Material Testing Market

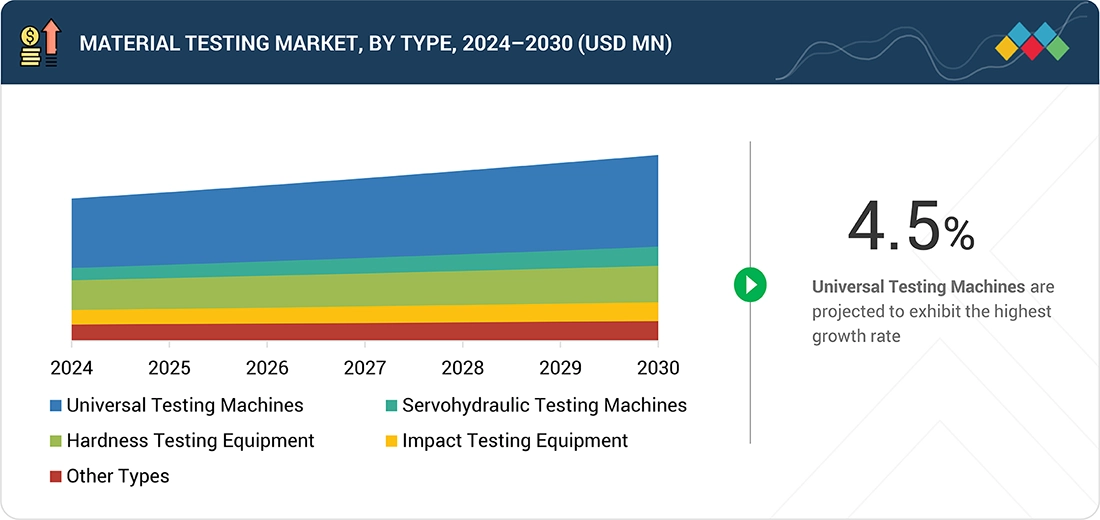

Material Testing Market by Type (Universal Testing Machine, Servohydraulic Testing Machine, Hardness Testing Equipment), Material (Metal, Plastic, Rubber & Elastomer), End User (Automotive, Construction), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

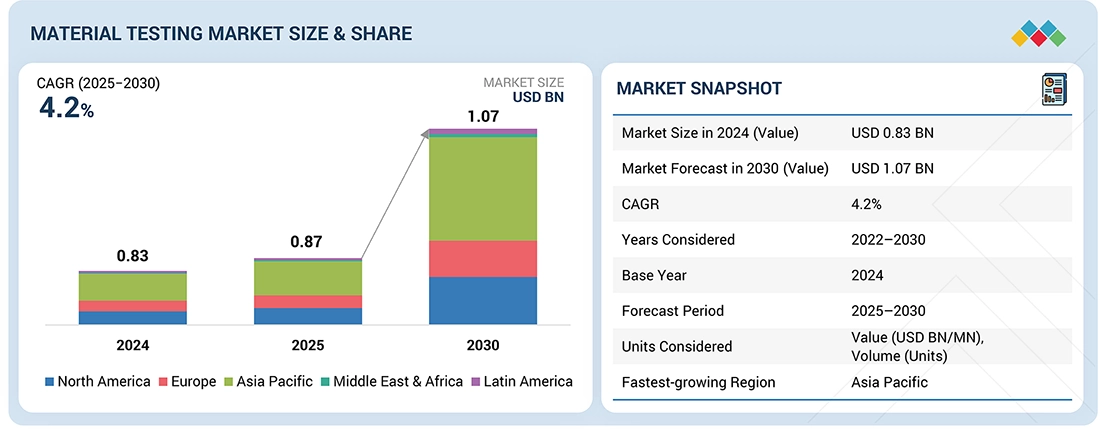

The global material testing market is projected to reach USD 1,070.9 million by 2030 from USD 871.9 million in 2025, at a CAGR of 4.2% during the forecast period. With the integration of AI and IoT technologies, the market has seen an increase in automated and digital testing solutions worldwide. The segments benefiting from the market growth are testing equipment, especially universal testing machines, and materials such as composites and ceramics.

