Baking Ingredients Market Size, Share, Industry Growth, Trends Report by Type (Emulsifiers, Leavening Agents, Enzymes, Baking Powders & Mixes, Oil, Fats & Shortenings, Starch, Colors & Flavors, Preservatives, Fibers), Application (Bread and Sweet Bakery), and Region - Forecast to 2026

Baking Ingredients Market Size, Share & Growth Report

The baking ingredients market size was estimated at USD 16.6 billion in 2021 and is expected to grow at a CAGR of 6.0% from 2021 to 2026. The market is expected to reach USD 22.3 billion by 2026.

There has been a significant rise in the consumption of bakery goods due to the growing popularity of convenient foods caused by contemporary lifestyle-influenced consumption modifications. The appearance, taste, texture, smell, shelf life, and fortification of baked goods significantly impact consumers purchasing decisions. While the pricing of bakery items strongly impacts older consumers, younger consumers are more influenced by the quality of the bakery products.

Consequently, bakers are largely employing baking ingredients to maintain the quality of the baked foods and cater to the demands of expanding population. There is also an expanding market for sustainable and natural bakery ingredients like fibers, owing to the shift in food patterns brought on by food crises, environmental concerns, and lifestyle disorders. Due to the Covid-19 lockout, consumers stranded at home turned to bake more frequently, driving up demand for items like baking soda, baking powder, cocoa powder, and other condiments.

To know about the assumptions considered for the study, download the pdf brochure

Baking Ingredients Market Dynamics

Global rise in the consumption of bakery products and confectionery

The surging demand for confectionery and baked foods can be attributed to the rising food trend of convenience foods. Owing to prolonged working hours, hectic lifestyles, and lack of time, consumers are presently opting for foods that save time in procurement, preparation, and cleanup due to their hectic lifestyle and lack of time. In developing countries like US and UK, several local bakery businesses, cafes, and supermarkets have emerged in recent years to cater to the increased demand for fresh and frozen bakery goods and varied commercial bakery ingredients.

In low-income countries like India, the home bakery has gained much popularity in the past few years, suggesting increased use of bakery ingredients. The palatability, rich texture, extended shelf-life, easy accessibility, inexpensiveness, and nutrition associated with bakery foods are primarily influencing their sustenance in the modern market, propelling the demand for baking ingredients. In America, the USD 153 billion bakery industry, driven by high baked foods consumption, is augmenting the expansion of the baking ingredients market.

Health issues due to excess consumption of trans-fatty acids

Trans-fats in the form of vegetable shortenings and margarine are applied in baked food items to enhance their palatability, texture, mouthfeel, and shelf-life. However, increased consumption of trans fatty, rich items has added to the global burden of metabolic diseases like diabetes mellitus, heart diseases, obesity, and other related health issues. Thus, developing countries like the US and the UK are incorporating trans fatty acid intake limits in their national health policies. The baking industry is gradually replacing fats with the application of more natural ingredients like fibers to maintain the taste and texture of baked goods without impacting human health.

The growing trend of veganism and vegetarianism among consumers

The present-day purchasing behavior of consumers is influenced mainly by the rising concerns of sustainability, animal welfare, and climate change which is affecting the baking ingredients market. Considering the detrimental impacts of animal-based foods on the planet, many consumers are gradually adopting veganism and opting for plant-based, natural food products that ensure a reduced carbon footprint. Thus, there has been an increased demand for vegan cakes, muffins, and pastries made from plant-based bakery ingredients like dairy-free milk alternatives, fibers, natural colors, and flavors.

Growth of the frozen bakery products market

The taste, texture, easy availability, prolonged shelf-life, convenience, and health benefits associated with frozen bakery items have increased their popularity among consumers. The increasing demand for frozen bakery foods has created opportunities for frozen bakery manufacturers to expand their business. The bakers are incorporating functional ingredients like oats, fortified flour, millets, and prebiotics to cater to the specific needs of health-conscious consumers. It is anticipated that frozen bakery products have potential prospects of growth in fast-growing economic countries like China, owing to increased disposable income and purchasing power parity (PPP) of the country's expanding population.

