AC Power Sources Market by Phase Type (Single, Three), Modulation Type (PWM, Linear), Application (Aerospace, Defense & Government Services, Energy, Wireless Communication & Infrastructure, Consumer Electronics & Appliances) & Region - Global Forecast to 2027

AC Power Sources Market Size, Share, Statistics

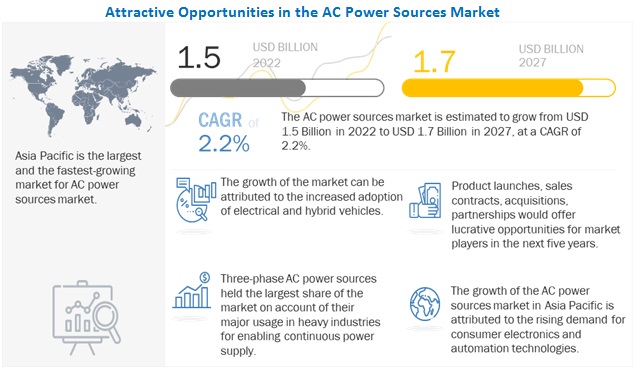

The global AC Power Sources market in terms of revenue was estimated to be worth $1.5 billion in 2022 and is poised to reach $1.7 billion by 2027, growing at a CAGR of 2.2% from 2022 to 2027.

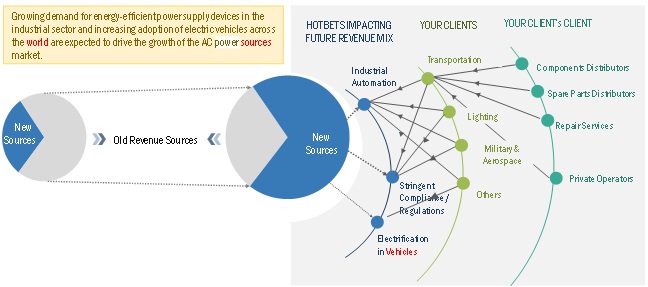

The growth of the AC power sources market can be attributed to the increasing Production of Equipment Used in Renewable Power Generation, Avionics, and Electric Vehicles. The increasing demand for energy-efficient devices in the industrial sector is also an important driver for the market.

To know about the assumptions considered for the study, Request for Free Sample Report

AC Power Sources Market Dynamics

Driver: Growing sales of electric vehicles worldwide Increasing Production of Equipment Used in Renewable Power Generation, Avionics, and Electric Vehicles

Industry 4.0 will be highly automated, with faster production timelines and a smart warehouse, allowing for rapid production and distribution of products. As a result an opportunity to create new forms of efficiency and flexibility by connecting different processes, information streams, and stakeholders (frontline workers, planners, etc.) in a streamlined fashion. Smart factory initiatives might also be referred to as “digital factories” or “intelligent factories.” High-power AC power sources are required for the development of these devices. It is critical to ensure their form and function as they are meant to perform a variety of complex operations.

Renewable power generation is increasing because of the heavy emphasis on clean energy generation and emission control. Devices such as PV inverters require extensive testing to get certified for grid-tied operation under all kinds of adverse line conditions. The aerospace & defense sector is growing significantly due to several developments, such as Unmanned Aircraft Systems (UAS), UAVs, and air traffic control systems. These complex systems require high power density and light-weight AC power sources for standard compliance testing, accuracy, and reliability testing, which, in turn, will boost the demand for AC power sources.

The automotive industry is shifting focus on manufacturing electric vehicles, which creates a demand for efficient electric motors and EV charging stations. The significant risks and costs associated with any failure in the automotive industry impose the demand for high testing levels as compared to normal product reliability testing. The rising technological advancements and increasing automation across industries drive the demand for AC power sources

