Adaptive Optics Market by Component (Wavefront Sensor, Wavefront Modulator, Control System), End-User Industry (Consumer, Astronomy, Military & Defense, Biomedical, Industrial & Manufacturing, Communication), and Geography - Global Forecast to 2023

[147 Pages Report] The Adaptive optics market was valued at USD 218.8 Million in 2016 and is expected to reach USD 2,190.9 Million by 2023, growing at a CAGR of 40.8% from 2017 to 2023. The base year used for this study is 2016 and the forecast period is from 2017 to 2023.

Objectives of the Study

- To define, describe, and forecast the overall market, in terms of value, on the basis of components, end-user industry, and geography

- To forecast the market size for various segments with respect to four main regions Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the adaptive optics market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in market for stakeholders and detail the competitive landscape for the market players

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile the key players and comprehensively analyze the market rankings and core competencies

- To analyze the competitive developments such as joint ventures, mergers and acquisitions, product launches, and research and development (R&D) activities in the adaptive optics market

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

- To benchmark players within the market using proprietary Competitive Leadership Mapping, which analyzes market players on various parameters within the broad categories of business and product strategy.

The adaptive optics market is expected grow from USD 218.8 Million in 2016 to USD 2,190.9 Million by 2023, at a CAGR of 40.8% from 2017 to 2023. The major drivers for the growth of this market are the adoption of adaptive optics in ophthalmology and retinal imaging as well as increased government funding. Moreover, advancing adaptive optics technology and need for corrective eyewear is further propelling its market growth.

In the component segment, wavefront sensors hold the largest share of market. Moreover, the market for wavefront sensors is expected to grow at the highest rate in market from 2017 to 2023. These sensors are used in various adaptive optics applications; for instance, wavefront sensors are used for many laser applications such as laser beam diagnostic and laser material processing for controlling laser beam shape and size to increase accuracy. The wavefront measurement is also required in many optical applications to characterize the profile of optical components or to estimate the aberrations to which the input wavefront has been subjected. Similarly, wavefront sensing can be used in metrology and microscopy.

Among the various end-user industries covered in this report, military and defense held the largest market share, followed by the biomedical industry. Adaptive optics in military and defense is used for the development of state-of-the art defense weapons and highly sophisticated guidance systems. These are also used as a method for improving the effectiveness of direct energy weapons. Also, there is a growing demand for finding ways to apply adaptive optics in horizontal path surveillance systems in the military industry. However, with the development of LCoS-SLM and MEMS deformable mirrors, the consumer industry is likely to exhibit the highest growth in the forecast period.

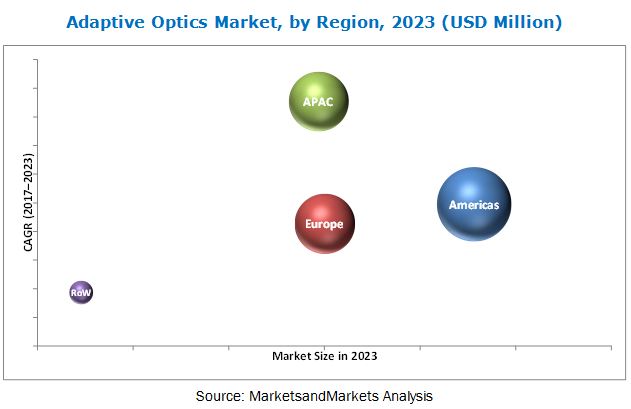

Of all the regions, Americas held the largest market share in terms of revenue in 2016. This market share is mainly attributed to the technological innovations and advancements that led to the innovation of new products. The increasing demands from the biomedical and astronomical applications have led to the growth of adaptive optics in Americas. However, APAC is expected to grow at the highest CAGR from 2017 to 2023. The market in APAC comprises developing economies such as China and India, which have a significant potential for adaptive optics applications.

The key restraining factors for this market are the complex designing techniques and high initial cost. Teledyne e2v (UK) LTD (UK), NORTHROP GRUMMAN CORPORATION (US), Thorlabs, Inc. (US), Imagine Optic SA (France), and Boston Micromachines Corporation (US), were some of the leading players in the adaptive optics market as of 2016.

These companies primarily focus on organic strategies for market expansion through product launches and in-house development. Some of the key players who follow these growth strategies are Thorlabs, Inc. (US), Teledyne e2v (UK) Ltd., and Flexible Optical B.V. (Netherlands). For instance, in November 2016, Thorlabs launched EXULUS-HD1, a reflective two-dimensional spatial light modulator (SLM) based on liquid crystal on silicon (LCoS) technology. This device provides high-speed phase modulation and high resolution and is suitable for applications such as optical trapping, beam steering and shaping, holography, and adaptive optics.

