High-performance Computing (HPC) Market by Component, Computation Type (Parallel Computing, Distributed computing and Exascale Computing), Industry, Deployment, Server Price Band, Verticals & Region - 2027

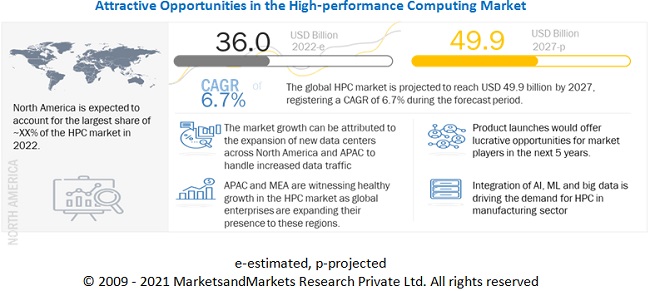

[206 Pages Report] The High performance computing (HPC) market is expected to grow from USD 36.0 billion in 2022 to USD 49.9 billion by 2027, at a CAGR of 6.7%. The market growth can be attributed to several factors, such as increasing demand for Cloud based HPC in applications such as media & entertainment.

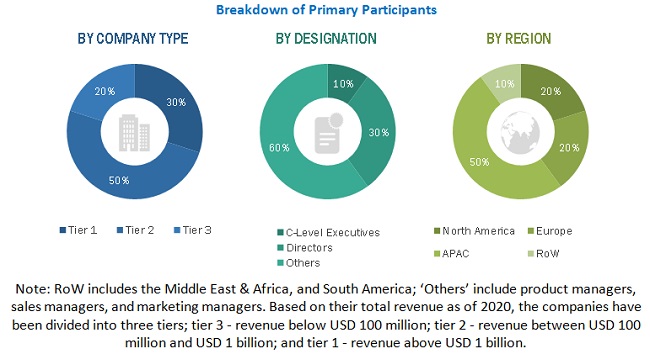

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global High-performance Computing (HPC) Market

The high performance computing industry includes major Tier II and Tier III suppliers such Advanced Micro Devices (US), Intel (US), HPE (US), IBM (US), Dell (US), Lenovo (China), Fujitsu (Japan), Atos (France), CISCO (US), Nvidia (Japan), NEC Corporation (Japan) and so on. These suppliers have their manufacturing facilities spread across various countries across North America, Europe, APAC, and RoW. COVID-19 has impacted their businesses as well.

Market Dynamics of High performance Computing (HPC)

Driver: Increasing demand for high-performance computing (HPC) systems in genomics research

According to MarketsandMarkets analysis, the high performance computing (HPC) market is expected to grow from USD 36 billion in 2022 to USD 49.9 billion by 2027, at a CAGR of 6.7% between 2022 and 2027.

Genomics research enables researchers to analyze and identify genetic variants associated with various diseases and their responses to treatments. Genomic sequencing helps detect all types of genetic variations across the entire genome. HPC systems have increased the speed, accuracy, and reliability of genomic research by efficiently analyzing a large amount of sequencing data. The advent of Next-Generation Sequencing (NGS) technologies has allowed the investigation of multiple areas of human health through different omics techniques.

Restraint: Cyber security concerns

With the growing use of HPC systems, concerns regarding cyber security are also rising as several entities access HPC systems, making data security a major concern. The nature of HPC exposes it to multiple potential security threats. For instance, in an airport, if HPC is an integral part of the security system, it also becomes the prime target for cyberattacks. Furthermore, HPC environments are clustered, making them vulnerable to many security threats. Since clustered HPC systems are heterogeneous, they require multiple management systems to operate. This slows down the implementation of security policies and security management processes; as a result, vulnerabilities are not remediated. Thus, security concerns are expected to restrain the growth of the HPC market.

Challenge: Limited budgets of SMEs

The potential users in many SMEs lack awareness about the benefits of HPC and do not have the budget to set up such systems. SMEs in many developing countries are still skeptical about adopting HPC due to the high investment costs involved. Many of them are unaware of HPC’s various advantages, such as high performance and customizable delivery. However, cloud computing can boost the use of HPC among SMEs, as it will considerably cut down the costs for them.

