Precision Source Measure Unit Market by Current Range (1΅A1mA,1mA1A,Above 1A) Application (Aerospace, Defense& Government Services; Automotive; Energy; Wireless Communication& Infrastructure) Form Factor(Benchtop, Modular) Region Global forecast to 2024

Precision Source Measure Unit Market

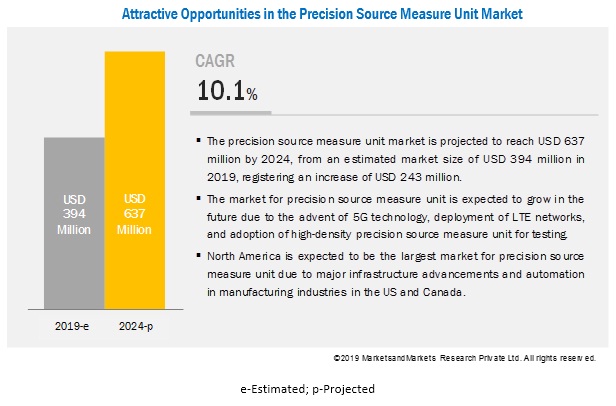

Precision source measure unit market is expected to grow at a CAGR of 10.1% during the forecast period (2019-2024)

Precision Source Measure Unit Market and Top Companies

Key market players profiled in the precision source measure unit market report includes:

- Keysight Technologies (US)

- National Instruments (US)

- Chroma ATE (Taiwan)

- Tektronix (US)

- Yokogawa Electric (Japan)

- Rohde & Schwarz (Germany)

- Artisan Technology Group (US)

- VX Instruments (Germany)

- Ossila (UK)

- Marvin Test Solutions (US)

Keysight Technologies (US) is a technology provider that offers designing and test solutions for electronics equipment. Agilent Technologies (parent company of Keysight Technologies) was split from Hewlett-Packard in 1999. In 2013, Agilent Technologies was again split into two separate measurement companies; Agilent Technologies and Keysight Technologies. Keysight Technologies was incorporated in 2013 and got listed on the New York Stock Exchange in November 2014. The company offers solutions related to the design, development, manufacture, installation, deployment, validation, optimization, and secure operation of electronics systems that are used in communications, networking, and other electronics applications. The company operates through four business segments: Communications Solutions Group, Electronic Industrial Solutions Group, Ixia Solutions Group, and Services Solutions Group.

National Instruments (US) designs and manufactures products in the field of measurement, embedded systems, and automation. The company accelerates productivity and innovation through an open, software-defined platform. It provides software and hardware platforms under the category of modular instrumentation (VXI/PXI-based instrumentation) to speed up the testing and measurement process. It offers a broad range of products, including source measure units, digital multimeters, waveform generators, digital instruments, oscilloscopes, power supplies, and loads.

Chroma ATE (Taiwan) Chroma ATE is one of the prominent international suppliers of precision test and measurement instrumentation, automated test systems, smart manufacturing systems, and turnkey solutions. The company primarily operates through four business segments: Special Materials, Test Instrument, Automatic Equipment, and Others.

Tektronix (US) designs and manufactures test and measurement solutions. Tektronix has become a subsidiary of Fortive in 2007. The company offers a broad range of product portfolio which includes oscilloscopes, analyzers, signal generators, sources & supplies, source measure units, digital multimeters, video test equipment, and semiconductors test systems for various applications such as semiconductor devices, laser diodes devices, circuit protection devices, airbags, fuses, and batteries.

Yokogawa Electric (Japan) is one of the leading providers of industrial automation, test and measurement solutions, and engineering solutions & services. It operates through three major segments namely industrial automation and control; test and measurement; and aviation and other businesses.

Rohde & Schwarz (Germany) is a Munich-based technology group that develops, produces, and sells a wide range of electronic goods for industry and government customers. It operates through four business segments namely aerospace & defense, test & measurement, broadcast & media, networks & cybersecurity.

