feed manufacturing companies. These shifts directly impact the revenues of end users such as food processors, beverage manufacturers, and animal feed producers. Consequently, fluctuations in end-user demand are expected to affect the consumption of organic acids, particularly those used for preservation, flavor enhancement, and pH regulation. This, in turn, influences the overall revenues of organic acid suppliers and manufacturers across the value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Multifunctional roles and applications of organic acids in food safety and quality

-

Rising use of sustainable formic acid in animal feed preservation

Level

-

Regulatory compliance & labeling requirements (food/pharma grades) increase cost/time

-

Increased transportation and logistics expenses are hindering the smooth supply of organic acids

Level

-

Emergence of organic acids in personal care and cosmetic formulations

-

Innovations in technologies and a wide industry scope

Level

-

Maintaining consistent product quality due to fermentation variability

-

Intense competition from large-scale chemical manufacturers offering low-cost synthetic acids

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising use of sustainable formic acid in animal feed preservation

The increasing adoption of formic acid as a preservative and antibacterial agent in animal feed is a key driver of the organic acid market. Formic acid’s strong antimicrobial properties inhibit bacteria and fungi growth, extending feed shelf life while preserving essential nutrients, thus enhancing animal health, digestion, and productivity. It also plays a crucial role in silage preservation by promoting lactic acid fermentation and preventing nutrient loss. On June 30, 2025, BASF launched its LowPCF (low product carbon footprint) formic acid on the eAuction platform in China, marking a major step toward sustainable feed additives. This low-carbon formic acid, produced at BASF’s global Verbund sites in Nanjing, Ludwigshafen, and Geismar, offers a lower cradle-to-gate carbon footprint compared to conventional fossil-based equivalents. The innovation aligns with BASF’s sustainability goals and enables customers to meet their environmental commitments while improving production efficiency. The dual advantage of performance and eco-friendliness is accelerating the adoption of formic acid in animal nutrition, strengthening its position as a sustainable growth driver in the global organic acid market.

Restraint: Regulatory compliance & labeling requirements (food/pharma grades) increase cost/time

Regulatory compliance and labeling requirements act as a significant restraint in the organic acid market due to the stringent standards governing their use in food, pharmaceutical, and cosmetic applications. Each acid, such as citric, lactic, or acetic, must meet precise purity, safety, and labeling norms depending on its end-use grade. For example, food-grade organic acids must comply with standards set by the US FDA (21 CFR), EFSA in Europe, and FSSAI in India, which demand detailed documentation on raw materials, manufacturing processes, and contaminant limits. Similarly, pharmaceutical-grade acids, such as lactic acid used in drug formulations or dialysis fluids, must conform to pharmacopeia specifications like USP-NF or EP, and require Good Manufacturing Practice (GMP) certification. These regulations extend lead times and increase production costs due to testing, audits, and validation procedures. Moreover, changes in global regulations, such as REACH compliance in the EU or labeling rules for “natural” claims, require constant adaptation. For smaller or new entrants, meeting these complex regulatory and labeling expectations adds significant financial and operational burdens, restraining overall market growth and limiting global competitiveness.

Opportunity: Innovations in technologies and a wide industry scope

The growing use of organic acids in agriculture as soil enhancers and pH regulators presents a significant opportunity for the organic acids market. Organic acids such as formic, lactic, acetic, and citric acids are increasingly being utilized to improve soil fertility, nutrient uptake, and microbial balance, leading to better crop yields and sustainable farming outcomes. As demonstrated by recent developments, including Bluejais’ August 2024 launch of RESILLOX® with Delvigent’s patented BMPE technology and Addcon’s February 2024 introduction of acid-based ProFeed, Formi Stable, and XL Forte in Indonesia, innovation in organic acid applications is accelerating across the agricultural sector. These advancements highlight the acids’ dual benefits in soil health and animal nutrition, aligning with the global transition toward eco-friendly and chemical-free farming practices. With rising concerns about soil degradation and the need for efficient nutrient management, farmers are increasingly adopting organic acid-based solutions as alternatives to synthetic fertilizers and pH stabilizers. This trend offers substantial growth potential for manufacturers focusing on biotechnology-driven, sustainable acid production to support regenerative agriculture worldwide.

