Aircraft Seat Upholstery Market by Material (Leather, Vinyl, Fabric), Seat Cover Type (Bottom Cover, Backrest, Headrest, Armrest, Seat rear pocket), Seat Type (First, Business, Premium, Economy), Aircraft Type, End Use and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

Aircraft Seat Upholstery Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Seat Upholstery Market Dynamics:

Drivers: Maintenance & retrofitting of existing aircraft

Existing aircraft are being retrofitted with new seat upholstery as airlines around the globe strive to provide more comfort in terms of seating and other services. A common trend in the airline industry is to upgrade aircraft seats as the old seats become outdated and cabin interiors become dull after a few years of putting the aircraft into service. The introduction of advanced and lightweight materials for cabin seats has led to the upgrading of existing aircraft seats to new seats. Additionally, business jet owners prefer personalizing their cabin seats, due to which aftermarket companies are now providing a vast range of designs and materials for the customization of aircraft cabin seats.

Restraints: Shortage of profitable airlines in emerging economies

The aviation sector in developing countries has enormous growth potential. This potential hasn't, however, been significantly used. The aircraft seating industry is dominated by industrialised nations like the US, where five major airlines—Midwest Airlines, Frontier Airlines, Northwest Airlines, AirTran Airlines, and American Airlines—have merged to boost profits. The US has also benefited from low oil prices, expansionary fiscal and monetary policies, and the deleveraging of the private sector, all of which have helped to enhance its position internationally along with its steady job market. The country also has a high percentage of consumer expenditure, which raises demand for air travel. The lack of adequate infrastructure and other additional levies levied by aviation authorities in countries like India and Africa, among others, have increased the cost of air travel.

Opportunities: Rise of low-cost airlines

Low-cost airlines are in charge of making air travel more accessible to the general public. In comparison to full-service airlines, these carriers also referred to as budget carriers offer inexpensive tickets with average to below-average service. The primary variables influencing the low-cost carrier segment are low prices and promotional offers. For short-haul travel, the low-cost model has been quite successful, boosting demand for narrow-body aircraft. The purpose of adopting this approach is to provide low-cost services to the expanding middle class population in emerging nations. Due to their preference for short flights and the ease of maintenance, low-cost airlines frequently purchase narrow body aircraft. As a result, the aircraft seat upholstery industry has been negatively impacted by the rise in demand for narrow body aircraft.

Challenges: Aircraft Delivery backlogs

Delay in aircraft deliveries is affecting the aviation industry. It can also impact operations and cash flow, resulting in losses for the lessees. The aircraft seat upholstery market is dependent on the aircraft market. A lag in aircraft deliveries can affect future procurements and contracts, potentially leading to heavy losses for aircraft seat upholstery manufacturers.. Additionally, because the new models are more cost-effective during periods of high oil prices, airlines have increased fleet renewal campaigns. As a result, routes' reopening has been delayed, and frequency has been decreased.

Based on seat cover type, the armrest segment is projected to grow at the highest CAGR during the forecast period

Based on seat cover, the aircraft seat upholstery market has been segmented into bottom cover, backrest, armrest, headrest, and seat rear pocket. Armrests provide comfort and support to the hands and arms of passengers. The demand for armrests for business class seats and for premium economy seats is expected to drive the armrests segment of the aircraft seat upholstery market.

Based on end use type, the aftermarket segment is projected to grow at the highest CAGR during the forecast period

Based on end use type, the aftermarket segment is estimated to have the largest CAGR during the forecast period. This segment is driven by the need of airliners to customize their cabin interiors and aircraft seating during the installation or repair of seats which generally includes a replacement of upholstery. It is also driven by the frequent need for maintenance of aircraft seat covers.

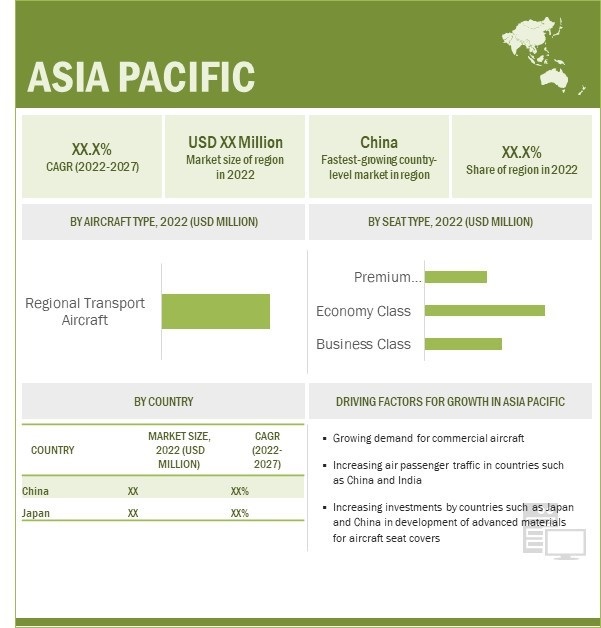

Asia Pacific is expected to account for the highest CAGR during the forecast period

Asia Pacific is estimated to account for the highest CAGR of the global aircraft seat upholstery OEM market in 2022 due to the growing demand for commercial aircraft, increasing investments by countries such as Japan and China in the development of advanced materials for aircraft seat covers. Countries in the Asia Pacific region are upgrading their manufacturing capabilities by undertaking developments in the field of aviation, thus offering a significant opportunity for OEM manufacturers to expand their business.

