Film Adhesives Market by Resin Type (Epoxy, Acrylic, Cyanate Ester), End-Use Industry (Electrical & Electronics, Aerospace, Automotive & Transportation, Consumer), and Region (APAC, North America, Europe, South America, and MEA) - Global Forecast to 2023

Film Adhesives Market was valued at USD 1.18 billion in 2017 and is projected to reach USD 1.62 billion by 2023, at a CAGR of 5.5% during the forecast period. The base year considered for this study is 2017 and the forecast period is 2018-2023.

Objectives of the Study:

- To define, segment, and forecast the film adhesives market, in terms of value and volume

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the film adhesives market based on resin type and end-use industry

- To analyze and forecast the market size, with respect to five main regions, namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments such as capacity expansions, new product launches, joint ventures, and mergers & acquisitions in the market

- To analyze opportunities in the market for stakeholders and provide competitive landscape of the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Both, top-down and bottom-up approaches were used to estimate and validate the size of the film adhesives market, and to estimate the size of various other dependent submarkets. The research study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, and Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for a technical, market-oriented, and commercial study of the film adhesives market.

To know about the assumptions considered for the study, download the pdf brochure

The film adhesives market has a diversified and established ecosystem of upstream players, such as raw material suppliers, and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations. Key players operating in the market include H.B. Fuller (US), Henkel (Germany), Arkema (Bostik) (France), 3M (US), and Cytec Solvay Group (Belgium).

Key Target Audience:

- Manufacturers of Film Adhesives

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of Film Adhesives

- Government & Regional Agencies and Research Organizations

- Investment Research Firms

Scope of the Report:

The film adhesives market has been segmented as follows:

Film Adhesives Market, By Resin Type:

- Epoxy

- Cyanate Ester

- Acrylic

- Others

Film Adhesives Market, By End-use Industry:

- Electrical & Electronics

- Aerospace

- Automotive & Transportation

- Consumer

- Others

Film Adhesives Market, By Region:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

The market has been further analyzed for key countries in each of these regions.

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the film adhesives market based on resin type and end-use industry

Company Information:

- Detailed analysis and profiles of additional market players

The preference for film adhesives over conventional adhesives in high-end aerospace applications is one of the most significant factors projected to drive the growth of the film adhesives market. This market is estimated to be USD 1.24 billion in 2018 and is projected to reach USD 1.62 billion by 2023, at a CAGR of 5.5% between 2018 and 2023.

Film adhesives are solvent cast adhesives that form a thin flexible bonding layer. These films are extensively used as alternatives to fasteners as well as paste and liquid adhesives in many end-use industries such as aerospace, electrical & electronics, and automotive & transportation. Film adhesives can be activated thermally, chemically, or using light or pressure. These films comprise a thin layer of pre-catalyzed adhesive resin provided on a liner and are sold in the roll or sheet form.

The epoxy segment is projected to be the largest and the fastest-growing resin type segment of the film adhesives market. Epoxies are high-performance adhesives providing high strength, high temperature resistance, and high fatigue resistance.

The automotive & transportation segment is projected to be the fastest-growing application segment of the film adhesives market. This growth can be attributed to the expansion of the automotive industry in the APAC region, which has led to a rise in the production of automobiles. Film adhesives are used in automotive manufacturing in bonding components and supporting assembly functions.

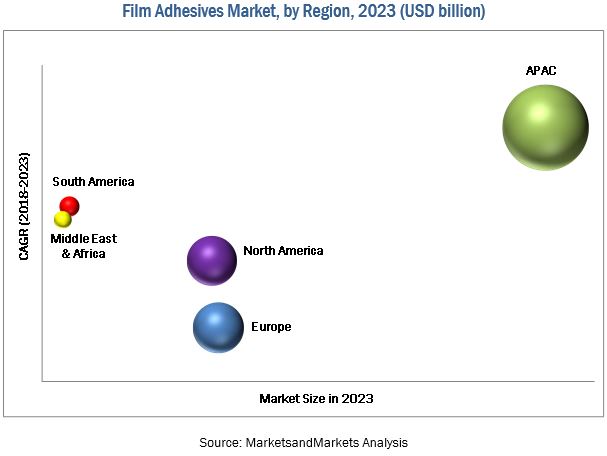

The film adhesives market in the APAC region is projected to grow at the highest CAGR during the forecast period. Film adhesives are preferred over conventional adhesives in high-end aerospace applications as they aid in the manufacturing of large parts, providing easy shop handling, which is crucial for high-end aerospace applications. Moreover, there is a gradual shift of manufacturing facilities to APAC countries due to low production cost. These factors are projected to drive the growth of the film adhesives market in the APAC region.

