Aircraft Sensors Market Size, Share & Analysis, 2025 To 2030

Aircraft Sensors Market by Sensor Type (Pressure, Proximity, Optical, Force, Radar, Temperature, Motion), Application (Propulsion, Aerostructures & Flight Control, Flight Deck), Connectivity, End Use, Aircraft Type and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

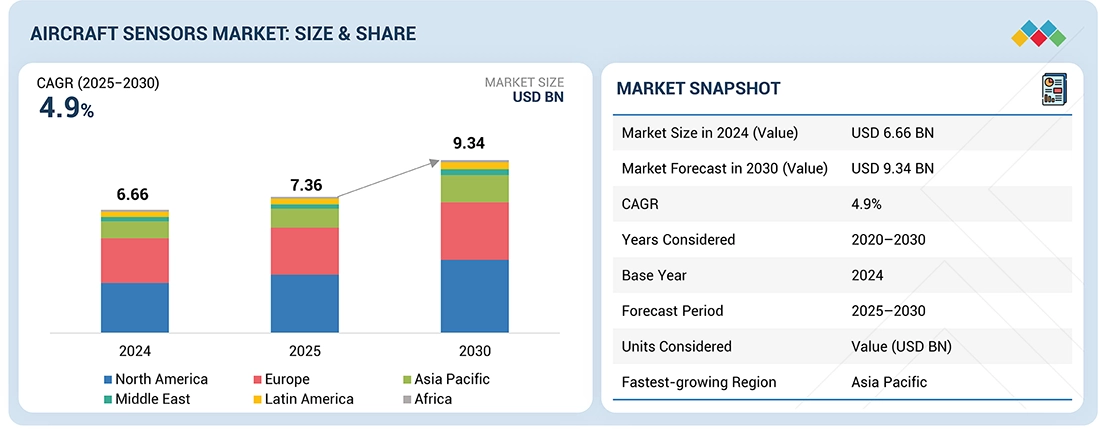

The aircraft sensors market is projected to reach USD 9.34 billion by 2030 from USD 7.36 billion in 2025, at a CAGR of 4.9% from 2025 to 2030. The growth of the aircraft sensors market is driven by theincreasing manufacturing of aircraft and growing air passenger traffic

KEY TAKEAWAYS

- North America is expected to account for a 42.8% share of the aircraft sensors market in 2025.

- By application, the others segment is projected to grow at the fastest rate, registering a CAGR of 6.3%.

- By aircraft type, the advanced air mobility segment is projected to grow at the fastest rate of 59.8%.

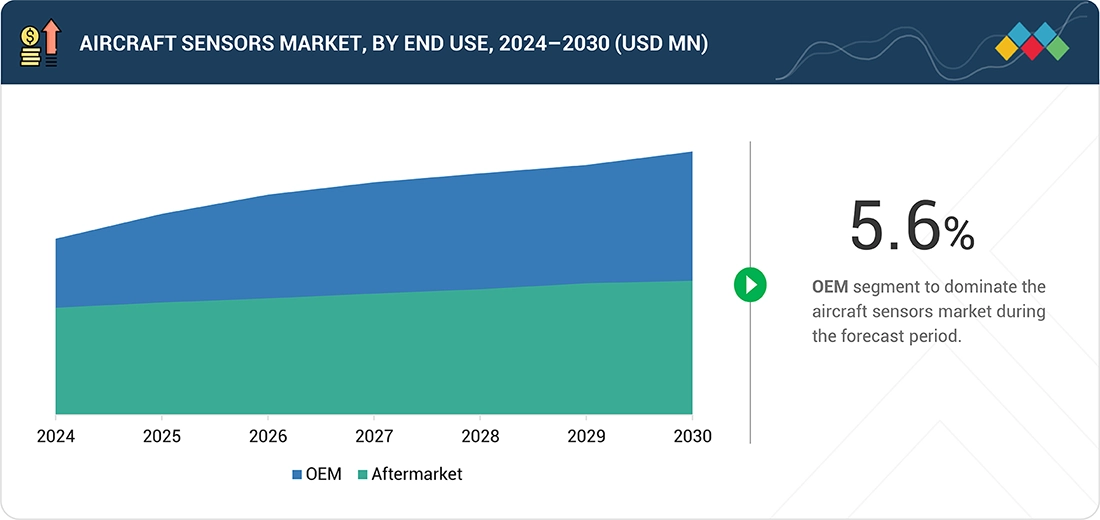

- By end use, the OEM segment is expected to account for the largest market share in 2025.

