Advanced Composites Market by Fiber Type (Carbon, S-Glass, Aramid), Resin Type (Thermosetting, Thermoplastic), Manufacturing Process (Filament Winding, Injection Molding, Pultrusion), End-use Industry, Region - Global Forecast to 2022

The advanced composites market is projected to reach USD 38.41 Billion by 2022, at a CAGR of 10.89%. The use of advanced composites is becoming crucial in the aerospace & defense, marine, sporting goods, transportation, and wind energy industries, owing to the high strength and reduced weight offered by advanecd composites. Furthermore, manufacturers of advanced composites are undertaking supply agreements with various end-use industries to secure their positions in the advanced composite market. In this study, the years considered to estimate the market size of the advanced composites market have been mentioned below:

- Base Year – 2016

- Estimated Year – 2017

- Projected Year – 2022

- Forecast Period – 2017 to 2022

2016 has been considered the base year to profile various companies in this report. For companies wherein information was unavailable for the base year, the year prior to it has been considered.

Objectives of the Advanced Composites Market Study

- To analyze and forecast the size of the advanced composites market, in terms of volume (kilotons) and value (USD million)

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the advanced composites market

- To define, describe, and forecast the advanced composite market on the basis of fiber type, resin type, manufacturing process, end-use industry, and region

- To analyze and forecast the advanced composites market for five major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa (MEA), Latin America, and their key countries

- To strategically analyze the composites market with respect to individual growth trends, future prospects, and contribution of various submarkets to the overall market

- To strategically profile the key players operating in the advanced composite market and analyze their core competencies

- To analyze competitive developments, such as investments & expansions, new product launches, and agreements of the key players operating in the advanced composites market

- To analyze the opportunities and competitive landscape for the stakeholders and market leaders in the advanced composite market

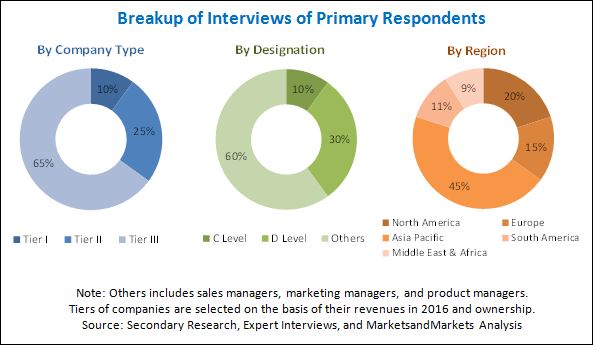

Various secondary sources, such as such as Factiva, Hoovers, Manta, and others have been referred to understand and gain insights on the advanced composites market. Experts from top composite companies have been interviewed to verify and collect critical information and to assess trends in the advanced composite market during the forecast period. The top-down, bottom-up, and data triangulation approaches have been implemented to calculate the exact values of the overall parent and individual market sizes.

To know about the assumptions considered for the study, download the pdf brochure

The advanced composites market has a diversified and established ecosystem of its upstream players, such as raw material suppliers and downstream stakeholders, which include advanced composites manufacturers, advanced composites vendors, end users, and government organizations. Since 2000, most of the leading players in the advanced composite market have adopted backward and forward integration to strengthen their positions in the market. Owens Corning, Teijin Limited, Toray Industries, Inc., SGL Group, Solvay, Hexcel Corporation, and Gurit are some of the leading players operating in the advanced composites market.

Target Audience in Advanced Composites Market

- Manufacturers of Advanced Composites

- Raw Material Suppliers

- Distributors & Suppliers of Advanced Composites

- End-use Industries

- Industry Associations

- Investment Research Firms

“This study answers several questions for the stakeholders, primarily which market segments they need to focus upon during the next two to five years, to prioritize their efforts and investments.”

