The study involved four major activities in estimating the size of the precision farming software market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering precision farming software have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

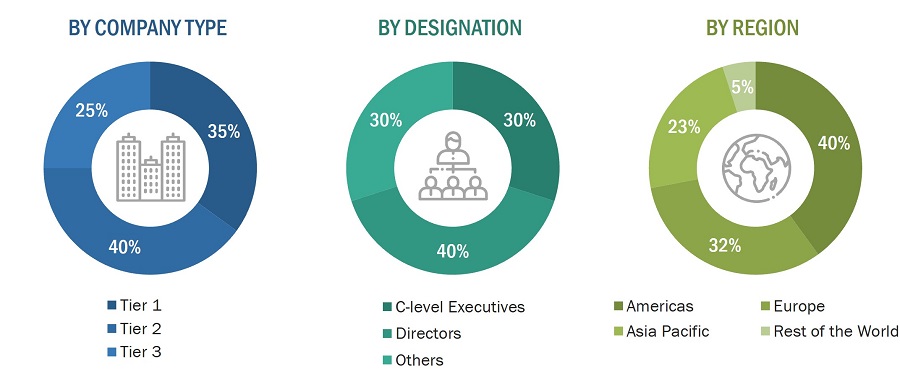

Extensive primary research has been conducted after understanding and analyzing the current scenario of the precision farming software market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: Americas, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

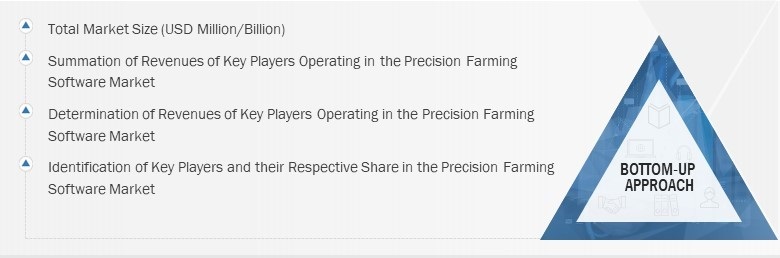

The bottom-up procedure has been employed to arrive at the overall size of the precision farming software market.

-

Identifying the entities in the precision farming software market influencing the entire market, along with the related players, including different types of precision farming software providers

-

Analyzing major precision farming software providers and studying their portfolios, and understanding different types of software

-

Analyzing trends pertaining to the use of different types of software for precision farming software applications

-

Tracking the ongoing and upcoming developments in the market, such as investments made, R&D activities, government support, software launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to understand the different types of software, functions, applications, and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

-

Arriving at the market estimates by analyzing revenues of the companies generated from precision farming software and then combining the same to get the market estimates

-

Dividing the overall market into various other market segments

-

Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders, such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

-

Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

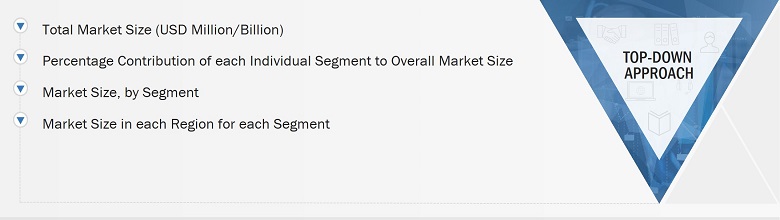

The top-down approach has been used to estimate and validate the total size of the precision farming software market.

-

Focusing initially on top-line investments and expenditures being made in the ecosystems of the precision farming software market

-

Calculating the market size considering the revenues generated by players through the sale of different types of precision farming software

-

Further segmentation based on R&D activities and key developments in key market areas

-

Further segmenting the market based on mapping usage of precision farming software for different functions & applications.

-

Collecting the information related to the revenues generated by players through different offerings

-

Conducting multiple on-field discussions with key opinion leaders across major companies involved in the development of precision farming software

-

Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region, the role of major players in the market for the development of innovative products, adoption, and penetration rates in particular countries for various applications, government support, investments, and other factors.

Data Triangulation

After arriving at the overall size of the precision farming software market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

Precision farming software has revolutionized modern agriculture by leveraging data-driven insights and advanced technologies to optimize farming practices. These software solutions integrate various data sources, including satellite imagery, soil sampling, weather forecasts, and crop sensors, to provide farmers with actionable information for decision-making.

One of the key features of precision farming software is field mapping, which allows farmers to create detailed maps of their fields, including information about soil types, topography, and boundaries. This enables farmers to better understand their land and make informed decisions about crop planning and management.

Key Stakeholders

-

Precision farming component providers

-

Precision farming integrators and installers

-

Precision farming solution providers

-

Consulting companies

-

Product manufacturers

-

Precision farming software providers

-

Precision farming-related associations, organizations, forums, and alliances

-

Government and corporate bodies

-

Research institutes and organizations

-

Venture capitalists, private equity firms, and start-ups

-

Distributors and traders

-

OEMs

-

End users

-

Research institutes and organizations

-

Market research and consulting firms

-

Agri-food buyers

-

Agriculture technology providers

Report Objectives

-

To describe and forecast the precision farming software market in terms of value, based on delivery model, technology, application, and region.

-

To forecast the market size, in terms of value, for various segments, with respect to four main regions—Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

-

To provide detailed information regarding the major factors influencing the growth of

the market (drivers, restraints, opportunities, and challenges).

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

-

To analyze opportunities for the market stakeholders by identifying high-growth segments of the precision farming software market.

-

To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of market rank and product offering.

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders.

-

To track and analyze competitive developments, such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches in the precision farming software market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Greg

May, 2015

I am interested/curious about gps driven data capture technologies and handheld devices in north America and Europe e.g. trimble and Topcon and their many competitors worldwide and how smart phones are impacting these traditional suppliers.

R

Apr, 2016

Increasing need for real time data management and integration of smartphone with agriculture hardware is driving Agtech software market. Have you included Software as a service (SaaS) revenue for this market..

stephen

Jun, 2015

Equipment services in agriculture industry is prevailing from long time. What different services have you included in your study. Do you provide country wise data for services..

Chinmay

Aug, 2019

I am creating a business plan for our robotics and AI product. Need top-line market size numbers, particularly for crop scouting application. .

Alberto

Oct, 2019

We are currently selecting equipment and software for a precision agriculture application using IoT platorm. These systems are to be used in vineyards and fruit trees. Do you have vendor analysis report for this platform..

Jacques

Dec, 2016

Have you included software vendors revenue in your study. I am looking for software market data for farm management AG Tech.

Rod

Mar, 2018

I am looking to estimated market for SaaS services in the Horticultural and forecast period. Thanks..