Aircraft and Marine Turbochargers Market by Platform (Aircraft, Marine, Unmanned Aerial Vehicle (UAV)), Component (Compressor, Turbine, Shaft), Technology (Single Turbo, Twin Turbo, Electro-Assist Turbo) and Region - Global Forecast to 2023

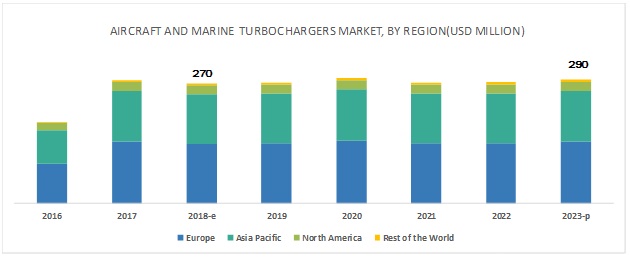

[126 Pages Report] The market aircraft and marine turbochargers is projected to grow from USD 270 million in 2018 to USD 290 million by 2023, at a Compound Annual Growth Rate (CAGR) of 1.41% from 2018 to 2023. The rising demand for fuel-efficient aircraft engines, increasing number of aircraft deliveries, rising demand for light jets from countries such as the US, the UK, China, India, and Japan, and flourishing maritime tourism industry across the globe are leading to the growth of the aircraft and marine turbochargers market.

Based on component, the compressor segment is projected to be the largest contributor to the aircraft and marine turbochargers market during the forecast period.

Based on component, the compressor segment is projected to lead the aircraft and marine turbochargers market during the forecast period. Compressor wheels, which are commonly made of aluminum alloys, are the common component used in turbos. However, some commercial diesel and performance racing applications of aircraft and marine turbochargers have started using titanium wheels machined on 5-axes mills. Though these wheels are extremely expensive, they do tend to avert premature failures of turbocharger components witnessed in high boost applications in aircraft and ships.

Based on platform, the ultralight (turboprop) aircraft segment is projected to lead the aircraft and marine turbochargers market from 2018 to 2023.

In ultralight (turboprop) aircraft, turboprop engines are used. These engines are the advanced version of the traditional jet engines, wherein engine inlets are equipped with propellers. These propellers are rotated at high speed using power produced by engines, which is transferred to gearboxes. The use of turboprop engines is limited to applications, wherein aircraft operates at low speeds because of the huge size of propellers. These engines are used mainly in general aviation applications. The market for turboprop engines is projected to grow during the forecast period as they are more fuel-efficient than traditional jet engines.

The European region is projected to lead the aircraft and marine turbochargers market during the forecast period.

The European region is estimated to account for the largest share of the aircraft and marine turbochargers market in 2018. The growth of the Europe aircraft and marine turbochargers market can be attributed to the presence of a large number of turbocharger manufacturers in the region that include PBS Velka Bites (the Czech Republic), Rolls-Royce (UK), and ABB (Switzerland), among others. Moreover, the stringent implementation of various emission norms in countries such as Germany, the UK, and France of the region is also leading to the increased demand for fuel-efficient engines, which, in turn, is contributing to the growth of the aircraft and marine turbochargers market in the European region.

The major vendors in the aircraft and marine turbochargers market are Hartzell Engine Technologies (US), PBS Velka Bites (the Czech Republic), Rolls-Royce (UK), Mitsubishi Heavy Industries (Japan), Main Turbo Systems (US), ABB (Switzerland), Cummins (US), Kawasaki Heavy Industries (Japan), and MAN Energy Solutions (Germany).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component, Platform, Technology, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World (RoW) |

|

Companies covered |

Hartzell Engine Technologies (US), PBS Velka Bites (the Czech Republic), Rolls-Royce (UK), Mitsubishi Heavy Industries (Japan), Main Turbo Systems (US), ABB (Switzerland), Cummins (US), Kawasaki Heavy Industries (Japan), and MAN Energy Solutions (Germany) |

This research report categorizes the aircraft and marine turbochargers market based on component, platform, technology, and region.

