Aerodynamic Market for Automotive by Application (Air Dam, Diffuser, Gap Fairing, Grille Shutter, Side Skirts, Spoiler & Wind Deflector), by EV Type (BEV & HEV), Mechanism (Active & Passive), Vehicle Type (LDVs & HCVs), and Region - Global Forecast to 2025

The Aerodynamic Market for automotive was valued at USD 22.80 billion in 2017 and is projected to reach USD 32.77 billion by 2025, at a CAGR of 4.77% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the Report

- To define, segment, and forecast this market (2018–2025), in terms of volume (thousand units) and value (USD million)

- To provide a detailed analysis of the various forces impacting this market(drivers, restraints, opportunities, and challenges)

- To segment the market and forecast the market size, by volume and value, based on application (grille shutter, spoiler, air dam, side skirts, diffuser, wind deflectors, and gap fairing)

- To segment and forecast the size of this market, in terms of volume and value, based on electric vehicle type (BEV and HEV)

- To segment and forecast the size of the market , in terms of volume and value, based on mechanism (active system and passive system)

- To segment and forecast the size of this market, in terms of volume and value, based on vehicle type (light-duty vehicles and heavy commercial vehicles)

- To segment this market and forecast the market size in four major regions including the Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by the key industry participants

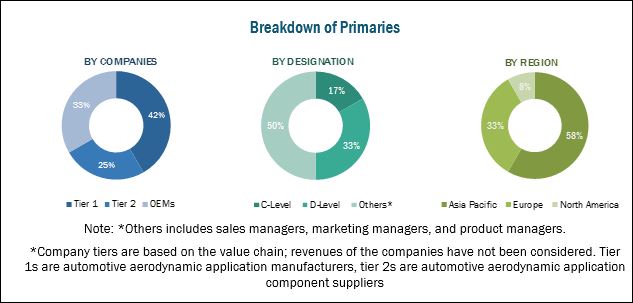

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of the aerodynamic market for automotive. This analysis involves historical trends as well as existing market penetrations by country as well as vehicle class. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs. The analysis has been discussed and validated by primary respondents that include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Society of Indian Automotive Manufacturers, SAE International, and paid databases and directories such as Factiva.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the aerodynamic market for automotive consists of established automotive aerodynamic application manufacturers such as Magna (Canada), Roechling Automotive (Germany), Plastic Omnium (France), SMP Deutschland GmbH (Germany), Valeo (France), SRG Global, Inc. (US), Polytec Holding AG (Austria), AP Plasman (Canada), INOAC Corporation (Japan), Rehau Ltd. (Switzerland), PU Tech Industry Sdn. Bhd (Malaysia), Brose Fahrzeugteile GmbH & Co. KG (Australia), HBPO GmbH (Germany), Spoiler Factory (Australia), Batz, S Coop. (Spain), Piedmont Plastics, Inc. (US), Airflow Deflector Inc. (US), and a few globally-established suppliers such as Hilton Docker Mouldings Ltd. (UK), Johnson Electric Holdings Ltd. (Hong Kong), and Sonceboz (Switzerland).

Target Audience

- Original equipment manufacturers (OEMs) of automobiles

- Manufacturers of automotive aerodynamic parts

- Material providers for automotive aerodynamic parts

- Automotive Parts Manufacturers’ Association (APMA)

- Chemicals and plastic manufacturers

- Suppliers of automotive Computational Fluid Dynamics (CFD)

Scope of the Report

Global Market, By Application

- Grille Shutter

- Spoiler

- Air Dam

- Side Skirts

- Diffuser

- Wind Deflectors

- Gap Fairing

Global Market, By EV Type

- BEV

- HEV

Global Market, By Mechanism

- Active System

- Passive System

Global Market, By Vehicle Type

- Light Duty Vehicles

- Heavy Commercial Vehicles

Global Market, By Region

- Asia Pacific (China, India, Japan, South Korea, Thailand, and Rest of the Asia Pacific)

- Europe (France, Germany, Russia, Spain, Turkey, UK, and Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Iran, and Others)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Aerodynamic market for Automotive, By vehicle type, by country

- Aerodynamic market for Automotive, By EV type, by application

The aerodynamic market for automotive is projected to grow at a CAGR of 4.77% from 2018 to 2025. The market is estimated to be USD 23.65 billion in 2018 and is projected to reach USD 32.77 billion by 2025. The key growth drivers of this market are the flourishing demand for faster and sophisticated vehicles, better mileage, weight reduction, and increased stability of the vehicles.