Restraint: R&D and Testing rates are higher mostly in developed economies

Mature markets, also known as developed markets, are countries that have the most advanced economies and capital markets. These countries have high GDP, GNP, and per capita income. Mature markets are also characterized by industrialization, including countries with primarily service economies. Well-established industry players have their R&D laboratory and manufacturing facilities in Germany, the UK, and the US. These facilities are the major hubs for manufacturing equipment and devices, which are integral components of any end-use industry. AC power sources are used to test this equipment. Few new companies enter the market, and innovation takes place slowly. While a successful mature market entry can provide stability, they face several challenges and drawbacks in entering. Competitors have more familiarity with the industry, business operations, and customers. The costs to enter a mature market successfully are usually high. It takes much more money to enter as a new competitor to establish a brand reputation and promote yourself to get customers away from other providers. These factors put you at a strategic disadvantage

However, the life span of an AC power source unit varies from 5 to 10 years, depending upon the usage. In case of any default, repair & maintenance, and recalibration services are offered by the respective OEMs. Hence, the annual sales are less for the AC power sources market as they have a long life span and negligible maintenance cost.

Opportunities: Implementation of smart city concept

Smart cities aim to reduce anticipated complexities (such as power failures and power security) and expenses that accompany future urbanization. Hence, the integration of information and communication technology (ICT) will improve the energy efficiency of the equipment. The integration of information and communication technology provides a data-driven understanding of a customer and employee and aligns well with the company’s overall strategic objectives as defined by the sustainability action plan. The development of smart cities is likely to drive innovations in industries such as manufacturing, automotive, consumer electronics, wireless communication, and infrastructure (green buildings) which will fuel the demand for AC power source devices.

Challenges: Availability of cheaper products in the market

The AC Power source market is highly fragmented, with many local and international players. Product quality is a primary parameter for any manufacturer to differentiate from others. The organized sector mainly targets industrial buyers and maintains superior product quality by adhering to various industrial standards. On the contrary, the unorganized sector, mainly the local Chinese manufacturers, offers a cheaper alternative to entering the untapped local markets. Local manufacturers in most countries target the unorganized sector and compete strongly with global suppliers in the respective markets. The leading market players are currently facing stiff competition from such new players from the unorganized sector, supplying cheap and low-quality power supply products that emit toxic gases when heated or exposed to fire. These grey market players overpower the big players in terms of price competitiveness and local distribution network, which is a major challenge for the big players in the AC power source market.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Three-phase segment, by power phase supply, is expected to be the largest market during the forecast period

The three-phase segment is expected to be the largest market during the forecast period. The efficiency of a three-phase power system is significantly higher than a single-phase system carrying the same load, hence the demand for a three-phase segment is rising, which will, in turn, increase the demand for AC power sources.

By modulation, the PWM segment is expected to be the fastest growing market for the global AC power sources market during the forecast period

By modulation, the AC power sources market has been segmented into PWM, and linear. PWM is expected to be the fastest growing market during the forecast period with the highest CAGR. The rising demand for PWM in switch mode power supplies due to high efficiency and compact size is the prime reason for the growth of this market

“Asia Pacific: The fastest AC power sources market”

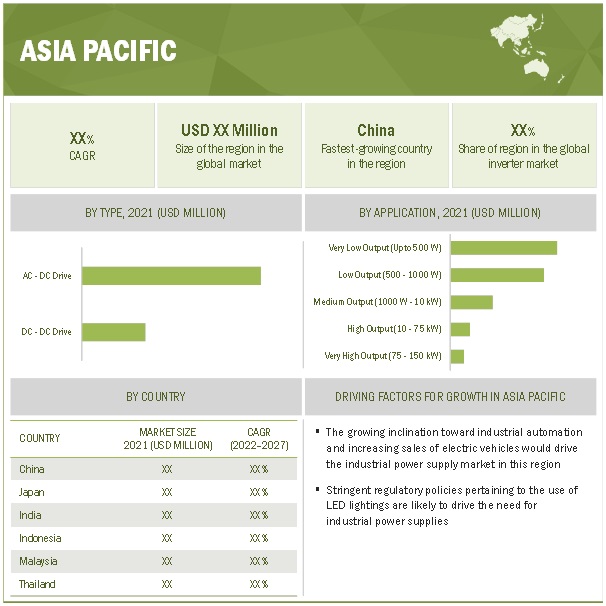

Asia Pacific is expected to be the fastest growing region for the global AC power sources market between 2022–2027, followed by Europe and North America. The growing inclination of China and Japan toward industrial automation and the rising adoption of electric vehicles in the region are among the reasons for the region’s significant market size.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the AC power sources market are Keysight Technologies (US), Chroma ATE (Taiwan), AMETEK (US), Pacific Power Source (US), and Matsusada Precision (Japan). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts to capture a larger share of the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