KEY TAKEAWAYS

-

The material testing market for universal testing machines, servohydraulic testing machines, hardness testing, and impact testing equipment is growing steadily due to rising demand for automated and digital solutions that enhance accuracy and efficiency.

-

Key market trends in the material testing market by metal, plastics, rubber & elastomer, and ceramic & composite material types include rising demand for precise testing of high-performance metals & specialty alloys and growth in plastics testing driven by lightweight and sustainable materials.

-

Key market trends and insights in the material testing market by automotive, construction, educational institutions, aerospace & defense, medical devices, and power end users show increasing adoption of automated, AI-driven testing solutions to meet the rising demand for accuracy, regulatory compliance, and sustainability.

-

The material testing market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to grow the fastest, with a CAGR of 4.7%, fueled by rapid industrialization and strong research and development activities in countries like China, Japan, and India.

-

Key players in the material testing market adopt inorganic strategies such as mergers and acquisitions to expand their service portfolios and geographic reach, while organic strategies focus on investing in R&D, technological innovation, and strategic partnerships to enhance automation, digitalization, and AI-driven testing capabilities. Thus, they strengthen their competitive positioning and address evolving customer needs.

The market for material testing is driven by the increasing demand for quality assurance and regulatory compliance in many industries to ensure material safety and reliability. Additionally, the growth in infrastructure and other end-use sectors, such as automotive and aerospace, will expand a vast market for contracting material testing services. Lastly, technological advancements, including automation, artificial intelligence (AI), and non-destructive testing, will drive the material testing market—especially as testing becomes more accurate, faster, and easier.

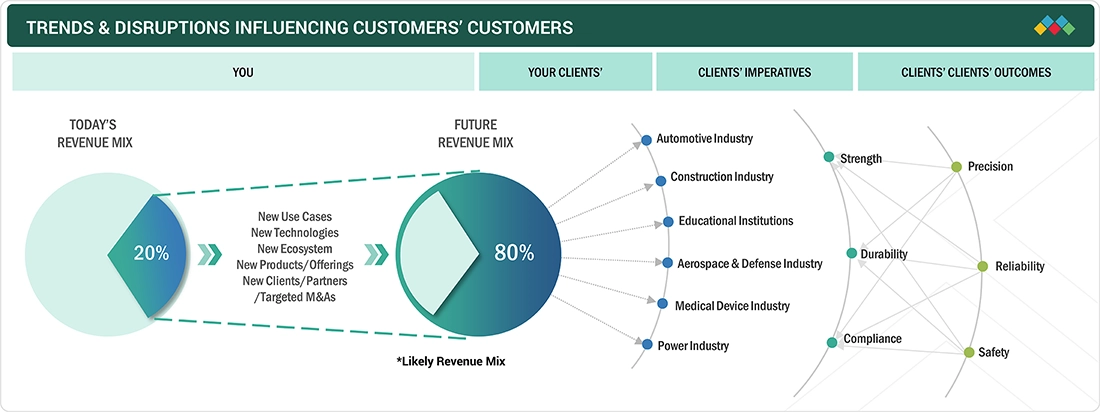

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The adoption of automation and AI-powered digital materials testing equipment is developing customer businesses by affording faster, better, and more efficient testing, real-time quality control, and conformity with more stringent international standards for testing. Disruption in the field, such as the change to sustainable and environmentally-friendly material testing, high-cost equipment, and insufficient highly skilled technicians, is causing customers to rethink their investments and workflows. The need for more sophisticated validation in multiple end-sectors and the rapid pace of material innovation are attracting manufacturers to commit to high-throughput, data-centric, and local testing solutions and investments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in infrastructure and construction

-

Technological advancements in testing equipment

Level

-

High initial costs and maintenance

-

Complexity of testing advanced materials

Level

-

Adoption of industry 4.0 technologies

-

Rise of additive manufacturing

Level

-

High costs of advanced equipment

-

Economic and supply chain disruptions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for quality assurance and regulatory compliance