On the basis of component, the aircraft and marine turbochargers market has been segmented as follows:

- Compressor

- Turbine

- Shaft

- Others (Waste Gate Butterfly, Waste Gate Actuator, Throttle Butterfly, and Over Boost Control Valve)

On the basis of platform, the aircraft and marine turbochargers market has been segmented as follows:

- Aircraft

- Ultralight (Turboprop)

- Ultralight (Piston)

- Marine

- Military Ships

- Commercial Ships

- Unmanned Aerial Vehicle (UAV)

- Tactical UAV

- Strategic UAV

- Special Purpose UAV

On the basis of technology, the aircraft and marine turbochargers market has been segmented as follows:

- Single-turbo

- Twin-turbo

- Electro-assist Turbo

- Variable Geometry Turbocharger

On the basis of region, the aircraft and marine turbochargers market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (Middle East & Latin America)

Recent Developments

- In February 2018, Rolls-Royce received a contract worth USD 47 million from the US Department of Defense to manufacture aircraft turbochargers for AE 2100D3 turboprop engine aircraft such as C-130J aircraft, C-27J transport, and US-2 seaplanes.

- In September 2017, ABB signed long-term service agreements with several marine and offshore transport firms for the service maintenance of 400 turbochargers units.

- In August 2017, Continental Motors Group launched CD-265 and CDR-285 piston engines with turbochargers for the aircraft platform.

Key Questions Addressed by the Report

- What will be the revenue pockets for the aircraft and marine turbochargers market in the next five years?

- Who are the leading manufacturers of aircraft and marine turbochargers in the global market?

- What are the growth prospects of the aircraft and marine turbochargers market in the next five years?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Aircraft and Marine Turbocharger Market, 2018-2023

4.2 Aircraft and Marine Turbocharger Market, By Platform

4.3 Aircraft Turbochargers Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Growth in Maritime Tourism

5.3.2 Increasing Focus on Fuel-Efficient Aircraft Engines

5.3.3 Increasing Number of Aircraft Deliveries

5.3.4 Rising Demand for Light Jets in Emerging Economies

5.4 Opportunities

5.4.1 Growing Demand for Lightweight Aircraft Engines

5.4.2 Adoption of 3d Printing for Aircraft Turbocharger Manufacturing

5.4.3 Marine Turbochargers for Gasoline & Diesel Engines

5.5 Challenges

5.5.1 Complex Design of Aircraft Turbochargers, Leading to Maintenance Difficulties

5.5.2 Global Marine Freight Rates

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Technology Trends

6.2.1 3d Printing Technology for Turbochargers

6.2.2 Air Foil Bearings

6.2.3 Hybrid Turbochargers for Marine Engines

6.2.4 Variable Geometry Turbocharger for Marine

6.2.5 Electro-Assist Turbo Technology for Marine Turbocharged Diesel Engines

6.3 Regulatory Landscape

6.3.1 Component Design

6.3.2 Airline/Marine Operations

6.3.2.1 Durability

6.3.2.2 Reparability

6.3.3 Manufacturing

6.3.3.1 Reproducibility

7 Aircraft and Marine Turbochargers Market, By Platform (Page No. - 43)

7.1 Introduction

7.2 Aircraft

7.2.1 Ultralight (Turboprop)

7.2.1.1 Increased Use of Fuel Efficient Aircraft in Ultralight

7.2.2 Ultralight (Piston)

7.2.2.1 The Main Advantage of Piston Engine is to Allow the Plane to Have A More Narrow Front Fuselage That Reduces Drag

7.3 UAV

7.3.1 Tactical UAV

7.3.1.1 The Major Factor Driving the Tactical UAV is Used to Observe and Locate Targets From A Long Distance

7.3.2 Strategic UAV

7.3.2.1 The Major Factor Driving the Strategic UAV is Used to Carry Large Platform Payloads at A Maximum Altitude

7.3.3 Special Purpose UAV

7.3.3.1 Special Purposed UAV Mostly Being Used in Military Applications Such As, Surveillance, and Aerial Photography

7.4 Marine

7.4.1 Military Ships

7.4.1.1 Surface Naval Ship

7.4.1.1.1 Surface Naval Ship are A Subset of Naval Warships Which are Designed for Warfare on the Surface of the Water

7.4.1.2 Aircraft Carrier

7.4.1.2.1 Aircraft Carrier is Used to Deploy Balloons to Nuclear-Powered Warships That Carry Numerous Fighters, Strike Aircraft, Helicopters, and Other Types of Aircraft.