Regional Insights

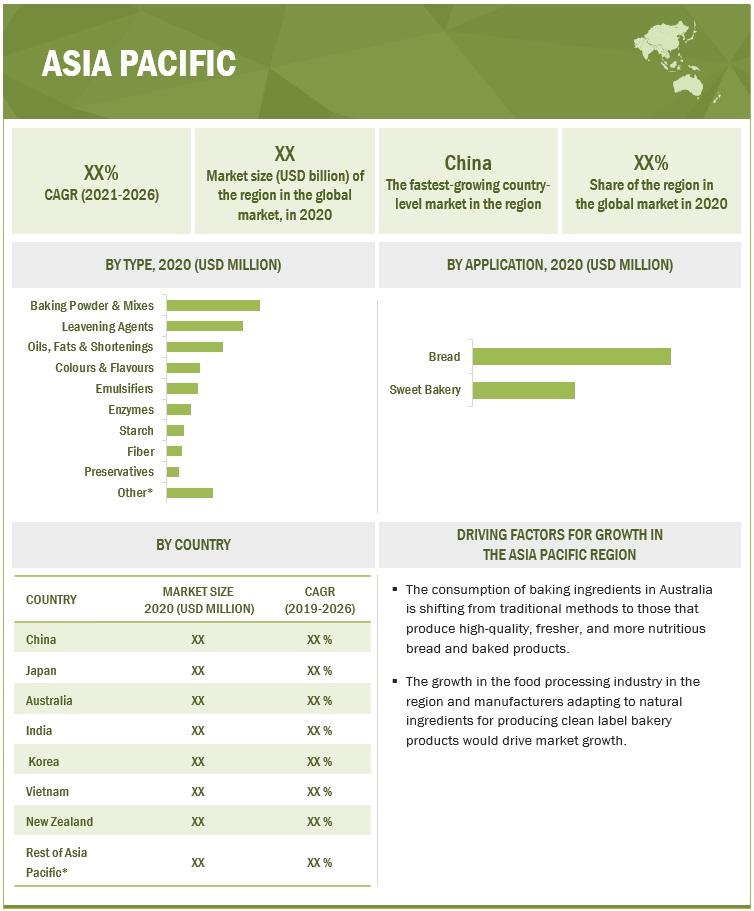

Asia Pacific is projected to grow with a CAGR of 7.2% during the forecast period (2021-2026)

The Asia Pacific region is anticipated to be the fastest-growing in baking ingredients market, attributed to its growing economy and increasing purchasing power of consumers. Urbanization has brought about lifestyle changes that have modified the traditional consumption patterns of consumers in this region. There is an increased demand for convenience and packaged foods owing to the increasing number of working consumers having fast-paced lives. The Asia pacific produces baked goods with a shorter shelf life but can be prepared quickly to cater to the changing needs of consumers. With surging disposable incomes and young people gaining more buying power and shifting their priorities towards sustainable, convenient, vegan food products, Asians are turning towards ready-made bakery products for consumption.

To know about the assumptions considered for the study, download the pdf brochure

Top Baking Ingredients Companies in the Market

The key players in market include Associated British Foods Plc (England), AAK AB (Sweden), Cargill (US), and Kerry Group Plc (Ireland).

Baking Ingredients Market Report Scope

|

Report Metric |

Details |

|

Market valuation in 2021 |

USD 16.6 billion |

|

Revenue prediction in 2026 |

USD 22.3 billion |

|

Progress rate |

CAGR of 6.0% from 2021 - 2026 |

|

Base year considered |

2020 |

|

Fastest-growing region |

Asia Pacific |

|

Companies covered |

|

|

Market driver |

Global rise in the consumption of bakery products and confectionery |

|

Market opportunities |

The increasing demand for frozen bakery foods has created opportunities for frozen bakery manufacturers to expand their business. . |

Baking Ingredients Market Report Segmentation

The study categorizes the market based on type, applications, form component at the regional and global levels.

|

Aspect |

Details |

|

By Type |

|

|

By Application |

|

|

By Form |

|

|

By Region |

|

Recent Developments in the Baking Ingredients Market

- In June 2020, Cargill partnered with a local manufacturer in western India to launch its first chocolate manufacturing operation in the Asia Pacific.

- .In June 2019, Associated British Foods plc and Yihai Kerry Arawana Holdings Co., Ltd, a subsidiary of Wilmar International Limited (Singapore), executed a binding term sheet, setting out their intention to form a 50:50 joint venture in China for the manufacture, sale, and distribution of yeast and bakery ingredients.

- In April 2019, Lallemand Baking introduced Lal^ferm–the new brand for fresh baker’s yeast- the organic yeast portfolio of the company.

Frequently Asked Questions (FAQ):

What is the baking ingredients market growth?

The global baking ingredients market is forecasted to reach USD 22.3 billion by 2026 growing at a CAGR of 6.0% from 2021 to 2026.

What is the future growth potential of baking ingredients market?

The future growth potential of the baking ingredients market appears strong for several reasons. Firstly, the rising demand for convenience foods and baked goods, driven by busy lifestyles and increasing disposable incomes, is expected to fuel market growth. Additionally, the growing popularity of home baking and the proliferation of baking-related content on social media platforms are likely to contribute to increased consumption of baking ingredients. Furthermore, innovations in ingredient formulations, such as gluten-free, organic, and natural alternatives, are expanding the market by catering to diverse consumer preferences and dietary requirements.

What are the major revenue pockets in the baking ingredients market currently?

The baking ingredients market in the Asia Pacific region is expected to experience rapid growth due to several factors.

Who are the key players in baking ingredients market?

The key players in the baking ingredients market include Associated British Foods Plc (England), AAK AB (Sweden), Cargill (US), and Kerry Group Plc (Ireland), and all of them are growing at a fast pace.