High storage & transportation cost and time-consuming processing techniques are expected to restrain the growth of the film adhesives market, globally.

Key manufacturers of film adhesives include H.B. Fuller (US), Henkel (Germany), Arkema (Bostik) (France), 3M (US), and Cytec Solvay Group (Belgium).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

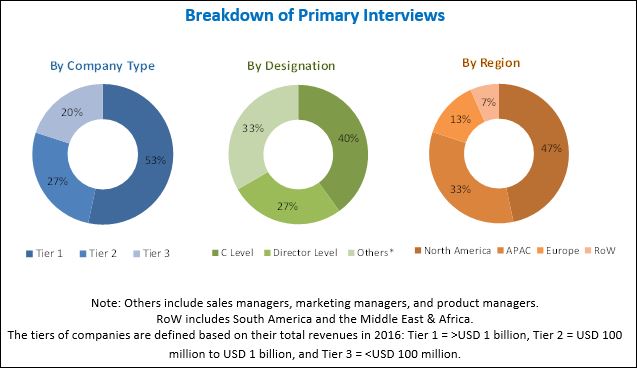

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities for Market Players

4.2 Film Adhesives Market: By Resin Type

4.3 Film Adhesives Market in APAC

4.4 Global Film Adhesives Market

4.5 Film Adhesives Market: Developed vs Developing Nations

4.6 Film Adhesives Market: Growing Demand From APAC

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Preference Over Conventional Adhesives in High-End Aerospace Applications

5.2.1.2 Controlled Bond-Line Thickness

5.2.1.3 No Mix Required

5.2.2 Restraints

5.2.2.1 High Storage & Transportation Cost and Time-Consuming Processing Techniques

5.2.3 Opportunities

5.2.3.1 Growing Demand From Medical and Fitness Wear

5.2.4 Challenges

5.2.4.1 Reduction in Cure Time and Cure Temperature

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of Substitutes

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Indicators (Page No. - 37)

6.1 Introduction

6.1.1 Global GDP Trends and Forecasts

6.1.2 Growth Indicators in the Automotive Industry

6.1.3 Trends and Forecast of the Aerospace Industry

7 Film Adhesives Market, By Resin Type (Page No. - 40)

7.1 Introduction

7.2 Epoxy

7.3 Cyanate Ester

7.4 Acrylic

7.5 Others

8 Film Adhesives Market, By Technology* (Page No. - 46)

8.1 Introduction

8.2 Heat Cured

8.3 Pressure Cured

8.4 EB/UV Cured

*Chapter Limited to Qualitative Information

9 Film Adhesives Market, By End-Use Industry (Page No. - 48)

9.1 Introduction

9.2 Aerospace

9.3 Electrical & Electronics

9.4 Automotive & Transportation

9.5 Consumer

9.6 Others

10 Film Adhesives Market, By Region (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 UK

10.3.5 Russia

10.3.6 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Taiwan

10.4.6 Rest of APAC

10.5 South America

10.5.1 Brazil

10.5.2 Rest of South America

10.6 Middle East & Africa

10.6.1 South Africa

10.6.2 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 84)

11.1 Overview

11.2 Competitive Scenario

11.3 New Product Launch

11.4 Merger & Acquisition

11.5 Expansions

12 Company Profiles (Page No. - 87)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Henkel

12.2 H.B. Fuller

12.3 3M Company

12.4 Arkema (Bostik)

12.5 Hexcel Corporation

12.6 Cytec Solvay Group

12.7 Royal Ten Cate (Tencate Advanced Composites)

12.8 Master Bond

12.9 Nusil

12.10 Axiom Materials, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12.11 Other Key Companies

12.11.1 Lord Corporation

12.11.2 Bondline Electronic Adhesives

12.11.3 AI Technology

12.11.4 Gurit

12.11.5 Fastel Adhesives and Substrate Products

12.11.6 Rogers Corporation

12.11.7 Plitek

12.11.8 Gluetex

12.11.9 Dai Nippon Printing Co., Ltd.

12.11.10 HMT Manufacturing

12.11.11 Everad Adhesives

12.11.12 Permabond

12.11.13 Protavic International

12.11.14 L&L Products

13 Appendix (Page No. - 110)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (73 Tables)

Table 1 Film Adhesives Market Snapshot (2018 vs 2023)

