Meat Substitutes Market Size, Share, Industry Growth, Trends Report by Product (Tofu, Tempeh, Textured Vegetable Protein, Seitan, Quorn and Other Product), Source (Soy Protein, Wheat Protein, Pea Protein and Other Sources), Types ( Concentrates, Isolates and Textured), Form (Solid, Liquid), Category (Frozen, Refrigerated and Shelf Table) and Region (North America, Europe, Asia Pacific, Rest of the World) - Forecast 2027

Meat Substitutes Market Size, Share and Growth Report

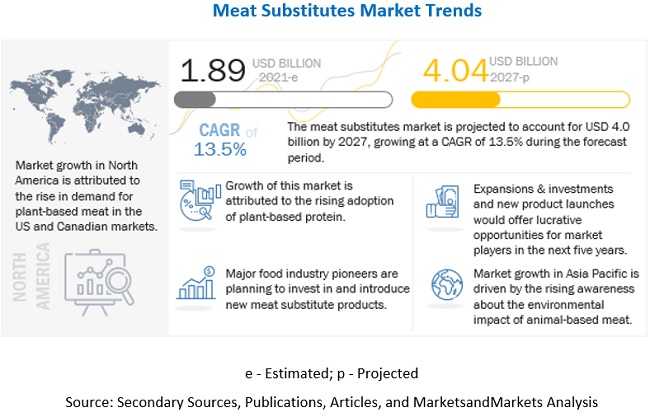

The global meat substitutes market was valued at $1.89 billion in 2021 & is projected to reach $4.04 billion by 2027, at a CAGR of 13.5% in forecast period. According to MarketsandMarkets, the meat substitute market would see highest growth in Asia Pacific at a CAGR of 14.3%.

To know about the assumptions considered for the study, Request for Free Sample Report

Meat Substitutes Market Growth Dynamics

Drivers: Growing Preference for Plant-based Proteins

In the last decade, the global market for meat-based proteins has seen a surge in demand, with the majority of people in Europe and North America relying on meat products for their daily protein needs. While meat proteins provide the body with the necessary amino acids, they are also heavy in cholesterol, which has been linked to a number of major health problems. This became the main driver of increased demand for plant-based protein foods, particularly in industrialized countries such as the United States, Germany, France, and the United Kingdom.

A substantial increase in the vegan population has been noticed in various regions, such as the US and the UK. For instance, according to an article published by the Food Revolution Organization in 2018, the number of vegans in the US has increased by 600% in the last three years. This growing preference for plant based protein is expected to propel the meat substitutes market.

Restraints: Allergy concerns among consumers for soy products

Food allergies and intolerances have been documented for hundreds of years. However, in recent years, the prevalence of food allergies has risen, causing consumers and food manufacturers tremendous concern. According to the Food Allergy Research & Education Organization (US), soy and wheat are two of the top eight major food allergens responsible for the majority of significant food allergy reactions in the United States. Soybeans, for example, are high in nutrients including vitamins, minerals, isoflavones, and proteins; yet, anti-nutritional components in soy may create health problems like soy allergy. People with a soy allergy may experience itching and hives. Gas, bloating, and modest levels of intestinal tissue irritation are a few of the other symptoms.

Opportunities: Technological advancements in extrusion and processing will expand the opportunities of plant based proteins

Extrusion and processing play an important role in the meat substitutes market. Processing involves the extraction of pea protein, soy protein, and wheat protein. The traditional dry extraction technologies produce protein flour containing only 20% to 40% proteins and concentrate containing 46% to 60% proteins. But in new extrudable fat technology it replicates animal fat, allowing for more authentic fat textures, such as marbling, in plant-based meats – acquired from Coasun.

The technology allows to run fat through an extruder and then combine it with protein to create a better ingredient where the fat and the protein are physically linked together. Another technology used in plant based meat are Prolamin technology: Uses plant-based ingredients to improve the texture of plant-based cheese, allowing it to melt, bubble, and stretch like animal-derived dairy – licensed from the University of Guelph.

Challenges: High cost of pea is creating price pressure for pea protein

Pea protein is expensive to produce there is shortages of pea due to climatic changes, which is drastically increasing the price of peas. Its manufacturers are looking to increase production capacities by using advanced technologies for pea protein extraction and processing. However, the less availability of pea protein is forcing food manufacturers to import pea, increasing the price of raw materials, and eventually increasing the prices of the final meat alternative products. Due to this, pea protein-based meat substitute is considered a premium product in various countries.

Scope of the Meat Substitutes Market Report

|

Report Attributes |

Details |

|

Market valuation in 2021 |

USD 1,889.1 million |

|

Revenue Prediction in 2027 |

USD 4,041.3 million |

|

Progress Rate |

13.5% CAGR |

|

Market size estimation |

2019–2027 |

|

Market Drivers |

Health benefits associated with meat substitutes have been a major factor leading to the rising demand for them |

|

Market Opportunities |

Technological advancements in extrusion and processing will expand the opportunities in the meat substitutes market |

|

Largest Growing Region in Meat Alternatives Market |

Asia Pacific |

|

Market Segmentation |

|

|

Regions covered |

|

|

Companies studied |

|

Meat Substitutes Market Analysis

Tofu has a Major Application in the production of Plant-Based Burgers and Patties

Tofu is also known as soybean curd or bean curd, as it is made from curdled soy milk. Curdled soy milk is an iron-rich liquid and extracted from cooked soybeans. Tofu is a staple food in Asian cuisines for centuries. The nutrition value of tofu is very high; it contains a significant amount of iron, potassium, protein, calcium, and vitamin 12, which are very important for a healthy vegan diet.

For health reasons, environmental sustainability, and a vegetarian lifestyle or reducing consumption of animal products has become life style today, consumers now pay more attention to the types of food that are vegan. In International Congress of Meat Science and Technology(2018) it has been studied that, consumers are increasingly concerned about fat consumption and they have a viewpoint that red meat is high in fat, but sources of vegetable protein as raw material of burger patties are fat free. Thus, the trend of plant based burgers will propel the meat substitutes market.

