Gluten-Free Products Market

Gluten-free Products Market by Type (Bakery Products, Snacks & RTE Products, Pizzas & Pastas, Condiments & Dressings), Form, Distribution Channel (Conventional Stores, Specialty Stores, and Drugstores & Pharmacies), Source - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

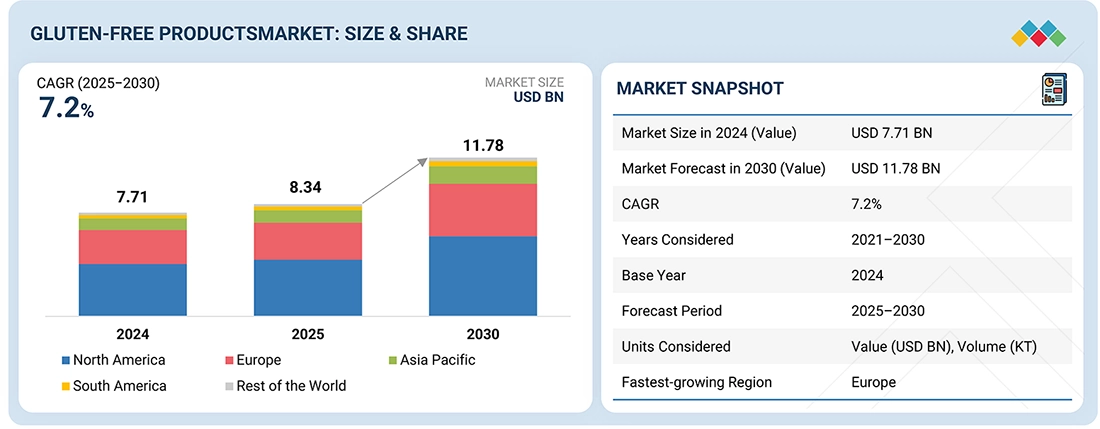

The gluten-free products market is projected to grow from USD 8.34 billion in 2025 to USD 11.78 billion by 2030, at a CAGR of 7.2%. the gluten-free products market is transitioning from a niche, condition-driven category to a mainstream functional food segment. Growth is increasingly shaped by regulatory convergence, portfolio integration by large FMCG players, and innovation in texture, taste, and cost parity, positioning gluten-free products as a sustained growth opportunity across retail and foodservice channels globally.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to account for 50.4% of the gluten-free products market in 2025

-

BY PRODUCT TYPEBy product type, the Snacks & RTE products segment is projected to grow at the highest rate from 2025 to 2030.

-

BY Distribution ChannelBy Distribution Channel, the Conventional stores segment is estimated to dominate the market with a share of 71.7% in 2025.

