Adhesive Films Market by Resin Type (Acrylic, Rubber, Silicone), by Film Material(PP, PVC, PE), by Application (Tapes, Graphic Films, Labels), by End-Use Industry(Packaging, Construction, Transportation, Electronics), and Region (APAC, North America, Europe, South America, MEA) - Global Forecast to 2030

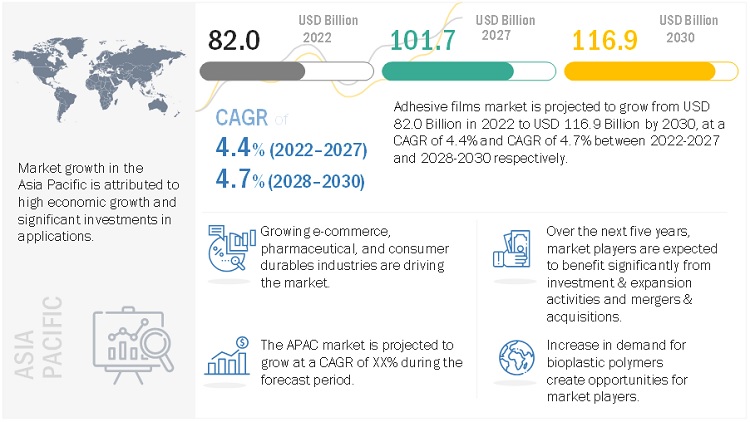

The adhesive films market is projected to grow from USD 82.0 billion in 2022 to USD 116.9 billion by 2030, at a cagr 4.4% and cagr 4.7% between 2022-2027 and 2028-2030 respectively. The adhesive tapes, by application segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for adhesive films.

Adhesive Films Market Dynamics

Drivers: Increasing urban population in Asia Pacific

The increasing urban population is a major factor which is attributed to the increase in the demand for products such as medicines, beverages, FMCGs, and other consumer durables. In the Asia Pacific region, the population shift has raised growth in urban population even further. According to the Population Division of the United Nations, the total population of the Asia Pacific is projected to reach 5.1 billion by 2050, wherein the urban population is expected to account for at least 64% of the total. The positive shift in living standards is expected to increase the demand for high-quality products, which is expected to lead to the rise in the demand for adhesive films.

Restraints: Volatility in prices of raw materials

The prices and availability of raw materials are the major factors that affect the prices of end products. Crude oil is among the major raw materials used in the production of various polymers. The raw materials required for polymer films (and other plastics) have witnessed oscillating price trends due to the shortages occurring as a result of supply chain disruptions after the Russia - Ukraine war. Most of the raw materials of adhesive films are petroleum-based products such as phenolic resins, melamine resins, and vinyl films which are vulnerable to fluctuations in commodity prices. Prices of oil have been fluctuating by up to 8.0% in recent years. These fluctuations in raw material prices are restraining the growth of the market.

Opportunities: Increase in demand for bioplastic polymers

Rising environmental concerns are driving the market for bioplastic materials. Bioplastic films are made from cellulose, a biodegradable material. Polymers such as PE, PP, and PVC can also be made from renewable resources such as bioethanol and can also be used as raw materials for laminated graphic films. These polymers are derived from renewable biomass sources or biodegradable sources. Bioplastic films are therefore compostable or biodegradable and have a negligible carbon footprint as compared to conventional plastic materials. The use of these materials in applications such as tapes, labels, and graphic films are expected to offer newer opportunities in the adhesive films market.

Challenges: Implementation of stringent regulatory policies

The chemical industry is facing challenges from regulatory authorities such as the Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and Environmental Protection Agency (EPA) in Europe and North America. Adhesive films release solvents into the environment, which, if inhaled, can harm individuals. Manufacturers in Europe and North America are adhering to these regulations in the production and usage of adhesive films in various applications to reduce VOC emissions. This has affected the production of those companies who were mainly manufacturing adhesive films through the use of the solvent-based technology. These regulations require manufacturers to shift from the solvent-based to the water-based adhesive tape technology, which is a significant challenge for manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Adhesive Tapes accounted for the fastest growing segment of the adhesive films market between 2022 and 2030.