Challenge: Intense competition from large-scale chemical manufacturers offering low-cost synthetic acids

Intense competition from large-scale chemical manufacturers offering low-cost synthetic acids represents a significant challenge for the organic acid market. Synthetic acids, produced through petrochemical routes, often benefit from economies of scale, lower production costs, and established global supply chains, enabling them to be priced far below bio-based organic acids. Despite the growing consumer shift toward sustainable and natural ingredients, cost remains a decisive factor for manufacturers in the food, beverage, and cosmetic industries, particularly in price-sensitive markets. Large players like BASF and Dow continue to dominate the synthetic acid segment through high-volume, cost-efficient production and consistent product quality. This price disparity makes it difficult for bio-based producers that face higher raw material and fermentation costs to compete on a commercial scale. Moreover, end users may hesitate to switch from proven synthetic alternatives due to performance familiarity and stable pricing. As a result, organic acid manufacturers must focus on technological innovation, process optimization, and sustainability-driven differentiation to overcome the cost advantage held by synthetic acid producers and strengthen their market position.

Organic Acids Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Organic acids and acid-based feed additives for poultry and swine nutrition | Enhanced gut health, improved feed efficiency, and reduced pathogen load in livestock |

|

Lactic and citric acids for food preservation, flavor enhancement, and beverage formulation | Extended shelf life, balanced acidity, and improved product stability and taste consistency |

|

Low-PCF formic acid for sustainable chemical and feed applications | Lower carbon footprint, improved sustainability performance, and compliance with green manufacturing goals |

|

Circular lactic acid from biobased production | Reduced waste, improved resource efficiency, and strengthened position in sustainable biochemicals |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The organic acids market ecosystem comprises interconnected relationships among key stakeholders, including raw material suppliers, acid manufacturers, distributors, and end users across various industries such as food & beverage, feed, pharmaceuticals, and chemicals. Raw material suppliers provide biomass, sugars, or petrochemical-based feedstocks used in organic acid fermentation or synthesis. Manufacturers convert these raw materials into acids such as citric, lactic, formic, and acetic acids, which are further processed for diverse industrial and food-grade applications. Distributors and suppliers act as intermediaries, linking producers with end users such as food processors, beverage companies, feed formulators, and chemical manufacturers, thereby optimizing the supply chain to enhance product availability, quality, and operational efficiency across global markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Organic Acids Market, by Type

Acetic acid is projected to lead the organic acids market by type, supported by its wide-ranging applications in the food, beverage, and animal feed industries, as well as strategic industry developments enhancing global production capacity. Serving as a key acidulant, preservative, and flavor enhancer, acetic acid plays a vital role in extending shelf life, improving flavor, and ensuring food safety. Its inclusion in feed formulations has also gained momentum due to its ability to promote gut health and control microbial activity in livestock. The market is witnessing a significant shift toward sustainable and bio-based acetic acid production, exemplified by Sekab’s May 2023 expansion of bio-based acetic acid output, which reduces carbon emissions by up to 50%. Additionally, in November 2024, INEOS Acetyls and GNFC signed an MoU to develop a 600-kilotonne-per-year acetic acid plant in Gujarat, India, aimed at boosting domestic supply and aligning with India’s “Make in India” initiative. Together, these advancements underscore acetic acid’s growing importance in industrial self-reliance, environmental sustainability, and diverse end-use applications, cementing its position as the dominant segment in the global organic acids market.