USD 250,000 – 500,000 and above Server price band to grow with the highest CAGR during the forecast period

The USD 250,000–500,000 and above server price band comprises supercomputer and divisional systems groups. These systems are developed based on state-of-the-art HPC infrastructures to solve highly complex problems in the shortest time. They comprise many connected computing nodes with distributed memory, which are controlled by a single master unit. These servers operate through 2 types of operating systems, i.e., Linux and Windows.

SMEs to hold the largest share of the market during the forecast period

Organizations having an employee base of fewer than 1,000 people can be termed SMEs. Desktop computers are inefficient in fulfilling the computational and storage demand for high-end applications in SMEs. Thus, SMEs are shifting toward solutions that can cater to their high-computational demands. SMEs face three critical challenges: capital, skills, and scalability. To tackle these challenges, SMEs are adopting cloud-based HPC solutions, which offer the flexibility to scale their IT infrastructure as per their requirement. SMEs face intense competition from large enterprises; thus, to gain a competitive edge, they are increasingly deploying HPC solutions that aid them in increasing productivity, and the trend is expected to continue during the forecast period.

Banking, Financial services, and Insurance vertical is expected to hold the largest market shares during the forecast period.

The BFSI sector comprises organizations that offer banking services such as core banking, corporate, retail, investment banking, hedge funds, as well as financial services (payment gateways, stockbroking, and mutual funds) and insurance services covering both life and general risks. Financial institutes such as insurance companies and banks require innovative IT solutions to manage operational risks, achieve sustainable growth, and deliver optimal performance. Moreover, the increase in high-frequency trading has resulted in innovations in connectivity, data access, and computational power systems used in these organizations. For instance, in February 2022, SambaNova launched a new HPC-based offering called SambaNova GPT Banking for performing sentiment analysis, language translation, and entity recognition in banking services. Regulatory standards related to the financial industry have further driven the need for installing robust HPC solutions for meeting various compliance needs. Thus, organizations are increasingly installing robust, reliable, and secured HPC systems capable of delivering high-end computing outputs.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The High performance computing (HPC) companies include Advanced Micro Devices (US), Intel (US), HPE (US), IBM (US), Dell (US), Lenovo (China), Fujitsu (Japan), Atos (France), CISCO (US), and so on.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion/Million) |

|

Segments covered |

by Component, Computation Type, Industry, Deployment ,Server Price Band, Verticals, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Advanced Micro Devices (US), Intel (US), HPE (US), IBM (US), Dell (US), Lenovo (China), Fujitsu (Japan), Atos (France), CISCO (US), Nvidia (Japan), and NEC Corporation (Japan) |

Comprehensive Analysis of the High-Performance Computing (HPC) Market

The report on the High-Performance Computing market encompasses both the current market scenario as well as the industry's growth prospects over the forecast period. The report provides a comprehensive examination of the HPC market, including market segmentation based on product type, application, end-user industry, and geography. The report contains a detailed check of the market's drivers, restraints, opportunities, and challenges. It also discusses the HPC market's competitive landscape, highlighting the key players, their market share, product portfolio, and business strategies. The report also contains detailed information about the HPC market's key trends and advancements, as well as market size and revenue projections for the industry over the forecast period. The report provides an in-depth analysis of the HPC market.

In this research report, the the high performance computing market has been segmented on the basis of Component, Computation Type, Industry, Deployment ,Server Price Band, Verticals, and Region.

High performance computing market, by Component

- Solutions

- Services

High performance computing market, by Computation Type

- Parallel Computing

- Distributed Computing

- Exascale computing

High performance computing market, by Deployment

- Cloud

- On-Premises

High performance computing market,By Organisation Size

- Small and Medium-Sized Enterprises (MSME)

- Large Enterprises

High performance computing market,By Server Prise Band

- USD 250,000 – 500,000 and above

- USD 250,000 – 100,000 and below

High performance computing market, by Vertical

- Banking, Finance services, and Insurance

- Earth Science

- Education and Research

- Energy and Utilities

- Government and Defense

- Healthcare and Life sciences

- Manufacturing

- Media and Entertainment

- Other application areas

Region Analysis

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In February 2022, AMD completed the acquisition of Xilinx(US). The acquisition has led to the expansion of AMD’s product portfolio and customer base across several regions.

- In February 2022, IBM acquired Sentaca (US), a software consulting firm and cloud migration specialist that supports telcos and communication service providers. Sentaca, in conjunction with IBM, will provide scalable, cloud- and edge-enabled process automation and process safety solutions.

Frequently Asked Questions (FAQ):

What is the current size of the global high performance computing (HPC) market?