Adhesive tapes are of various types based on the technological developments and requirements of the applications, namely, single-coated, double-coated, reinforced, and unsupported. Single-coated tapes have adhesives applied to only one side of the backing. Double-coated tapes have adhesive applied to both sides of the backing. The tape is coated on both sides of the carrier, which is typically a polymeric film such as 0.5 mil polyester. Examples of double-coated tapes include mounting, medical, and membrane switch tapes. Reinforced adhesive tapes include a reinforcement layer of woven or knitted cloth or glass strands parallel to the machine direction in addition to backing and adhesive. Unsupported adhesive tapes consist of release liners and adhesives. Adhesive tapes are extensively used due to their properties such as corrosion resistance, superior bonding, and esthetics. The trend toward using lightweight devices is leading to the increasing applications of adhesive tapes in the electrical & electronics industry.

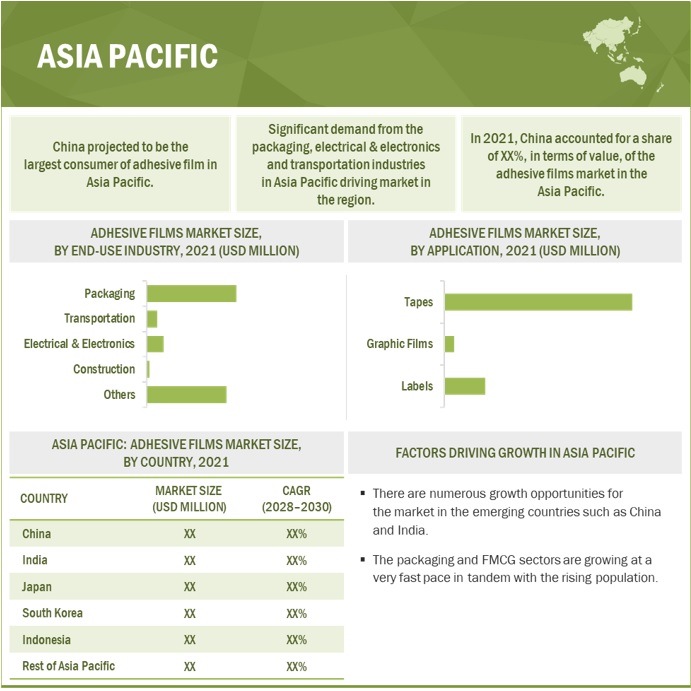

Asia Pacific is the fastest-growing adhesive films market.

Asia Pacific is the fastest adhesive films market in terms of value and volume during the forecast period. The development of the market is mainly attributed to the high economic growth rate followed by heavy investment across different manufacturing industries.

3M Company (US), Avery Dennison Corporation (US), Henkel AG & Co. KGAA (Germany), UPM-Kymmene Oyj (Finland), and H.B. Fuller Company (US) are the key players in the global adhesive films market.

Avery Dennison Corporation manufactures, markets, and sells pressure sensitive materials, self-adhesive base materials, and self-adhesive consumer & office products. The company, through its Labels and Graphic Materials segment, manufactures and sells pressure sensitive labels and packaging materials, reflective products, and tapes for the automotive, building & construction, electronics, industrial, and personal care sectors. It manufactures and markets medical-grade skin adhesives and wound dressings.

Scope of the report

|

Report Metric |

Details |

|

Years Considered for the study |

2018-2030 |

|

Base year |

2021 |

|

Forecast period |

2022–2030 |

|

Units considered |

Value (USD) and Volume (MSM) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

3M Company (US), Avery Dennison Corporation (US), Henkel AG & Co. KGAA (Germany), UPM-Kymmene Oyj (Finland), and H.B. Fuller Company (US). A total of 26 players have been covered. |

This research report categorizes the adhesive films market based on resin type, film material, application, end-use industry, and region.

By Resin Type:

- Acrylic

- Rubber

- Silicone

- Others

By Film Material:

- PVC

- PP

- PE

- Others

By Application:

- Tapes

- Graphic Films

- Labels

By End-use Industry:

- Packaging

- Construction

- Transportation

- Electrical & Electronics

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2021, Avery Dennison Corporation acquired the majority of Acpo’s assets. Acpo Ltd. is a US based, privately owned company which manufactures self-wound, pressure-sensitive roll label films for the label printing and flexible packaging industries as well as industrial tapes.