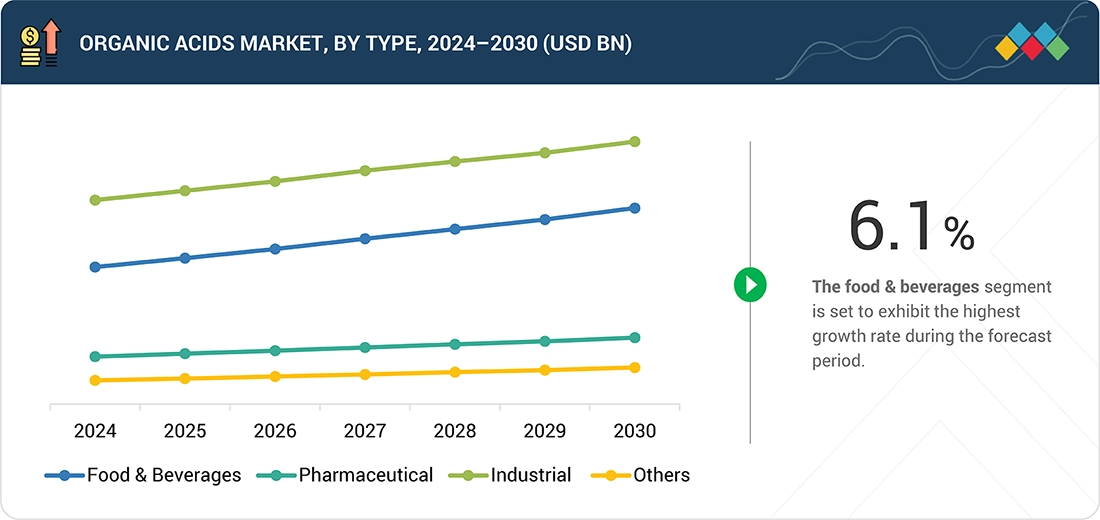

Organic Acids Market, by Application

The food & beverage applications segment is set to lead the organic acids market, driven by their critical role in enhancing flavor, preserving freshness, and ensuring food safety. Organic acids such as citric, lactic, and acetic acids are widely used as natural preservatives, pH regulators, and acidulants in processed foods, sauces, bakery products, and condiments. China continues to maintain its leadership in citric acid production, contributing nearly 70% of global exports and projected to reach 1.2 million tonnes by the end of 2024. Chinese producers are heavily investing in automation, sustainable manufacturing, and R&D to develop clean-label, bio-based acids that cater to the growing demand for natural and eco-friendly food ingredients. Additionally, innovations like Jungbunzlauer’s magnesium citric acid salt are improving nutritional value and expanding the use of organic acids in fortified and functional foods. These advancements, coupled with rising consumer preference for safe, high-quality, and natural food products, firmly position food applications as the leading segment in the global organic acids market.

Organic Acids Market, by Source

Bio-based sources are poised to form the fastest-growing segment in the organic acids market, driven by the global transition toward sustainability and renewable resource utilization. Produced from biomass, agricultural residues, and sugar-based feedstocks, bio-based organic acids are gaining preference over synthetic variants due to their reduced carbon footprint, biodegradability, and alignment with circular economy principles. The growing demand for eco-friendly and clean-label ingredients in food, beverages, pharmaceuticals, and personal care products is accelerating this shift. Moreover, supportive government policies and stricter environmental regulations are encouraging manufacturers to invest in bio-based production technologies. As industries continue to prioritize greener alternatives, bio-based sources are expected to maintain a leading position, driving sustainable growth in the global organic acids market.

REGION

Asia Pacific to be fastest-growing region in global organic acids market during forecast period

The Asia Pacific region is emerging as the fastest-growing market in the global organic acids industry, driven by rapid industrialization, expansion of the food processing and animal nutrition sectors, and rising demand for bio-based and sustainable ingredients. Countries such as Thailand, China, and India are at the forefront of this growth due to strong manufacturing capabilities, abundant raw material availability, and supportive government policies promoting green chemistry. Recent developments underline this momentum; for instance, in May 2024, Corbion expanded its partnership with IMCD to distribute its PURAC® range of lactic acid products in Thailand, strengthening its regional presence. Similarly, Afyren partnered with Mitr Phol to establish a 28,000 t/y bio-based organic acid plant near Bangkok, expected to begin operations by 2025. These advancements highlight the region’s growing commitment to local production, technological innovation, and sustainable value chains. With increasing investments in biotechnology, renewable feedstocks, and clean-label ingredient solutions, Asia Pacific is set to play a pivotal role in shaping the future of the organic acids market, offering vast opportunities for both global and regional manufacturers.