Artisan Technology Group (US) is a distributor of maintenance solutions for critical industrial, commercial, and military systems. The company offers its products under five segments namely artisan test, artisan cots & ate, artisan plc, artisan scientific, and artisan ecotech.

VX Instruments (Germany) develops and produces measurement instruments and test systems for automation and production. The company offers a broad range of product portfolio, which includes high power source measure units, waveform digitizer, waveform generator, quad system power supply, and cable adapter.

Ossila (UK) manufactures electronic equipment. The company offers a broad range of processing and measuring equipment such as source measure unit, OFET & sensing, OLED, contact angle, spin coater, dip coater, and UV ozone cleaner.

Marvin Test Solutions (US) a subsidiary of the Marvin Group, is a vertically integrated aerospace test and measurement company that creates and delivers innovative and reliable test systems. It offers various products and services such as source measure units, chassis & controller, digital instrumentation, measurement systems such as digital multi meters, A/D converters, precision DC source instrumentation, switching products, and power supplies.

Precision Source Measure Unit Market and Current range

Current ranges in precision source measure unit market are:

- 1 ΅A 1 mA

- 1 mA 1 A

- Above 1 A

1 ΅A 1 mA The 1 ΅A 1 mA current range SMUs are ideal for a wide variety of current and voltage (IV) measurements that require both high resolution and accuracy, such as the characterization, parametric/reliability tests of semiconductors, general electronic devices, and active/passive components. Semiconductor component test & ate systems drive the demand for 1 ΅a 1 ma segment

1 mA 1 A Easy system integration drives the demand for 1 ma 1 a current range. Such current range offers high speed, high precision digitization with TSP (Test Script Processing) technology. Easy system integration and TSP processing are expected to increase the demand for such current range.

Above 1 A Triaxial connectivity and source adapt technology are the major growth drivers for the above 1 a segment. These are high density source measure units specifically used for 5G applications. Source measure units such as PXI source measure units provide six times more DC channel density than 1 and 4 channeled PXI source measure units for testing RF, MEMS, mixed-signal, and other analog semiconductor components. Such current range source measure units offer 4-wire remote sense and guard with Triaxial connectivity and source adapt technology.

Precision Source Measure Unit Market and Form factor

Form factors in precision source measure unit market are:

- Benchtop

- Modular

Benchtop The benchtop segment of precision source measure unit market is driven owing to design engineering and troubleshooting applications. Benchtop precision source measure units are gaining momentum as they prove to be an ideal choice for testing semiconductors, active/passive components, and a variety of other devices and materials. Also, benchtop precision source measure units are used in R&D, education and industrial development, and test and manufacturing applications. They can operate as a standalone or system components.

Modular Multichannel system design application is expected to drive the modular source measure unit market. A modular precision source measure unit is an essential instrument for precise design engineers and test engineers. With the development of modular source measure units, designing a multichannel system has become possible. This approach also saves the per-square-foot cost of semiconductor facilities.

Key Developments: Precision Source Measure Unit Market

- In December 2019, Tektronix launched Keithley I-V Tracer software that stimulates classic curve tracer functions for Keithley source meter SMUs. Tracer uses the full capabilities of supported SMUs, including the dual high-speed digitizers.

- In February 2018, National Instruments launched the PXIe-4163 module, a new SMU in PXI format, which is distinguished by the density of its channels.

[148 Pages Report] The global precision source measure unit market size is projected to reach USD 637 million by 2024 from an estimated value of USD 394 million in 2019, at a CAGR of 10.1 % during the forecast period. The growth of the precision source measure unit industry can be attributed to a high level of integration & flexibility of the precision source measure unit, and growing demand from the automotive and medical industries.