Table 2 GDP Trends and Forecasts, By Key Country, 20162022 (USD Billion)

Table 3 Global Automotive Production, By Key Country, 20112016 (Million Units)

Table 4 Growth Indicators of Aerospace Industry, 2015-2033

Table 5 Growth Indicators of Aerospace Industry, By Region, 2015-2033

Table 6 New Airplane Deliveries, By Region, 2015-2033

Table 7 Film Adhesives Market Size, By Resin Type, 2016-2023 (USD Million)

Table 8 Film Adhesives Market, By Resin Type, 2016-2023 (MSM)

Table 9 Epoxy Film Adhesives Market Size, By Region, 2016-2023 (USD Million)

Table 10 Epoxy Film Adhesives Market Size, By Region, 2016-2023 (MSM)

Table 11 Cyanate Ester Film Adhesives Market Size, By Region, 2016-2023 (USD Million)

Table 12 Cyanate Ester Film Adhesives Market Size, By Region, 2016-2023 (MSM)

Table 13 Acrylic Film Adhesives Market Size, By Region, 2016-2023 (USD Million)

Table 14 Acrylic Film Adhesives Market Size, By Region, 2016-2023 (MSM)

Table 15 Other Film Adhesives Market Size, By Region, 2016-2023 (USD Million)

Table 16 Other Film Adhesives Market Size, By Region, 2016-2023 (MSM)

Table 17 Film Adhesives Market Size, By End-Use Industry, 20162023 (USD Million)

Table 18 Film Adhesives Market Size, By End-Use Industry, 20162023 (MSM)

Table 19 Film Adhesives Market Size in Aerospace, By Region, 20162023 (USD Million)

Table 20 Film Adhesives Market Size in Aerospace, By Region, 20162023 (MSM)

Table 21 Film Adhesives Market Size in Electrical & Electronics, By Region, 20162023 (USD Million)

Table 22 Film Adhesives Market Size in Electrical & Electronics, By Region, 20162023 (MSM)

Table 23 Film Adhesives Market Size in Automotive & Transportation, By Region, 20162023 (USD Million)

Table 24 Film Adhesives Market Size in Automotive & Transportation, By Region, 20162023 (MSM)

Table 25 Film Adhesives Market Size in Consumer, By Region, 20162023 (USD Million)

Table 26 Film Adhesives Market Size in Consumer, By Region, 20162023 (MSM)

Table 27 Film Adhesives Market Size in Other End-Use Industries, By Region, 20162023 (USD Million)

Table 28 Film Adhesives Market Size in Other End-Use Industries, By Region, 20162023 (MSM)

Table 29 Film Adhesives Market Size, By Region, 20162023 (USD Million)

Table 30 Film Adhesives Market Size, By Region, 20162023 (MSM)

Table 31 North America: Market Size, By Country, 20162023 (USD Million)

Table 32 North America: Market Size, By Country, 20162023 (MSM)

Table 33 North America: Market Size, By Resin Type, 20162023 (USD Million)

Table 34 North America: Market Size, By Resin Type, 20162023 (MSM)

Table 35 North America: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 36 North America: Market Size, By End-Use Industry, 20162023 (MSM)

Table 37 US: Film Adhesives Market Size, By Resin Type, 20162023 (USD Million)

Table 38 US: Film Adhesives Market Size, By Resin Type, 20162023 (MSM)

Table 39 Europe: Market Size, By Country, 20162023 (USD Million)

Table 40 Europe: Market Size, By Country, 20162023 (MSM)

Table 41 Europe: Market Size, By Resin Type, 20162023 (USD Million)

Table 42 Europe: Market Size, By Resin Type, 20162023 (MSM)

Table 43 Europe: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 44 Europe: Market Size, By End-Use Industry, 20162023 (MSM)