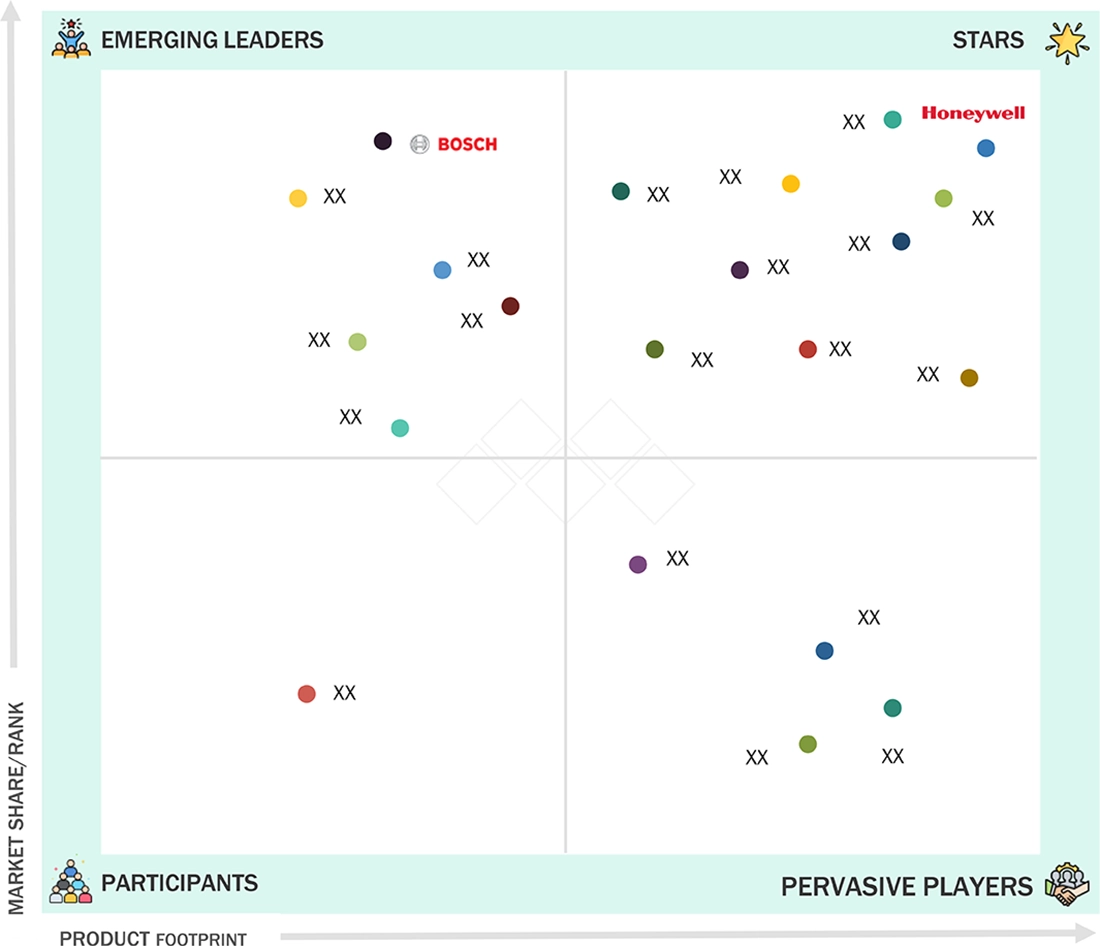

- Honeywell International Inc., Safran, and TE Connectivity were identified as some of the star players in the aircraft sensors market, given their strong market share and product footprint.

