AI Camera Market by Offering (Image Sensor, Al Processor, Memory), Technology (Deep Learning, Computer Vision, Language Processing), Product(Smartphone, DSLR, CCTV), Biometric (Image, Facial, Speech, OCR), Connectivity & Region - Global Forecast to 2028

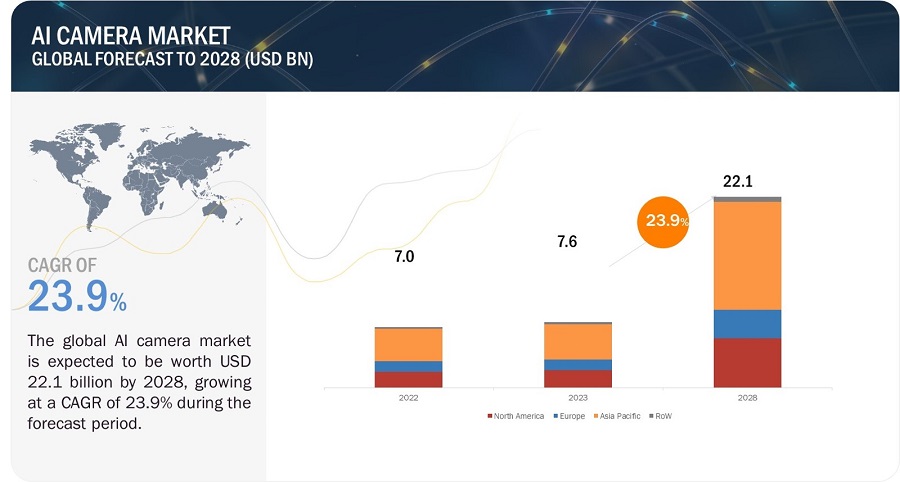

The global AI Camera market is expected to reach USD 22.1 billion in 2028 from USD 7.6 billion in 2023, at a CAGR of 23.9% during the forecast period. High demand for advanced surveillance solution systems from industries attracted the growth of the AI camera market in various sectors, ranging from industrial and residential to public safety. In industries, these cameras enhance efficiency in detecting defects on the production lines, while in residential settings, they guarantee home security with alerts against unauthorized access. Integrating AI cameras with IoT enables smart environments, as these devices connect easily with other devices for better automation and energy efficiency. Retailers install AI cameras to analyze customer behavior in real-time, offering better store layouts, inventory management, and personalized shopping. AI-powered video analytics, in turn, gives it much more strength, opening ways for such applications as traffic management, environmental monitoring, and public safety. Thus, the market for AI cameras is growing, as this technology is indispensable in various industries.

AI Camera Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: AI Camera integration with the Internet of Things

As more and more artificial intelligence cameras end up in the Internet of Things (IoT) ecosystem, it has become easier to connect different physical objects and devices to the internet for data gathering and sharing. This combination of AI cameras with IoT technologies has far-reaching consequences on the development of smart homes and smart buildings.

For example, in a home or building setting, AI cameras equipped with IoT capabilities can be connected easily to other smart devices as well as systems. Therefore, they can exchange information amongst themselves hence raising their functionalities by working together with other loT gadgets, which leads to an overall higher understanding for the entire environment. Additionally, the ability to capture and analyse visual information like pictures or even video clips is one of the things that AI cameras can perform. However, when such visual data is paired with that from other IoT sensors like temperature meters, motion detectors or door-openers in lots; it acts accordingly giving more insights into automation.

Restraint: Concerns regarding data security

Al cameras are fitted with advanced sensors along with facial recognition, object detection, action recognition capabilities. These cameras continuously capture video images and process them simultaneously leading to huge volumes of data being produced almost in real time. Handling and protecting such huge data sets can be an enormous challenge. In order to store this large amount of data, you need a reliable infrastructure, including secure servers, data centers and cloud-based solutions. It is important to choose the suitable storage technology as well as security measures in order not to suffer from data leakage.

The monitoring or analyzing sites might require transmitting some amount of information generated by the AI cameras through networks remotely. If encryption is improper during transferring even between two connected devices, then the interception opportunities or unauthorized access may occur during the process of moving. Thus, it is very crucial to regulate entry points into a database with all electric eyes’(AI) facts and figures on them in the formers’ storage sites. Any unprivileged people could break into databases without permission, but they will take groveling only after few minutes if they could manage to receive codes identifying others’ rightness. Because unauthorized access can happen if there are weak or outdated access control systems.

Opportunity: Growth in video content creation and streaming

The increasing surge in the creation and streaming of videos has opened exciting opportunities for AI Camera manufacturers. With YouTube, TikTok, and Instagram present, many people and content creators would find video production and sharing quite easy. As more and more people dive into creating content, high-quality audio becomes more demanding.

These cameras come with various features like automatic framing, scene recognition, and real-time editing that facilitate the process of content creation, making it look more polished. This is being spearheaded by leading companies in this line of business. Specifically, Canon’s PowerShot series and Sony’s Alpha cameras encompass AI technologies to offer outstanding autofocus features, dexterous exposure settings and thus better image stabilization. In addition, GoPro’s most recent models use artificial intelligence to automatically come up with highlight reels or edit videos to make it easier for users to generate professional-caliber products at the least cost possible.