By form factor, the modular precision source measure unit segment is expected to make the largest contribution to the market during the forecast period

The precision source measure unit market has been segmented based on form factor into benchtop and modular. The modular precision source measure unit segment is estimated to be the fastest-growing during the forecast period. A precision modular source measure unit is an essential instrument for precise design engineers and test engineers. With the development of modular precision source measure units, designing a multichannel system has become possible to meet the test goals. It provides the flexibility required to reduce the cost of a test, and it is possible to add capabilities such as integrating different types of instruments in a modular precision source measure unit. Thus, designing a multichannel system is expected to drive the modular precision source measure unit market during the forecast period.

By application, the automotive segment is expected to grow at the fastest rate during the forecast period.

The automotive application segment is expected to grow at a high CAGR during the forecast period. New-generation precision source measure units are adopted in all these end-user industries based on application requirements. The automotive industry has adopted automation on a massive scale for manufacturing vehicles. With the increasing number of electronic parts in vehicles, there is a need for these parts to perform their functions accurately and flawlessly. To address these challenges, precision source measure units are used to provide multipoint measurements in automotive test applications. Thus, the increasing adoption of automation in the automotive industry is expected to drive the precision source measure unit market in the automotive segment during the forecast period.

In the current range segment, 1 ΅A 1 mA current range is growing at the fastest rate during the forecast period

The precision source measure unit market has been segmented, based on current type into 1 ΅A 1 mA, 1 mA 1 A, and more than 1 A. In the current range segment, 1 ΅A 1 mA current range is expected to be the fastest-growing market during the forecast period. Such current range offers highly flexible, four-quadrant voltage and current source/load coupled with precision voltage and current meters. The increasing demand for test and measurement solutions in the semiconductor industry in the North America and Asia Pacific regions are expected to drive the market for 1 ΅A 1 mA precision source measure units during the forecast period.

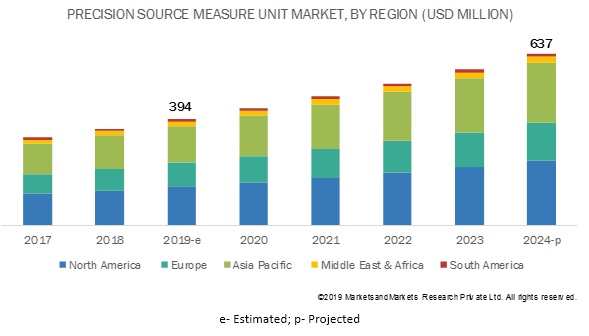

North America is expected to be the largest market during the forecast period

In this report, the precision source measure unit market, based on geography, has been segmented into four geographic regions, namely, North America, Asia Pacific, Europe, Middle East & Africa, and South America. The North American market is estimated to grow at the highest rate during the forecast period. The market in this region is expected to be driven by the demand from various end-user industries such as aerospace, defense & government services, automotive, and energy. Furthermore, the shift toward connected cars and intelligent transportation systems is expected to drive the precision source measure unit market in this region.

Key Market Players

The major players in the precision source measure unit market are Tektronix (US), Keysight Technologies (US), National Instruments (US), Chroma ATE (Taiwan), Yokogawa Electric (Japan), Rohde & Schwarz (Germany), VX Instruments (Germany), and Osilla (UK).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Current range, form factor, application, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Tektronix (US), Keysight Technologies (US), National Instruments (US), Chroma ATE (Taiwan), Yokogawa Electric (Japan), VX Instruments (Germany), Rohde & Schwarz (Germany), Ossila (UK), and Marvin Test Solutions (US) |

This research report categorizes the precision source measure unit market based on the current range, form factor, application, and region.

Based on the channel:

- 1 ΅A 1 mA

- 1 mA - 1 A

- More than 1

Based on the application:

- Aerospace, defense & government services

- Automotive

- Energy

- Wireless communication & infrastructure

- Others (Consumer electronics & appliances, and medical equipment manufacturing)

Based on the Form factor type:

- Benchtop

- Modular

Based on the region:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In May 2017, Keysight Technologies launched M9111A PXIe module with 1-slot, 2-quadrant that provides stable, glitch-free sourcing and sinking, and high accuracy measurements. It offers high-throughput and measurement quality for design validation and production test of RF power amplifiers.