Advanced Composites Market Report Scope

The research report segments the advanced composites market as follows:

Advanced Composites Market, by Fiber Type:

- Carbon Fiber Composites

- Aramid Fiber Composites

- S-Glass Fiber Composites

- Other Fiber Composites

Advanced Composites Market, by Resin Type:

- Advanced Thermosetting Composites

- Advanced Thermoplastic Composites

Advanced Composites Market, by Manufacturing Process:

- Hand layup/ Spray Layup

- AFP/ATL

- Filament Winding

- Injection Molding

- Pultrusion

- Compression Molding

- RTM/VARTM

- Others

Advanced Composite Market, by End-use Industry:

- Transportation

- Aerospace & Defense

- Wind Energy

- Sporting Goods

- Electrical & Electronics

- Civil Engineering

- Pipes & Tanks

- Medical

- Marine

- Others

Advanced Composites Market, by Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa (MEA)

- South America

Advanced Composites Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Advanced Composites Market Product Analysis

- Product matrix that gives a detailed comparison of product portfolio of each company

Advanced Composites Market Regional Analysis

- Further breakdown of the North America advanced composites market

- Further breakdown of the Europe advanced composite market

- Further breakdown of the Asia Pacific advanced composites market

- Further breakdown of the Middle East & Africa advanced composite market

- Further breakdown of the South America advanced composites market

Advanced Composites Market Company Information

- Detailed analysis and profiles of additional market players

The advanced composites market is projected to grow from an estimated USD 22.91 Billion in 2017 to USD 38.41 Billion by 2022, at a CAGR of 10.89% between 2017 and 2022. The growth of the advanced composite market can be attributed to increased use of advanced composites in the aerospace & defense, sporting goods, and transportation industries, as these offer a high strength-to-weight ratio and increased heat resistance. Moreover, these are lightweight, which increases the fuel efficiency of vehicles manufactured using advanced composites and also provides structural stability.

The advanced composites market has been segmented based on fiber type, resin type, manufacturing process, end-use industry, and region.

Among manufacturing processes, the AFP/ATL manufacturing process segment led the advanced composite market in 2016 both, in terms of value as well as volume. Growth of this segment of the market is attributed to the ease of manufacturing complex structures which is not possible in any other manufacturing process.

North America is the largest consumer of advanced composites across the globe in terms of value and volume. The growth of the North America advanced composites market is driven by the increasing consumption of advanced composites in various applications such as aerospace & defense, wind energy, and transportation. The US is the largest consumer of advanced composites globally, in terms of value and volume and is expected to strengthen its position further during the forecast period. The growth of the US advanced composite market is attributed to the establishment of a number of new carbon fiber production plants in the country and increased investments by various Europe-based companies dealing in the aerospace & defense, transportation, and wind energy industries.

Among fiber types, the carbon fiber composites segment is projected to lead the advanced composites market in terms of value and volume during the forecast period, as carbon fiber composites are lightweight and strong and are therefore used in a wide range of applications in various industries.

Among resin types, the advanced thermoplastic composites segment accounted for the largest share in the advanced composite market in terms of value as well as volume in 2016. The growth of this segment of the market can be attributed to increased use of advanced thermoplastic composites in the aerospace & defense, transportation, sporting goods, and many other end-use industries. Advanced thermosetting composites are also used in various other industries. These do not expand under high-heat and moist conditions, making them suitable for highly corrosive and high-temperature applications.

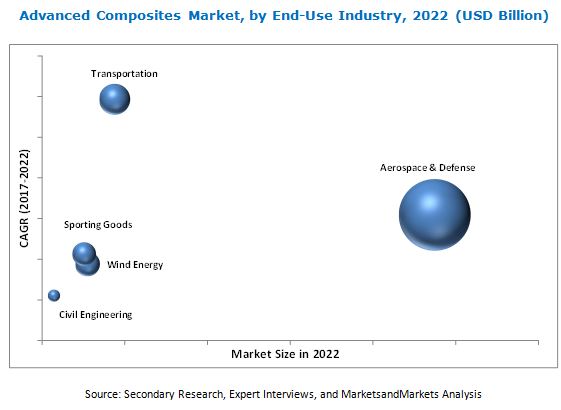

Based on end-use industry, the advanced composites market has been segmented into aerospace & defense, transportation, wind energy, civil engineering, pipes & tanks, sporting goods, marine, medical, electrical & electronics, and others. Among these, the largest market is the aerospace & defense industry, which is expected to grow at a high CAGR due to the properties offered by advanced composites in terms of shape stability, high strength, excellent damage resistance, and high longitudinal stiffness.

The aerospace & defense industry is the largest market, but transportation is the fastest- growing market due to the mass production of parts using advanced composites.

