Lactic Acid and Polylactic Acid Market by Application (Biodegradable Polymers, Food & Beverages, Pharmaceutical Products), Raw Material, Form (Dry, Liquid), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2028

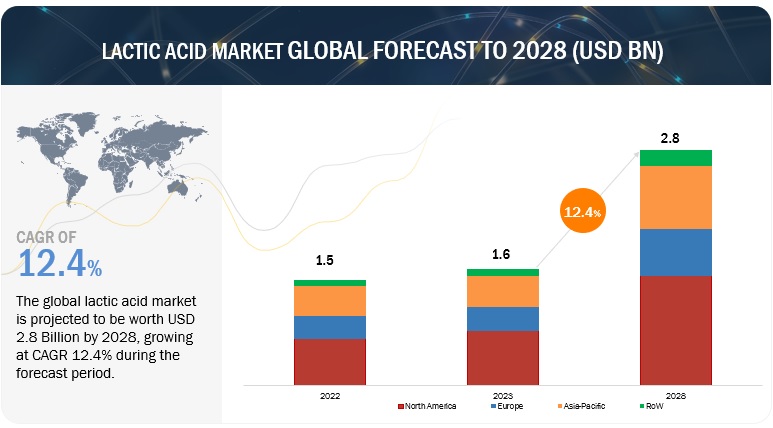

The global Lactic Acid and Polylactic Acid Market size was valued at USD 1.6 billion and USD 1.3 billion in 2023 and are anticipated to grow at CAGRs of 12.4% and 17.7%, respectively, between 2023 and 2028, attributed to the growing revenue of $2.8 billion and $2.9 billion by 2028. The base year for estimation is 2022, and the historical data spans from 2023 to 2028.

The overall production of polymers worldwide was reportedly around 9 billion tonnes in 2021, as per the estimates provided by the scientific article “.Poly(lactic Acid): A Versatile Biobased Polymer for the Future with Multifunctional Properties From Monomer Synthesis, Polymerization Techniques and Molecular Weight Increase to PLA Applications”, published in 2021. Only 9–10% of these plastics are recycled and repurposed, and only 12% are burned. The majority (78–79%) end up in the environment (oceans, lakes, rivers, and landfills). They consequently provide significant issues, most notably with regard to disposal, environmental contamination, ecosystem toxicity, and human health. Utilizing renewable resources to produce biobased polymers is one way to address these issues. Recently, there has been an increase in interest in biobased polymers on a global scale. Polylactic acid (PLA), a well-known eco-friendly biodegradable and biobased polyester, has been extensively explored and is being considered as an ideal replacement for petroleum-based polymers. The 2020 market data on global bioplastics production, compiled by European Bioplastics in collaboration with the nova-Institute, indicates a projected growth from about 2.11 million tons in 2020 to approximately 2.87 million tons by 2025. Results from the same report suggest that the global PLA production was around 190,000 tons in 2019, indicating significant growth potential for the lactic and polylactic acid market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Rise in demand for alternative environment-friendly resources

The increasing demand for alternative eco-friendly resources is driving significant market growth in the lactic acid and polylactic acid (PLA) market. With growing environmental concerns and a shift towards sustainable practices, there is a rising preference for bio-based and biodegradable materials. Lactic acid and PLA, being derived from renewable resources and offering biodegradability, are emerging as attractive alternatives to traditional petrochemical-based products. These materials find extensive applications in various industries, including packaging, textiles, medical, and personal care. The demand for eco-friendly packaging solutions, driven by consumer awareness and regulatory measures, is particularly boosting market growth. The versatile properties of lactic acid and PLA, such as biocompatibility, thermal stability, and moldability, make them suitable for a wide range of applications. Additionally, ongoing advancements in production processes and technological innovations further enhance the market prospects of lactic acid and PLA. Single-use plastic bags, cutlery, and straws have all been prohibited in major Chinese cities since 2021. Portugal has prohibited the use of single-use plastics from catering services as well as free plastic bags in all commercial establishments since 2020. The combined factors of environmental consciousness, regulatory support, expanding eco-friendly packaging demands, and technological advancements are fueling the growth trajectory of the lactic acid and PLA market.

