Agricultural Sprayers Market by Type (Self-propelled, Tractor-mounted, Trailed, Handheld, Aerial), Capacity, Farm Size, Crop Type, Nozzle Type, Usage, Power Source (Fuel-based, Electric & Battery-driven, Manual, Solar), & Region - Global Forecast to 2027

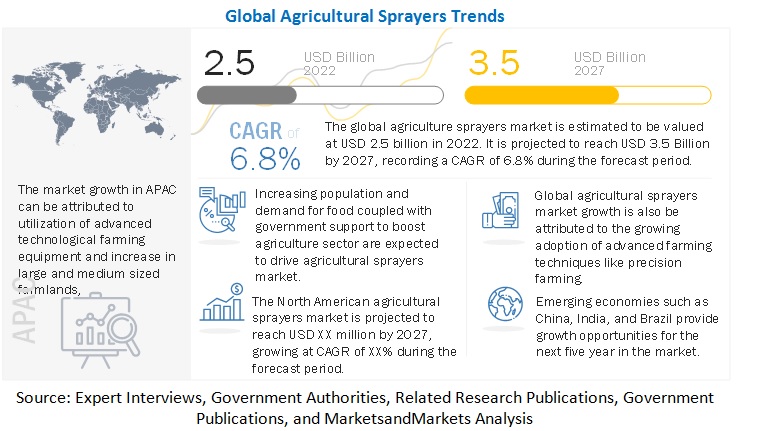

The global agricultural sprayers market is projected to reach USD 3.5 billion by 2027, recording a CAGR of 6.8% during the forecast period. It is estimated to be valued at USD 2.5 billion in 2022.

Farming equipment are essential to enhance crop yield and cut down the labor cost. Over the past few years, agricultural sprayers have become important for farmers for spraying fertilizers, as well as other chemicals such as herbicides and pesticides during the harvest time as per the need. Technological developments permit farmers to apply chemicals in an effective manner. Therefore, the market for agricultural sprayers has gained a momentum because change in farming techniques and technological adoption. The global market can be classified based on type, farm size, nozzle type, power source, capacity, crop type, usage, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Agricultural Sprayers Market Dynamics

Driver: Growing focus on farm efficacy to increase yield

Farmers or growers are not only faced with different challenges associated to farm functions but also various market challenges. Some of the market challenges include fluctuating prices, uncontrollable weather conditions, finding buyers for their product, and lack of natural resources. The newer technology versions of agricultural sprayers have provided various benefits to the farmers, such as low cost, increased spray efficiency, safety, and less damage to the crops and environment. This is substantially increasing the demand for agricultural sprayers in the global market.

Restraint: High capital investment is needed for technologically-advanced farm equipment

New farming technologies such as GPS, drones, and GIS to collect input data, variable rate technology, and satellite devices are expensive as compared to other non-tech devices and need huge capital investment. The majority of the farmers are marginal farmers or small landholding farmers who find it difficult to invest in expensive equipment. This restraint is particularly high in developing countries such as India, China, and Brazil. Currently, most developing countries are importing farming equipment from other countries, which increases the product cost, which in turn expected to lower the market growth of agricultural sprayers in near future.

Opportunity: Adoption of precision farming technique to create opportunities in agricultural sprayers market

Modern agricultural techniques such as precision farming help growers to make more revenue from agribusinesses. Precision farming helps obtain accurate information regarding the application of irrigation water, liquid fertilizers, nutrients, herbicides, and pesticides on the field, thereby reducing the wastage of resources. Precision farming allows farmers to utilize optimal resources in an economical way. Therefore, lately farmers are adopting precision fermentation techniques, which in turn developing opportunities in the global market.

Challenge: Increase in risk of spray drift

According to a report of the non-profit organization Pesticide Action Network (PAN), “When pesticides are sprayed, they can drift and settle on playgrounds, porches, laundry, toys, pools, furniture and more.” Drift pesticides are harmful to human health as well as wildlife and ecosystems in and around agricultural, as well as residential areas where harsh chemicals are used to ward off pests. This is expected to be one of the challenging factors for agricultural sprayers market growth.

The cereals segment holds the largest market share in the global agricultural sprayers market

The cereals segment comprises corn, rice, wheat, barley, and other cereals & grains. The use of agricultural sprayers helps farmers cover larger farm sizes and protect crops, resulting in higher crop yield. Agricultural sprayers involve high demand from cereal producers to increase crop yield. The market for agricultural sprayers is expanding as a result of the growing demand for grains and cereals in consumers' diets.

Growing farm sizes and rising technological advancements in fuel-based sprayers are the major factors driving the fuel-based sprayers segment

The major types of power sources that are used to drive agricultural sprayers include fuel-based, electric & battery-driven, solar, and manual. Fuel-operated sprayers are most efficient due to their strong engine, capacity to cover large farm areas, and reduced human effort, but they also demand proper maintenance. Fuel based sprayers are used for high volume spraying. Due to rising demand and its large capacity, fuel-based sprayers are dominating the global market.

Ultra-low volume agricultural sprayers are adopted small-scale farmers and households

The capacity of agricultural sprayers plays a major role in the uniform distribution of chemicals throughout the crop foliage. These sprayers are utilized for small jobs that does not require large power equipment. Spray droplets for ultra-low volume sprayers are very tiny. Therefore, the nozzles incorporated in this type of sprayers, such as thermal and centrifugal nozzles, are different. Changing climatic conditions and water scarcity leads to increase the demand for ultra-low volume agriculture sprayers because these sprayers need less water unlike traditional conventional high-volume sprayers.

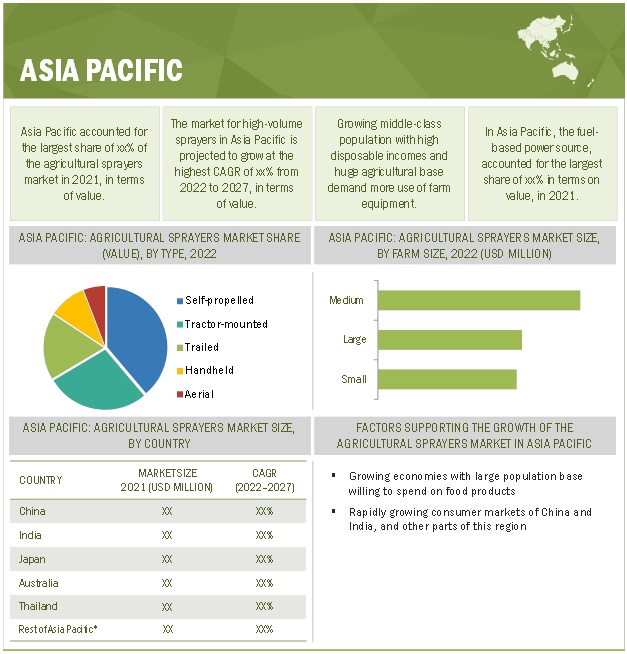

Asia Pacific Agricultural Sprayers Trends

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific dominated the agricultural sprayers market, with a value of USD 932.2 million in 2021; it is projected to reach USD 1430.4 million by 2027, at a CAGR of 7.5% during the forecast period.