Challenge: Compatibility issues in AI Camera

Due to the fast development and integration of AI cameras in everyday life, compatibility problems remain a major issue. AI cameras often employ advanced technologies like machine learning algorithms, sensors, and proprietary systems. This complexity can cause interoperability concerns with current hardware and software environments. For example, persons may have difficulties linking AI cameras to older computers which might lack the newest AI software specifications or processing abilities. In addition, various operating systems and video editing programs may result to compatibility challenges whose effect is diminished work rate for content creators.

Companies such as Canon, Sony, and GoPro have taken several measures to deal with these issues, such as issuing regular updates on their firmware to support wider compatibility. Nevertheless, new models face even more integration problems with traditional systems or third-party applications due to the fast pace at which artificial intelligence technologies evolve. Furthermore, standardization remains absent within the features and interfaces found in AI cameras, thus heightening confusion over complex compatibility issues, causing difficulties for users who want a free-flowing interaction experience. Tackling these challenges demands constant cooperation between manufacturers of AI cameras, producers of software, and clients.

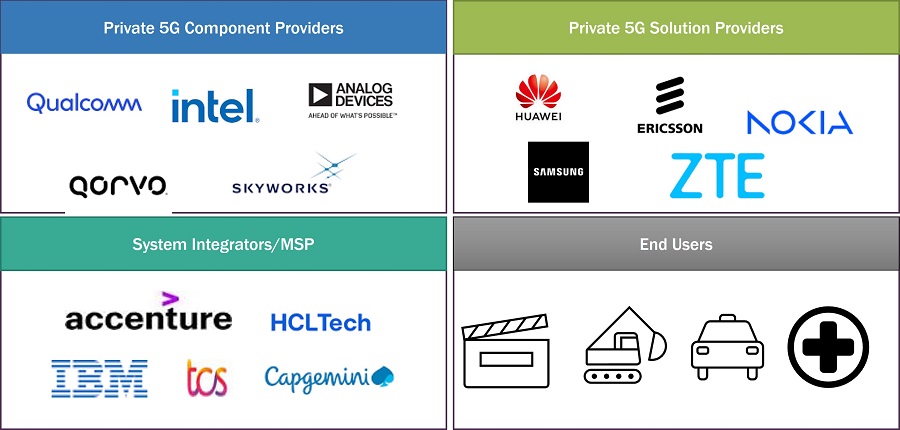

AI Camera Market Ecosystem

The AI Camera market is fragmented, with major companies such as Knowles Electronics LLC (US), Goertek (China), AAC Technologies (China), TDK Corporation (Japan), Infineon Technologies (Germany), STMicroelectronics (Switzerland), ZILLTEK Technology (Taiwan), Hosiden Corporation (Japan), SONION (Denmark), Cui Devices (US), and numerous small- and medium-sized enterprises. Almost all players offer different types of products in the AI Camera market.

Image Sensors for AI Cameras are expected to hold the market share during the forecast period

A crucial part of Al cameras is their image sensors. They are critical because they receive raw input data, which represents the visual information the Al algorithm will process. Light is received by the image sensors which are then converted into electronic signals producing images or frames in video format. This forms the visual content used by AI algorithms for analysis and processing. As such, Al cameras rely on image sensors for environmental observation. They receive visible light or infrared/thermal, among other light emissions in the optical spectrum under consideration.

AI cameras draw their sight using image sensors because these enable them to access the visual data required by AI algorithms to make sense of things happening around us at any given time. Images and video frames, for instance, may result from processing light rays falling on these devices and transforming them into electrical impulses; hence, they can be seen as a source of visual information upon which algorithms utilize diverse techniques when interpreting scene dynamics. The kind of image sensor used and how good it directly affects how well a camera can recognize objects and analyze scenes in real-time. Trackers feed the images needed by AI algorithms to recognize components within them. Al cameras employ them to track features based on color patterns from images taken during scanning operations across areas containing various objects, including human faces or car plate numbers.

Computer vision technology for AI cameras is expected to hold the highest CAGR during the forecast period

Computer vision has the fastest CAGR in the Artificial Intelligence (AI) sector, especially the camera sector, because it affects many fields. Rapid growth is due to improvements in deep learning algorithms, enhanced image processing abilities and access to high quality datasets. The development of AI cameras is happening gradually; they can now recognize faces, detect objects in real-time and analyze videos automatically which were previously only available in research laboratories. These features are highly valued in areas such as security, automotive, retail, and entertainment.

The proliferation of smart devices and rising demand for automation and intelligent solutions plays an important role in adoption of computer vision in AI cameras. Companies like Google, Amazon and Apple invest heavily on R&D work so as to incorporate leading edge computer vision functionalities into their products that improve user experience thus increasing market demand for such devices. Also, public safety requires more effective surveillance systems, as indicated by expanding smart cities that rely on computer vision technology, making it a major player in shaping the future of the AI camera market.

Based on product type, 360-degree camera types to hold the highest CAGR during the forecasted period

Among AI camera product categories, 360-degree cameras are experiencing the highest CAGR. One contributing factor is their rapidly increasing popularity in immersive content creation and virtual reality (VR) applications. These cameras' capability to capture all angles at once enables the production of very engaging and interactive materials for platforms like YouTube, Facebook, or VR headsets. The improved user experience and immersive storytelling have been crucial factors promoting the uptake of 360-degree cameras.