The high performance computing (HPC) market is expected to grow from USD 36.0 Billion in 2022 to USD 49.9 Billion by 2027, at a CAGR of 6.7%.

Who are the winners in the global high performance computing (HPC) market?

Some of the key companies operating in the high performance computing (HPC) market are Advanced Micro Devices (US), Intel (US), HPE (US), IBM (US), Dell (US), Lenovo (China), Fujitsu (Japan), Atos (France), CISCO (US), Nvidia (Japan), NEC Corporation (Japan) and so on. These players have adopted various growth strategies such as product launches, acquisitions, collaborations, agreements, and partnerships to expand their global presence and increase their share in the global high performance computing (HPC) market.

What are the major drivers for the high performance computing (HPC) market?

The factors such as Increasing deployment of IT infrastructures, such as servers, storage, and network devices, to enhance data computing and increase data accuracy by enterprises is expected to fuel the market growth

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

What are the impact of COVID-19 on the global high performance computing (HPC) market?

The outbreak of the COVID-19 pandemic has significantly impacted the high performance computing market. Various regions worldwide are still moderately affected, and governments in these regions have responded to this pandemic accordingly. As the COVID-19 pandemic continues to persist in certain parts of North America and a few countries in Asia Pacific, the manufacturing sector is facing tremendous challenges. The US and Chinese manufacturing units, which are some of the biggest in the world, have been suffering intermittent stagnation since the 3rd quarter of 2020. Various manufacturing companies have downsized their production activities across the region. Besides, the extreme scarcity of hardware accessories required to manufacture HPC system hardware has deterred the market’s growth for a few years .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HIGH-PERFORMANCE COMPUTING MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 HIGH-PERFORMANCE COMPUTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

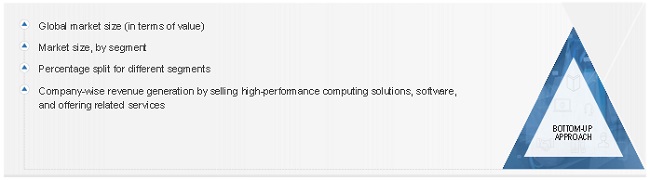

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION OF COMPANIES FROM SALES OF HIGH-PERFORMANCE COMPUTING

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size using top-down analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM SALE OF HIGH-PERFORMANCE COMPUTING SERVER SOLUTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENTS

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

TABLE 2 HPC MARKET, BY SERVER SHIPMENTS 2018–2021 (MILLION UNITS)

TABLE 3 HPC MARKET, BY SERVER SHIPMENTS 2022–2027 (MILLION UNITS)

TABLE 4 HPC MARKET, 2018–2021 (USD BILLION)

TABLE 5 HPC MARKET, 2022–2027 (USD BILLION)

FIGURE 8 IMPACT OF COVID-19 ON HPC MARKET

3.2 POST-COVID-19 SCENARIO

TABLE 6 POST-COVID-19 SCENARIO: HPC MARKET, 2022–2027 (USD BILLION)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 7 OPTIMISTIC SCENARIO (POST-COVID-19): HPC MARKET, 2022–2027 (USD BILLION)

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 8 PESSIMISTIC SCENARIO (POST-COVID-19): HPC MARKET, 2022–2027 (USD BILLION)

FIGURE 9 HEALTHCARE & LIFE SCIENCES SEGMENT TO EXHIBIT HIGHEST CAGR IN HPC MARKET FROM 2022 TO 2027

FIGURE 10 NORTH AMERICA TO REGISTER HIGHEST GROWTH RATE IN HPC MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN HIGH-PERFORMANCE COMPUTING MARKET

FIGURE 11 INCREASING DEMAND FOR HIGH-PERFORMANCE COMPUTING IN BANKING, FINANCIAL SERVICES & INSURANCE AND HEALTHCARE & LIFE SCIENCES VERTICALS TO DRIVE MARKET GROWTH FROM 2022 TO 2027

4.2 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPONENT

FIGURE 12 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE OF HIGH-PERFORMANCE COMPUTING MARKET FROM 2022 TO 2027

4.3 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPONENT AND REGION

FIGURE 13 SOLUTIONS SEGMENT AND NORTH AMERICA TO HOLD LARGEST SHARES OF HIGH-PERFORMANCE COMPUTING MARKET IN 2022

4.4 HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY

FIGURE 14 HIGH-PERFORMANCE COMPUTING MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 HIGH-PERFORMANCE COMPUTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing need for efficient computing, high scalability, and reliable storage