In developing countries, the markets for agri-food products are changing rapidly, becoming increasingly open and homogenized toward international standards. Acquiring technical know-how and financial resources to incorporate standards such as quality assurance, safety, and traceability is difficult to do as it marginalizes many small and medium farms and agro-enterprises. Adoption of Unmanned aerial vehicles (UAVs) in Australia, high dependency on agriculture in India, and increasing export of agricultural machineries in China are some of the important factors fueling the Asia-Pacific agricultural sprayers market growth in the near future.

Key Market Players

Key players in this market include John Deere (US), CNH Industrial N.V. (UK), Kubota Corporation (Japan), Mahindra & Mahindra Ltd. (India), STIHL (Germany), AGCO Corporation (US), Yamaha Motor Corp. (Japan), Bucher Industries AG (Switzerland), EXEL Industries (France), AMAZONEN-Werke (Germany), BGROUP S.p.A. (Italy), Agro Chem Inc. (US), Boston Crop Sprayers Ltd. (UK), H&H Farm Machine Co. (US), Buhler Industries Inc. (Canada), AG Spray Equipment, Inc. (US), DJI (China), Case IH (US), H.D. Hudson Manufacturing Co. (US), and John Rhodes AS Ltd (UK)

Target Audience:

- Agricultural machinery manufacturers

- Farm equipment traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to agricultural sprayers manufacturers

-

Government agricultural departments and regulatory bodies:

- European Agricultural Machinery Industry Association (CEMA)

- International Trade Association (ITA)

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- Food Safety and Standards Authority of India (FSSAI)

Scope of the Report

|

Report Metric |

Details |

|

Revenue Forecast in 2027 |

USD 3.5 BN |

|

Market Size Value in 2022 |

USD 2.5 BN |

|

Growth Rate |

CAGR of 6.8% from 2022 to 2027 |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2022-2027 |

|

Historical Base Year |

2021 |

|

Key Market Dynamics |

|

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

Asia Pacific |

|

Leading Manufacturers In Agricultural Sprayers Market |

|

This research report categorizes the agricultural sprayers market based on type, farm size, nozzle type, power source, capacity, crop type, usage, and region.

By Type

- Handheld

- Self-propelled

- Low HP

- Medium HP

- High HP

- Tractor-mounted

- Trailed

- Aerial

By Farm Size

- Large

- Medium

- Small

By Nozzle Type

- Hydraulic nozzle

- Gaseous nozzle

- Centrifugal nozzle

- Thermal nozzle

By Power Source

- Fuel-based

- Electric & battery-driven

- Solar

- Manual

By Capacity

- Ultra-low volume

- Low volume

- High volume

By Crop Type

- Cereals

- Corn

- Wheat

- Rice

- Other cereals & grains

- Oilseeds

- Soybean

- Rapeseed/Canola

- Sunflower & Cottonseed

- Other oilseeds

- Fruits & vegetables

- Other crop types

By Usage

- Field Sprayers

- Orchards Sprayers

- Gardening Sprayers

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Key Features of the Agricultural Sprayers Market

- Variety of sprayer types: The agricultural sprayers market offers a range of sprayer types, including backpack sprayers, handheld sprayers, ATV/UTV sprayers, and tractor-mounted sprayers, to cater to different farming needs and operations.

- Advancements in technology: The market is witnessing advancements in technology such as GPS-enabled sprayers, variable rate application, and remote control operation, which helps farmers in precision spraying and reducing chemical wastage.

- Increase in demand for food: With the increasing population, there is a rise in demand for food, which is driving the adoption of agricultural sprayers for efficient crop protection and crop yield enhancement.

- Government initiatives: Government initiatives such as subsidies and financial assistance to farmers for the purchase of agricultural equipment, including sprayers, are promoting the adoption of these tools among farmers.

- Environment-friendly options: The market is witnessing an increase in the demand for environment-friendly options such as electric and battery-powered sprayers, which reduces emissions and noise pollution.

- Customizable options: Agricultural sprayers are available in customizable options, such as nozzle selection, boom width, and tank size, which allows farmers to choose the best-suited sprayer for their specific needs.

Agricultural Sprayers Market Recent Developments

- In November 2022, DJI released the upgraded T50 with two sets of active phased array radars, two sets of binocular vision, and a dual atomization spraying system, which integrates functions of aerial survey and flight defense. Weighed at 52kg, it supports the spreading of a 50kg load and spraying a 40kg load, with a 2200mm maximum wheelbase, 16 L/min spraying and 108 kg/min sowing. It is also equipped with a seven-inch remote controller screen, which supports intelligent route planning and a transmission distance as far as 2 km.

- In November 2022, Pyka, maker of the Pelican Spray, a fully autonomous and 100% electric agricultural aerial application aircraft, received the first ever regulatory approval to fly unmanned aerial spray missions at night with a fixed wing aircraft. Authorized by the General Directorate of Civil Aviation (DGAC) in Costa Rica, the Pelican Spray has approval to be used by Pyka’s local customers to spray large commercial banana plantations, both day and night.

- In October 2022, Yamaha developed a new product, the FAZER R AP, which adds an automatic flight function to the FAZER R industrial unmanned helicopter used for agricultural applications, with new features added for improved spraying efficiency. It will facilitate higher-precision straight-line, long-distance spraying in large-scale fields, reduced operator workload, more efficient spraying of pesticides and fertilizers, and a more even spraying quality.

- In October 2022, Hylio introduced its new AG-130 drone for large scale agricultural operations. The company’s largest to date, the AG-130 is a fully autonomous, eight-rotor UAS platform equipped with a high-precision spraying system consisting of two 4-gallon tanks, air-induction nozzles, and electronic flowmeters. It has also two wide-angle radars, a built-in HD camera and two GPS units.

- In October 2022, DJI introduced the new flagship DJI AGRAS T40 for the United States and surrounding regions at AirWorks 2022. Its ultra-large flow rate and Dual Atomized Spray System, greatly improves the adhesion rate of sprayed droplets on the back of fruit tree leaves. With a payload weight capacity of 50 kg and enhanced spreading efficiency of 1.5 tonnes per hour, it is designed to meet majority of needs of users in aerial crop protection for fruit trees.