-

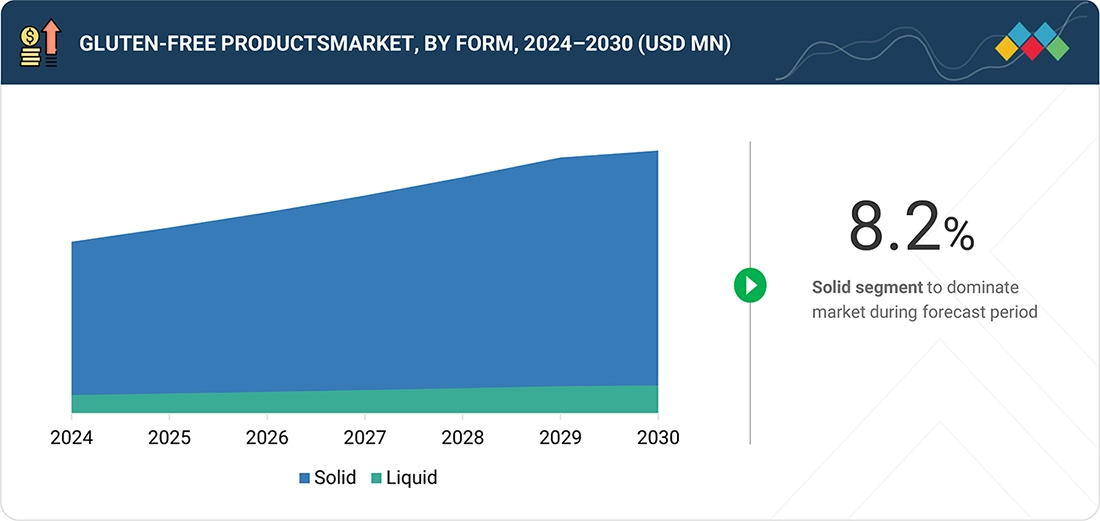

BY FORMBy form, the solid segment is estimated to account for 90.3% of the market in 2025.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSThe Kraft Heinz Company (U.S.), The Hain Celestial Group (U.S.), General Mills, Inc. (U.S.), Conagra Brands, Inc. (U.S.)were identified as some of the star players in the gluten-free products market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPSKellanova , Barilla G. e R. F.lli S.p.A. , Raisio Oyj among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Beyond clinical needs, gluten-free consumption is increasingly influenced by perceived digestive benefits, energy optimization, and clean-label preferences. Fitness-oriented and wellness-focused consumers are actively seeking allergen-friendly foods that align with broader nutritional goals.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

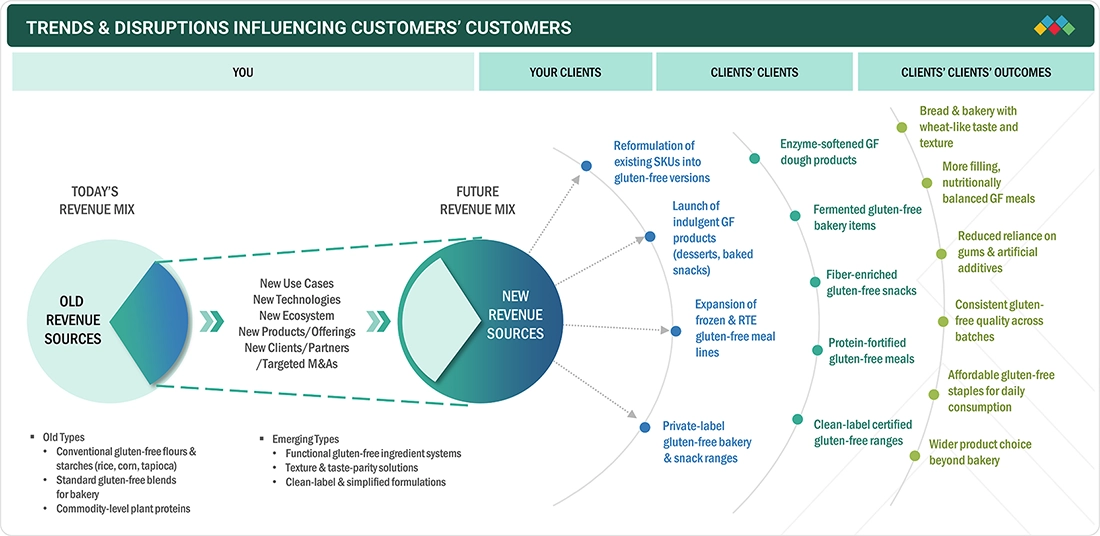

Shifts in customer trends and industry disruptions directly influence the business performance of end users in the gluten-free products market. Emerging “hotspots”—new additive types, evolving Distribution Channel sectors, and changing end-use patterns—are reshaping demand dynamics. As these trends accelerate or shift, they impact the revenue streams of end users, which in turn affects the overall market performance and growth opportunities for gluten-free productsmanufacturers across the globe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased diagnosis of celiac disease and other food allergies

-

Growing awareness of benefits including nutritive and free-from foods in daily diets