- In February 2021, Avery Dennison Corporation acquired JDC Solutions Inc. JDC manufactures specialty tapes for use in a variety of high-value industrial applications and has longstanding relationships with us converters serving the automotive, consumer appliance, and building & construction industries, among others. With the completion of the acquisition, JDC’s manufacturing operations, workforce, and product portfolio are expected to become part of Avery Dennison’s performance tapes North America business.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of adhesive films?

The global adhesive films market is driven by increasing urbanization.

What are the major applications for adhesive films?

The major applications of adhesive films are packaging, construction, transportation, and electrical & electronics.

Who are the major manufacturers?

3M Company (US), Avery Dennison Corporation (US), Henkel AG & Co. KGAA (Germany), UPM-Kymmene Oyj (Finland), and H.B. Fuller Company (US) are some of the leading players operating in the global adhesive films market.

Why adhesive films are gaining market share?

The growth of this market is attributed to the increase in product efficiency, customer service, and advanced technology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing urban population in Asia Pacific- Growing e-commerce, pharmaceutical, and consumer durables industries- Growing consumer demand for product information- Increase in product efficiency, customer service, and advanced technologyRESTRAINTS- Volatility in prices of raw materialsOPPORTUNITIES- Forward integration in value chain- Increase in demand for bioplastic polymers- Use of recyclable polymer films and linersCHALLENGES- Implementation of stringent regulatory policies

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 MACRO INDICATOR ANALYSISINTRODUCTIONTRENDS AND FORECAST OF GDP

-

5.7 INDUSTRY TRENDSTRENDS AND FORECAST FOR GLOBAL CONSTRUCTION INDUSTRYTRENDS IN AUTOMOTIVE SECTOR

- 5.8 AVERAGE PRICING ANALYSIS

-

5.9 ADHESIVE FILMS ECOSYSTEM AND INTERCONNECTED MARKETSTRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

-

5.10 EXPORT–IMPORT TRADE ANALYSISIMPORT TRADE DATAEXPORT TRADE DATA

-

5.11 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTION ANALYSISTOP APPLICANTS

- 5.12 CASE STUDY ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.15 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSENVIRONMENTAL REGULATION STANDARDS

-

5.16 GLOBAL ECONOMIC SCENARIOS IMPACTING MARKET GROWTHRUSSIA–UKRAINE WARCHINA- China’s debt problem- Australia–China trade war- Environmental commitmentsEUROPE- Political instability in Germany- Energy crisis in Europe

- 6.1 INTRODUCTION

-

6.2 ACRYLIC ADHESIVE FILMSEXCELLENT ADHESION PROPERTIES TO DRIVE DEMAND IN PACKAGING AND AUTOMOTIVE INDUSTRIES

-

6.3 RUBBER ADHESIVE FILMSRUBBER-BASED ADHESIVE FILMS WIDELY USED IN INDUSTRIAL AND DOMESTIC APPLICATIONS

-

6.4 SILICONE ADHESIVE FILMSEXCELLENT TEMPERATURE, CHEMICAL, ENVIRONMENTAL STABILITY, AND FLEXIBILITY TO DRIVE MARKETWOUND CARE HEALING SOLUTIONS OFFERED BY SILICONE ADHESIVE FILMS

-

6.5 OTHER ADHESIVE FILMSEVA ADHESIVE FILMSPOLYURETHANE ADHESIVE FILMSHYBRID ADHESIVE FILMSHYDROPHILIC ADHESIVE FILMS

- 7.1 INTRODUCTION

-

7.2 PP BACKED ADHESIVE FILMSVERSATILITY AND COST-EFFECTIVENESS TO DRIVE GROWTH

-

7.3 PVC BACKED ADHESIVE FILMSVERSATILITY FOR WIDE VARIETY OF APPLICATIONS TO DRIVE DEMAND

-

7.4 PE BACKED ADHESIVE FILMSFASTEST-GROWING BIO-FILM MATERIAL- Low-Density Polyethylene (LDPE)- High-Density Polyethylene (HDPE)- Linear Low-Density Polyethylene (LLDPE)

-

7.5 OTHERSPETPAPU

- 8.1 INTRODUCTION

-

8.2 TAPESDEMAND FOR LIGHTWEIGHT DEVICES LEADING TO INCREASING APPLICATIONS IN ELECTRICAL & ELECTRONICS INDUSTRY

-

8.3 LABELSRISE IN E-COMMERCE, PHARMACEUTICAL SUPPLIES, AND CONSUMER AWARENESS TO DRIVE MARKET- Permanent labels- Peelable labels- Ultra-peelable labels- Freezer or frost fix labels- High tack labels- Specialty labels