5.2.1.2 Increasing demand for high-speed data processing with accuracy

5.2.1.3 Increased use of high-performance computing and deep learning frameworks in development of COVID-19 vaccines

5.2.1.4 Growing demand for high-performance computing (HPC) systems in genomics research

FIGURE 16 HPC MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Cyber security concerns

5.2.2.2 High deployment costs associated with commercial high-performance computing (HPC) clusters

FIGURE 17 HPC MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing focus on adoption of hybrid high-performance computing (HPC) systems

5.2.3.2 Introduction of Exascale computing

5.2.3.3 Rising investments in data centers supporting HPC capability

FIGURE 18 HPC MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Less technical expertise related to high-performance computing (HPC)

5.2.4.2 Limited budgets of SMEs

5.2.4.3 Challenges in cooling HPC systems

5.2.4.4 Requirement of advanced frameworks to improve fault tolerance and ensure resiliency

FIGURE 19 HPC MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 RAW MATERIAL SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS COLLECTIVELY ADD MAJOR VALUE TO FINAL PRODUCT

5.4 TECHNOLOGY ANALYSIS

5.4.1 EXASCALE COMPUTING IN HPC SYSTEMS

5.4.2 CLOUD COMPUTING IN HPC SYSTEMS

5.5 ECOSYSTEM ANALYSIS

FIGURE 21 HPC MARKET: ECOSYSTEM

TABLE 9 HPC MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.7 CASE STUDIES

5.7.1 CASE STUDY 1: EDUCATION

5.7.2 CASE STUDY 2: ENERGY AND UTILITIES

5.7.3 CASE STUDY 3: EDUCATION

5.8 PORTER’S FIVE FORCES ANALYSIS

5.8.1 BARGAINING POWER OF SUPPLIERS

5.8.2 BARGAINING POWER OF BUYERS

5.8.3 THREAT OF NEW ENTRANTS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 10 IMPACT OF PORTER’S FIVE FORCES ON HPC MARKET, 2021

5.9 PRICING ANALYSIS

TABLE 11 HIGH-PERFORMANCE COMPUTING MARKET: PRICING ANALYSIS (2021–2022)

5.9.1 AVERAGE SELLING PRICES OF 4 KEY PLAYER OFFERINGS, BY HPC SERVERS

FIGURE 22 AVERAGE SELLING PRICES OF 4 KEY PLAYER OFFERINGS, BY HPC SERVERS

5.10 TRADE ANALYSIS

FIGURE 23 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 24 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.1 PATENTS ANALYSIS

FIGURE 25 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 12 TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 13 LIST OF FEW PATENTS IN HPC MARKET, 2021–2022

5.11 KEY CONFERENCES AND EVENTS BETWEEN 2022 AND 2023

TABLE 14 HPC MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS (%)

5.12.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 INDUSTRY VERTICALS

TABLE 16 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

5.13 REGULATIONS AND STANDARDS

TABLE 17 REGULATIONS AND STANDARDS FOR HPC MARKET

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPONENT (Page No. - 78)

6.1 INTRODUCTION

FIGURE 29 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPONENT

6.1.1 DRIVERS: HIGH-PERFORMANCE COMPUTING MARKET FOR COMPONENT

6.1.2 COVID-19 IMPACT

TABLE 21 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 22 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

6.2 SOLUTIONS

TABLE 23 SOLUTIONS: HIGH-PERFORMANCE COMPUTING MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 24 SOLUTIONS: HIGH-PERFORMANCE COMPUTING MARKET, BY TYPE, 2022–2027 (USD BILLION)

6.2.1 SERVER

6.2.1.1 Supercomputer and divisional systems

6.2.1.2 Departmental and workgroup systems

6.2.2 STORAGE

6.2.3 NETWORKING DEVICES

6.2.4 SOFTWARE

6.3 SERVICES

6.3.1 DESIGN AND CONSULTING

6.3.2 INTEGRATION AND DEPLOYMENT

7 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPUTATION TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 30 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPUTATION TYPE

TABLE 25 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPUTATION TYPE, 2018–2021 (USD BILLION)

TABLE 26 HIGH-PERFORMANCE COMPUTING MARKET, BY COMPUTATION TYPE, 2022–2027 (USD BILLION)