- In February 2018, National Instruments launched the PXIe-4163 module, a new source measure units in PXI format, which is distinguished by the density of its channels.

- In December 2019, Tektronix launched Keithley I-V Tracer software that stimulates classic curve tracer functions for Keithley source meter source measure units. Tracer uses the full capabilities of supported source measure units, including the dual high-speed digitizers.

- In April 2018, Marvin Test Solutions launched a new 4-Channel PXI Source Measure Unit. Thus, precision 3U PXI module sources and measures sense both voltage and current over a range of ±20 V and up to ± 1 A. It includes API features & UI software packages which can be supported for Linux 32/64 operating systems.

Key Questions Addressed by the Report

- What are the revolutionary technology trends that could be witnessed over the next five years?

- What will be the revenue pockets for the precision source measure unit market in the next five years?

- Which of the type segments will have the maximum opportunity to grow during the forecast period?

- Which will be the leading regions with the largest market share by 2024?

- How are the companies implementing organic and inorganic strategies to gain increased precision source measure unit market share?

Frequently Asked Questions (FAQ):

What are the revolutionary technology trends that could be witnessed over the next five years?

Growing IoT market for device testing as well as a high level of integration and flexibility of precision source measure unit is witnessed to increase the technology trend over the next five years.

What will be the revenue pockets for the precision source measure unit market in the next five years?

The advent of 5G technology and deployment of LTE networks will hold the revenue pockets for the precision source measure unit market in the next five years.

Which of the type segments will have the maximum opportunity to grow during the forecast period?

The modular source measure units witness high demand in the designing of multichannel systems. They optimize the devices in which they are used according to the application-specific requirements. Such factors make modular source measure units hold maximum opportunities during the forecast period.

Which will be the leading regions with the largest market share by 2024?

North America and Asia Pacific will be the largest regions holding the majority of the market share by 2024.

How are the companies implementing organic and inorganic strategies to gain increased precision source measure unit market share?

Major players have implemented new product launches as an organic strategy to hold the largest market share by 2024.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Precision Source Measure Unit Market, By Current Range: Inclusions vs. Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Supply-Side Analysis

2.3.1.1 Assumptions

2.3.1.1.1 Key Primary Insights

2.3.1.2 Calculation

2.3.2 Demand Analysis

2.3.2.1 Key Parameters / Trends

2.3.3 Forecast

2.4 Market Breakdown and Data Triangulation

2.5 Primary Insights

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Precision Source Measure Unit Market

4.2 Precision Source Measure Unit Market, By Current Range

4.3 Precision Source Measure Unit Market, By Form Factor

4.4 Precision Source Measure Unit Market, By Application

4.5 North America Precision Source Measure Unit Market, By Application & Country

4.6 Precision Source Measure Unit Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Level of Integration and Flexibility of Precision Source Measure Unit

5.2.1.2 Growing Demand From the Automotive and Medical Industries

5.2.1.3 Growing Iot Market Leverages Precision Smus for Device Testing

5.2.2 Restraints

5.2.2.1 Technical Factors Inhibiting the Market Growth of Precision Source Measure Unit

5.2.2.2 Availability of Alternatives

5.2.3 Opportunities

5.2.3.1 Advent of 5g Technology and Deployment of Lte Networks

5.2.3.2 Adoption of High-Density Precision Source Measure Unit for Testing

5.2.4 Challenges

5.2.4.1 Matching Pace With Constantly Evolving Technologies

6 Precision Source Measure Market, By Current Range (Page No. - 45)

6.1 Introduction

6.2 1 ΅a 1 Ma

6.2.1 Semiconductor Component Test & ATE Systems Drive the Demand for 1 ΅a 1 Ma Segment

6.3 1 Ma 1 A

6.3.1 Easy System Integration Drives the Demand for 1 Ma 1 A Current Range

6.4 Above 1 A

6.4.1 Triaxial Connectivity and Source Adapt Technology are the Major Growth Drivers for the Above 1 A Segment

7 Precision Source Measure Unit Market, By Form Factor (Page No. - 50)

7.1 Introduction

7.2 Benchtop

7.2.1 Design Engineering and Troubleshooting Applications Drive the Demand for Benchtop Source Measure Units

7.3 Modular

7.3.1 Multichannel System Design Application is Expected to Drive the Modular Source Measure Unit Market

8 Precision Source Measure Unit Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Aerospace, Defense & Government Services

