Accelerometer and Gyroscope Market by Accelerometer Type (MEMS, Piezoelectric, and Piezoresistive), Gyroscope Type (MEMS, FOG, RLG, HRG, and DTG), Dimension (1, 2, and 3 Axis), Application (Low End and High End), and Geography - Global Forecast to 2022

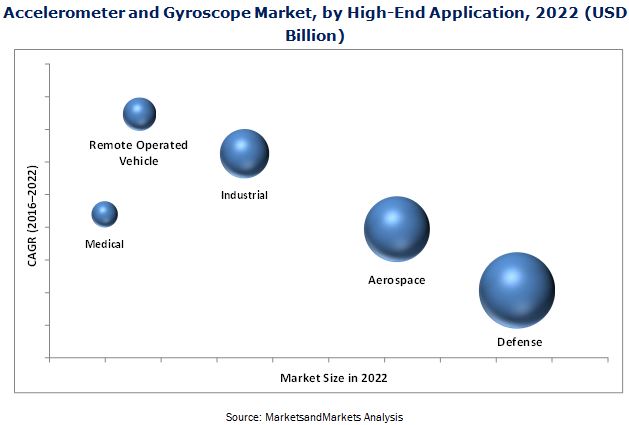

The accelerometer and gyroscope market is expected to reach USD 3.50 Billion by 2022. The high-end market is expected to grow at a CAGR of 3.8% between 2016 and 2022, to reach USD 2.07 Billion by 2022 from USD 1.59 Billion in 2015. Continuously increasing defense expenditure globally majorly drives the high-end accelerometer & gyroscope market, whereas the overall market is driven by factors such as the huge demand from the consumer electronics industry; stringent government regulations for the automotive industry; the emergence of efficient, economic, and compact MEMS technology; growing adoption of automation in industries and homes; and rising demand from emerging economies. For this study, the base year considered is 2015 and the market forecast provided is between 2016 and 2022.

The prime objectives of this report can be summarized in the following points:

- To define, describe, and forecast the global accelerometer and gyroscope market on the basis of type, dimension, application, and geography

- To analyze competitive developments such as joint ventures, mergers and acquisitions, and new product launches, along with research and development (R&D) in the accelerometer & gyroscope market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of accelerometer & gyroscope market

- To strategically profile the key players of the accelerometer & gyroscope market and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and the details of the competitive landscape for the market leaders.

The huge demand from the consumer electronics industry; stringent government regulations for the automotive industry; the emergence of efficient, economic, and compact MEMS technology; growing adoption of automation in industries and homes; and rising demand from emerging economies are the driving factors which will be making the overall accelerometer and gyroscope market to be worth USD 3.50 Billion by 2022. The increase in the defense expenditure globally is also making the high-end accelerometer and gyroscope to grow at an expected CAGR of 3.8% between 2016 and 2022. The market for high-end accelerometer and gyroscope is expected to reach USD 2.07 Billion from USD 1.59 Billion in 2015.

The accelerometer and gyroscope market has been segmented into different types of accelerometers and gyroscopes. The types of accelerometers include MEMS accelerometers, piezoelectric accelerometers, piezoresistive accelerometers, and others. The types of gyroscopes include MEMS gyroscopes, ring laser gyroscopes, fiber-optic gyroscopes, hemispherical resonator gyroscopes, dynamically tuned gyroscopes, and others. Among all the major types, MEMS accelerometers and gyroscopes are expected to hold the largest share in terms of value in 2016.

The market has also been segmented on the basis of axial dimensions into 1 axis, 2 axis, and 3 axis. Of all the mentioned dimensions, 3-axis accelerometer and gyroscope market held the largest share in 2015 and trend is expected to remain the same by 2022. This can be attributed to the growing level of integration, which is driving manufacturers to integrate several functionalities in one system to reduce the number of components per device and to reduce the size and weight of the overall product, for which 3-axis devices are highly suitable. The 1-axis accelerometer & gyroscope market held the second largest share in 2015 and is expected to be succeeded by 2-axis accelerometer and gyroscope by 2022.