- In September 2022, AgNext Technologies introduced e-sprayer, an electrostatic-based pesticide sprayer for 360° crop coverage, zero pesticide wastage or excessive pesticide dripping. E-spray disperses electrostatically charged atomised liquid spray. The e-sprayer contains an IoT device that allows users to track spraying activity in real-time.

- In August 2022, Solinftec unveiled its Solix Sprayer robot designed to detect and spray weeds in partnership with manufacturing, research, and development company, McKinney Corporation. The Solix Sprayer robot will provide autonomous and sustainable spot-spray applications on grower’s fields. The new cutting-edge technology is slated to become commercially available in 2023.

- In August 2022, Case IH and Raven Industries introduced an autonomous spreader, the Case IH Trident 5550 applicator with Raven Autonomy. It includes driverless technology and agronomically designed spreading platform. The technology stack is powered by guidance and steering, propulsion control, perception, and path planning software developed by Raven.

- In June 2022, CNH Industrial The company launched an upgraded version of the Guardian Sprayer using precision technology from Raven Industries. The lineup of SP310F, SP370F and SP410F Guardian front boom sprayers feature the advanced precision technologies from Raven with the high horsepower and large tanks. This comes in the form of Slingshot from Raven, and the IntelliSpray II, with data collected and aggregated by Raven’s Connected Workflow system. The sprayers are equipped with IntelliView 12 and Viper 4+ displays, allowing operators to monitor the sprayer’s vital functions like suspension information, liquid management controls, auto rinse functions, 4-wheel steering, tread width adjustments etc.

- In March 2022, Case IH has revamped its entire self-propelled Patriot sprayer line- 40 series; the new 50 series (three models, the 3250, 4350 and 4450) were to be available for the fall of 2022. The revamp includes completely redesigned styling and look of the hoods, new operator environment, new armrest, some upgrades to the seat suspension, new chassis suspension, new spray systems and a whole suite of connectivity solution.

- In January 2022, Eavision launched its new all-area-aware intelligent drone EA-30X designed by Pininfarina Shanghai. The professional agriculture spraying drone is especially designed with new generation of EA-30X dual-eye environment sensing technology, for hills and mountains that can cover all terrains, all time, and all plant protection application scenarios.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the agricultural sprayers market?

North America dominated the global agricultural sprayers market, with a value of USD 615 million in 2021; it is projected to reach USD 882 million by 2027.

What is the current size of the global agricultural sprayers market?

The global agricultural sprayers market is estimated at USD 2.5 Billion in 2022. It is projected to reach USD 3.5 Billion by 2027, recording a CAGR of 6.8 % during the forecast period.

Which are the key players in the market, and how intense is the competition?

Key players in this market include John Deere (US), CNH Industrial N.V. (UK), Kubota Corporation (Japan), Mahindra & Mahindra Ltd. (India), STIHL (Germany), AGCO Corporation (US), Yamaha Motor Corp. (Japan), Bucher Industries AG (Switzerland), and EXEL Industries (France) .

What are the key factors driving the growth of the agricultural sprayers market?

Some key factors driving the growth of the agricultural sprayers market include an increase in crop yields, a rise in population leading to an increased demand for food, and a rise in the adoption of precision farming techniques.

What is an agricultural sprayer?

An agricultural sprayer is a device used to apply pesticides, herbicides, and fertilizers to crops.

What are the major applications of agricultural sprayers?

The major applications of agricultural sprayers include the application of pesticides, herbicides, and fertilizers to crops.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 INCLUSIONS & EXCLUSIONS

TABLE 1 AGRICULTURAL SPRAYERS MARKET: INCLUSIONS & EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 2 AGRICULTURAL SPRAYERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 AGRICULTURAL SPRAYERS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 4 MARKET SIZE ESTIMATION (DEMAND-SIDE)

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS AND RISK ASSESSMENTS

3 EXECUTIVE SUMMARY (Page No. - 62)

TABLE 3 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 8 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET SHARE (VALUE), BY FARM SIZE, 2022 VS. 2027

FIGURE 10 MARKET, BY POWER SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 12 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

4.2 AGRICULTURAL SPRAYERS MARKET: KEY COUNTRIES, 2021

FIGURE 13 INDIA EXPECTED TO GROW AT HIGHEST RATE

4.3 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE & REGION, 2021

FIGURE 14 CEREAL CROPS SEGMENT DOMINATED MARKET IN 2021

4.4 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2022 VS. 2027

FIGURE 15 SELF-PROPELLED SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

4.5 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2022 VS. 2027

FIGURE 16 FUEL-BASED SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

4.6 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY CAPACITY & COUNTRY, 2021

FIGURE 17 CHINA EXPECTED ACCOUNTED FOR LARGEST SHARE IN 2021

5 AGRICULTURAL SPRAYERS MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN DEMAND FOR ARABLE LAND

TABLE 4 LAND WITH RAINFED CROP PRODUCTION POTENTIAL, BY REGION/GROUP, 2018

5.3 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS: AGRICULTURAL SPRAYERS

5.3.1 DRIVERS

5.3.1.1 Increasing focus on farm efficiency and productivity

5.3.1.2 Increase in farm size

5.3.1.3 Government support for modern agricultural techniques

5.3.1.4 Increase in mechanization of agricultural activities

FIGURE 19 LEVEL OF MECHANIZATION OF AGRICULTURE, BY COUNTRY, 2018

5.3.2 RESTRAINTS

5.3.2.1 High capital investments in modern agricultural equipment

5.3.3 OPPORTUNITIES

5.3.3.1 Growth in precision and other modern farming practices

5.3.3.2 Growth of agriculture in developing economies

FIGURE 20 ASIA: GROSS AGRICULTURE PRODUCTION INDEX, 2015–2018

5.3.4 CHALLENGES

5.3.4.1 Risks associated with spray drift

6 AGRICULTURAL SPRAYERS INDUSTRY TRENDS (Page No. - 79)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 21 AGRICULTURAL SPRAYERS MARKET: VALUE CHAIN ANALYSIS

6.2.1 RAW MATERIALS

6.2.2 RESEARCH & DEVELOPMENT

6.2.3 MANUFACTURING

6.2.4 DISTRIBUTION, MARKETING & SALES, AND END USERS

6.3 TECHNOLOGY ANALYSIS

6.3.1 VARIABLE RATE TECHNOLOGY

6.3.2 MAGNETIC SPRAYING

6.3.3 ARTIFICIAL INTELLIGENCE AND IOT

6.4 PRICING ANALYSIS

6.4.1 AVERAGE SELLING PRICE TREND ANALYSIS

FIGURE 22 AVERAGE SELLING PRICE FOR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018-2021 (USD PER UNIT)