-

8.4 GRAPHIC FILMSSUPERIOR RESISTANCE PROPERTIES TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 PACKAGINGONLINE SHOPPING TO BOOST MARKET

-

9.3 CONSTRUCTIONGROWTH OF HOUSING SECTOR IN EMERGING COUNTRIES TO DRIVE MARKET

-

9.4 TRANSPORTATIONWIDE APPLICATIONS IN AUTOMOTIVE SECTOR AND AEROSPACE AND MARINE INDUSTRIES TO DRIVE MARKET

-

9.5 ELECTRICAL & ELECTRONICSDEMAND FOR VARIOUS CONSUMER ELECTRONIC DEVICES TO DRIVE MARKET

-

9.6 OTHER END-USE INDUSTRIESMEDICALSIGNAGEFMCG AND OTHER CONSUMER GOODS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Growth of packaging industry in e-commerce leading to rise in market demandINDIA- Increasing urbanization and government initiatives to provide broadband connectivity across rural areas to support market expansionJAPAN- Presence of well-established automotive industry to boost marketSOUTH KOREA- Consumer electronics end-use industry to drive marketINDONESIA- Cheap raw material and ease of availability of labor to boost demandREST OF ASIA PACIFIC

-

10.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Increasing demand from infrastructure and automotive industries to drive marketCANADA- Growing investments in infrastructure and development projects to boost demandMEXICO- Rising demand for smart devices & electronics to lead to market growth

-

10.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- New technologies to increase demand for adhesive films in electronics and automotive end-use industriesFRANCE- Favorable government initiatives to boost marketUK- Demand from manufacturing sector to lead to market growthITALY- Advancing automobile industry to pave path for adhesive films marketSPAIN- Large automotive sector and transportation industry to drive marketTURKEY- Rising packaging end-use industry to offer lucrative opportunitiesRUSSIA- Packaging application to boost market.REST OF EUROPE

-

10.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Building & construction end-use industry to drive marketARGENTINA- High demand for adhesive films from construction and automotive sectors to drive marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EASTSAUDI ARABIA- Mega housing projects to boost demand for adhesive filmsSOUTH AFRICA- Government policies for developing manufacturing industries to lead to market growthREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

-

11.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.3 STRENGTH OF PRODUCT PORTFOLIO

-

11.4 SME MATRIX, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.5 MARKET SHARE ANALYSIS

-

11.6 REVENUE ANALYSIS3M COMPANYAVERY DENNISON CORPORATIONHENKEL AG & CO. KGAAUPM-KYMMENE OYJH.B. FULLER COMPANY

- 11.7 MARKET RANKING ANALYSIS

-

11.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 11.9 COMPETITIVE BENCHMARKING

- 11.10 STRATEGIC DEVELOPMENTS

-

12.1 MAJOR PLAYERS3M COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVERY DENNISON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUPM-KYMMENE OYJ- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewH.B. FULLER COMPANY- Business overview- Products/Solutions/Services offered- MnM viewCCL INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsCONSTANTIA FLEXIBLES- Business overview- Products/Solutions/Services offered- Recent developmentsCOSMO FILMS- Business overview- Products/Solutions/Services offeredTORAY INDUSTRIES- Business overview- Products/Solutions/Services offeredMONDI GROUP- Business overview- Products/Solutions/Services offered

-

12.2 OTHER COMPANIESLOHMANN GMBH & CO. KG- Products/Solutions/Services offeredCOVERIS- Products/Solutions/Services offeredADHESIVE FILMS INC.- Products/Solutions/Services offeredSCAPA GROUP PLC (SWM INTERNATIONAL)- Products/Solutions/Services offeredSHURTAPE TECHNOLOGIES- Products/Solutions/Services offeredESTER CHEMICAL INDUSTRIES PVT. LTD.- Products/Solutions/Services offeredNITTO DENKO CORPORATION- Products/Solutions/Services offeredINTERTAPE POLYMER GROUP, INC.- Products/Solutions/Services offeredDRYTAC CORPORATION- Products/Solutions/Services offeredFUJI SEAL INTERNATIONAL- Products/Solutions/Services offeredHUHTAMAKI- Products/Solutions/Services offeredLINTEC- Products/Solutions/Services offeredDUNMORE CORPORATION- Products/Solutions/Services offeredDOUBLE FISH ENTERPRISE CO., LTD.- Products/Solutions/Services offeredDONLEE- Products/Solutions/Services offeredDEXERIALS- Products/Solutions/Services offered