The accelerometer and gyroscope market has been segmented on the basis of application into low-end applications and high-end applications. Low-end applications include transportation, electronics, and others including augmented and virtual reality, home automation, IoT, and structural health monitoring, among others. The high-end applications include defense, aerospace, remotely operated vehicle, industrial, and medical. High-end applications are the fastest-growing applications of the accelerometer and gyroscopes. Among all the major high-end applications, the remotely operated vehicles segment is expected to grow at the highest CAGR owing to the huge demand for remotely operated vehicles from the defense as well as commercial sectors.

The accelerometer and gyroscope market has also been broadly classified on the basis of geography into the Americas, Europe, Asia-Pacific (APAC), and Rest of the World (RoW). The Asia-Pacific region accounted for the largest market size followed by Americas with second largest market size of the market in 2015. APAC is emerging as the manufacturing hub for low-end applications such as automotive and consumer electronics. Hence, the accelerometer & gyroscope market holds a comparatively large share in the APAC region and is expected to follow the same trend during the forecast period.

The accelerometer and gyroscope market, the low return on investment and the growing level of integration are the challenges for this market. Furthermore, the highly complex manufacturing process and demanding cycle time as well as the capital-intensive applications inhibit the growth of this market. However, factors such as the growing demand for wearable electronics, commercialization of IoT, introduction of advanced consumer applications, rising demand for unmanned vehicles, and increase in fleet size in commercialization aviation can generate significant opportunities for this market in the near future.

The key players in the accelerometer and gyroscope market are Analog Devices Inc. (U.S.), Colibrys Ltd. (Switzerland), Fizoptika Corp. (Russia), Honeywell International, Inc. (U.S.), InnaLabs (Ireland), InvenSense, Inc. (U.S.), Kionix, Inc. (U.S.), KVH Industries, Inc. (U.S.), Murata Manufacturing Co., Ltd. (Japan), Northrop Grumman LITEF GmbH (Germany), NXP Semiconductors N.V. (Netherlands), Robert Bosch GmbH (Germany), Sensonsor AS (Norway), STMicroelectronics N.V. (Switzerland), and Systron Donner Inertial (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Supply- and Demand-Side Analysis

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.3.3 Market Ranking Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 39)

4.1 Attractive Market Opportunities in the Global Accelerometer and Gyroscope Market

4.2 Accelerometer & Gyroscope Market, By Dimension

4.3 Accelerometer & Gyroscope Market, By Type

4.4 Country-Wise Analysis of the Accelerometer & Gyroscope Market

4.5 Accelerometer & Gyroscope Market Size, By Region

4.6 Accelerometer & Gyroscope Market, By Application

4.7 Accelerometer & Gyroscope Market Life Cycle Analysis, By Application (2016)

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 Accelerometer & Gyroscope Market, By Type

5.3.2 Accelerometer & Gyroscope Market, By Dimension

5.3.3 Accelerometer & Gyroscope Market, By Application

5.3.4 Accelerometer & Gyroscope Market, By Geography

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Huge Demand From Consumer Electronics Industry