6.4.2 AVERAGE SELLING PRICE TREND ANALYSIS, BY CAPACITY

FIGURE 23 AVERAGE SELLING PRICE FOR AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018-2021 (USD PER UNIT)

6.5 PATENT ANALYSIS

FIGURE 24 PATENTS GRANTED FOR AGRICULTURAL SPRAYERS MARKET, 2011-2021

FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR THE GLOBAL MARKET, 2011-2021

TABLE 5 KEY PATENTS PERTAINING TO AGRICULTURAL SPRAYERS MARKET, 2019-2022

6.6 MARKET MAP

6.6.1 MARKET MAP

FIGURE 26 AGRICULTURAL SPRAYERS MARKET: MARKET MAP

TABLE 6 MARKET ECOSYSTEM

6.7 TARIFF AND REGULATORY LANDSCAPE

6.7.1 REGULATORY FRAMEWORKS

6.7.1.1 Asia Pacific

6.7.1.2 North America

6.7.1.3 Europe

6.7.1.4 South America

6.7.1.5 Rest of the World

6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.7.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 27 REVENUE SHIFT FOR AGRICULTURAL SPRAYERS MARKET

6.8 CASE STUDY ANALYSIS

6.8.1 ARABLE CROP SPRAYER TECHNOLOGY DELIVERING NOVEL TECHNOLOGY AND SYSTEMS

6.8.2 VARIABLE-RATE AGRICULTURE BY AGCO USING INTERNET OF THINGS TECHNOLOGY

6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

6.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING AGRICULTURAL SPRAYERS FOR DIFFERENT FARM SIZES

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING AGRICULTURAL SPRAYERS FOR DIFFERENT FARM SIZES (BY PERCENTAGE)

6.9.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR AGRICULTURAL SPRAYER TYPES

TABLE 12 KEY BUYING CRITERIA FOR AGRICULTURAL SPRAYER TYPES

7 AGRICULTURAL SPRAYERS MARKET, BY NOZZLE TYPE (Page No. - 93)

7.1 INTRODUCTION

7.2 HYDRAULIC NOZZLE

7.2.1 PRESSURE PUMPS USED IN HYDRAULIC NOZZLES PROVIDE MORE COVERAGE WITH LESSER LIQUID CONTENT

7.3 GASEOUS NOZZLE

7.3.1 GASEOUS NOZZLES HELP FARMERS MONITOR AMOUNT OF LIQUID ADMINISTERED INTO FIELD

7.4 CENTRIFUGAL NOZZLE

7.4.1 CENTRIFUGAL NOZZLES IN DRONES MAKE FOR INNOVATIVE NOZZLE SPRAY TECHNOLOGY

7.5 THERMAL NOZZLE

7.5.1 THERMAL NOZZLES WIDELY USED TO OBTAIN MIST APPLICATION FOR CROPS

8 AGRICULTURAL SPRAYERS MARKET, BY TYPE (Page No. - 96)

8.1 INTRODUCTION

FIGURE 30 SELF-PROPELLED SEGMENT EXPECTED TO DOMINATE THE GLOBAL MARKET BY 2027

TABLE 13 AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 15 MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 16 MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

8.2 SELF-PROPELLED

8.2.1 USE OF SELF-PROPELLED SPRAYERS FOR LARGE-SCALE CROP PRODUCTION

TABLE 17 SELF-PROPELLED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 19 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 20 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 21 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3 TRACTOR-MOUNTED

8.3.1 BETTER MANEUVERABILITY OF TRACTOR-MOUNTED SPRAYERS

TABLE 23 TRACTOR-MOUNTED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 26 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.4 TRAILED

8.4.1 GREATER TANK CAPACITY OF TRAILED SPRAYERS

TABLE 27 TRAILED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 30 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.5 HANDHELD

8.5.1 COST-EFFECTIVE HANDHELD SPRAYERS PREFERRED BY SMALL FARMERS

TABLE 31 HANDHELD AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 34 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.6 AERIAL

8.6.1 COST AND TIME-EFFECTIVENESS OF AERIAL SPRAYERS

TABLE 35 AERIAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 38 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE (Page No. - 109)

9.1 INTRODUCTION

FIGURE 31 FUEL-BASED SEGMENT EXPECTED TO DOMINATE THE GLOBAL MARKET BY 2027

TABLE 39 AGRICULTURAL SPRAYERS MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

TABLE 41 MARKET, BY POWER SOURCE, 2018–2021 (THOUSAND UNITS)

TABLE 42 MARKET, BY POWER SOURCE, 2022–2027 (THOUSAND UNITS)

9.2 FUEL-BASED

9.2.1 FUEL-BASED SPRAYERS USED FOR HIGH VOLUME SPRAYING TECHNOLOGIES

TABLE 43 FUEL-BASED AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 46 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.3 ELECTRIC AND BATTERY-DRIVEN

9.3.1 COST-EFFICIENCY OF ELECTRIC AND BATTERY-DRIVEN SPRAYERS

TABLE 47 ELECTRIC AND BATTERY-DRIVEN AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 50 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.4 MANUAL

9.4.1 USE OF MANUAL SPRAYERS FOR SMALL-SIZED APPLICATIONS

TABLE 51 MANUAL AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 54 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.5 SOLAR

9.5.1 SUSTAINABILITY AND ENVIRONMENTAL-FRIENDLY CHARACTERISTICS OF SOLAR SPRAYERS

TABLE 55 SOLAR AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 58 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY (Page No. - 119)

10.1 INTRODUCTION

FIGURE 32 LOW VOLUME SPRAYERS SEGMENT EXPECTED TO DOMINATE THE GLOBAL MARKET BY 2027

TABLE 59 AGRICULTURAL SPRAYERS MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 61 MARKET, BY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 62 MARKET, BY CAPACITY, 2022–2027 (THOUSAND UNITS)

10.2 LOW VOLUME

10.2.1 WIDER COVERAGE AND GOOD PENETRATION OF LOW VOLUME SPRAYERS

TABLE 63 LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 66 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.3 HIGH VOLUME

10.3.1 USE OF SELF-PROPELLED, TRACTOR-MOUNTED, AND TRAILED SPRAYERS FOR DISPENSING HIGH VOLUME SPRAYS

TABLE 67 HIGH VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 70 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.4 ULTRA-LOW VOLUME

10.4.1 ADOPTION OF ULTRA-LOW VOLUME SPRAYERS BY SMALL-SCALE FARMERS AND PRIVATE HOUSEHOLDS

TABLE 71 ULTRA-LOW VOLUME AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 73 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 74 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

11 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE (Page No. - 127)

