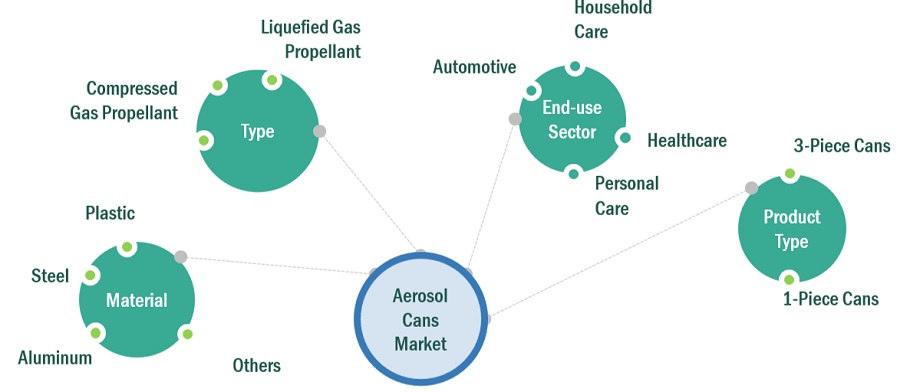

Aerosol Cans Market by Material (Aluminium, Plastic), Product Type (1-piece cans, 3-piece cans), Type (Liquefied Gas, Compressed Gas), End-use Sector (Personal care, Healthcare, Household care), & Region-Global Forecast to 2028

Updated on : August 25, 2025

Aerosol Cans Market

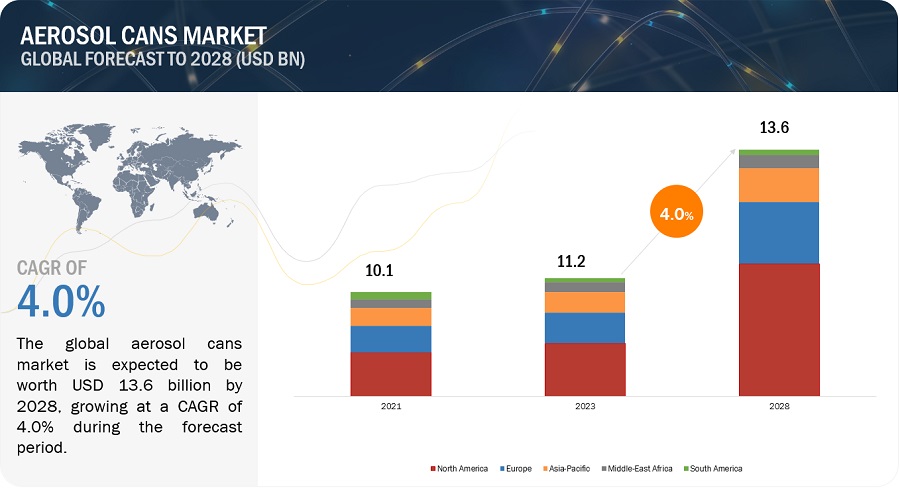

The global aerosol cans market was valued at USD 11.2 billion in 2023 and is projected to reach USD 13.6 billion by 2028, growing at 4.0% cagr from 2023 to 2028. This growth is fueled by increasing demand across various sectors, including personal care, household care, automotive, healthcare, and more.

Aerosol Cans Market Size, Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Aerosol Cans Market

Aerosol Cans Market Dynamics

Driver: Growth of the cosmetic & personal care industry

The burgeoning growth of the cosmetics and personal care industry stands as a significant driver for the aerosol cans market. As urbanization accelerates and disposable incomes rise globally, more consumers are investing in personal grooming and beauty products. This global trend is amplified by the pervasive influence of social media and digital platforms. Platforms like Instagram and YouTube have become instrumental in shaping beauty standards and consumer preferences, with influencers and makeup artists showcasing an array of products and routines. The industry's dynamism is further highlighted by its frequent innovative product launches, catering to a vast range of skin types, tones, and preferences. Notably, the market for male grooming products has also seen a substantial uptick. Given this context, aerosol cans, with their convenience and efficacy in packaging products like hairsprays, deodorants, and shaving foams, have become increasingly vital. Their ability to offer a hygienic, sealed environment ensures product integrity, making them a preferred choice for many cosmetics and personal care brands.

Restraint: Rising Preference for Cost-Effective and Sustainable Packaging Alternatives**

The materials integral to the aerosol can production tend to carry a heftier price tag compared to their conventional counterparts. When combined with manufacturing and disposal costs, the overall expense for aerosol cans becomes notably higher. For many applications not mandating spray dispensing, there's a pivot towards more economical options such as tubes, thermoformed packages, and other flexible or rigid plastic and metal containers. Even within spray applications, there's a noticeable shift towards refillable spray bottles. Not only are these bottles more wallet-friendly – given their reduced disposal needs – but they also champion a more eco-conscious approach by minimizing waste. This burgeoning preference for sustainable and cost-efficient alternatives could potentially dampen the aerosol can market's expansion in the upcoming years.