Level

-

Premium pricing of gluten-free products compared to conventional products

-

Fiber deficiency in gluten-free products

Level

-

Adoption of microencapsulation technology to improve shelf-life

-

Favorable regulatory framework and initiatives promoting gluten-free foods

Level

-

Formulation challenges faced by manufacturers

-

Cross-contamination risk & compliance costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased diagnosis of celiac disease and other food allergies

The gluten-free products market continues to be fundamentally driven by the rising medical diagnosis of celiac disease and non-celiac gluten sensitivity. Improved diagnostic protocols, wider access to gastroenterology care, and updated screening guidelines in North America, Europe, and parts of Asia have expanded the diagnosed patient pool.

Restraint: Premium pricing of gluten-free products compared to conventional products

Despite scale improvements, gluten-free products continue to carry a price premium due to higher ingredient costs, dedicated manufacturing lines, certification expenses, and lower economies of scale. Specialized raw materials such as rice flour, almond flour, and functional binders increase formulation costs. This pricing gap remains a key adoption barrier in emerging markets and among middle-income consumers, particularly where gluten-free diets are perceived as optional rather than medically required.

Opportunity: Adoption of microencapsulation technology to improve shelf-life

Microencapsulation is gaining attention as a solution to improve the stability, shelf-life, and sensory performance of gluten-free products. Encapsulated enzymes, flavors, and nutrients help mitigate texture degradation and moisture loss, particularly in baked goods. Ingredient suppliers and food technology firms are increasingly collaborating with gluten-free manufacturers to deploy these technologies at commercial scale, supporting product consistency and wider geographic distribution.

Challenge: Formulation challenges faced by manufacturers

Developing gluten-free products that replicate the functional properties of gluten—such as elasticity, structure, and moisture retention—remains technically complex. Manufacturers must balance sensory quality, nutritional adequacy, clean-label requirements, and cost efficiency while ensuring strict cross-contamination control. These formulation challenges intensify as consumers increasingly expect gluten-free products to match conventional equivalents in taste, texture, and shelf stability, placing sustained pressure on R&D capabilities and ingredient sourcing strategies.

GLUTEN-FREE PRODUCTS MARKET SIZE, TRENDS & FORECAST TO 2029: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Expanded its gluten-free ingredient portfolio by offering rice- and corn-based flours, tapioca starches, texturizing systems, and clean-label binders for gluten-free bakery, snacks, and ready meals. Cargill also supports manufacturers with application labs focused on gluten-free dough rheology and texture optimization. | Enables food manufacturers to achieve better texture, volume, and shelf life in gluten-free bakery and snacks while improving cost efficiency and formulation consistency at industrial scale. |

|

Introduced gluten-free flour blends, plant proteins, and functional fibers designed to enhance nutritional density and mouthfeel in gluten-free baked goods, cereals, and snack products. ADM supports gluten-free claims through traceable sourcing and allergen-controlled processing. | Strengthens manufacturers’ ability to launch nutrient-enhanced, clean-label gluten-free products, addressing consumer demand for protein, fiber, and better-for-you positioning. |

|

Provides clean-label starches, rice flours, and pulse-based ingredients tailored for gluten-free bakery, sauces, and snacks. Ingredion works closely with brands on reformulation of mainstream SKUs into gluten-free variants. | Helps brands maintain label simplicity, stable texture, and scalable production, enabling faster gluten-free line extensions of existing products. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The gluten-free products ecosystem is composed of manufacturers, regulatory bodies, research organizations, and demand side companies. It is a fast-growing, innovation-driven landscape shaped by rising demand for science-backed nutrition, efficiency, and sustainable production practices. The market brings together established multinational companies and agile emerging players, all of whom contribute to the development of gluten-free products that influenced by perceived digestive benefits, energy optimization, and clean-label preferences.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

gluten-free products Market,By Type

Based on type, bakery products dominate the gluten-free market because of their broad consumption and vital intake in daily diets, including bread, cakes, cookies, etc.

gluten-free products Market, By Distribution Channel

Conventional stores, which comprise supermarkets, hypermarkets, and internet retailers, are expected to dominate the gluten-free products market during the forecast period. Their comprehensive accessibility, convenience, and extensive range of products make them the primary choice among consumers seeking gluten-free food.

gluten-free products Market, By Form

The solid segment is expected to hold a significant market share, owing to its convenience in handling, longer shelf life, and widespread use in commercial manufacturing.