Key Players in Advanced Composites Market

The high cost of raw materials required to manufacture advanced composites acts as a barrier to the growth of the advanced composites market across the globe. However, companies are adopting various organic and inorganic strategies to enable a strong foothold in the advanced composite market. Toray Industries, Inc. , Teijin Limited, Owens Corning , and Hexcel Corporation are a few major manufacturers of advanced composites across the globe. These companies have been able to hold leading positions in the advanced composites market by tapping various regional markets. They have undertaken expansions & investments and agreements to accommodate the increased demand for advanced composites from various industries across the globe as well as enhance their market shares and customer bases.

Frequently Asked Questions (FAQ):

What is the Advanced Composites Market growth?

Growth of Advanced Composites Market - At a CAGR of 10.89% from 2017 to 2022.

Who leading market players in Advanced Composites industry?

Some of the leading manufacturers of composites include Owens Corning, Solvay SGL Group, Hexcel Corporation, Koninklijke Ten Cate bv, Teijin Limited, Toray Industries, Inc., Huntsman Corporation, Jushi Group, and Gurit, among others. These players have adopted various organic and inorganic strategies to strengthen their foothold in the advanced composites market.

How big is the Advanced Composites Market?

The advanced composites market is projected to reach USD 38.41 Billion by 2022.

Which segments are covered in Advanced Composites Market report?

By Fiber Type (Carbon, S-Glass, Aramid), Resin Type (Thermosetting, Thermoplastic), Manufacturing Process (Filament Winding, Injection Molding, Pultrusion) & End-use Industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Methodology

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Advanced Composites Market

4.2 Advanced Composite Market, By Manufacturing Process

4.3 Advanced Composites Market, By Key End-Use Industry and Region

4.4 Advanced Composite Market Size, By End-Use Industry, 2017 vs 2022

4.5 Advanced Composites Market Growth, By Country

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand of Carbon Fiber and S-Glass Fiber Composites in Aerospace & Defense Industry

5.3.1.2 Increase in Demand for Fuel-Efficient Vehicles

5.3.1.3 Focus on Production of Electricity From Renewable Sources

5.3.2 Restraints

5.3.2.1 High Cost of Advanced Composites

5.3.3 Opportunities

5.3.3.1 Penetration of Carbon Fiber Composites in New End-Use Industries Such as Civil Engineering, Medical, and Pipes & Tanks

5.3.3.2 Growing Demand From Emerging Markets

5.3.3.3 Reduction of Carbon Fibers Cost

5.3.4 Challenges

5.3.4.1 Producing Low-Cost Advanced Composites

5.3.4.2 Recycling Advanced Composites

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

6 Macro Economic Overview and Key Trends (Page No. - 48)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Per Capita GDP vs Per Capita Composite Materials Demand