5.4.1.2 Stringent Government Regulations for the Automotive Industry

5.4.1.3 Emergence of Efficient, Economic, and Compact MEMS Technology

5.4.1.4 Growing Adoption of Automation in Industries and Homes

5.4.1.5 Rising Demand From Emerging Economies

5.4.1.6 Increasing Defense Expenditure Globally

5.4.2 Restraints

5.4.2.1 Highly Complex Manufacturing Process and Demanding Cycle Time

5.4.2.2 Capital-Intensive Applications

5.4.3 Opportunities

5.4.3.1 Growing Demand for Wearable Electronics

5.4.3.2 Commercialization of Iot

5.4.3.3 Introduction of Advanced Consumer Applications

5.4.3.4 Rising Demand for Unmanned Vehicles

5.4.3.5 Increase in Fleet Size in Commercial Aviation

5.4.4 Challenges

5.4.4.1 Low Return on Investment

5.4.4.2 Growing Level of Integration

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Competitive Rivalry

7 Accelerometer and Gyroscope Market, By Type (Page No. - 68)

7.1 Introduction

7.2 Accelerometer

7.2.1 MEMS Accelerometer

7.2.2 Piezoelectric Accelerometer

7.2.3 Piezoresistive Accelerometer

7.2.4 Others

7.3 Gyroscope

7.3.1 MEMS Gyroscope

7.3.2 Ring Laser Gyroscope (RLG)

7.3.3 Fiber-Optic Gyrocope (FOG)

7.3.4 Hemispherical Resonator Gyroscope (HRG)

7.3.5 Dynamically Tuned Gyroscope (DTG)

7.3.6 Others

8 Accelerometer and Gyroscope Market, By Dimension (Page No. - 83)

8.1 Introduction

8.2 1 Axis

8.3 2 Axis

8.4 3 Axis

9 Accelerometer and Gyroscope Market, By Application (Page No. - 94)

9.1 Introduction

9.2 Low-End Application

9.2.1 Transportation

9.2.1.1 Railway

9.2.1.2 Automotive

9.2.2 Electronics

9.2.2.1 Smartphones, Tablets, and Laptops

9.2.2.2 Wearable Devices

9.2.2.3 Portable Navigation Devices (PNDS)

9.2.2.4 Portable Media Players

9.2.2.5 Digital Cameras

9.2.2.7 Other Electronic Devices

9.2.3 Others

9.2.3.1 Home Automation

9.2.3.2 Iot

9.2.3.3 Structural Health Monitoring

9.3 High-End Application

9.3.1 Defense

9.3.2 Aerospace

9.3.2.1 Commercial Aircraft

9.3.2.2 Military Aircraft

9.3.2.3 Spacecraft

9.3.3 Remotely Operated Vehicle (ROV)

9.3.3.1 Unmanned Underwater Vehicle (UUV)

9.3.3.2 Unmanned Aerial Vehicle (UAV)

9.3.3.3 Unmanned Ground Vehicle (UGV)

9.3.4 Industrial

9.3.4.1 Stabilization

9.3.4.2 Flow/Level Sensors

9.3.4.3 Others

9.3.5 Medical

10 Geographic Analysis (Page No. - 119)

10.1 Introduction

10.2 Americas

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.2.4 Brazil

10.2.5 Rest of the Americas

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 China

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East

10.5.2 Africa

11 Competitive Landscape (Page No. - 133)

11.1 Overview

11.2 Market Rank Analysis

11.3 Competitive Scenario

11.3.1 New Product Launches

11.3.2 Acquisitions, Expansions, Partnerships, and Agreements

12 Company Profiles (Page No. - 138)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Introduction

12.2 Robert Bosch GmbH

12.3 Stmicroelectronics N.V.

12.4 Analog Devices, Inc.

12.5 Colibrys Ltd.

12.6 Honeywell International, Inc.

12.7 Northrop Grumman Litef GmbH

12.8 KVH Industries, Inc.

12.9 Murata Manufacturing Co., Ltd.

12.10 NXP Semiconductors N.V.

12.11 Invensense, Inc.

12.12 Kionix, Inc.

12.13 Fizoptika Corp.

12.14 Innalabs Holding Inc.

12.15 Sensonor as

12.16 Systron Donner Inertial

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 172)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (69 Tables)

Table 1 Various Government Regulations for the Automotive Industry

Table 2 Porter’s Five Forces Analysis With Their Weightage Impact

Table 3 Accelerometer & Gyroscope Market, 2014–2022 (USD Million)

Table 4 Accelerometer & Gyroscope Market, 2014–2022 (Million Units)

Table 5 Accelerometer Market, By Type, 2014–2022 (USD Million)