7.2 PARALLEL COMPUTING

7.2.1 PARALLEL COMPUTING HELPS IN SOLVING COMPLEX MATHEMATICAL PROBLEMS

7.2.2 CASE STUDY: AWS AND ASTRAZENECA

7.2.3 BIT-LEVEL PARALLELISM

7.2.4 INSTRUCTION-LEVEL PARALLELISM

7.2.5 TASK PARALLELISM

7.3 DISTRIBUTED COMPUTING

7.3.1 DISTRIBUTED COMPUTING HELPS IN LEVERAGING HPC RESOURCES USING LOW-VALUE COMMODITY HARDWARE

7.3.2 USE CASE: DELL AND WALT DISNEY ANIMATION STUDIO

7.3.3 GRID COMPUTING

7.3.4 CLUSTER COMPUTING

7.3.5 CLOUD COMPUTING

7.3.5.1 USE CASE: FRAUD DETECTION IN BFSI SECTOR

7.4 EXASCALE COMPUTING

7.4.1 EXASCALE COMPUTING HELPS IN MAKING NEW SCIENTIFIC DISCOVERIES BY PROCESSING LARGE AMOUNTS OF DATA IN SHORT TIME

7.4.2 USE CASE: VACCINE DEVELOPMENT

8 HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT (Page No. - 90)

8.1 INTRODUCTION

FIGURE 31 HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT

8.1.1 DRIVERS: HIGH-PERFORMANCE COMPUTING MARKET FOR DEPLOYMENT TYPE

8.1.2 COVID-19 IMPACT

TABLE 27 HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 28 HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

8.2 CLOUD

TABLE 29 CLOUD: HIGH-PERFORMANCE COMPUTING MARKET, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 30 CLOUD: HIGH-PERFORMANCE COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

8.3 ON-PREMISES

TABLE 31 ON-PREMISES: HIGH-PERFORMANCE COMPUTING MARKET, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 32 ON-PREMISES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

9 HIGH-PERFORMANCE COMPUTING MARKET, BY ORGANIZATION SIZE (Page No. - 95)

9.1 INTRODUCTION

FIGURE 32 HIGH-PERFORMANCE COMPUTING MARKET, BY ORGANIZATION SIZE

9.1.1 DRIVERS: HIGH-PERFORMANCE COMPUTING MARKET FOR ORGANIZATION SIZE

9.1.2 COVID-19 IMPACT

TABLE 33 HIGH-PERFORMANCE COMPUTING MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD BILLION)

TABLE 34 HIGH-PERFORMANCE COMPUTING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

9.2 SMALL- AND MEDIUM-SIZED ENTERPRISES

9.3 LARGE ENTERPRISES

10 HIGH-PERFORMANCE COMPUTING MARKET, BY SERVER PRICE BAND (Page No. - 98)

10.1 INTRODUCTION

FIGURE 33 HIGH-PERFORMANCE COMPUTING MARKET, BY SERVER PRICE BAND

TABLE 35 HIGH-PERFORMANCE COMPUTING MARKET, BY SERVER PRICE BAND, 2018–2021 (USD BILLION)

TABLE 36 HIGH-PERFORMANCE COMPUTING MARKET, BY SERVER PRICE BAND, 2022–2027 (USD BILLION)

10.2 USD 250,000–500,000 AND ABOVE

10.2.1 USD 250,000–500,000 AND ABOVE SERVER PRICE BAND COMPRISES SYSTEMS THAT HELP IN SOLVING HIGHLY COMPLEX MATHEMATICAL PROBLEMS

10.3 USD 250,000–100,000 AND BELOW

10.3.1 USD 250,000–100,000 AND BELOW SERVER PRICE BAND COMPRISE SYSTEMS THAT CAN SOLVE MODERATELY COMPLEX MATHEMATICAL PROBLEMS

11 HIGH-PERFORMANCE COMPUTING MARKET, BY VERTICAL (Page No. - 101)

11.1 INTRODUCTION

FIGURE 34 HPC MARKET, BY VERTICAL

11.1.1 DRIVERS: HIGH-PERFORMANCE COMPUTING MARKET FOR VERTICAL

11.1.2 COVID-19 IMPACT

TABLE 37 HIGH-PERFORMANCE COMPUTING MARKET, BY VERTICAL, 2018–2021 (USD BILLION)