Aircraft Seat Upholstery Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Seat Upholstery Companies - Key Market Players

The Aircraft Seat Upholstery Companies are dominated by a few globally established Players such as Spectra Interior Products (US), Aerotex Aircraft Interiors (Canada), Tritex Corporation (US), OmnAvia Interiors (US), Lantal Textiles AG (Switzerland), and Tapis Corp (US). The report covers various industry trends and new technological innovations in the aircraft seat upholstery market for the period 2018-2027.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Material, Seat Type, Seat Cover Type, Aircraft Type, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East, Africa, and Latin America |

|

Companies Covered |

Lantal Textiles AG (Switzerland), Franklin Products (US), Aircraft Interior Products (US), Aircraft Cabin Modification GmbH (Germany), Perrone Performance Leathers & Textiles (US), International Aero Services (US), ELeather (UK), Spectra Interior Products (US), Tritex Corporation (US), Aerotex (Canada), OmnAvia Interiors (US), Tapis Corporation (US), and Douglass Interior Products (US) |

Aircraft Seat Upholstery Market Highlights

This research report categorizes the aircraft seat upholstery market based on material, seat cover type, seat type, aircraft type, end user, and region.

|

Aspect |

Details |

|

By Material: |

|

|

By Seat Cover: |

|

|

By Seat Type |

|

|

By Aircraft Type: |

|

|

By End User: |

|

|

OEM by Region: |

|

|

Aftermarket by Region: |

|

Recent Developments

- In November 2022, contract for the restoration of the airline's first two Airbus A320s was signed by J&C Aero and Crown Airlines of Libya. The agreement involved the design and production of a range of interior cabin items for aircraft, including seat belts, carpets, and cabin curtains. In accordance with the requirements of the two aircraft's new operator, galley upgrades were also covered by the contract.

- In July 2022, the flag carrier of Poland, LOT Polish Airlines, signed a contract with J&C Aero, an international aviation center for innovation in cabin transformation, to make more than 3000 extremely durable leather seat coverings for the carrier's fleet of Embraer 170/175/190/195 aircraft. The agreement included the establishment of a complete set of seat covers that consists of the headrest, literature pocket, backrest, and bottom of a passenger seat.

- In August 2022, the first sustainable leather producer, ELeather, partnered with Southwest Airlines to make a joint presentation at the upcoming Aircraft Cabin Innovation Summit that will emphasize the value of innovation and cooperation in the quest for sustainability.

- In December 2020, in order to cover 13,020 seats in its new fleet with designed, sustainable leather, JetSMART and ELeather signed a contract. The fleet consists of 70 A320 NEO family aircraft, each with 186 seats, and will be gradually incorporated into the business through 2026. The first batch of 11 aircraft with sustainable seats was delivered in 2021. Because ELeather is 48% lighter than conventional leather, using it can save up to $10,000 in fuel expenses annually per plane, among other advantages.

Frequently Asked Questions (FAQs):

What is the current size of the aircraft seat upholstery market?

The aircraft seat upholstery market is projected to grow from an estimated USD 1.9 billion in 2022 to USD 2.3 billion by 2027, at a CAGR of 3.6% from 2022 to 2027.

Who are the winners in the aircraft seat upholstery market?

Lantal Textiles AG (Switzerland), Franklin Products (US), J&C Aero (Lithuania), ELeather (UK), and Aircraft Cabin Modification Gmbh (Germany), are some of the winners in the market.

What are some of the opportunities in the aircraft seat upholstery market?

Rise in low-cost airlines and the demand to meet aviation sustainability goals are few of the opportunities in the aircraft cabin interiors market.

What are some of the technological advancements in the market?