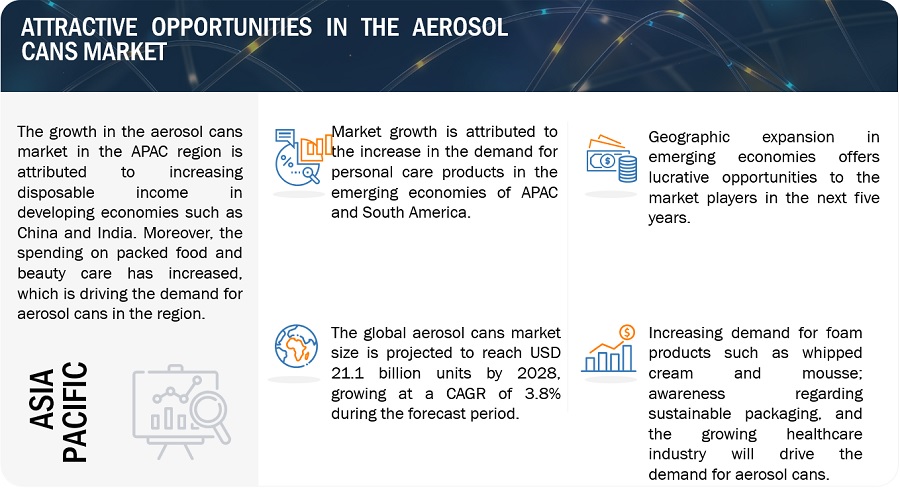

Opportunity: Untapped Potential in Rapidly Growing Economies

The accelerating economic landscapes of nations like those in the BRIC (Brazil, Russia, India, and China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) clusters present a golden opportunity for the aerosol cans industry. The momentum in these nations is propelled not just by their evolving economic stature but also by factors like demographic shifts, swelling middle-class populations, and enhanced purchasing power. As household incomes rise and consumer behaviors evolve, there's a noticeable tilt towards products that offer convenience and modernity, underpinning the allure of aerosol-packaged goods. Moreover, urbanization trends and increasing market penetration of global brands in these regions further amplify the demand for sophisticated packaging solutions like aerosol cans. Harnessing this potential could be pivotal for stakeholders looking to tap into new growth frontiers in the aerosol can sector.

Challenges: Navigating the Maze of Regulatory Compliance

The intrinsic convenience of aerosol cans is juxtaposed with the complexities surrounding their disposal. Aerosol cans, if not entirely emptied, can house propellants deemed hazardous by entities like the US EPA, necessitating strict adherence to defined disposal guidelines. Commonly used propellants in these cans, such as propane, carbon dioxide, and butane, are also recognized greenhouse gases, implicated in exacerbating global warming and smog proliferation. Renowned institutions, including the likes of NASA and the NSF's CAICE, have voiced concerns about the detrimental effects of such propellants on both the climate and the ozone layer. The amalgamation of these environmental and regulatory challenges presents a tangible hurdle to the unabated growth of the aerosol cans market. As the global emphasis on environmental sustainability intensifies, the industry must innovate and adapt to ensure both compliance and market viability.

Aerosol Cans Market Ecosystem

Dominance of Aluminum in the Aerosol Cans Material Segment;

Within the aerosol cans market, the aluminum material segment emerges as the predominant player. This dominance can be attributed to aluminum's multifaceted advantages, positioning it as a favored choice for packaging. Aluminum boasts properties that make it an ideal packaging solution: it's lightweight, ensuring ease of transportation and reduced shipping costs; its shatterproof nature guarantees product safety; and its impermeability ensures the contents remain uncontaminated and are preserved for extended periods. Moreover, aluminum's inherent flexibility allows for innovative design possibilities, while its corrosion-resistant quality ensures longevity. Importantly, in an era increasingly focused on sustainability, aluminum stands out for its recyclability, aligning with global trends emphasizing eco-friendly solutions. These collective advantages underscore why aluminum leads the charge in the global aerosol cans material segment.

“Liquefied Gas Propellant is the largest type segment of the aerosol cans market.”

The Liquefied Gas Propellant segment emerges as a frontrunner in the aerosol cans market. The inherent properties of this propellant ensure that even as the product diminishes, evaporation sustains a consistent pressure within the can. This dynamic ensures that the spray's performance remains steadfast from the first to the last use, elucidating the dominant market position of liquefied gas propellants.