Leading food company Danone was the first company in Europe to transition to PLA packaging, using NatureWorks' IngeoPLA. Danone reduced the carbon footprint of the packaging for its Activia brand by 25% by switching from polystyrene to PLA and by using 43% fewer fossil resources.

Restraint: Concerns over the quality of lactic acid used in food & beverage products

Lactic acid and PLA exhibit excellent biodegradability, biocompatibility, and thermal stability, making them suitable for diverse applications. In the packaging industry, lactic acid and PLA serve as sustainable alternatives to conventional plastics, offering barrier properties and prolonging product shelf life. In the medical field, they find applications in drug delivery systems, tissue engineering, and biodegradable implants. The textile industry benefits from their use in eco-friendly fabrics and fibers. Moreover, lactic acid and PLA are employed in the production of personal care products, cleaning agents, and 3D printing materials. The versatility and broad range of functionalities provided by lactic acid and PLA position them as attractive options for industries seeking sustainable and innovative solutions. As consumer demand for eco-friendly products continues to rise, the multi-functionality of lactic acid and PLA opens up significant growth opportunities for market expansion and the development of new applications.

Opportunity: Multi-functionalities of lactic and polylactic acids

Lactic acid and PLA exhibit excellent biodegradability, biocompatibility, and thermal stability, making them suitable for diverse applications. In the packaging industry, lactic acid and PLA serve as sustainable alternatives to conventional plastics, offering barrier properties and prolonging product shelf life. In the medical field, they find applications in drug delivery systems, tissue engineering, and biodegradable implants. The textile industry benefits from their use in eco-friendly fabrics and fibers. Moreover, lactic acid and PLA are employed in the production of personal care products, cleaning agents, and 3D printing materials. The versatility and broad range of functionalities provided by lactic acid and PLA position them as attractive options for industries seeking sustainable and innovative solutions. As consumer demand for eco-friendly products continues to rise, the multi-functionality of lactic acid and PLA opens up significant growth opportunities for market expansion and the development of new applications.

Danone, the multinational food products company uses lactic acid in their dairy products, such as yogurts and fermented milk drinks, for flavor enhancement and pH adjustment. The cosmetics and beauty giant, L’Oréal, incorporates lactic acid in some of its skincare and hair care products for exfoliation, pH balancing, and moisturizing effects. Procter & Gamble employs lactic acid in some of its cleaning and laundry products for its disinfecting and stain removal properties.

Challenge: High investment costs involved for small and medium enterprises

The high initial investment cost for small and medium enterprises (SMEs) poses a significant challenge to the growth of the lactic acid and polylactic acid market. Lactic acid is a promising and versatile compound used in various industries, including food and beverages, pharmaceuticals, and bioplastics. However, the production of lactic acid requires substantial capital investment in infrastructure, equipment, and research and development. SMEs, which often operate with limited financial resources, struggle to allocate the necessary funds for these upfront costs. This financial barrier prevents many SMEs from entering the lactic acid and polylactic acid market and limits their ability to compete with larger, more established players. Consequently, the concentration of market power among a few major companies hinders market growth, stifles innovation, and restricts the overall development of the lactic acid and polylactic acid industry. Efforts to address this challenge, such as providing financial support, grants, and fostering collaborations between SMEs and larger corporations, could help mitigate the impact of high initial investment costs and stimulate the growth of the lactic acid and polylactic acid market.

Lactic Acid and Polylactic Acid Market Report Ecosystem

Based on raw materials, the sugarcane segment is estimated to grow at the fastest rate during the forecast period of the lactic acid market.