US $1.5 billion |

|

Market size value in 2027 |

US $1.7 billion |

|

Growth Rate |

2.2% CAGR |

|

Largest Market |

Asia Pacific |

|

Market Segments Covered |

Power supply phase, Modulation type, Application, and Region |

|

AC Power Sources Market Drivers |

|

|

AC Power Sources Market Opportunities |

|

|

Companies in the global cyber security market |

Keysight Technologies (US), Chroma ATE (Taiwan), AMETEK Inc. (US), Pacific Power Source (US), Matsusada Precision (Japan), Kikusui Electronics Corporation (Japan), Good Will Instrument (Taiwan), REGATRON (Switzerland), AC Power Corp. (Taiwan), B&K Precision Corporation (US), Ainuo Instruments (China), Orbit International Corp. (US), Ikonix Corporation (US), Newtons4th ltd. (UK), Aplab Limited (India), NH Research, Inc. (US), NF Corporation (Japan), Sophpower Electronics (China), ET Systems Electronic (Germany), and ITECH Electronic (Taiwan) and many more. |

This research report categorizes the AC power sources market by Power supply phase, Modulation type, Application, and Region

On the basis of the power supply phase:

- Single-phase

- Three-phase

On the basis of Modulation type:

- PWM

- Linear

On the basis of Application:

- Aerospace

- Defense & government services

- Energy

- Wireless Communication & Infrastructure

- Consumer electronics & appliances

- Others

On the basis of region:

- North America

- South America

- Europe

- Middle East and Africa

- Asia Pacific

Recent Developments

- In November 2021, Chroma introduced Chroma 61800-100 Regenerative Grid Simulator for 105 kVA high-power AC power supply solutions for EVSE testing

- In March 2021, Keysight launched the SL1200A Series Scienlab Regenerative 3-phase AC emulators for electric vehicle charging and grid-tied applications.

- In April 2019, Pacific Power Source launched a new ADF Series of AC power sources, which are cost-effective, stable, and well-regulated AC power conversion from 45 to 500 Hz, available in single-and three-phase models.

- In July 2018, AMETEK developed MIL-STD-1399 300 Revision B is an electrical interface for shipboard and submarine equipment

Frequently Asked Questions (FAQ):

What is the current size of the AC power sources market?

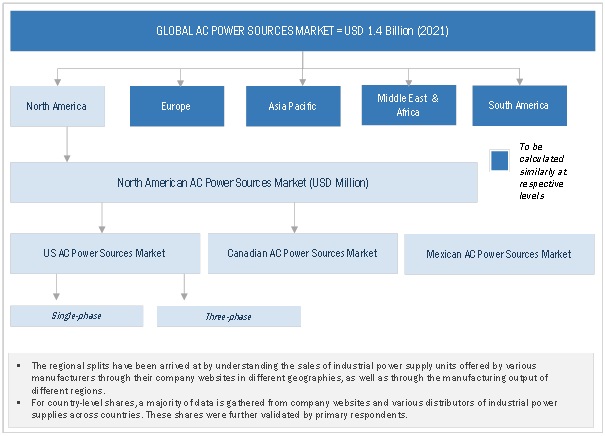

The current market size of the global AC power sources market is USD 1.4 billion in 2021.

What is the major drivers for the AC power sources market?

The growth of the AC power sources market can be attributed to the increasing Production of Equipment Used in Renewable Power Generation, Avionics, and Electric Vehicles. The increasing demand for energy-efficient devices in the industrial sector is also an important driver for the AC power sources market.

Which is the fastest-growing region during the forecasted period in the AC power sources market?