11.1 INTRODUCTION

FIGURE 33 MEDIUM-SIZED SEGMENT TO DOMINATE AGRICULTURAL SPRAYERS MARKET THROUGH 2027

TABLE 75 AGRICULTURAL SPRAYERS MARKET, BY FARM SIZE, 2018–2021 (USD MILLION)

TABLE 76 MARKET, BY FARM SIZE, 2022–2027 (USD MILLION)

TABLE 77 MARKET, BY FARM SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 78 MARKET, BY FARM SIZE, 2022–2027 (THOUSAND UNITS)

11.2 MEDIUM-SIZED

11.2.1 HIGH ADOPTION OF SELF-PROPELLED, TRACTOR-MOUNTED, AND TRAILED SPRAYERS IN MEDIUM FARMS

TABLE 79 AGRICULTURAL SPRAYERS MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 82 MARKET FOR MEDIUM-SIZED FARMS, BY REGION, 2022–2027 (THOUSAND UNITS)

11.3 LARGE

11.3.1 INCREASE IN APPLICATION OF AERIAL SPRAYERS IN LARGE-SIZED FARMS

TABLE 83 AGRICULTURAL SPRAYERS MARKET FOR LARGE FARMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR LARGE FARMS, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 MARKET FOR LARGE FARMS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 86 MARKET FOR LARGE FARMS, BY REGION, 2022–2027 (THOUSAND UNITS)

11.4 SMALL

11.4.1 HANDHELD (MANUAL) SPRAYERS MOSTLY USED IN SMALL-SIZED FARMS DUE TO THEIR AFFORDABILITY AND EASY AVAILABILITY

TABLE 87 AGRICULTURAL SPRAYERS MARKET FOR SMALL FARMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 AGRICULTURAL SPRAYERS MARKET FOR SMALL FARMS, BY REGION, 2022–2027 (USD MILLION)

TABLE 89 MARKET FOR SMALL FARMS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 90 MARKET FOR SMALL FARMS, BY REGION, 2022–2027 (THOUSAND UNITS)

12 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE (Page No. - 136)

12.1 INTRODUCTION

FIGURE 34 CEREALS SEGMENT EXPECTED TO DOMINATE THE GLOBAL MARKET THROUGH 2027

TABLE 91 AGRICULTURAL SPRAYERS MARKET, BY CROP TYPE, 2018–2021 (USD MILLION)

TABLE 92 MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.2 CEREALS

12.2.1 INCREASING DEMAND FOR CEREALS AND GRAINS

TABLE 93 AGRICULTURAL SPRAYERS MARKET FOR CEREALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 MARKET FOR CEREALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 95 MARKET, BY CEREAL, 2018–2021 (USD MILLION)

TABLE 96 MARKET, BY CEREAL, 2022–2027 (USD MILLION)

12.2.2 MAIZE

12.2.3 WHEAT

12.2.4 OTHER CEREALS AND GRAINS

12.3 OILSEEDS

12.3.1 INCREASE IN DEMAND FOR HIGH-YIELDING AND DISEASE-RESISTANT OILSEEDS

TABLE 97 AGRICULTURAL SPRAYERS MARKET FOR OILSEEDS, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 MARKET FOR OILSEEDS, BY REGION, 2022–2027 (USD MILLION)

TABLE 99 MARKET, BY OILSEED, 2018–2021 (USD MILLION)

TABLE 100 MARKET, BY OILSEED, 2022–2027 (USD MILLION)

12.3.2 SOYBEAN

12.3.3 RAPESEED/CANOLA

12.3.4 SUNFLOWER AND COTTONSEED

12.3.5 OTHER OILSEEDS

12.4 FRUITS AND VEGETABLES

12.4.1 HIGHER CULTIVATION OF FRUITS AND VEGETABLES UNDER CONTROLLED CONDITIONS DRIVING USAGE OF AGRICULTURAL SPRAYERS

TABLE 101 AGRICULTURAL SPRAYERS MARKET FOR FRUITS AND VEGETABLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 MARKET FOR FRUITS AND VEGETABLES, BY REGION, 2022–2027 (USD MILLION)

12.5 OTHER CROP TYPES

TABLE 103 MARKET FOR OTHER CROPS, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 MARKET FOR OTHER CROPS, BY REGION, 2022–2027 (USD MILLION)

13 AGRICULTURAL SPRAYERS MARKET, BY USAGE (Page No. - 147)

13.1 INTRODUCTION

13.2 FIELD SPRAYERS

13.2.1 FIELD SPRAYERS - AN IMPORTANT TOOL FOR CROP PROTECTION

13.3 ORCHARD SPRAYERS

13.3.1 ORCHARD SPRAYERS COVERING A LARGER AREA WITH LESS LABOR

14 AGRICULTURAL SPRAYERS MARKET, BY REGION (Page No. - 149)

14.1 INTRODUCTION

FIGURE 35 INDIA EXPECTED TO GROW AT FASTEST RATE DURING FORECAST PERIOD

TABLE 105 AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 108 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

14.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 109 ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 113 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 116 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 117 ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 120 ASIA PACIFIC: MARKET, BY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 121 ASIA PACIFIC: MARKET, BY FARM SIZE, 2018–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY FARM SIZE, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY FARM SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 124 ASIA PACIFIC: MARKET, BY FARM SIZE, 2022–2027 (THOUSAND UNITS)

TABLE 125 ASIA PACIFIC: MARKET, BY CROP TYPE, 2018–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY POWER SOURCE, 2018–2021 (THOUSAND UNITS)

TABLE 130 ASIA PACIFIC: MARKET, BY POWER SOURCE, 2022–2027 (THOUSAND UNITS)

14.2.1 CHINA

14.2.1.1 Country’s heavy reliance on agriculture persuading government to adopt advanced technologies and machinery

TABLE 131 CHINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 132 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 133 CHINA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 134 CHINA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.2.2 INDIA

14.2.2.1 Demand for agricultural sprayers expected to rise with rising demand for food

TABLE 135 INDIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 137 INDIA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 138 INDIA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.2.3 JAPAN

14.2.3.1 Country’s highly industrialized and developed agricultural sprayers industry

TABLE 139 JAPAN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 141 JAPAN: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 142 JAPAN: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.2.4 AUSTRALIA

14.2.4.1 Agriculture contributing to country’s GDP and promoting mechanization

TABLE 143 AUSTRALIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 144 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 145 AUSTRALIA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 146 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.2.5 THAILAND

14.2.5.1 Government’s focus on developing agricultural sector by emphasizing automation

TABLE 147 THAILAND: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 148 THAILAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 149 THAILAND: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 150 THAILAND: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.2.6 REST OF ASIA PACIFIC

TABLE 151 REST OF ASIA PACIFIC: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 154 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.3 NORTH AMERICA