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for baking ingredients market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: BAKING INGREDIENTS MARKET

1.3.2 INCLUSIONS AND EXCLUSIONS

1.3.3 GEOGRAPHIC SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2020

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 BAKING INGREDIENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN

2.2.2 BOTTOM-UP

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.3.1 SUPPLY SIDE

2.3.2 DEMAND SIDE

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 BAKING INGREDIENTS MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 2 BAKING INGREDIENTS MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 10 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 12 GROWING DEMAND FOR NATURAL INGREDIENTS DUE TO INCREASING CONSUMER AWARENESS TO DRIVE THE GROWTH OF THE GLOBAL MARKET

4.2 MARKET, BY APPLICATION & REGION

FIGURE 13 EUROPE DOMINATED THE MARKET ACROSS ALL APPLICATIONS IN 2020

4.3 MARKET, BY FORM

FIGURE 14 THE DRY SEGMENT DOMINATED THE GLOBAL MARKET ACROSS ALL FORMS

4.4 EUROPE: MARKET, BY APPLICATION & COUNTRY, 2017

FIGURE 15 THE BREAD SEGMENT ACCOUNTED FOR THE LARGEST SHARE, BY APPLICATION, IN 2020, IN EUROPE

4.5 BAKING INGREDIENTS MARKET: KEY COUNTRY

FIGURE 16 INDIA TO BE THE FASTEST-GROWING COUNTRY IN THE GLOBAL MARKET BY 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 INCREASED DEMAND FOR CONVENIENCE FOOD IS DRIVING THE GROWTH OF THE MARKET

5.2.1 DRIVERS

5.2.1.1 Global rise in the consumption of bakery products and confectionery

FIGURE 18 PER CAPITA CONSUMPTION OF BAKED PRODUCTS, 2020, (KG PER YEAR)

5.2.1.2 Fast-paced lifestyles of consumers and changing consumption patterns

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations and international quality standards

5.2.2.2 Health issues due to excess consumption of trans-fatty acids

5.2.3 OPPORTUNITIES

5.2.3.1 Growing trend of veganism and vegetarianism among consumers

FIGURE 19 RETAIL SALES OF PLANT-BASED FOOD PRODUCTS, 2019 (USD MILLION)

5.2.3.2 Emerging functions of baking ingredients

5.2.3.3 Growth of the frozen bakery products market

5.2.4 CHALLENGES in the BAKING INGREDIENTS MARKET

5.2.4.1 Increase in awareness about health & wellness impacting the consumption of bakery products

5.2.4.2 Intense competition and product rivalry due to similar products

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

5.4 TECHNOLOGY ANALYSIS

5.4.1 TRANSCENDENTAL EMULSIFICATION

5.4.2 DETECTING BREAD QUALITY WITH 3D X-RAY

5.4.3 SODIUM REDUCTION TECHNOLOGY

5.4.4 RECOMBINANT DNA TECHNOLOGY AND PROTEIN ENGINEERING INVOLVED IN THE PRODUCTION OF ENZYME

5.5 PATENT ANALYSIS

FIGURE 21 NUMBER OF PATENTS GRANTED FOR BAKING INGREDIENT PRODUCTS, 2015–2021

FIGURE 22 REGIONAL ANALYSIS OF PATENTS GRANTED IN THE GLOBAL MARKET, 2015–2021

TABLE 3 LIST OF A FEW PATENTS IN THE BAKING INGREDIENTS MARKET, 2020

5.6 ECOSYSTEM & MARKET MAP

FIGURE 23 MARKET ECOSYSTEM

FIGURE 24 MARKET MAP

5.6.1 UPSTREAM

5.6.2 DOWNSTREAM

5.6.2.1 Regulatory bodies

5.6.2.2 Ingredient and raw material providers

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 DEGREE OF COMPETITION

5.8 YC-YCC SHIFT

FIGURE 25 YC & YCC SHIFT FOR THE BAKING INGREDIENTS MARKET

5.9 CASE STUDIES

5.9.1 PRODUCTION OF FIBER-RICH BROWNIES FOR THE UK MARKET

TABLE 5 DEVELOPMENT OF REDUCED SUGAR SNACK FOR KIDS

5.9.2 ADDING PROBIOTICS AND NOVEL FLAVOR TO A NEW, HEALTHIER BAKERY CONCEPT WITH INSIGHTS FROM KERRY TRENDSPOTTER

TABLE 6 DEVELOPMENT OF TASTY AND HEALTHY BAKERY ITEM

5.1 TRADE ANALYSIS

5.10.1 EXPORT SCENARIO OF ENZYMES

FIGURE 26 ENZYMES EXPORTS, BY KEY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 27 LEAVENING AGENTS EXPORTS, BY KEY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 28 STARCHES EXPORTS, BY KEY COUNTRY, 2016–2019 (USD THOUSAND)

5.10.2 IMPORT SCENARIO OF ENZYMES

FIGURE 29 ENZYMES IMPORTS, BY KEY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 30 LEAVENING AGENT IMPORTS, BY KEY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 31 STARCHES IMPORTS, BY KEY COUNTRY, 2016–2019 (USD THOUSAND)