Asia Pacific is expected to be the fastest growing region for the global AC power sources market between 2022–2027, followed by Europe and North America. The growing inclination of China and Japan toward industrial automation and the rising adoption of electric vehicles in the region are among the reasons for the region’s significant market size

Which is the fastest-growing segment, by modulation during the forecasted period in the AC power sources market?

By modulation, the AC power sources market has been segmented into PWM, and linear. PWM is expected to be the fastest growing market during the forecast period with about a CAGR of 2.3%. The rising demand for PWM in switch mode power supplies due to high efficiency and compact size is the prime reason for the growth of this market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 AC POWER SOURCES MARKET, BY POWER SUPPLY PHASE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY MODULATION TYPE: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.3.4 MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STUDY LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 AC POWER SOURCES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.2.1 SECONDARY AND PRIMARY RESEARCH

2.2.2 SECONDARY DATA

2.2.2.1 List of key secondary sources

2.2.2.2 Key data from secondary sources

2.2.3 PRIMARY DATA

2.2.3.1 Key data from primary sources

2.2.3.2 Breakdown of primaries

2.3 RESEARCH SCOPE

2.4 DEMAND-SIDE ANALYSIS

FIGURE 4 PARAMETERS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR AC POWER SOURCES

2.4.1 DEMAND-SIDE ANALYSIS: BOTTOM-UP APPROACH

FIGURE 5 MARKET: REGION/COUNTRY-WISE ANALYSIS

2.4.1.1 Approach for obtaining market size using bottom-up analysis (demand side)

2.4.1.2 Calculation of demand-side analysis of market

2.4.1.3 Key assumptions while calculating demand-side market size

2.4.2 SUPPLY-SIDE ANALYSIS: TOP-DOWN APPROACH

2.4.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN MARKET

2.4.2.2 Calculations for supply-side analysis

FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF AC POWER SOURCES

2.4.2.3 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 8 COMPANY REVENUE ANALYSIS, 2021

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 RESEARCH LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 AC POWER SOURCES MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC LED MARKET IN 2021

FIGURE 10 THREE-PHASE AC POWER SOURCES EXPECTED TO COMMAND MARKET THROUGHOUT FORECAST PERIOD

FIGURE 11 PWM AC POWER SOURCES TO LEAD MARKET FROM 2022 TO 2027

FIGURE 12 ENERGY APPLICATION TO CONTINUE TO HOLD LARGEST SHARE OF MARKET BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 13 INCREASING DEMAND FOR ENERGY-EFFICIENT DEVICES IN INDUSTRIAL SECTOR TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR AC POWER SOURCES DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

FIGURE 15 CONSUMER ELECTRONICS & APPLIANCES SEGMENT AND CHINA DOMINATED MARKET IN ASIA PACIFIC

4.4 MARKET, BY POWER SUPPLY PHASE

FIGURE 16 THREE-PHASE AC POWER SOURCES TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2027

4.5 AC POWER SOURCE MARKET, BY MODULATION TYPE

FIGURE 17 PWM TYPE TO CAPTURE LARGER MARKET SHARE IN 2027

4.6 MARKET, BY APPLICATION

FIGURE 18 ENERGY SEGMENT TO HOLD LARGEST MARKET SHARE IN 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for renewable energy equipment, avionics, and electric vehicles

FIGURE 20 RENEWABLE ELECTRICITY CAPACITY ADDITION, 2014–2021

FIGURE 21 INSTALLED RENEWABLE ELECTRICITY GENERATION CAPACITY, 2020–2050

5.2.1.2 Surging requirement for energy-efficient devices in industrial processes

FIGURE 22 INDUSTRY ENERGY PRODUCTIVITY, BY REGION

5.2.2 RESTRAINTS

5.2.2.1 Reduced R&D spending by manufacturers of AC power sources

5.2.2.2 Difficulty in understanding complex system interface

5.2.3 OPPORTUNITIES

5.2.3.1 Rising focus on developing smart cities

5.2.3.2 Growing number of EV charging stations across many countries

FIGURE 23 ELECTRIC CAR SALES, 2021

5.2.4 CHALLENGES

5.2.4.1 Availability of cheaper substitute products

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 24 REVENUE SHIFT IN MARKET PLAYERS