The active aerodynamic system segment is projected to have the highest growth rate, by value, in this market by 2025. This is because this is an advanced offering that guarantees higher fuel economy as well as better aesthetics. The price of these systems is currently high but is bound to decrease in the next 5-8 years, with their increasing adoption of mid-priced and economy LDVs as well as luxury HCVs.

Aerodynamic application mechanisms, especially passive aerodynamic systems have become an integral part of light-duty vehicles. While they are primarily incorporated for reduction in fuel consumption and visual appeal, some LDV manufacturers also have them in their models to stay competitive in the market. Hence, the automotive aerodynamics market is proportionately increasing with the production volumes of LDVs. Thus, the LDV segment has the highest market share in the automotive aerodynamics market.

The sales of the BEV segment is expected to grow at a brisk speed by 2025 because of the depleting fuel resources around the world and the push from OEMs to promote their EV models to cater to the emission standards. The automotive aerodynamic market is thus expected to the highest for the BEV segment.

The grille segment is estimated to be the largest segment in this market, by application. This is because, all the vehicle types, be it ICE vehicles, i.e., LDVs and HCVs, or EV types, i.e., BEVs and HEVs, are equipped with grilles that primarily serve the cooling requirements of engines. The latest development in these grilles known as the active grille shutter is the most commonly used active aerodynamic system in LDVs. All these factors contribute to the highest market share of this application in the automotive aerodynamics market.

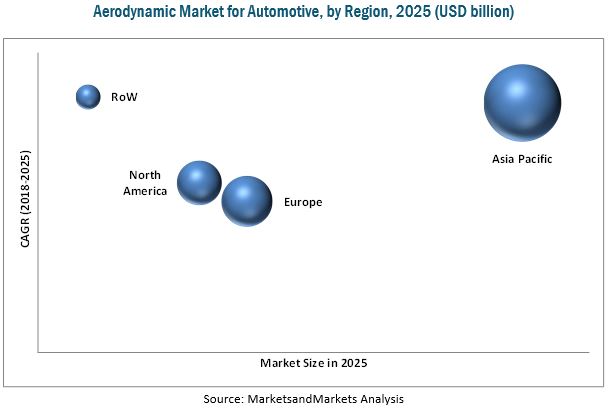

The Asia Pacific region is estimated to dominate this market, by volume as well as value. The Asia Pacific region currently accounts for more than 50% of the global automobile production. The increase in disposable income in developing countries such as India and China and the growing stringency of emission regulations are the key factors driving this market in this region.

A key factor restraining the growth of this market is the difference of opinions between vehicle designers and engineers while experimenting with new aerodynamic applications.

Some of the key players in the aerodynamic market for automotive are Magna (Canada), Roechling Automotive (Germany), Plastic Omnium (France), SMP Deutschland GmbH (Germany), and Valeo (France).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Aerodynamic Market for Automotive

4.2 Market, By Region

4.3 Market, By Country

4.4 Market, By Mechanism

4.5 Market, By Vehicle Type

4.6 Market, By Electric Vehicle Type

4.7 Market, By Application

5 Technological Overview (Page No. - 37)

5.1 Introduction

5.2 Mechanisms of Aerodynamic Parts

5.2.1 Aerodynamic Market for Automotive, By Mechanism

5.2.1.1 Active Systems

5.2.1.2 Passive Systems

5.3 Testing Systems of Aerodynamic Parts

5.3.1 Aerodynamic Market for Automotive, By Testing Systems

5.3.1.1 Wind Tunnel Test

5.3.1.2 Computational Fluid Dynamics (CFD)

6 Market Overview (Page No. - 40)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Need to Minimize External Noise and CO2 Emission