Table 45 Germany: Film Adhesives Market Size, By Resin Type, 20162023 (USD Million)

Table 46 Germany: Film Adhesives Market Size, By Resin Type, 20162023 (MSM)

Table 47 APAC: Market Size, By Country, 20162023 (USD Million)

Table 48 APAC: Market Size, By Country, 20162023 (MSM)

Table 49 APAC: Market Size, By Resin Type, 20162023 (USD Million)

Table 50 APAC: Market Size, By Resin Type, 20162023 (MSM)

Table 51 APAC: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 52 APAC: Market Size, By End-Use Industry, 20162023 (MSM)

Table 53 China: Market Size, By Resin Type, 20162023 (USD Million)

Table 54 China: Market Size, By Resin Type, 20162023 (MSM)

Table 55 India: Film Adhesives Market Size, By Resin Type, 20162023 (USD Million)

Table 56 India: Film Adhesives Market Size, By Resin Type, 20162023 (MSM)

Table 57 Japan: Film Adhesives Market Size, By Resin Type, 20162023 (USD Million)

Table 58 Japan: Film Adhesives Market Size, By Resin Type, 20162023 (MSM)

Table 59 South America: Market Size, By Country, 20162023 (USD Million)

Table 60 South America: Market Size, By Country, 20162023 (MSM)

Table 61 South America: Market Size, By Resin Type, 20162023 (USD Million)

Table 62 South America: Market Size, By Resin Type, 20162023 (MSM)

Table 63 South America: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 64 South America: Market Size, By End-Use Industry, 20162023 (MSM)

Table 65 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 66 Middle East & Africa: Market Size, By Country, 20162023 (MSM)

Table 67 Middle East & Africa: Market Size, By Resin Type, 20162023 (USD Million)

Table 68 Middle East & Africa: Market Size, By Resin Type, 20162023 (MSM)

Table 69 Middle East & Africa: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 70 Middle East & Africa: Market Size, By End-Use Industry, 20162023 (MSM)

Table 71 New Product Launches, 20132018

Table 72 Mergers & Acquisitions, 20132018

Table 73 Expansions, 20132018

List of Figures (31 Figures)

Figure 1 Film Adhesives Market Segmentation

Figure 2 Film Adhesives Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Film Adhesives Market: Data Triangulation

Figure 6 APAC to Dominate the Film Adhesives Market

Figure 7 Electrical & Electronics to Be the Fastest-Growing End-Use Industry for Film Adhesives

Figure 8 Epoxy Film Adhesives to Be the Most Preferred Segment to Invest

Figure 9 APAC Was the Largest Film Adhesives Market in 2017

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players

Figure 11 Epoxy Film Adhesives Market to Register the Highest CAGR

Figure 12 Electrical & Electronics Was the Largest End-Use Industry of Film Adhesives

Figure 13 India Emerging as A Lucrative Market for Film Adhesives

Figure 14 Film Adhesives Market in Developing Countries to Register A Higher CAGR Between 2018 and 2023

Figure 15 India to Witness the Highest Growth Rate in the Next Five Years

Figure 16 Overview of the Factors Governing the Film Adhesives Market

Figure 17 Porters Five Forces Analysis

Figure 18 Epoxy Resin to Dominate the Film Adhesives Market

Figure 19 Electrical & Electronics Industry to Drive the Market

Figure 20 India to Be the Fastest-Growing Film Adhesives Market, 20182023

Figure 21 North America: Film Adhesives Market Snapshot

Figure 22 Europe: Film Adhesives Market Snapshot

Figure 23 APAC: Film Adhesives Market Snapshot

Figure 24 New Product Launches and Mergers & Acquisitions Were the Key Growth Strategies Adopted Between 2013 and 2018

Figure 25 Henkel: Company Snapshot

Figure 26 H.B. Fuller: Company Snapshot

Figure 27 3M Company: Company Snapshot

Figure 28 Arkema (Bostik): Company Snapshot

Figure 29 Hexcel Corporation: Company Snapshot

Figure 30 Cytec Solvay Group: Company Snapshot

Figure 31 Royal Ten Cate Group: Company Snapshot

Growth opportunities and latent adjacency in Film Adhesives Market