The study involved four major activities in estimating the current market size for the aircraft gearbox market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, Dow Jones Factiva, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases. Secondary sources referred for this research study included General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

The aircraft gearbox market comprises several stakeholders, such as raw material providers, aircraft gearbox manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in materials and types. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

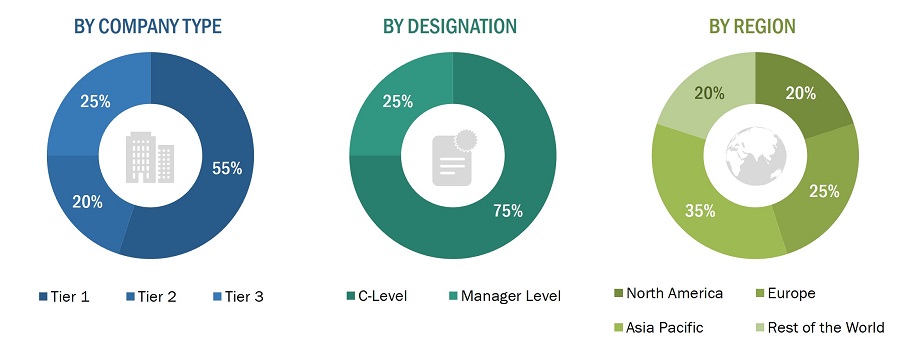

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the aircraft gearbox market. The research methodology used to estimate the size of the market includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, aircraft maintenance professionals, and SMEs of leading companies operating in the market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the aircraft gearbox market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

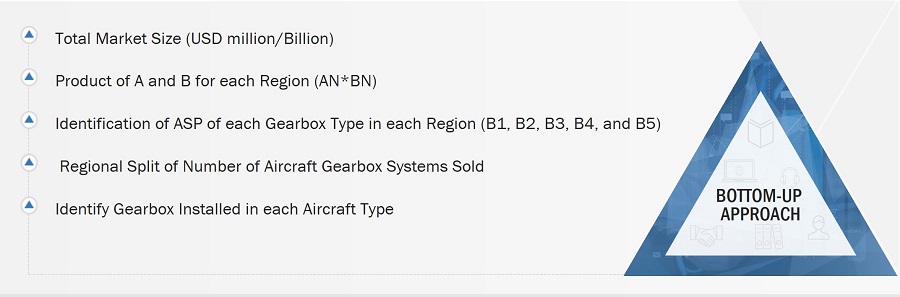

Market Size Estimation Methodology: Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the aircraft gearbox market. The number of aircraft deliveries of each aircraft type—civil aircraft and military aircraft—was mapped from 2000–2022 (Source: Boeing and Airbus Outlook) and further forecasted these numbers to 2028 along with their average selling price (ASP). The components of different types of gearbox were also considered for the aircraft gearbox market sizing. The number of gearboxes by each aircraft was then multiplied by the ASP of each gearbox type and the number of aircraft delivered in each country.

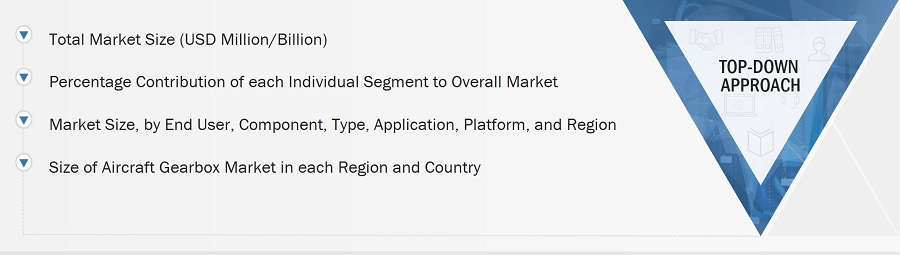

Market Size Estimation Methodology: Top-Down Approach

In the top-down approach, the overall aircraft gearbox market size was used to estimate the size of individual subsegments (mentioned in the market segmentation) through percentage splits in secondary and primary research. For the calculation of specific market segments, the most appropriate immediate parent market size was used to implement the top-down approach.

Triangulation And Validation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated numbers for the segments and subsegments of the aircraft gearbox market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Triangulation Through Secondary

-

Country-wise aircraft deliveries from 2000 to 2022 were considered as historical data. Data was taken from the Boeing and Airbus Outlook and various governing bodies of each country.

-

Aircraft layouts, block diagrams, and other secondary information were used to map the number of components in an aircraft.

Triangulation Through Primaries

-

The segments and subsegments of the aircraft gearbox market were validated through primaries.

-

Aircraft gearbox ASP and their component level breakdown were validated from primaries. This varies as per the aircraft type.

-

Information about the companies that have been profiled in the study was validated by primaries.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Market Definition

Aircraft gearboxes are mechanical devices that allow power to be transferred between the turbine and compressor while also allowing them to rotate at different speeds. Gearboxes are essential for improving engine efficiency and ensuring the smooth and safe operation of the aircraft. Therefore, they must be designed, manufactured, and maintained to the highest standards to ensure reliability and safety during flight.

Aircraft gearboxes are mechanical tools used to transfer power from aircraft engines to different parts, including fans, propellers, accessories, and flight controls. The main types of aircraft gearboxes include the main reduction gearbox, accessory gearbox, transfer gearbox, tail rotor gearbox, and auxiliary power unit gearbox.

Key Stakeholders

-

Aircraft manufacturers

-

Engine manufacturers

-

Gearbox manufacturers

-

Maintenance, repair, and overhaul (MRO) providers

-

Airlines

-

Government agencies

-

Research and development organizations

-

Investors

-

Suppliers of raw materials and components

-

Trade associations

-

Standards organizations

Report Objectives

-

To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft gearbox market

-

To analyze the impact of macro and micro indicators on the market

-

To forecast the market size of segments for four regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Along with major countries in each of these regions

-

To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

-

To strategically profile key market players and comprehensively analyze their market ranking and core competencies

-

To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

-

To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

-

To define, describe, segment, and forecast the aircraft gearbox market on the basis of application, type, components, platform, end use, and region

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 6)

Madhan

Jan, 2019

I am looking for a suitable partner to help understand the market for aerospace gears used in transmission systems. Will be great if I can speak to someone from your team, to discuss in detail..