High Availability of Wheat as a Raw Material is Encouraging Manufacturers to Incorporate it in the Production of Meat Substitutes

Wheat is among the most commonly consumed cereal grains at a global level. Wheat protein is a low-fat protein preferred by manufacturers of low-fat and high-protein food in response to the rising trend of low-fat diets. It also acts as a binder in meatballs, meatloaf and veggie burgers.

Plant based meat market – an adjacent market to Meat Substitutes Market - too has seen significant growth. Increased adoption of Seitan - made of wheat gluten - is now seen as a sustained practice.

Wheat proteins are very cost-effective meat alternative and can be used in numerous food products, such as nuggets, burger patties, sausages, and can be flavored with ginger, garlic, soy sauce, paprika, and fennel. Several plant-based protein manufacturers across the world are currently producing various plant proteins that cater to food & beverage applications. For consumers not having allergen issues, wheat serves as a source of antioxidants, vitamins, minerals, and fiber. Major players that offer wheat-based protein are Archer Daniels Midland Company (US) and Cargill (US).

Isolates are the purest form of Protein and a type with the highest amount of Protein

In meat substitutes, due to the protein content, they are offered in isolates form or pure form and these are highly accepted and preferred by protein food & beverage manufacturers. The various sources of protein isolates are soy, pea, rice, and canola. Recently, the awareness about protein-rich food and meat substitutes market is increasing because of the health and environmental benefits associated with them. This is driving the demand for protein isolates, as they are an excellent source of protein. Soy Protein Isolate (SPI) is the most consumed type of isolate protein; it is extracted from soybean legumes and contains 93%–97% of protein.

According to the Soyfoods Association of North America, “soy protein isolate is a dry powder -based ingredient that has been separated or isolated from the other components of soybean, making it 90%–95% protein and nearly carbohydrate and fat-free.” Soy protein isolates are not only used to improve the texture of meat products but also to increase protein content, enhance moisture retention, and emulsify. The other reason for using soy protein isolates is their nutty taste and high protein content. Also, they are low in fat, oligosaccharides, and fiber and cause less flatulence due to bacterial fermentation.

Meat Substitutes Market Regional Insights:

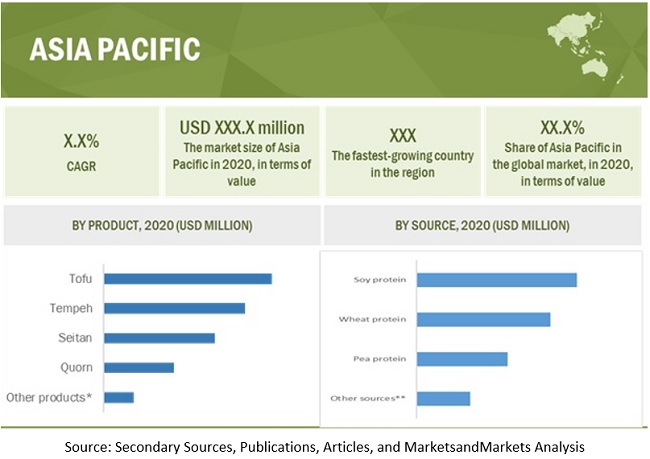

Asia pacific is projected to grow at the highest CAGR of 14.3% in the meat substitutes market during the forecast period.

Asia Pacific’s growth is attributed to the increasing awareness of healthy dietary habits among consumers. The key factors driving growth in the Asia Pacific region include health benefits, animal welfare, environment safety, cost affordability, and the growing variety of plant-based meat products.

The awareness through global animal welfare organizations, such as People for the Ethical Treatment for Animals (PETA), has led to people considering a meat-free diet. Non-meat-based meals are already popular in Asia, with tofu used extensively in Asian cuisines and bean-based congees widely consumed in countries such as China. This makes the Asia Pacific region the fastest-growing potential in the market.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in the Meat Substitutes Market

Key players in this market include ADM (US), Ingredion Incorporated (US), DuPont (US), Kerry Group (Ireland), and Roquette Frères (France) among others.

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Burger and patties manufacturers

- Meat substitute distributors

- Marketing directors

- Key executives from various key companies and organizations in meat alternative market

Meat Substitutes Market Report Segmentation:

In this report, the market segments are based on product, source, type, form, category, and region.

|

Aspect |

Details |

|

By Product |

|

|

By Source |

|

|

By Form |

|

|

By Region |

|

Recent Developments in Meat Substitutes Market

- In November 2022, Ingredion Incorporated entered into an agreement with its joint venture partners to acquire 100% of Verdient Foods (Canada), a manufacturer of plant-based protein. This acquisition is expected to enable Ingredion Incorporated to cater to the rising consumer demand for plant-based foods

- In April 2023, ADM announced its new cutting-edge, plant-based innovation lab, located in ADM's Biopolis research hub in Singapore. The new lab enabled the company to develop next-level, on-trend, and nutritious products, catering to the needs of the Asia Pacific market.

- In December 2021, Batory Foods acquired Polypro International (US), the largest distributor in the US and the Americas. With this acquisition, Batory Foods would be expected to be the largest distributor of clean label restaurants across the US.

Frequently Asked Questions (FAQ):

How big is the market for meat substitutes?

The global meat substitutes market was valued at USD 1,721.7 million in 2020, and is projected to reach USD 4,041.3 million by 2027, registering a CAGR of 13.5% from 2021 to 2027.

Which region is projected to account for the largest share in the meat substitutes market?

North America dominated the meat substitutes market, with a value of USD 673.9 million in 2020; it is projected to reach USD 1,536.3 million by 2027, at a CAGR of 13.0% during the forecast period. The US was one of the highest consumers of plant-based products across the globe, according to the Good Food Institute in 2018. The adoption of dairy and meat alternatives has been a major trend in the country, owing to the rising awareness of a sustainable environment and inclination toward a healthy lifestyle

Which players are involved in manufacturing of meat substitutes?