5.4 TRADE ANALYSIS

TABLE 2 REGION-WISE IMPORT DATA, 2019–2021 (USD MILLION)

TABLE 3 REGION-WISE EXPORT DATA, 2019–2021 (USD MILLION)

5.5 MARKET MAP

FIGURE 25 MARKET: MARKET MAP

5.6 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

TABLE 4 MARKET: ROLE IN ECOSYSTEM

5.6.1 RAW MATERIAL/COMPONENT PROVIDERS

5.6.2 ASSEMBLERS/MANUFACTURERS

5.6.3 DISTRIBUTORS

5.6.4 END-USERS

5.7 CODES AND REGULATIONS

5.7.1 CODES AND REGULATIONS RELATED TO AC POWER SOURCES

TABLE 5 MARKET: CODES AND REGULATIONS

5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.8 PATENT ANALYSIS

TABLE 11 AC POWER SOURCES: INNOVATION AND PATENT REGISTRATION, FEBRUARY 2016– NOVEMBER 2021

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF SUBSTITUTES

5.9.2 BARGAINING POWER OF SUPPLIERS

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 THREAT OF NEW ENTRANTS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 CASE STUDY ANALYSIS

5.10.1 AMP-LINE CORP. CONTINUES OFFERING HUBBELL POWER SYSTEMS WITH QUALITY AC POWER SUPPLIES

5.10.1.1 Problem statement

5.10.1.2 Solution

5.10.2 TI AUTOMOTIVE SYSTEMS USES CUSTOM AC POWER SOURCE THAT CAN PRODUCE REQUIRED FREQUENCY

5.10.2.1 Problem statement

5.10.2.2 Solution

5.11 AVERAGE PRICING OF AC POWER SOURCES

TABLE 13 GLOBAL AVERAGE SELLING PRICE OF AC POWER SOURCES, BY TYPE

5.12 TECHNOLOGY ANALYSIS

5.12.1 ADAPTATION OF METAL-OXIDE-SEMICONDUCTOR FIELD-EFFECT TRANSISTOR TECHNOLOGY

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR APPLICATIONS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MAJOR APPLICATIONS (%)

5.13.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR APPLICATIONS

TABLE 15 KEY BUYING CRITERIA, BY APPLICATION

5.14 KEY CONFERENCES AND EVENTS, 2022–2024

TABLE 16 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 MARKET, BY POWER SUPPLY PHASE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 30 MARKET SHARE, BY POWER SUPPLY PHASE, 2021

TABLE 17 MARKET, BY POWER SUPPLY PHASE, 2020–2027 (USD MILLION)

6.2 SINGLE-PHASE

6.2.1 DESIGNED FOR TESTING CONSUMER ELECTRONICS AND INDUSTRIAL DEVICES

TABLE 18 SINGLE-PHASE: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 THREE-PHASE

6.3.1 PROVIDES CONTINUOUS POWER SUPPLY NECESSARY IN HEAVY INDUSTRIES

TABLE 19 THREE-PHASE: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 MARKET, BY MODULATION TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 31 SHARE OF MODULATION TYPE IN MARKET, 2021

TABLE 20 MARKET, BY MODULATION TYPE, 2020–2027 (USD MILLION)

7.2 PWM

7.2.1 WIDELY USED IN SWITCH-MODE POWER SUPPLIES

TABLE 21 PWM: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 LINEAR

7.3.1 SUITABLE FOR APPLICATIONS REQUIRING LOW RIPPLE AND LESS ELECTROMAGNETIC EMISSION

TABLE 22 LINEAR: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 MARKET, BY APPLICATION (Page No. - 83)