- Aerosonic, Sensor Systems LLC, and Circor Aerospace, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Aircraft sensors monitor, control, and process data related to temperature, pressure, vibration, altitude, and fluid levels in aircraft cabins, engines, and fuel systems. These sensors ensure efficient flight control and improved situational awareness among the pilot and the ground support relay system, which, in turn, is expected to fuel its demand.

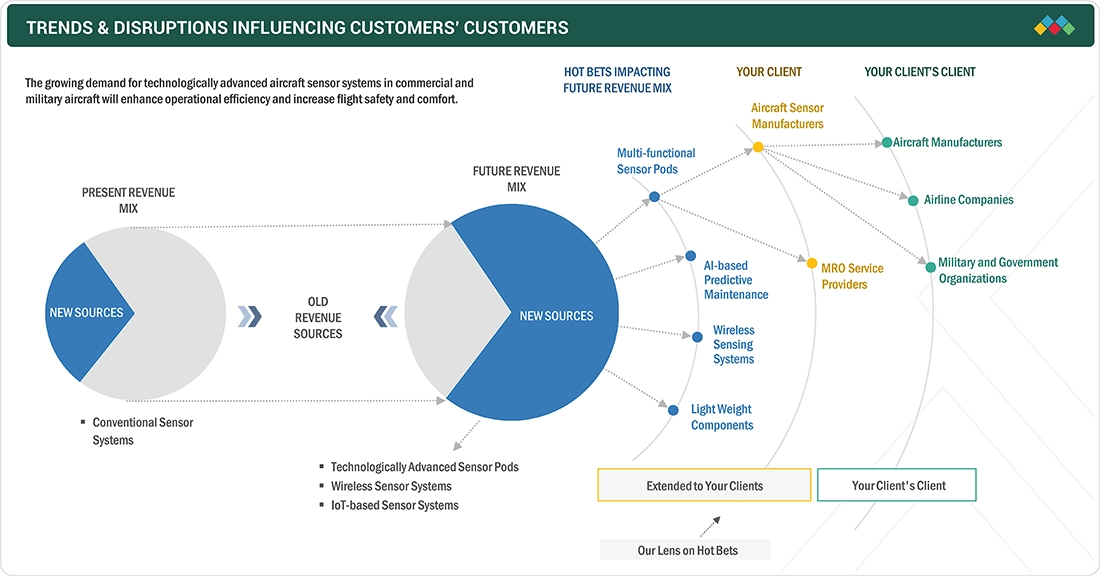

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Many players are investing in advanced manufacturing processes to cater to the demand for high-quality systems. Increasing R&D investments to develop lightweight components are also leading to technological advancements. A rise in the demand for increased efficiency and improved resiliency is expected to fuel the market for aircraft sensors, leading to new revenue opportunities for players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Extensive use of sensors for data sensing.

-

Innovations in microelectromechanical system technology.

Level

-

Need for frequent calibration of sensors.

-

High cost of advanced sensors.

Level

-

Rapid adoption of IoT in aviation.

-

Need for wireless sensors in structural health monitoring.

Level

-

Cybersecurity risks.

-

Complex integration with modern avionics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Extensive use of sensors for data sensing.

The extensive use of sensors for data sensing and measurement has emerged as a critical driver for the aircraft sensors market, reflecting the growing reliance on real-time data to enhance modern aircraft's efficiency, safety, and performance. As aircraft technology advances, sensors are increasingly integrated into various systems for continuous data collection, offering valuable insights that improve decision-making and operational outcomes.

Restraint: Need for frequent calibration of sensors.

Aircraft sensors require regular calibration to deliver accurate data to various onboard systems. These sensors are critical for maintaining flight safety, operational efficiency, and regulatory compliance. For instance, airspeed sensors are frequently calibrated to guarantee the correct functioning of auto-throttle systems and enable precise automatic landing sequences, which are vital in adverse weather conditions or low-visibility scenarios.

Opportunity: Rapid adoption of IoT in aviation.

The Internet of Things (IoT) and sensor networks are advancing rapidly, gaining significant traction across diverse sectors. Wireless sensors are widely adopted, serving as a crucial infrastructure for IoT development. These technologies enhance a comprehensive range of services in the aviation industry, from ensuring aircraft safety to improving passengers' overall travel experience.

