TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

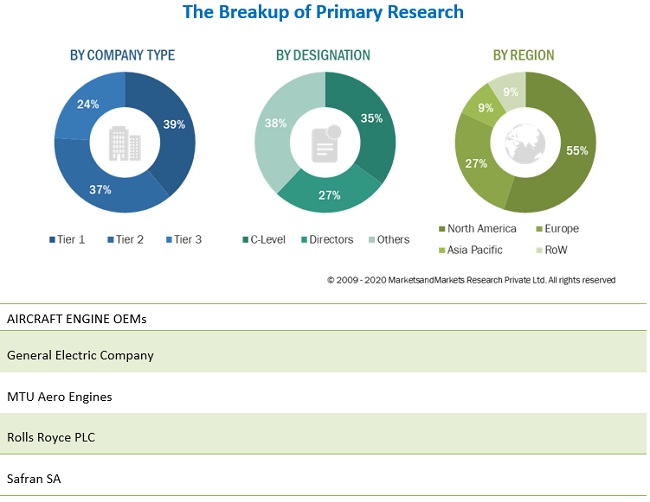

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

2.3 MARKET SCOPE

2.3.1 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH (DEMAND SIDE)

2.4.2 AIRCRAFT ENGINE MARKET

2.4.3 TOP-DOWN APPROACH

2.5 TRIANGULATION & VALIDATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE FACTORS

2.7 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 39)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES

4.2 MARKET, BY COMPONENT

4.3 MARKET, BY TECHNOLOGY

4.4 MARKET, BY TYPE

4.5 MARKET, BY PLATFORM

4.6 AIRCRAFT ENGINES SUPPLY-SIDE MARKET, BY COUNTRY

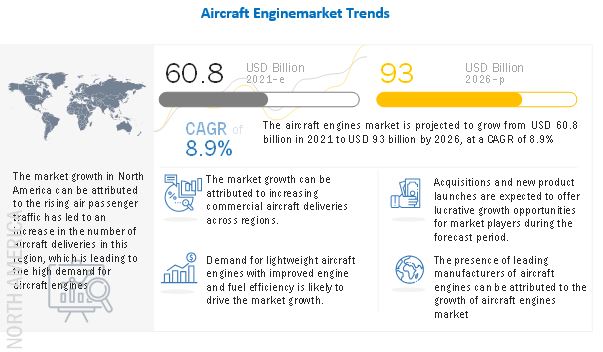

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing operations in commercial aircraft industry

5.2.1.2 Rising demand for fuel-efficient aircraft engines

5.2.2 RESTRAINTS

5.2.2.1 High cost of aircraft engines

5.2.2.2 Engine component manufacturing challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for zero-emission aircraft

5.2.3.2 Growing demand of UAVs for commercial and military applications

5.2.4 CHALLENGES

5.2.4.1 COVID-19 disrupting operations of the aircraft engine supply chain

5.2.4.2 Stringent regulatory environment for aircraft engine manufacturing and MRO

5.3 COVID-19 IMPACT

5.4 RANGES AND SCENARIOS

5.5 TECHNOLOGY ANALYSIS

5.5.1 FULL AUTHORITY DIGITAL ENGINE CONTROL (FADEC)

5.5.2 PREDICTIVE MAINTENANCE

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT ENGINE MARKET

5.7 MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

5.8 VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES MODEL

5.10 CASE STUDY ANALYSIS

5.10.1 AIRCRAFT ENGINE WEIGHT REDUCTION THROUGH TECHNOLOGY

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 FEDERAL AVIATION ADMINISTRATION ON ENGINE CERTIFICATION TEST AND ANALYSIS

6 INDUSTRIAL TRENDS (Page No. - 56)

6.1 INTRODUCTION

6.2 EMERGING TRENDS

6.2.1 HYBRID ENGINES

6.2.2 CERAMIC MATRIX COMPOSITE TECHNOLOGY

6.2.3 PREDICTIVE MAINTENANCE

6.2.4 TECHNOLOGICAL ADVANCEMENTS AND CONTINUOUS IMPROVEMENT

6.3 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.5 INNOVATIONS AND PATENT REGISTRATIONS, 2012-2020