The biotechnology approach offers a significant advantage over the chemical method in terms of cost-effective production of pure lactic acid, utilizing low-cost raw materials such as agro-industrial leftovers as a carbon source. Many countries, including Brazil and India, have access to abundant sugar cane molasses, a byproduct of sucrose manufacturing, which can serve as a suitable substrate for lactic acid fermentation. Brazil holds the position of the world's leading sugarcane producer, followed by India. According to the OECD-FAO Agricultural Outlook 2021–2030, these two countries are projected to account for approximately 21% and 18% of global sugar production by 2030, respectively. India alone generates around 100 million tonnes of sugarcane bagasse (SCB), one of the most prevalent agricultural waste products worldwide, annually, according to the 2021 paper “Sugarcane bagasse based biorefineries in India: potential and challenges”. This availability of raw materials and the biotechnological approach present lucrative opportunities for cost-effective lactic acid production in these regions, contributing to the growth and development of the industry.

The abundant availability of sugarcane bagasse, especially in regions with significant sugar production, provides a cost-effective and renewable resource for lactic acid production. Additionally, utilizing bagasse can help address waste management challenges associated with its disposal, contributing to a more circular and environmentally responsible approach. By tapping into the potential of sugarcane bagasse, the lactic acid market can benefit from increased feedstock availability, improved cost-efficiency, and a stronger sustainability profile, ultimately driving its growth and market adoption.

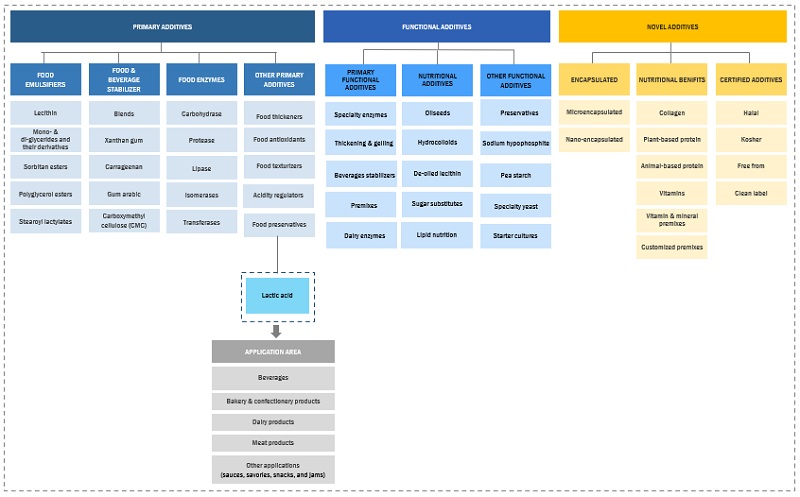

Based on application, the beverage sub segment of the food and beverage segment are anticipated to dominate the lactic acid market.

The growing consumer demand for healthier and natural beverage options has resulted in a notable preference for lactic acid as a safe and sustainable ingredient. Lactic acid offers various advantages, including taste enhancement, texture improvement, and preservation of freshness, across a wide range of beverages such as juices, soft drinks, sports drinks, and dairy-based beverages. Manufacturers have recognized these benefits and increasingly favor lactic acid as a key ingredient. Furthermore, lactic acid provides functional benefits such as microbial stability and acidification, ensuring product safety and maintaining stability throughout the beverage supply chain. As the beverage industry continues to advance and prioritize natural and clean label formulations, the widespread use of lactic acid as a crucial ingredient presents substantial growth prospects for the lactic acid market.

Kefir is a self-carbonated beverage with a unique flavour that comes from a combination of lactic acid, ethanol, carbon dioxide, and additional flavourings. The Swiss soft drink Rivella, which is made from milk whey, uses lactic acid as an acidifier

Based on application, the agriculture segment is projected to witness the highest CAGR during the forecast period of the polylactic acid market.

PLA offers several benefits that make it attractive for agricultural applications. Its biodegradability, derived from renewable resources, and low environmental impact make it a sustainable choice for various agricultural uses. PLA-based mulch films and biodegradable plant pots are gaining popularity as they can be directly incorporated into the soil, reducing waste and eliminating the need for plastic film removal. Additionally, PLA-based agricultural packaging solutions, such as trays and containers, provide a safe and environmentally friendly alternative to conventional plastic packaging. The versatility of PLA extends to the production of agricultural textiles, such as shade nets and erosion control fabrics, which offer excellent biodegradability and performance. Furthermore, PLA's biocompatibility and compatibility with bioactive substances have opened avenues for the development of controlled-release systems for agricultural inputs like fertilizers and pesticides, improving their efficiency and reducing environmental impact. As the agricultural industry increasingly prioritizes sustainable practices and seeks alternatives to traditional plastic materials, the application of PLA in agriculture presents significant growth opportunities for the polylactic acid market.