The diversity in application area makes it a good demand driver for 360-degree cameras. They offer potential buyers an exhaustive view of houses through virtual real estate tours. In tourism, they create immersive travel experiences, while in the security sector, they have a wide-angle view, which enhances surveillance capabilities. Major companies such as Insta360, GoPro, and Ricoh consistently renew their 360-degree camera products, incorporating AI functionalities such as automatic stitching, stabilization, or object tracking, which promotes even more market growth. This trend highlights the rising understanding that 360 degrees is a key baseline for capturing next-generation visuals that can be delivered to customers by 360-degree cameras.

Wireless AI Camera market to hold the highest market share by 2028

The term "wireless connectivity" in Al cameras refers to the ability of these cameras to connect and communicate with other devices or networks without necessarily needing any kind of physical cables. The additional abilities offered by this feature include the remote ability for monitoring and data transfer, which makes these cameras far more versatile and accessible. With wireless connectivity, Al cameras can be monitored and controlled remotely at a central point, which may be handy for vigilance systems. It has ease of installation and flexibility in the placement of cameras, as this does not require running extensive cables. Most wireless AI cameras can connect to cloud services for data storage, analysis, and sharing.

Wireless connectivity in AI cameras involves using various wireless technologies to enable data transfer, remote control, and camera communication with other devices or networks. In modern days, this capability is very relevant for next-generation surveillance and security systems and applications, including smart homes and industrial monitoring. The AI capabilities in these cameras can include facial recognition, object detection, and real-time analytics. Wireless connectivity ensures that Al algorithms will be updated and send alerts or data to central servers or other devices.

Facial recognition biometric method is expected to attain the highest market share during the forecast period

Facial recognition is likely to hold the highest share in the AI camera market due to its growing usage in security, surveillance, and access control systems. Advanced AI algorithms powering Facial Recognition Cameras guarantee unparalleled correctness and speed in identifying a person, making them one of the preferred choices of government agencies, businesses, and law enforcement agencies. Facial recognition corners the marketplace for its increasing demand for robust security measures and a growing emphasis on contactless solutions.

Face recognition is a process that quickens the method of access control, as individuals can get into areas by just being recognized; they don’t need to carry cards or keys with them. With AI cameras set up to alert in real time whenever unauthorized people or familiar faces appear on site, there is increased situational awareness and a prompt response to security threats. Also, it records crucial information such as the time of entry and exit for known individuals, their frequency of visitations and demographic data. Attendance tracking, visitor management and customer profiling are some of the uses for this data.

Automotive to be the fastest-growing end-user segment in AI camera market

The modern means of transport are undergoing drastic changes due to the introduction of automated systems. For example, automatic emergency braking systems and adaptive cruise control use ADAS cameras that supply real-time data on what is happening on the road. In addition, these cameras analyze where the vehicle is located, mark lanes and adjacent vehicles, and then estimate whether a collision may occur soon. In deciding the vehicle user’s behavior, these cameras play an important role thus enhancing safety on roads. Moreover, AI cameras can detect road stripes, enabling drivers to stay in their lanes. To do this, lane position is continuously monitored by these devices to send signals to the steering system, allowing it to remain upright along a straight path within a specific lane despite any other possible intersection or turning point. This way chances of unintentional lane changing are minimized.

On February 2023, a British research and innovation institute announced an investment worth around 30 million dollars towards developing the next-gen AI and control systems for driverless cars. Oxbotica from the UK raised USD 140 million on its part in January 2023. This financing will go into developing Software that can aid self-driving vehicles. All through the course of October 2022, Gatik company based in the US began operating self-driving commercial delivery services alongside Walmart Inc., one of its partners, and Loblaw Companies Ltd., another partner through which it makes short-haul deliveries using box trucks within Arkansas, as well as Ontario region in Canada. The growing demand for Al cameras market is being fueled by increasing investment in autonomous vehicle development within this region.

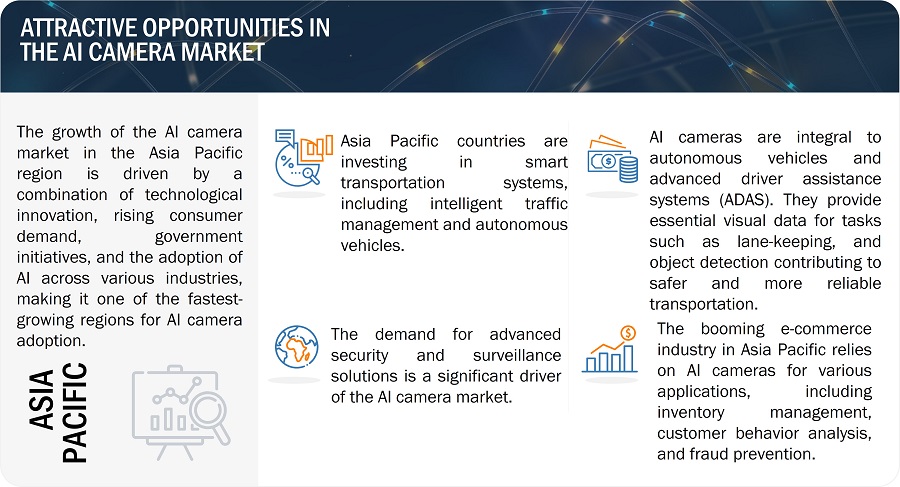

AI Camera market in Asia Pacific to hold the highest CAGR during the forecast period.