Challenge: Cybersecurity risks.

The aviation industry is evolving into a networked open ecosystem exposed to the outside world, replacing closed systems that only communicate with one another. Aircraft OEMs and integrators are employing IoT capabilities to proactively identify maintenance issues, place orders for replacements of faulty parts, and alert the ground maintenance crew while flying to resolve the problems without slowing down operations when the aircraft lands.

Aircraft Sensors Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Engine vibration/temperature sensors powering predictive maintenance on turbofans. | Cuts unplanned AOG and extends time-on-wing through early fault detection. |

|

Air-data and angle-of-attack sensors help the flight computer keep the aircraft within safe limits. | Smoother handling and lower risk of stalls. |

|

Landing-gear load sensors adjust braking and monitor touchdown quality. | Shorter stopping distances and less wear on brakes and tires. |

|

Radar, infrared, and terrain sensors work together to warn of obstacles and rising ground in poor visibility. | Safer approaches and departures with a lower chance of terrain collisions. |

|

GPS and attitude sensors generate a synthetic outside view on cockpit displays. | Better pilot orientation and reduced workload in cloud or at night. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

OEMs play a pivotal role in the aircraft sensors market by designing, developing, and producing advanced sensor solutions that meet stringent aerospace standards. They deliver integrated sensor systems directly to aircraft manufacturers and end users. System integrators are a critical link in the aircraft sensors market by combining various sensor technologies into fully functional subsystems or platforms for end users. End users represent the final segment of the aircraft sensors ecosystem, encompassing commercial airlines, defense forces, and general aviation operators.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aircraft Sensors Market, By Type

The growth of the proximity sensors segment of the aircraft sensors market is driven by the increasing adoption of automated and fly-by-wire systems that require reliable non-contact sensing solutions. The rising demand for enhanced safety and operational efficiency in modern aircraft is accelerating the integration of proximity sensors into critical subsystems. Additionally, the ability of proximity sensors to operate effectively in harsh and extreme environments aligns with evolving industry standards for durability and reliability, driving their widespread adoption.

Aircraft Sensors Market, By Application

Within fuel systems, sensors are integrated into fuel gauging and management systems to monitor fuel levels, activate control valves, and issue alerts in cases of abnormal fuel conditions. In hydraulic and pneumatic systems, sensors support the movement and control of essential components, including flight control surfaces and landing gear mechanisms, by providing accurate data to onboard control units. These systems are vital to the safe and efficient operation of the aircraft, functioning as key enablers of core operations such as braking, steering, actuation, and landing gear deployment.

Aircraft Sensors Market, By Aircraft Type

The commercial aviation segment, comprising narrow-body aircraft, wide-body aircraft, regional transport aircraft. and commercial helicopters, represents a significant share of the aircraft sensors market. The growth of this segment is driven by the rising global demand for air travel, leading to increased production and deliveries of new commercial aircraft to meet passenger traffic growth. Airlines are investing in fuel-efficient and next-generation aircraft, which integrate advanced sensor technologies to enhance operational safety, optimize performance, and reduce maintenance costs.

Aircraft Sensors Market, By End Use

The aftermarket segment in the aircraft sensors market consists of parts and components produced by third-party manufacturers to replace or upgrade original sensor systems. Unlike OEM parts, aftermarket sensors are designed to be compatible with existing aircraft systems and are often a more cost-effective alternative. However, consideration of the consistency, durability, and quality of aftermarket parts remains key in procurement decisions.

Aircraft Sensors Market, By Connectivity

Wireless sensor networks (WSNs) are decentralized systems that rely on wireless connectivity to monitor and transmit physical, environmental, and operational data within an aircraft. . In modern aircraft, WSNs are being adopted in landing gear systems, brake assemblies, and cabin interior structures, offering significant benefits over traditional wired networks. By eliminating complex wiring harnesses, WSNs reduce aircraft weight, simplify installation, and lower maintenance and labor costs.