An important driving force of the material testing market is the growing demand for quality control and regulatory compliance across various industries (aerospace, automotive, construction, and healthcare). The complexity and performance of materials produced are increasing, as is the importance of testing materials to ensure they perform appropriately. Hence, the risk of product failure, recalls, and liability is mitigated. In addition to this risk, the expectations placed on materials to meet safety, durability, and performance standards are increasing. Regulatory agencies worldwide (FDA, ASTM, ISO, and other national safety agencies) have increased standards and compliance, meaning manufacturers need to solidify and enforce their testing processes throughout the product lifecycle. This has driven increased investment in more advanced material testing equipment and services that can perform detailed characterization from mechanical properties to understanding chemical composition and resistance to environmental factors.

Restraint: High cost of advanced testing equipment

One major barrier to the growth of the materials testing market is the cost of advanced materials testing equipment and related costs. Many new materials testing instruments that have modern features, such as artificial intelligence (AI), automation, and digital data analytic capabilities, can be expensive investments, that can make even small and medium-sized enterprises (SMEs) and new market entrants hesitate to purchase. The capital cost for new materials testing equipment is not only the purchase cost, but also parts repair, calibrations, and consumables. The cost of testing equipment can inhibit any widespread adoption and is straining development in regions, like developing areas (due to limited budget, low levels of industrial automation, etc.). Additionally, complexity of some advanced testing systems requires trained technicians to operate the equipment and interpret generated test results. The requirement of skilled technicians affects training and labor costs, representing another barrier to new materials technology adoption, limiting efficient and effective use of advanced test technology

Opportunity: Rising adoption of digital technologies

The material testing market has a huge opportunity, given the increasing implementation of digital technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to modernize testing activities. These technologies are allowing for real-time data collection, predictive analytics, and automated decision-making to improve testing accuracy, speed, and efficiency. Digital twins—virtual representations of physical materials or processes—make it possible for companies to simulate and predict how materials would perform under various conditions, and to query the materials' behaviors without needing to conduct extensive physical tests, ultimately reducing costs and expediting research & development (R&D).

Challenge: Increasing complexity of materials and manufacturing processes

The numerous complexities of materials and processes in manufacturing are perhaps the most significant unique challenge facing the material testing market, which increases the need for more complex, flexible, and accurate methods of testing. The advent of advanced composites, nanomaterials, and additive manufacturing has made it impossible for the historical test protocols for characterizing properties of materials to accommodate new materials. The complexity of testing small-scale prototypes will lead to proprietary test protocols and instrumentation, which adds to costs and the length of the test. Comparable methods for testing emerging materials and processes are not developed in advance, which creates inconsistency in their results and creates difficulty for regulatory bodies to approve materials as well as for industry to accept new processes.

Material Testing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Fatigue testing of aluminum alloys to predict lifetime under cyclic loads in automotive and aerospace applications | Enabled lifetime prediction of aluminum alloys under cyclic loads for automotive and aerospace sectors |

|

Visualization of strain distribution and multi-channel strain measurement for composite mechanical properties evaluation. | Delivered comprehensive tensile and compression testing solutions widely used for quality assurance across industries |

|

Accurate simulation verification of composite materials using CAE analysis integrated with Shimadzu testing data | Developed servo-hydraulic and electromechanical testing systems for fatigue and material durability testing |

|

High-speed tensile and compression testing with digital imaging to analyze failure mechanisms in composites | High-speed testing with digital imaging for failure mechanisms in composites and lightweight metals |

|

Collaborative development with Laboratory Testing Inc. to optimize materials testing workflows and innovate testing systems | Enhances testing accuracy and reduces human error through integrated data analysis and automation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