7 MARKET, BY TYPE (Page No. - 61)

7.1 INTRODUCTION

7.2 TURBOPROP

7.3 TURBOFAN

7.4 TURBOSHAFT

7.5 PISTON ENGINE

8 MARKET, BY AIRCRAFT TYPE (Page No. - 64)

8.1 INTRODUCTION

8.2 FIXED WING

8.2.1 COMMERCIAL AVIATION

8.2.1.1 Narrow-body aircraft (NBA)

8.2.1.1.1 Rising air traffic driving growth

8.2.1.2 Wide-body aircraft (WBA)

8.2.1.2.1 Increasing international passenger air travel

8.2.1.3 Regional transport aircraft (RTA)

8.2.1.3.1 Rising demand for regional transport aircraft in the US and Asia Pacific

8.2.2 BUSINESS AND GENERAL AVIATION

8.2.2.1 Business jets

8.2.2.1.1 Increase in corporate activities globally to drive demand

8.2.2.2 Light aircraft

8.2.2.2.1 Advancements in technology for general aviation to drive demand

8.2.3 MILITARY AVIATION

8.2.3.1 Fighter aircraft

8.2.3.1.1 Growing national security to drive the market

8.2.3.2 Transport aircraft

8.2.3.2.1 Increasing use of transport aircraft in military operations to drive demand

8.2.3.3 Special mission aircraft

8.2.3.3.1 Growing defense spending and territorial disputes to drive demand

8.3 ROTARY WING

8.3.1 COMMERCIAL HELICOPTERS

8.3.1.1 Expanding applications of commercial helicopters

8.3.2 MILITARY HELICOPTERS

8.3.2.1 Advanced military helicopters equipped with next-generation sensors

8.4 UNMANNED AERIAL VEHICLES

9 MARKET, BY COMPONENT (Page No. - 73)

9.1 INTRODUCTION

9.2 TURBINE

9.3 COMPRESSOR

9.4 GEARBOX

9.5 EXHAUST SYSTEM

9.6 FUEL SYSTEM

9.7 OTHERS

10 MARKET, BY TECHNOLOGY (Page No. - 77)

10.1 INTRODUCTION

10.2 CONVENTIONAL

10.3 HYBRID

11 REGIONAL ANALYSIS (Page No. - 80)

11.1 INTRODUCTION

11.1.1 IMPACT OF COVID-19: BY REGION

11.1.2 DEMAND SIDE

11.1.3 SUPPLY SIDE

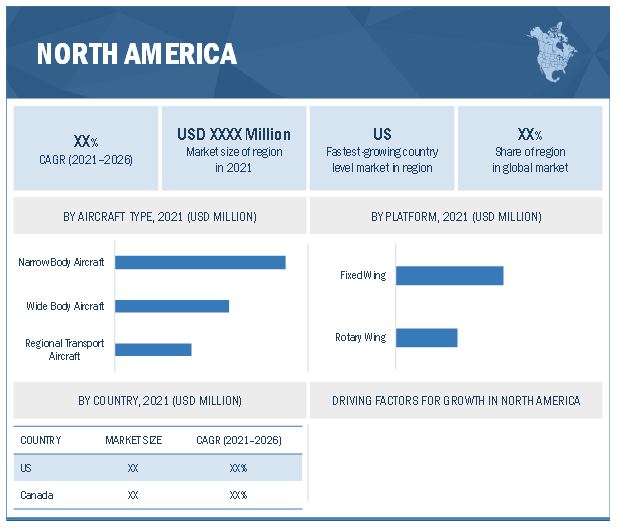

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS

11.2.2 DEMAND SIDE

11.2.3 SUPPLY SIDE

11.2.4 US

11.2.4.1 Presence of leading OEMs to drive the market

11.2.4.2 Demand side

11.2.4.3 Supply side

11.2.5 CANADA

11.2.5.1 Aircraft modernization programs expected to drive the market

11.2.5.2 Demand side

11.2.5.3 Supply side

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

11.3.2 DEMAND SIDE

11.3.3 SUPPLY SIDE

11.3.4 UK

11.3.4.1 Advancing technologies in air travel to drive the market

11.3.4.2 Demand side

11.3.4.3 Supply side

11.3.5 FRANCE

11.3.5.1 Heavy investments in aviation industry to drive the market