Key players in this market include ADM (US), Ingredion Incorporated (US), DuPont (US), Kerry Group (Ireland), and Roquette Frères (France).

What is the leading type in the meat substitutes market?

The textured segment was the highest revenue contributor to the market, with USD 827.6 million in 2020, and is estimated to reach USD 1,912.9 million by 2027, with a CAGR of 13.3%.

What is the leading product in the meat substitutes market?

The tofu segment was the highest revenue contributor to the market, with USD 894.6 million in 2020, and is estimated to reach USD 2,170.6 million by 2027, with a CAGR of 14.0%. . .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS: MEAT SUBSTITUTES MARKET

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN: MEAT SUBSTITUTES MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON SOURCES, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MEAT SUBSTITUTES MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2027

FIGURE 9 IMPACT OF COVID-19 ON THE MEAT SUBSTITUTES MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 10 MARKET SIZE, BY PRODUCT, 2021 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SIZE, BY SOURCE, 2021 VS. 2027 (USD MILLION)

FIGURE 12 MARKET SIZE, BY TYPE, 2021 VS. 2027 (USD MILLION)

FIGURE 13 MARKET SIZE, BY FORM, 2021 VS. 2027 (USD MILLION)

FIGURE 14 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 15 INCREASING INVESTMENTS IN PLANT-BASED PROTEIN INGREDIENTS TO PROPEL THE MARKET

4.2 NORTH AMERICA: MARKET, BY TYPE & COUNTRY

FIGURE 16 TEXTURED SEGMENT AND THE UNITED STATES TO ACCOUNT FOR THE LARGEST SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.3 MARKET, BY PRODUCT

FIGURE 17 TOFU SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET, BY SOURCE & REGION

FIGURE 18 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET, BY TYPE

FIGURE 19 TEXTURED SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY FORM

FIGURE 20 SOLID SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 21 COVID-19 IMPACT ON THE MEAT SUBSTITUTES MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MEAT SUBSTITUTE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising adoption of plant-based food

5.2.1.1.1 Increasing vegan & flexitarian population across the world

FIGURE 23 UNITED KINGDOM: VEGAN POPULATION, 2014–2018

FIGURE 24 FASTEST-GROWING TAKEAWAY CUISINES IN UNITED KINGDOM (2016–2019)

5.2.1.1.2 Increasing obesity globally

FIGURE 25 NUMBER OF OBESE POPULATION, BY COUNTRY, 2019

5.2.1.2 Increasing investments in plant-based protein ingredients

TABLE 3 INVESTMENTS: MEAT ALTERNATIVE INGREDIENT MANUFACTURERS

5.2.1.3 Increasing inclination for pea protein ingredients

5.2.2 RESTRAINTS: MEAT SUBSTITUTES MARKET

5.2.2.1 Rising market of cultured meat and insect protein

5.2.2.2 Allergy concerns among consumers for soy and wheat products

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets illustrate the great potential for meat substitutes

5.2.3.2 Increasing government initiatives

5.2.3.3 Technological advancements in extrusion and processing

5.2.4 CHALLENGES

5.2.4.1 Pricing pressure

5.2.4.2 Perception of taste

5.2.5 COVID-19 IMPACT ANALYSIS: (MARKET DYNAMICS)

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 PACKAGING

6.2.5 MARKETING & DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 26 VALUE CHAIN ANALYSIS OF THE MEAT SUBSTITUTES MARKET: RESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCING ARE KEY CONTRIBUTORS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN ANALYSIS OF THE MARKET

6.4 TECHNOLOGY ANALYSIS

6.4.1 EXTRUSION TECHNOLOGY

6.4.2 EXTRUDABLE FAT TECHNOLOGY

6.5 PRICING ANALYSIS:

TABLE 4 GLOBAL MEAT SUBSTITUTES AVERAGE SELLING PRICE (ASP), BY SOURCE, 2019–2021 (USD/TONS)

TABLE 5 GLOBAL AVERAGE SELLING PRICE (ASP), BY REGION, 2019–2021 (USD/TONS)

6.6 MARKET MAP AND ECOSYSTEM

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

6.6.3 PLANT-BASED INGREDIENTS: ECOSYSTEM VIEW

6.6.4 MEAT SUBSTITUTES: MARKET MAP

TABLE 6 MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 28 YC-YCC SHIFT FOR THE MEAT SUBSTITUTES MARKET

6.8 PATENT ANALYSIS

FIGURE 29 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 30 TOP TEN INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 31 TOP TEN APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 7 SOME OF THE PATENTS PERTAINING TO MEAT ALTERNATIVES, 2020–2021

6.9 TRADE ANALYSIS

6.9.1 SOYA BEANS

TABLE 8 TOP TEN IMPORTERS AND EXPORTERS OF SOYA BEANS, 2020 (KT)

6.9.2 WHEAT

TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF WHEAT, 2020 (KT)

6.9.3 PEA

TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF PEA, 2020 (KT)

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 MEAT SUBSTITUTES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.10.1 DEGREE OF COMPETITION

6.10.2 BARGAINING POWER OF SUPPLIERS

6.10.3 BARGAINING POWER OF BUYERS

6.10.4 THREAT OF SUBSTITUTES

6.10.5 THREAT OF NEW ENTRANTS

6.11 CASE STUDIES

6.11.1 GROWING DEMAND FOR MEAT ALTERNATIVES

6.11.2 INCREASING DEMAND FOR CLEAN LABEL PRODUCTS

6.12 REGULATIONS

6.12.1 INTRODUCTION

6.12.2 REGULATIONS, BY COUNTRY/REGION

6.12.2.1 United States

6.12.2.2 Canada

6.12.2.3 Europe

6.12.2.4 India

7 MEAT SUBSTITUTES MARKET, BY PRODUCT (Page No. - 83)

7.1 INTRODUCTION

FIGURE 32 MARKET SIZE, BY PRODUCT, 2021 VS. 2027 (USD MILLION)