Advanced Material, Biodegradable Seat Covers, Anti-Stain Effect and Hygiene Effect, among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

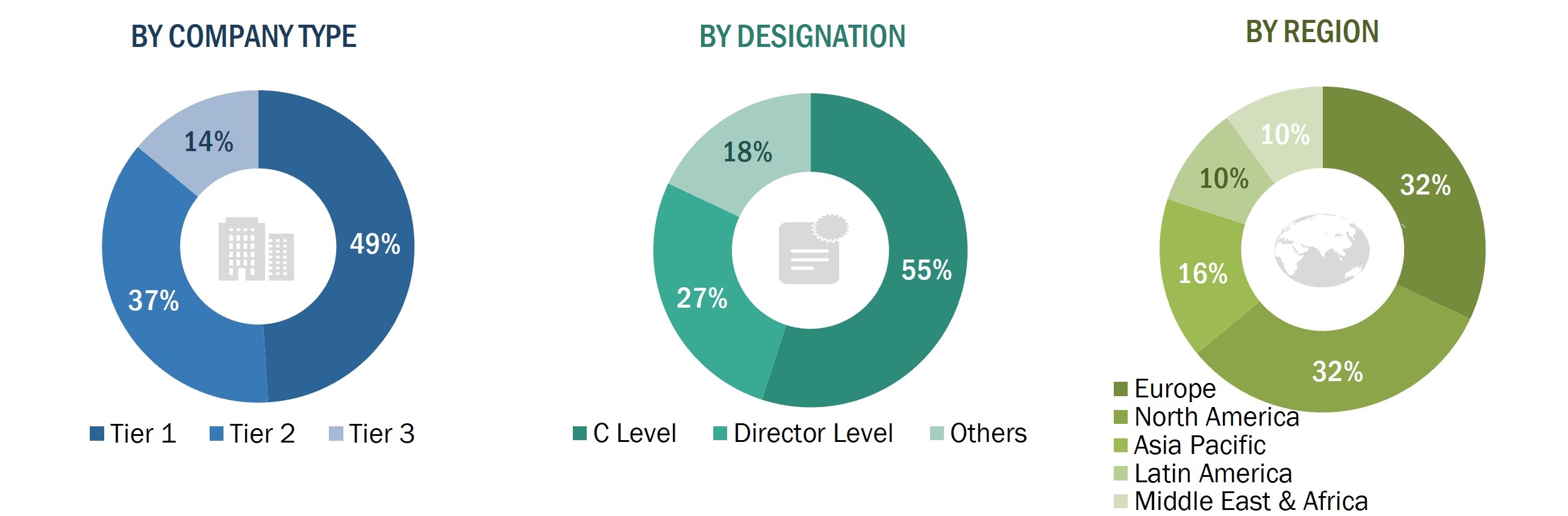

The research study conducted on the aircraft seat upholstery market involved extensive use of secondary sources, including directories, databases of articles, journals on aircraft seat upholstery, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the aircraft seat upholstery market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the aircraft seat upholstery industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the aircraft seat upholstery market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the aircraft seat upholstery industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the aircraft seat upholstery market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the aircraft seat upholstery market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