5.11 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.12 REGULATORY FRAMEWORK

5.12.1 CANADA

5.12.2 EU

5.12.3 CHINA

6 BAKING INGREDIENTS MARKET, BY TYPE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 32 MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 7 MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 MARKET SIZE, BY TYPE, 2019–2026 (KT)

6.2 COVID-19 IMPACT ON BAKING INGREDIENTS BY TYPE (2018–2021)

6.2.1 OPTIMISTIC SCENARIO

TABLE 9 COVID-19 IMPACT ON MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

6.2.2 REALISTIC SCENARIO

TABLE 10 COVID-19 IMPACT ON MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

6.2.3 PESSIMISTIC SCENARIO

TABLE 11 COVID-19 IMPACT ON MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

6.3 EMULSIFIERS

6.3.1 EMULSIFIERS ARE USED IN BAKED GOODS TO IMPROVE INTERACTION BETWEEN IMMISCIBLE ELEMENTS

TABLE 12 EMULSIFIERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 EMULSIFIERS MARKET SIZE, BY REGION, 2019–2026 (KT)

6.4 LEAVENING AGENTS: BAKING INGREDIENTS MARKET

6.4.1 YEAST—THE MOST POPULAR LEAVENING AGENT—NOT ONLY RISES THE DOUGH OR BATTER BUT ALSO IMPARTS FLAVOR TO THE PRODUCT

TABLE 14 LEAVENING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 LEAVENING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KT)

6.5 ENZYMES

6.5.1 SERVING AS A CLEAN-LABEL CATALYST FOR SEVERAL REACTIONS IN BAKERY FORMULATIONS LED TO THE RISING DEMAND FOR ENZYMES

TABLE 16 ENZYMES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 ENZYMES MARKET SIZE, BY REGION, 2019–2026 (KT)

6.6 BAKING POWDER & MIXES

6.6.1 GROWING PREFERENCE FOR ORGANIC AND CLEAN-LABEL BAKED PRODUCTS TO CREATE LUCRATIVE GROWTH OPPORTUNITIES FOR BAKING MIX MANUFACTURERS

TABLE 18 BAKING POWDER & MIXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 BAKING POWDER & MIXES MARKET SIZE, BY REGION, 2019–2026 (KT)

6.7 OILS, FATS, AND SHORTENINGS

6.7.1 FAT IS A POWERFUL TENDERIZER IN BAKING AND PLAYS AN IMPORTANT ROLE IN THE LEAVENING OF BAKED GOODS

TABLE 20 OILS, FATS AND SHORTENINGS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 OILS, FATS AND SHORTENINGS MARKET SIZE, BY REGION, 2019–2026 (KT)

6.8 COLORS & FLAVORS

6.8.1 COLORS & FLAVORS ADDED TO BAKED GOODS AFFECT CONSUMERS’ CHOICE TO PURCHASE AN ITEM

TABLE 22 COLORS & FLAVORS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 COLORS & FLAVORS MARKET SIZE, BY REGION, 2019–2026 (KT)

6.9 STARCH (BAKING INGREDIENTS MARKET)

6.9.1 STARCH ASSISTS WITH TEXTURE, VISCOSITY, GEL FORMATION, ADHESION, BINDING, AND MOISTURE RETENTION AND USED AS A FAT SUBSTITUTE

TABLE 24 STARCH MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 STARCH MARKET SIZE, BY REGION, 2019–2026 (KT)

6.10 FIBER

6.10.1 FIBER INGREDIENTS CAN BE ADDED TO BAKED GOODS TO IMPROVE VOLUME WHILE REDUCING A PRODUCT’S CALORIE COUNT

TABLE 26 FIBER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 27 FIBER MARKET SIZE, BY REGION, 2019–2026 (KT)

6.11 PRESERVATIVE

6.11.1 DEMAND FOR BAKING PRESERVATIVES INCREASES WITH THE INCREASE IN THE PURCHASE OF RETAIL BAKERY PRODUCTS GLOBALLY

TABLE 28 PRESERVATIVE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 PRESERVATIVE MARKET SIZE, BY REGION, 2019–2026 (KT)

6.12 OTHER TYPES

TABLE 30 OTHER TYPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 OTHER TYPES MARKET SIZE, BY REGION, 2019–2026 (KT)

7 BAKING INGREDIENTS MARKET, BY APPLICATION (Page No. - 92)

7.1 INTRODUCTION

FIGURE 33 MARKET SIZE, BY APPLICATION, 2017 VS. 2022 (USD MILLION)

TABLE 32 MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 33 SWEET BAKERY MARKET SIZE, BY SUB-APPLICATION, 2019–2026 (USD MILLION)

7.2 COVID-19 IMPACT ON BAKING INGREDIENTS BY APPLICATION (2018–2021)

7.2.1 OPTIMISTIC SCENARIO

TABLE 34 COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

7.2.2 REALISTIC SCENARIO

TABLE 35 COVID-19 IMPACT ON MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