REGION

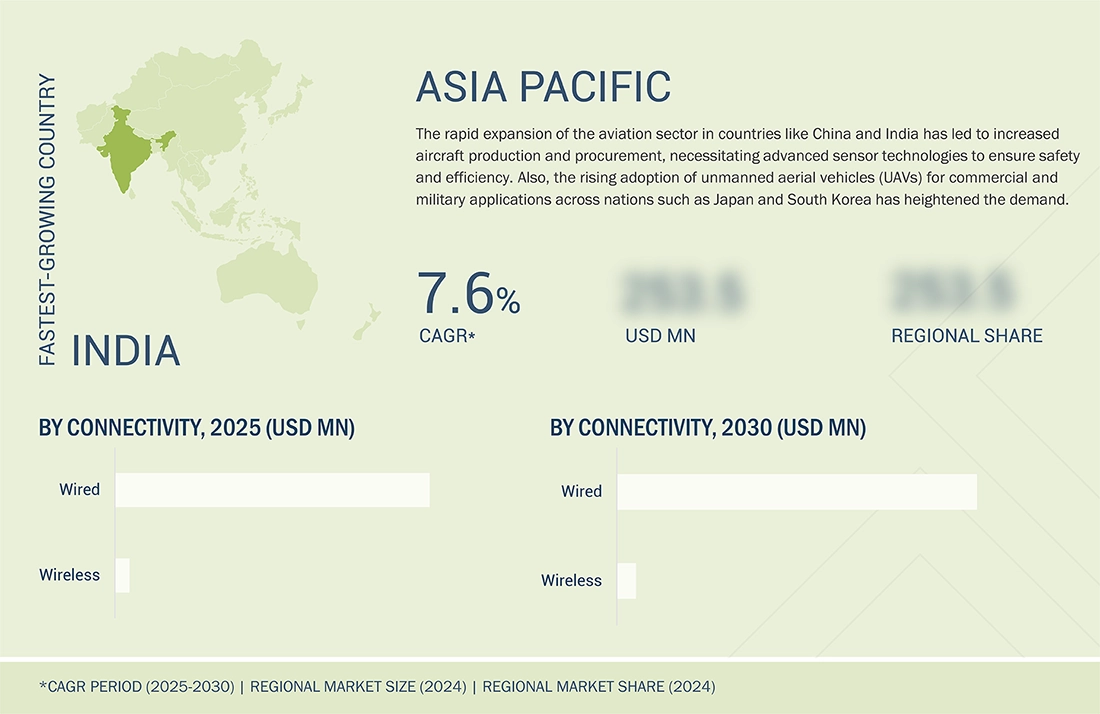

Asia Pacific to be fastest-growing region in global aircraft sensors market during forecast period

The rising defense spending and regional security dynamics influence Asia Pacific’s aircraft sensors market. Countries such as China, India, Japan, and Australia are actively modernizing their air forces and expanding surveillance capabilities, driving the demand for advanced sensor systems. Government-led aerospace initiatives, including indigenous fighter jet and UAV programs, are key contributors to sensor demand. Additionally, regional collaborations, such as ASEAN defense partnerships and Australia’s alliances under AUKUS, are creating opportunities for sensor manufacturers to supply cutting-edge technologies for military and dual-use platforms.

Aircraft Sensors Market: COMPANY EVALUATION MATRIX

Honeywell International Inc. (US), Safran (France), Meggitt PLC (UK), TE Connectivity Ltd. (Switzerland), AMETEK Inc. (US), Lockheed Martin Corporation (US), RTX (US), Thales (France), L3Harris Technologies Inc. (US) and Amphenol Corporation (US) are the star players in the aircraft sensors matrix. Emerging leaders have demonstrated significant product innovations compared to their competitors and have broad product portfolios. Woodward Inc. (US), The Bosch Group (Germany), Trimble Inc. (US), Eaton Corporation (US), TDK Corporation (Japan), and Curtiss-Wright Corporation (US) are the emerging leaders in the ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.66 Billion |

| Market Forecast in 2030 (Value) | USD 9.34 Billion |

| Growth Rate | CAGR of 4.9% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Latin America, Africa |