Companies that are profiled in this report are Teledyne e2v (UK) LTD (UK), NORTHROP GRUMMAN CORPORATION (US), Thorlabs, Inc. (US), Iris AO, Inc. (US), Adaptica S.r.l. (Italy), Active Optical Systems, LLC (US), Flexible Optical B.V. (Netherlands), Imagine Optic SA (France), Boston Micromachines Corporation (US), and Phasics Corp. (France).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

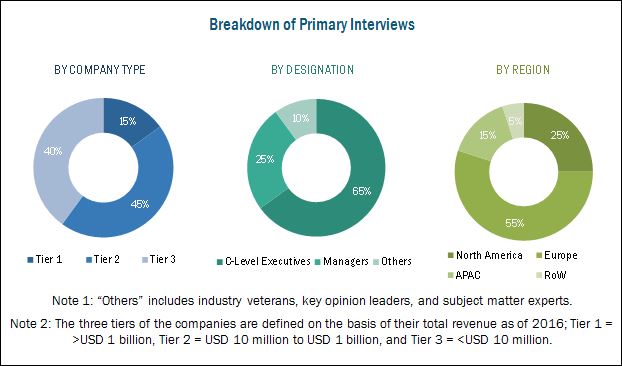

2.1.3.2 Breakdown of Primaries

2.1.3.3 Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Adaptive Optics Market

4.2 Market, By Components

4.3 Market in APAC, By End-User Industry and Country

4.4 Market, By Geography

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Value Chain Analysis

6 Adaptive Optics Market, By Component

6.1 Introduction

6.2 Wavefront Sensor

6.3 Wavefront Modulator

6.3.1 Deformable Mirror

6.4 Control System

7 Adaptive Optics Market, By End-User Industry

7.1 Introduction

7.2 Consumer

7.3 Head-Mounted Display

7.3.1 Camera Lenses

7.3.2 Other Consumer Devices

7.4 Astronomy

7.5 Biomedical

7.5.1 Ophthalmology

7.5.1.1 Retinal Imaging

7.5.2 Biomedical Microscopy

7.5.2.1 Adaptive Scanning Optical Microscope

7.5.3 Cell Analysis

7.5.4 Other Applications

7.5.4.1 3D Bioprinting

7.5.4.2 Atomic Force Microscope

7.6 Military & Defense

7.6.1 Laser Defense System

7.6.1.1 High-Energy Lasers

7.6.2 Biometric Security

7.6.3 Surveillance

7.6.3.1 Light Detection & Ranging

7.6.4 Other Applications

7.6.4.1 Other Defense Applications

7.7 Industrial & Manufacturing

7.7.1 Precision Manufacturing

7.7.2 Machine Vision

7.7.3 3D Printing

7.7.4 Other Applications

7.8 Communication & Other Applications

7.8.1 Free-Space Optical Communication (FSOC)

7.8.2 Sensing

7.8.3 Other Applications

8 Adaptive Optics Market, By Type (Qualitative)

8.1 Introduction

8.2 Natural guide star adaptive optics (NGAO)

8.3 Laser guide star adaptive optics (LGAO)

8.4 Multi-conjugate (MCAO)

8.5 Multi-object (MOAO)

8.6 Ground-layer (GLAO)

9 Adaptive Optics Market, By Region

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.4 APAC

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.5 Rest of the World (RoW)

9.5.1 Middle East

9.5.2 Africa

10 Competitive Landscape

10.1 Introduction

10.2 Market Player Ranking Analysis, 2016

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Business Strategy Excellence (25 Players)

10.4.2 Strength of Product Portfolio (25 Players) (Product Portfolio Analysis)

10.4.3 Patent Analysis (Top 10 Companies)

10.5 Competitive Situation and Trends

10.5.1 Product Launches & Developments

10.5.2 Recent Development

10.5.3 Market Expansion, Diversification, & Others

10.6 Industry Market Entry Scenario

11 Company Profiles

11.1 Introduction

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, MnM View, and Key Relationships)*

11.2 Introduction

11.3 Teledyne e2v (UK) LTD

11.4 NORTHROP GRUMMAN CORPORATION

11.5 Thorlabs, Inc.

11.6 Iris Ao, Inc.

11.7 Adaptica S.R.L.

11.8 Active Optical Systems, LLC

11.9 Flexible Optical B.V.

11.10 Imagine Optic Sa

11.11 Boston Micromachines Corporation

11.12 PHASICS CORP.

11.13 Key Innovators

11.13.1 Hamamatsu Photonics K.K.

11.13.2 ALPAO S.A.S.

11.13.3 Turn LTD.

Note: The company profiles section will cover 20 companies

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, MnM View, and Key Relationships Might Not Be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Insights from Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (101 Tables)