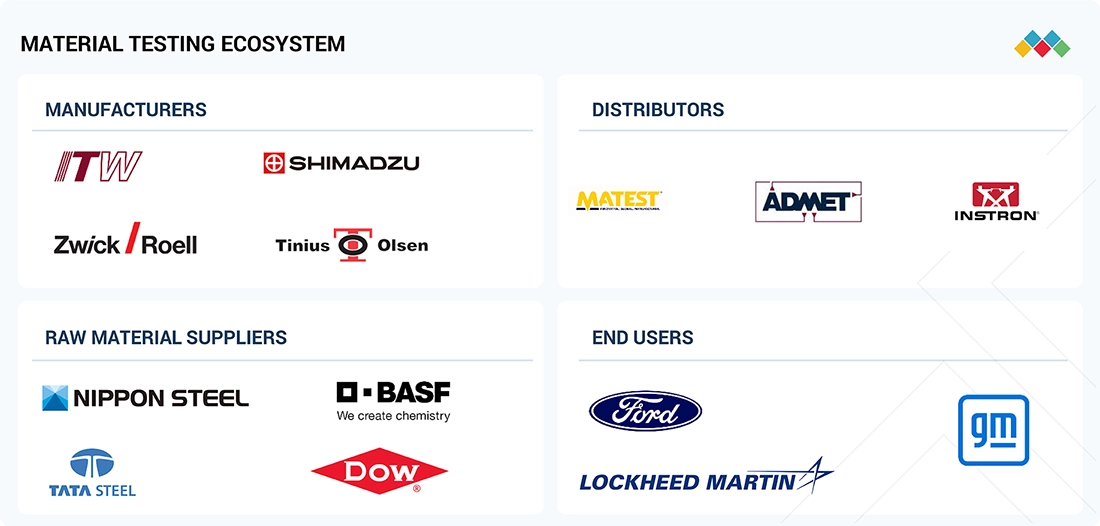

MARKET ECOSYSTEM

The ecosystem of the material testing market includes manufacturers, distributors, and end-users. The supply chain continues through distributors and retailers. The material testing market functions in a network of manufacturers, testing laboratories, service providers, and regulatory bodies, comprising all elements of equipment and testing solutions in many industries. The market is based on quality assurance and compliance, innovation, and attention to detail, resulting from collaboration, technological advancement, and a worldwide demand for trustworthy material characterization and safety validation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Material Testing Market, By Type

Universal testing machines (UTMs) hold the largest share in the materials testing market by type due to their versatility offered to users and the many applications across industries. UTMs can perform many tests, including tension, compression, bending, and shear, on various materials, including metals, polymers, composites, and ceramics. UTMs are seen as irreplaceable in many industries to assist with quality control and product development programs. In addition, the speed of industrialization and growth of infrastructure in newer economies drives the demand growth for UTM-based testing equipment, as it provides flexibility in the testing of a massive diversity of materials. Overall, UTMs are the fastest-growing and largest type of equipment in the materials testing market due to their capabilities, accuracy, and regulatory expectations.

Material Testing Market, By Material

Metals dominate the material testing market because they have a considerable market share and because they are used in a number of major industries: construction, automotive, aerospace, and manufacturing. As a result of their strength, durability, and resistance, metals have to undergo extensive testing to support safe and reliable use, particularly for structural and load-bearing purposes. Furthermore, the development of numerous high-performance alloys, along with the introduction of specialty metals such as stainless steel, titanium, and superalloys, and other specific metals, has dictated the demand for full phe-testing, such as tensile strength testing, hardness testing, fatigue, and corrosion resistance testing. In addition to the investments in manufacturing quality, metals will remain the largest and fastest-growing segment in the material testing market.

Material Testing Market, By End User

Educational institutions are expected to hold the largest share of the material testing market during the forecast period. This is largely due to significant government and business-based research and development efforts. Schools need to acquire innovative testing equipment to experiment with and fully understand new materials before they teach the next generation of engineers and scientists. The continuous evolution of innovations and updates to course materials, particularly in advanced testing solutions, greatly influences the overall value of the market.