6.2.1.2 Increasing Electric Vehicle Production

6.2.1.3 Increased Appeal Through Enhanced Aerodynamic Components

6.2.2 Restraints

6.2.2.1 Deficient Testing Mechanisms

6.2.3 Opportunities

6.2.3.1 Increasing Adoption of Aerodynamic Components in HCVS

6.2.3.2 Developing Active Aerodynamic Systems for Economy Vehicles

6.2.4 Challenges

6.2.4.1 Differentiating Vehicle Design While Maintaining Aerodynamic Efficiency

7 Aerodynamic Market for Automotive, By Electric Vehicle Type (Page No. - 46)

7.1 Introduction

7.2 BEV

7.3 HEV

8 Aerodynamic Market for Automotive, By Mechanism (Page No. - 51)

8.1 Introduction

8.2 Active System

8.3 Passive System

9 Aerodynamic Market for Automotive, By Vehicle Type (Page No. - 57)

9.1 Introduction

9.2 Light-Duty Vehicles

9.3 Heavy Commercial Vehicles

10 Aerodynamic Market for Automotive, By Application (Page No. - 61)

10.1 Introduction

10.2 Air Dam

10.3 Diffuser

10.4 Gap Fairing

10.5 Grille Shutter

10.6 Side Skirts

10.7 Spoiler

10.8 Wind Deflector

11 Aerodynamic Market for Automotive, By Region (Page No. - 62)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Thailand

11.2.6 Rest of the Asia Pacific

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Russia

11.3.4 Spain

11.3.5 Turkey

11.3.6 UK

11.3.7 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World

11.5.1 Brazil

11.5.2 Iran

11.5.3 Others

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situations & Trends

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Partnerships/Supply Contracts/Collaborations/ Joint Ventures/Agreements/Mergers & Acquisitions

13 Company Profiles (Page No. - 107)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Magna Exteriors

13.2 Roechling Automotive

13.3 Plastic Omnium

13.4 SMP Deutschland GmbH

13.5 Valeo

13.6 SRG Global, Inc.

13.7 Polytec Holding AG

13.8 Ap Plasman

13.9 Inoac Corporation

13.10 Rehau Group

13.11 P.U. Tech Industry Sdn.Bhd

13.12 Brose Fahrzeugteile GmbH & Co. Kg

13.13 Hbpo GmbH

13.14 Spoiler Factory

13.15 Batz, S. Coop.

13.16 Piedmont Plastics, Inc.

13.17 Airflow Deflector Inc.

13.18 Hilton Docker Mouldings Ltd

13.19 Johnson Electric Holdings Limited

13.20 Sonceboz

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 132)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.4.1 Aerodynamic Market for Automotive, By Vehicle Type, By Country

14.4.2 Market, By Ev Type, By Application

14.5 Related Reports

14.6 Author Details

List of Tables (81 Tables)

Table 1 Currency Exchange Rates (Wrt USD)

Table 2 Impact of Market Dynamics During the Forecast Period

Table 3 Aerodynamic Market, By Electric Vehicle Type, 2016–2025 (Thousand Units)

Table 4 Market, By Electric Vehicle Type, 2016–2025 (USD Million)

Table 5 BEV: Market, By Region, 2016–2025 (Thousand Units)

Table 6 BEV: Market, By Region, 2016–2025 (USD Million)

Table 7 HEV: Market, By Region, 2016–2025 (Thousand Units)

Table 8 HEV: Market, By Region, 2016–2025 (USD Million)

Table 9 Market for Automotive, By Mechanism, 2016–2025 (000’ Units)

Table 10 Market, By Mechanism, 2016–2025 (USD Million)

Table 11 Active System: Market, By Region, 2016–2025 (000’ Units)

Table 12 Active System: Market, By Region, 2016–2025 (USD Million)

Table 13 Passive System: Market, By Region, 2016–2025 (000’ Units)

Table 14 Passive System: Market, By Region, 2016–2025 (USD Million)

Table 15 Market, By Vehicle Type, 2016–2025 (Thousand Units)