TABLE 12 MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY PRODUCT, 2021–2027 (USD MILLION)

7.1.1 COVID-19 IMPACT ON MEAT SUBSTITUTE MARKET, BY PRODUCT

7.1.1.1 Optimistic scenario

TABLE 14 OPTIMISTIC SCENARIO: MARKET SIZE FOR MEAT SUBSTITUTES, BY PRODUCT, 2019–2022 (USD MILLION)

7.1.1.2 Realistic scenario

TABLE 15 REALISTIC SCENARIO: MARKET SIZE, BY PRODUCT, 2019–2022 (USD MILLION)

7.1.1.3 Pessimistic scenario

TABLE 16 PESSIMISTIC SCENARIO: MARKET SIZE, BY PRODUCT, 2019–2022 (USD MILLION)

7.2 TOFU

7.2.1 TOFU HAS A MAJOR APPLICATION IN THE PRODUCTION OF PLANT-BASED BURGERS AND PATTIES

TABLE 17 TOFU: MEAT SUBSTITUTES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 TOFU: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.3 TEMPEH

7.3.1 INCREASING AWARENESS RELATED TO THE HEALTH BENEFITS ASSOCIATED WITH FERMENTED FOOD PRODUCTS TO BOOST THE DEMAND FOR TEMPEH

TABLE 19 TEMPEH: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 TEMPEH: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 SEITAN

7.4.1 DENSE TEXTURE AND NEUTRAL FLAVOR MAKE SEITAN A POPULAR MEAT SUBSTITUTE

TABLE 21 SEITAN: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 SEITAN: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.5 QUORN

7.5.1 VARIOUS HEALTH AND ENVIRONMENTAL BENEFITS PROVIDED BY QUORN TO DRIVE ITS DEMAND FOR MEAT SUBSTITUTES

TABLE 23 QUORN: MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 24 QUORN: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

7.6 OTHER PRODUCTS

7.6.1 VARIOUS HEALTH-RELATED BENEFITS OFFERED BY MEAT ALTERNATIVE PRODUCTS TO DRIVE THEIR DEMAND

TABLE 25 OTHER PRODUCTS: MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 OTHER PRODUCTS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8 MEAT SUBSTITUTES MARKET, BY SOURCE (Page No. - 93)

8.1 INTRODUCTION

FIGURE 33 MARKET SIZE FOR MEAT SUBSTITUTES, BY SOURCE, 2021 VS. 2027 (USD MILLION)

TABLE 27 MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 28 MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

TABLE 29 MARKET SIZE, BY SOURCE, 2017–2020 (KT)

TABLE 30 MARKET SIZE, BY SOURCE, 2021–2027 (KT)

8.1.1 COVID-19 IMPACT ON THE MARKET, BY SOURCE

8.1.1.1 Optimistic scenario

TABLE 31 OPTIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

8.1.1.2 Realistic scenario

TABLE 32 REALISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

8.1.1.3 Pessimistic scenario

TABLE 33 PESSIMISTIC SCENARIO: MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

8.2 SOY PROTEIN

8.2.1 SOY PROTEIN IS PREFERRED BY MANUFACTURERS AS IT IMPARTS SIMILAR TEXTURE TO MEAT SUBSTITUTES AS TRADITIONAL MEAT

TABLE 34 SOY PROTEIN: MEAT SUBSTITUTES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 SOY PROTEIN: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 36 SOY PROTEIN: MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 37 SOY PROTEIN: MARKET SIZE, BY REGION, 2021–2027 (KT)

8.3 WHEAT PROTEIN

8.3.1 HIGH AVAILABILITY OF WHEAT AS A RAW MATERIAL IS ENCOURAGING MANUFACTURERS TO INCORPORATE IT IN THE PRODUCTION OF MEAT SUBSTITUTES

TABLE 38 WHEAT PROTEIN: MEAT SUBSTITUTE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 WHEAT PROTEIN: MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2021–2027 (USD MILLION)

TABLE 40 WHEAT PROTEIN: MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 41 WHEAT PROTEIN: MARKET SIZE, BY REGION, 2021–2027 (KT)

8.4 PEA PROTEIN

8.4.1 RISING INVESTMENT BY MANUFACTURERS TO BOOST THE DEMAND FOR PEA PROTEIN

TABLE 42 PEA PROTEIN: MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 PEA PROTEIN: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 44 PEA PROTEIN: MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 45 PEA PROTEIN: MARKET SIZE, BY REGION, 2021–2027 (KT)

8.5 OTHER SOURCES

8.5.1 INCREASING DEMAND FOR PLANT-BASED PROTEINS AND ALTERNATIVES OF SOY PROTEIN TO DRIVE THE MARKET FOR OTHER SOURCES

TABLE 46 OTHER SOURCES: MEAT SUBSTITUTES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 OTHER SOURCES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 48 OTHER SOURCES: MARKET SIZE, BY REGION, 2017–2020 (TONS)

TABLE 49 OTHER SOURCES: MEAT SUBSTITUTE MARKET SIZE, BY REGION, 2021–2027 (TONS)

9 MEAT SUBSTITUTES MARKET, BY TYPE (Page No. - 106)

9.1 INTRODUCTION

FIGURE 34 MARKET SIZE FOR MEAT SUBSTITUTES, BY TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 50 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE MARKET, BY TYPE

9.1.1.1 Optimistic scenario

TABLE 52 OPTIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

9.1.1.2 Realistic scenario

TABLE 53 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 54 PESSIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

9.2 CONCENTRATES

9.2.1 LOWER PRICE OF CONCENTRATES TO BOOST ITS DEMAND IN THE MARKET

TABLE 55 CONCENTRATES: MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 CONCENTRATES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3 ISOLATES

9.3.1 ISOLATES ARE THE PUREST FORM OF PROTEIN AND A TYPE WITH THE HIGHEST AMOUNT OF PROTEIN

TABLE 57 ISOLATES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 ISOLATES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.4 TEXTURED