6.4 Trends in Wind Energy Industry

6.5 Trends in Aerospace Industry

6.6 Trends of Automotive Industry

7 Advanced Composites Market, By Fiber Type (Page No. - 56)

7.1 Introduction

7.2 Carbon Fiber Composites

7.3 Aramid Fiber Composites

7.4 S-Glass Composites

7.5 Other Composites

8 Advanced Composite Market, By Resin Type (Page No. - 66)

8.1 Introduction

8.2 Advanced Thermosetting Composites

8.2.1 Polyester Resin

8.2.2 Vinyl Ester Resin

8.2.3 Epoxy Resin

8.2.4 Polyurethane Resin

8.2.5 Phenolic

8.2.6 Others

8.3 Advanced Thermoplastic Composites

8.3.1 Polyphenylene Sulfide (PPS)

8.3.2 Polyetherimide (PEI)

8.3.3 Polyetheretherketone (PEEK)

8.3.4 Others

9 Advanced Composite Market, By Manufacturing Process (Page No. - 74)

9.1 Introduction

9.2 AFP/ATL

9.3 Compression Molding Process

9.4 Hand Layup/Spray Layup Process

9.5 Resin Transfer Molding Process

9.6 Filament Winding Process

9.7 Injection Molding Process

9.8 Pultrusion Process

9.9 Others

10 Advanced Composites Market, By End-Use Industry (Page No. - 85)

10.1 Introduction

10.2 Aerospace & Defense

10.3 Wind Energy

10.4 Transportation

10.5 Sporting Goods

10.6 Pipes & Tanks

10.7 Marine

10.8 Civil Engineering

10.9 Electrical & Electronics

10.10 Medical

10.11 Others

11 Advanced Composites Market, By Region (Page No. - 103)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 U.K.

11.3.4 Italy

11.3.5 Austria

11.3.6 Netherlands

11.3.7 Poland

11.3.8 Sweden

11.3.9 Spain

11.3.10 Russia

11.3.11 Turkey

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Australia & New Zealand

11.4.6 Malaysia

11.4.7 Singapore

11.5 Middle East & Africa

11.5.1 UAE

11.5.2 Israel

11.5.3 South Africa

11.6 South America

11.6.1 Brazil

11.6.2 Argentina

12 Competitive Landscape (Page No. - 127)

12.1 Market Share Analysis

12.1.1 Toray Industries, Inc.

12.1.2 Teijin Limited

12.1.3 Mitsubishi Chemical Holdings Corporation

13 Company Profiles (Page No. - 129)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

13.1 Toray Industries, Inc.

13.2 Recent Developments

13.3 Teijin Limited

13.4 Mitsubishi Chemical Holdings Corporation

13.5 SGL Group

13.6 Koninklijke Ten Cate BV.

13.7 Huntsman International, LLC.

13.8 Solvay

13.9 Hexcel Corporation

13.10 Hexion

13.11 E. I. Du Pont Nemours & Co.

13.12 Owens Corning

13.13 Other Players

13.13.1 BASF SE

13.13.2 Gurit

13.13.3 AGY

13.13.4 Dowaksa

13.13.5 Honeywell International Inc.

13.13.6 Advanced Composites Inc.

13.13.7 Renegade Materials Corporation

13.13.8 Kineco-Kaman

13.13.9 Henkel AG & Co. KGaA

13.13.10 Gaffco Ballistics

13.13.11 Nippon Graphite Fiber Co., Ltd.

13.13.12 Plasan Carbon Composites, Inc.

13.13.13 Quantum Composites

13.13.14 Hyosung

*Details Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 173)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (85 Tables)

Table 1 Eu: New Passenger Vehicles Co2 Emissions By Manufacturer and Corresponding 2015 and 2020 Targets (G/Km)

Table 2 Production Cost Structure With Current Technology, 2016

Table 3 Trends and Forecast of GDP, 2017–2022 (USD Billion)

Table 4 Per Capita GDP vs Per Capita Composite Materials Demand, 2016

Table 5 Wind Energy Installation, MW (2015–2016)

Table 6 Market for New Airplanes, 2016

Table 7 Automotive Production, Million Units (2011–2016)

Table 8 Applications of Advance Fiber Composites in Aerospace & Defense End-Use Industry

Table 9 Advanced Composites Market Size, By Fiber Type, 2017–2022 (USD Million)

Table 10 Market Size, By Fiber Type, 2015–2022 (Kiloton)

Table 11 Carbon Fiber Composites Market Size, By Region, 2015–2022 (USD Million)

Table 12 Carbon Fiber Composites Market Size, By Region, 2015–2022 (Kiloton)

Table 13 Aramid Fiber Composites Market Size, By Region, 2015–2022 (USD Million)

Table 14 Aramid Fiber Composites Market Size, By Region, 2015–2022 (Kiloton)

Table 15 S-Glass Fiber Composites Market Size, By Region, 2015–2022 (USD Million)

Table 16 S-Glass Fiber Composites Market Size, By Region, 2015–2022 (Kiloton)

Table 17 Other Advanced Composites Market Size, By Region, 2015–2022 (USD Million)

Table 18 Other Advanced Composite Market Size, By Region, 2015–2022 (Kiloton)

Table 19 Properties of Resins: Thermosetting vs Thermoplastic Resins

Table 20 Market Size, By Resin Type, 2015–2022 (USD Million)

Table 21 Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 22 Advanced Thermosetting Composites Market Size, By Region, 2015–2022 (USD Million)

Table 23 By Composites Market Size, By Region, 2015–2022 (Kiloton)

Table 24 Advanced Thermoplastic Composites Market Size, By Region, 2015–2022 (USD Million)

Table 25 By Composites Market Size, By Region, 2015–2022 (Kiloton)

Table 26 Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 27 Market Size, By Manufacturing Process, 2015–2022 (Kiloton)