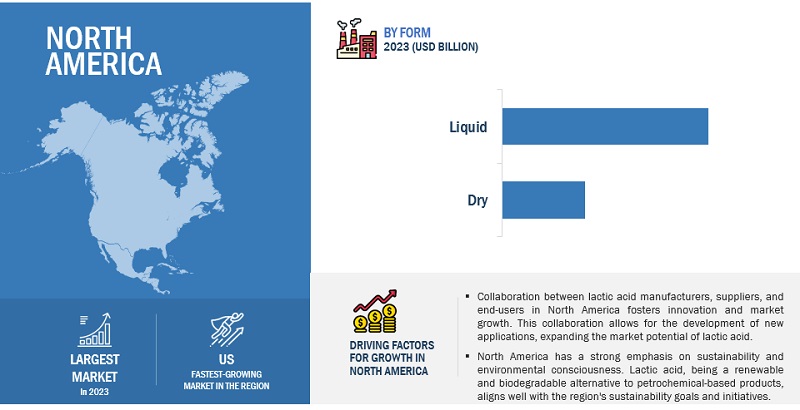

The North America market is projected to contribute the largest lactic acid market share.

The United States is one of the world's top sugar producers. The sugarcane and sugarbeet industries in the United States are both sizable and well-established, unlike those in the majority of other producers. Since the middle of the 2000s, sugarcane has contributed between 40 and 45% of the nation's total sugar production, and sugarbeets have contributed between 55 and 60%. The increased output is the result of a substantial investment in new processing equipment, the adoption of new technologies, the use of improved crop types, and an increase in area (owing to higher prices for sugar crops in comparison to other crops). Increased sugar production from sugarcane also suggests the availability of sugarcane bagasse which act as raw materials for lactic acid production and thus offer lucrative opportunities for the lactic acid in the region. There is an increasing demand for lactic acid in various industries, including food and beverages, pharmaceuticals, cosmetics, and bioplastics. The region's strong focus on sustainability and environmental consciousness is driving the adoption of lactic acid as a renewable and biodegradable alternative to petrochemical-based ingredients. Additionally, the growing consumer preference for natural and clean label products is fueling the demand for lactic acid in food and beverage applications, where it serves as a pH regulator, preservative, and flavor enhancer. Moreover, North America's advanced industrial infrastructure and technological advancements in lactic acid production processes contribute to the market's growth by ensuring efficient manufacturing and supply capabilities. The region's favorable regulatory environment, stringent quality standards, and government support for sustainable products further facilitate market expansion. With the increasing awareness and adoption of lactic acid-based solutions, North America is poised for continued lactic acid market growth, catering to the evolving needs of various industries and driving the shift towards more sustainable practices.