8.2.1 ATE Systems and Calibration Services Applications Drive the Demand in Aerospace, Defense & Government Services

8.3 Automotive

8.3.1 Increasing Demand for Evs is Expected to Increase the Demand for Multipoint Test & Measurements

8.4 Energy

8.4.1 Wide Adoption of Solar Technology and Its Growing Applications Lead the Development of Solar (Pv) Products

8.5 Wireless Communication & Infrastructure

8.5.1 Growing Iot Market Demands Precision Source Measure Units for Device Testing

8.6 Others

8.6.1 Increasing Demand for Consumer Electronic Products Drives the Market for Precision Test & Measurement Equipment

9 Precision Source Measure Unit Market, By Region (Page No. - 61)

9.1 Introduction

9.2 North America

9.2.1 By Current Range

9.2.2 By Form Factor

9.2.3 By Application

9.2.3.1 Application, By Country

9.2.4 By Country

9.2.4.1 Us

9.2.4.1.1 High Adoption of Communication Test & Measurement Solutions is Expected to Drive the Precision Source Measure Unit Market

9.2.4.2 Canada

9.2.4.2.1 Increasing R&D Investment in Canadas Automotive Sector is Expected to Drive the Demand

9.2.4.3 Mexico

9.2.4.3.1 Increasing Fdis in Automotive and Aerospace Industries Drive the Precision Source Measure Unit Market

9.3 Asia Pacific

9.3.1 By Current Range

9.3.2 By Form Factor

9.3.3 By Application

9.3.3.1 Application, By Country

9.3.4 By Country

9.3.4.1 Australia

9.3.4.1.1 Rising Investment in R&D Will Drive the Australian Precision Source Measure Unit Market

9.3.4.2 Japan

9.3.4.2.1 Rapid Adoption of Plug in E-Vehicles and Supportive Government Policies Will Drive the Market for Precision Source Measure Unit

9.3.4.3 India

9.3.4.3.1 Rapidly Growing Semiconductor Demand Will Drive Indias Precision Source Measure Unit Market

9.3.4.4 China

9.3.4.4.1 The Ongoing Green Energy Development in China Drives the Precision Source Measure Unit Market

9.3.4.5 South Korea

9.3.4.5.1 Growing Automotive Industry and Super-Fast 5g Network in South Korea Drive the Precision Source Measure Unit Market

9.3.4.6 Rest of Asia Pacific

9.4 Europe

9.4.1 By Current Range

9.4.2 By Form Factor

9.4.3 By Application

9.4.3.1 Application, By Country

9.4.4 By Country

9.4.4.1 Germany

9.4.4.1.1 Connected Vehicle Market in Germany Boosts the Precision Source Measure Unit Market for the Automotive Sector

9.4.4.2 France

9.4.4.2.1 R&D and Manufacturing Facilities for the A&D Industry in France Offer Opportunities for the Precision Source Measure Unit Market

9.4.4.3 UK

9.4.4.3.1 Shift Towards Renewable Energy Power is Expected to Drive the Demand for Precision Smu Market in the UK

9.4.4.4 Spain

9.4.4.4.1 Increasing Number of Ev Charging Stations is Expected to Drive the Demand for Precision Test & Measurement

9.4.4.5 Russia

9.4.4.5.1 Increasing Investments in the Defense Sector Will Drive the Precision Source Measure Unit Market

9.4.4.6 Italy

9.4.4.6.1 Emergence of Small Cell Wireless Technologies for 5g Network is Expected to Drive the Precision Smu Market

9.4.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 By Current Range

9.5.2 By Form Factor

9.5.3 By Application

9.5.3.1 Application, By Sub-Region

9.5.4 By Sub-Region

9.5.4.1 Middle East

9.5.4.1.1 Increasing Consumer Electronic Applications Due to Rapid Urbanization is Expected to Drive the Precision Smu Market