REGION

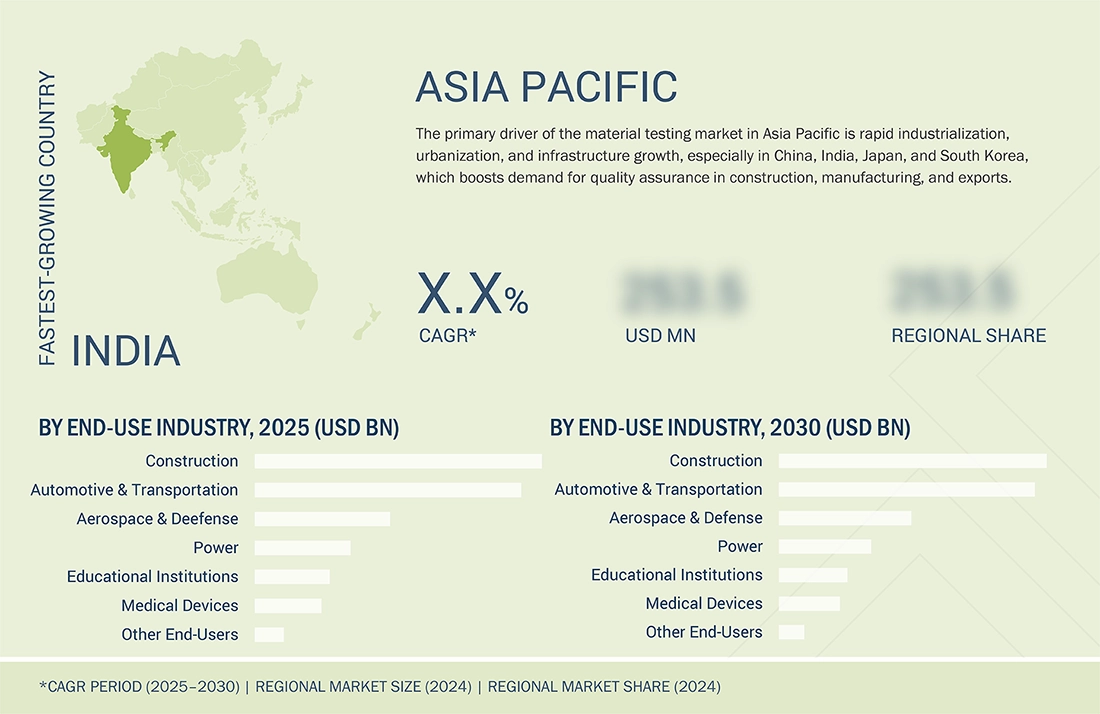

Asia Pacific to be fastest-growing region in global material testing market during forecast period

The Asia Pacific region is the fastest-growing market for material testing, as countries across the area continue to industrialize, urbanize, and build infrastructure rapidly. Government-led initiatives, such as "Make in India," aim to boost production. Advocating for construction efforts in China and a combined stimulus action has led to increased manufacturing and construction, resulting in a rise in material testing. As the sector also promotes employment in line with international standards and quality and safety regulations, material testing is in demand from an increasingly diversified range of industries. Economic expansion in diverse industries such as automotive, electronics, aerospace, and metals sets a chain reaction for demand, as these industries need advanced and thorough material characterization. With the rise in exports related to manufacturing and the increasing adoption of smart testing technologies, including automation and digital tools, the breadth of material testing in the industry is expanding, leading to growth in demand. Increased investment from the government into research and development, and increased cooperation and collaboration between academic institutions and industries are supporting increased material testing capabilities throughout the region and as part of current growth, and in line with current conditions, which are ultimately essential for the efficacy of any economy, the market for material testing is growing in the Asia Pacific region. These economies are already ripe for accelerated growth, and increasingly favorable government policy support in combination with their large industrial and manufacturing bases should support lasting market growth.