8.1 INTRODUCTION

FIGURE 32 MARKET, BY APPLICATION, 2021

TABLE 23 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 AEROSPACE

8.2.1 DEMAND FOR AEROSPACE AND AIRBORNE ELECTRONICS THAT COMPLY WITH SAFETY STANDARDS TO BOOST MARKET GROWTH

TABLE 24 AEROSPACE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 WIRELESS COMMUNICATION & INFRASTRUCTURE

8.3.1 FOCUS OF TELECOM SECTOR ON DIGITALIZATION TO GENERATE NEED FOR AC POWER SOURCES

TABLE 25 WIRELESS COMMUNICATION & INFRASTRUCTURE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 CONSUMER ELECTRONICS & APPLIANCES

8.4.1 REQUIREMENT FOR AC POWER SOURCES FOR TESTING SMART HOME APPLIANCES TO ACCELERATE GROWTH

TABLE 26 CONSUMER ELECTRONICS & APPLIANCES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5 DEFENSE & GOVERNMENT SERVICES

8.5.1 ADOPTION OF ELECTRICALLY POWERED SYSTEMS IN DEFENSE TO SUPPORT MARKET GROWTH

TABLE 27 DEFENSE & GOVERNMENT SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.6 ENERGY

8.6.1 IMPLEMENTATION OF AC POWER SOURCES TO IMPROVE SAFETY AND EFFICIENCY OF GRID-CONNECTED DEVICES TO DRIVE MARKET

TABLE 28 ENERGY: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.7 OTHERS

TABLE 29 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 MARKET, BY REGION (Page No. - 91)

9.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2021

TABLE 30 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 31 MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

9.2.1 BY POWER SUPPLY PHASE

TABLE 32 NORTH AMERICA: MARKET, BY POWER SUPPLY PHASE, 2020–2027 (USD MILLION)

9.2.2 BY MODULATION TYPE

TABLE 33 NORTH AMERICA: MARKET, BY MODULATION TYPE, 2020–2027 (USD MILLION)

9.2.3 BY APPLICATION

TABLE 34 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 35 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.4.1 US

9.2.4.1.1 Increasing military expenditure to support market growth

TABLE 36 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.2 Canada

9.2.4.2.1 Government initiatives in renewable energy projects to drive demand for AC power sources

TABLE 37 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.3 Mexico

9.2.4.3.1 High demand for renewable energy and electric vehicles to fuel market growth

TABLE 38 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 39 ASIA PACIFIC: MARKET, BY POWER SUPPLY PHASE, 2020–2027 (USD MILLION)

9.3.1 BY MODULATION TYPE

TABLE 40 ASIA PACIFIC: MARKET, BY MODULATION TYPE, 2020–2027 (USD MILLION)

9.3.2 BY APPLICATION

TABLE 41 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3 BY COUNTRY

TABLE 42 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.3.1 China

9.3.3.1.1 Government focus on clean energy to create opportunity for market players

TABLE 43 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3.2 Japan

9.3.3.2.1 Need to test automation gadgets and consumer electronics to stimulate demand for AC power sources

TABLE 44 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3.3 South Korea

9.3.3.3.1 Increased manufacturing activities in consumer electronics and automotive sectors to generate need for AC power sources

TABLE 45 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3.4 India

9.3.3.4.1 Surging demand for high-end consumer electronics to fuel market growth

TABLE 46 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3.5 Australia

9.3.3.5.1 Integration of digital technologies in manufacturing to fuel need for AC power sources

TABLE 47 AUSTRALIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.3.6 Rest of Asia Pacific

TABLE 48 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4 EUROPE

9.4.1 BY PHASE TYPE

TABLE 49 EUROPE: MARKET, BY POWER SUPPLY PHASE, 2020–2027 (USD MILLION)

9.4.2 BY MODULATION TYPE

TABLE 50 EUROPE: MARKET, BY MODULATION TYPE, 2020–2027 (USD MILLION)

9.4.3 BY APPLICATION

TABLE 51 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 52 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.4.4.1 Germany