Table 6 MEMS Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 7 MEMS Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 8 Piezoelectric Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 9 Piezoelectric Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 10 Piezoresistive Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 11 Piezoresistive Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 12 Accelerometer Market for Other Types, By High-End Application, 2014–2022 (USD Million)

Table 13 Gyroscope Market, By Type, 2014–2022 (USD Million)

Table 14 MEMS Gyroscope Market, By Low-End Application, 2014–2022 (USD Million)

Table 15 MEMS Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 16 Ring Laser Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 17 Fiber-Optic Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 18 Hemispherical Resonator Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 19 Dynamically Tuned Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 20 Gyroscope Market for Other Types, By High-End Application, 2014–2022 (USD Million)

Table 21 Accelerometer Market, By Dimension, 2014–2022 (USD Million)

Table 22 Gyroscope Market, By Dimension, 2014–2022 (USD Million)

Table 23 1-Axis Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 24 1-Axis Gyroscope Market, By Low-End Application, 2014–2022 (USD Million)

Table 25 1-Axis Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 26 1-Axis Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 27 2-Axis Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 28 2-Axis Gyroscope Market, By Low-End Application, 2014–2022 (USD Million)

Table 29 2-Axis Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 30 2-Axis Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 31 3-Axis Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 32 3-Axis Gyroscope Market, By Low-End Application, 2014–2022 (USD Million)

Table 33 3-Axis Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 34 3-Axis Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 35 Accelerometer Market, By Application Type, 2014–2022 (USD Million)

Table 36 Accelerometer Market, By Application Type, 2014–2022 (Million Units)

Table 37 Gyroscope Market, By Application Type, 2014–2022 (USD Million)

Table 38 Gyroscope Market, By Application Type, 2014–2022 (Million Units)

Table 39 Accelerometer Market, By Low-End Application, 2014–2022 (USD Million)

Table 40 Accelerometer Market, By Low-End Application, 2014–2022 (Million Units)

Table 41 Gyroscope Market, By Low-End Application, 2014–2022 (USD Million)

Table 42 Gyroscope Market, By Low-End Application, 2014–2022 (Million Units)

Table 43 Accelerometer Market for Transportation Application, By Type, 2014–2022 (USD Million)

Table 44 Accelerometer Market for Other Low-End Applications, By Type, 2014–2022 (USD Million)

Table 45 Accelerometer Market, By High-End Application, 2014–2022 (USD Million)

Table 46 Accelerometer Market, By High-End Application, 2014–2022 (Million Units)

Table 47 Gyroscope Market, By High-End Application, 2014–2022 (USD Million)

Table 48 Gyroscope Market, By High-End Application, 2014–2022 (Million Units)

Table 49 Accelerometer Market for Defense Application, By Type, 2014–2022 (USD Million)

Table 50 Gyroscope Market for Defense Application, By Type, 2014–2022 (USD Million)

Table 51 Accelerometer Market for Aerospace Application, By Type, 2014–2022 (USD Million)

Table 52 Gyroscope Market for Aerospace Application, By Type, 2014–2022 (USD Million)

Table 53 Accelerometer Market for Remotely Operated Vehicle Application, By Type, 2014–2022 (USD Million)

Table 54 Gyroscope Market for Remotely Operated Vehicle Application, By Type, 2014–2022 (USD Million)

Table 55 Accelerometer Market for Industrial Application, By Type, 2014–2022 (USD Million)

Table 56 Gyroscope Market for Industrial Application, By Type, 2014–2022 (USD Million)

Table 57 Accelerometer Market for Medical Application, By Type, 2014–2022 (USD Million)

Table 58 Gyroscope Market for Medical Application, By Type, 2014–2022 (USD Million)

Table 59 Accelerometer & Gyroscope Market, By Region, 2014–2022 (USD Million)

Table 60 Accelerometer Market, By Region, 2014–2022 (USD Million)

Table 61 Gyroscope Market, By Region, 2014–2022 (USD Million)