TABLE 38 HIGH-PERFORMANCE COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

11.2 GOVERNMENT & DEFENSE

TABLE 39 GOVERNMENT & DEFENSE: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 40 GOVERNMENT & DEFENSE: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 41 GOVERNMENT & DEFENSE: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 42 GOVERNMENT & DEFENSE: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.3 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 44 BANKING, FINANCIAL SERVICES, AND INSURANCE: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 45 BANKING, FINANCIAL SERVICES, AND INSURANCE: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 46 BANKING, FINANCIAL SERVICES, AND INSURANCE: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.4 EDUCATION & RESEARCH

11.4.1 RECENT DEVELOPMENTS

TABLE 47 EDUCATION & RESEARCH: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 48 EDUCATION & RESEARCH: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 49 EDUCATION & RESEARCH: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 50 EDUCATION & RESEARCH: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.5 MANUFACTURING

TABLE 51 MANUFACTURING: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 52 MANUFACTURING: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 53 MANUFACTURING: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 54 MANUFACTURING: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.6 MEDIA & ENTERTAINMENT

TABLE 55 MEDIA & ENTERTAINMENT: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 56 MEDIA AND ENTERTAINMENT: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 57 MEDIA & ENTERTAINMENT: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 58 MEDIA AND ENTERTAINMENT: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.7 HEALTHCARE & LIFE SCIENCES

TABLE 59 HEALTHCARE & LIFE SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 60 HEALTHCARE & LIFE SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 61 HEALTHCARE & LIFE SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 62 HEALTHCARE & LIFE SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.8 ENERGY & UTILITIES

TABLE 63 ENERGY & UTILITIES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 64 ENERGY & UTILITIES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 65 ENERGY & UTILITIES: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 66 ENERGY & UTILITIES: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.9 EARTH SCIENCES

TABLE 67 EARTH SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 68 EARTH SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 69 EARTH SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 70 EARTH SCIENCES: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

11.10 OTHERS

TABLE 71 OTHERS: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 72 OTHERS: HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 73 OTHERS: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2018–2021 (USD BILLION)

TABLE 74 OTHERS: HIGH-PERFORMANCE COMPUTING MARKET, BY DEPLOYMENT, 2022–2027 (USD BILLION)

12 HIGH-PERFORMANCE COMPUTING MARKET, BY REGION (Page No. - 119)

12.1 INTRODUCTION

FIGURE 35 HIGH-PERFORMANCE COMPUTING MARKET IN CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 75 HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 76 HIGH-PERFORMANCE COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

12.2 NORTH AMERICA

12.2.1 DRIVERS: NORTH AMERICAN HIGH-PERFORMANCE COMPUTING MARKET

12.2.2 COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATIONS

FIGURE 36 NORTH AMERICA: HIGH-PERFORMANCE COMPUTING MARKET

TABLE 77 NORTH AMERICA: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 78 NORTH AMERICA: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

12.2.4 US

12.2.4.1 Presence of advanced IT infrastructure is fueling demand for high-performance computing (HPC) solutions in US

12.2.5 CANADA

12.2.5.1 Government-led support to increase adoption of digital technologies to fuel demand for high-performance computing (HPC) solutions

12.2.6 MEXICO

12.2.6.1 Expanding industrial sector to fuel demand for high-performance computing (HPC)

12.3 EUROPE

12.3.1 DRIVERS: EUROPEAN HIGH-PERFORMANCE COMPUTING MARKET

12.3.2 COVID-19 IMPACT

12.3.3 EUROPE: REGULATIONS

FIGURE 37 SNAPSHOT OF HIGH-PERFORMANCE COMPUTING MARKET IN EUROPE

TABLE 79 EUROPE: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 80 EUROPE: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

12.3.4 UK

12.3.4.1 Increased adoption of high-performance computing (HPC) systems in medical sector to drive market growth

12.3.5 GERMANY

12.3.5.1 Rising deployment of high-performance computing (HPC) systems due to high internet penetration to drive market growth

12.3.6 FRANCE

12.3.6.1 Government initiatives to increase adoption of AI and ML technologies in public sector to fuel market growth

12.3.7 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 DRIVERS: ASIA PACIFIC HIGH-PERFORMANCE COMPUTING MARKET

12.4.2 COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 38 SNAPSHOT HIGH-PERFORMANCE COMPUTING MARKET IN ASIA PACIFIC