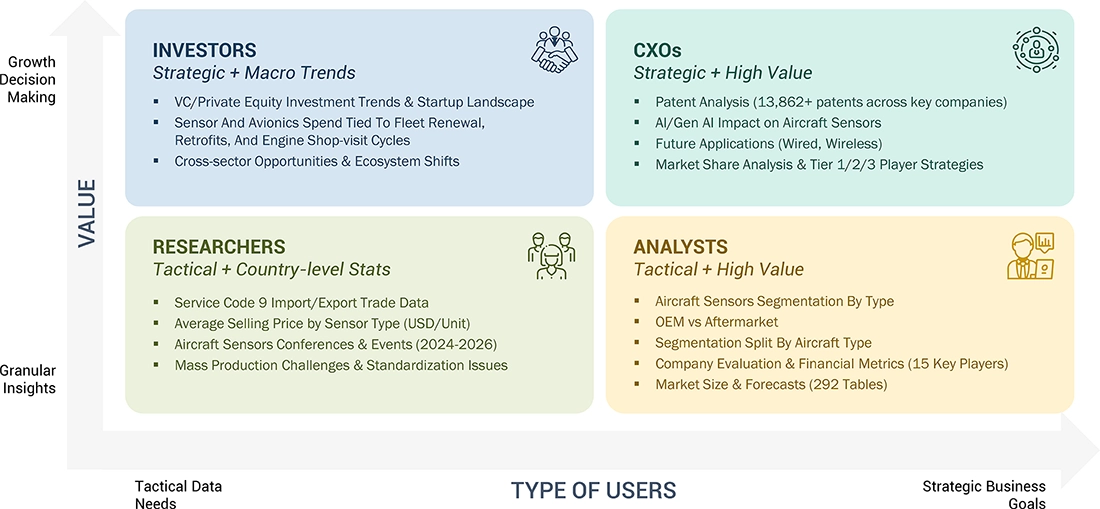

WHAT IS IN IT FOR YOU: Aircraft Sensors Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Sensor OEM | Cross-market analysis by aircraft type, application and sensor type | Highlight opportunities at cross-segment level to understand the current penetration and future growth potential of sensors by application and aircraft categories |

RECENT DEVELOPMENTS

- January 2025 : The US Air Force awarded Lockheed Martin Corporation a contract worth USD 270 million to integrate next-generation infrared defensive sensors on the F-22 Raptor. These sensors are designed to enhance the aircraft’s survivability and lethality significantly

- December 2024 : L3Harris Technologies entered a contract with Airbus Helicopters to equip the latter’s new fleet of multi-role H145M helicopters with WESCAM MX-15D electro-optical/infrared sensor systems.

- December 2024 : Woodward signed a definitive agreement to acquire Safran Electronics & Defense’s electromechanical actuation business in the US, Mexico, and Canada. This acquisition would allow Woodward to enhance its sensor technology portfolio for aircraft systems, particularly in motion control, actuation, and fuel management, further strengthening its presence in the aircraft sensors market.