“Personal Care is the largest end-use sector segment of the aerosol cans market.”

Delving into end-use sectors, Personal Care stands out as the principal segment. Aerosol cans are increasingly becoming the go-to packaging solution for a spectrum of personal care commodities, spanning from deodorants and perfumes to face and body creams. The buoyancy in this segment is undergirded by rising disposable incomes, particularly in burgeoning economies. As affluence grows, so does the consumer propensity to invest in personal care, giving a fillip to the demand for aerosol cans.

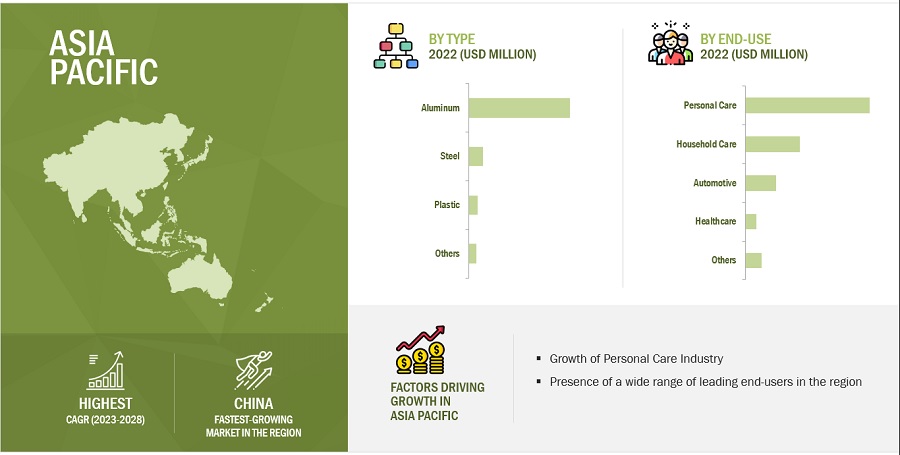

“APAC is the speediest-growing market for aerosol cans market.”

The Asia-Pacific (APAC) region is poised to be the torchbearer in terms of growth rate for the aerosol cans market. This surge is forecasted to outpace other regions, with a remarkable CAGR. The nexus of factors driving this growth encompasses burgeoning disposable incomes, particularly in powerhouses like China and India, coupled with industrialization trends. The escalation in the convenience food industry, amplification in manufacturing endeavors, and robust retail sales are other pivotal drivers. Furthermore, as consumers in the region exhibit an uptick in spending on packaged food and beauty care, the aerosol cans market is set to benefit, cementing APAC's position as a growth hotspot.

To know about the assumptions considered for the study, download the pdf brochure

Aerosol Cans Market Players

Key stakeholders steering the trajectory of the aerosol cans market include Ball Corporation (US), Trivium Packaging (US), Crown (US), Mauser Packaging Solutions (US), Toyo Seikan Co. Ltd.(Japan), Nampak Ltd. (South Africa), CCL Container (US), Colep (Portugal), CPMC Holdings Ltd. (China), and Guangdong Sihai Iron-Printing and Tin-Making Co.,Ltd (China). To solidify their positions in this competitive market, these industry frontrunners have judiciously employed a range of growth strategies. This encompasses acquisitions, diversifying their product lineup, geographical expansions, and forging productive partnerships, collaborations, and agreements. Through these strategic maneuvers, they aim to cater to the escalating demand for aerosol cans, particularly from dynamic emerging markets.

Aerosol Cans Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Million Units) |

|

Segments |

Type, Material, Product Type, End-Use Sector, and Region |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies |

The major players are Ball Corporation (US), Trivium Packaging (Netherlands), Crown (US), Mauser Packaging Solutions (US), and Toyo Seikan Co. Ltd. (Japan) and others are covered in the Aerosol Cans market. |

This research report categorizes the global Aerosol Cans market on the basis of Type, Application, and Region.

Aerosol Cans Market by Type:

- Liquefied Gas Propellant

- Compressed Gas Propellant

Aerosol Cans Market by Product Type:

- 1-Piece Cans

- 3-Piece Cans

Aerosol Cans Market by Material:

Aerosol Cans Market by End-use Sector:

- Personal care

- Household care

- Healthcare

- Automotivel

- Others

Aerosol Cans Market by Region:

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In March 2021, Trivium Packaging (Argentina) expanded the recycling and reuse of aluminum from aerosol cans in Latin America through the Creando Concienca Partnership. This is a groundbreaking recycling initiative in Argentina, which aims to raise awareness and accelerate sustainability practices for customers and the planet, further driving company toward sustainability.