- 13.1 INTRODUCTION

- 13.2 HOT-MELT ADHESIVES MARKET LIMITATIONS

- 13.3 HOT-MELT ADHESIVES MARKET DEFINITION

- 13.4 HOT-MELT ADHESIVES MARKET OVERVIEW

- 13.5 HOT-MELT ADHESIVES MARKET ANALYSIS, BY RESIN TYPE

- 13.6 HOT-MELT ADHESIVES MARKET ANALYSIS, BY APPLICATION

- 13.7 HOT-MELT ADHESIVES MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- TABLE 4 ADHESIVE FILMS MARKET SNAPSHOT, 2022 VS. 2027 VS. 2030

- TABLE 5 SUPPLY CHAIN ECOSYSTEM

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA FOR ADHESIVE FILMS

- TABLE 9 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2019–2027

- TABLE 10 AUTOMOTIVE PRODUCTION, BY REGION, 2018–2021

- TABLE 11 SUPPLY CHAIN OF ADHESIVE FILMS MARKET

- TABLE 12 COUNTRY-WISE IMPORT VALUE DATA IN USD THOUSAND, 2019–2021

- TABLE 13 COUNTRY-WISE EXPORT VALUE DATA IN USD THOUSAND, 2019–2021

- TABLE 14 PUBLICATION TRENDS, 2017–2023

- TABLE 15 TOP 10 PATENT OWNERS IN LAST FEW YEARS

- TABLE 16 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 COMPARISON BETWEEN ACRYLIC ADHESIVE FILMS, RUBBER ADHESIVE FILMS, AND SILICONE ADHESIVE FILMS

- TABLE 20 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 21 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 22 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 23 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 24 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 25 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 26 PROPERTIES OF PP

- TABLE 27 PP BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 28 PP BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 PP BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (USD MILLION)

- TABLE 30 PP BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 31 PP BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 32 PP BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 33 PROPERTIES OF PVC

- TABLE 34 PVC BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 35 PVC BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 36 PVC BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (USD MILLION)

- TABLE 37 PVC BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 38 PVC BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 39 PVC BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 40 PROPERTIES OF PE

- TABLE 41 PE BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 42 PE BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 PE BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (USD MILLION)

- TABLE 44 PE BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 45 PE BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 46 PE BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 47 OTHER FILM MATERIAL BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 48 OTHER FILM MATERIAL BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 OTHER FILM MATERIAL BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (USD MILLION)

- TABLE 50 OTHER FILM MATERIAL BACKED ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 51 OTHER FILM MATERIAL BACKED ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 52 OTHER FILM MATERIAL BACKED ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 53 ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 54 ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 55 ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 56 ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 57 ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 58 ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 59 ADHESIVE FILMS MARKET IN TAPES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 60 ADHESIVE FILMS MARKET IN TAPES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 ADHESIVE FILMS MARKET IN TAPES, BY REGION, 2028–2030 (USD MILLION)

- TABLE 62 ADHESIVE FILMS MARKET IN TAPES, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 63 ADHESIVE FILMS MARKET IN TAPES, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 64 ADHESIVE FILMS MARKET IN TAPES, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 65 ADHESIVE FILMS MARKET IN LABELS, BY REGION, 2018–2021 (USD MILLION)

- TABLE 66 ADHESIVE FILMS MARKET IN LABELS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 ADHESIVE FILMS MARKET IN LABELS, BY REGION, 2028–2030 (USD MILLION)

- TABLE 68 ADHESIVE FILMS MARKET IN LABELS, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 69 ADHESIVE FILMS MARKET IN LABELS, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 70 ADHESIVE FILMS MARKET IN LABELS, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 71 ADHESIVE FILMS MARKET IN GRAPHIC FILMS, BY REGION, 2018–2021 (USD MILLION)

- TABLE 72 ADHESIVE FILMS MARKET IN GRAPHIC FILMS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 ADHESIVE FILMS MARKET IN GRAPHIC FILMS, BY REGION, 2028–2030 (USD MILLION)