Table of Contents

Methodology

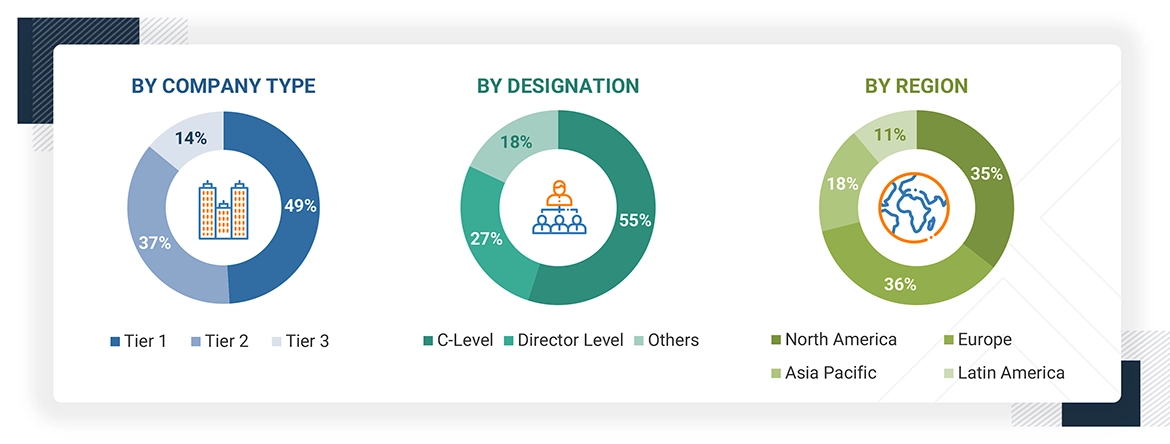

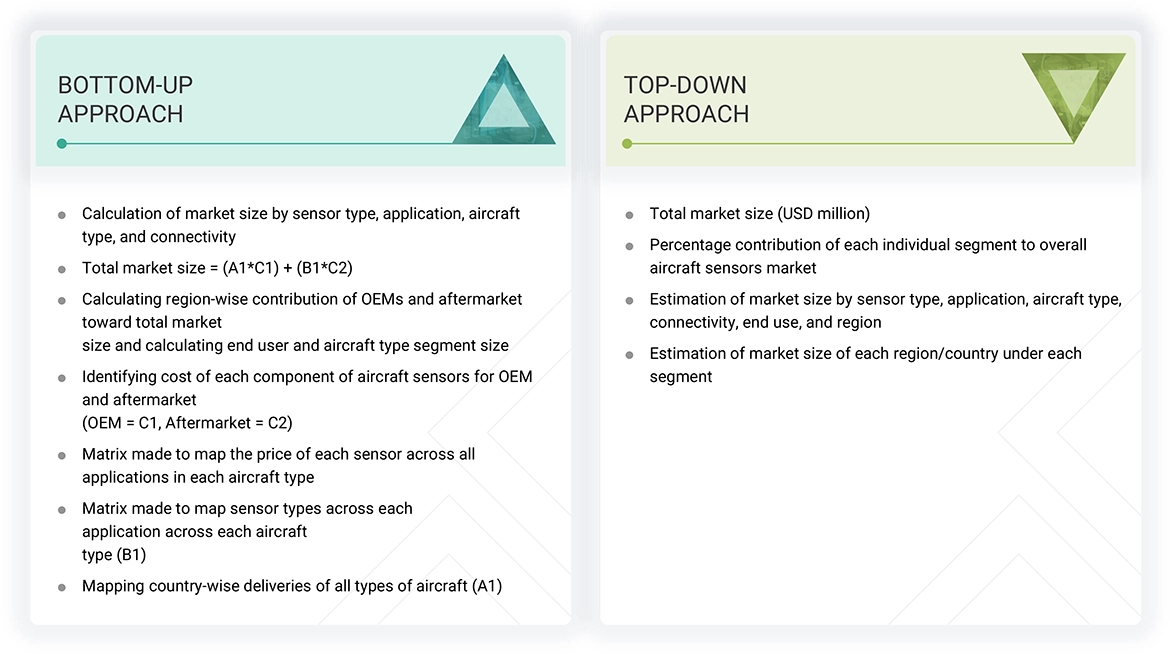

This research study extensively uses secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect relevant information on the aircraft sensors market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess the prospects of the aircraft sensors market. A deductive approach, also known as the top-down approach, has been used to forecast the size of different market segments.

Secondary Research

The ranking of companies operating in the aircraft sensors market has been arrived at based on the secondary data made available through paid and unpaid sources, the analysis of product portfolios of major companies in the market, and their ratings based on their performance and quality. Primary sources have further validated these data points.

Secondary sources referred to for this research study include government sources, such as corporate filings that included annual reports, investor presentations, and financial statements of trade, business, and professional associations. Secondary data has been collected and analyzed to determine the overall market size, which various primary respondents have further validated.

Primary Research

Extensive primary research has been conducted after obtaining information about the aircraft sensors market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply sides across various regions: North America, Europe, Asia Pacific, Latin America, and Africa. Approximately 40% of the primary interviews have been from the demand side, while 60% have been from the supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

Note 1: C-level executives include the CEO, COO, and CTO, among others.