11.3.5.2 Demand side

11.3.5.3 Supply side

11.3.6 GERMANY

11.3.6.1 Rising expenditure in air travel and connectivity to drive the market

11.3.6.2 Demand side

11.3.6.3 Supply side

11.3.7 ITALY

11.3.7.1 High demand for commercial helicopters to drive the market

11.3.7.2 Demand side

11.3.8 RUSSIA

11.3.8.1 Increasing military budget for manufacturing advanced aircraft to drive the market

11.3.8.2 Demand side

11.3.8.3 Supply side

11.3.9 REST OF EUROPE

11.3.9.1 Demand side

11.3.9.2 Supply side

11.4 ASIA-PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

11.4.2 DEMAND SIDE

11.4.3 SUPPLY SIDE

11.4.4 CHINA

11.4.4.1 Growing demand for aerospace products to drive the market

11.4.4.2 Demand side

11.4.4.3 Supply side

11.4.5 INDIA

11.4.5.1 Modernization plan for armed forces to drive the market

11.4.5.2 Demand side

11.4.6 JAPAN

11.4.6.1 Growing in-house development of aircraft to drive the market

11.4.6.2 Demand side

11.4.6.3 Supply side

11.4.7 AUSTRALIA

11.4.7.1 Increasing air traffic and new aircraft deliveries to drive the market

11.4.7.2 Demand side

11.4.8 SOUTH KOREA

11.4.8.1 Modernizing programs in aviation industry to drive the market

11.4.8.2 Demand side

11.4.9 REST OF ASIA PACIFIC

11.4.9.1 Demand side

11.5 LATIN AMERICA

11.5.1 PESTLE ANALYSIS: LATIN AMERICA

11.5.2 DEMAND SIDE

11.5.3 BRAZIL

11.5.3.1 Presence of OEMs and growing opportunities for airlines to drive the market

11.5.3.2 Demand side

11.6 MIDDLE EAST

11.6.1 PESTLE ANALYSIS: MIDDLE EAST

11.6.2 DEMAND SIDE

11.6.3 SUPPLY SIDE

11.6.4 TURKEY

11.6.4.1 Significant rise in military spending and development of UAVs to drive the market

11.6.4.2 Demand side

11.6.4.3 Supply side

11.6.5 ISRAEL

11.6.5.1 Increased spending in R&D of UAVs for military and commercial applications to drive the market

11.6.5.2 Demand side

12 COMPETITIVE LANDSCAPE (Page No. - 161)

12.1 INTRODUCTION

12.2 RANKING OF LEADING PLAYERS, 2020

12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

12.5 COMPETITIVE OVERVIEW

12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

12.7 COMPANY EVALUATION QUADRANT

12.7.1 STAR

12.7.2 EMERGING LEADER

12.7.3 PERVASIVE

12.7.4 PARTICIPANT

12.8 COMPETITIVE SCENARIO

12.8.1 DEALS

12.8.2 PRODUCT LAUNCHES

13 COMPANY PROFILES (Page No. - 173)

13.1 KEY PLAYERS

13.1.1 GENERAL ELECTRIC COMPANY