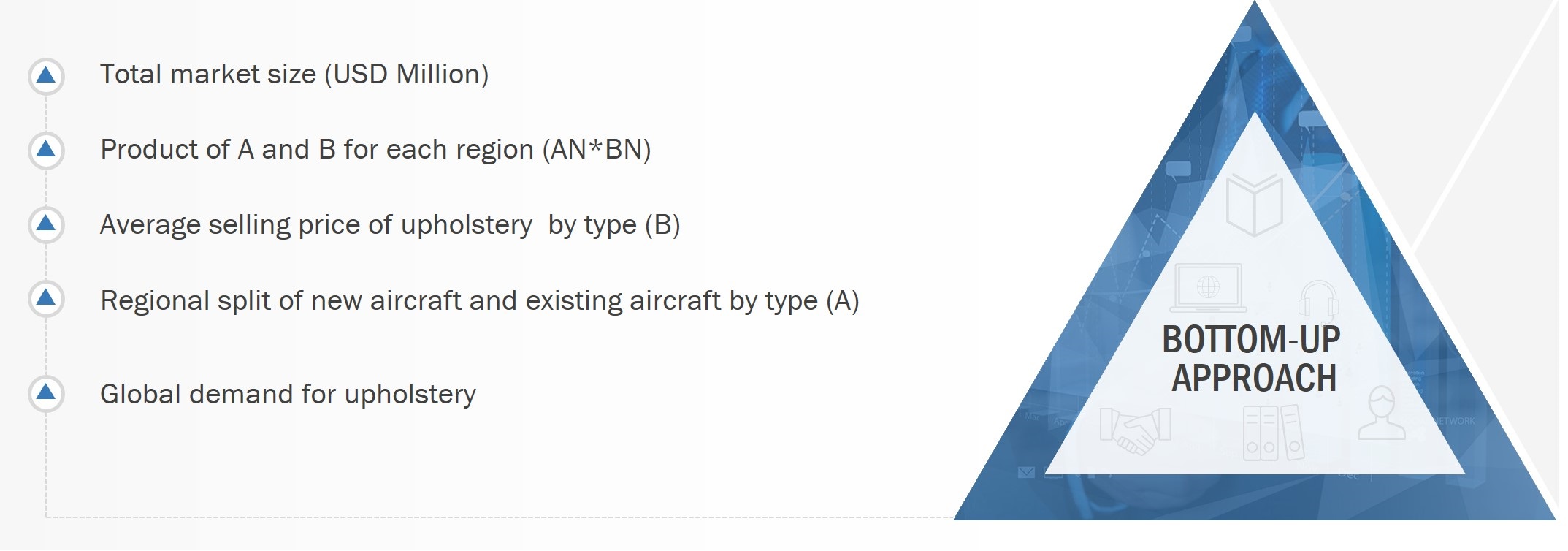

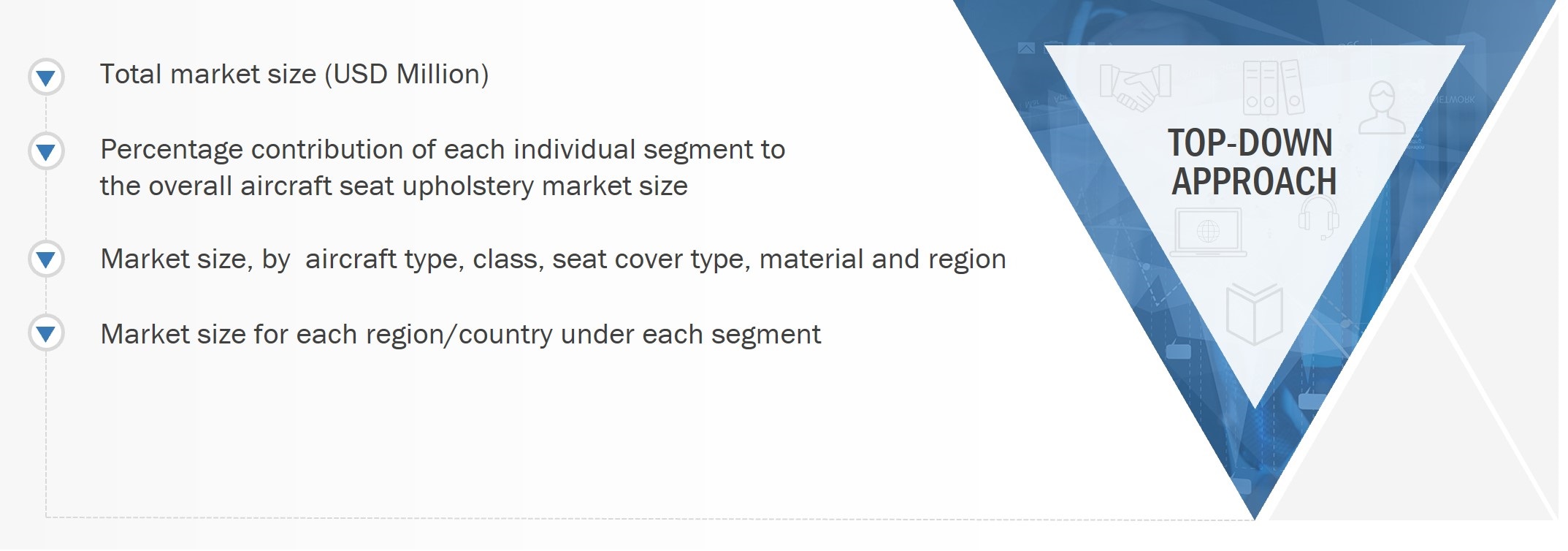

The aircraft seat upholstery market is an emerging one due to the growing demand for aircraft. Both top-down and bottom-up approaches were used to estimate and validate the size of the aircraft seat upholstery market. The research methodology used to estimate the market size also included the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top down approach

Data Triangulation

After arriving at the overall size of the aircraft seat upholstery market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the aircraft seat upholstery market based on s material, seat type, seat cover type, aircraft type, end-use, and region.

- To analyze the degree of competition in the market by identifying various parameters, including key market players

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the aircraft seat upholstery market

- To analyze macro and micro indicators of the market and provide a factor analysis for them

- To forecast the market size of various segments of the aircraft seat upholstery OEM market with respect to four major regions, namely, North America, Europe, Asia Pacific, and Latin America, along with major countries in each region

- To forecast the market size of various segments of the aircraft seat upholstery aftermarket with respect to six major regions, namely, North America, Europe, Asia Pacific, Latin America, Middle East, and Africa, along with major countries in each region

- To strategically analyze micromarkets with respect to individual technological trends and prospects of the aircraft seat upholstery market

- To strategically profile key market players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, and new product launches & developments of key players in the aircraft seat upholstery market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the aircraft seat upholstery market

- To identify industry trends, market trends, and technology trends currently prevailing in the aircraft seat upholstery market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Seat Upholstery Market