7.2.3 PESSIMISTIC SCENARIO

TABLE 36 COVID-19 IMPACT ON MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

7.3 BREAD

7.3.1 BREAD VARIETIES PLAY A CRUCIAL ROLE IN IMPROVING NUTRITION AND OBTAINING FOOD SECURITY

TABLE 37 BREAD MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4 SWEET BAKERY

TABLE 38 SWEET BAKERY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4.1 CAKES

7.4.1.1 Competition among brands, convenience, and health attributes have significantly impacted the consumption of cakes

TABLE 39 CAKES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4.2 PASTRIES

7.4.2.1 The increasing demand for pastries is due to the use of convenience foods with high indulgence

TABLE 40 PASTRIES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4.3 DONUT

7.4.3.1 The increased snacking and demand for indulgence products is driving donut sales globally

TABLE 41 DONUTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 42 OTHER APPLICATIONS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 BAKING INGREDIENTS MARKET, BY FORM (Page No. - 101)

8.1 INTRODUCTION

FIGURE 34 MARKET SIZE, BY FORM, 2021 VS. 2026 (USD MILLION)

8.2 COVID-19 IMPACT ON BAKING INGREDIENTS BY APPLICATION (2018–2021)

8.2.1 OPTIMISTIC SCENARIO

TABLE 43 COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY FORM, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

8.2.2 REALISTIC SCENARIO

TABLE 44 COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY FORM, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

8.2.3 PESSIMISTIC SCENARIO

TABLE 45 COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY FORM, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

TABLE 46 MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

8.3 DRY

8.3.1 APPROPRIATE AMOUNT OF DRY INGREDIENTS – A NEED FOR PERFECT BAKING

TABLE 47 DRY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4 LIQUID

8.4.1 LIQUID INGREDIENTS ARE USED AS A BINDER FOR DRY INGREDIENTS TO PREPARE A DOUGH

TABLE 48 LIQUID BAKING INGREDIENTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 BAKING INGREDIENTS IN MARKET, BY REGION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 35 BAKING INGREDIENTS MARKET, 2019-2026

TABLE 49 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 COVID-19 IMPACT ON MARKET, BY REGION (2018-2021)

9.2.1 OPTIMISTIC SCENARIO

TABLE 50 COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

9.2.2 PESSIMISTIC SCENARIO

TABLE 51 COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2020–2023 (USD MILLION) (PESSIMISTIC SCENARIO)

9.2.3 REALISTIC SCENARIO

TABLE 52 COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

9.3 NORTH AMERICA

FIGURE 36 US TO DOMINATE THE NORTH AMERICAN BAKING INGREDIENTS MARKET DURING THE FORECAST PERIOD

TABLE 53 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (KT)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

9.3.1 UNITED STATES

9.3.1.1 Presence of a large number of restaurants serving baked goods driving the market for baking ingredients

TABLE 59 UNITED STATES: MARKET SIZE FOR BAKING INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 61 UNITED STATES: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Increase in preference for high-value bakery products propelling the demand for various baking ingredients

TABLE 62 CANADA: BAKING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 CANADA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 64 CANADA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 The demand for convenience food in the region has propelled the consumption of bakery products

TABLE 65 MEXICO: MARKET SIZE FOR BAKING INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 MEXICO: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 MEXICO: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 37 EUROPE: BAKING INGREDIENTS MARKET

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE FOR BAKING INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (KT)

TABLE 71 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

9.4.1 UNITED KINGDOM

9.4.1.1 Consumption of bread as a staple food drives the market for baking ingredients

TABLE 74 UNITED KINGDOM: MARKET SIZE FOR BAKING INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 UNITED KINGDOM: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Easy availability of baked goods in various retail stores leads to higher consumption of baked goods

TABLE 77 FRANCE: MARKET SIZE FOR BAKING INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 FRANCE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 FRANCE: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4.3 GERMANY

9.4.3.1 Rise in the number of health-conscious people to drive the demand for low-calorie and free-from baked goods

TABLE 80 GERMANY: BAKING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 82 GERMANY: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Increased consumption of bakery products to drive imports and production of baked goods

TABLE 83 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 ITALY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 ITALY: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Demand for healthier bakery products would lead to the introduction of more natural baking ingredients in Spain

TABLE 86 SPAIN: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 SPAIN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 SPAIN: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4.6 RUSSIA

9.4.6.1 Presence of a strong food processing sector in Russia generating consistent demand for baking ingredients

TABLE 89 RUSSIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 RUSSIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 RUSSIA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 92 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5 ASIA PACIFIC

TABLE 95 ASIA PACIFIC: BAKING INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (KT)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

9.5.1 CHINA

9.5.1.1 Rising sale of cakes through various retail channels to drive the demand for baking ingredients

TABLE 101 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 103 CHINA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.2 JAPAN