13.1.1.1 Business overview

13.1.1.2 Products/solutions/services offered

13.1.1.3 Recent developments

13.1.1.4 MNM view

13.1.1.4.1 Key strengths and right to win

13.1.1.4.2 Strategic choices

13.1.1.4.3 Weaknesses and competitive threats

13.1.2 ROLLS-ROYCE PLC.

13.1.2.1 Business overview

13.1.2.2 Products/solutions/services offered

13.1.2.3 MNM view

13.1.2.3.1 Key strengths and right to win

13.1.2.3.2 Strategic choices

13.1.2.3.3 Weaknesses and competitive threats

13.1.3 COLLINS AEROSPACE

13.1.3.1 Business overview

13.1.3.2 Products/solutions/services offered

13.1.3.3 MnM view

13.1.3.3.1 Key strengths and right to win

13.1.3.3.2 Strategic choices made

13.1.3.3.3 Weaknesses and competitive threats

13.1.4 SAFRAN SA

13.1.4.1 Business overview

13.1.4.2 Products/solutions/services offered

13.1.4.3 MnM view

13.1.4.3.1 Key strengths and right to win

13.1.4.3.2 Strategic choices made

13.1.4.3.3 Weaknesses and competitive threats

13.1.5 HONEYWELL INTERNATIONAL, INC.

13.1.5.1 Business overview

13.1.5.2 Products/solutions/services offered

13.1.5.3 MnM view

13.1.5.3.1 Key strengths and right to win

13.1.5.3.2 Strategic choices made

13.1.5.3.3 Weaknesses and competitive threats

13.1.6 ENGINE ALLIANCE LLC

13.1.6.1 Business overview

13.1.6.2 Products/solutions/services offered

13.1.7 TEXTRON INC.

13.1.7.1 Business overview

13.1.7.2 Products/solutions/services offered

13.1.8 INTERNATIONAL AERO ENGINES

13.1.8.1 Business overview

13.1.8.2 Products/solutions/services offered

13.1.9 MTU AERO ENGINES

13.1.9.1 Business overview

13.1.9.2 Products/solutions/services offered

13.1.10 PRATT AND WHITNEY

13.1.10.1 Business overview

13.1.10.2 Products/solutions/services offered

13.1.11 BARNES GROUP INC.

13.1.11.1 Business overview

13.1.11.2 Products/solutions/services offered

13.1.12 WILLIAMS INTERNATIONAL

13.1.12.1 Business overview

13.1.12.2 Products/solutions/services offered

13.1.13 UEC AVIADVIGATEL

13.1.13.1 Business overview

13.1.13.2 Products/solutions/services offered

13.1.14 IHI CORPORATION

13.1.14.1 Business overview

13.1.14.2 Products/solutions/services offered

13.1.15 LYCOMING ENGINES

13.1.15.1 Business overview

13.1.15.2 Products/solutions/services offered

14 APPENDIX (Page No. - 204)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

LIST OF TABLES (311 TABLES)