9.4.1 TEXTURED PROTEIN TO WITNESS HIGH GROWTH DUE TO ITS RESEMBLANCE WITH CONVENTIONAL MEAT IN TERMS OF TEXTURE

TABLE 59 TEXTURED: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 TEXTURED: MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2021–2027 (USD MILLION)

10 MEAT SUBSTITUTES MARKET, BY FORM (Page No. - 114)

10.1 INTRODUCTION

FIGURE 35 MARKET SIZE FOR MEAT SUBSTITUTES, BY FORM, 2021 VS. 2027 (USD MILLION)

TABLE 61 MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 62 MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE GLOBAL MARKET, BY FORM

10.1.1.1 Optimistic scenario

TABLE 63 OPTIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

10.1.1.2 Realistic scenario

TABLE 64 REALISTIC SCENARIO: MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 65 PESSIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

10.2 SOLID

10.2.1 SOLID FORM OF PROTEINS IS PREFERRED BECAUSE IT IS EASIER TO STORE AND HANDLE

TABLE 66 SOLID: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 SOLID: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

10.3 LIQUID

10.3.1 DEMAND FOR LIQUID PLANT PROTEINS TO BE LOW IN THE FUTURE AS THEY DO NOT PROVIDE CONVENIENCE TO MANUFACTURERS

TABLE 68 LIQUID: MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 LIQUID: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11 MEAT SUBSTITUTES MARKET, BY CATEGORY (Page No. - 120)

11.1 INTRODUCTION

11.2 FROZEN

11.2.1 FREEZING MEAT SUBSTITUTES HELP IN PRESERVING THEIR NUTRITIONAL VALUE

11.3 REFRIGERATED

11.3.1 REFRIGERATED MEAT SUBSTITUTES ARE BEING PREFERRED BY CONSUMERS AS THEY ARE FRESHER AS COMPARED TO FROZEN PRODUCTS

11.4 SHELF STABLE

11.4.1 SHELF-STABLE MEAT ALTERNATIVES IS A CATEGORY EXPLORED BY VARIOUS STARTUPS

12 MEAT SUBSTITUTES MARKET, BY REGION (Page No. - 122)

12.1 INTRODUCTION

FIGURE 36 REGIONAL SNAPSHOT: GERMANY AND SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR IN THE MARKET IN 2020

TABLE 70 MARKET SIZE FOR MEAT SUBSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MEAT SUBSTITUTE MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 72 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 73 MARKET SIZE, BY REGION, 2021–2027 (KT)

12.2 COVID-19 IMPACT ON THE MARKET, BY REGION

12.2.1 OPTIMISTIC SCENARIO

TABLE 74 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

12.2.2 REALISTIC SCENARIO

TABLE 75 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

12.2.3 PESSIMISTIC SCENARIO

TABLE 76 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MEAT SUBSTITUTE MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: MARKET SIZE FOR MEAT SUBSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MEAT SUBSTITUTES MARKET, BY SOURCE, 2017–2020 (KT)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2027 (KT)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MEAT SUBSTITUTE MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MEAT SUBSTITUTE MARKET, BY TYPE, 2021–2027 (USD MILLION)

12.3.1 UNITED STATES

12.3.1.1 Shift of focus to pea protein by key players

12.3.1.2 Increasing veganism in the country

TABLE 89 UNITED STATES: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 90 UNITED STATES: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.3.2 CANADA

12.3.2.1 High-growth potential with supporting government initiatives

12.3.2.2 Consumer shift toward plant-based protein products

TABLE 91 CANADA: MEAT SUBSTITUTES MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 An untapped market owing to the high prices of plant-based protein in the country

TABLE 93 MEXICO: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 94 MEXICO: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.4 EUROPE

TABLE 95 EUROPE: MEAT SUBSTITUTE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 96 EUROPE: MEAT SUBSTITUTE MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

TABLE 99 EUROPE: MEAT SUBSTITUTES MARKT SIZE, BY SOURCE, 2017–2020 (KT)

TABLE 100 EUROPE: MARKET SIZE, BY SOURCE, 2021–2027 (KT)

TABLE 101 EUROPE: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 103 EUROPE: MEAT SUBSTITUTE MARKET, BY FORM, 2017–2020 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 Rising trend of veganism and government support for the meat alternatives market to drive the market growth

TABLE 107 GERMANY: MEAT SUBSTITUTES MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.4.2 UNITED KINGDOM

12.4.2.1 Entry of major players in the global market to attract consumers

TABLE 109 UNITED KINGDOM: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 110 UNITED KINGDOM: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 Awareness about the drawbacks of animal-based meat to shift the inclination of consumers toward plant-based meat

TABLE 111 FRANCE: MEAT SUBSTITUTE MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 112 FRANCE: MEAT SUBSTITUTE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

12.4.4 ITALY

12.4.4.1 Entry of key players in the Italian vegan market to drive the growth of meat substitutes

TABLE 113 ITALY: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 114 ITALY: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.4.5 SPAIN

12.4.5.1 Production and promotion of plant-based meat by numerous companies to drive the growth of the market

TABLE 115 SPAIN: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 116 SPAIN: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.4.6 NETHERLANDS

12.4.6.1 Market for meat substitutes in the country at an extremely nascent stage

TABLE 117 NETHERLANDS: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 118 NETHERLANDS: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.4.7 REST OF EUROPE

TABLE 119 REST OF EUROPE: MEAT SUBSTITUTES MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 120 REST OF EUROPE: MEAT SUBSTITUTE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: MEAT SUBSTITUTE MARKET SNAPSHOT

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MEAT SUBSTITUTE MARKET, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2020 (KT)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2027 (KT)

TABLE 127 ASIA PACIFIC: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MEAT SUBSTITUTE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