9.5.2.1 Decreasing consumption of rice increasing the demand for baked goods

TABLE 104 JAPAN : BAKING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 106 JAPAN: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.3 AUSTRALIA

9.5.3.1 Consumption of different varieties of bread to drive the availability of baking ingredients

TABLE 107 AUSTRALIA : MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 AUSTRALIA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.4 INDIA

9.5.4.1 Growing demand for specialty flour to produce bakery and confectionery products

TABLE 110 INDIA : MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 INDIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 112 INDIA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.5 KOREA

9.5.5.1 Growing demand for bakery mixes and dough to drive the market in the region

TABLE 113 KOREA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 KOREA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 KOREA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.6 VIETNAM

9.5.6.1 Increasing expansion of bakery outlets to surge the demand for various baking ingredients

TABLE 116 VIETNAM : BAKING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 VIETNAM: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 118 VIETNAM: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.7 NEW ZEALAND

9.5.7.1 Growing demand for frozen bakery products to drive market growth in New Zealand

TABLE 119 NEW ZEALAND : MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 121 NEW ZEALAND: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.5.8 REST OF ASIA PACIFIC

TABLE 122 REST OF ASIA PACIFIC : MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 124 REST OF ASIA PACIFIC: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6 REST OF THE WORLD

TABLE 125 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 126 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2019–2026 (KT)

TABLE 128 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 129 REST OF THE WORLD: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

TABLE 130 REST OF THE WORLD: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Rising consumption of artisanal bakery products to surge the demand for high-quality baking ingredients

TABLE 131 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 133 BRAZIL: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Gradual increase in the purchasing power of Argentinians to increase the consumption of convenience food

TABLE 134 ARGENTINA: BAKING INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 ARGENTINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 136 ARGENTINA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.3 CHILE

9.6.3.1 Increased wheat production for more bread consumption creating demand for other baking ingredients

TABLE 137 CHILE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 CHILE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 139 CHILE: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.4 AFRICA

9.6.4.1 Growing consumption of a wide variety of bread

TABLE 140 AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 142 AFRICA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.5 MIDDLE EAST

9.6.5.1 Transition of consumers from supermarket bakeries to specialized bakers to drive demand for special baking ingredients

TABLE 143 MIDDLE EAST: BAKING INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 144 MIDDLE EAST: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 146 MIDDLE EAST: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.6 UNITED ARAB EMIRATES

9.6.6.1 Increasing availability of bakery products from grocery retailers to surge the consumption of baked goods

TABLE 147 UAE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 UAE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 149 UAE: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.7 SAUDI ARABIA

9.6.7.1 Rise in the sale of baked goods through online channels to drive market growth in the region

TABLE 150 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 152 SAUDI ARABIA: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

9.6.8 REST OF MIDDLE EAST

TABLE 153 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 155 REST OF MIDDLE EAST: MARKET SIZE, BY SWEET BAKERY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 174)

10.1 OVERVIEW

10.2 REVENUE ANALYSIS OF BUSINESS SEGMENTS, 2019

FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN THE BAKING INGREDIENTS MARKET, 2017-2019 (USD MILLION)

10.3 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE PLAYERS

10.3.4 PARTICIPANTS

FIGURE 39 MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

10.4 PRODUCT FOOTPRINT

TABLE 156 MARKET: COMPANY TYPE FOOTPRINT

TABLE 157 COMMERCIAL BAKERY INGREDIENTS MARKET: REGIONAL FOOTPRINT

TABLE 158 BAKERY INGREDIENTS MARKET: PRODUCT FOOTPRINT (OVERALL)

10.5 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY (FOR START-UPS/SME’S)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 40 BAKING INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SME’S, 2020

10.6 KEY PLAYER STRATEGIES

TABLE 159 OVERVIEW OF STRATEGIES DEPLOYED BY BAKING INGREDIENTS COMPANIES

10.7 COMPETITIVE SCENARIO

10.7.1 NEW PRODUCT LAUNCHES

TABLE 160 BAKING INGREDIENTS : PRODUCT LAUNCHES, 2018- 2021

10.7.2 DEALS

TABLE 161 BAKING INGREDIENTS : DEALS, 2018-2021

11 COMPANY PROFILES (Page No. - 185)

11.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

11.1.1 ASSOCIATED BRITISH FOODS PLC

TABLE 162 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 41 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

TABLE 163 ASSOCIATED BRITISH FOODS PLC: DEALS

11.1.2 KONINKLIJKE DSM N.V.

TABLE 164 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

FIGURE 42 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 165 KONINKLIJKE DSM N.V.: NEW PRODUCT LAUNCHES

11.1.3 LALLEMAND INC.

TABLE 166 LALLEMAND INC: BAKING INGREDIENTS MARKET BUSINESS OVERVIEW

TABLE 167 LALLEMAND INC: NEW PRODUCT LAUNCHES

TABLE 168 LALLEMAND INC: DEALS

TABLE 169 LALLEMAND INC: OTHERS

11.1.4 KERRY GROUP PLC

TABLE 170 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 43 KERRY GROUP PLC: COMPANY SNAPSHOT