The Al camera market has recently witnessed the emergence of the Asia Pacific region as an important growth hub due to rising security concerns, the proliferation of smart city initiatives, advancements in Al and computer vision technologies, and increasing demand for automation across multiple sectors. Agricultural applications, environmental monitoring, and autonomous vehicles are some areas that present key opportunities. Major global and local technology corporations are involved in the Asia Pacific Al camera industry. Examples of major players include Hikvision Technology Co., Ltd., Sony Group Corporation, Panasonic Holdings Corporation, and Samsung.

Importantly, these technologies have transformed production processes and made them more efficient. AI cameras are being used to monitor quality, optimize processes, and automate manufacturing plants, thereby improving overall efficiency. To enhance customer analytics, retailers in some nations, such as China and Japan, exploit Artificial Intelligence (AI) cameras. These systems are capable of following consumers’ movements within shop premises, allowing for targeted marketing that enhances retail experiences.

AI Camera Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The AI Camera companies is dominated by a few globally established players such as Sony Group Corporation (Japan) , Panasonic Corporation (Japan), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Samsung (South Korea), Axis Communications AB (Sweden), VIVOTEK Inc. (Taiwan), Zhejiang Dahua Technology Co., Ltd. (China), Robert Bosch GmbH (Germany) , Honeywell International Inc. (US), Hanwha Vision Co., Ltd. (China), Apple Inc. (US), Alphabet Incorporation (US), Huawei Technologies (China), Teledyne FLIR LLC (US), and others.

AI Camera Market Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 7.6 billion |

|

Projected Market Size |

USD 22.1 billion |

|

Growth Rate |

23.9 |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Offering, By Technology, By Product Type, By Connectivity, By Biometric Method, and By End-user |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Sony Group Corporation (Japan), Panasonic Corporation (Japan), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Samsung (South Korea), Axis Communications AB (Sweden), VIVOTEK Inc. (Taiwan), Zhejiang Dahua Technology Co., Ltd. (China), Robert Bosch GmbH (Germany), Honeywell International Inc. (US), Hanwha Vision Co., Ltd. (China), Apple Inc. (US), Alphabet Incorporation (US), Huawei Technologies (China). (Total 28 players are profiled) |

AI Camera Market Highlights

The study categorizes the AI camera market based on the following segments:

|

Segment |

Subsegment |

|

By offering |

|

|

By technology |

|

|

By product type |

|

|

By connectivity |

|

|

By biometric method |

|

|

By end-user |

|

|

By region |

|

Recent Developments

- In September 2024, security solutions company Dahua Technology has released its latest AI-supported technology, AcuPick 2.0, for its camera range, including its three-in-one camera. AcuPick 2.0 allows users to quickly and accurately locate and track targets throughout multiple locations, distinguishing between humans, vehicles and animals. The search capabilities extend to attribute target search, instead of solely filtering by location or timestamp.

- In July 2024, security installers chose Hanwha Vision’s SolidEDGE AI camera, an edge-based VMS recording solution, as the ‘Technological Innovation of the Year’ in Publisher Professional Security Installer’s (PSI) 2024 Premier Awards. The SolidEDGE offering is a Solid-State Drive-based AI camera – an ideal and innovative serverless VMS recording solution for businesses.

- In January 2024, Hikvision expanded its camera lineup by adding new Stealth Edition Cameras featuring black housings. The new cameras combine high aesthetics with various innovative features like 24/7 full color with ColorVu and AI human and vehicle detection with AcuSense.

- In December 2023, Panasonic Holdings Co., Ltd. has developed an image recognition AI with a new classification algorithm that can handle the multimodal nature of data derived from subject and shooting conditions. Experiments have shown that the recognition accuracy exceeds that of conventional methods.

Frequently Asked Questions:

Which are the major companies in the AI Camera market? What are their significant strategies to strengthen their market presence?

The major companies in the AI Camera market are Sony Group Corporation (Japan), Panasonic Corporation (Japan), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Samsung (South Korea), Axis Communications AB (Sweden), VIVOTEK Inc. (Taiwan), Zhejiang Dahua Technology Co., Ltd. (China), Robert Bosch GmbH (Germany). The major strategies adopted by these players are product launches and developments, collaborations, acquisitions, and expansions.

What is the potential market for the AI Camera in terms of the region?

The Asia Pacific region is expected to dominate the AI Camera market due to the presence of major companies in various industries.

What are the opportunities for new market entrants?

There are significant opportunities in the AI Camera market for start-up companies. These companies provide innovative and diverse service portfolios in Automotive, Medical, Industrial, Consumer Electronics, and other industries.

What are the major AI Camera applications expected to drive the market's growth in the next five years?

There has been a consistent rise in the usage of AI cameras across different sectors due to their ability to provide high-quality video content creation and streaming capabilities, which attract advanced features such as auto framing and real-time editing functionalities, thus improving overall production value. In addition, smart city initiatives coupled with an increasing demand for intelligent surveillance systems are great prospects for growth, driving innovation and adoption of AI camera technologies across several sectors..

What is the market size for AI camera market?