REGION

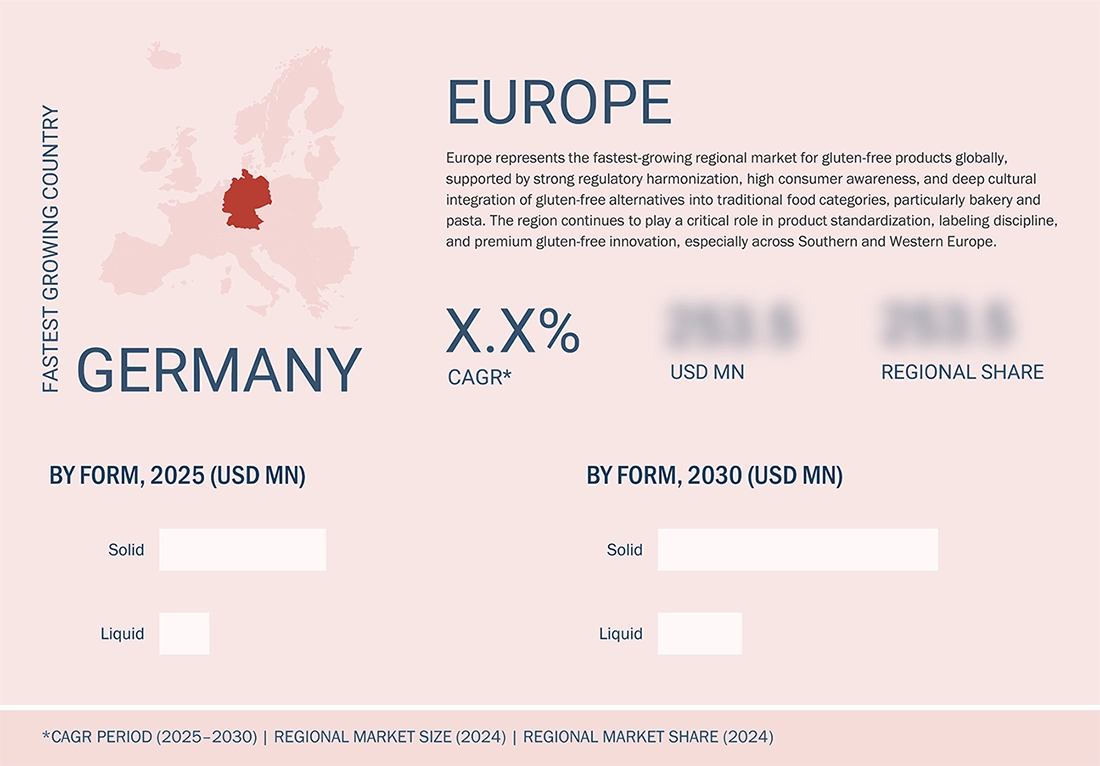

Asia Pacific to lead global gluten-free products market during forecast period

North America is poised to lead the gluten-free products market, driven by a shift from a condition-driven niche to a mainstream functional food segment. Growth is increasingly shaped by regulatory maturity, portfolio-wide integration by large FMCG players, and continued innovation in texture, taste, and cost parity.