TABLE 171 KERRY GROUP PLC: NEW PRODUCT LAUNCHES

TABLE 172 KERRY GROUP PLC: DEALS

TABLE 173 KERRY GROUP PLC: OTHERS

11.1.5 LESAFFRE

TABLE 174 LESAFFRE: BUSINESS OVERVIEW

TABLE 175 LESAFFRE: OTHERS

11.1.6 TATE & LYLE

TABLE 176 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 44 TATE & LYLE: COMPANY SNAPSHOT

TABLE 177 TATE & LYLE: NEW PRODUCT LAUNCHES

TABLE 178 TATE & LYLE: DEALS

TABLE 179 TATE & LYLE: OTHERS

11.1.7 CARGILL

TABLE 180 CARGILL: BAKING INGREDIENTS MARKET BUSINESS OVERVIEW

FIGURE 45 CARGILL: COMPANY SNAPSHOT

TABLE 181 CARGILL: NEW PRODUCT LAUNCHES

TABLE 182 CARGILL: OTHERS

11.1.8 AAK AB

TABLE 183 AAK AB - BUSINESS OVERVIEW

FIGURE 46 AAK AB: COMPANY SNAPSHOT

TABLE 184 AAK AB: DEALS

TABLE 185 AAK AB: OTHERS

11.1.9 DUPONT

TABLE 186 DUPONT - BUSINESS OVERVIEW

FIGURE 47 DUPONT: COMPANY SNAPSHOT

11.1.10 BRITISH BAKELS

TABLE 187 BRITISH BAKELS – BUSINESS OVERVIEW

TABLE 188 BRITISH BAKELS: NEW PRODUCT LAUNCHES

11.1.11 ARCHER DANIELS MIDLAND COMPANY

TABLE 189 ARCHER DANIELS MIDLAND COMPANY - BUSINESS OVERVIEW

FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 190 ARCHER DANIELS MIDLAND COMPANY: OTHERS

11.1.12 CORBION

TABLE 191 CORBION - BAKING INGREDIENTS MARKET BUSINESS OVERVIEW

FIGURE 49 CORBION: COMPANY SNAPSHOT

TABLE 192 CORBION: NEW PRODUCT LAUNCHES

TABLE 193 CORBION: DEALS

11.1.13 DAWN FOODS PRODUCTS, INC.

TABLE 194 DAWN FOOD PRODUCTS, INC. - BUSINESS OVERVIEW

11.1.14 INTERNATIONAL FLAVORS AND FRAGRANCES INC.

TABLE 195 INTERNATIONAL FLAVORS & FRAGRANCES INC. - BUSINESS OVERVIEW

FIGURE 50 INTERNATIONAL FLAVORS AND FRAGRANCES INC.: COMPANY SNAPSHOT

TABLE 196 INTERNATIONAL FLAVORS AND FRAGRANCES INC.: OTHERS

11.1.15 IFFCO

TABLE 197 IFFCO - BUSINESS OVERVIEW

TABLE 198 IFFCO: OTHERS

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS IN BAKING INGREDIENTS MARKET

11.2.1 MILLBAKER SAS.

11.2.2 CARIF

11.2.3 PURATOS

11.2.4 RICH PRODUCT CORPORATION

11.2.5 IREKS GMBH

11.2.6 INGREDION

11.2.7 SWISS BAKE INGREDIENTS PVT. LTD

11.2.8 OYC AMERICAS

11.2.9 TASTETECH

11.2.10 SENSIENT TECHNOLOGIES CORPORATION

12 ADJACENT & RELATED MARKETS (Page No. - 239)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 FOOD ADDITIVES MARKET

12.3.1 MARKET DEFINITION

12.3.2 BAKING INGREDIENTS MARKET MARKET OVERVIEW

FIGURE 51 FOOD ADDITIVES MARKET EXPECTED TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

12.3.3 FOOD ADDITIVES MARKET, BY APPLICATION

FIGURE 52 FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2014 (USD MILLION)

TABLE 199 FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

12.3.4 BAKERY & CONFECTIONERY

12.3.5 BEVERAGES

TABLE 201 FOOD ADDITIVES IN BEVERAGES MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

12.3.6 CONVENIENCE FOOD

FIGURE 53 FOOD ADDITIVES IN CONVENIENCE FOODS MARKET SIZE, BY REGION, 2015 VS. 2020 (USD MILLION)

TABLE 202 FOOD ADDITIVES IN CONVENIENCE FOODS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

12.3.7 DAIRY & FROZEN DESSERTS

FIGURE 54 FOOD ADDITIVES IN DAIRY & FROZEN DESSERTS MARKET SIZE, BY REGION, 2015 VS. 2020 (USD MILLION)