The global AI Camera market is expected to reach USD 22.1 billion in 2028 from USD 7.6 billion in 2023, at a CAGR of 23.9% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for surveillance solutions- Integration with Internet of Things- Wide applications of AI cameras in retail analytics- Increasing demand for enhanced video analyticsRESTRAINTS- Significant upfront investment- Concerns regarding data securityOPPORTUNITIES- Increasing number of smart cities- Potential to enhance industrial automation- Integration of AI cameras in healthcareCHALLENGES- Privacy concerns- Lack of standardization

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY END USERSAVERAGE SELLING PRICE TRENDS, BY REGION (USD)AVERAGE SELLING PRICE TRENDS OF AI CAMERA, BY PRODUCT TYPE, 2019–2028

-

5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Computer vision- Deep learning- Edge computing- Internet of Things (IoT)COMPLEMENTARY TECHNOLOGIES- Global Positioning System (GPS) and Global Navigation Satellite System (GNSS)- Facial recognition software- Cloud computingADJACENT TECHNOLOGIES- Thermal imaging- Robotics vision- Facial emotion analysis

-

5.11 PATENT ANALYSIS

- 5.12 TRADE DATA ANALYSIS

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS RELATED TO AI CAMERA MARKET

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2025

- 6.1 INTRODUCTION

-

6.2 IMAGE SENSORCMOS IMAGE SENSOR- Longer operating time and reduced costs to drive marketTOF IMAGE SENSOR- Ability to capture real-time depth data at high frame rates to drive market

-

6.3 PROCESSORAI PROCESSING UNIT- Enhanced AI workload and real-time analysis to drive market

-

6.4 MEMORY AND STORAGEPROCESSING, STORING, AND DELIVERY OF HIGH-QUALITY AI-DRIVEN CONTENT EFFECTIVELY TO DRIVE MARKET

-

6.5 SOFTWAREAI ANALYTICS- Analytics at edge- Analytics at server

- 7.1 INTRODUCTION

-

7.2 DEEP LEARNINGWIDE ADOPTION OF AI CAMERAS FOR OBJECT RECOGNITION APPLICATIONS TO DRIVE MARKET

-

7.3 NATURAL LANGUAGE PROCESSINGDEMAND FOR BETTER SECURITY MEASURES AND FASTER RESPONSE TO DRIVE MARKET

-

7.4 COMPUTER VISIONPREDICTIVE ANALYSIS AND OBJECT RECOGNITION CAPABILITIES TO DRIVE MARKET

-

7.5 CONTEXT-AWARE COMPUTINGMULTI-MODAL DATA FUSION FOR BETTER DECISION-MAKING TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 COMPACT CAMERASMARTPHONE CAMERA- Increased integration in modern smartphones to drive marketWEARABLE CAMERA- Demand for scene recognition, object tracking, and image enhancement to drive market

-

8.3 DSLR CAMERAASSISTANCE IN IMAGE STABILIZATION TO DRIVE MARKET

-

8.4 CCTV CAMERADOME CAMERA- Growing adoption of cameras for security & surveillance to drive marketPTZ (PAN-TILT-ZOOM) CAMERA- Autofocus capabilities to drive marketBOX AND BULLET CAMERA- Outdoor use for visible deterrent effects to drive marketPANORAMIC AND FISHEYE- Real-time monitoring abilities of vast areas to drive market

-

8.5 360 DEGREE CAMERAWIDE ADOPTION IN PUBLIC SPACES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 WIRED CONNECTIVITYCAPABILITY TO TRANSMIT LARGE AMOUNTS OF HIGH RESOLUTION DATA TO DRIVE MARKET

-

9.3 WIRELESS CONNECTIVITYPROVISION FOR REMOTE ACCESS TO CAMERA FEED AND DATA TO DRIVE MARKETBLUETOOTH- Growing use due to mobile app integration to drive marketWI-FI- Connectivity supporting multiple AI cameras to drive marketCELLULAR- Remote monitoring and accessibility capabilities to drive market

- 10.1 INTRODUCTION

-

10.2 IMAGE RECOGNITIONUTILIZATION IN OPTIMIZING STORE OPERATIONS AND CUSTOMER EXPERIENCE TO DRIVE MARKET

-

10.3 FACIAL RECOGNITIONNEED TO DETECT UNAUTHORIZED INDIVIDUALS AND ACCESS TO DRIVE MARKET

-

10.4 VOICE/SPEECH RECOGNITIONUSER-FRIENDLY VOICE INTERACTION TO DRIVE MARKET

-

10.5 OPTICAL CHARACTER RECOGNITION (OCR)TEXT RECOGNITION AND DETAILED ANALYSIS OF VIDEO CONTENT AND IMAGES TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 CONSUMER ELECTRONICSGROWING ADOPTION OF AI CAMERAS IN SMARTPHONES TO DRIVE MARKET

-

11.3 SECURITY & SURVEILLANCERESIDENTIAL- Need to analyze objects and human behavior patterns in residential properties to drive marketCOMMERCIAL

-

11.4 AUTOMOTIVEDEMAND FOR ADAS IN AUTOMOBILE AI CAMERAS TO DRIVE MARKET

-

11.5 ROBOTICSGROWING ADOPTION OF ROBOTS IN INDUSTRIAL AUTOMATION TO DRIVE MARKET

-

11.6 MEDICALINCREASING ADOPTION OF AI CAMERAS IN MEDICAL IMAGING TO DRIVE MARKET

-

11.7 OTHER END USERSINFRASTRUCTURE DEVELOPMENT WITHIN SMART CITIES TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Integration of AI algorithms and machine learning in cameras for security & surveillance to drive marketCANADA- Increasing adoption of AI cameras in healthcare to drive marketMEXICO- Increasing investment in industrial automation, robotic arms, and machines to drive market