Lactic Acid and Polylactic Acid Market Players

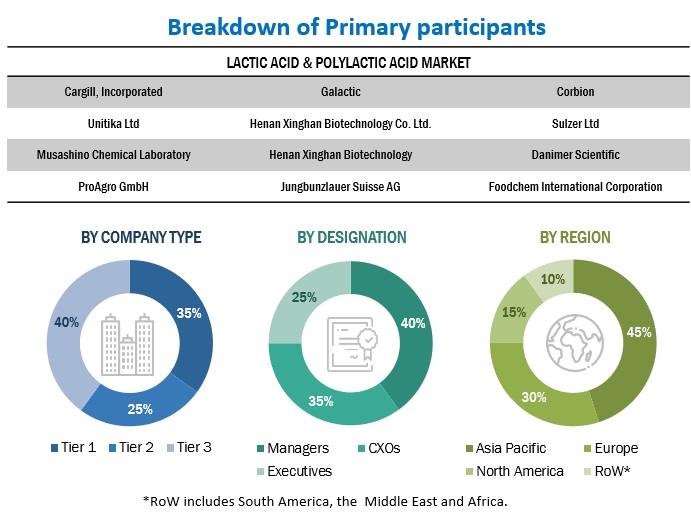

Corbion (Netherlands), Cargill, Incorporated (US), Galactic (Belgium), Unitika Ltd (Japan), Henan Jindan lactic acid Technology Co., Ltd. (China), TORAY INDUSTRIES, INC. (Japan), and Sulzer Ltd (China). are among the key players in the global market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the lactic acid market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Scope of the Report

|

|

Details |

|

Lactic Acid Market Size in 2028 |

$2.8 Billion |

|

Polylactic Acid Market Size in 2028 |

$2.9 Billion |

|

Lactic Acid Market Report Growth Rate |

12.4% CAGR |

|

Polylactic Acid Market Report Growth Rate |

17.7% CAGR |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Lactic Acid and Polylactic Acid Market forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Raw Material, By Application, By Form, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Lactic Acid Market:

By Raw Materials

- Corn

- Cassava

- Sugarcane

- Yeast Extract

- Others

By Form

- Dry

- Liquid

By Application

- Bio-degradable Polymers

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Personal Care Products

- Pharmaceutical Products

- Other Applications

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Polylactic Acid Market:

By Application

- Packaging

- Fiber & Fabrics

- Agriculture

- Electronic & Electricals

- Automobiles

- Other Applications

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Note 1: Other food applications include sauces, savories, snacks, and jams.

Note 2: Other lactic acid applications include lactate solvents, descaling agents, neutralizers, cleaning agents, metal complexing agents, chiral intermediates, and humectants.

Note 3: Other PLA applications include 3D printing, coating & adhesives, and building & construction.

Note 4: Other raw materials include wheat, molasses, rice, raw sweet potato, apple pomace, and wood.

Note 5: RoW includes South America, the Middle East, and Africa.

Recent Developments

- In November 2022, NatureWorks signed a collaboration agreement with CJ Biomaterials, a division of South Korea-based CJ CheilJedang and leading producer of polyhydroxyalkanoate (PHA). The aim of collaboration is the development of sustainable material solutions based on CJ Biomaterials’ PHACT Biodegradable Polymers and NatureWorks’ Ingeo biopolymers. Both companies will develop high-performance biopolymer solutions alternative to fossil-fuel-based plastics in applications ranging from compostable food packaging and food serviceware to personal care, films, and other end products.

- In October 2020, Galactic’s Futerro started operating its first integrated polylactic acid (PLA) production unit in China in collaboration with its historical partner BBCA Biochemical (China), with a production capacity of 30,000 tons/year. This expansion would improve the company’s presence in the Asian market.

Frequently Asked Questions (FAQ):

How big is the Lactic Acid and Polylactic Acid Industry?

What is growth rate of the Lactic Acid and Polylactic Acid Market?

What are the key trends affecting the global Lactic Acid and Polylactic Acid Market?

- Bio-degradable Polymers

- Food & Beverages

- Meat Products

- Dairy Products

Who are the key players in Lactic Acid and Polylactic Acid Market?

Who will be the leading hub for Lactic Acid and Polylactic Acid Market?

What are the key opportunities in the global Lactic Acid and Polylactic Acid Market?

What is fermented milk called?

What are common fermented milk products?

Is Fermented milk healthy?