- In August 2020, Crown Holdings, Inc. announced its plans to start its operations at a new one-line beverage can plant in Rio Verde, Brazil.

- In July 2020, Ball Corporation signed two virtual power purchase agreements to strengthen 100% European renewable energy goals.

- In May 2020, Ball Corporation entered into a partnership agreement with Acosta, the leading marketing and sales agency in the consumer-packaged goods industry to represent the company's aluminum cups in retail and on-premises outlets.

- In January 2020, Ball Corporation announced its plans to build a new aluminum end manufacturing facility in Bowling Green, Kentucky, US.

Frequently Asked Questions (FAQ):

What growth prospects does the aerosol cans market present?

Emerging markets, notably the BRIC (Brazil, Russia, India, and China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) countries, are forecasted to drive a significant portion of the global aerosol cans market growth. The impetus behind this expansion is rooted in these nations' favorable demographics, escalating household incomes, and evolving consumer lifestyles, all converging towards a heightened inclination for aerosol-packaged products.

How do material choices influence the aerosol cans market dynamics?

The market is categorized based on materials into segments like aluminum, steel, plastic, among others. Aluminum, due to its myriad beneficial properties - including being lightweight, durable, airtight, flexible, resistant to corrosion, and recyclable - has emerged as the leading material choice. Its capability to effectively seal and prolong the shelf life of volatile contents further cements its dominance.

Which end-use sectors predominantly utilize aerosol cans?

Segmented by end-use sectors, the market spans personal care, household care, automotive, healthcare, and more. The personal care segment claims the largest market share, with aerosol cans being the chosen packaging for diverse products ranging from deodorants and perfumes to face and body creams.

Which companies are at the forefront of the aerosol cans market?

Major market players include Ball Corporation (US), Trivium Packaging (US), Crown(US), Mauser Packaging Solutions (US), Toya Seikan Co. Ltd. (Japan), Nampak Ltd.(South Africa), CCL Container(US), Colep (Portugal), CPMC Holdings Ltd. (China), and Guangdong Sihai Iron-Printing and Tin-Making Co. Ltd. (China), among others.

What are the pivotal factors poised to influence the market in the forecast period?

The ascending demand from sectors like personal care, household care, automotive, and healthcare is propelling the aerosol cans market forward. Key contributors to this growth trajectory include the eco-friendly nature of aerosol cans, the variety in shapes and sizes enhancing product allure, and the convenience they offer in application. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from personal care and cosmetic industries- Recyclability of aerosol cans- Convenience factors- Growing automotive industries to drive demand for spray paintsRESTRAINTS- Availability of alternatives in terms of packaging and priceOPPORTUNITIES- Emerging economies offer high growth potential- Development of eco-friendly packagingCHALLENGES- Stringent government regulations

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSRIVALRY AMONG EXISTING COMPETITORS

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 KEY MARKETS FOR IMPORT AND EXPORT (TRADE ANALYSIS)

-

6.5 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 TARIFF AND REGULATORY LANDSCAPE

-

6.9 CASE STUDY ANALYSISINLINE ORIENTING SYSTEM FOR PACKAGING- Customer container handling challenge- Solution statement

- 6.10 KEY CONFERENCES & EVENTS, 2022–2023

-

6.11 PRICING ANALYSISCHANGES IN AEROSOL CANS PRICING IN 2022

-

6.12 ECOSYSTEM MAPPING

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPES, 2019–2023INSIGHTSTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 LIQUEFIED GASADVANTAGEOUS PROPERTIES TO DRIVE MARKET

-

7.3 COMPRESSED GASCOST EFFICIENCY TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 1-PIECE CANSRISE IN DEMAND FROM SEVERAL INDUSTRIES TO DRIVE MARKET

-

8.3 3-PIECE CANSLOW COST, SIMPLE MANUFACTURING PROCESS, AND LOW-COST MAKING TO BOOST MARKET

- 9.1 INTRODUCTION

-

9.2 ALUMINUMMOST PREFERRED MATERIAL TO PRODUCE AEROSOL CANS

-

9.3 STEELPREVENTION OF RUSTING & PROTECTION OF FOOD FLAVORS TO BOOST DEMAND

-

9.4 PLASTICUSE IN APPLICATIONS OF HOME & PERSONAL CARE GOODS INDUSTRY TO BOOST DEMAND

- 9.5 OTHER MATERIALS

- 10.1 INTRODUCTION

-

10.2 PERSONAL CARERISE IN DISPOSABLE INCOME TO DRIVE SPENDING ON PERSONAL CARE PRODUCTS

-

10.3 HOUSEHOLD CAREWIDE RANGE OF APPLICATIONS IN HOUSEHOLD SECTOR TO DRIVE DEMAND

-

10.4 HEALTHCAREFAVORABLE FEATURES OF AEROSOL CANS TO BOOST DEMAND

-

10.5 AUTOMOTIVEWIDE RANGE OF APPLICATIONS TO INCREASE DEMAND

- 10.6 OTHER END-USE SECTORS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACTUS- Increasing demand for deodorants, room fresheners, and perfumes to drive marketCANADA- Rising demand for beauty products to drive marketMEXICO- Increasing demand from household care and personal care sectors to drive market