Table 16 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 17 Light-Duty Vehicles: Market, By Region, 2016–2025 (Thousand Units)

Table 18 Light-Duty Vehicles: Market, By Region, 2016–2025 (USD Million)

Table 19 Heavy Commercial Vehicles: Aerodynamic Market for Automotive, By Region, 2016–2025 (Thousand Units)

Table 20 Heavy Commercial Vehicles: Aerodynamic Market for Automotive, By Region, 2016–2025 (USD Million)

Table 21 Market, By Region, 2016–2025 (000’ Units)

Table 22 Market, By Region, 2016–2025 (USD Million)

Table 23 Market, By Application, 2016–2025 (000’ Units)

Table 24 Market for Automotive, By Application, 2016–2025 (USD Million)

Table 25 Asia Pacific: Market, By Country, 2016–2025 (000’ Units)

Table 26 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 27 Asia Pacific: Market, By Application, 2016–2025 (000’ Units)

Table 28 Asia Pacific: Market, By Application, 2016–2025 (USD Million)

Table 29 China: Market, By Application, 2016–2025 (000’ Units)

Table 30 China: Market, By Application, 2016–2025 (USD Million)

Table 31 India: Market, By Application, 2016–2025 (000’ Units)

Table 32 India: Market, By Application, 2016–2025 (USD Million)

Table 33 Japan: Market, By Application, 2016–2025 (000’ Units)

Table 34 Japan: Market, By Application, 2016–2025 (USD Million)

Table 35 South Korea: Market, By Application, 2016–2025 (000’ Units)

Table 36 South Korea: Market, By Application, 2016–2025 (USD Million)

Table 37 Thailand: Market, By Application, 2016–2025 (000’ Units)

Table 38 Thailand: Market, By Application, 2016–2025 (USD Million)

Table 39 Rest of the Asia Pacific: Aerodynamic Market, By Application, 2016–2025 (000’ Units)

Table 40 Rest of the Asia Pacific: Market, By Application, 2016–2025 (USD Million)

Table 41 Europe: Market, By Country, 2016–2025 (000’ Units)

Table 42 Europe: Market, By Country, 2016–2025 (USD Million)

Table 43 Europe: Market, By Application, 2016–2025 (000’ Units)

Table 44 Europe: Market, By Application, 2016–2025 (USD Million)

Table 45 France: Market, By Application, 2016–2025 (000’ Units)

Table 46 France: Market, By Application, 2016–2025 (USD Million)

Table 47 Germany: Market, By Application, 2016–2025 (000’ Units)

Table 48 Germany: Market, By Application, 2016–2025 (USD Million)

Table 49 Russia: Market, By Application, 2016–2025 (000’ Units)

Table 50 Russia: Market, By Application, 2016–2025 (USD Million)

Table 51 Spain: Market, By Application, 2016–2025 (000’ Units)

Table 52 Spain: Market, By Application, 2016–2025 (USD Million)

Table 53 Turkey: Market, By Application, 2016–2025 (000’ Units)

Table 54 Turkey: Market, By Application, 2016–2025 (USD Million)

Table 55 UK: Market, By Application, 2016–2025 (000’ Units)

Table 56 UK: Market, By Application, 2016–2025 (USD Million)

Table 57 Rest of Europe: Market, By Application, 2016–2025 (000’ Units)

Table 58 Rest of Europe: Market, By Application, 2016–2025 (USD Million)

Table 59 North America: Market, By Country, 2016–2025 (000’ Units)

Table 60 North America: Market, By Country, 2016–2025 (USD Million)

Table 61 North America: Market, By Application, 2016–2025 (000’ Units)

Table 62 North America: Market, By Application, 2016–2025 (USD Million)

Table 63 Canada: Market, By Application, 2016–2025 (000’ Units)

Table 64 Canada: Market, By Application, 2016–2025 (USD Million)

Table 65 Mexico: Market, By Application, 2016–2025 (000’ Units)

Table 66 Mexico: Market, By Application, 2016–2025 (USD Million)

Table 67 US: Market, By Application, 2016–2025 (000’ Units)