Table 62 Accelerometer & Gyroscope Market in Americas, By Country, 2014–2022 (USD Million)

Table 63 Accelerometer & Gyroscope Market in Europe, By Country, 2014–2022 (USD Million)

Table 64 Accelerometer & Gyroscope Market in APAC, By Country, 2014–2022 (USD Million)

Table 65 Accelerometer & Gyroscope Market in RoW, By Region, 2014–2022 (USD Million)

Table 66 Top 5 Players in the Acceleromoeter & Gyroscoepe Market for Low-End Application, 2015

Table 67 Top 5 Players in the Accelerometer & Gyroscope Market for High-End Application, 2015

Table 68 10 Most Recent New Product Launches in the Accelerometer and Gyroscope Market

Table 69 5 Most Recent Acquisitions, Expansions, Partnerships, and Agreements in the Accelerometer and Gyroscope Market

List of Figures (75 Figures)

Figure 1 Accelerometer and Gyroscope Market: Research Design

Figure 2 Secondary Sources Distribution

Figure 3 IoT Ecosystem Taxonomy

Figure 4 Time-Scale Analysis

Figure 5 Delphi Method

Figure 6 Process Flow

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Market Breakdown & Data Triangulation

Figure 10 Assumptions of the Research Study

Figure 11 3-Axis Accelerometers and Gyroscopes to Hold the Largest Market Share During the Forecast Period

Figure 12 MEMS Accelerometer and Gyroscope Accounts for the Largest Market Share in 2016

Figure 13 Accelerometers and Gyroscopes Used in Remotely Operated Vehicle Applications to Grow at the Highest CAGR During the Forecast Period

Figure 14 Americas Likely to Be the Fastest-Growing Region in the Accelerometer and Gyroscope Market During the Forecast Period

Figure 15 Emergence of Advanced Applications Expected to Increase the Demand for Accelerometers and Gyroscopes

Figure 16 3-Axis Accelerometers and Gyroscopes Expected to Hold A Large Size of the Market During the Forecast Period

Figure 17 MEMS Accelerometers and Gyroscopes Have Highest Demand in 2016

Figure 18 U.S. Expected to Hold the Largest Share of the Accelerometer and Gyroscope Market in 2016

Figure 19 Accelerometer and Gyroscope Market in the Americas Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Remotely Operated Vehicle and Industrial Applications Recently Entered the Growth Stage and are Expected to Grow at the Highest Rate in the Near Future

Figure 21 Evolution of the Accelerometer and Gyroscope Market

Figure 22 Accelerometer and Gyroscope Market, By Geography

Figure 23 Emergence of Efficient, Economic, and Compact MEMS Technology to Propel the Demand for Accelerometers and Gyroscopes

Figure 24 Total Smartphone Users in the World (2014–2020)

Figure 25 Defense Expenditure By Top 10 Countries in 2015

Figure 26 Estimated New Airplane Deliveries Between 2016 and 2035

Figure 27 Value Chain Analysis: Major Value Added During the Original Equipment Manufacturing and System Integration Phases

Figure 28 Porter’s Five Force Model for Accelerometer and Gyroscope Market, 2016

Figure 29 Porter’s Five Forces Analysis

Figure 30 High Dominance of Existing Players and Moderate Growth Rate are Decreasing the Impact of Threat of New Entrants

Figure 31 Low Threat of Substitutes Owing to Lack of Viable Alternatives

Figure 32 Medium Impact of Bargaining Power of Suppliers Due to High Switching Costs and Low Supplier Concentration

Figure 33 Buyer Volume Leverage and High Buyer Concentration vs Industry Strengthening the Buyers’ Bargaining Power

Figure 34 High Degree of Competitive Rivalry in the Market Owing to Presence of Large Number of Players

Figure 35 Gyroscope Market Expected to Hold A Larger Size During the Forecast Period