-

11.3 EUROPERECESSION IMPACTGERMANY- Growing food & beverages, personal care, and cosmetic industries to drive marketUK- Increased spending on healthcare sector to drive marketFRANCE- Increase in demand for personal care products to drive marketSPAIN- Growth of personal care and cosmetic industries to drive marketITALY- Increased demand from retail, cosmetics, food, and healthcare industries to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACTCHINA- Rise in consumption of home & personal care products to drive marketINDIA- Growing packaging industry to drive marketJAPAN- Growing manufacturing industries to drive marketAUSTRALIA- Government spending on infrastructure projects to drive marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACTUAE- Growth in personal care products demand to drive marketSAUDI ARABIA- Increase in spending on beauty products to drive marketSOUTH AFRICA- Growth in the personal care and household care sectors to drive marketTURKEY- Growth of personal care and cosmetic sectors to drive demandREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Increasing demand for processed foods, personal care & household care products, and pharmaceuticals to drive marketARGENTINA- High-income economy with rich natural resources and strong industrial base to drive marketREST OF SOUTH AMERICA

- 12.1 OVERVIEW

- 12.2 COMPANIES ADOPTED ACQUISITIONS, PARTNERSHIPS, AND PRODUCT LAUNCHES AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- 12.3 MARKET RANKING ANALYSIS

- 12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE COMPANIES

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHES

-

13.1 KEY PLAYERSBALL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRIVIUM PACKAGING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCROWN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMAUSER PACKAGING SOLUTIONS- Business overview- Products/Solutions/Services offered- MnM viewNAMPAK LTD.- Business overview- Products/Solutions/Services offered- MnM viewTOYO SEIKAN CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewCCL CONTAINER- Business overview- Products/Solutions/Services offered- MnM viewCOLEP PACKAGING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCPMC HOLDINGS LIMITED- Business overview- Products/Solutions/Services offered- MnM viewGUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSALUCON PUBLIC COMPANY LIMITEDDS CONTAINERSJAMESTRONG PACKAGINGSPRAY PRODUCTSITW SEXTONSWAN INDUSTRIES (THAILAND) COMPANY LIMITEDTUBEXG. STAEHLE GMBH U. CO. KG.KIAN JOO CAN FACTORY BERHADGRAHAM PACKAGING COMPANYMASSILLY HOLDING S.A.SBHARAT CONTAINERSTECNOCAP S.P.ALINHARDTMONTEBELLO PACKAGING

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 PRODUCTION OF MOTOR VEHICLES BY COUNTRY IN EUROPE, 2019–2022 (UNITS)

- TABLE 2 AEROSOL CANS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 CONTAINERS OF IRON OR STEEL, FOR COMPRESSED OR LIQUEFIED GAS (731100) IMPORTS (BY COUNTRY), IN 2022

- TABLE 4 CONTAINERS OF IRON OR STEEL, FOR COMPRESSED OR LIQUEFIED GAS (731100) EXPORTS (BY COUNTRY), IN 2022

- TABLE 5 WORLD GDP GROWTH PROJECTION, 2019–2026 (USD BILLION)

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 AEROSOL CANS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 8 PRICING ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PERSONAL CARE SECTOR (%)

- TABLE 10 KEY BUYING CRITERIA FOR AEROSOL CANS FOR PERSONAL CARE

- TABLE 11 LIST OF PATENTS

- TABLE 12 AEROSOL CANS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 13 AEROSOL CANS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 14 AEROSOL CANS MARKET, BY TYPE, 2019–2021 (MILLION UNIT)

- TABLE 15 AEROSOL CANS MARKET, BY TYPE, 2022–2028 (MILLION UNIT)

- TABLE 16 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

- TABLE 17 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2022–2028 (USD MILLION)

- TABLE 18 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2019–2021 (MILLION UNIT)

- TABLE 19 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2022–2028 (MILLION UNIT)

- TABLE 20 AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 21 AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 22 AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 23 AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 24 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 25 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 26 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 27 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 28 STEEL AEROSOL CANS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 29 STEEL AEROSOL CANS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 30 STEEL AEROSOL CANS MARKET, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 31 STEEL AEROSOL CANS MARKET, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 32 PLASTIC AEROSOL CANS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 33 PLASTIC AEROSOL CANS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 34 PLASTIC AEROSOL CANS MARKET, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 35 PLASTIC AEROSOL CANS MARKET, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 36 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 37 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 38 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 39 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 40 AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (USD MILLION)