12.5.1 CHINA

12.5.1.1 Relatively fragmented market with multiple startups developing generic plant proteins

TABLE 133 CHINA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 134 CHINA: MEAT SUBSTITUTES MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.5.2 JAPAN

12.5.2.1 Inclination of Japanese consumers toward cultured meat products

TABLE 135 JAPAN: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 136 JAPAN: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.5.3 SINGAPORE

12.5.3.1 Key players entering the market as consumers accepted meat substitute products

TABLE 137 SINGAPORE: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 138 SINGAPORE: MEAT SUBSTITUTE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

12.5.4 AUSTRALIA & NEW ZEALAND

12.5.4.1 Health benefits offered by vegan meat attract consumers

TABLE 139 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY SOURCE, 2017–2020 (USD THOUSAND)

TABLE 140 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY SOURCE, 2021–2027 (USD THOUSAND)

12.5.5 REST OF ASIA PACIFIC

TABLE 141 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MEAT SUBSTITUTE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 143 SOUTH AMERICA: MEAT SUBSTITUTES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 145 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

TABLE 147 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (KT)

TABLE 148 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2027 (KT)

TABLE 149 SOUTH AMERICA: MEAT SUBSTITUTE MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 150 SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 151 SOUTH AMERICA: MEAT SUBSTITUTE MARKET, BY FORM, 2017–2020 (USD MILLION)

TABLE 152 SOUTH AMERICA: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

TABLE 153 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 154 SOUTH AMERICA: MEAT SUBSTITUTE MARKET, BY TYPE, 2021–2027 (USD MILLION)

12.6.1 BRAZIL

12.6.1.1 Increasing investments in plant-based meat by key players to remain high in this market

12.6.1.2 Rising consumer preference for plant-based proteins

TABLE 155 BRAZIL: MEAT SUBSTITUTES MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 156 BRAZIL: MEAT SUBSTITUTE MARKET, BY SOURCE, 2021–2027 (USD MILLION)

12.6.2 ARGENTINA

12.6.2.1 Argentina to offer growth opportunities for meat alternative manufacturers

TABLE 157 ARGENTINA: MARKET SIZE, BY SOURCE, 2017–2020 (USD THOUSAND)

TABLE 158 ARGENTINA: MARKET SIZE, BY SOURCE, 2021–2027 (USD THOUSAND)

12.6.3 REST OF SOUTH AMERICA

TABLE 159 REST OF SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD THOUSAND)

TABLE 160 REST OF SOUTH AMERICA: MARKET SIZE FOR MEAT SUBSTITUTES, BY SOURCE, 2021–2027 (USD THOUSAND)

12.7 REST OF THE WORLD

TABLE 161 ROW: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 162 ROW: MEAT SUBSTITUTE MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 163 ROW: MARKET SIZE FOR MEAT SUBSTITUTES, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 164 ROW: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

TABLE 165 ROW: MEAT SUBSTITUTE MARKET, BY SOURCE, 2017–2020 (TON)

TABLE 166 ROW: MARKET SIZE, BY SOURCE, 2021–2027 (TON)

TABLE 167 ROW: MEAT SUBSTITUTE MARKET, BY PRODUCT, 2017–2020 (USD THOUSAND)

TABLE 168 ROW: MARKET SIZE FOR MEAT SUBSTITUTES, BY PRODUCT, 2021–2027 (USD THOUSAND)

TABLE 169 ROW: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 170 ROW: MEAT SUBSTITUTE MARKET, BY FORM, 2021–2027 (USD MILLION)

TABLE 171 ROW: MARKET SIZE FOR MEAT MEAT SUBSTITUTES, BY TYPE, 2021–2027 (USD MILLION)

12.7.1 UNITED ARAB EMIRATES

12.7.1.1 Increasing industrialization to lead to growth in the food industry

TABLE 173 UNITED ARAB EMIRATES: MEAT SUBSTITUTES MARKET SIZE, BY SOURCE, 2017–2020 (USD THOUSAND)

TABLE 174 UNITED ARAB EMIRATES: MARKET SIZE, BY SOURCE, 2021–2027 (USD THOUSAND)

12.7.2 SOUTH AFRICA

12.7.2.1 Introduction of affordable range of plant-based meat products by key players in South Africa

TABLE 175 SOUTH AFRICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 176 SOUTH AFRICA: MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

12.7.3 REST OF MIDDLE EAST & AFRICA

TABLE 177 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD THOUSAND)

TABLE 178 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2021–2027 (USD THOUSAND)

13 COMPETITIVE LANDSCAPE (Page No. - 174)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2020

TABLE 179 MARKET SHARE ANALYSIS, 2020

13.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

13.4 COVID-19- SPECIFIC COMPANY RESPONSE

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 40 MEAT SUBSTITUTES MARKET, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

13.5.5 PRODUCT FOOTPRINT

TABLE 180 COMPANY FOOTPRINT, BY TYPE

TABLE 181 COMPANY FOOTPRINT, BY SOURCE

TABLE 182 COMPANY REGIONAL, BY FOOTPRINT

TABLE 183 OVERALL COMPANY FOOTPRINT

13.6 MARKET FOR MEAT SUBSTITUTES, START-UP/SME EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 41 MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SMES)

13.7 COMPETITIVE SCENARIO

13.7.1 NEW PRODUCT LAUNCHES

TABLE 184 MEAT SUBSTITUTE MARKET: NEW PRODUCT LAUNCHES, 2019–2021

13.7.2 DEALS

TABLE 185 MARKET FOR MEAT SUBSTITUTES: DEALS, 2019–2021

13.7.3 EXPANSIONS AND INVESTMENTS

TABLE 186 MEAT SUBSTITUTES MARKET: EXPANSIONS, 2018–2020

14 COMPANY PROFILES (Page No. - 185)

14.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

14.1.1 INGREDION INCORPORATED

TABLE 187 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 42 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 188 INGREDION INCORPORATED: PRODUCTS OFFERED