TABLE 81 ASIA PACIFIC: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 82 ASIA PACIFIC: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

12.4.4 AUSTRALIA AND NEW ZEALAND (ANZ)

12.4.4.1 Rising use of high-performance computing (HPC) systems in media & entertainment vertical to propel market growth

12.4.5 JAPAN

12.4.5.1 Growing use of high-performance computing (HPC) solutions in metrology to boost market growth

12.4.6 CHINA

12.4.6.1 Growing adoption of digital technologies such as AI, IoT, and big data to drive the market growth in China

12.4.7 REST OF ASIA PACIFIC

12.5 REST OF WORLD

FIGURE 39 SNAPSHOT HIGH-PERFORMANCE COMPUTING MARKET IN REST OF WORLD

TABLE 83 ROW: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 84 ROW: HIGH-PERFORMANCE COMPUTING MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.2 DRIVERS: MIDDLE EAST & AFRICA HIGH-PERFORMANCE COMPUTING MARKET

12.5.3 COVID-19 IMPACT

12.5.4 MIDDLE EAST & AFRICA: REGULATIONS

12.5.5 SOUTH AMERICA

12.5.6 DRIVERS: SOUTH AMERICA HIGH-PERFORMANCE COMPUTING MARKET

12.5.7 COVID-19 IMPACT

12.5.8 SOUTH AMERICA: REGULATIONS

13 COMPETITIVE LANDSCAPE (Page No. - 137)

13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

13.2 OVERVIEW

13.3 TOP 5 COMPANY ANALYSIS

FIGURE 40 TOP 5 COMPANY REVENUE ANALYSIS FOR HPC MARKET, 2019–2021

13.4 MARKET SHARE ANALYSIS (2021)

TABLE 85 HPC MARKET: MARKET SHARE ANALYSIS

13.5 COMPANY EVALUATION QUADRANT, 2021

13.5.1 STAR

13.5.2 PERVASIVE

13.5.3 EMERGING LEADER

13.5.4 PARTICIPANT

FIGURE 41 HPC MARKET COMPANY EVALUATION QUADRANT, 2021

13.6 SME EVALUATION QUADRANT, 2021

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 42 HPC MARKET, SME EVALUATION QUADRANT, 2021

FIGURE 43 HPC MARKET: DETAILED LIST OF KEY STARTUPS/SMES

FIGURE 44 HPC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 86 HPC MARKET: COMPANY FOOTPRINT

TABLE 87 HPC MARKET: COMPANY VERTICAL FOOTPRINT

TABLE 88 HPC MARKET: COMPANY REGIONAL FOOTPRINT

13.7 COMPETITIVE SCENARIO

TABLE 89 HPC MARKET: PRODUCT LAUNCHES, MARCH 2019−MARCH 2022

TABLE 90 HPC: DEALS, MARCH 2019−MARCH 2022

14 COMPANY PROFILES (Page No. - 149)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 ADVANCED MICRO DEVICES

TABLE 91 ADVANCED MICRO DEVICES: BUSINESS OVERVIEW

FIGURE 45 ADVANCED MICRO DEVICES: COMPANY SNAPSHOT

TABLE 92 ADVANCED MICRO DEVICES: PRODUCTS OFFERED

14.1.2 INTEL

TABLE 93 INTEL: BUSINESS OVERVIEW

FIGURE 46 INTEL: COMPANY SNAPSHOT

TABLE 94 INTEL: PRODUCT OFFERINGS

14.1.3 HEWLETT PACKARD ENTERPRISE (HPE)

TABLE 95 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 47 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

TABLE 96 HEWLETT PACKARD ENTERPRISE: PRODUCT OFFERINGS

14.1.4 IBM

TABLE 97 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 98 IBM: PRODUCT OFFERINGS