7.4.1.3 Surface Combatant

7.4.1.3.1 Increasing Use of Surface Combatant is to Engage Space, Air, Surface, and Submerged Targets With Weapons Deployed From the Ship

7.4.1.4 Coastal Defense

7.4.1.4.1 Coastal Defense Ship is Specially Designed Shallow Draft Vessels Capable of Littoral Operations

7.4.1.5 Patrol Combatant

7.4.1.5.1 Increasing Use of Patrol Combatant Ship for Anti-Smuggling, Anti-Piracy, Fisheries Patrols, and Immigration Law Enforcement

7.4.1.6 Amphibious Warfare

7.4.1.6.1 Amphibious Warfare Ships Majorly Used to Support Ground Forces, Such as Marines, on Enemy Territory During an Amphibious Assault.

7.4.1.7 Combat Logistics

7.4.1.7.1 Combat Logistics is Responsible for Marine Air-Ground Task Providing Logistic Support

7.4.1.8 Mine Warfare

7.4.1.8.1 Mine Warfare Ships are Designed as Mine Hunter-Killers Capable of Finding, Classifying, and Destroying Moored and Bottom Mines of Ships.

7.4.1.9 Sealift

7.4.1.9.1 Sealift Ships are Majorly Used for the Purpose to Support the Army, Navy, Air Force, Marine Corps and Defense Logistics Agency

7.4.2 Commercial Ships

7.4.2.1 Merchant Ship

7.4.2.1.1 Increasing Demand for Merchant Ships is Due to Increase in Cargo Transport

7.4.2.2 Bulk Carrier

7.4.2.2.1 Bulk Carrier is Specially Designed to Transport Unpackaged Bulk Cargo, Such as Grains, Coal, Ore, and Cement

7.4.2.3 Container

7.4.2.3.1 Container Ships Majorly Used in Commercial Freight Transport and Non-Bulk Cargo.

7.4.2.4 Oil Tanker

7.4.2.4.1 Oil Tanker is Designed for the Bulk Transport of Oil Or Its Products.

7.4.2.5 Offshore Vessel

7.4.2.5.1 Offshore Vessel is Used to Support and Transportation of Goods, Tools, Equipment and Personnel to and From Offshore Oil Platforms and Other Offshore Structures.

7.4.2.6 Recreational Boat

7.4.2.6.1 Increasing Demand for the Recreational Boat is Due to Fishing Expeditions and Water Sport

8 Aircraft and Marine Turbochargers Market, By Component (Page No. - 52)

8.1 Introduction

8.2 Compressor

8.2.1 Increasing Demand for the High Performance Materials for Compressor

8.3 Turbine

8.3.1 Turbine is Mostly Used to Control Exhaust Airflow, Aircraft Wastegates and Manage the Turbine Speed

8.4 Shaft

8.4.1 Shaft is One of the Most Important Component to Produce Shaft Power Than Jet Thrust.

8.5 Others

9 Aircraft and Marine Turbochargers Market, By Technology (Page No. - 56)

9.1 Introduction

9.2 Single Turbo

9.2.1 Single Turbo is Used to Increase the Power Output for Turbocharger

9.3 Twin Turbo

9.3.1 Reduced Operating Costs and Maintenance is the Major Factors for Twin Turbo

9.4 Electro-Assist Turbo

9.4.1 Increasing Demand for Electro-Assist Turbochargers in Marine Industry for the Use of Marine Diesel Engine

9.5 Variable-Geometry Turbo

9.5.1 Increasing Demand for Variable-Geometry Turbocharger for Marine Industry to Produce High Engine Speeds

10 Aircraft and Marine Turbochargers Market, By Region (Page No. - 58)

10.1 Introduction

10.2 North America

10.2.1 US

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 Italy

10.3.4 Switzerland

10.3.5 UK

10.3.6 Russia

10.3.7 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Australia

10.4.4 New Zealand

10.4.5 Japan

10.4.6 South Korea

10.4.7 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Latin America

10.5.2 Middle East

11 Competitive Landscape (Page No. - 91)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Contracts

11.3.2 New Product Developments

11.3.3 Acquisitions and Agreements

12 Company Profiles (Page No. - 96)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Hartzell Engine Technologies

12.2 PBS Velka Bites

12.3 Rolls-Royce

12.4 Mitsubishi Heavy Industries

12.5 Main Turbo Systems

12.6 Textron Inc.

12.7 General Electric

12.8 ABB

12.9 Cummins

12.10 Kawasaki Heavy Industries

12.11 Jrone Turbocharger

12.12 Lycoming Engines

12.13 Continental Motors Group

12.14 Man Energy Solutions

12.15 Innovators

12.15.1 Mahindra Aerospace

12.15.2 A&S Turbochargers Co.

12.15.3 Van Der Lee Turbo Systems

12.15.4 Sprintaero

12.15.5 Diamond Aircraft Industries

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 120)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