Organic Acids Market: COMPANY EVALUATION MATRIX

In the organic acids market, Corbion (Netherlands), positioned as a leading player, drives the industry with its strong portfolio of lactic acid, lactates, and other fermentation-based organic acids used widely across food, beverage, pharmaceutical, and industrial applications. Celanese Corporation (US), recognized as an Emerging Leader, is rapidly gaining traction through sustained investments in acetic acid capacity expansion and the development of high-purity grades for specialized downstream uses. While Corbion maintains its dominance with an extensive global footprint and long-standing customer relationships, Celanese demonstrates robust growth momentum supported by process innovation, strategic expansions, and increasing penetration in value-added organic acid segments. Together, both companies significantly influence the competitive landscape, with Celanese showing strong potential to advance toward the leaders’ quadrant of the global organic acids market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF SE (Germany)

- Cargill, Incorporated (US)

- Archer Daniels Midland Company (US)

- Celanese Corporation (US)

- Eastman Chemical Company (US)

- Corbion N.V. (Netherlands)

- Tate & Lyle PLC (UK)

- Koninklijke DSM N.V. (Netherlands)

- Henan Jindan Lactic Acid Technology Co., Ltd. (China)

- Myriant Corporation (US)

- Jungbunzlauer Suisse AG (Switzerland)

- The Dow Chemical Company (US)

- NatureWorks LLC (US)

- Perstorp AB (Sweden)

- Alpha Chemika (India)

- Loba Chemie Pvt Ltd. (India)

- Chemtex Specialty Ltd. (India)

- Dairen Chemical Corporation (Taiwan)

- Royal Castor Products Limited (India)

- Transmetal Limited (India)

- Fuso Chemical Co., Ltd. (Japan)

- Gadot Biochemical Industries Ltd. (Israel)

- Thyssenkrupp AG (Germany)

- LUXI Group Co., Ltd. (China)

- Shandong Enno New Material Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 14.34 Billion |

| Market Forecast, 2030 (Value) | USD 19.54 Billion |

| Growth Rate | CAGR of 5.2% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Thousand), Volume (Tonne) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Rest of the World |

WHAT IS IN IT FOR YOU: Organic Acids Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Food Ingredient Manufacturer | Detailed organic acid demand forecast by type (citric, lactic, acetic, formic, fumaric) and application (food, feed, pharmaceuticals, industrial) | Enabled strategic sourcing and production planning across food preservation and flavoring applications |

| Plant-based Food Producer | Functional analysis of organic acids in plant-based dairy, meat substitutes, and clean-label beverages | Improved product stability, extended shelf life, and enhanced natural taste without synthetic preservatives |

| Animal Feed Manufacturer | Profiling of key organic acids for gut health, feed efficiency, and microbial control | Supported formulation optimization and compliance with sustainable livestock production standards. |

| Pharmaceutical Company | Assessment of organic acid utilization in drug formulation, excipients, and biopreservation | Strengthened product safety and shelf stability while meeting stringent regulatory benchmarks |

| Industrial Chemical Producer | Mapping of bio-based and synthetic organic acid production capacities and pricing trends | Enabled investment prioritization in low-carbon, renewable feedstock-based acid production |

RECENT DEVELOPMENTS

- May 2024 : Corbion expanded its partnership with IMCD to include Thailand, further strengthening its presence across the Asia Pacific region. IMCD, a leading global distributor of specialty chemicals and ingredients, would enhance the regional availability of Corbion’s PURAC range of lactic acids. With Corbion’s largest lactic acid production facility located in Rayong, Thailand, this collaboration was set to bolster commercial operations and formulation support across key markets such as Singapore, Australia, New Zealand, and other neighboring countries, reinforcing Corbion’s regional distribution network and market reach.