- TABLE 74 ADHESIVE FILMS MARKET IN GRAPHIC FILMS, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 75 ADHESIVE FILMS MARKET IN GRAPHIC FILMS, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 76 ADHESIVE FILMS MARKET IN GRAPHIC FILMS, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 77 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 78 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 79 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 80 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 81 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 82 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 83 ADHESIVE FILMS MARKET IN PACKAGING END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 84 ADHESIVE FILMS MARKET IN PACKAGING END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 ADHESIVE FILMS MARKET IN PACKAGING END-USE INDUSTRY, BY REGION, 2028–2030 (USD MILLION)

- TABLE 86 ADHESIVE FILMS MARKET IN PACKAGING END-USE INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 87 ADHESIVE FILMS MARKET IN PACKAGING END-USE INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 88 ADHESIVE FILMS MARKET IN PACKAGING END-USE INDUSTRY, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 89 ADHESIVE FILMS MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 90 ADHESIVE FILMS MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 ADHESIVE FILMS MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2028–2030 (USD MILLION)

- TABLE 92 ADHESIVE FILMS MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 93 ADHESIVE FILMS MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 94 ADHESIVE FILMS MARKET IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 95 ADHESIVE FILMS MARKET IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 96 ADHESIVE FILMS MARKET IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 97 ADHESIVE FILMS MARKET IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2028–2030 (USD MILLION)

- TABLE 98 ADHESIVE FILMS MARKET IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 99 ADHESIVE FILMS MARKET IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 100 ADHESIVE FILMS MARKET IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 101 ADHESIVE FILMS MARKET IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 102 ADHESIVE FILMS MARKET IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 103 ADHESIVE FILMS MARKET IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2028–2030 (USD MILLION)

- TABLE 104 ADHESIVE FILMS MARKET IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 105 ADHESIVE FILMS MARKET IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 106 ADHESIVE FILMS MARKET IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 107 ADHESIVE FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 108 ADHESIVE FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 109 ADHESIVE FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2028–2030 (USD MILLION)

- TABLE 110 ADHESIVE FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 111 ADHESIVE FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 112 ADHESIVE FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 113 ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 114 ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 115 ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (USD MILLION)

- TABLE 116 ADHESIVE FILMS MARKET BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 117 ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 118 ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (MILLION SQUARE METER)

- TABLE 119 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 123 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 124 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 125 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 129 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 130 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 131 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 135 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 136 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 137 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 141 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 142 ASIA PACIFIC: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 143 NORTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 144 NORTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 145 NORTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 147 NORTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 148 NORTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 149 NORTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 150 NORTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 151 NORTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 152 NORTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 153 NORTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 154 NORTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 155 NORTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 156 NORTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 157 NORTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 159 NORTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 160 NORTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 161 NORTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 162 NORTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 163 NORTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 165 NORTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 166 NORTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 167 EUROPE: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 168 EUROPE: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 169 EUROPE: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 170 EUROPE: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 171 EUROPE: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 172 EUROPE: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 173 EUROPE: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 174 EUROPE: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 175 EUROPE: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 176 EUROPE: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 177 EUROPE: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 178 EUROPE: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 179 EUROPE: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 180 EUROPE: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 181 EUROPE: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 182 EUROPE: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 183 EUROPE: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 184 EUROPE: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 185 EUROPE: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 186 EUROPE: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 187 EUROPE: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (USD MILLION)

- TABLE 188 EUROPE: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 189 EUROPE: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 190 EUROPE: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 191 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 192 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 193 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 195 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 196 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 197 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 198 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 199 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 200 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 201 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 202 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 203 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 204 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 205 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 207 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 208 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 209 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 210 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 211 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (USD MILLION)

- TABLE 212 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 213 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 214 SOUTH AMERICA: ADHESIVE FILMS MARKET, BY COUNTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 215 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 219 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 220 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 221 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 225 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 226 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 227 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 231 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 232 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 233 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SIZE, BY COUNTRY, 2028–2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 237 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 238 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SIZE, BY COUNTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 239 OVERVIEW OF STRATEGIES ADOPTED BY KEY ADHESIVE FILMS MARKET PLAYERS

- TABLE 240 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 241 COMPANY REGION FOOTPRINT