Table 1 List of Major Secondary Sources

Table 2 Number of Ophthalmologists Per Million Population of Some Emerging Countries

Table 3 Some of the Recent Investment in the Field of Photonics/Optoelectronics

Table 4 Some of the Promising Ongoing Telescope Installations Worldwide

Table 5 Market, By Component, 2015–2023 (USD Million)

Table 6 Market, By End-User Industry, 2015–2023 (USD Million)

Table 7 Market for Consumer Industry, By Application, 2015–2023 (USD Million)

Table 8 Market for Head-Mounted Display, By Region, 2015–2023 (USD Thousand)

Table 9 Market for Camera Lenses, By Region, 2015–2023 (USD Thousand)

Table 10 Market for Other Consumer Devices, By Region, 2015–2023 (USD Thousand)

Table 11 Market for Consumer Devices, By Region, 2015–2023 (USD Million)

Table 12 Adaptive Optics Market for Astronomy, By Region, 2015–2023 (USD Million)

Table 13 Market for Biomedical, By Application, 2015–2023 (USD Million)

Table 14 Market for Ophthalmology, By Region, 2015–2023 (USD Million)

Table 15 Market for Biomedical Microscopy, By Region, 2015–2023 (USD Million)

Table 16 Market for Cell Analysis, By Region, 2015–2023 (USD Million)

Table 17 Market for Other Biomedical Applications, By Region, 2015–2023 (USD Million)

Table 18 Market for Biomedical, By Region, 2015–2023 (USD Million)

Table 19 Market for Military & Defense, By Application, 2015–2023 (USD Million

Table 20 Market for Laser Defense System, By Region, 2015–2023 (USD Million)

Table 21 Market for Biometric Security, By Region, 2015–2023 (USD Million)

Table 22 Market for Surveillance, By Region, 2015–2023 (USD Million)

Table 23 Market for Other Defense Applications, By Region, 2015–2023 (USD Million)

Table 24 Market for Military & Defense, By Region, 2015–2023 (USD Million)

Table 25 Market for Industrial & Manufacturing, By Application, 2015–2023 (USD Thousand)

Table 26 Market for Precision Manufacturing, By Region, 2015–2023 (USD Thousand)

Table 27 Adaptive Optics Market for Machine Vision, By Region, 2015–2023 (USD Thousand)

Table 28 Market for 3D Printing, By Region, 2015–2023 (USD Thousand)

Table 29 Market for Other Applications, By Region, 2015–2023 (USD Thousand)

Table 30 Market for Industrial & Manufacturing, By Region, 2015–2023 (USD Million)

Table 31 Market for Communication and Others, By Application, 2015–2023 (USD Million)

Table 32 Market for FSOC, By Region, 2015–2023 (USD Million)

Table 33 Market for Sensing, By Region, 2015–2023 (USD Million)

Table 34 Market for Other Applications, By Region, 2015–2023 (USD Thousand)

Table 35 Market for Communication and Other Applications, By Region, 2015–2023 (USD Million)

Table 36 Market, By Region, 2015–2023 (USD Million)

Table 37 Adaptive Optics Market in Americas, By End-User Industry, 2015–2023 (USD Million)

Table 38 Market for Consumer Industry in Americas, By Geography, 2015–2023 (USD Thousand)

Table 39 Market for Astronomy Industry in Americas, By Geography, 2015–2023 (USD Million)

Table 40 Market for Biomedical Industry in Americas, By Geography, 2015–2023 (USD Million)

Table 41 Market for Military & Defense Industry in Americas, By Geography, 2015–2023 (USD Million)

Table 42 Market for Industrial & Defense Industry in Americas, By Geography, 2015–2023 (USD Thousand)

Table 43 Market for Communication & Other Industries in Americas, By Geography, 2015–2023 (USD Thousand)

Table 44 Market in Americas, By Region, 2015–2023 (USD Million)

Table 45 Market in Europe, By End-User Industry, 2015–2023 (USD Million)

Table 46 Market for Consumer Industry in Europe, By Country, 2015–2023 (USD Thousand)

Table 47 Market for Astronomy Industry in Europe, By Country, 2015–2023 (USD Million)

Table 48 Market for Biomedical Industry in Europe, By Country, 2015–2023 (USD Million)

Table 49 Market for Military & Defense Industry in Europe, By Country, 2015–2023 (USD Million)