14.1.5 DELL

TABLE 99 DELL: BUSINESS OVERVIEW

FIGURE 49 DELL: COMPANY SNAPSHOT

TABLE 100 DELL: PRODUCT OFFERINGS

14.1.6 LENOVO

TABLE 101 LENOVO: BUSINESS OVERVIEW

FIGURE 50 LENOVO: COMPANY SNAPSHOT

TABLE 102 LENOVO: PRODUCT OFFERINGS

14.1.7 FUJITSU

TABLE 103 FUJITSU: BUSINESS OVERVIEW

FIGURE 51 FUJITSU: COMPANY SNAPSHOT

TABLE 104 FUJITSU: PRODUCT OFFERINGS

14.1.8 ATOS

TABLE 105 ATOS: BUSINESS OVERVIEW

FIGURE 52 ATOS: COMPANY SNAPSHOT

TABLE 106 ATOS: PRODUCT OFFERINGS

14.1.9 CISCO

TABLE 107 CISCO: BUSINESS OVERVIEW

FIGURE 53 CISCO: COMPANY SNAPSHOT

TABLE 108 CISCO: PRODUCT OFFERINGS

14.1.10 NVIDIA

TABLE 109 NVIDIA: BUSINESS OVERVIEW

FIGURE 54 NVIDIA: COMPANY SNAPSHOT

TABLE 110 NVIDIA: PRODUCT OFFERINGS

14.2 OTHER PLAYERS

14.2.1 NEC CORPORATION

TABLE 111 NEC CORPORATION: BUSINESS OVERVIEW

14.2.2 AMAZON WEB SERVICES

TABLE 112 AMAZON WEB SERVICES: BUSINESS OVERVIEW

14.2.3 ORACLE

TABLE 113 ORACLE: BUSINESS OVERVIEW

14.2.4 MICROSOFT

TABLE 114 MICROSOFT: BUSINESS OVERVIEW

14.2.5 INSPUR

TABLE 115 INSPUR: BUSINESS OVERVIEW

14.2.6 NETAPP

TABLE 116 NETAPP: BUSINESS OVERVIEW

14.2.7 IRON GLOBAL

TABLE 117 IRON: BUSINESS OVERVIEW

14.2.8 ASPEN SYSTEM

TABLE 118 ASPEN SYSTEM: BUSINESS OVERVIEW

14.2.9 ADVANCED CLUSTERING TECHNOLOGIES

TABLE 119 ADVANCED CLUSTERING TECHNOLOGIES: BUSINESS OVERVIEW

14.2.10 DAWNING INFORMATION INDUSTRY CO. LTD. (SUGON)

TABLE 120 SUGON: BUSINESS OVERVIEW

14.2.11 DASSAULT SYSTEMS

TABLE 121 DASSAULT SYSTEMS: BUSINESS OVERVIEW

14.2.12 ARM LIMITED

TABLE 122 ARM LIMITED: BUSINESS OVERVIEW

14.2.13 MONTAGE TECHNOLOGY

TABLE 123 MONTAGE TECHNOLOGY: BUSINESS OVERVIEW

14.2.14 ADAPTIVE COMPUTING

TABLE 124 ADAPTIVE COMPUTING: BUSINESS OVERVIEW

14.2.15 ADVANCED HPC

TABLE 125 ADVANCED HPC: BUSINESS OVERVIEW

14.2.16 DATADIRECT NETWORKS

TABLE 126 DATADIRECT NETWORKS: BUSINESS OVERVIEW

14.2.17 EQUUS COMPUTERS

TABLE 127 EQUUS COMPUTERS: BUSINESS OVERVIEW

14.2.18 EXCELERO

TABLE 128 EXCELERO: BUSINESS OVERVIEW

14.2.19 GIGA-BYTE

TABLE 129 GIGA-BYTE: BUSINESS OVERVIEW

14.2.20 PENGUIN COMPUTING

TABLE 130 PENGUIN COMPUTING: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 198)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involved four major activities in estimating the size of the high performance computing market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to the study. These secondary sources include annual reports; press releases; investor presentations of companies; white papers; certified publications; and articles from recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the industry’s supply chain, market’s monetary chain, total pool of key players, and market segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size and further validated through primary research

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the the high performance computing market scenario through secondary research. In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the the high performance computing market. After the complete market engineering (which includes calculations for the market statistics, market breakdown, data triangulation, market estimation, and market forecasting), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the the high performance computing market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global High performance computing (HPC) market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define and forecast the high-performance computing (HPC) market based on component, computation type, deployment, organization size, service price band, vertical, and region in terms of value

- To describe and forecast the size of the HPC market in four key regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the HPC market

- To provide information regarding the impact of the COVID-19 on the HPC market, its segments, and the market players

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the HPC ecosystem

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies, and provide a detailed competitive landscape

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the HPC market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in High-performance Computing (HPC) Market

Interested in knowing the market size for Eurpoe Cloud computing in Scientific/Engineering industry

Interested in High Performance Computing study