GLUTEN-FREE PRODUCTS MARKET SIZE, TRENDS & FORECAST TO 2029: COMPANY EVALUATION MATRIX

In the gluten-free products market landscape, Cargill and ADM (Stars) lead with a strong market presence supported by their extensive production capabilities, broad gluten-free products portfolios, and well-established distribution networks across Distribution Channel sectors. Their scale, innovation in nutrition solutions, and deep integration with large commercial operations reinforce their dominant position. Emerging players such as as Barilla G. e R. F.lli S.p.A. (Italy), Raisio Oyj (Finland), Dr. Schär AG / SPA (Italy),) further boosts the market growth through active investment in product innovation and the expansion of production capacity to meet market demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- The Kraft Heinz Company (United States)

- The Hain Celestial Group (United States)

- General Mills Inc. (United States)

- Conagra Brands, Inc. (United States)

- Kellanova (United States)

- Barilla G. e R. Fratelli S.p.A. (Italy)

- Raisio Oyj (Finland)

- Dr. Schär AG / SPA (Italy)

- Ecotone (France)

- Enjoy Life (United States)

- Alara Wholefoods Ltd (United Kingdom)

- Katz Gluten Free (United States)

- Genius Foods (United Kingdom)

- Silly Yaks – For Real Taste (Australia)

- Norside Foods Ltd (United Kingdom)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 8.34 BN |

| Market Forecast in 2030 (Value) | USD 11.78 BN |

| Growth Rate | CAGR of 7.2% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Rest of the World |

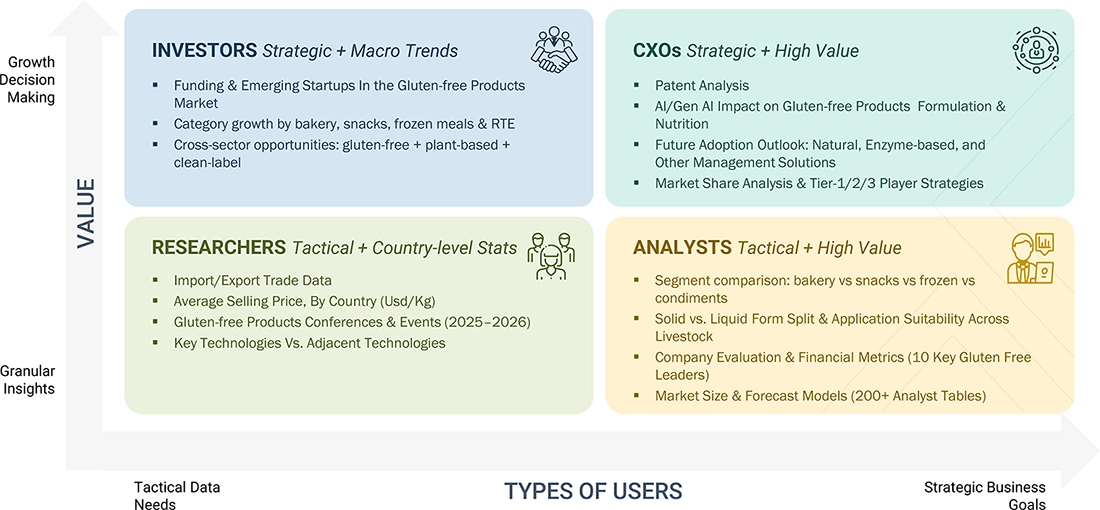

WHAT IS IN IT FOR YOU: GLUTEN-FREE PRODUCTS MARKET SIZE, TRENDS & FORECAST TO 2029 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based gluten-free products Manufacturers | Detailed gluten-free products analysis by product types (bakery products, snacks & ready-to-eat (RTE) products, condiments & dressings, pizzas & pasta, and other types), competitive landscape, and key manufacturer profiling (financial performance, production capacity, and product portfolio mapping). Customer landscape assessment by Distribution Channel category (conventional stores, specialty stores, and drugstores & pharmacies) and distribution channels. Market share benchmarking, pricing analysis, and regulatory environment review for gluten-free products in the US and Canada. | Identified & profiled 20+ gluten-free products manufacturersmerica, including integrators, mills, and specialty suppliers. Tracked adoption trends in high-growth additive categories (bakery products, snacks & ready-to-eat (RTE) products, condiments & dressings, pizzas & pasta, and other types). Highlighted emerging Distribution Channel clusters and demand pockets driven by consumer preferences and precision nutrition trends. |