- TABLE 242 COMPANY FOOTPRINT

- TABLE 243 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 244 MOST FOLLOWED STRATEGIES

- TABLE 245 DETAILED LIST OF KEY MARKET PLAYERS

- TABLE 246 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 247 PRODUCT LAUNCHES, 2016–2022

- TABLE 248 DEALS, 2016–2022

- TABLE 249 3M COMPANY: COMPANY OVERVIEW

- TABLE 250 3M COMPANY: PRODUCT LAUNCHES

- TABLE 251 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 252 AVERY DENNISON CORPORATION: DEALS

- TABLE 253 AVERY DENNISON CORPORATION: OTHERS

- TABLE 254 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 255 HENKEL AG & CO. KGAA: DEALS

- TABLE 256 UPM-KYMMENE OYJ: COMPANY OVERVIEW

- TABLE 257 UPM-KYMMENE OYJ: PRODUCT LAUNCHES

- TABLE 258 UPM-KYMMENE OYJ: DEALS

- TABLE 259 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 260 CCL INDUSTRIES: COMPANY OVERVIEW

- TABLE 261 CCL INDUSTRIES: DEALS

- TABLE 262 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

- TABLE 263 CONSTANTIA FLEXIBLES: DEALS

- TABLE 264 COSMO FILMS: COMPANY OVERVIEW

- TABLE 265 TORAY INDUSTRIES: COMPANY OVERVIEW

- TABLE 266 MONDI GROUP: COMPANY OVERVIEW

- TABLE 267 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 268 COVERIS: COMPANY OVERVIEW

- TABLE 269 ADHESIVE FILMS INC.: COMPANY OVERVIEW

- TABLE 270 SCAPA GROUP PLC (SWM INTERNATIONAL): COMPANY OVERVIEW

- TABLE 271 SHURTAPE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 272 ESTER CHEMICAL INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 273 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- TABLE 274 INTERTAPE POLYMER GROUP, INC.: COMPANY OVERVIEW

- TABLE 275 DRYTAC CORPORATION: COMPANY OVERVIEW

- TABLE 276 FUJI SEAL INTERNATIONAL: COMPANY OVERVIEW

- TABLE 277 HUHTAMAKI: COMPANY OVERVIEW

- TABLE 278 LINTEC: COMPANY OVERVIEW

- TABLE 279 DUNMORE CORPORATION: COMPANY OVERVIEW

- TABLE 280 DOUBLE FISH ENTERPRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 281 DONLEE: COMPANY OVERVIEW

- TABLE 282 DEXERIALS: COMPANY OVERVIEW

- TABLE 283 HOT-MELT ADHESIVES MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 284 HOT-MELT ADHESIVES MARKET, BY RESIN TYPE, 2021–2027 (USD MILLION)

- TABLE 285 HOT-MELT ADHESIVES MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 286 HOT-MELT ADHESIVES MARKET, BY RESIN TYPE, 2021–2027 (KILOTON)

- TABLE 287 HOT-MELT ADHESIVES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 288 HOT-MELT ADHESIVES MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 289 HOT-MELT ADHESIVES MARKET, BY APPLICATION, 2017–2020 (KILOTON)

- TABLE 290 HOT-MELT ADHESIVES MARKET, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 291 HOT-MELT ADHESIVES MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 292 HOT-MELT ADHESIVES MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 293 HOT-MELT ADHESIVES MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 294 HOT-MELT ADHESIVES MARKET, BY REGION, 2021–2027 (KILOTON)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 POLYPROPYLENE FILM MATERIAL SEGMENT TO DOMINATE ADHESIVE FILMS MARKET, IN TERMS OF VALUE

- FIGURE 7 TAPES TO BE LARGEST APPLICATION SEGMENT IN ADHESIVE FILMS MARKET, IN TERMS OF VALUE

- FIGURE 8 PACKAGING SEGMENT TO DOMINATE GLOBAL ADHESIVE FILMS MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF ADHESIVE FILMS MARKET IN 2022

- FIGURE 10 ADHESIVE FILMS MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 11 POLYPROPYLENE TO BE LARGEST FILM MATERIAL SEGMENT OF ADHESIVE FILMS MARKET

- FIGURE 12 MARKETS IN EMERGING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

- FIGURE 13 PACKAGING SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2021

- FIGURE 14 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ADHESIVE FILMS MARKET