Figure 36 MEMS Accelerometer Expected to Hold the Largest Size of the Accelerometer Market Based on Type During the Forecast Period

Figure 37 Hemispherical Resonator Gyroscope Expected to Grow at the Highest Rate During the Forecast Period

Figure 38 3-Axis Accelerometer Expected to Hold the Largest Size of the Accelerometer Market Based on Dimension During the Forecast Period

Figure 39 2-Axis and 3-Axis Gyroscopes Expected to Grow at the Highest Rate During the Forecast Period

Figure 40 Accelerometer Market for High-End Applications Expected to Grow at A High Rate Than That of Low-End Applications During the Forecast Period

Figure 41 High-End Application Expected to Dominate the Gyroscope Market During the Forecast Period

Figure 42 Accelerometer Market for Other Low-End Applications Expected to Growing at the Highest Rate During the Forecast Period

Figure 43 Gyroscope Market for Other Low-End Applications to Grow at the Highest Rate During the Forecast Period

Figure 44 MEMS Gyroscope Market for Transportation Application, 2014–2022 (USD Million)

Figure 45 MEMS Accelerometer Market for Electronics Application, 2014–2022 (USD Million)

Figure 46 MEMS Gyroscope Market for Electronics Application, 2014–2022 (USD Million)

Figure 47 MEMS Gyroscope Market for Other Low-End Applications, 2014–2022 (USD Million)

Figure 48 Accelerometer Market for Remotely Operated Vehicle Application Expected to Grow at the Highet Rate During the Forecast Period

Figure 49 Gyroscope Market for Remotely Operated Vehicle Application Expected to Register the Highest Growth Rate During the Forecast Period

Figure 50 Accelerometer and Gyroscope Market: Geographic Snapshot

Figure 51 Americas: Accelerometer and Gyroscope Market Snapshot

Figure 52 Europe: Accelerometer and Gyroscope Market Snapshot

Figure 53 APAC: Accelerometer and Gyroscope Market Snapshot

Figure 54 RoW: Accelerometer and Gyroscope Market Snapshot

Figure 55 Companies Adopted New Product Launches as the Key Growth Strategy Between January 2014 and October 2016

Figure 56 Accelerometer and Gyroscope Market Evaluation Framework

Figure 57 Battle for the Market Share

Figure 58 Geographic Revenue Mix of Top Market Players

Figure 59 Robert Bosch GmbH: Company Snapshot

Figure 60 Robert Bosch GmbH: SWOT Analysis

Figure 61 Stmicroelectronics N.V.: Company Snapshot

Figure 62 Stmicroelectronics N.V.: SWOT Analysis

Figure 63 Analog Devices, Inc.: Company Snapshot

Figure 64 Analog Devices, Inc.: SWOT Analysis

Figure 65 Colibrys Ltd.: Company Snapshot

Figure 66 Colibrys Ltd.: SWOT Analysis

Figure 67 Honeywell International, Inc.: Company Snapshot

Figure 68 Honeywell International, Inc.: SWOT Analysis

Figure 69 Northrop Grumman Litef GmbH: Company Snapshot

Figure 70 Northrop Grumman Litef GmbH: SWOT Analysis

Figure 71 KVH Industries, Inc.: Company Snapshot

Figure 72 Murata Manufacturing Co., Ltd.: Company Snapshot

Figure 73 NXP Semiconductors N.V.: Company Snapshot

Figure 74 Invensense, Inc.: Company Snapshot

Figure 75 Kionix, Inc.: Company Snapshot

The sizing of the accelerometer and gyroscope market has been done by the top-down and bottom-up approach. The bottom-up approach has been employed to arrive at the overall size of the market from the revenues of key players (companies) and their share in the market. Calculations are made on the basis of the number of accelerometers and gyroscopes used in each type of application, which is further multiplied by the production of various applications for all major countries. Finally, the volume is multiplied by the average selling price of each accelerometer and gyroscope to arrive at the overall market size. In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary research (including study of associations, databases, journals such as The Groupe Speciale Mobile Association (GSMA), U.S. Department of Defense, and others), and primary researches. For the calculation of specific market segments, the most appropriate parent market size has been used to implement the top-down approach.