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISUK- Increasing investments in augmented reality and virtual reality to drive marketGERMANY- Wide applications of AI cameras in autonomous vehicles to drive marketFRANCE- Increasing government investments in developing smart infrastructure to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increasing use of AI cameras in consumer electronics and growing demand for AI-enabled smartphones to drive demandJAPAN- Development of security systems for elderly care and integration of AI cameras with robotics to drive marketSOUTH KOREA- Investments in medical imaging, telemedicine, and diagnostics to drive marketREST OF ASIA PACIFIC

-

12.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Applications of AI cameras in smart cities, defense, and transportation to drive marketSOUTH AMERICA- AI camera deployment for traffic management, public safety, and environmental monitoring to drive market

- 13.1 INTRODUCTION

-

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

-

13.3 MARKET SHARE ANALYSIS, 2022KEY PLAYERS IN AI CAMERA MARKET, 2022

- 13.4 REVENUE ANALYSIS OF KEY PLAYERS IN AI CAMERA MARKET

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.7 COMPANY FOOTPRINT ANALYSIS

-

13.8 STARTUP FOOTPRINT ANALYSIS

-

13.9 COMPETITIVE SCENARIO

-

14.1 KEY PLAYERSSONY GROUP CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPANASONIC HOLDINGS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSAMSUNG- Business overview- Products/Services/Solutions offered- MnM viewAXIS COMMUNICATIONS AB- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewVIVOTEK INC.- Business overview- Products/Services/Solutions offered- Recent developmentsZHEJIANG DAHUA TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offeredROBERT BOSCH GMBH- Business overview- Products/Services/Solutions offered- Recent developmentsHANWHA VISION CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsAPPLE INC.- Business overview- Products/Services/Solutions offeredALPHABET INC.- Business overview- Products/Services/Solutions offeredHUAWEI TECHNOLOGIES- Business overview- Products/Services/Solutions offered

-

14.2 OTHER COMPANIESTELEDYNE FLIR LLCAVIGILON CORPORATIONMERIT LILIN ENT. CO., LTD.TIANDY TECHNOLOGIES CO., LTD.VICON INDUSTRIES, INC.REOLINKGEOVISION INC.AMARYLLO INC.NETATMOYI TECHNOLOGYVERKADA INC.WYZE LABS, INC.VIVINT, INC.PELCOZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ASSUMPTIONS RELATED TO RECESSION IMPACT

- TABLE 3 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 7 PRICING ANALYSIS OF KEY PLAYERS

- TABLE 8 USE CASE: AMAZON AND INTEL REALSENSE COLLABORATED TO TRACK CUSTOMERS AND THEIR MOVEMENTS IN STORES

- TABLE 9 USE CASE: WALMART PARTNERED WITH NVIDIA CORPORATION TO IMPLEMENT AI CAMERAS IN STORES

- TABLE 10 USE CASE: PHILIPS COLLABORATED WITH VAYYAR IMAGING FOR HEALTHCARE SETTINGS

- TABLE 11 USE CASE: CHICAGO CITY PARTNERED WITH MOTOROLA SOLUTIONS TO DEPLOY AI CAMERAS FOR SMART CITY SURVEILLANCE

- TABLE 12 USE CASE: DUBAI POLICE UTILIZED BRIEFCAM’S AI CAMERA TECHNOLOGY TO ANALYZE VIDEO FOOTAGE FOR SECURITY & SURVEILLANCE

- TABLE 13 LIST OF MAJOR PATENTS IN AI CAMERA MARKET, 2020–2022

- TABLE 14 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 15 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 16 MFN TARIFFS FOR HS CODE: 852580 EXPORTED BY JAPAN

- TABLE 17 MFN TARIFFS FOR HS CODE: 852580 EXPORTED BY CHINA

- TABLE 18 MFN TARIFF FOR HS CODE: 852580 EXPORTED BY US

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2025

- TABLE 24 AI CAMERA MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 25 AI CAMERA MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 26 SOFTWARE: AI CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 27 SOFTWARE: AI CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 28 AI CAMERA MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 29 AI CAMERA MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 30 AI CAMERA MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 31 AI CAMERA MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 32 COMPACT CAMERA: AI CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 33 COMPACT CAMERA: AI CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 COMPACT CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 35 COMPACT CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 36 DSLR CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 37 DSLR CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 38 CCTV CAMERA: AI CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 39 CCTV CAMERA: AI CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 40 CCTV CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 41 CCTV CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 42 360 DEGREE CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 43 360 DEGREE CAMERA: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 44 AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 45 AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 46 WIRED CONNECTIVITY: AI CAMERA MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 47 WIRED CONNECTIVITY: AI CAMERA MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 48 WIRED CONNECTIVITY: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 49 WIRED CONNECTIVITY: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 50 WIRELESS CONNECTIVITY: AI CAMERA MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 51 WIRELESS CONNECTIVITY: AI CAMERA MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 52 WIRELESS CONNECTIVITY: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 53 WIRELESS CONNECTIVITY: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 54 WIRELESS CONNECTIVITY: AI CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 55 WIRELESS CONNECTIVITY: AI CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 57 AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 58 IMAGE RECOGNITION: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 59 IMAGE RECOGNITION: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 60 FACIAL RECOGNITION: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 61 FACIAL RECOGNITION: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 62 VOICE/SPEECH RECOGNITION: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 63 VOICE/SPEECH RECOGNITION: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 64 OPTICAL CHARACTER RECOGNITION: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 65 OPTICAL CHARACTER RECOGNITION: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 66 AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 67 AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 73 CONSUMER ELECTRONICS: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 74 SECURITY & SURVEILLANCE: AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 SECURITY & SURVEILLANCE: AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 SECURITY & SURVEILLANCE: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 77 SECURITY & SURVEILLANCE: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 78 SECURITY & SURVEILLANCE: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 79 SECURITY & SURVEILLANCE: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 80 AUTOMOTIVE: AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 AUTOMOTIVE: AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 AUTOMOTIVE: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 83 AUTOMOTIVE: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 84 AUTOMOTIVE: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 85 AUTOMOTIVE: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 86 ROBOTICS: AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 ROBOTICS: AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 ROBOTICS: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 89 ROBOTICS: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 90 ROBOTICS: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 91 ROBOTICS: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 92 MEDICAL: AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 MEDICAL: AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 MEDICAL: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 95 MEDICAL: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 96 MEDICAL: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 97 MEDICAL: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 98 OTHER END USERS: AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 OTHER END USERS: AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 OTHER END USERS: AI CAMERA MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 101 OTHER END USERS: AI CAMERA MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 102 OTHER END USERS: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2019–2022 (USD MILLION)