- FIGURE 16 ADHESIVE FILMS VALUE CHAIN

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- FIGURE 19 KEY BUYING CRITERIA FOR ADHESIVE FILMS

- FIGURE 20 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 21 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- FIGURE 22 AVERAGE PRICE COMPETITIVENESS IN ADHESIVE FILMS MARKET, BY REGION

- FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN ADHESIVE FILMS MARKET, BY FILM MATERIAL

- FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN ADHESIVE FILMS MARKET, BY APPLICATION

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN ADHESIVE FILMS MARKET, BY END-USE INDUSTRY

- FIGURE 26 ADHESIVE FILMS MARKET ECOSYSTEM

- FIGURE 27 YC AND YCC SHIFT

- FIGURE 28 PUBLICATION TRENDS, 2017–2023

- FIGURE 29 NUMBER OF PATENTS PUBLISHED, 2017–2023

- FIGURE 30 LEGAL STATUS OF PATENTS, 2017–2023

- FIGURE 31 PATENTS PUBLISHED BY JURISDICTION, 2022

- FIGURE 32 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2022

- FIGURE 33 PP TO BE LARGEST FILM MATERIAL SEGMENT IN ADHESIVE FILMS MARKET

- FIGURE 34 TAPES APPLICATION TO LEAD OVERALL ADHESIVE FILMS MARKET, 2022–2030 (USD MILLION)

- FIGURE 35 PACKAGING END-USE INDUSTRY SEGMENT TO LEAD OVERALL ADHESIVE FILMS MARKET

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING ADHESIVE FILMS MARKET

- FIGURE 37 ASIA PACIFIC: ADHESIVE FILMS MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICA: ADHESIVE FILMS MARKET SNAPSHOT

- FIGURE 39 EUROPE: ADHESIVE FILMS MARKET SNAPSHOT

- FIGURE 40 SOUTH AMERICA: ADHESIVE FILMS MARKET SNAPSHOT

- FIGURE 41 MIDDLE EAST & AFRICA: ADHESIVE FILMS MARKET SNAPSHOT

- FIGURE 42 COMPANY EVALUATION QUADRANT MATRIX, 2021

- FIGURE 43 SMALL- AND MEDIUM-SIZED ENTERPRISES’ COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 44 MARKET SHARE, BY KEY PLAYERS (2021)

- FIGURE 45 REVENUE ANALYSIS OF TOP PLAYERS, 2016–2021

- FIGURE 46 MARKET RANKING ANALYSIS, 2021

- FIGURE 47 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 48 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 50 UPM-KYMMENE OYJ: COMPANY SNAPSHOT

- FIGURE 51 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 52 CCL INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 53 CONSTANTIA FLEXIBLES: COMPANY SNAPSHOT

- FIGURE 54 COSMO FILMS: COMPANY SNAPSHOT

- FIGURE 55 TORAY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 56 MONDI GROUP: COMPANY SNAPSHOT

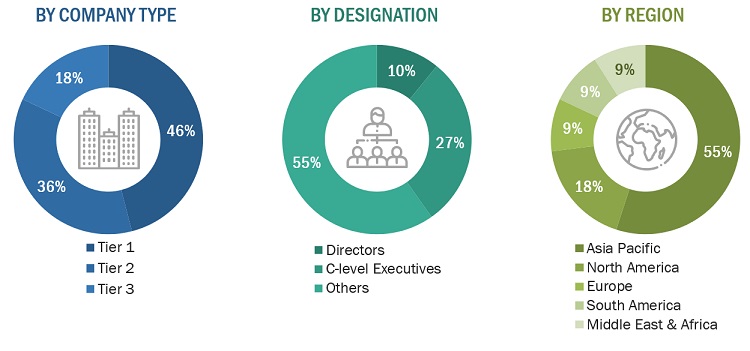

The study involves four major activities in estimating the current market size of Adhesive films. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Adhesive films market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as packaging, transportation, construction, and electrical & electronics. The supply side is characterized by advancements in formulations. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Adhesive films market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Adhesive films Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the Adhesive films market, in terms of value and volume

- To define, describe, and forecast the Adhesive films market by resin type, film material, application, end-use industry, and region

- To forecast the Adhesive films market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the Adhesive films market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the adhesive films market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Adhesive films market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Adhesive Films Market