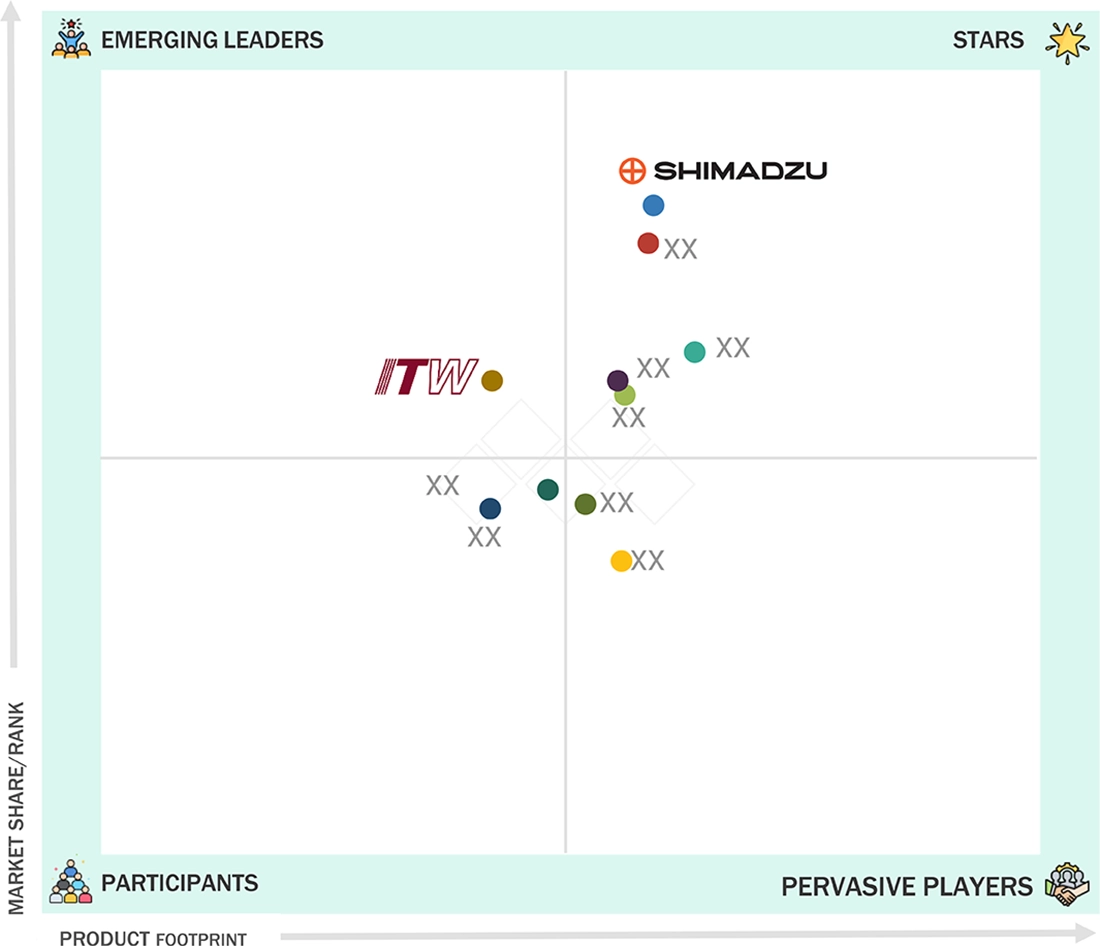

Material Testing Market: COMPANY EVALUATION MATRIX

Shimadzu's precision and reliable test systems are commonly used in labs and manufacturing. Illinois Tool Works has strong brand names like Instron and MTS Systems to provide complete solutions with decentralized customer support and local knowledge. Both firms are recognized for meeting evolving compliance, quality, and sustainability demands in different industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.83 Billion |

| Market Forecast in 2030 (value) | USD 1.07 Billion |

| Growth Rate | CAGR of 4.2% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