TABLE 155 NORTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 158 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 159 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 160 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 162 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 163 NORTH AMERICA: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 164 NORTH AMERICA: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 165 NORTH AMERICA: MARKET, BY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 166 NORTH AMERICA: MARKET, BY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 167 NORTH AMERICA: MARKET, BY FARM SIZE, 2018–2021 (USD MILLION)

TABLE 168 NORTH AMERICA: MARKET, BY FARM SIZE, 2022–2027 (USD MILLION)

TABLE 169 NORTH AMERICA: MARKET, BY FARM SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 170 NORTH AMERICA: MARKET, BY FARM SIZE, 2022–2027 (THOUSAND UNITS)

TABLE 171 NORTH AMERICA: MARKET, BY CROP TYPE, 2018–2021 (USD MILLION)

TABLE 172 NORTH AMERICA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 173 NORTH AMERICA: MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 174 NORTH AMERICA: MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

TABLE 175 NORTH AMERICA: MARKET, BY POWER SOURCE, 2018–2021 (THOUSAND UNITS)

TABLE 176 NORTH AMERICA: MARKET, BY POWER SOURCE, 2022–2027 (THOUSAND UNITS)

14.3.1 US

14.3.1.1 Increasing shift toward precision agriculture

TABLE 177 US: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 178 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 179 US: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 180 US: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.3.2 CANADA

14.3.2.1 Improved efficiency through use of agricultural sprayers

TABLE 181 CANADA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 182 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 CANADA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 184 CANADA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.3.3 MEXICO

14.3.3.1 Increasing agricultural activities offering opportunities to agricultural sprayers

TABLE 185 MEXICO: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 186 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 187 MEXICO: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 188 MEXICO: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4 EUROPE

TABLE 189 EUROPE: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 190 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 191 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 192 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 193 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 194 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 195 EUROPE: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 196 EUROPE: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 197 EUROPE: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 198 EUROPE: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 199 EUROPE: MARKET, BY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 200 EUROPE: MARKET, BY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 201 EUROPE: MARKET, BY FARM SIZE, 2018–2021 (USD MILLION)

TABLE 202 EUROPE: MARKET, BY FARM SIZE, 2022–2027 (USD MILLION)

TABLE 203 EUROPE: MARKET, BY FARM SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 204 EUROPE: MARKET, BY FARM SIZE, 2022–2027 (THOUSAND UNITS)

TABLE 205 EUROPE: MARKET, BY CROP TYPE, 2018–2021 (USD MILLION)

TABLE 206 EUROPE: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 207 EUROPE: MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 208 EUROPE: MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

TABLE 209 EUROPE: MARKET, BY POWER SOURCE, 2018–2021 (THOUSAND UNITS)

TABLE 210 EUROPE: MARKET, BY POWER SOURCE, 2022–2027 (THOUSAND UNITS)

14.4.1 FRANCE

14.4.1.1 Increased government support and focus on improving agricultural productivity

TABLE 211 FRANCE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 212 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 213 FRANCE: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 214 FRANCE: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4.2 GERMANY

14.4.2.1 High adoption of self-propelled and trailed sprayers equipped with advanced technologies

TABLE 215 GERMANY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 216 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 217 GERMANY: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 218 GERMANY: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4.3 RUSSIA

14.4.3.1 Usage of agricultural equipment with multi-functional sprayers and aerial technology

TABLE 219 RUSSIA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 220 RUSSIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 221 RUSSIA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 222 RUSSIA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4.4 SPAIN

14.4.4.1 Dry climate and shortage of rainfall fueling demand for sprayers for applying water and agrochemicals

TABLE 223 SPAIN: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 224 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 225 SPAIN: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 226 SPAIN: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4.5 UK

14.4.5.1 Strong government support spurring business development in farming

TABLE 227 UK: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 228 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 229 UK: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 230 UK: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4.6 ITALY

14.4.6.1 Increasing need for farm mechanization and rise in technological advancements

TABLE 231 ITALY: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 232 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 233 ITALY: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 234 ITALY: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.4.7 REST OF EUROPE

TABLE 235 REST OF EUROPE: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 236 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 237 REST OF EUROPE: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 238 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.5 SOUTH AMERICA

TABLE 239 SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 240 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 241 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 242 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 243 SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 244 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 245 SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 246 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 247 SOUTH AMERICA: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 248 SOUTH AMERICA: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 249 SOUTH AMERICA: MARKET, BY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 250 SOUTH AMERICA: MARKET, BY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 251 SOUTH AMERICA: MARKET, BY FARM SIZE, 2018–2021 (USD MILLION)

TABLE 252 SOUTH AMERICA: MARKET, BY FARM SIZE, 2022–2027 (USD MILLION)

TABLE 253 SOUTH AMERICA: MARKET, BY FARM SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 254 SOUTH AMERICA: MARKET, BY FARM SIZE, 2022–2027 (THOUSAND UNITS)

TABLE 255 SOUTH AMERICA: MARKET, BY CROP TYPE, 2018–2021 (USD MILLION)

TABLE 256 SOUTH AMERICA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 257 SOUTH AMERICA: MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 258 SOUTH AMERICA: MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

TABLE 259 SOUTH AMERICA: MARKET, BY POWER SOURCE, 2018–2021 (THOUSAND UNITS)

TABLE 260 SOUTH AMERICA: MARKET, BY POWER SOURCE, 2022–2027 (THOUSAND UNITS)

14.5.1 BRAZIL

14.5.1.1 Technological advancements, favorable soil & weather conditions, and strong government support boosting growth

TABLE 261 BRAZIL: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 262 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 263 BRAZIL: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 264 BRAZIL: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.5.2 ARGENTINA

14.5.2.1 Country employing highly skilled workers to strengthen its farm mechanization industry

TABLE 265 ARGENTINA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 266 ARGENTINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 267 ARGENTINA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 268 ARGENTINA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.5.3 REST OF SOUTH AMERICA

TABLE 269 REST OF SOUTH AMERICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 270 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 271 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 272 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.6 REST OF THE WORLD (ROW)

TABLE 273 ROW: AGRICULTURAL SPRAYERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 274 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 275 ROW: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 276 ROW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 277 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 278 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 279 ROW: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 280 ROW: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 281 ROW: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 282 ROW: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 283 ROW: MARKET, BY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 284 ROW: MARKET, BY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 285 ROW: MARKET, BY FARM SIZE, 2018–2021 (USD MILLION)

TABLE 286 ROW: MARKET, BY FARM SIZE, 2022–2027 (USD MILLION)

TABLE 287 ROW: MARKET, BY FARM SIZE, 2018–2021 (THOUSAND UNITS)

TABLE 288 ROW: MARKET, BY FARM SIZE, 2022–2027 (THOUSAND UNITS)