Table 28 AFP/ATL Process Market Size, By Region, 2015–2022 (USD Million)

Table 29 AFP/ATL Process Market Size, By Region, 2015–2022 (Kiloton)

Table 30 Compression Molding Process Market Size, By Region, 2015–2022 (USD Million)

Table 31 Compression Molding Process Market Size, By Region, 2015–2022 (Kiloton)

Table 32 Hand Layup/Spray Layup Process Market Size, By Region, 2015–2022 (USD Million)

Table 33 Hand Layup/Spray Layup Process Market Size, By Region, 2015–2022 (Kiloton)

Table 34 RTM/VARTM Process Market Size, By Region, 2015–2022 (USD Million)

Table 35 RTM/VARTM Process Market Size, By Region, 2015–2022 (Kiloton)

Table 36 Filament Winding Process Market Size, By Region, 2015–2022 (USD Million)

Table 37 Filament Winding Process Market Size, By Region, 2015–2022 (Kiloton)

Table 38 Injection Molding Process Market Size, By Region, 2015–2022 (USD Million)

Table 39 Injection Molding Process Market Size, By Region, 2015–2022 (Kiloton)

Table 40 Pultrusion Process Market Size, By Region, 2015–2022 (USD Million)

Table 41 Pultrusion Process Market Size, By Region, 2015–2022 (Kiloton)

Table 42 Other Process Market Size, By Region, 2015–2022 (USD Million)

Table 43 Other Process Market Size, By Region, 2015–2022 (Kiloton)

Table 44 Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 45 Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 46 Demand for New Airplanes, By Region, 2016–2035

Table 47 Market Size in Aerospace & Defense End-Use Industry, By Region, 2015–2022 (USD Million)

Table 48 Advanced Composites Market Size in Aerospace & Defense End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 49 Europe: Annual Wind Energy Installations, 2016 (MW)

Table 50 Asia-Pacific: Annual Wind Energy Installations, 2016 (MW)

Table 51 Market Size in Wind Energy End-Use Industry, By Region, 2015–2022 (USD Million)

Table 52 Market Size in Wind Energy End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 53 Market Size in Transportation End-Use Industry, By Region, 2015–2022 (USD Million)

Table 54 Market Size in Transportation End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 55 Market Size in Sporting Goods End-Use Industry, By Region, 2015–2022 (USD Million)

Table 56 Advanced Composites Market Size in Sporting Goods End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 57 Market Size in Pipes & Tanks End-Use Industry, By Region, 2015–2022 (USD Million)

Table 58 Market Size in Pipes & Tanks End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 59 Market Size in Marine End-Use Industry, By Region, 2015–2022 (USD Million)

Table 60 Advanced Composites Market Size in Marine End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 61 Market Size in Civil Engineering End-Use Industry, By Region, 2015–2022 (USD Million)

Table 62 Advanced Composites Market Size in Civil Engineering End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 63 Market Size in Electrical & Electronics End-Use Industry, By Region, 2015–2022 (USD Million)

Table 64 Advanced Composites Market Size in Electrical & Electronics End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 65 Composites Market Size in Medical End-Use Industry, By Region, 2015–2022 (USD Million)

Table 66 Composites Market Size in Medical End-Use Industry, By Region, 2015–2022 (Kiloton)

Table 67 Market Size in Other End-Use Industries, By Region, 2015–2022 (USD Million)

Table 68 Advanced Composites Market Size in Other End-Use Industries, By Region, 2015–2022 (Kiloton)

Table 69 Market Size, By Region, 2015–2022 (USD Million)

Table 70 Advanced Composites Market Size, By Region, 2015–2021 (Kiloton)

Table 71 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 72 North America: Market Size, By Country, 2014–2021 (Kiloton)

Table 73 U.S.: New Wind Energy Installations, 2010–2016, (MW)

Table 74 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 75 Europe: Market Size, By Country, 2014–2021 (Kiloton)

Table 76 Germany: New Wind Energy Installations, 2010–2016 (MW)

Table 77 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 78 Asia-Pacific: Market Size, By Country, 2015–2022 (Kiloton)

Table 79 China: New Wind Energy Installations, 2010–2016 (MW)

Table 80 India: New Wind Energy Installations, 2010–2016 (MW)