Table 50 Market for Industrial & Manufacturing Industry in Europe, By Country, 2015–2023 (USD Thousand)

Table 51 Market for Communication & Other Industries in Europe, By Country, 2015–2023 (USD Thousand)

Table 52 Market in Europe, By Country, 2015–2023 (USD Million)

Table 53 Adaptive Optics Market in APAC, By End-User Industry, 2015–2023 (USD Million)

Table 54 Market for Consumer Industry in APAC, By Country, 2015–2023 (USD Thousand)

Table 55 Market for Astronomy Industry in APAC, By Country, 2015–2023 (USD Million)

Table 56 Market for Biomedical Industry in APAC, By Country, 2015–2023 (USD Million)

Table 57 Market for Biomedical Industry in APAC, By Country, 2015–2023 (USD Million)

Table 58 Market for Military & Defense Industry in APAC, By Country, 2015–2023 (USD Million)

Table 59 Market for Industrial & Manufacturing Industry in APAC, By Country, 2015–2023 (USD Thousand)

Table 60 Market for Communication & Other Industries in APAC, By Country, 2015–2023 (USD Million)

Table 61 Market in APAC, By Country, 2015–2023 (USD Million)

Table 62 Market in RoW, By End-User Industry, 2015–2023 (USD Million)

Table 63 Market for Consumer Industry in RoW, By Region, 2015–2023 (USD Thousand)

Table 64 Market for Astronomy Industry in RoW, By Region, 2015–2023 (USD Thousand)

Table 65 Market for Biomedical Industry in RoW, By Region, 2015–2023 (USD Million)

Table 66 Market for Military & Defense Industry in RoW, By Region, 2015–2023 (USD Million)

Table 67 Market for Industrial & Manufacturing Industry in RoW, By Region, 2015–2023 (USD Thousand)

Table 68 Market for Communication & Other Industries in RoW, By Region, 2015–2023 (USD Thousand)

Table 69 Market in RoW, By Region, 2015–2023 (USD Million)

Table 70 Market for Wavefront Sensor, by Region, 2015–2023 (USD Million)

Table 71 Market for Wavefront Modulator by Region, 2015–2023 (USD Million)

Table 72 Market for Control System, by Region, 2015–2023 (USD Million)

Table 73 Market for Wavefront Sensor in Americas, By Country, 2015–2023 (USD Million)

Table 74 Market for Wavefront Modulator in Americas, By Country, 2015–2023 (USD Million)

Table 75 Market for Control System in Americas, By Country, 2015–2023 (USD Million)

Table 76 Market for Wavefront Sensor in Europe, By Country, 2015–2023 (USD Million)

Table 77 Market for Wavefront Modulator in Europe, By Country, 2015–2023 (USD Million)

Table 78 Market for Control System in Europe, By Country, 2015–2023 (USD Million)

Table 79 Market for Wavefront Sensor in APAC, By Country, 2015–2023 (USD Million)

Table 80 Market for Wavefront Modulator in APAC, By Country, 2015–2023 (USD Million)

Table 81 Market for Control System in Europe, By APAC, 2015–2023 (USD Million)

Table 82 Market for Wavefront Sensor in RoW, By Country, 2015–2023 (USD Million)

Table 83 Market for Wavefront Modulator in RoW, By Country, 2015–2023 (USD Million)

Table 84 Market for Control System in Europe, By RoW, 2015–2023 (USD Million)

Table 85 Adaptive Optics Market in Americas, By Component, 2015–2023 (USD Million)

Table 86 Adaptive Optics Market in Europe, By Component, 2015–2023 (USD Million)

Table 87 Adaptive Optics Market in APAC, By Component, 2015–2023 (USD Million)

Table 88 Adaptive Optics Market in RoW, By Component, 2015–2023 (USD Million)

Table 89 Adaptive Optics Market in US, By Component, 2015–2023 (USD Million)

Table 90 Adaptive Optics Market in Canada, By Component, 2015–2023 (USD Million)

Table 91 Adaptive Optics Market in UK, By Component, 2015–2023 (USD Million)

Table 92 Adaptive Optics Market in Germany, By Component, 2015–2023 (USD Million)

Table 93 Adaptive Optics Market in France, By Component, 2015–2023 (USD Million)

Table 94 Adaptive Optics Market in China, By Component, 2015–2023 (USD Million)

Table 95 Adaptive Optics Market in Japan, By Component, 2015–2023 (USD Million)

Table 96 Adaptive Optics Market in South Korea, By Component, 2015–2023 (USD Million)

Table 97 Adaptive Optics Market in India, By Component, 2015–2023 (USD Million)