- TABLE 41 AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 42 AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (MILLION UNIT)

- TABLE 43 AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (MILLION UNIT)

- TABLE 44 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2019–2021 (USD MILLION)

- TABLE 45 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2022–2028 (USD MILLION)

- TABLE 46 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 47 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 48 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2019–2021 (USD MILLION)

- TABLE 49 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2022–2028 (USD MILLION)

- TABLE 50 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 51 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 52 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2019–2021 (USD MILLION)

- TABLE 53 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2022–2028 (USD MILLION)

- TABLE 54 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 55 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 56 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2019–2021 (USD MILLION)

- TABLE 57 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2022–2028 (USD MILLION)

- TABLE 58 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 59 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 60 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 61 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 62 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 63 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2022–2028 (MILLION UNIT)

- TABLE 64 AEROSOL CANS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 65 AEROSOL CANS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 66 AEROSOL CANS MARKET, BY REGION, 2019–2021 (MILLION UNIT)

- TABLE 67 AEROSOL CANS MARKET, BY REGION 2022–2028 (MILLION UNIT)

- TABLE 68 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 69 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (MILLION UNIT)

- TABLE 71 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (MILLION UNIT)

- TABLE 72 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (USD MILLION)

- TABLE 73 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (MILLION UNIT)

- TABLE 75 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (MILLION UNIT)

- TABLE 76 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 79 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 80 US: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 81 US: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 82 US: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 83 US: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 84 CANADA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 85 CANADA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 86 CANADA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 87 CANADA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 88 MEXICO: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 89 MEXICO: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 90 MEXICO: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 91 MEXICO: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 92 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 93 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 94 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (MILLION UNIT)

- TABLE 95 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (MILLION UNIT)

- TABLE 96 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (USD MILLION)

- TABLE 97 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 98 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (MILLION UNIT)

- TABLE 99 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (MILLION UNIT)

- TABLE 100 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 101 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 102 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 103 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 104 GERMANY: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 105 GERMANY: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 106 GERMANY: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 107 GERMANY: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 108 UK: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 109 UK: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 110 UK: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 111 UK: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 112 FRANCE: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 113 FRANCE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 114 FRANCE: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 115 FRANCE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 116 SPAIN: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 117 SPAIN: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 118 SPAIN: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 119 SPAIN: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 120 ITALY: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 121 ITALY: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 122 ITALY: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 123 ITALY: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 124 REST OF EUROPE: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 125 REST OF EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 127 REST OF EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 128 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 129 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (MILLION UNIT)

- TABLE 131 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (MILLION UNIT)

- TABLE 132 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (MILLION UNIT)

- TABLE 135 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (MILLION UNIT)

- TABLE 136 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 139 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 140 CHINA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 141 CHINA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 142 CHINA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 143 CHINA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 144 INDIA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 145 INDIA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 146 INDIA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 147 INDIA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 148 JAPAN: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 149 JAPAN: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 150 JAPAN: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 151 JAPAN: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 152 AUSTRALIA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 153 AUSTRALIA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 154 AUSTRALIA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 155 AUSTRALIA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 156 REST OF ASIA PACIFIC: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 159 REST OF ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 160 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (MILLION UNIT)

- TABLE 163 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (MILLION UNIT)

- TABLE 164 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (MILLION UNIT)

- TABLE 167 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (MILLION UNIT)

- TABLE 168 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 171 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 172 UAE: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 173 UAE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 174 UAE: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 175 UAE: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 176 SAUDI ARABIA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 177 SAUDI ARABIA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 178 SAUDI ARABIA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 179 SAUDI ARABIA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 180 SOUTH AFRICA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 181 SOUTH AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 182 SOUTH AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 183 SOUTH AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 184 TURKEY: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 185 TURKEY: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 186 TURKEY: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 187 TURKEY: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 192 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 193 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 194 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019–2021 (MILLION UNIT)

- TABLE 195 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022–2028 (MILLION UNIT)

- TABLE 196 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (USD MILLION)

- TABLE 197 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 198 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019–2021 (MILLION UNIT)

- TABLE 199 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022–2028 (MILLION UNIT)

- TABLE 200 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 201 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 202 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 203 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 204 BRAZIL: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 205 BRAZIL: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 206 BRAZIL: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 207 BRAZIL: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 208 ARGENTINA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 209 ARGENTINA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 210 ARGENTINA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 211 ARGENTINA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 212 REST OF SOUTH AMERICA: AEROSOL CANS MARKET BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019–2021 (MILLION UNIT)