TABLE 189 INGREDION INCORPORATED: NEW PRODUCT LAUNCHES

TABLE 190 INGREDION INCORPORATED: DEALS

TABLE 191 INGREDION INCORPORATED: OTHERS

14.1.2 ADM

TABLE 192 ADM: BUSINESS OVERVIEW

FIGURE 43 ADM: COMPANY SNAPSHOT

TABLE 193 ADM: PRODUCTS OFFERED

TABLE 194 ADM: DEALS

TABLE 195 ADM: OTHERS

14.1.3 DUPONT

TABLE 196 DUPONT: MEAT SUBSTITUTES MARKET BUSINESS OVERVIEW

FIGURE 44 DUPONT: COMPANY SNAPSHOT

TABLE 197 DUPONT: PRODUCTS OFFERED

TABLE 198 DUPONT: NEW PRODUCT LAUNCHES

14.1.4 KERRY GROUP

TABLE 199 KERRY GROUP: BUSINESS OVERVIEW

FIGURE 45 KERRY GROUP: COMPANY SNAPSHOT

TABLE 200 KERRY GROUP: PRODUCTS OFFERED

TABLE 201 KERRY GROUP: DEALS

14.1.5 ROQUETTE FRÈRES

TABLE 202 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 203 ROQUETTE FRÈRES: PRODUCTS OFFERED

TABLE 204 ROQUETTE FRÈRES: NEW PRODUCT LAUNCHES

14.1.6 THE NISSHIN OILLIO GROUP, LTD.

TABLE 205 THE NISSHIN OILLIO GROUP, LTD.: BUSINESS OVERVIEW

FIGURE 46 THE NISSHIN OILLIO GROUP, LTD.: COMPANY SNAPSHOT

TABLE 206 THE NISSHIN OILLIO GROUP, LTD.: PRODUCTS OFFERED

14.1.7 CARGILL

TABLE 207 CARGILL: MEAT SUBSTITUTES MARKET BUSINESS OVERVIEW

FIGURE 47 CARGILL: COMPANY SNAPSHOT

TABLE 208 CARGILL: PRODUCTS OFFERED

TABLE 209 CARGILL: NEW PRODUCT LAUNCHES

TABLE 210 CARGILL: OTHERS

14.1.8 BATORY FOODS

TABLE 211 BATORY FOODS: BUSINESS OVERVIEW

TABLE 212 BATORY FOODS: PRODUCTS OFFERED

TABLE 213 BATORY FOODS: DEALS

14.1.9 WILMAR INTERNATIONAL LIMITED

TABLE 214 WILMAR INTERNATIONAL LIMITED: BUSINESS OVERVIEW

FIGURE 48 WILMAR INTERNATIONAL LIMITED: COMPANY SNAPSHOT

TABLE 215 WILMAR INTERNATIONAL LIMITED: PRODUCTS OFFERED

TABLE 216 WILMAR INTERNATIONAL LIMITED: OTHERS

14.1.10 CRESPEL & DEITERS

TABLE 217 CRESPEL & DEITERS: BUSINESS OVERVIEW

TABLE 218 CRESPEL & DEITERS: PRODUCTS OFFERED

14.2 START-UPS/SMES

14.2.1 A&B INGREDIENTS

TABLE 219 A&B INGREDIENTS: MEAT SUBSTITUTES MARKET BUSINESS OVERVIEW

TABLE 220 A&B INGREDIENTS: PRODUCTS OFFERED

14.2.2 ALL ORGANIC TREASURES GMBH

TABLE 221 ALL ORGANIC TREASURES GMBH: BUSINESS OVERVIEW

TABLE 222 ALL ORGANIC TREASURES GMBH: PRODUCTS OFFERED

14.2.3 SONIC BIOCHEM LTD.

TABLE 223 SONIC BIOCHEM LTD.: BUSINESS OVERVIEW

TABLE 224 SONIC BIOCHEM LTD.: PRODUCTS OFFERED

14.2.4 PURIS

TABLE 225 PURIS: BUSINESS OVERVIEW

TABLE 226 PURIS: PRODUCTS OFFERED

14.2.5 SOTEXPRO S.A

14.2.6 AXIOM FOODS

14.2.7 THE GREEN LABS LLC

14.2.8 SHANDONG JIANYUAN GROUP

14.2.9 ET CHEM

14.2.10 BENEO

14.3 LONG LIST OF COMPANIES: MEAT SUBSTITUTES MARKET

Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 221)

15.1 INTRODUCTION

TABLE 227 ADJACENT MARKETS TO MEAT SUBSTITUTES

15.2 LIMITATIONS

15.3 DAIRY ALTERNATIVES MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 228 DAIRY ALTERNATIVES MARKET SIZE, BY SOURCE, 2018–2026 (USD MILLION)

15.4 PLANT-BASED MEAT MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 229 PLANT-BASED MEAT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

16 APPENDIX (Page No. - 224)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating meat substitutes market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The meat substitutes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of processed food & beverage manufacturers and government & research organizations. The supply side is characterized by the presence of meat alternative product manufacturer, distributors, marketing directors, research officers and quality control officers, and key executives from various key companies and organizations operating in meat substitute market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

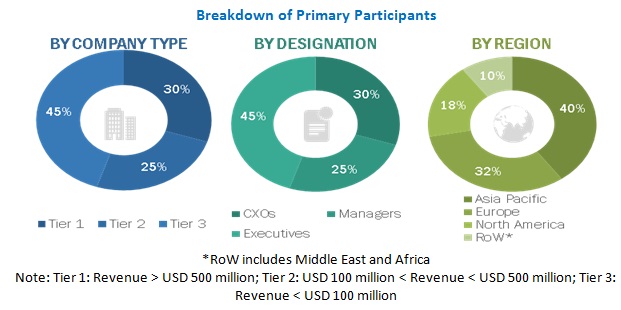

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Growth Drivers for Textured Vegetable Protein Market

Textured Vegetable Protein (TVP) is a popular meat substitute made from soybeans, wheat, or other plant-based sources. Here are some of the growth drivers for the TVP business, from macro to micro:

Macro-Level Drivers:

1. Rising demand for plant-based protein: The global population is increasing, and so is the demand for protein. However, traditional animal-based protein sources are not sustainable in the long run. This has led to a growing interest in plant-based protein sources, including TVP.