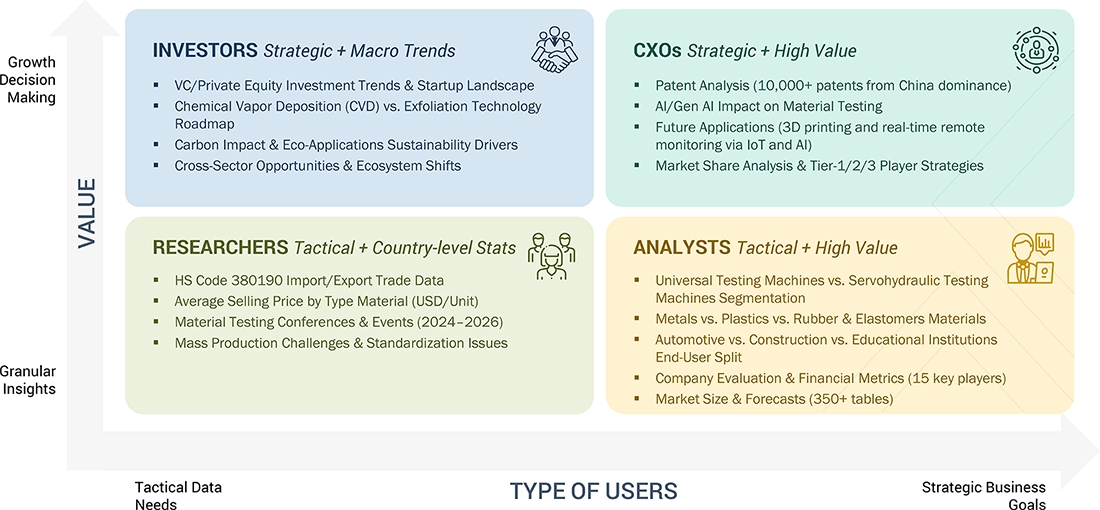

WHAT IS IN IT FOR YOU: Material Testing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Material Testing Equipment Manufacturer |

|

|

| APAC-based Universal Testing Machines Manufacturer |

|

|

| US-based Material Testing Raw Material Supplier |

|

|

| Automotive Material Testing Customer |

|

|

RECENT DEVELOPMENTS

- May 2025 : Shimadzu Corporation launched the Autograph AGS-V Series, a high-precision universal testing machine.

- April 2025 : Ametek has opened a new Customer Solutions Center in Beijing to enhance the localized customer experience.

- February 2024 : ZwickRoell announced a strategic partnership with IFS (Industrial and Financial Systems) to implement IFS Cloud ERP and CRM systems, enhancing its business processes and operational efficiency in the materials testing market.

- November 2022 : Nova Measurements LLC acquired VJ Tech Limited, a UK-based specialist in geotechnical testing equipment.

- December 2021 : Illinois Tool Works Inc. (ITW) completed the acquisition of the Test & Simulation business of MTS Systems Corporation from Amphenol Corporation.