- TABLE 215 REST OF SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022–2028 (MILLION UNIT)

- TABLE 216 AEROSOL CANS MARKET: DETAILED LIST OF PLAYERS

- TABLE 217 AEROSOL CANS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 218 DEALS, 2019–2023

- TABLE 219 PRODUCT LAUNCHES, 2019–2023

- TABLE 220 BALL CORPORATION: COMPANY OVERVIEW

- TABLE 221 BALL CORPORATION: DEALS

- TABLE 222 BALL CORPORATION: PRODUCT LAUNCH

- TABLE 223 BALL CORPORATION.: OTHER DEVELOPMENTS

- TABLE 224 TRIVIUM PACKAGING: COMPANY OVERVIEW

- TABLE 225 TRIVIUM PACKAGING: DEALS

- TABLE 226 TRIVIUM PACKAGING: OTHERS

- TABLE 227 CROWN: COMPANY OVERVIEW

- TABLE 228 CROWN: DEALS

- TABLE 229 MAUSER PACKAGING SOLUTIONS: COMPANY OVERVIEW

- TABLE 230 NAMPAK LTD.: COMPANY OVERVIEW

- TABLE 231 TOYO SEIKAN CO., LTD.: COMPANY OVERVIEW

- TABLE 232 CCL CONTAINER: COMPANY OVERVIEW

- TABLE 233 COLEP PACKAGING: COMPANY OVERVIEW

- TABLE 234 COLEP PACKAGING: DEALS

- TABLE 235 CPMC HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 236 GUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD: COMPANY OVERVIEW

- TABLE 237 GUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD: OTHERS

- TABLE 238 ALUCON PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 239 DS CONTAINERS: COMPANY OVERVIEW

- TABLE 240 JAMESTRONG PACKAGING: COMPANY OVERVIEW

- TABLE 241 SPRAY PRODUCTS: COMPANY OVERVIEW

- TABLE 242 ITW SEXTON: COMPANY OVERVIEW

- TABLE 243 SWAN INDUSTRIES (THAILAND) COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 244 TUBEX: COMPANY OVERVIEW

- TABLE 245 G. STAEHLE GMBH U. CO. KG.: COMPANY OVERVIEW

- TABLE 246 KIAN JOO CAN FACTORY BERHAD: COMPANY OVERVIEW

- TABLE 247 GRAHAM PACKAGING COMPANY: COMPANY OVERVIEW

- TABLE 248 MASSILLY HOLDING S.A.S: COMPANY OVERVIEW

- TABLE 249 BHARAT CONTAINERS: COMPANY OVERVIEW

- TABLE 250 TECNOCAP S.P.A: COMPANY OVERVIEW

- TABLE 251 LINHARDT: COMPANY OVERVIEW

- TABLE 252 MONTEBELLO PACKAGING: COMPANY OVERVIEW

- TABLE 253 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 254 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2023–2028 (BILLION UNITS)

- FIGURE 1 AEROSOL CANS MARKET SEGMENTATION

- FIGURE 2 AEROSOL CANS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 AEROSOL CANS MARKET: SUPPLY-SIDE APPROACH 1

- FIGURE 6 AEROSOL CANS MARKET: SUPPLY-SIDE APPROACH 2

- FIGURE 7 AEROSOL CANS MARKET: SUPPLY-SIDE APPROACH 3

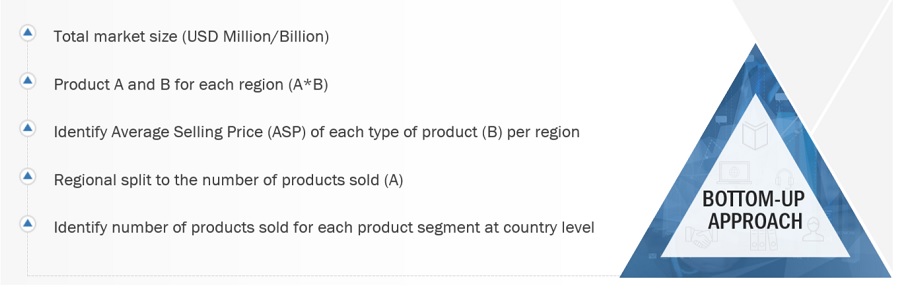

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 AEROSOL CANS MARKET: DATA TRIANGULATION