- TABLE 103 OTHER END USERS: AI CAMERA MARKET, BY BIOMETRIC METHOD, 2023–2028 (USD MILLION)

- TABLE 104 AI CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 AI CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AI CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: AI CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: AI CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: AI CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 113 EUROPE: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AI CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AI CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 118 REST OF THE WORLD: AI CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 119 REST OF THE WORLD: AI CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 REST OF THE WORLD: AI CAMERA MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 121 REST OF THE WORLD: AI CAMERA MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 122 KEY STRATEGIES ADOPTED BY COMPANIES IN AI CAMERA MARKET

- TABLE 123 MARKET SHARE ANALYSIS, 2022

- TABLE 124 COMPANY FOOTPRINT ANALYSIS

- TABLE 125 COMPANY FOOTPRINT, BY OFFERING

- TABLE 126 COMPANY FOOTPRINT, BY PRODUCT TYPE

- TABLE 127 COMPANY FOOTPRINT, BY BIOMETRIC METHOD

- TABLE 128 COMPANY FOOTPRINT, BY TECHNOLOGY

- TABLE 129 COMPANY FOOTPRINT, BY CONNECTIVITY

- TABLE 130 COMPANY FOOTPRINT, BY END USER

- TABLE 131 COMPANY FOOTPRINT, BY REGION

- TABLE 132 DETAILED LIST OF KEY STARTUPS

- TABLE 133 STARTUP FOOTPRINT ANALYSIS

- TABLE 134 STARTUP FOOTPRINT, BY OFFERING

- TABLE 135 STARTUP FOOTPRINT, BY PRODUCT TYPE

- TABLE 136 STARTUP FOOTPRINT, BY BIOMETRIC METHOD

- TABLE 137 STARTUP FOOTPRINT, BY TECHNOLOGY

- TABLE 138 STARTUP FOOTPRINT, BY CONNECTIVITY

- TABLE 139 STARTUP FOOTPRINT, BY END USER

- TABLE 140 STARTUP FOOTPRINT, BY REGION

- TABLE 141 PRODUCT LAUNCHES, 2022–2023

- TABLE 142 DEALS, JANUARY 2023–MARCH 2023

- TABLE 143 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 144 SONY GROUP CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 145 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 146 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 147 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 148 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 149 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 150 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 151 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 152 SAMSUNG: COMPANY OVERVIEW

- TABLE 153 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 154 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 155 AXIS COMMUNICATIONS AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 157 AXIS COMMUNICATIONS AB: DEALS

- TABLE 158 VIVOTEK INC.: COMPANY OVERVIEW

- TABLE 159 VIVOTEK INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 160 VIVOTEK INC.: PRODUCT LAUNCHES

- TABLE 161 VIVOTEK INC.: DEALS

- TABLE 162 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 163 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 164 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 165 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 166 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 168 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 169 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 170 HANWHA VISION CO., LTD.: BUSINESS OVERVIEW

- TABLE 171 HANWHA VISION CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 HANWHA VISION CO., LTD.: PRODUCT LAUNCHES

- TABLE 173 APPLE INC.: COMPANY OVERVIEW

- TABLE 174 APPLE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 ALPHABET INC.: COMPANY OVERVIEW

- TABLE 176 ALPHABET INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 HUAWEI TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 178 HUAWEI TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 180 AVIGILON CORPORATION: COMPANY OVERVIEW

- TABLE 181 MERIT LILIN ENT. CO., LTD.: COMPANY OVERVIEW

- TABLE 182 TIANDY TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 183 VICON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 184 REOLINK: COMPANY OVERVIEW