Table of Contents

Methodology

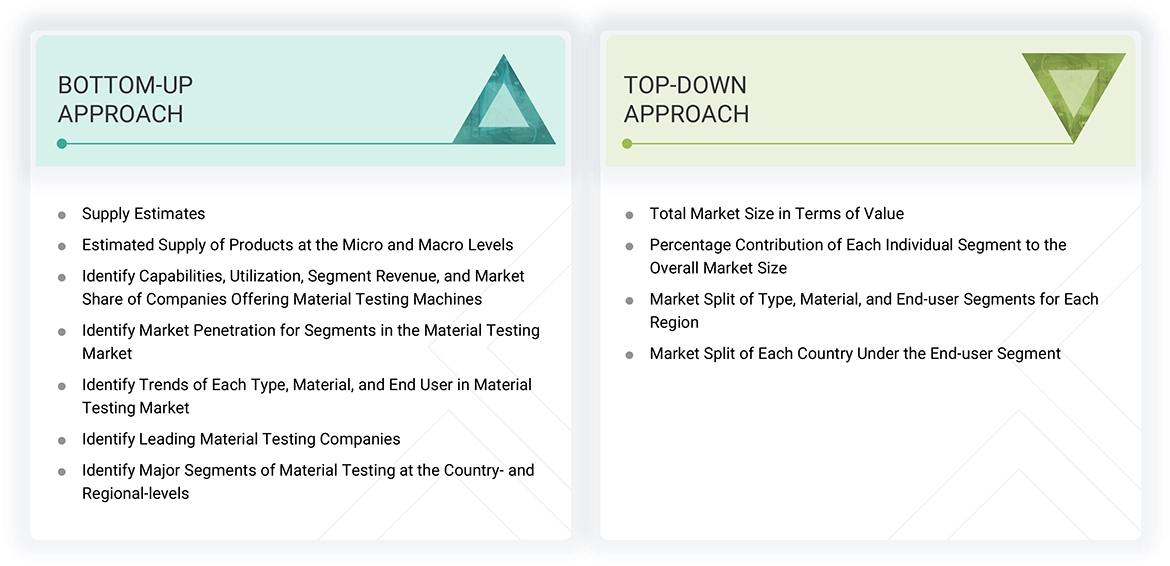

The study involved four major activities in estimating the market size of the material testing market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The material testing market comprises several stakeholders in the value chain, which include manufacturers and end users. Various primary sources from the supply and demand sides of the material testing market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in industrial sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the material testing industry. Primary interviews were conducted to gather insights such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, material, end user, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of material testing and outlook of their business, which will affect the overall market.

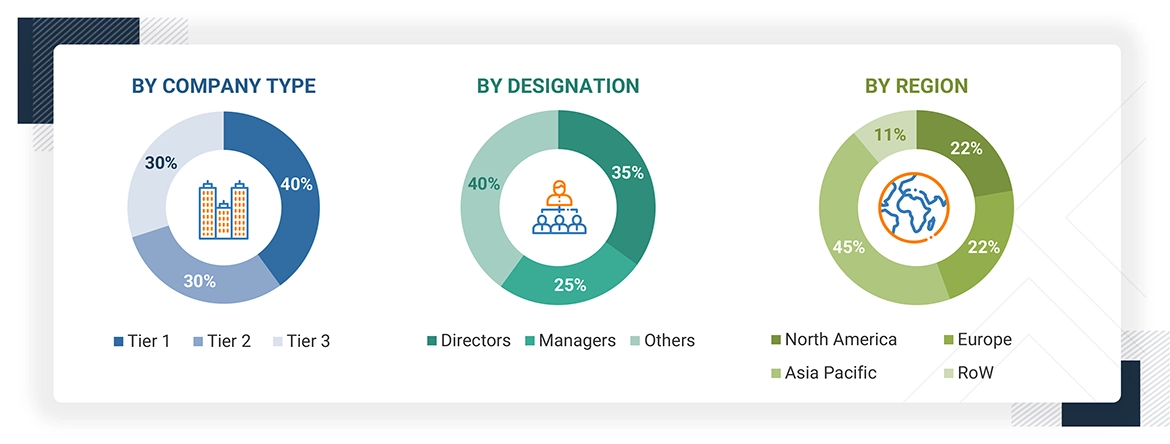

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the material testing market.

- The key players in the industry have been identified through extensive secondary research

- The supply chain of the industry has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The material testing market is an industry that has equipment, systems, and services that test mechanical, physical, and chemical properties of materials - metals, polymers, composites, and ceramics. Testing of these characteristics is critical in determining product safety and quality as well as compliance with premises relating to internationally regulated and global industry standards in a variety of industries: automotive, aerospace, construction, energy, and healthcare. The material testing market involves destructive testing and is ultimately enabling innovations, validating performance, and establishing reliability in production and R&D processes around the world.

Stakeholders

- Senior Management

- End Users

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the material testing market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, material, end-user and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, product launches, partnerships, agreements, and acquisitions in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the current size of the global material testing market?

The material testing market is valued at an estimated USD 871.9 million in 2025.

Who are the key players in the global material testing market?

Key players include Illinois Tool Works Inc. (US), ZwickRoell (Germany), Shimadzu Corporation (Japan), Tinius Olsen (US), Ametek (US), Mitutoyo Corporation (Japan), QATM (Germany), ERICHSEN GmbH & Co. KG (Germany), Hegewald & Peschke (Germany), and Nova Measurements LLC (US). These companies have potential to expand their product portfolios and compete effectively in the market.

What are some of the drivers for market growth?

Growth is driven by increasing demand for quality assurance and technological advancements in testing equipment.

What are the different types of material testing equipment?

Common types include universal testing machines, servohydraulic testing machines, hardness testing equipment, and impact testing equipment.

Who are the major end-users in the material testing market?

Major end-users include the automotive, construction, educational institutions, aerospace & defense, medical devices, and power sectors.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Material Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Material Testing Market