TABLE 289 ROW: MARKET, BY CROP TYPE, 2018–2021 (USD MILLION)

TABLE 290 ROW: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 291 ROW: MARKET, BY POWER SOURCE, 2018–2021 (USD MILLION)

TABLE 292 ROW: MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

TABLE 293 ROW: MARKET, BY POWER SOURCE, 2018–2021 (THOUSAND UNITS)

TABLE 294 ROW: MARKET, BY POWER SOURCE, 2022–2027 (THOUSAND UNITS)

14.6.1 MIDDLE EAST

14.6.1.1 Continued growth in agriculture fueling demand for agricultural sprayers

TABLE 295 MIDDLE EAST: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 296 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 297 MIDDLE EAST: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 298 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

14.6.2 AFRICA

14.6.2.1 Government support and shift toward digital agriculture techniques increasing demand for sprayers

TABLE 299 AFRICA: AGRICULTURAL SPRAYERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 300 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 301 AFRICA: MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 302 AFRICA: MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

15 COMPETITIVE LANDSCAPE (Page No. - 220)

15.1 OVERVIEW

15.2 MARKET SHARE ANALYSIS

TABLE 303 AGRICULTURAL SPRAYERS MARKET SHARE (CONSOLIDATED)

15.3 KEY PLAYER STRATEGIES

TABLE 304 KEY PLAYER STRATEGIES, 2019–2021

15.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 37 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD BILLION)

15.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

15.5.1 STARS

15.5.2 PERVASIVE PLAYERS

15.5.3 EMERGING LEADERS

15.5.4 PARTICIPANTS

FIGURE 38 AGRICULTURAL SPRAYERS MARKET, COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

15.5.5 PRODUCT FOOTPRINT

TABLE 305 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 306 COMPANY APPLICATION FOOTPRINT

TABLE 307 COMPANY REGIONAL FOOTPRINT

TABLE 308 OVERALL COMPANY FOOTPRINT

15.6 AGRICULTURAL SPRAYERS MARKET, STARTUP/SME EVALUATION QUADRANT

15.6.1 PROGRESSIVE COMPANIES

15.6.2 STARTING BLOCKS

15.6.3 RESPONSIVE COMPANIES

15.6.4 DYNAMIC COMPANIES

FIGURE 39 AGRICULTURAL SPRAYERS MARKET, COMPANY EVALUATION QUADRANT, 2021 (STARTUP/SME)

15.6.5 COMPETITIVE BENCHMARKING

TABLE 309 AGRICULTURAL SPRAYERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 310 AGRICULTURAL SPRAYERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

15.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

15.7.1 PRODUCT LAUNCHES

TABLE 311 AGRICULTURAL SPRAYERS MARKET: PRODUCT LAUNCHES, 2020–2021

15.7.2 DEALS

TABLE 312 AGRICULTURAL SPRAYERS MARKET: DEALS, 2019–2022

16 COMPANY PROFILES (Page No. - 234)

16.1 KEY PLAYERS

(Business overview. Products offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

16.1.1 JOHN DEERE

TABLE 313 JOHN DEERE: BUSINESS OVERVIEW

FIGURE 40 JOHN DEERE: COMPANY SNAPSHOT

TABLE 314 JOHN DEERE: PRODUCT LAUNCHES

TABLE 315 JOHN DEERE: DEALS

16.1.2 CNH INDUSTRIAL N.V.

TABLE 316 CNH INDUSTRIAL N.V.: BUSINESS OVERVIEW

FIGURE 41 CNH INDUSTRIAL N.V.: COMPANY SNAPSHOT

16.1.3 KUBOTA CORPORATION

TABLE 317 KUBOTA CORPORATION: BUSINESS OVERVIEW

FIGURE 42 KUBOTA CORPORATION: COMPANY SNAPSHOT

TABLE 318 KUBOTA CORPORATION: DEALS

16.1.4 MAHINDRA & MAHINDRA LTD.

TABLE 319 MAHINDRA AND MAHINDRA LTD.: BUSINESS OVERVIEW

FIGURE 43 MAHINDRA & MAHINDRA LTD.: COMPANY SNAPSHOT

TABLE 320 MAHINDRA AND MAHINDRA LTD.: DEALS

16.1.5 STIHL

TABLE 321 STIHL: BUSINESS OVERVIEW

FIGURE 44 STIHL: COMPANY SNAPSHOT

TABLE 322 STIHL: PRODUCT LAUNCHES

16.1.6 AGCO CORPORATION

TABLE 323 AGCO CORPORATION: BUSINESS OVERVIEW

FIGURE 45 AGCO CORPORATION: COMPANY SNAPSHOT

TABLE 324 AGCO CORPORATION: DEALS

TABLE 325 AGCO CORPORATION: OTHERS

16.1.7 YAMAHA MOTOR CORPORATION

TABLE 326 YAMAHA MOTOR CORPORATION: BUSINESS OVERVIEW

FIGURE 46 YAMAHA MOTOR CORPORATION: COMPANY SNAPSHOT

TABLE 327 YAMAHA MOTOR CORPORATION: OTHERS

16.1.8 BUCHER INDUSTRIES AG

TABLE 328 BUCHER INDUSTRIES AG: BUSINESS OVERVIEW

FIGURE 47 BUCHER INDUSTRIES AG: COMPANY SNAPSHOT

16.1.9 DJI

TABLE 329 DJI: BUSINESS OVERVIEW

TABLE 330 DJI: DEALS

TABLE 331 DJI: PRODUCT LAUNCHES

16.1.10 EXEL INDUSTRIES

TABLE 332 EXEL INDUSTRIES: BUSINESS OVERVIEW

FIGURE 48 EXEL INDUSTRIES: COMPANY SNAPSHOT

16.1.11 AMAZONEN-WERKE

TABLE 333 AMAZONEN-WERKE: BUSINESS OVERVIEW

TABLE 334 AMAZONEN-WERKE: DEALS

16.1.12 BGROUP S.P.A

TABLE 335 BGROUP S.P.A.: BUSINESS OVERVIEW

16.1.13 CASE IH

TABLE 336 CASE IH: BUSINESS OVERVIEW

16.1.14 H.D. HUDSON MANUFACTURING CO.

TABLE 337 H.D. HUDSON MANUFACTURING CO.: BUSINESS OVERVIEW

16.1.15 BUHLER INDUSTRIES INC.

TABLE 338 BUHLER INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 49 BUHLER INDUSTRIES INC.: COMPANY SNAPSHOT

16.1.16 AMERICAN SPRING & PRESSING WORKS PVT. LTD.

TABLE 339 AMERICAN SPRING & PRESSING WORKS PVT. LTD.: BUSINESS OVERVIEW

16.1.17 AGRO CHEM INC.

TABLE 340 AGRO CHEM INC.: BUSINESS OVERVIEW

16.1.18 H & H FARM MACHINE CO.

TABLE 341 H & H FARM MACHINE CO.: BUSINESS OVERVIEW

16.1.19 AG SPRAY EQUIPMENT, INC.

TABLE 342 AG SPRAY EQUIPMENT, INC.: BUSINESS OVERVIEW

16.1.20 EQUIPMENT TECHNOLOGIES

TABLE 343 EQUIPMENT TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 344 EQUIPMENT TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 345 EQUIPMENT TECHNOLOGIES: OTHERS