What type of polymer is PLA?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

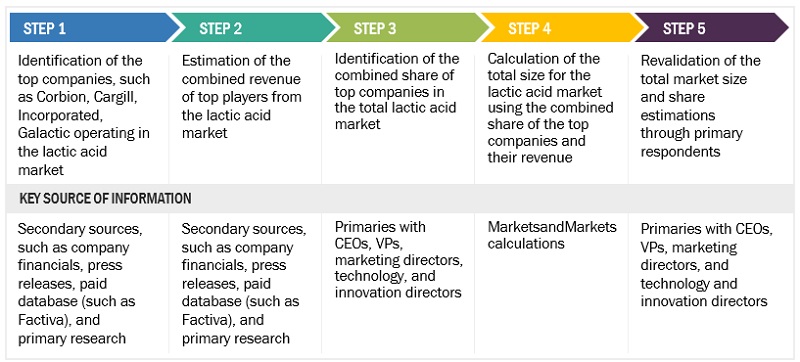

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the lactic acid and polylactic acid market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, EU Commission, The Food and Agriculture Organization (FAO), Food and Drug Administration (FDA), US Department of Agriculture (USDA), European Food Safety Agency (EFSA), Agriculture and Agri-Food Canada, European bioplastics, BBIA – Bio-Based and Biodegradable Industries Associations, Australian Bioplastics Association (ABA), and Plastics Industry Association have been referred to, to identify and collect information for this study. The secondary sources also included lactic acid and polylactic acid annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The lactic acid and polylactic acid market comprises of multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of lactic acid and polylactic acid from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major lactic acid and polylactic acid manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the lactic acid and polylactic acid market has been arrived at.

Bottom-up approach:

- Based on the share of lactic acid and polylactic acid for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for lactic acid and polylactic acid were estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of lactic acid and polylactic acid, are the demand for biopolymers, environmental concerns, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the lactic acid and polylactic acid market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the lactic acid and polylactic acid market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the US FDA, “Lactic acid is a chemical 2-hydroxypropanoic acid, which occurs naturally in several foods. It is produced commercially either by fermentation of carbohydrates, such as glucose, sucrose, or lactose or by a procedure involving the formation of lactonitrile from acetaldehyde and hydrogen cyanide and subsequent hydrolysis to lactic acid.

Lactic acid is one of the bio-based chemicals that finds applications in the food & beverages, polymer, cosmetics & personal care, and pharmaceutical industry. Lactic acid is used in the production of polylactic acid (PLA) plastics that are mainly used in packaging products that comply with the environmental norms.

Polylactic acid is a thermoplastic aliphatic polyester that is derived by the polymerization of lactic acid. It is a versatile polymer that has many potential applications in packaging, textile, and medical. It is similar to traditional plastic in terms of physical and mechanical properties, allowing the user to handle the polymer in the way plastics are handled.

Stakeholders

- Intermediate suppliers such as traders and distributors of lactic acid and polylactic acid

- Manufacturers of food & beverage ingredients and processed food products

- Other manufacturing industries such as personal care, pharmaceutical, automobiles, fiber & fabrics, electronics & agriculture

- Renewable chemical suppliers

- Packaging services providers

- Packaging film producers

- Biodegradable plastics manufacturers

- Polymer manufacturers

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- The Food and Agriculture Organization (FAO)

- Food and Drug Administration (FDA)

- US Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- Agriculture and Agri-Food Canada

- European bioplastics

- BBIA – Bio-Based and Biodegradable Industries Associations

- Australian Bioplastics Association (ABA)

- Plastics Industry Association

Report Objectives

Market Intelligence

- Determining and projecting the size of the lactic acid market, with respect to raw material, application, form, and regions over a five-year period, ranging from 2023 to 2028.

- Determining and projecting the size of the polylactic acid market, with respect to application and regions over a five-year period, ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for significant countries related to the lactic acid and polylactic acid market

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the global lactic acid and polylactic acid market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global lactic acid and polylactic acid market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Lactic acid and polylactic acid into the Poland, Netherlands, Denmark, Belgium, Switzerland, Sweden, Greece, and other EU and non-EU countries.

- Further breakdown of the Rest of South America market for Lactic acid and polylactic acid into Colombia, Peru, Paraguay, Chile, and Venezuela

- Further breakdown of the Rest of Asia Pacific for Lactic acid and polylactic acid into the Malaysia, Singapore, Philippines, Vietnam, South Korea, and other Asian countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Lactic Acid and Polylactic Acid Market