9.5.4.2 Africa

9.5.4.2.1 Growing Communication, Infrastructure, and Network Application in Africa is Driving the Demand for Precision Smu

9.6 South America

9.6.1 By Current Range

9.6.2 By Form Factor

9.6.3 By Application

9.6.3.1 Application, By Country

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.1.1 High Investment in the Aerospace Industry is Expected to Drive the Precision Smu Market of Brazil

9.6.4.2 Argentina

9.6.4.2.1 Governments Investments in Thermal & Hydropower Energy Generation Would Drive the Market for Precision Smu

9.6.4.3 Chile

9.6.4.3.1 Investment in Energy and Communication Infrastructure Sectors Drives the Demand for Precision Smu

10 Competitive Landscape (Page No. - 107)

10.1 Overview

10.2 Ranking of Players, 2018

10.3 Competitive Scenario

10.3.1 New Product Launches

11 Company Profiles (Page No. - 110)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Original Equipment Manufacturer

11.1.1 Keysight Technologies

11.1.2 National Instruments

11.1.3 Chroma ATE

11.1.4 Tektronix

11.1.5 Yokogawa Electric

11.1.6 Rohde & Schwarz

11.1.7 Artisan Technology Group

11.1.8 Vx Instruments

11.1.9 Ossila

11.1.10 Marvin Test Solutions

11.2 Distributors

11.2.1 Amplicon Liveline

11.2.2 Mouser Electronics

11.2.3 Entest

11.2.4 Dan-El Technologies

11.2.5 Testequity

11.2.6 Transcat

11.2.7 Vigven

11.2.8 Ttid (Thurlby Thandar Instrument Distribution)

11.2.9 Element14

11.2.10 Testpower

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 141)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 RelATEd Reports

12.6 Author Details

List of Tables (105 Tables)

Table 1 Precision Source Measure Unit Market: Players/Companies Connected

Table 2 Precision Source Measure Unit Market: Industry/Country Analysis

Table 3 Precision Source Measure Unit Market Snapshot

Table 4 Precision Source Measure Unit, By Current Range, 20172024 (USD Thousand)

Table 5 1 ΅a 1 Ma: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 6 1 Ma 1 A: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 7 Above 1 A: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 8 Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 9 Benchtop: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 10 Modular: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 11 Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 12 Aerospace, Defense & Government Services: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 13 Automotive: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 14 Energy: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 15 Wireless Communication & Infrastructure: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 16 Others: Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 17 Precision Source Measure Unit Market Size, By Region, 20172024 (USD Thousand)

Table 18 North America: Precision Source Measure Unit Market Size, By Current Range, 20172024 (USD Thousand)

Table 19 North America: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 20 North America: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 21 Aerospace, Defense & Government Services: North America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 22 Automotive: North America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 23 Energy: North America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 24 Wireless Communication & Infrastructure: North America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 25 Others: North America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 26 North America: Precision Source Measure Unit Market Size, By Country, 20172024 (USD Thousand)

Table 27 US: Precision Source Measure Unit Market Size, By Form Factor,20172024 (USD Thousand)

Table 28 US: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 29 Canada: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 30 Canada: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 31 Mexico: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 32 Mexico: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 33 Asia Pacific: Precision Source Measure Unit Market Size, By Current Range, 20172024 (USD Thousand)

Table 34 Asia Pacific: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 35 Asia Pacific: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 36 Aerospace, Defense & Government Services: Asia Pacific Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 37 Automotive: Asia Pacific Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 38 Energy: Asia Pacific Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 39 Wireless Communication & Infrastructure: Asia Pacific Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 40 Others: Asia Pacific Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 41 Asia Pacific: Precision Source Measure Unit Market Size, By Country, 20172024 (USD Thousand)