16.2 OTHER PLAYERS

16.2.1 3THI ROBOTICS PRIVATE LIMITED

TABLE 346 3THI ROBOTICS PRIVATE LIMITED: COMPANY OVERVIEW

16.2.2 FUSITE CO. LTD.

TABLE 347 FUSITE CO. LTD.: COMPANY OVERVIEW

16.2.3 NEPTUNE SPRAYERS

TABLE 348 NEPTUNE SPRAYERS: COMPANY OVERVIEW

16.2.4 HYLIO

TABLE 349 HYLIO: COMPANY OVERVIEW

16.2.5 GANPATHY AGRO INDUSTRIES

TABLE 350 GANPATHY AGRO INDUSTRIES: COMPANY OVERVIEW

*Details on Business overview. Products offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 ADJACENT MARKETS (Page No. - 291)

17.1 INTRODUCTION

17.2 LIMITATIONS

17.3 AGRICULTURAL PUMPS MARKET

17.3.1 MARKET DEFINITION

17.3.2 MARKET OVERVIEW

17.3.3 AGRICULTURAL PUMPS MARKET, BY TYPE

17.3.3.1 Introduction

TABLE 351 AGRICULTURAL PUMPS MARKET, BY TYPE, 2018–2025 (USD MILLION)

17.3.4 AGRICULTURAL PUMPS MARKET, BY REGION

17.3.4.1 Introduction

17.3.4.2 Asia Pacific

TABLE 352 ASIA PACIFIC: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 353 ASIA PACIFIC: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 354 ASIA PACIFIC: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

17.3.4.3 Europe

TABLE 355 EUROPE: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 356 EUROPE: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 357 EUROPE: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

17.3.4.4 North America

TABLE 358 NORTH AMERICA: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 359 NORTH AMERICA: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 360 NORTH AMERICA: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

17.3.4.5 South America

TABLE 361 SOUTH AMERICA: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 362 SOUTH AMERICA: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 363 SOUTH AMERICA: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

17.3.4.6 Rest of the World (RoW)

TABLE 364 ROW: AGRICULTURAL PUMPS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 365 ROW: ROTODYNAMIC PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 366 ROW: POSITIVE DISPLACEMENT PUMPS MARKET, BY SUBTYPE, 2018–2025 (USD MILLION)

17.4 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET

17.4.1 LIMITATIONS

17.4.2 MARKET DEFINITION

17.4.3 MARKET OVERVIEW

17.4.4 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY TYPE

17.4.4.1 Introduction

TABLE 367 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY TYPE, 2015–2022 (USD MILLION)

17.4.5 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY REGION

17.4.5.1 Introduction

TABLE 368 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY REGION, 2015–2022 (USD MILLION)

17.4.5.2 North America

TABLE 369 NORTH AMERICA: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015–2022 (USD MILLION)

17.4.5.3 Europe

TABLE 370 EUROPE: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015–2022 (USD MILLION)

17.4.5.4 Asia Pacific

TABLE 371 ASIA PACIFIC: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015–2022 (USD MILLION)

17.4.5.5 South America

TABLE 372 SOUTH AMERICA: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015–2022 (USD MILLION)

17.4.5.6 Rest of the World (RoW)

TABLE 373 ROW: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD, 2015–2022 (USD MILLION)

18 APPENDIX (Page No. - 304)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 CUSTOMIZATION OPTIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

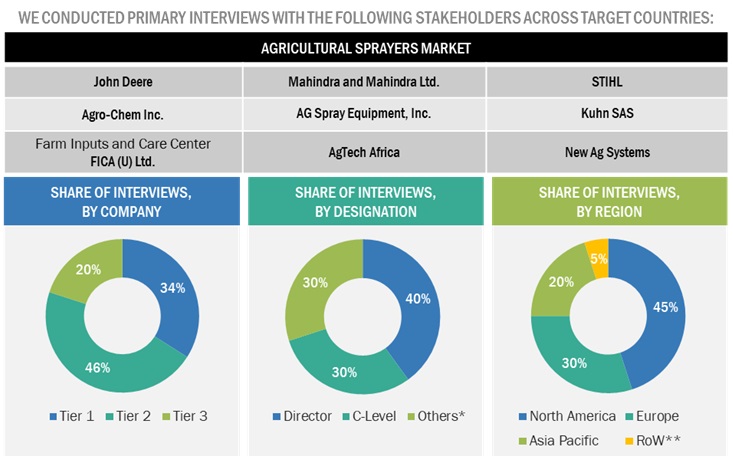

This research study involved the usage of extensive secondary sources, including directories and databases (Hoovers, Forbes, Bloomberg Businessweek, and Factiva), to identify and collect information useful for this technical, market-oriented, and commercial study of the agricultural sprayers market. The primary sources included industry experts from core and related industries and preferred suppliers, dealers, manufacturers, technology developers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the market research methodology applied in drafting this report on the agricultural sprayers market

Secondary Research

Various sources have been referred to in the secondary research process to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases, which have been used to identify & collect information.

Secondary research has been used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, and geographic markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

Extensive primary research was conducted after acquiring information about the agricultural pumps market scenario through secondary research. Several primary interviews were conducted with market experts from the demand (agricultural sprayers manufacturing companies, and government organizations) and supply sides (manufacturers, suppliers, distributors, and exporters) across countries of the studied regions. This primary data was collected through questionnaires, e-mails, and telephonic interviews

Breakdown of Primary participants

To know about the assumptions considered for the study, download the pdf brochure

Agricultural Sprayers Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural sprayers market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The grain alcohol market’s value chain and market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- Given below is an illustration of the overall market size estimation process employed for the purpose of this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for agricultural sprayers on the basis of product type, source, nature, application and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the agricultural sprayers market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European market into Italy, Belgium, the Netherlands, Poland, Portugal, and Ukraine

- Further breakdown of the Rest of Asia Pacific market into Indonesia, Malaysia, South Korea, Thailand, and Vietnam.

- Further breakdown of the Rest of South American market into Chile, Colombia, Paraguay, Uruguay, and Peru.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Sprayers Market