Table 81 MEA: Market Size, By Country, 2015–2022 (USD Million)

Table 82 MEA: Market Size, By Country, 2015–2022 (Kiloton)

Table 83 South America: Market Size, By Country, 2015–2022 (USD Million)

Table 84 South America: Market Size, By Country, 2015–2022 (Kiloton)

Table 85 Brazil: New Wind Energy Installations, 2010–2016 (MW)

List of Figures (48 Figures)

Figure 1 Advanced Composites Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Advanced Composite Market: Data Triangulation

Figure 5 Carbon Fiber Segment Dominates Overall Market of Advanced Composites

Figure 6 Aerospace & Defense End-Use Industry Set to Drive Market of Advanced Composites, 2017–2022

Figure 7 AFP/ATL Process to Register Highest CAGR in Advanced Composites Market Between 2017 and 2022

Figure 8 Europe is Projected to Register Highest CAGR Between 2017 and 2022

Figure 9 Emerging Economies Offer Lucrative Opportunities in the Market

Figure 10 AFP/ATL Manufacturing Processes Set to Drive Market of Advanced Composites, 2017–2022

Figure 11 North America Dominates Global Market of Advanced Composites

Figure 12 Aerospace & Defense to Dominate Market of Advanced Composites

Figure 13 France to Be Fastest Growing Market, 2017–2022

Figure 14 Fast Development of Advanced Composites for Industry Applications

Figure 15 Drivers, Restraints, Opportunities & Challenges in the Advanced Composite Market

Figure 16 Advanced Composites Market: Porter’s Five Forces Analysis

Figure 17 Trends and Forecast of GDP, 2017–2022 (USD Billion)

Figure 18 Per Capita GDP vs Per Capita Advanced Composite Materials Demand

Figure 19 Wind Energy Installed Capacity, MW (2014–2015)

Figure 20 Trends of New Airplane Deliveries, By Region, 2016

Figure 21 Automotive Production in Key Countries, Million Units (2015 vs 2016)

Figure 22 Carbon Fiber Composites to Lead the Market of Advanced Composites, 2017 Vs.2022

Figure 23 North America to Dominate the Carbon Fiber Composites Market

Figure 24 North America to Dominate S-Glass Fiber Composites Market During the Forecast Period

Figure 25 Advanced Thermosetting Composite to Dominate the Market, 2017 vs 2022

Figure 26 North America to Dominate Advanced Thermoplastic Composites Market, 2017 vs 2022

Figure 27 AFP/ATL Manufacturing Process to Dominate Market of Advanced Composites

Figure 28 Aerospace & Defense to Lead Market of Advanced Composites

Figure 29 North America to Drive Market of Advanced Composites in Aerospace & Defense End-Use Industry

Figure 30 North America to Dominate Market of Advanced Composites in Transportation End-Use Industry

Figure 31 North America to Dominate Market of Advanced Composites in Civil Engineering End-Use Industry

Figure 32 France to Be the Fastest Growing in the Global Market of Advanced Composites

Figure 33 North America Market Snapshot: U.S. - Most Lucrative Market in North America

Figure 34 France: Fastest-Growing Market of Advanced Composites in Europe

Figure 35 China Dominates Market of Advanced Composites in Asia-Pacific

Figure 36 Aerospace & Defense to Be the Fastest-Growing Application for Advanced Composites Market in South America (2017–2022)

Figure 37 Market Share of Key Players, 2016

Figure 38 Toray Industries, Inc.: Company Snapshot

Figure 39 Teijin Limited: Company Snapshot

Figure 40 Mitsubishi Chemical Holdings Corporation: Company Snapshot

Figure 41 SGL Group: Company Snapshot

Figure 42 Koninklijke Ten Cate BV.: Company Snapshot

Figure 43 Huntsman International, LLC.: Company Snapshot

Figure 44 Solvay: Company Snapshot

Figure 45 Hexcel Corporation: Company Snapshot

Figure 46 Hexion: Company Snapshot

Figure 47 E. I. Du Pont Nemours & Co.: Company Snapshot

Figure 48 Owens Corning: Company Snapshot

Growth opportunities and latent adjacency in Advanced Composites Market

Information on thermoset composites for Sports and recreation

Market information on advances composites in automotive and sporting goods for the UK market