| gluten-free products, Type & Application Segment Assessment | Segmentation of gluten-free products demand across major Distribution Channel groups (conventional stores, specialty stores, and drugstores & pharmacies). Benchmarking adoption across additive types such as bakery products, snacks & ready-to-eat (RTE) products, condiments & dressings, pizzas & pasta, and other types. Switching barrier analysis for feed mills and integrators (cost sensitivity, proven efficacy, regulatory compliance, and formulation compatibility). | Delivered revenue share & growth outlook for key additive categories across different Distribution Channel species. Identified substitution risks & opportunities in cost-sensitive segments (e.g., bakery vs. snacks). Mapped regulatory frameworks across North America, highlighting compliance pathways and ingredient approval requirements. |

RECENT DEVELOPMENTS

- July 2024 : The flavors of Ore-Ida and GoodPop, brands of The Kraft Heinz Company, joined forces with frozen novelties in the creation of Fudge n' Vanilla French Fry Pops, which is manufactured using vanilla oat milk, a chocolate fudge shell, crispy potato bits. With strategic placement into the gluten-free category, these two innovative, first-of-their-kind products were expected to place the companies in an excellent position to meet the increasing consumer demand for unique and allergen-friendly snacks.

- March 2024 : Garden Veggie, The Hain Celestial Group’s brand, introduced Flavor Burst Tortilla Chips. These gluten-free tortilla chips were expected to be available in vegetable-infused flavors like Nacho Cheese and Zesty Ranch. This innovation is expected to help the company grow by providing consumers with healthy and nutritious gluten-free snacking options.

- February 2024 : General Mills Inc.'s yogurt brand, Yoplait, also launched Yoplait Original with Chocolate Shavings in Cherry, Raspberry, and Strawberry flavors to add creaminess to this guilt-free treat of real chocolate. These gluten-free product offerings are expected to give the company a competitive edge in the market.

Table of Contents

Methodology

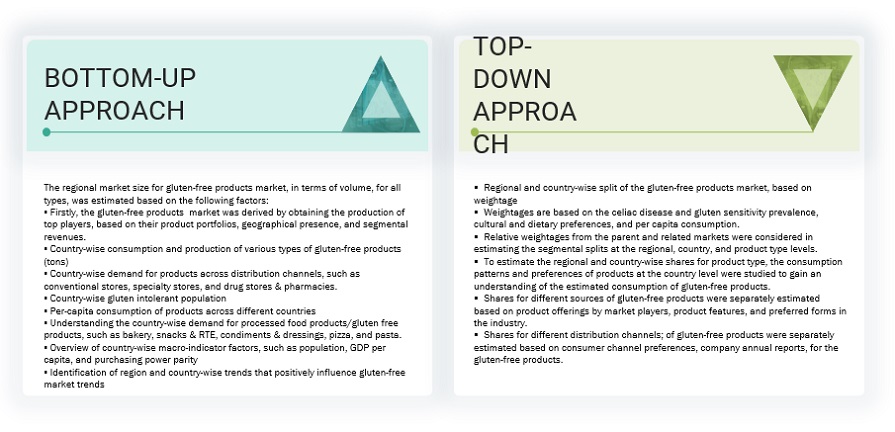

The study involved major segments in estimating the current size of the global gluten-free products market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the gluten-free products market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