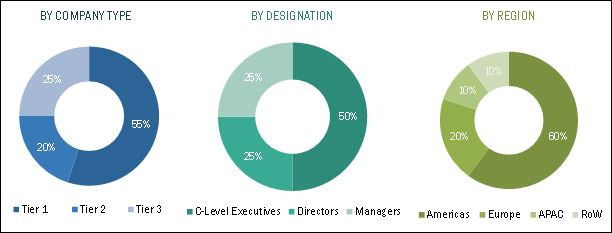

In the process of determining and verifying the market size for several segments and subsegments obtained through secondary research, extensive primary interviews have been conducted with key opinion leaders. The break-up of the profiles of primary participants is given below:

To know about the assumptions considered for the study, download the pdf brochure

The accelerometer and gyroscope ecosystem comprises major players such as Analog Devices Inc. (U.S.), Colibrys Ltd. (Switzerland), Fizoptika Corp. (Russia), Honeywell International Inc. (U.S.), InnaLabs (Ireland), InvenSense, Inc. (U.S.), Kionix, Inc. (U.S.), KVH Industries, Inc. (U.S.), Murata Manufacturing Co., Ltd. (Japan), Northrop Grumman LITEF GmbH (Germany), NXP Semiconductors N.V. (Netherlands), Robert Bosch GmbH (Germany), Sensonsor AS (Norway), STMicroelectronics N.V. (Switzerland), and Systron Donner Inertial (U.S.), among others.

All these companies have their own R&D facilities and extensive sales offices and distribution channels. The products of these companies can be used across various industries for various applications. The report provides the competitive landscape of the key players which indicates their growth strategies in the accelerometer and gyroscope market.

Target Audience:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

“The study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years (depends on range of forecast period) for prioritizing the efforts and investments.”

Scope of the Report:

The market covered in this report has been segmented as follows:

Accelerometer and Gyroscope Market, by Type:

-

Accelerometer

- MEMS Accelerometer

- Piezoelectric Accelerometer

- Piezoresistive Accelerometer

- Others (including Mechanical Accelerometer)

-

Gyroscope

- MEMS Gyroscope

- Ring Laser Gyroscope (RLG)

- Fiber-Optic Gyroscope (FOG)

- Hemispherical Resonator Gyroscope (HRG)

- Dynamically Tuned Gyroscope (DTG)

- Others (including Gyrostat, Vibrating Structure Gyroscope (VSG) or Coriolis Vibratory Gyroscope (CVG), London Moment Gyroscope, and Other Mechanical Gyroscopes)

Accelerometer and Gyroscope Market, by Dimension:

- 1 Axis

- 2 Axis

- 3 Axis

Accelerometer and Gyroscope Market, by Application:

-

Low-End Applications

- Transportation

- Electronics

- Others (including Home Automation, IoT, Structural Health Monitoring, and Augmented and Virtual Reality)

-

High-End Applications

- Defense

- Aerospace

- Remotely Operated Vehicle (ROV)

- Industrial

- Medical

Accelerometer and Gyroscope Market, by Geography:

-

Americas

- U.S.

- Canada

- Mexico

- Brazil

- Rest of the Americas (including Argentina and Chile)

-

Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe (including Spain, Sweden, Switzerland, Finland, the Netherlands, Russia, Ireland, and other East European countries)

-

Asia-Pacific

- Japan

- China

- South Korea

- India

- Rest of APAC (including Australia, Taiwan, Singapore, Indonesia, and the Philippines)

-

Rest of the World

- Middle East

- Africa

Available Customizations:

- Further breakdown of the application segment, by dimension and geography

- Further breakdown of the geography segment, by application

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

Growth opportunities and latent adjacency in Accelerometer and Gyroscope Market