- FIGURE 11 ALUMINUM LEAD AEROSOL CANS MARKET DURING FORECAST PERIOD

- FIGURE 12 1-PIECE AEROSOL CANS SEGMENT TO BE LARGER SEGMENT THROUGH 2028

- FIGURE 13 LIQUEFIED GAS PROPELLANT TO DOMINATE AEROSOL CANS MARKET BY 2028

- FIGURE 14 PERSONAL CARE SEGMENT TO LEAD MARKET FOR AEROSOL CANS THROUGH 2028

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 EMERGING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN AEROSOL CANS MARKET

- FIGURE 17 EUROPE: UK ACCOUNTED FOR LARGEST SHARE OF AEROSOL CANS MARKET IN 2022

- FIGURE 18 ALUMINUM SEGMENT TO LEAD AEROSOL CANS MARKET DURING FORECAST PERIOD

- FIGURE 19 PERSONAL CARE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 20 LIQUEFIED GAS PROPELLANT TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 21 1-PIECE CANS TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 22 AEROSOL CANS MARKET IN INDIA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AEROSOL CANS MARKET

- FIGURE 24 EUROPEAN MARKET FOR COSMETIC PRODUCTS (RSP BASIS) (USD BILLION)

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 AEROSOL CANS: VALUE CHAIN ANALYSIS

- FIGURE 27 GROWING DEMAND FOR AEROSOL CANS IN END-USE SECTORS TO BRING IN CHANGE IN FUTURE REVENUE MIX

- FIGURE 28 ECOSYSTEM MAP

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 30 KEY BUYING CRITERIA FOR PERSONAL CARE SECTOR

- FIGURE 31 DOCUMENT TYPES, 2019–2023

- FIGURE 32 PUBLICATION TRENDS, 2019–2023

- FIGURE 33 JURISDICTION ANALYSIS, 2019–2023

- FIGURE 34 TOP APPLICANTS, BY NUMBER OF PATENTS (TILL 2023)

- FIGURE 35 LIQUEFIED GAS PROPELLANT TO DOMINATE AEROSOL CANS MARKET DURING FORECAST PERIOD

- FIGURE 36 1-PIECE AEROSOL CANS TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ALUMINUM SEGMENT TO DOMINATE AEROSOL CANS MARKET DURING FORECAST PERIOD

- FIGURE 38 PERSONAL CARE TO DOMINATE AEROSOL CANS MARKET DURING FORECAST PERIOD

- FIGURE 39 INDIA TO BE FASTEST-GROWING AEROSOL CANS MARKET, 2023 – 2028

- FIGURE 40 EUROPE: AEROSOL CANS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: AEROSOL CANS MARKET SNAPSHOT

- FIGURE 42 AEROSOL CANS MARKET: MARKET RANK ANALYSIS

- FIGURE 43 REVENUE ANALYSIS FOR KEY COMPANIES IN AEROSOL CANS MARKET

- FIGURE 44 COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 SME EVALUATION MATRIX, 2022

- FIGURE 46 BALL CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 TRIVIUM PACKAGING: COMPANY SNAPSHOT

- FIGURE 48 CROWN: COMPANY SNAPSHOT

- FIGURE 49 NAMPAK LTD: COMPANY SNAPSHOT

- FIGURE 50 CPMC HOLDINGS LTD: COMPANY SNAPSHOT

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Aerosol Cans market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Aerosol Cans market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, managers, directors, and CEOs of companies in the Aerosol Cans market. Primary sources from the supply side include associations and institutions involved in the Aerosol Cans industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

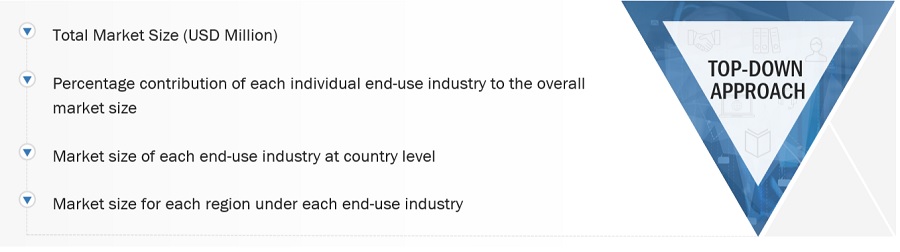

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Aerosol Cans market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

Aerosol cans are typically pressurized containers that utilize propellants to expel the product contents in the form of a fine spray, mist, or foam when the valve or nozzle is actuated. These cans are used across multiple areas, including personal care, household, automotive, healthcare, and industrial sectors, to package a wide range of products such as cosmetics, cleaning agents, paints, lubricants, pharmaceuticals, and more.

Key Stakeholders

- Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Aerosol Cans manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Aerosol Cans market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, material, product type, end-use sectors, and region

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Aerosol Cans market

- Further breakdown of the Rest of Europe’s Aerosol Cans market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aerosol Cans Market