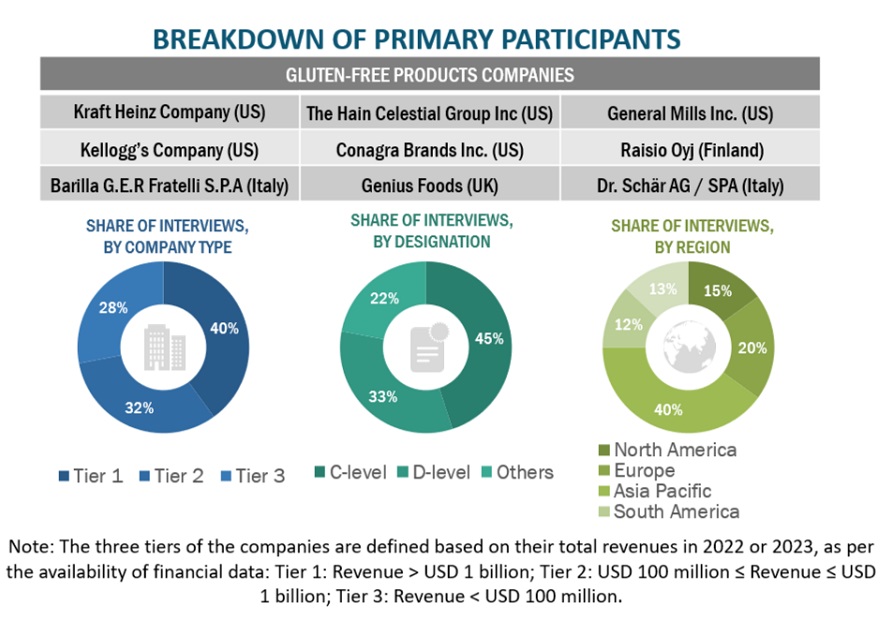

Primary Research

Extensive primary research was conducted after obtaining information regarding the gluten-free products market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to gluten-free products type, form, distribution channel and region. Stakeholders from the demand side, who use gluten-free ingredients, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of gluten-free products and the outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

Kraft Heinz Company (US) |

Regional Sales Manager |

|

The Hain Celestial Group Inc (US) |

Marketing Manager |

|

General Mills (US) |

General Manager |

|

Conagra Brands Inc (US) |

Sales Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total market size. These approaches were also used to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Gluten-free Products Market: Bottom-Up Approach and Top-Down Approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall gluten-free products market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

- According to the Food and Drug Administration (FDA), gluten-free products are food products that do not contain any of the following:

- An ingredient that is any type of wheat, rye, barley, or crossbreeds of these grains

- An ingredient derived from these grains, and that has not been processed to remove gluten

- An ingredient derived from these grains that has been processed to remove gluten, if it results in the food containing 20 or more parts per million (ppm) gluten.

Key Stakeholders

- Supply-side: Gluten-free products manufacturers, suppliers, distributors, importers, and exporters

- Gluten-free products additive manufacturers and traders

- Demand-side: Gluten-free product manufacturers

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies.

- Associations and industry bodies such as:

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Gluten-Free Certification Organization (GFCO)

- National Foundation for Celiac Awareness (NFCA)

- Gluten-Free Standards Organization (GFSA)

- International Certification Services (ICS)

Report Objectives

- To define, segment, and forecast the global gluten-free products market based on type, form, source, distribution channel and region from 2020 to 2023 and a forecast period from 2024 to 2029

- To provide detailed information about the key factors, including drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

To analyze the demand-side factors based on the following:

- Impact of macro and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Strategically profile the key players and comprehensively analyze their core competencies

- Competitive developments, such as partnerships, mergers & acquisitions, new product developments, and expansions & investments in the gluten-free products market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Gluten-free products market into key countries

- Further breakdown of the Rest of Asia Pacific Gluten-free products market into key countries

- Further breakdown of the South American Gluten-free products market into key countries

COMPANY INFORMATION

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gluten-free Products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Gluten-free Products Market