Table 98 Ranking of Major Players in Market, 2016

Table 99 Product Launches & Developments in Market, 2014-2017

Table 100 Recent Development in the Adaptive Optics Market, 2014-2017

Table 101 Market Expansion, Diversification, & Others, 2014-2017

List of Figures (32 Figures)

Figure 1 Adaptive Optics Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions for the Research Study

Figure 6 Market, By Component, 2017–2023 (USD Million)

Figure 7 Market Share, By End-User Industry (2017 & 2023)

Figure 8 Market, By Geography, 2016

Figure 9 The Global Adaptive Optics Market Presents Substantial Growth Opportunities During the Forecast Period

Figure 10 Wavefront Sensors Dominated the Market in 2016

Figure 11 Military & Defense in APAC Held the Largest Market Share of Market in 2016

Figure 12 Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Adoption of Adaptive Optics in Ophthalmology and Increased Government Funding Act as Major Driving Factors for the Market

Figure 14 Adaptive Optics Market, By Component

Figure 15 Wavefront Sensors Expected to Dominate the Market in 2017

Figure 16 Market, By End-User Industry

Figure 17 APAC Expected to Witness the Highest CAGR for Market in Astronomy During the Forecast Period

Figure 18 Americas Expected to Dominate the Market for Biomedical Applications During the Forecast Period

Figure 19 Americas Expected to Dominate the Market for Military & Defense During the Forecast Period

Figure 20 APAC Expected to Witness the Highest CAGR for Market in Industrial & Manufacturing Vertical During the Forecast Period

Figure 21 Americas Expected to Dominate the Market for Communication and Other Applications During the Forecast Period

Figure 22 APAC is Emerging as A Key Region for the Growth of the Market During the Forecast Period

Figure 23 Adaptive Optics Market, By Geography

Figure 24 Market Snapshot: Americas

Figure 25 Market Snapshot: Europe

Figure 26 Market Snapshot: APAC

Figure 27 Market Snapshot: RoW

Figure 28 Companies Adopted Product Launches and Recent Development as the Key Growth Strategies Between 2014 and 2017

Figure 29 Adaptive Optics Market (Global): Competitive Leadership Mapping, 2017

Figure 30 Battle for Market Share: Product Launch Was the Key Strategy From 2014 to 2017

Figure 31 Teledyne e2v (UK) Ltd: Company Snapshot

Figure 32 NORTHROP GRUMMAN CORPORATION: Company Snapshot

To estimate the size of the adaptive optics market, top-down and bottom-up approaches have been followed in the study. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases; journals such as “Short-wave infrared adaptive optics and applications” by Xenics nv (Belgium), “Adaptive Optics” by Indian Institute of Astrophysics (India); paid databases such as Google Finance, Factiva (By Dow Jones & Company), and Yahoo Finance; and interviews with industry experts. Also, the average revenue generated by the companies according to the region was used to arrive at the overall market size. This overall market size was used in the top-down procedure to estimate the sizes of other individual markets via percentage splits from secondary and primary research.

To know about the assumptions considered for the study, download the pdf brochure

The adaptive optics ecosystem comprises equipment manufacturers such as Teledyne e2v (UK) LTD (UK), NORTHROP GRUMMAN CORPORATION (US), Thorlabs, Inc. (US), Iris AO, Inc. (US), Adaptica S.r.l. (Italy), Active Optical Systems, LLC (US), Flexible Optical B.V. (Netherlands), Imagine Optic SA (France), Boston Micromachines Corporation (US), and Phasics Corp. (France).

Target Audience:

- Raw material and manufacturing equipment suppliers

- Third-party service providers

- Communication network providers

- Government labs

- In-house testing labs

- Original design manufacturers (ODMs) and original equipment manufacturers (OEMs) technology solution providers

- Distributors and retailers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Adaptive Optics Market Scope:

By Component

- Wavefront Sensor

- Wavefront Modulator

- Control System

- Others

By End-User Industry

-

Consumer

- Head-Mounted Display

- Camera Lenses

- Other Consumer Devices

- Astronomy

-

Biomedical

- Ophthalmology

- Biomedical Microscopy

- Cell Analysis

- Other Applications

-

Military & Defense

- Laser Defense System

- Biometric Security

- Surveillance

- Other Applications

-

Industrial & Manufacturing

- Precision Manufacturing

- Machine Vision

- 3D Printing

- Other Applications

-

Communication & Others

- Free-Space Optical Communications

- Sensing

- Other Applications

By Geography

-

Americas

- US

- Canada

- Mexico

- South America

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

Rest of the World

- Middle East

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the clients’ specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of region/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Adaptive Optics Market