Table 42 Australia: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 43 Australia: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 44 Japan: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 45 Japan: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 46 India: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 47 India: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 48 China: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 49 China: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 50 South Korea: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 51 South Korea: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 52 Rest of Asia Pacific: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 53 Rest of Asia Pacific: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 54 Europe: Precision Source Measure Unit Market Size, By Current Range, 20172024 (USD Thousand)

Table 55 Europe: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 56 Europe: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 57 Aerospace, Defense & Government Services: Europe Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 58 Automotive: Europe Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 59 Energy: Europe Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 60 Wireless Communication & Infrastructure: Europe Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 61 Others: Europe Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 62 Europe: Precision Source Measure Unit Market Size, By Country, 20172024 (USD Thousand)

Table 63 Germany: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 64 Germany: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 65 France: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 66 France: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 67 UK: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 68 UK: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 69 Spain: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 70 Spain: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 71 Russia: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 72 Russia: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 73 Italy: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 74 Italy: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 75 Rest of Europe: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 76 Rest of Europe: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 77 Middle East & Africa: Precision Source Measure Unit Market Size, By Current Range, 20172024 (USD Thousand)

Table 78 Middle East & Africa: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 79 Middle East & Africa: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 80 Aerospace, Defense & Government Services: Middle East & Africa Precision Source Measure Unit Market, By Sub-Region, 20172024 (USD Thousand)

Table 81 Automotive: Middle East & Africa Precision Source Measure Unit Market, By Sub-Region, 20172024 (USD Thousand)

Table 82 Energy: Middle East & Africa Precision Source Measure Unit Market, By Sub-Region, 20172024 (USD Thousand)

Table 83 Wireless Communication & Infrastructure: Middle East & Africa Precision Source Measure Unit Market, By Sub-Region, 20172024 (USD Thousand)

Table 84 Others: Middle East & Africa Precision Source Measure Unit Market, By Sub-Region, 20172024 (USD Thousand)

Table 85 Middle East & Africa: Precision Source Measure Unit Market Size, By Sub-Region, 20172024 (USD Thousand)

Table 86 Middle East: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 87 Middle East: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 88 Africa: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 89 Africa: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 90 South America: Precision Source Measure Unit Market Size, By Current Range, 20172024 (USD Thousand)

Table 91 South America: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 92 South America: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 93 Aerospace, Defense & Government Services: South America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 94 Automotive: South America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 95 Energy: South America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 96 Wireless Communication & Infrastructure: South America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 97 Others: South America Precision Source Measure Unit Market, By Country, 20172024 (USD Thousand)

Table 98 South America: Precision Source Measure Unit Market Size, By Country, 20172024 (USD Thousand)

Table 99 Brazil: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 100 Brazil: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 101 Argentina: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 102 Argentina: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 103 Chile: Precision Source Measure Unit Market Size, By Form Factor, 20172024 (USD Thousand)

Table 104 Chile: Precision Source Measure Unit Market Size, By Application, 20172024 (USD Thousand)

Table 105 Developments of Key Players in the Market, 2015 December 2019

List of Figures (35 Figures)

Figure 1 Precision Source Measure Unit Market: Research Design

Figure 2 Research Methodology: Illustration of Precision Source Measure Unit Market Company Revenue Estimation (2018)

Figure 3 Ranking of Key Players, 2018

Figure 4 Data Triangulation Methodology

Figure 5 Key Service Providers Point of View

Figure 6 1 Ma 1 A Segment By Current Range Type is Expected to Dominate the Precision Smu Market During the Forecast Period

Figure 7 Modular Source Measure Unit, By Form Factor, is Expected to Witness Highest Cagr During the Forecast Period

Figure 8 Automotive Segment, By Application, is Expected to Lead the Precision Source Measure Unit Market During the Forecast Period