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AIRCRAFT ENGINE MARKET

TABLE 2 ECOSYSTEM

TABLE 3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 5 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 7 MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 8 MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 9 COMMERCIAL AVIATION: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 10 COMMERCIAL AVIATION: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 11 BUSINESS AND GENERAL AVIATION: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 12 BUSINESS AND GENERAL AVIATION: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 13 MILITARY AVIATION: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 14 MILITARY AVIATION: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 15 ROTARY WING: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 16 ROTARY WING: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 17 UAV: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 18 UAV: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 19 MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 20 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 21 MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 22 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 23 DEMAND SIDE: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 DEMAND SIDE: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 SUPPLY SIDE: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 SUPPLY SIDE: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 27 DEMAND SIDE: NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 28 DEMAND SIDE: NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 29 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 30 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 31 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 32 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 33 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 34 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 35 DEMAND SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 36 DEMAND SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 37 SUPPLY SIDE: NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 38 SUPPLY SIDE: NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 39 SUPPLY SIDE: NORTH AMERICA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 40 SUPPLY SIDE: NORTH AMERICA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 41 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 42 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 43 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 44 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 45 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 46 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 47 SUPPLY SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 48 SUPPLY SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 49 DEMAND SIDE: US: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 50 DEMAND SIDE: US: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 51 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 52 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 53 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 54 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 55 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 56 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 57 DEMAND SIDE: US: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 58 DEMAND SIDE: US: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 59 SUPPLY SIDE: US: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 60 SUPPLY SIDE: US: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 61 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 62 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 63 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 64 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 65 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 66 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 67 SUPPLY SIDE: US: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 68 SUPPLY SIDE: US: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 69 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 70 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 71 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 72 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 73 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 74 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 75 SUPPLY SIDE: CANADA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 76 SUPPLY SIDE: CANADA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 77 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 78 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 79 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 80 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 81 SUPPLY SIDE: CANADA: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 82 SUPPLY SIDE: CANADA: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 83 DEMAND SIDE: EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 84 DEMAND SIDE: EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 85 DEMAND SIDE: EUROPE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 86 DEMAND SIDE: EUROPE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 87 SUPPLY SIDE: EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 SUPPLY SIDE: EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 SUPPLY SIDE: EUROPE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 90 SUPPLY SIDE: EUROPE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 91 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 92 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 93 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 94 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 95 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 96 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 97 SUPPLY SIDE: EUROPE: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 98 SUPPLY SIDE: EUROPE: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 99 DEMAND SIDE: UK: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 100 DEMAND SIDE: UK: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 101 DEMAND SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 102 DEMAND SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 103 SUPPLY SIDE: UK: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 104 SUPPLY SIDE: UK: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 105 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 106 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 107 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 108 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 109 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 110 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 111 SUPPLY SIDE: UK: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 112 SUPPLY SIDE: UK: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 113 DEMAND SIDE: FRANCE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 114 DEMAND SIDE: FRANCE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 115 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 116 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 117 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 118 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 119 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 120 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 121 DEMAND SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 122 DEMAND SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 123 SUPPLY SIDE: FRANCE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 124 SUPPLY SIDE: FRANCE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 125 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 126 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 127 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 128 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 129 SUPPLY SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 130 SUPPLY SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 131 DEMAND SIDE: GERMANY: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 132 DEMAND SIDE: GERMANY: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 133 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 134 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 135 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 136 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 137 SUPPLY SIDE: GERMANY: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 138 SUPPLY SIDE: GERMANY: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 139 SUPPLY SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 140 SUPPLY SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 141 SUPPLY SIDE: GERMANY: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 142 SUPPLY SIDE: GERMANY: ROTARY WING AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 143 DEMAND SIDE: ITALY: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 144 DEMAND SIDE: ITALY: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 145 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 146 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 147 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 148 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 149 DEMAND SIDE: ITALY: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 150 DEMAND SIDE: ITALY: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 151 DEMAND SIDE: RUSSIA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 152 DEMAND SIDE: RUSSIA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 153 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 154 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 155 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 156 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 157 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 158 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 159 DEMAND SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 160 DEMAND SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 161 SUPPLY SIDE: RUSSIA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 162 SUPPLY SIDE: RUSSIA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 163 SUPPLY SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 164 SUPPLY SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 165 SUPPLY SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 166 SUPPLY SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 167 DEMAND SIDE: REST OF EUROPE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 168 DEMAND SIDE: REST OF EUROPE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 169 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 170 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 171 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 172 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 173 SUPPLY SIDE: REST OF EUROPE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 174 SUPPLY SIDE: REST OF EUROPE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 175 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 176 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 177 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 178 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 179 DEMAND SIDE: ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 180 DEMAND SIDE: ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 181 DEMAND SIDE: ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 182 DEMAND SIDE: ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 183 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 184 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 185 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 186 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 187 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 188 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 189 DEMAND SIDE: ASIA PACIFIC: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 190 DEMAND SIDE: ASIA PACIFIC: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 191 SUPPLY SIDE: ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 192 SUPPLY SIDE: ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 193 SUPPLY SIDE: ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 194 SUPPLY SIDE: ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 195 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 196 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 197 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 198 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 199 DEMAND SIDE: CHINA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 200 DEMAND SIDE: CHINA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 201 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 202 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 203 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 204 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 205 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 206 SUPPLY SIDE: CHINA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 207 SUPPLY SIDE: CHINA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 208 SUPPLY SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 209 SUPPLY SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 210 SUPPLY SIDE: CHINA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 211 DEMAND SIDE: INDIA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 212 DEMAND SIDE: INDIA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 213 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 214 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 215 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 216 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 217 DEMAND SIDE: INDIA: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 218 DEMAND SIDE: INDIA: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 219 DEMAND SIDE: JAPAN: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 220 DEMAND SIDE: JAPAN: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 221 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 222 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 223 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 224 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 225 DEMAND SIDE: JAPAN: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 226 DEMAND SIDE: JAPAN: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 227 SUPPLY SIDE: JAPAN: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 228 SUPPLY SIDE: JAPAN: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 229 SUPPLY SIDE: JAPAN: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 230 SUPPLY SIDE: JAPAN: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 231 DEMAND SIDE: AUSTRALIA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 232 DEMAND SIDE: AUSTRALIA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 233 DEMAND SIDE: AUSTRALIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 234 DEMAND SIDE: AUSTRALIA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 235 DEMAND SIDE: SOUTH KOREA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 236 DEMAND SIDE: SOUTH KOREA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 237 DEMAND SIDE: SOUTH KOREA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 238 DEMAND SIDE: SOUTH KOREA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 239 DEMAND SIDE: REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 240 DEMAND SIDE: REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 241 DEMAND SIDE: REST OF ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET, BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 242 DEMAND SIDE: REST OF ASIA PACIFIC: FIXED WING AIRCRAFT ENGINES MARKET, BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 243 DEMAND SIDE: LATIN AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 244 DEMAND SIDE: LATIN AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 245 DEMAND SIDE: LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 246 DEMAND SIDE: LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 247 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 248 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 249 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 250 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 251 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 252 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 253 DEMAND SIDE: BRAZIL: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 254 DEMAND SIDE: BRAZIL: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 255 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 256 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINES MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 257 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 258 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINES MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 259 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 260 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 261 DEMAND SIDE: MIDDLE EAST: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 262 DEMAND SIDE: MIDDLE EAST: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 263 DEMAND SIDE: MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 264 DEMAND SIDE: MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 265 DEMAND SIDE: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 266 DEMAND SIDE: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 267 DEMAND SIDE: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 268 DEMAND SIDE: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 269 SUPPLY SIDE: MIDDLE EAST: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 270 SUPPLY SIDE: MIDDLE EAST: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 271 DEMAND SIDE: TURKEY: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 272 DEMAND SIDE: TURKEY: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 273 DEMAND SIDE: TURKEY: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 274 DEMAND SIDE: TURKEY: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 275 SUPPLY SIDE: TURKEY: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 276 SUPPLY SIDE: TURKEY: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 277 SUPPLY SIDE: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 278 SUPPLY SIDE: ROTARY WING AIRCRAFT ENGINES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 279 DEMAND SIDE: ISRAEL: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 280 DEMAND SIDE: ISRAEL: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 281 DEMAND SIDE: ISRAEL: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 282 DEMAND SIDE: ISRAEL: FIXED WING AIRCRAFT ENGINES MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 283 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE AIRCRAFT ENGINES MARKET BETWEEN 2017 AND 2021