TABLE 203 FOOD ADDITIVES IN DAIRY & FROZEN PRODUCTS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

12.3.8 SAUCES, DRESSINGS, SPICES & CONDIMENTS

TABLE 204 FOOD ADDITIVES IN SAUCES, DRESSINGS, SPICES & CONDIMENTS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

12.3.9 OTHER APPLICATIONS: BAKING INGREDIENTS MARKET

FIGURE 55 FOOD ADDITIVES IN OTHER APPLICATIONS MARKET SIZE, BY REGION, 2014

TABLE 205 FOOD ADDITIVES IN OTHER APPLICATIONS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

12.3.10 FOOD ADDITIVES MARKET, BY REGION

TABLE 207 EUROPE: FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

TABLE 208 ASIA-PACIFIC: FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

TABLE 209 ROW: FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

12.4 BAKERY PREMIXES MARKET

12.4.1 MARKET DEFINITION

12.4.2 MARKET OVERVIEW

FIGURE 56 BAKERY PREMIXES MARKET EXPECTED TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

12.4.3 BAKERY PREMIXES MARKET, BY APPLICATION

FIGURE 57 BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2019 VS. 2025 (USD THOUSAND)

TABLE 210 BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 211 BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (KT)

FIGURE 58 BAKERY PRODUCTS MARKET SIZE, BY SUB-APPLICATION, 2019 VS. 2025 (USD THOUSAND)

TABLE 212 BAKERY PRODUCT PREMIXES MARKET SIZE, BY SUB-APPLICATION, 2017–2025 (USD THOUSAND)

12.5 BREAD PRODUCTS: BAKING INGREDIENTS MARKET

12.5.1 HIGH CONSUMPTION OF BREAD AND INCREASING DEMAND FOR SPECIALIZED BREAD PRODUCTS ARE THE MAJOR FACTORS THAT ARE PROJECTED TO DRIVE THE BREAD PREMIXES MARKET

TABLE 213 BREAD PRODUCT PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6 BAKERY PRODUCTS

TABLE 214 BAKERY PRODUCT PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.1 CAKES

12.6.1.1 Rise in demand for flavored cake is projected to drive the demand for cake premixes

TABLE 215 CAKE PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.2 PASTRIES

12.6.2.1 Growth in the consumption of pastries in various countries projected to drive the demand for pastry premixes

TABLE 216 PASTRIES PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.3 MUFFINS

12.6.3.1 Higher demand for a variety of muffins is projected to drive the demand for muffin mixes

TABLE 217 MUFFIN PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.4 DONUTS

12.6.4.1 The growth in the trend of snacking is projected to drive demand for donuts mix

TABLE 218 DONUT PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.5 PANCAKES

12.6.5.1 Greater preference for ready-to-eat food products is projected to drive the market growth of pancake mixes

TABLE 219 PANCAKE PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.6 OTHERS (BAKING INGREDIENTS MARKET)

12.6.6.1 Increase in preference for convenience products is projected to drive the demand for bakery premixes

TABLE 220 OTHER BAKERY PREMIXES MARKET SIZE, BY REGION, 2017–2025 (USD THOUSAND)

12.6.7 BAKERY PREMIXES MARKET, BY REGION

TABLE 221 NORTH AMERICA: BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 222 EUROPE: BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 223 ASIA PACIFIC: BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 224 SOUTH AMERICA: BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 225 ROW: BAKERY PREMIXES MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

13 APPENDIX (Page No. - 262)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

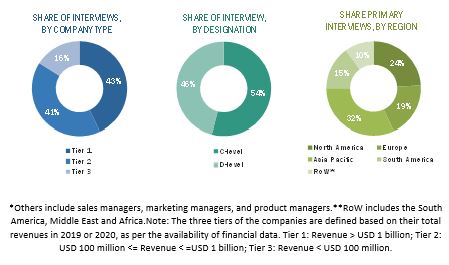

The study involves four major activities to estimate the current market size of the baking ingredients market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Agriculture organization (FAO), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The baking ingredients market comprises several stakeholders such as in the Supply-side: Baking ingredients producers, suppliers, distributors, importers, and exporters, and in the Demand-side: Large-scale bakery manufacturers, processed food manufacturers, SMEs & Artisanal Bakeries, and research organizations. Regulatory-side: Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies, Food product consumers, Regulatory bodies, including government agencies and NGOs, Commercial research & development (R&D) institutions and financial institutions, Government and research organizations

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Baking Ingredients Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Baking Ingredients Market Size: Bottom-Up Approach

- With the bottom-up approach, baking ingredients for each type, form, and application were added to arrive at the global and regional market size and CAGR.

- The pricing analysis was conducted based on types in regions. From this, we derived the market sizes, in terms of volume, for each region and type of baking ingredients.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the baking ingredients market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Report Objectives

- To define, segment, and estimate the size of the baking ingredients market with respect to ingredients type, applications, form, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific baking ingredients market -Thailand, Malaysia, and Singapore

- Further breakdown of the Rest of Europe market - Ireland, The Netherlands, Sweden, Turkey, and Belgium

- Further breakdown of the Rest of South America into Peru, Chile, and Colombia.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Baking Ingredients Market