Note 2: Others include sales, marketing, and product managers.

Note 3: The tiers of the companies have been defined based on their total revenue as of 2024.

Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the aircraft sensors market. The figures depicted below represent the overall market size estimation process employed for this study on the aircraft sensors market. The key players in the market have been identified through extensive secondary research. This includes the study of annual and financial reports of the top market players and extensive interviews with leaders, including chief executive officers (CEOs), directors, and marketing executives of leading companies operating in the market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Key market players were identified through secondary research, and their market share was All possible parameters that affect the aircraft sensors market and its segments covered in this research study have been viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Aircraft Sensors Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the size of the aircraft sensors market from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for the market segments and subsegments, the market breakdown and data triangulation procedures have been implemented, wherever applicable. The data has been triangulated by studying various factors from the demand and supply sides. In addition, the market size has been validated using the top-down and bottom-up approaches.

Market Definition

Aircraft sensors are devices used to detect and respond to electrical or physical signals both within and outside an aircraft. Most sensors in an aircraft convert physical signals into usable electrical signals. Safe and effective aircraft handling requires feedback on a wide range of flight conditions and the state of various flight equipment and systems. A wide range of sensors continuously monitor these conditions, feeding information to flight computers for processing before being displayed to the pilot.

Key Stakeholders

- Aircraft Sensors Manufacturers

- Aircraft Sensors Wholesalers, Retailers, and Distributors

- Subcomponent Manufacturers

- Technology Support Providers

- Research Bodies

- System Integrators

- Aircraft Manufacturers

- Airline Operators

- Defense Organizations

Report Objectives

- To define, describe, and forecast the aircraft sensors market based on sensor type, application, aircraft type, end use, connectivity, and region

- To forecast the size of various segments of the market with respect to the following regions: North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the aircraft sensors market

- To provide an overview of the regulatory landscape with respect to aircraft sensor regulations across regions

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To evaluate the degree of competition in the market by analyzing recent developments such as contracts, agreements, and partnerships adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- Infrared Sensors: Infrared sensors detect infrared radiation from objects and convert it to measurable data. They are also used in temperature measurement, engine condition monitoring, and weather detection. They avoid engine failure by revealing overheating or coolant leakage. Infrared sensors are also applied in weather radar systems to determine precipitation and turbulence, enabling secure and efficient flying operations.

- Accelerometers: These systems track acceleration on the x, y, and z axes and help monitor g-forces and dynamic movement. They are needed for flight stability, structural health monitoring, and peak fuel efficiency. Accelerometers detect vibrations and damage and enable predictive maintenance and in-flight adjustments to flight paths during takeoff, turbulence, or high-speed flight.

- Autonomous Systems: These systems utilize sensors such as LiDAR, radar, ultrasonic sensors, and cameras to offer autonomous aerial vehicles and autonomous airplanes obstacle detection, airspace monitoring, and stable flight capabilities. They provide dense environment capabilities and are founded on advanced algorithms for navigation assistance, collision avoidance, and urban air mobility applications.

- Wireless Communications Systems: These systems enable real-time transfer of sensor data between aircraft and ground infrastructure. They offer performance monitoring, remote diagnostics, and predictive maintenance. By allowing communication through Wi-Fi or satellite, operators can monitor aircraft performance and optimize fuel use and scheduling decisions.

- Multi-function and Multi-parameter Sensing: The system tracks several parameters like vibration, temperature, and pressure in a single sensor. This lowers the deployment of individual sensors, thereby reducing aircraft weight and maintenance complexity. Sensor fusion allows more effective system architecture, particularly in engines, flight control, and landing gear assemblies.

- Electric Advanced Fiber Optic Sensing: Fiber optic sensors are light, resistant to electromagnetic interference, and built for harsh environments. They are essential to engine performance and structural health monitoring. Fiber optic sensors generate demand in commercial and defense platforms, particularly in next-generation configurations like UAVs, military fighters, and urban air mobility aircraft.

- Extensive use of sensors for data sensing

- Innovations in microelectromechanical system technology

- Shift toward modern warfare technique

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aircraft Sensors Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aircraft Sensors Market