TABLE 284 COMPANY PRODUCT FOOTPRINT

TABLE 285 COMPANY TECHNOLOGY FOOTPRINT

TABLE 286 COMPANY INDUSTRY FOOTPRINT

TABLE 287 COMPANY REGION FOOTPRINT

TABLE 288 DEALS, 2016-2021

TABLE 289 PRODUCT LAUNCHES, 2017-2020

TABLE 290 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

TABLE 291 GENERAL ELECTRIC COMPANY: DEALS

TABLE 292 ROLLS-ROYCE HOLDING PLC: BUSINESS OVERVIEW

TABLE 293 ROLLS ROYCE HOLDINGS PLC: DEALS

TABLE 294 COLLINS AEROSPACE: BUSINESS OVERVIEW

TABLE 295 COLLINS AEROSPACE: DEALS

TABLE 296 SAFRAN SA: BUSINESS OVERVIEW

TABLE 297 SAFRAN SA: DEALS

TABLE 298 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

TABLE 299 ENGINE ALLIANCE LLC.: BUSINESS OVERVIEW

TABLE 300 TEXTRON INC. BUSINESS OVERVIEW

TABLE 301 TEXTRON INC: DEALS

TABLE 302 INTERNATIONAL AERO ENGINES: BUSINESS OVERVIEW

TABLE 303 MTU AERO ENGINES: BUSINESS OVERVIEW

TABLE 304 MTU AERO ENGINES: DEALS

TABLE 305 PRATT AND WHITNEY: BUSINESS OVERVIEW

TABLE 306 PRATT AND WHITNEY: DEALS

TABLE 307 BRANES GROUP INC.: BUSINESS OVERVIEW

TABLE 308 WILLIAMS INTERNATIONAL: BUSINESS OVERVIEW

TABLE 309 UEC AVIADVIGATEL: BUSINESS OVERVIEW

TABLE 310 IHI CORPORATION: BUSINESS OVERVIEW

TABLE 311 LYCOMING ENGINES CORPORATION: BUSINESS OVERVIEW

LIST OF FIGURES (49 FIGURES)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 AIRCRAFT ENGINE MARKET TO GROW AT A HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

FIGURE 5 MARKET SIZE CALCULATION

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 9 DATA TRIANGULATION

FIGURE 10 MARKET SHARE, BY PLATFORM, 2021

FIGURE 11 MARKET SHARE, BY COMPONENT, 2021

FIGURE 12 MARKET SHARE, BY TECHNOLOGY, 2021

FIGURE 13 MARKET SHARE, BY TYPE, 2021

FIGURE 14 MARKET IN ASIA PACIFIC IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 15 INCREASING NUMBER OF AIRCRAFT DELIVERIES EXPECTED TO DRIVE MARKET FROM 2021 TO 2026

FIGURE 16 TURBINE SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

FIGURE 17 CONVENTIONAL AIRCRAFT SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

FIGURE 18 TURBOFAN SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

FIGURE 19 FIXED-WING SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

FIGURE 20 CHINA PROJECTED TO BE FASTEST GROWING MARKET DURING 2021–2026

FIGURE 21 MARKET DYNAMICS

FIGURE 22 FIXED-WING UAV MARKET, 2019-2026 (USD MILLION)

FIGURE 23 REVENUE SHIFT IN MARKET

FIGURE 24 MARKET ECOSYSTEM MAP

FIGURE 25 VALUE CHAIN ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES

FIGURE 27 EMERGING TRENDS

FIGURE 28 SUPPLY CHAIN ANALYSIS

FIGURE 29 TURBOFAN SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 30 FIXED-WING SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 31 TURBINE SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 32 CONVENTIONAL SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 33 REGIONAL SNAPSHOT

FIGURE 34 NORTH AMERICA: AIRCRAFT ENGINES DEMAND SIDE MARKET SNAPSHOT

FIGURE 35 EUROPE: SNAPSHOT

FIGURE 36 ASIA PACIFIC: SNAPSHOT

FIGURE 37 MARKET RANKING OF LEADING PLAYERS IN MARKET, 2021

FIGURE 38 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN MARKET, 2020

FIGURE 39 REVENUE ANALYSIS OF LEADING PLAYERS IN MARKET, 2020

FIGURE 40 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

FIGURE 41 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 42 ROLLS ROYCE PLC: COMPANY SNAPSHOT

FIGURE 43 COLLINS AEROSPACE: COMPANY SNAPSHOT

FIGURE 44 SAFRAN SA: COMPANY SNAPSHOT

FIGURE 45 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

FIGURE 46 TEXTRON INC: COMPANY SNAPSHOT

FIGURE 47 MTU AERO ENGINES: COMPANY SNAPSHOT

FIGURE 48 BARNES GROUP INC.: COMPANY SNAPSHOT

FIGURE 49 IHI CORPORATION.: COMPANY SNAPSHOT

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Engine Market

As part of my leadership program, I am running a project for GE Aviation and I need to start with a competitive analysis and a market trend research. Thanks

Hello Sir, We are interested in buying this report. However, before putting the order, we would like to know if your methodology fits our requirements. I saw that you have the number of the market size of 68.05 billion for the engine market. Please share with us the methodology and how you reached this number. Thanks, Marco