- December 2023 : Corbion announced the mechanical completion of its new circular lactic acid manufacturing plant in Rayong, Thailand. The facility used a novel process that recycles processing chemicals, eliminating lime usage and gypsum formation, resulting in the world’s lowest carbon footprint for lactic acid production. Commissioning began in early 2024, with startup expected soon after.

- November 2023 : ADM partnered with Solugen to develop and scale plant-based organic acid production using Solugen’s chemoenzymatic Bioforge platform. The partnership involved building a 500,000 sq. ft. manufacturing facility in Marshall, Minnesota, adjacent to ADM’s corn complex, leveraging ADM’s dextrose supply to produce lower-carbon organic acids and new biomaterials for use in energy, agriculture, construction, cleaning, and personal care sectors. The project began construction in 2024, with operations expected in 2025.

- September 2022 : BASF launched Propionic Acid with a cradle-to-gate product carbon footprint of zero, achieved through the biomass balance (BMB) approach using renewable raw materials and energy. The acid serves applications in feed, food, agriculture, and fragrance industries, helping customers reduce Scope 3 CO2 emissions while maintaining identical product quality and performance.

- August 2022 : ADM and LG Chem launched two joint ventures—GreenWise Lactic and LG Chem Illinois Biochem—to produce 150,000 tons of lactic acid and 75,000 tons of polylactic acid (PLA) annually. The projects, located in Decatur, Illinois, aim to meet growing demand for plant-based and eco-friendly bioplastics used in food, feed, cosmetics, and industrial applications.

Table of Contents

Methodology

The study employed two primary approaches to estimate the current size of the organic acids market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to for identifying and collecting information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the organic acids market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, the Middle East, and Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, source, form, and function. Stakeholders from the demand side, such as research institutions and universities, and third-party vendors, were interviewed to understand the buyer’s perspective on the service, and their current usage of organic acid and the outlook of their business, which will affect the overall market.

Breakdown Of Primary Interviews

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| BASF SE (Germany) | R&D Expert | |

| Cargill, Incorporated (US) | Sales Manager | |

| ADM (US) | Manager | |

| Corbion (Netherlands) | Sales Manager | |

| Eastman Chemical Company (US) | Marketing Manager | |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the organic acids market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Organic Acids Market: Bottom-up & Top-down Approaches

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall organic acids market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Organic acids are types of organic compounds that have acidic properties. Chemically, organic acids are weak acids that contain a carbon atom in their compound, the most popular of which are carboxylic acids. These acids have the tendency to slowly dissolve in solvents and can dissolve iron oxides without damaging the base metal. The simplest form of organic acids is acetic and formic, which are less reactive compared to non-organic acids such as hydrochloric acid and sulfuric acid. Apart from containing the carboxyl (R-COOH) functional group, organic compounds that include the thiol (R-SH), enol (alkenols), and phenol (aromatic hydrocarbons-OH) groups are also considered under organic acids.

Stakeholders

- Raw material suppliers

- Organic acid manufacturers

- Technology & equipment providers

- End-use industries

- Research & academic institutions

- Investors & funding agencies

- Regulatory & certification bodies

- Distributors & traders

- Industry associations & consortia

- European communities

- World Health Organization (WHO)

- OECD-FAO Agricultural Outlook

- United States Department of Agriculture (USDA)

Report Objectives

- To determine, define, and project the size of the organic acids market, with respect to type, source, form, application, function, and regional markets, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To strategically profile key market players and comprehensively analyze their core competencies in each segment

- To track and analyze competitive developments, such as alliances, joint ventures, new product developments, mergers, and acquisitions, in the organic acids market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Organic Acids Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Organic Acids Market

User

Feb, 2020

I am looking for historic market numbers from 2013 and forecast numbers till 2025. .

User

Feb, 2020

Can you add more application industries such as agriculture, chemical, and industrial in the report? .

User

Feb, 2020

Need customer analysis and mapping at the country level for acetic acid, lactic acid, and gluconic acid (particularly for North American and ASEAN countries). .