List of Tables (80 Tables)

Table 1 Aircraft and Marine Turbochargers Market, By Platform, 2016-2023 (USD Million)

Table 2 Aircraft Turbochargers Market, By Region, 2016-2023 (USD Million)

Table 3 Aircraft Turbochargers Market, By Aircraft Type, 2016-2023 (USD Million)

Table 4 UAV Turbochargers Market, By Region, 2016-2023 (USD Million)

Table 5 UAV Turbochargers Market, By Type, 2016-2023 (USD Million)

Table 6 Marine Turbochargers Market, By Region, 2016-2023 (USD Million)

Table 7 Marine Turbochargers Market, By Ship Type, 2016-2023 (USD Million)

Table 8 Aircraft Turbochargers Market, By Component, 2016-2023 (USD Million)

Table 9 Marine Turbochargers Market, By Component, 2016-2023 (USD Million)

Table 10 Aircraft Turbochargers Market Size, By Region, 2016-2023 (USD Million)

Table 11 Marine Turbochargers Market Size, By Region, 2016-2023 (USD Million)

Table 12 North America Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 13 North America Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 14 North America Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 15 North America Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 16 North America Aircraft Turbochargers Market Size, By Country, 2016-2023 (USD Million)

Table 17 North America Marine Turbochargers Market Size, By Country, 2016-2023 (USD Million)

Table 18 US Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 19 US Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 20 US Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 21 US Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 22 Europe Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 23 Europe Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 24 Europe Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 25 Europe Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 26 Europe Aircraft Turbochargers Size, By Country, 2016-2023 (USD Million)

Table 27 Europe Marine Turbochargers Size, By Country, 2016-2023 (USD Million)

Table 28 France Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 29 France Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 30 France Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 31 France Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 32 Germany Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 33 Germany Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 34 Germany Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 35 Germany Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 36 Italy Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 37 Italy Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 38 Italy Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 39 Italy Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 40 Switzerland Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 41 Switzerland Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 42 UK Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 43 UK Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 44 Russia Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 45 Russia Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 46 Rest of Europe Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 47 Rest of Europe Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 48 Asia Pacific Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 49 Asia Pacific Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 50 Asia Pacific Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 51 Asia Pacific Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 52 Asia Pacific Aircraft Turbochargers Size, By Country, 2016-2023 (USD Million)

Table 53 Asia Pacific Marine Turbochargers Size, By Country, 2016-2023 (USD Million)

Table 54 China Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 55 China Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 56 China Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 57 China Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 58 India Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 59 India Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 60 Australia Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 61 Australia Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 62 New Zealand Aircraft Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 63 New Zealand Aircraft Turbochargers Market Size, By Aircraft Type, 2016-2023 (USD Million)

Table 64 Japan Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 65 Japan Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 66 South Korea Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 67 South Korea Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 68 Rest of Asia Pacific Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 69 Rest of Asia Pacific Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 70 Rest of the World Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 71 Rest of the World Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 72 Rest of the World Marine Turbochargers Size, By Region, 2016-2023 (USD Million)

Table 73 Latin America Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 74 Latin America Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 75 Middle East Marine Turbochargers Market Size, By Component, 2016-2023 (USD Million)

Table 76 Middle East Marine Turbochargers Market Size, By Ship Type, 2016-2023 (USD Million)

Table 77 Ranking of Players in the Global Aircraft and Marine Turbocharger Market

Table 78 Contracts, July 2014–February 2018

Table 79 New Product Developments, July 2014–February 2018

Table 80 Acquisitions and Agreements, July 2014–February 2018

List of Figures (36 Figures)

Figure 1 Research Flow

Figure 2 Research Design: Aircraft and Marine Turbocharger Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Compressor Segment Projected to Lead the Aircraft and Marine Turbocharger Market By Component During the Forecast Period

Figure 8 Ultralight (Turboprop) Subsegment of Aircraft Platform Projected to Dominate the Aircraft Turbochargers Market During the Forecast Period

Figure 9 Commercial Ships Subsegment of Marine Platform to Account for the Largest Share of the Marine Turbochargers Market During the Forecast Period