9.4.4.1.1 Safety standards in aerospace sector to boost demand for AC power sources

TABLE 53 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.2 France

9.4.4.2.1 Participation in renewable energy projects fuels market growth

TABLE 54 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.3 UK

9.4.4.3.1 Investments in renewable energy projects to spur demand for AC power sources

TABLE 55 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.4 Italy

9.4.4.4.1 Telecom infrastructure developments to support market growth

TABLE 56 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.5 Spain

9.4.4.5.1 Focus on climate neutrality to support market growth

TABLE 57 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.6 Rest of Europe

TABLE 58 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 BY POWER SUPPLY PHASE

TABLE 59 MIDDLE EAST & AFRICA: MARKET, BY POWER SUPPLY PHASE, 2020–2027 (USD MILLION)

9.5.2 BY MODULATION TYPE

TABLE 60 MIDDLE EAST & AFRICA: MARKET, BY MODULATION TYPE, 2020–2027 (USD MILLION)

9.5.3 BY APPLICATION

TABLE 61 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 62 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.5.4.1 Saudi Arabia

9.5.4.1.1 Rapid developments in industrial and energy sectors to drive demand for AC power sources

TABLE 63 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.2 UAE

9.5.4.2.1 Energy, transportation, and healthcare sectors to contribute to market growth

TABLE 64 UAE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.3 South Africa

9.5.4.3.1 Automobile companies and wireless communication service providers to witness significant demand for AC power sources

TABLE 65 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.4 Rest of Middle East & Africa

TABLE 66 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 BY POWER SUPPLY PHASE

TABLE 67 SOUTH AMERICA: MARKET, BY POWER SUPPLY PHASE, 2020–2027 (USD MILLION)

9.6.2 BY MODULATION TYPE

TABLE 68 SOUTH AMERICA: MARKET, BY MODULATION TYPE, 2020–2027 (USD MILLION)

9.6.3 BY APPLICATION

TABLE 69 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 70 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.6.4.1 Brazil

9.6.4.1.1 Developments in wireless communication infrastructure drive demand for AC power sources

TABLE 71 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4.2 Argentina

9.6.4.2.1 Investments in grid projects generating need for AC power sources

TABLE 72 ARGENTINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4.3 Chile

9.6.4.3.1 Plan to become carbon-neutral by 2050 to boost market growth

TABLE 73 CHILE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4.4 Rest of South America

TABLE 74 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 126)

10.1 KEY PLAYERS STRATEGIES

TABLE 75 REVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF AC POWER SOURCES

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

FIGURE 37 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN MARKET, 2021

TABLE 76 MARKET: DEGREE OF COMPETITION

FIGURE 38 MARKET SHARE ANALYSIS, 2021

10.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 39 REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET FROM 2017 TO 2021

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

FIGURE 40 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

10.5 START-UP/SME EVALUATION QUADRANT

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 41 MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

10.5.5 COMPETITIVE BENCHMARKING

TABLE 77 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 78 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.6 MARKET: COMPANY FOOTPRINT

TABLE 79 POWER SUPPLY PHASE: COMPANY FOOTPRINT

TABLE 80 MODULATION TYPE: COMPANY FOOTPRINT

TABLE 81 BY APPLICATION: COMPANY FOOTPRINT

TABLE 82 REGION: COMPANY FOOTPRINT

TABLE 83 COMPANY FOOTPRINT

10.7 COMPETITIVE SCENARIOS AND TRENDS

TABLE 84 MARKET: PRODUCT LAUNCHES, SEPTEMBER 2019–JANUARY 2022

11 COMPANY PROFILES (Page No. - 141)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 KEYSIGHT TECHNOLOGIES

TABLE 85 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 42 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

11.1.2 CHROMA ATE

TABLE 86 CHROMA ATE: BUSINESS OVERVIEW

FIGURE 43 CHROMA ATE: COMPANY SNAPSHOT

11.1.3 AMETEK

TABLE 87 AMETEK: BUSINESS OVERVIEW

FIGURE 44 AMETEK: COMPANY SNAPSHOT

11.1.4 PACIFIC POWER SOURCE

TABLE 88 PACIFIC POWER SOURCE: BUSINESS OVERVIEW

11.1.5 MATSUSADA PRECISION

TABLE 89 MATSUSADA PRECISION: BUSINESS OVERVIEW

11.1.6 ADAPTIVE POWER SYSTEMS

TABLE 90 ADAPTIVE POWER SYSTEMS: BUSINESS OVERVIEW

11.1.7 KIKUSUI ELECTRONICS CORPORATION

TABLE 91 KIKUSUI ELECTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 45 KIKUSUI ELECTRONICS CORPORATION: COMPANY SNAPSHOT