Figure 9 North America Dominated the Precision Source Measure Unit Market in 2018

Figure 10 Advent of 5g Technology and Deployment of Lte Networks Expected to Drive Precision Source Measure Unit Market, 20192024

Figure 11 1 Ma 1 A Dominated the Precision Source Measure Unit Market, By Current Range, in 2018

Figure 12 Modular Segment, By Form Factor Type, Dominated the Precision Source Measure Unit Market in 2018

Figure 13 Automotive Segment, By Application, Dominated the Precision Source Measure Unit Market, in 2018

Figure 14 Aerospace, Defense & Government Services (Application) and the Us (Country) Dominated the North America Precision Source Measure Unit Market in 2018

Figure 15 North America is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 16 Drivers, Restraints, Opportunities & Challenges: Precision Source Measure Unit

Figure 17 Electric Vehicle Ev30@30 Scenario, 2018-2030

Figure 18 Iot Device Volume Growth, 2015-2020 (Million Units)

Figure 19 Precision Source Measure Unit Market, By Application, 2018

Figure 20 Regional Snapshot (20192024): North America to Grow at the Highest Cagr During the Forecast Period

Figure 21 North America is Expected to Dominate the Precision Source Measure Unit Market During the Forecast Period

Figure 22 North America: Precision Source Measure Unit Market Overview, 2018

Figure 23 Asia Pacific: Precision Source Measure Unit Market Overview, 2018

Figure 24 Key Developments in the Precision Source Measure Unit Market, June 2015 to December 2019

Figure 25 Ranking of Key Players, 2018

Figure 26 Keysight Technologies: Company Snapshot

Figure 27 Keysight Technologies: SWOT Analysis

Figure 28 National Instruments: Company Snapshot

Figure 29 National Instruments: SWOT Analysis

Figure 30 Chroma ATE: Company Snapshot

Figure 31 Chroma ATE: SWOT Analysis

Figure 32 Tektronix: SWOT Analysis

Figure 33 Yokogawa Electric: Company Snapshot

Figure 34 Yokogawa Electric: SWOT Analysis

Figure 35 Rohde & Schwarz: Company Snapshot

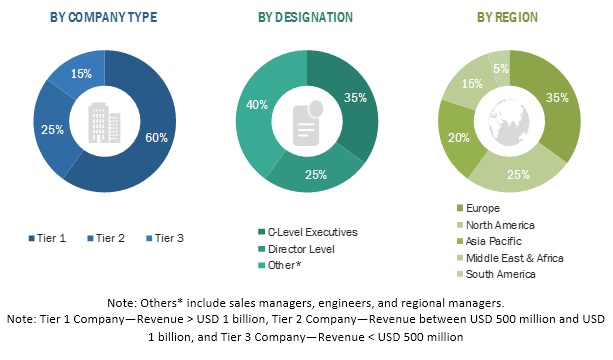

This study involved four major activities in estimating the current size of the global precision source measure unit market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global precision source unit market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The precision source measure unit market comprises several stakeholders, such as product manufacturers and end-users in the supply chain. The demand-side of this market is characterized by its companies operating within the industries, such as aerospace, defense & government services, automotive, energy, and wireless communication & infrastructure, consumer electronics & appliance, and medical equipment manufacturing. The supply-side is characterized by precision source measure unit equipment manufacturers, component providers, and distributors. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents are given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global precision source measure unit market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall precision source measure unit market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the precision source measure units, R&D investments, and end-user sectors.

Report Objectives

- To define, describe, segment, and forecast the global precision source measure unit market based on the form factor, current range, application, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the global precision source measure unit market with respect to individual growth trends, future market expansions, and the contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the global precision source measure unit market with respect to the main regions [North America; Asia Pacific; Europe; Middle East & Africa; and South America]

- To profile and rank key players in the global precision source measure unit market and comprehensively analyze their market share

- To analyze competitive developments such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations in the precision source measure unit market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Precision Source Measure Unit Market