Table 68 US: Market, By Application, 2016–2025 (USD Million)

Table 69 RoW: Market, By Country, 2016–2025 (000’ Units)

Table 70 RoW: Market, By Country, 2016–2025 (USD Million)

Table 71 RoW: Market, By Application, 2016–2025 (000’ Units)

Table 72 RoW: Market, By Application, 2016–2025 (USD Million)

Table 73 Brazil: Market, By Application, 2016–2025 (000’ Units)

Table 74 Brazil: Market, By Application, 2016–2025 (USD Million)

Table 75 Iran: Market, By Application, 2016–2025 (000’ Units)

Table 76 Iran: Market, By Application, 2016–2025 (USD Million)

Table 77 Others: Market for Automotive, By Application, 2016–2025 (000’ Units)

Table 78 Others: Market, By Application, 2016–2025 (USD Million)

Table 79 New Product Developments, 2015–2018

Table 80 Expansions, 2015-2018

Table 81 Partnerships/Supply Contracts/Collaborations/ Joint Ventures/Agreements/Mergers & Acquisitions, 2015–2018

List of Figures (43 Figures)

Figure 1 Aerodynamic Market for Automotive Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market, By Vehicle Type: Bottom-Up Approach

Figure 6 Market, By Mechanism: Top-Down Approach

Figure 7 Market: Market Dynamics

Figure 8 Active Aerodynamic System to Witness the Highest Growth in the Market, 2018 vs 2025 (USD Million)

Figure 9 Asia Pacific to Hold the Largest Share of the Market, 2018 vs 2025 (USD Million)

Figure 10 Market: Market Size

Figure 11 Increasing Adoption of Aerodynamic Applications for Better Fuel Economy and Aesthetics to Drive the Market in the Next 7 Years

Figure 12 Asia Pacific to Be the Largest Market for Automotive, 2018 vs 2025 (By Value)

Figure 13 Indian Market Expected to Witness the Highest Growth During the Forecast Period (By Value)

Figure 14 Active System to Grow at the Highest Rate Between 2018 and 2025 (By Value)

Figure 15 LDV Segment Expected to Dominate the Overall Market Between 2018 and 2025 (By Value)

Figure 16 BEV Segment Projected to Have the Highest Market Share By 2025 (By Value)

Figure 17 Grille Segment Projected to Have the Highest Market Share in 2018 (By Value)

Figure 18 Active Rear Spoiler in Bugatti Veyron

Figure 19 Passive Rear Spoiler in Porsche Gt3

Figure 20 Aerodynamic: Market Dynamics

Figure 21 Electric Vehicle Sales (2016 vs 2017)

Figure 22 Market for Automotive, By Electric Vehicle Type, 2018 vs 2025 (USD Million)

Figure 23 Market, By Mechanism, 2018 vs 2025 (USD Million)

Figure 24 Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 25 Market, By Region, 2018 vs 2025

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Europe: Market, By Country, 2018 vs 2025 (000’ Units)

Figure 28 North America: Market, By Country, 2018 vs 2025 (USD Million)

Figure 29 RoW: Market, By Country, 2018 vs 2025 (USD Million)

Figure 30 Key Developments By Leading Players in the Market for 2015–2018

Figure 31 Market for Automotive Ranking: 2017

Figure 32 Magna Exteriors: Company Snapshot

Figure 33 Magna Exteriors: SWOT Analysis

Figure 34 RoEchling Automotive: Company Snapshot

Figure 35 RoEchling Automotive: SWOT Analysis

Figure 36 Plastic Omnium: Company Snapshot

Figure 37 Plastic Omnium: SWOT Analysis

Figure 38 SMP Deutschland GmbH: Company Snapshot

Figure 39 SMP Deutschland GmbH: SWOT Analysis

Figure 40 Valeo: Company Snapshot

Figure 41 Valeo: SWOT Analysis

Figure 42 Polytec Holding AG: Company Snapshot

Figure 43 Inoac Corporation: Company Snapshot

Growth opportunities and latent adjacency in Aerodynamic Market