2. Health and wellness trend: Consumers are becoming more health-conscious, and many are looking to reduce their intake of animal-based products. TVP is a low-fat, low-calorie, and cholesterol-free protein source that can help consumers meet their health goals.

3. Sustainability concerns: The environmental impact of meat production is significant, including greenhouse gas emissions, water usage, and land use. TVP is a more sustainable alternative to meat, requiring fewer resources to produce.

Micro-Level Drivers:

1. Product innovation: TVP manufacturers are constantly innovating and developing new products to meet consumer demand. This includes new flavors, textures, and forms of TVP.

2. Marketing and advertising: As TVP is still a relatively new product in many markets, effective marketing and advertising campaigns can help raise awareness and drive demand.

3. Distribution channels: TVP manufacturers need to have effective distribution channels in place to reach consumers. This includes partnerships with retailers, wholesalers, and foodservice providers.

4. Cost competitiveness: While TVP is generally less expensive than meat, manufacturers need to ensure that their products are cost-competitive with other meat substitutes and protein sources.

Overall, the TVP business has strong growth potential, driven by macro-level trends such as rising demand for plant-based protein and sustainability concerns, as well as micro-level factors such as product innovation and effective marketing and distribution.

Future of Meat Substitutes Market / Market Potential and Risks

Meat alternatives, also known as plant-based meats, have been gaining popularity in recent years as more consumers look for sustainable and healthier options to replace animal-based products. Here are some potential future use cases of meat alternatives, along with commentary on their adoption, market potential, and risks:

1. Fast food chains and restaurants: Fast food chains and restaurants are increasingly adding plant-based meat options to their menus to cater to changing consumer preferences. This trend is likely to continue, with more restaurants and fast food chains offering plant-based meat alternatives in the coming years. This trend is already quite popular in the Western world, and it is gradually spreading to other regions, such as Asia, Africa, and the Middle East. The market potential for meat alternatives in this segment is enormous, given the vast size of the global fast food and restaurant industry.

2. Retail: Plant-based meats are also becoming more widely available in retail outlets, including grocery stores, supermarkets, and online retailers. The market potential for meat alternatives in this segment is significant, as consumers are increasingly looking for healthier and sustainable food options. However, there are some risks associated with this segment, such as competition from traditional meat products and challenges in distribution and logistics.

3. Foodservice: Meat alternatives are also finding their way into institutional foodservice, such as hospitals, schools, and prisons. This segment represents a significant opportunity for meat alternative producers, as institutional foodservice providers often have strict dietary requirements and are increasingly looking for sustainable and healthy food options. The market potential in this segment is significant, and the adoption rate is likely to increase in the coming years.

4. Ingredients: Meat alternatives are also being used as ingredients in various food products, such as snacks, ready meals, and sauces. This segment represents a significant opportunity for meat alternative producers, as food manufacturers are increasingly looking for sustainable and healthy ingredients. The market potential for meat alternatives as ingredients is significant, but there are risks associated with this segment, such as competition from traditional ingredients and challenges in scaling production to meet demand.

Overall, the future looks bright for meat alternatives, with significant potential in various segments of the food industry. However, there are risks associated with this market, including competition from traditional meat products, challenges in scaling production to meet demand, and regulatory hurdles. Meat alternative producers will need to be strategic and innovative to overcome these challenges and capitalize on the growing demand for sustainable and healthy food options.

Top Future Hypothetic Growth Opportunities for Vegan Meat substitutes Market

The market for vegan meat substitutes is growing rapidly, driven by changing consumer preferences, sustainability concerns, and health and wellness trends. Here are some potential future use cases and growth opportunities for vegan meat substitutes:

1. Meat-free fast food chains: As more consumers adopt plant-based diets, there is a growing opportunity for meat-free fast food chains. These chains would serve only plant-based meat substitutes, providing consumers with healthy and sustainable fast food options. This market has enormous potential, particularly in regions with a high prevalence of fast food chains.

2. Institutional foodservice: Vegan meat substitutes are also finding their way into institutional foodservice, such as hospitals, schools, and prisons. This segment represents a significant opportunity for vegan meat substitute producers, as institutional foodservice providers often have strict dietary requirements and are increasingly looking for sustainable and healthy food options.

3. Convenience foods: Vegan meat substitutes are already widely used in convenience foods, such as frozen meals, snacks, and ready-to-eat sandwiches. As demand for plant-based foods grows, there is a significant opportunity for vegan meat substitute producers to innovate and create new convenience food products.

4. Premium foodservice: Vegan meat substitutes are also finding their way into premium foodservice, such as high-end restaurants and specialty food stores. This segment represents a significant opportunity for vegan meat substitute producers to showcase their products and appeal to consumers who are willing to pay a premium for healthy and sustainable food options.

5. Emerging markets: As plant-based diets become more popular globally, there is a growing opportunity for vegan meat substitutes in emerging markets. These markets are often underserved by traditional meat producers and have a high prevalence of vegetarianism and veganism. Vegan meat substitutes could provide a sustainable and healthy source of protein for these consumers.

Overall, the future looks bright for vegan meat substitutes, with significant growth opportunities in various segments of the food industry. As consumers become more health-conscious and sustainability-minded, demand for plant-based protein sources is likely to continue to grow, driving innovation and new product development in the vegan meat substitute market.

Meat Substitutes Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the global market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of meat substitute market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Meat Substitutes Market Report Objectives

- To describe and forecast meat substitutes market, in terms of product, source, type, form, and region

- To describe and forecast meat substitute market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of meat substitute market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of meat substitute market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in this market

Available Customizations :

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific meat substitutes market, by key country

- Further breakdown of the Rest of European market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Meat Substitutes Market