- TABLE 185 GEOVISION INC.: COMPANY OVERVIEW

- TABLE 186 AMARYLLO INC.: COMPANY OVERVIEW

- TABLE 187 NETATMO: COMPANY OVERVIEW

- TABLE 188 YI TECHNOLOGY: COMPANY OVERVIEW

- TABLE 189 VERKADA INC.: COMPANY OVERVIEW

- TABLE 190 WYZE LABS, INC.: COMPANY OVERVIEW

- TABLE 191 VIVINT, INC.: COMPANY OVERVIEW

- TABLE 192 PELCO: COMPANY OVERVIEW

- TABLE 193 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 GDP GROWTH PROJECTION UNTIL 2023 FOR MAJOR ECONOMIES

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 RESEARCH PROCESS FLOW

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF AI CAMERA PRODUCTS AND SOLUTIONS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 SOFTWARE SEGMENT TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 CCTV CAMERA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 CONSUMER ELECTRONICS TO ACQUIRE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF AI CAMERA MARKET IN 2022

- FIGURE 13 INCREASING DEMAND FOR SECURITY & SURVEILLANCE SOLUTIONS TO DRIVE MARKET

- FIGURE 14 CHINA AND CONSUMER ELECTRONICS TO HOLD LARGEST MARKET SHARES IN ASIA PACIFIC MARKET IN 2023

- FIGURE 15 CHINA TO HOLD LARGEST SHARE OF AI CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 16 AI CAMERA MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 17 AI CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS OF AI CAMERA MARKET DRIVERS

- FIGURE 19 IMPACT ANALYSIS OF AI CAMERA MARKET RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS OF AI CAMERA MARKET OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS OF AI CAMERA MARKET CHALLENGES

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 KEY PLAYERS IN AI CAMERA MARKET

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN AI CAMERA MARKET

- FIGURE 28 PATENTS GRANTED IN AI CAMERA MARKET, 2012–2022

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 SOFTWARE TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 COMPUTER VISION TECHNOLOGY FOR AI CAMERAS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 360 DEGREE CAMERA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 WIRELESS CONNECTIVITY TO HOLD LARGER SHARE OF AI CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 35 FACIAL RECOGNITION TO LEAD AI CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 36 AUTOMOTIVE TO BE FASTEST-GROWING END USER IN AI CAMERA MARKET FROM 2023 TO 2028

- FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: AI CAMERA MARKET SNAPSHOT

- FIGURE 39 EUROPE: AI CAMERA MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: AI CAMERA MARKET SNAPSHOT

- FIGURE 41 MARKET SHARE ANALYSIS, 2022

- FIGURE 42 REVENUE ANALYSIS OF KEY PLAYERS IN AI CAMERA MARKET, 2020–2022

- FIGURE 43 COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 45 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 49 VIVOTEK INC.: COMPANY SNAPSHOT

- FIGURE 50 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 52 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 53 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 54 ALPHABET INC.: COMPANY SNAPSHOT

- FIGURE 55 HUAWEI TECHNOLOGIES: COMPANY SNAPSHOT

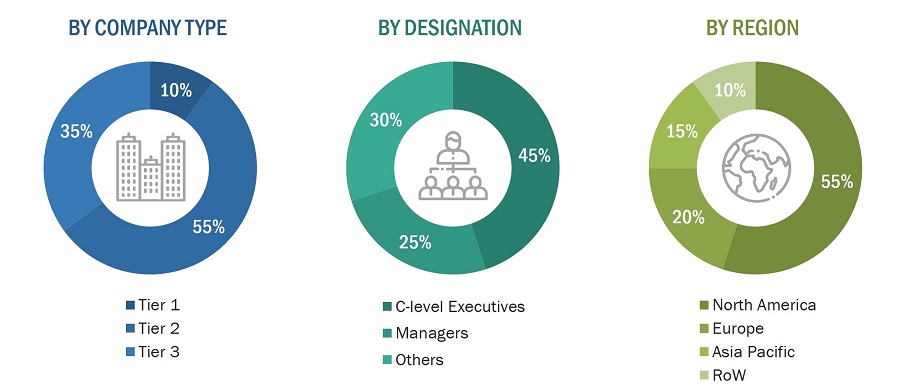

The study involved four major activities in estimating the current size of the AI camera market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

Federal Trade Commission (FTC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

European Data Protection Supervisor (EDPS) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the AI camera market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the AI camera market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the AI camera market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various verticals using or expected to implement AI camera

- Analyzing each end-user and use case, along with the major related companies and AI camera providers

- Estimating the AI camera market for end-user

- Understanding the demand generated by companies operating across different end-use applications

- Tracking the ongoing and upcoming implementation of projects based on AI camera technology by end-users and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of AI camera products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the AI camera market

- Arriving at the market estimates by analyzing AI camera companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

- To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

- The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end-users.

- Building and developing the information related to the market revenue generated by key AI camera manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of AI camera products in various applications

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of AI camera, and the level of solutions offered in end-user industries

- Impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

An AI camera, also known as an artificial intelligence camera, incorporates artificial intelligence (AI) and computer vision technologies to enhance its functionality and capabilities. Unlike traditional cameras that rely solely on hardware components, AI cameras use software algorithms to process and analyze images and videos in real time.

Key Stakeholders

- Manufacturers and Suppliers

- Tech Companies

- Startups and Innovators

- Consumers

- Enterprise Customers

- Regulatory Authorities

- Research and Development (R&D) Institutions

- Integration and Installation Services Providers

- Software Developers

- Retailers and Distributors

- Law Enforcement and Security Agencies

Report Objectives

- To define, describe, and forecast the AI camera market based on offering, technology, product type, biometric method, connectivity, end-user, and region.

- To forecast the shipment data of AI camera market.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the AI camera market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the AI camera market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the AI Camera market.

Growth opportunities and latent adjacency in AI Camera Market