11.1.8 GOOD WILL INSTRUMENT

TABLE 92 GOOD WILL INSTRUMENT: BUSINESS OVERVIEW

FIGURE 46 GOOD WILL INSTRUMENT: COMPANY SNAPSHOT

11.1.9 REGATRON

TABLE 93 REGATRON: BUSINESS OVERVIEW

11.1.10 AC POWER CORPORATION

TABLE 94 AC POWER CORPORATION: BUSINESS OVERVIEW

11.1.11 B&K PRECISION CORPORATION

TABLE 95 B&K PRECISION: BUSINESS OVERVIEW

11.1.12 AINUO INSTRUMENTS

TABLE 96 AINUO INSTRUMENTS: BUSINESS OVERVIEW

11.1.13 ORBIT INTERNATIONAL

TABLE 97 ORBIT INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 47 ORBIT INTERNATIONAL: COMPANY SNAPSHOT

11.1.14 IKONIX

TABLE 98 IKONIX: BUSINESS OVERVIEW

11.1.15 APLAB LIMITED

TABLE 99 APLAB: BUSINESS OVERVIEW

FIGURE 48 APLAB LIMITED: COMPANY SNAPSHOT

11.1.16 NH RESEARCH

11.1.17 NF CORPORATION

11.1.18 SOPHPOWER ELECTRONICS

11.1.19 ET SYSTEM ELECTRONIC GMBH

11.1.20 ITECH ELECTRONIC

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 180)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involved major activities in estimating the current size of the AC power sources market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The research study on the market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, World Bank, Observatory of Economic Complexity (OEC), International Energy Agency, Ceicdata, Researchgate, Onepetro, International Electrotechnical Commission, US Energy Information Administration (EIA), Electrical Equipment Associations, UNESCO Institute for Statistics (UIS) Bloomberg, Businessweek, Factiva, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

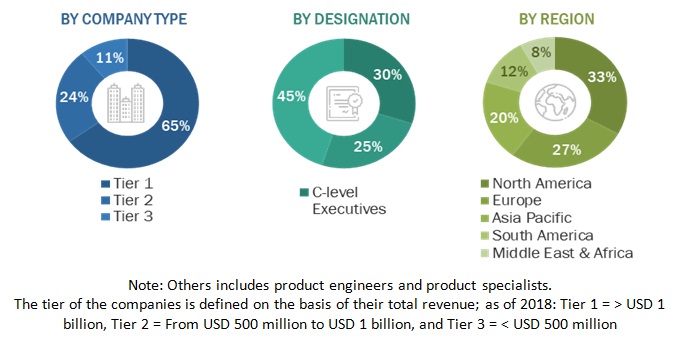

The AC power sources market comprises several stakeholders such as AC power sources manufacturers, raw material providers, manufacturers of subcomponents of AC power sources, manufacturing technology providers, technical support providers, and end users in the supply chain. The demand side of this market is characterized by the rising demand for electric vehicle charging infrastructure in major countries around the world and the rapid pace of industrialization and urbanization across the globe across a wide variety of end users. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global AC Power Sources Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the AC power sources market size, by power supply phase, modulation type, Application, and region, in terms of value

- To define, describe, segment, and forecast the market size, by region, in terms of volume

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the AC power sourcess market

- To provide detailed information on the market map, value chain, case studies, pricing, technologies, market ecosystem, tariff, and regulatory landscape, Porter’s five forces, and trends/disruptions impacting customers’ businesses that are specific to the market

- The analyze impact of COVID-19 on the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to 5 main regions (along with countries), namely, North America, South America, Asia Pacific, Middle East and Africa, and Europe.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AC Power Sources Market