Figure 10 North America Projected to Account for the Largest Share of the Aircraft Turbochargers Market in 2018

Figure 11 Europe Projected to Account for the Largest Share of the Marine Turbochargers Market in 2018

Figure 12 Emerging Demand for Hybrid Turbocharger Technology for Marine Engines is the Fastest-Growing Trend in Marine Turbochargers Market

Figure 13 Ultralight (Turboprop) Subsegment of Aircraft Platform Projected to Lead the Aircraft Turbochargers Market During the Forecast Period

Figure 14 Military Ships Marine Platform Subsegment Expected to Register the Highest CAGR During the Forecast Period

Figure 15 North America Estimated to Account for the Largest Share of the Aircraft Turbochargers Market in 2018

Figure 16 North America Marine Turbochargers Market to Grow at the Highest Rate During the Forecast Period

Figure 17 Aircraft and Marine Turbochargers: Market Dynamics

Figure 18 Airbus and Boeing Aircraft Fleet Growth Forecast By 2035, By Region

Figure 19 Marine Segment Estimated to Lead the Aircraft and Marine Turbocharger Market During the Forecast Period

Figure 20 Compressor Segment Estimated to Lead the Aircraft and Marine Turbocharger Market During the Forecast Period

Figure 21 Europe Estimated to Account for the Largest Share of the Aircraft Turbochargers Market in 2018

Figure 22 North America Marine Turbochargers Market Snapshot

Figure 23 Europe Marine Turbochargers Market Snapshot

Figure 24 Asia Pacific Marine Turbochargers Market Snapshot

Figure 25 Rest of the World Marine Turbochargers Market Snapshot

Figure 26 Companies Adopted Agreements and Acquisitions as Key Growth Strategies From July 2014 to September 2017

Figure 27 Rolls-Royce: Company Snapshot

Figure 28 Rolls-Royce: SWOT Analysis

Figure 29 Mitsubishi Heavy Industries: Company Snapshot

Figure 30 Mitsubishi Heavy Industries: SWOT Analysis

Figure 31 Textron Inc.: Company Snapshot

Figure 32 General Electric: Company Snapshot

Figure 33 General Electric: SWOT Analysis

Figure 34 ABB: Company Snapshot

Figure 35 Cummins: Company Snapshot

Figure 36 Kawasaki Heavy Industries: Company Snapshot

The study on the aircraft and marine turbochargers market involved 4 major activities to estimate the current size of the market. The exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain of aircraft and marine turbochargers through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size estimation process. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments of the aircraft and marine turbochargers market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to, so as to identify and collect information for this study on the aircraft and marine turbochargers market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, and certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

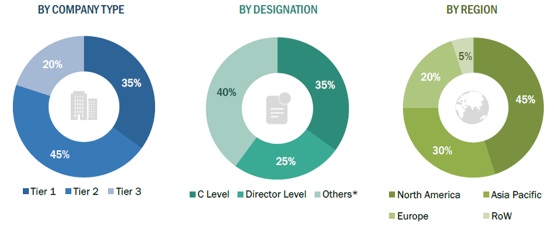

The aircraft and marine turbochargers market comprises several stakeholders such as raw material suppliers, processors, end product manufacturers, and regulatory organizations in the supply chain of aircraft and marine turbochargers. The demand side of this market was characterized by the development of different components, technologies, and applications. The supply side of the market was characterized by advancements in technologies used in aircraft and marine turbochargers. Various primary sources from both, supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft and marine turbochargers market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the aircraft and marine turbochargers industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size of the aircraft and marine turbochargers market using the market size estimation processes explained above, the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides based on component and platform.

Objectives of the Report

- To define, segment, and project the global size of the aircraft and marine turbochargers market

- To understand the structure of the aircraft and marine turbochargers market by identifying its various segments and subsegments

- To provide detailed information about the key factors such as drivers, opportunities, and challenges influencing the growth of the market

- To analyze micromarkets with respect to the individual growth trends, future prospects, and their contribution to the overall market

- To project the size of the market and its submarkets, in terms of value, with respect to 4 key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective key countries

- To profile key players in the aircraft and marine turbochargers market and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by the leading market players across key regions

- To analyze the competitive developments such as partnerships, agreements, and collaborations; and new product launches in the aircraft and marine turbochargers market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe aircraft and marine turbochargers into Norway and Denmark.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Aircraft and Marine Turbochargers Market